Best Auto Insurance Companies for High-Risk Drivers – Quick Reference Guide

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Mar 15, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Mar 15, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Finding an affordable auto insurance provider after a DUI isn’t easy.

You are looking at paying more for auto insurance.

Potentially a lot more.

Depending on where you live, you may be limited to a few non-standard, specialized auto insurance carriers that offer high-risk insurance coverage.

When shopping for a high-risk policy, the best way to get the most coverage for your dollar is to shop around.

You’ll want to look at more than just the price.

It is important to get familiar with the non-standard companies available to you and know what each company offers to get the best deal.

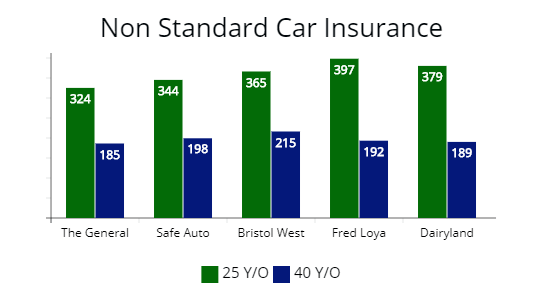

Illustrated above are quotes from companies offering non-standard insurance. Each driver had driving violations on record and poor credit. If you recently had an insurer drop your coverage, you should consider any of the 9 best non-standard companies I reviewed below. Your auto insurance policy will vary depending on your driver profile, which is an important factor and more financial risk.

Illustrated above are quotes from companies offering non-standard insurance. Each driver had driving violations on record and poor credit. If you recently had an insurer drop your coverage, you should consider any of the 9 best non-standard companies I reviewed below. Your auto insurance policy will vary depending on your driver profile, which is an important factor and more financial risk.

- Car Insurance for High Risk Drivers

- Car Insurance for High-Risk Drivers: What You Need to Know

- What happens to your car insurance after a DUI?

- SR-22 Insurance in 2024: Here Are the Best Companies

- How long does a DUI stay on your insurance?

- The Best Auto Insurance Companies for People With Tickets

- How To Get Cheap DUI Insurance In California

- What Every DUI Offender That Needs Car Insurance Should Know

- How To Find & How Much is Car Insurance With a Suspended License?

- Car Insurance for a Suspended License Driver: 4 Tips to Getting the Better Rates

The General

The General is often considered one of the leading auto insurance companies for offenders with at least one drunk driving conviction and a repeat offender.

| Pros | Cons |

|---|---|

| Offers SR-22 filing for drivers | No discounts |

| More affordable for high-risk drivers | Higher premium than competitors |

| Driver history check 3 previous years only | Claims cannot be reported online |

They offer specialized, flexible rate plans for high-risk drivers in every state except Hawaii, Massachusetts, Michigan, and New Jersey.

The auto insurance company makes it easy to file an SR-22.

New customers are asked if they need one when signing up for auto insurance with The General.

If the document is needed, it is included in the enrollment paperwork.

No matter your driving record or traffic violations, you will be able to get the coverage you need at a favorable rate with The General.

| Age | Quote (monthly)* |

|---|---|

| 25 y/o driver | $324 |

| 30 y/o driver | $273 |

| 45 y/o driver | $185 |

*with drunk driving offense including prescription drugs & full coverage.

Safe Auto

Safe Auto has specialized in providing people with state-minimum auto insurance policies for more than 20 years.

| Pros | Cons |

|---|---|

| Offers SR-22 filing | Poor customer support |

| Good option with low credit score | Can't bundle with life or health insurance |

| Same-day claims payout | Claims cannot be reported online |

They target their policies to people that are considered high-risk or previously had a license suspension.

That includes drivers that have a DUI conviction or multiple moving violations.

The provider offers some discounts to its customers.

These discounts are available for customers with more than one motor vehicle, own a home, or take a driver safety course.

Although Safe Auto makes it easy for drivers to get coverage after a DUI, the provider only offers its services in 17 states.

