Nebraska Cheapest Car Insurance & Best Coverage Options

The Nebraska cheapest car insurance and best coverage options are at State Farm and Farmers Mutual of Nebraska. State Farm has the cheapest minimum coverage, averaging just $28 per month. Nebraska drivers who prefer full coverage will find the cheapest rates at Farmers for an average of $114 per month.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

UPDATED: Feb 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Feb 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

- State Farm’s minimum Nebraska rates average $28 per month

- Farmers Mutual of Nebraska’s full coverage averages $114 per month

- Full coverage is the best financial protection for Nebraska drivers

The best auto insurance companies for Nebraska cheapest car insurance and best coverage options are State Farm and Farmers. However, what you will pay depends partly on your coverage choices, driving record, and more, which we go over in more detail. Continue reading to find out how to get cheap auto insurance in Nebraska.

To get Nebraska auto insurance quotes right away, enter your ZIP code in our free quote comparison tool.

Affordable Nebraska Car Insurance Rates

The best way drivers in Nebraska can save more on car insurance premiums is by comparing quotes by zip code from multiple insurers with the lowest rates from our insurance study.

| Cheapest Car Insurance in Nebraska - Key Takeaways |

|---|

The cheapest Nebraska car insurance options are: The cheapest Nebraska car insurance options are:Cheapest for minimum coverage: State Farm Cheapest for full coverage: Farmers Mutual of Nebraska Cheapest after an at-fault accident: State Farm Cheapest after a speeding ticket: American Family Cheapest after a DUI: Farmers Mutual Cheapest for poor credit history: Nationwide Cheapest for young drivers: American Family For younger drivers with a speeding violation: Farm Bureau For younger drivers with an at-fault accident: State Farm |

Check out this useful guide on Nebraska auto insurance to help you find the best rates and get more details on the average rates from leading insurance providers for various age groups.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Nebraska for Minimum Coverage

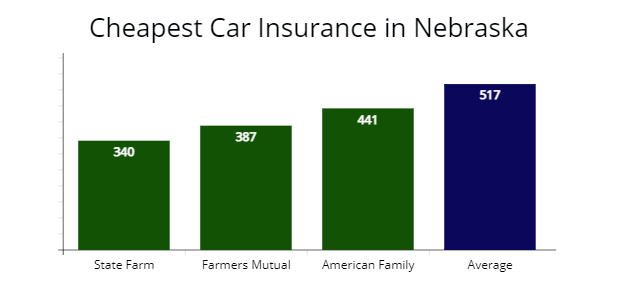

Our agents found that State Farm has the most affordable annual rates for drivers in Nebraska, with a $340 per year quote for minimum coverage for our sample 30-year-old male driver.

The average Nebraska rate for minimum liability insurance policies is $517 per year, and State Farm’s rate is $177 cheaper or 34% less expensive (learn more: Understanding Liability Auto Insurance).

| Company | Average annual rate |

|---|---|

| State Farm | $340 |

| USAA | $347 |

| Farmer Mutual of Nebraska | $387 |

| American Family | $441 |

| Geico | $468 |

| Progressive | $490 |

| Nationwide | $514 |

| Allstate | $528 |

| Farmers | $618 |

*USAA is for qualified military members, their spouses, and direct family members. Your rates may be different based on the driver’s profile.

Drivers in Nebraska who only want a minimum coverage policy can drive legally for less by switching to one of the cheapest insurance companies illustrated above.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Cheapest Full Coverage Car Insurance in Nebraska

Farmers Mutual of Nebraska offers the cheapest insurance option for those with good driving records in Nebraska with a quote at $1,365 per year or $113 per month for affordable full coverage rates (learn more: Understanding Full Coverage Car Insurance). Farmer Mutual’s rate is 28% less expensive than Nebraska’s average rates of $1,887 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Farmers Mutual of Nebraska | $1,365 | $113 |

| State Farm | $1,429 | $119 |

| American Family | $1,588 | $132 |

| Nebraska average | $1,887 | $157 |

The average cost of full coverage in Nebraska is $113 per month or $1,887 annually. Full coverage insurance, which includes comprehensive and collision coverage, reimburses you for property damage to your vehicle no matter who is at fault.

Learn more:

- Understanding Collision Car Insurance Coverage: What You Need to Know

- Understanding Comprehensive Car Insurance Coverage: What You Need to Know

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

AutoInsureSavings.org licensed agents suggest drivers in the Cornhusker State who own a newer vehicle or are worth more than $3,000 should consider a full coverage insurance policy to guarantee they won’t pay out of pocket if an auto accident occurs that leaves their car totaled.

