A Review of Top Comparison Sites for Your Auto Insurance Needs

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Apr 27, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Apr 27, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Online shopping is a vital part of purchasing an auto insurance policy.

It is recommended you compare rates from four to five different companies before deciding whom to get your policy from.

Before we begin, here are the key considerations and takeaways.

| Comparing Online Quotes - Key Considerations |

|---|

| Upon our analysis at AutoInsureSavings.org, we found the top sites to compare real-time insurance quotes: Insurify, The Zebra, and Compare.com. The best websites for estimated quotes are NerdWallet and Gabi.com. The top lead generation sites are ValuePenguin, MoneyGeek.com, and SmartFinancial. All websites have helpful articles and tips for users hoping to save money by switching to a new insurance provider. |

While many factors go into choosing the right company, most drivers will agree that the policy’s price is the most important consideration.

And no two drivers will ever receive the same car insurance quotes, even if they own the same type of car.

If you are looking for the most affordable rate or cheaper car insurance, you need to learn about the best comparison websites to help you find the right quote.

How do vehicle quote comparison sites work?

These websites allow you to easily compare quotes from top insurance companies from the comfort of your own home.

It doesn’t matter if you live in Florida, Hawaii, Michigan, or Virginia.

They can cut your research time in half, make sure you find the most affordable options, and offer personalized rates by allowing you to choose from the car insurance coverage options you need.

They provide you with a thorough side by side analysis of everything each company offers during the shopping experience.

To provide you with the most accurate car insurance rates, these websites will ask for specific details, including your occupation, your vehicle information, such as make, model, and year, your zip code, marital status, and some details about your driving history.

Other insurance cost details they may ask include.

| Additional details |

|---|

| --Amount of liability coverage. --Collision and comprehensive coverage deductibles. --If you need uninsured/underinsured motorist coverage, personal injury protection, or medical payments coverage. --Additional coverage add-ons such as roadside assistance. |

The results will be a detailed list of what each company’s rates are, along with information about their coverage options and discounts.

The Difference Between Lead Generation and Real-Time Quote Sites

There are two website types: online lead generation sites and those that compare car insurance quotes.

A lead generation website will sell your personal details, like your address and email, to their marketing partners, usually other insurance providers.

These websites are typically not created to give you the best quotes, and in most cases, they are not helpful when you want to compare auto insurance rates.

| Website | Real Quotes | Lead Generation | Insurance Company |

|---|---|---|---|

| Insurify.com | |||

| Compare.com | |||

| The Zebra | |||

| Policy Genius (Coverhound) | |||

| NerdWallet | |||

| Gabi | |||

| NetQuote | |||

| ValuePenguin | |||

| SmartFinancial | |||

| MoneyGeek | |||

| Progressive | |||

| Esurance |

Unless you are interested in receiving many calls and texts from various insurance companies, you should avoid lead generation sites.

Quote comparison sites allow users to look for rates based on the information they provide.

Some sites may request your current policy coverage limits and other data.

After the rates are given, the user can choose which quote they would like to pursue.

The data they submitted is transferred to a company or an agent, which shortens the time spent purchasing a car insurance policy.

Unlike lead generation websites, quote comparison sites do not sell your details to other companies or agents.

| Sells your personal details | |

|---|---|

| Lead Generation | Yes |

| Real Quotes | No |

| Insurance Company | No |

You can break these websites into more categories, such as estimated quote websites and those that offer real-time car insurance quotes.

Estimated quotes are usually not up to date.

To get reliable information about current insurance rates, you should visit a comparison site that offers real-time quotes for the Insurance industry.

Comparing the Top Car Insurance Quote Comparison Websites

When you are shopping for the best rates, are you searching for real and accurate quotes available at an affordable price?

Or perhaps you are more interested in receiving an estimate of the best price that could change as you dive deeper into buying insurance.

Three websites can provide you with real-time car insurance quotes.

These websites are Insurify, Compare.com, and The Zebra.

| Real-time accurate quotes | |

|---|---|

| Insurify | Yes |

| Compare.com | Yes |

| The Zebra | Yes |

They will provide you with the most accurate, up-to-date quotes from the leading companies, all without selling your information to advertisers.

Two more websites for you to consider are Gabi and NerdWallet.