It should also be noted that Safe Auto gets mixed reviews related to its handling of claims.

Additionally, the provider has received more complaints to state regulators about its auto insurance coverage than its competitors.

Despite the complaints, Safe Auto is a worthy option for people driving under the influence violation in the states it serves.

| Age | Quote (monthly)* |

|---|---|

| 25 y/o driver | $344 |

| 30 y/o driver | $289 |

| 45 y/o driver | $198 |

*Full coverage with drunk driving conviction with blood alcohol over.o8 BAC.

Bristol West

As part of Farmers, Bristol West specializes in providing coverage to high-risk drivers and those with a suspended license.

| Pros | Cons |

|---|---|

| Offers SR-22 & FR-44 filing | Poor customer support |

| Low down payment option | Have to work with an agent to get quotes & policies |

| A rated company | Customers report unexpected price increases |

The provider offers coverage in 42 states.

Like The General, they make it easy to obtain the necessary documentation.

Bristol West also offers an extensive list of discounts, even for a young driver with a DUI on their record.

Depending on your state, you might qualify for a discount with Bristol West if you:

– insure more than one car

– own a home

– make electronic payments

– are at least 55 years old and have completed a driver improvement course

With an extensive list of potential discounts and its availability in most states, Bristol West could be an attractive option for high-risk drivers needing coverage.

| Age | Quote (monthly)* |

|---|---|

| 25 y/o driver | $365 |

| 30 y/o driver | $303 |

| 45 y/o driver | $215 |

*Full coverage with DUI.

Acceptance

Like Safe Auto, Acceptance is available in 17 states nationwide.

| Pros | Cons |

|---|---|

| Offers SR-22 filing | Low policy limits |

| Easy quote process | Coverage is more expensive than other insurers |

| Offers basic coverage for high-risk drivers | Claims process is not 24 hours a day |

An insurer is a viable option for those unable to get car insurance quotes through a mainstream provider.

Or those with a suspended license.

If you have a DUI on your record, Acceptance will be able to file this form for you.

Although the company doesn’t offer all the “extras” found at other auto insurance companies, they offer a Ticketproof program that may entice some.

As part of their Ticketproof program, Acceptance will reimburse drivers for a portion of their costs related to a reckless driving infraction, a speeding ticket, or multiple tickets.

They will reimburse up to $200 towards legal fees, $100 towards paid citations, and $250 towards court-ordered defensive driving courses.

| Age | Quote (monthly)* |

|---|---|

| 25 y/o driver | $422 |

| 30 y/o driver | $342 |

| 45 y/o driver | $201 |

*with drunk driving conviction & full coverage.

Fred Loya

Depending on your area, Fred Loya may be sold as Young America, Rodney D. Young, or National.

| Pros | Cons |

|---|---|

| Offers SR-22 filing | Few discounts |

| Agents required to settle claims in 24 hours | Coverage is more expensive than other insurers |

| Coverage for specialized vehicles | No 24/7 claims process |

Coverage is offered in just 11 states.

With offices in Walmart stores around the country, it benefits from its retail presence.

However, the insurer falls short when it comes to meeting the needs of its customers.

Fred Loya does not offer the option for customers to file claims online.

That means you can only file claims by phone during regular business hours.

The insurer has also been hit with legal issues in the past.

While Fred Loya offers bare minimum coverage for people driving under the influence moving violation, there are better alternatives out there.

| Age | Quote (monthly)* |

|---|---|

| 25 y/o driver | $397 |

| 30 y/o driver | $316 |

| 45 y/o driver | $192 |

*with comprehensive, collision, uninsured motorists protection, and DUI conviction.

Dairyland

Dairyland has been offering coverage for drivers in the high-risk auto insurance category for nearly 70 years.

| Pros | Cons |

|---|---|

| Online policy sign up | Long wait times for claims payout |

| Accepts foreign drivers licenses | High risk pool means higher rates |

| Offers coverage for old, antique, extra-large and unique vehicles | No online claims process |

Like many other specialized insurers, it only offers its coverage in a select number of states.