The cheapest insurance with a speeding ticket in Nebraska?

Nebraska’s drivers can find the cheapest insurance with a speeding ticket on driving records with American Family (AmFam), which has average annual premium costs of $1,588 per year. We found American Family’s rate is 27% cheaper than Nebraska’s mean speeding violation rate of $2,167 per year. Take a look at the rates below to see how a traffic ticket can impact your car insurance rates in Nebraska.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| American Family | $1,588 | $132 |

| State Farm | $1,632 | $136 |

| Geico | $1,731 | $144 |

| Nebraska average | $2,167 | $180 |

According to the Insurance Information Institute (III.org), drivers in Nebraska can expect their car insurance rates to increase by an average of 25% after receiving a traffic violation. The rate increase depends on how fast you were going and how many speeding tickets you already have on your driving record in Nebraska.

The cheapest insurance in Nebraska with a car accident?

Drivers in Nebraska with an at-fault accident on driving records can still save on their car insurance rates with State Farm, which offers a $145 monthly rate or 32% cheaper than Nebraska’s average rates.

Learn more: 5 Tips to Get Cheap Car Insurance After an Accident

We suggest comparing auto insurance quotes with American Family to get the best price, which provided us a $162 monthly rate for drivers with an at-fault accident.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $1,742 | $145 |

| American Family | $1,951 | $162 |

| Geico | $2,160 | $180 |

| Nebraska average | $2,563 | $213 |

Will car insurance rates increase after an accident? Just one at-fault accident on your record in Nebraska can significantly increase your car insurance premium. Our research found that the difference between average auto insurance premiums for a driver with a good driving record and a driver with one accident is $766 per year.

The cheapest insurance coverage in Nebraska with a DUI?

According to our rate analysis, Farmers Mutual of Nebraska offers the cheapest insurance rates for Nebraska drivers with a DUI with a $1,834 per year rate or $152 per month.

Farmers Mutual’s rate is 37% less expensive than Nebraska’s average insurance premium for drivers with a DUI in their driving history.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Farmers Mutual | $1,834 | $152 |

| State Farm | $1,940 | $161 |

| Progressive | $2,361 | $196 |

| Nebraska average | $2,894 | $241 |

A DUI is a severe offense that can cause numerous consequences for a Nebraska policyholder. Along with a rate increase of 35%, the driver could also have a six-month driver’s license suspension with an ignition interlock device (IID) installed in their motor vehicle plus a $500 fine.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

The Nebraska Department of Insurance recommends taking a defensive driving course to lower insurance costs.

Cheapest car insurance with poor credit in Nebraska?

Drivers with a poor credit score in Nebraska can find the best and cheap auto insurance with Nationwide, which provided our agents a $1,982 per year rate for full coverage car insurance. Nationwide’s rate is 26% lower than average rates for 30-year-old drivers.

The next cheapest insurance options are Geico and Allstate for drivers in Nebraska with a poor credit score if you shop around. Both auto insurers are more than 13% lower than average rates.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Nationwide | $1,982 | $165 |

| Geico | $2,064 | $172 |

| Allstate | $2,351 | $195 |

| Nebraska average | $2,648 | $220 |

Your credit history in Nebraska can have an impact on how much you pay for car insurance. Credit scores are among the many factors that car insurance companies consider when providing you with a quote. It is found that drivers who have poor credit pay 65% more for insurance, file more claims, and be involved in more accidents than drivers who have good credit.

Cheapest car insurance coverage in Nebraska for young drivers?

During our comparison analysis, young Nebraska drivers or college students can get the cheapest insurance with American Family, which provided us a $2,713 per year rate for full coverage insurance.

Young or teen drivers who need minimum coverage should compare quotes with American Family, State Farm, and Farmers Mutual of Nebraska, as these companies provide the best car insurance for new drivers.

American Family offers the cheapest minimum liability coverage rate at $1,065 per year for adolescent drivers, while State Farm is $1,088 per year, and Farmers Mutual’s insurance rate is $1,114 per year.

All three car insurers are 28% cheaper than Nebraska’s state minimum liability rate for younger drivers.

| Insurer | Full coverage | Minimum coverage |

|---|---|---|

| USAA | $2,713 | $987 |

| American Family | $3,154 | $1,065 |

| State Farm | $3,289 | $1,088 |

| Farmers Mutual of Nebraska | $3,419 | $1,114 |

| Geico | $3,675 | $1,276 |

| Allstate | $4,275 | $1,202 |

| Nationwide | $4,862 | $1,639 |

| Progressive | $5,660 | $2,184 |

| Farmers | $6,037 | $2,462 |

| Nebraska average | $4,837 | $1,547 |

*USAA is for qualified military members, their spouses, and direct family members. Your rates may be different based on the driver’s profile.