These do not provide real-time online quotes, but you will get reliable estimates and quick access to quotes from leading car insurance providers.

| Reliable quote estimates | |

|---|---|

| Gabi | Yes |

| NerdWallet | Yes |

Some lead generation websites you may want to avoid visiting if you do not want your personal information sold include:

- DMV.org

- InsuranceQuotes.com

- NetQuote

- SmartFinancial

- ValuePenguin

Do Insurance Sites with Real-Time Quotes Exist?

The following websites offer real-time insurance quotes for car insurance shoppers with excellent customer satisfaction.

PolicyGenius

Image credit: PolicyGenius.com

Headquartered out of New York, PolicyGenius specializes in providing quotes for car insurance and life, homeowner’s, pet, renters, and disability insurance.

Their “bundling only” website has teamed up with CoverHound so users can compare and purchase auto insurance with their new quoting tool.

By visiting the website and clicking the “Get Quotes” button on the auto insurance home page, the site then scans for savings on the user’s current policy by comparing it to several other insurers.

You will receive results in around five minutes.

Before entering in any details, you are given a chance to bundle your car and homeowner’s insurance policies for additional savings, which is an added benefit for those who would like to compare different policies and save time.

Here are the results from PolicyGenuis for a 35-year-old female with fair credit and excellent driving history. She drives a 2020 Nissan Altima with minimum coverage.

| Insurance Company | Premium | Term |

|---|---|---|

| Farmers | $456 / $76 a month | 6 months |

| Geico | $474 / $79 a month | 6 months |

| Nationwide | $1,176/ $98 a month | 12 months |

| Liberty Mutual | $840 / $140 a month | 6 months |

| Mercury Insurance | $852 / $142 a month | 6 months |

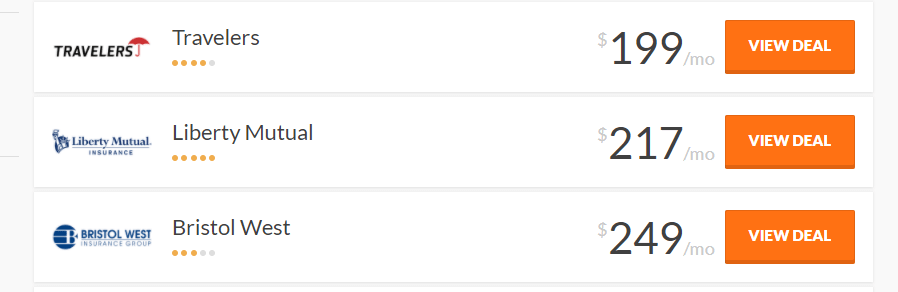

Insurify

Image credit: Insurify.com

Insurify, located in Massachusetts, provides real-time car insurance quotes from some top providers in the United States.

This free comparison website is top-ranking and highly recommended by those who have used it in the past.

The website has a simple user interface and provides quotes from a broad range of providers to help users find the cheapest car insurance.

Insurify has provided millions of quotes to motorists from companies such as Liberty Mutual, Nationwide, MetLife, and The General.

It has been featured in top publications such as The Wall Street Journal and CNET as one of the leading insurance comparison sites available.

When you visit the website, you will be asked several questions to help Insurify provide you with the most accurate, real-time results.

The questions are straightforward and easy to answer, and the process takes most users under five minutes to complete.

Here are the results for a 42-year-old male with excellent credit, good driving history, and driving a 2020 Honda Accord with full coverage.

| Results | Premium | Term |

|---|---|---|

| Travelers | $1,194 / $199 a month | 6 months |

| Liberty Mutual | $1,302 / $217 a month | 6 months |

| Geico | $2,628/ $219 a month | 12 months |

| Bristol West | $1,494 / $249 a month | 6 months |

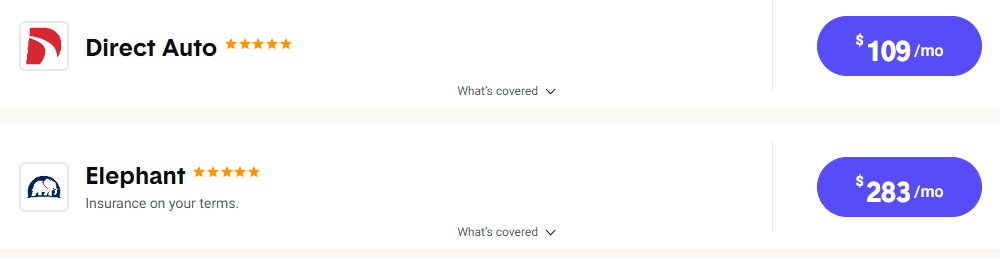

The Zebra

Image Credit: TheZebra.com

This website’s name refers to the founder’s effort to provide insurance services in “black and white.”

