Post

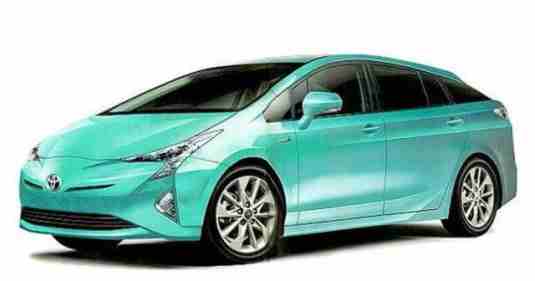

PostHow much does Toyota auto insurance cost?

Auto insurance is an essential aspect of owning a vehicle, providing financial protection against unexpected events such as accidents, theft, and damage. Toyota auto insurance costs can vary widely depending on several factors, including the driver’s age, driving experience, location, and the model and age of the Toyota vehicle. In this article, we will explore...

Auto insurance is an essential aspect of owning a vehicle, p...