Although Dairyland doesn’t have the online presence that some of the larger high-risk insurers have, it does allow its customers to handle claims and pay bills online.

Dairyland also has a mobile app available to its customers, making it easy to access your account.

| Age | Quote (monthly)* |

|---|---|

| 25 y/o driver | $379 |

| 30 y/o driver | $298 |

| 45 y/o driver | $189 |

*with an SR-22 filing

Direct Auto

Besides providing coverage for drivers with a DUI, Direct Auto also offers life and renters coverage.

| Pros | Cons |

|---|---|

| Broad range of coverage options | High number of complaints |

| Flexible payment options based on your budget | Lower than average customer service |

| DirectDrive app to monitor driving and reduce rates | Claims by phone only |

That means its customers can take advantage of bundling discounts that aren’t available from other companies specializing in high-risk drivers.

The company also stands out by offering customers flexible, customizable payment options.

Unfortunately, Direct Auto only offers its coverage in 12 states, making it a viable option only for drivers in the states it serves.

| Age | Quote (monthly)* |

|---|---|

| 25 y/o driver | $361 |

| 30 y/o driver | $288 |

| 45 y/o driver | $193 |

*with comprehensive, collision, poor driving record and credit history.

Kemper

A DUI on your record doesn’t mean you can’t get coverage from a bigger company.

| Pros | Cons |

|---|---|

| Easy online quote process | No free policy cancellation |

| Wide array of discounts | Not all vehicle brands & models covered |

| 24/7 availability | No rideshare coverage |

As one of the largest companies in the United States, Kemper is well known for its high-risk coverage.

Kemper’s coverage is more extensive than some other specialty providers that only offer state-minimums.

They also offer salvaged vehicle coverage and will even provide text alerts to their customers to avoid penalties for missing payments.

| Age | Quote (monthly)* |

|---|---|

| 25 y/o driver | $354 |

| 30 y/o driver | $271 |

| 45 y/o driver | $184 |

*with poor driving record and credit score.

Nationwide (Titan)

If you’re looking for a major provider that still offers specialized coverage for drivers with a DUI on their record, Nationwide is a solid option.

| Pros | Cons |

|---|---|

| Affiliated with Nationwide | Claims by phone only |

| More affordable compared to other non-standard companies | Minimum features with shopping for policy options |

| Coverage for travel to Mexico | Reviews slant towards with unfavorable |

The provider previously offered high-risk coverage under the name Titan before absorbing the subsidiary and the services it offered.

Before being absorbed by Nationwide, Titan stood out from its competitors due to its lack of consumer complaints and its strong customer service rating.

Customers can expect that same quality of service with Nationwide while also taking advantage of bundling discount options available through the insurer.

| Age | Quote (monthly)* |

|---|---|

| 25 y/o driver | $387 |

| 30 y/o driver | $290 |

| 45 y/o driver | $189 |

*with SR-22 filing.

If you recently had a DUI added to your record, it’s only natural that you have some questions about how the conviction will affect your car insurance premium.

How will a DUI conviction affect my insurance premium?

To put it simply, you’re going to pay more for coverage.

It isn’t uncommon to see rates double after a DUI conviction.

Companies will see you as a high-risk customer that could be costly to insure.

That means they’ll charge you more to protect their bottom-line.

In some cases, your existing car insurance company may opt not to renew your policy once it expires.

That’s why it is important to keep an open communication line with your insurer if you get a DUI on your record.

How much can I expect to pay for car insurance after a DUI?

While rates fluctuate, you can expect to pay more than $1000 per year for minimum coverage.

Full coverage will set you back at least $2500 per year.

How long will a DUI impact my car insurance rates?

Unfortunately, a DUI will haunt your rates for at least 3 years.

In some states, you’ll pay a high premium for as long as the DUI is on your record.

That could be as long as 10 years.

What is an SR-22? Do I need one?