The Zebra is a free car insurance comparison site that includes a lot of helpful advice on finding the right policy at an affordable price.

The process for finding an accurate quote using their site is similar to other comparison sites.

It also offers the user the chance to connect their Facebook or Google account to help compare car insurance quotes even faster.

Users can receive as many as nine or more results from various car insurance providers. Having a variety of results allows users to consider more than just cheap car insurance rates, but auto policy coverage options provided as well.

Here are the results for a 20-year-old military member with poor credit and driving a 2020 Subaru Outback.

This comparison of rates included a $1,000 deductible for comprehensive and collision coverage.

| Results | Premium | Term |

|---|---|---|

| Direct Auto | $654 / $109 a month | 6 months |

| USAA | $906 / $151 a month | 6 months |

| Erie | $1,482/ $247 a month | 6 months |

| Elephant | $1,698 / $283 a month | 6 months |

What Are Websites with Estimated Quotes?

Some websites only offer estimated quotes instead of real-time information.

These sites use local data about drivers and policyholders to give reliable quotes from various insurance companies.

Here are two of the top comparison websites for auto insurance.

NerdWallet

NerdWallet is a helpful site that provides a multitude of information on all areas of personal finance.

They have quote comparison tools you can use for free to find the best rates for auto, life, and home insurance.

The website also features reviews of various insurance companies and many helpful tips on choosing your budget’s best rate.

To get a quote from NerdWallet, you will need to register an account. It is free to sign up.

There will be a disclaimer you will need to sign that allows the website to pull credit reports and share details about your credit score with their partners.

The website will ask you questions about your car, insurance, driving history, and deductible.

They may also ask you how much you currently pay for car insurance.

| NerdWallet.com Rating | |

|---|---|

| Shopper Approved | 4.4 / 5 |

| Trust Pilot | 1.6 / 5 |

Gabi

Gabi.com is a licensed insurance agency and services company located in California.

They claim to save their users hundreds of dollars on their car insurance premiums.

Users can link their current insurance to the account they made with Gabi.com or send in details of their current policy.

Using their technology and real-life advisors, Gabi finds users the best quote with all the information they gather.

The website allows users to compare as many as 20 insurance quotes from top-rated companies at one time.

| Gabi.com Rating | |

|---|---|

| Yelp | 4.0 / 5 |

| Trust Pilot | N/A |

What are lead generation insurance sites?

While it is often a good idea to avoid lead generation websites, the following sites offer valuable information on how to get the most affordable quotes.

If you are still having trouble finding a good deal for a new insurance policy, check out these websites for additional help.

NetQuote

This is a no-cost comparison tool that offers insurance agents leads from interested motorists.

Besides giving auto insurance quotes, this comparison tool also offers rates to those looking for health, renters, business, home, and life insurance.

NetQuote is a top-rated comparison site and is simple to use.

You only need to enter your zip code to get the process started, similar to many other comparison website processes.

| NetQuote.com Rating | |

|---|---|

| ConsumerAffairs | 1.3 / 5 |

ValuePenguin

ValuePenguin is a personal finance website that is similar to NerdWallet.

It has many helpful articles and tips for users hoping to save money by switching to a new insurance provider.

The website can also help visitors learn more about credit cards, investments, and banking with quoting tools, product reviews, and various analyses of current industry trends.

Once you type in your zip code, you are taken to a page with links to several auto insurers.

Instead of creating their own comparison tool, ValuePenguin instead sends the user directly to others.

If you are looking to save time, it would be best to skip ValuePenguin and go to a comparison website instead.

| ValuePenguin.com Rating | |

|---|---|

| SiteJabber | 1 / 5 (only one review) |

| TrustPilot | 0 / 5 no reviews |

| Glassdoor | 4.9 / 5 |

SmartFinancial

The SmartFinancial website states it can provide users with results from the top auto insurance companies in just three minutes.

Their comparison tool offers insurance quotes for home, health, life, and auto insurance policies.

The process does work quickly, and after the user is asked a few general questions, the site also requests your email address.

Before you receive your quote, you must agree to allow their advertising partners to get in touch with you.

| SmartFinancial.com Rating | |

|---|---|

| Yelp.com | 3.5 / 5 |

| ConsumerAffairs | No reviews |

| 4.2 / 5 |

MoneyGeek

MoneyGeek is another useful website for those looking for financial advice.

The site offers various tools and resources for anyone in need of guidance for loans, credit cards, and insurance.

You can get information on the best car insurance rates in every state or read up on an ultimate guide regarding coverage levels.

You only need to enter your zip code to begin.

You will be provided with results from the best companies with the most affordable rates in your local area.

| MoneyGeek.com Rating | |

|---|---|

| 5 / 5 |

Which car insurance companies have comparison platforms?

Many insurance companies offer comparison platforms allowing users to compare car insurance rates with their competitors while they shop for a new policy.

This is a great way to enforce trust with customers and increase transparency.

If these companies allow users to compare quotes with the competition, it shows consumers how serious they are about saving them money.

Progressive

Progressive is one of the the most popular car insurance companies in the country, thanks to their well-known advertising campaigns. They also benefit a lot from their rate comparison experience they provide to website visitors.

To find out if you can find a cheaper, non-Progressive rate from the provider, enter your zip code.

You will be taken to the Progressive Direct site to complete your quote.

The site will note how many people in your area have purchased a Progressive policy within the last 30 days.

After filling out the application, you are provided with a six-month quote.

Note: Unfortunately, not every user will be provided a quote that isn’t from Progressive, so if you want a broader search with more options from different companies, you should go with a comparison website instead.

Esurance

The Esurance website features its own insurance quote comparison page.

The company states they work with a partner company known as Answer Financial, to provide a list of comparison quotes from top insurers.

After entering your zip code, you are provided with an immediate list of quotes.

While there are no real-time quotes, Esurance shows users ads from several other companies such as Liberty Mutual, Geico, Allstate, and Progressive.

Frequently Asked Questions (FAQ)

Which insurance comparison sites are best?

Out of all the car insurance sites reviewed, Insurify is the best site among users.

It has a 4.8 out of 5 ratings with Shopper Approved.

The website helps secure thousands of dollars in savings for visitors from across the country daily.

Additional insurance sites to consider are The Zebra and Compare.com.

How many insurance quotes should I compare?

You should never rely on just one insurance quote from a single provider.

It is always best to compare four or five quotes from different companies.

It will offer you more accurate details and help guarantee you will save more on your monthly premium.

Most experts recommend comparing car insurance policies once a year or when your policy is up for renewal.

How do you find the best insurance quotes from multiple companies all at once?

Use either real-time insurance comparison websites or quote comparison tools.

Insurify, Compare.com, and The Zebra all offer real-time insurance quotes that show the latest savings you can receive from the industry’s top insurance providers.

What information do you need to compare insurance rates?

To get started with a quote comparison, all you need is your zip code.

To complete an application, you will need more information like your name and address, your car’s make and model, and your driving record.

Is insurance cheaper for homeowners?

Several insurance companies such as State Farm will offer discounts for policyholders who have more than one policy with them, such as car and homeowner’s insurance.

Adding on additional policies such as life insurance can sometimes help you save even more.

To learn more about which car insurance comparison website is the best, contact the experts at AutoInsureSavings.org.

Our licensed professionals will be happy to answer any questions you have.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kristen Gryglik

Licensed Insurance Agent

Kristen is a licensed insurance agent working in the greater Boston area. She has over 20 years of experience counseling individuals and businesses on which insurance policies best fit their needs and budgets. She knows everyone has their own unique needs and circumstances, and she is passionate about counseling others on which policy is right for them. Licensed in Massachusetts, New Hampshire,...

Licensed Insurance Agent

UPDATED: Apr 27, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.