An SR-22 is an official document that proves you’ve purchased the state’s minimum liability insurance.

You have the financial responsibility to keep it the coverage required by state law.

It allows you to keep your driving privileges (or have them reinstated, if needed).

The companies mentioned above offer this filing.

Although there is usually a $25 cost to file an SR-22, many of the mentioned insurers will do so for free when you purchase coverage through them.

In some states, like Florida and Virginia, an FR-44 form must be filed.

This form requires drivers with a DUI conviction to purchase more than the state’s minimum coverage.

How can I save money on car insurance after a DUI?

The best thing you can do after a DUI is to shop around immediately.

Because your existing provider can drop you as a customer once your existing policy expires, you’ll want to have another provider lined up to avoid any gaps in coverage.

By getting multiple quotes, you’ll make sure you get the cheapest rate for the best coverage.

Depending on your state, you’ll want to shop around again in 3 years.

After 3 years, insurers will start to drop your rates, allowing you to start saving money again.

Besides shopping around now and in the future, I recommend making sure your credit score is in good shape.

Even if you have a clean driving history, you’ll pay more with poor credit.

With poor credit and a DUI on your record, you’ll be stuck paying astronomical prices while trying to get a cheap car insurance rate.

I’m often asked if coverage is even needed after a DUI and if one can save by skipping out on car insurance coverage.

Despite the high car insurance costs after a DUI, you absolutely need to have it.

Driving without insurance with a DUI on your record could cost you far more than premium increases with high-risk auto insurance.

If you have an at-fault accident, you could face jail time.

Then you have a criminal record.

How do I know which high-risk insurer is right for me?

Many carriers offering coverage for a convicted driver or those with a criminal conviction from a serious moving violation are limited to select states.

That might limit your options.

When shopping for high-risk coverage or if you need to compare rates, you should pay attention to two things:

– How many complaints the car insurance company has received.

– How strong the company is financially.

An insurance carrier’s financial strength is especially important because it indicates if they will pay out claims.

Sources

https://www.dairylandinsurance.com/auto

Quadrant Information Services

{“@context”:”https://schema.org”,”@type”:”FAQPage”,”mainEntity”:[{“@type”:”Question”,”name”:”How will a DUI conviction affect my premium?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”To put it simply, you’re going to pay more for coverage. It isn’t uncommon to see rates double after a DUI conviction. Companies will see you as a high-risk customer that could be costly to insure. That means they’ll charge you more to protect their bottom-line. In some cases, your existing auto insurance provider may opt not to renew your policy once it expires. That’s why it is important to keep an open line of communication with your insurer if you get a DUI on your record.”}},{“@type”:”Question”,”name”:”How much can I expect to pay for car insurance after a DUI?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”While rates fluctuate, you can expect to pay more than $1000 per year for minimum coverage. Full coverage will set you back at least $2500 per year.”}},{“@type”:”Question”,”name”:”How long will a DUI impact my car insurance rates?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”Unfortunately, a DUI will haunt your rates for at least 3 years. In some states, you’ll pay increased premiums for as long as the DUI is on your record. That could be as long as 10 years.”}},{“@type”:”Question”,”name”:”What is an SR-22? Do I need one?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”An SR-22 is an official document that proves you’ve purchased the state’s minimum liability coverage. It allows you to keep your driving privileges (or have them reinstated, if needed). Although there is usually a $25 cost to file an SR-22, many of the mentioned insurers will do so for free when you purchase coverage through them. In some states, like Florida and Virginia, an FR-44 form must be filed. This form requires drivers with a DUI conviction to purchase more than the state’s minimum coverage.”}},{“@type”:”Question”,”name”:”How do I know which high-risk insurer is right for me?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”Many high-risk providers are limited to select states. That might limit your options. When shopping for high-risk coverage, you should pay attention to two things: (1) How many complaints the insurance provider has received, (2) How strong the company is financially. An insurance providers financial strength is especially important because it indicates if they will be able to pay out claims.”}}]}

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Mar 15, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.