Young or teen drivers requiring coverage in Nebraska will pay more 55% more for their car insurance premium regardless of what company they choose.

According to the National Highway Traffic Safety Administration (NHTSA), drivers in a younger age group are at a higher risk than older and more experienced drivers.

Our licensed agents recommend a teen driver go on their parent’s full coverage policy or have an adult family member as a primary policyholder to save money.

The cheapest car insurance for young drivers with speeding tickets?

Young Nebraska drivers with traffic tickets should look to Farm Bureau to get the best auto insurance rates. The average car insurance cost from Farm Bureau is $3,350 per year for full coverage.

Farm Bureau’s speeding ticket rate is 37% cheaper than the $5,254 average rates in Nebraska for younger drivers.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Farm Bureau | $3,350 | $279 |

| State Farm | $3,613 | $301 |

| Nationwide | $4,862 | $405 |

| Nebraska average | $5,254 | $437 |

Learn more: How much will my auto insurance go up with a speeding ticket?

The cheapest insurance for young drivers in Nebraska with a car accident?

The cheapest insurance coverage for younger drivers with an accident in Nebraska is State Farm, which provided our agents a $288 monthly rate for full coverage or $192 per month less than Nebraska’s average rates at $480 per month.

The next cheapest option is American Family, with a $328 monthly car insurance rate or 32% less expensive than Nebraska’s average auto insurance quotes.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $3,754 | $288 |

| American Family | $3,940 | $328 |

| Nationwide | $4,862 | $405 |

| Nebraska average | $5,760 | $480 |

Best Car Insurance Companies in Nebraska

AutoInsureSavings.org licensed agents found the Geico Nationwide and American Family insurance companies offer some of the most affordable rates with excellent customer satisfaction and good financial strength to various Nebraska drivers.

ValuePenguin surveyed with similar insurance company results:

| Company | % respondents extremely satisfied with recent claim | % respondents rated customer service as excellent |

|---|---|---|

| American Family (AmFam) | 86% | 50% |

| Geico | 80% | 53% |

| USAA | 78% | 62% |

| Nationwide | 78% | 53% |

| Farm Bureau | 77% | 60% |

| Progressive | 74% | 34% |

| State Farm | 73% | 46% |

| Allstate | 72% | 47% |

| Farmers Insurance | 71% | 38% |

If you are in the market for a new auto insurance policy and are only concerned about the price, these three auto insurance companies in Nebraska offer some of the state’s best auto insurance rates.

We also used data from the National Association of Insurance Commissioners (NAIC), J.D. Power’s claims satisfaction survey, and each car insurance company’s financial strength ratings from A.M. Best.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

NAIC complaint ratio looks at the number of complaints of the best car insurance company based on market share.

The lower the complaint ratio, the better. It is an indication of the quality of the car insurance carrier’s customer service and claims satisfaction.

| Insurer | NAIC Complaint Index | J.D. Power claims satisfaction score | AM Best Financial Strength Rating |

|---|---|---|---|

| Nationwide | 0.41 | 876 | A+ |

| Farm Bureau | 0.43 | n/a | A |

| American Family | 0.45 | 862 | A |

| Farmers | 0.45 | 872 | A |

| Allstate | 0.63 | 876 | A+ |

| State Farm | 0.66 | 881 | A++ |

| USAA | 0.68 | 890 | A++ |

| Progressive | 0.82 | 856 | A+ |

In this instance, the car insurance carrier who rated the best based on a low amount of complaints is Nationwide with 0.41, which is lower than the national average of 1.00. USAA has the best J.D. Power claims satisfaction score at 890 out of 1,000.

When you have more information about what each car insurance provider has to provide you with, it will be easier for you to narrow down your choices and make an informed decision on the best auto insurance company in Nebraska is the best option for you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Average Car Insurance Costs by City in Nebraska

Your zip code in Nebraska is a significant factor in your average auto insurance rates, along with driver profiles, including driving record, marital status, type of motor vehicle, and coverage levels.

Typically, densely populated areas, high crime areas, or poor road conditions tend to have expensive auto insurance rates, as the likelihood of a driver filing a claim in these areas is higher.Daniel Walker Licensed Insurance Agent

AutoInsureSavings.org car insurance experts did a study on the most populous Nebraska cities.

Cheapest auto insurance in Omaha, NE?

Omaha’s drivers can find the cheapest insurance with State Farm who provided our agents a $1,424 per year rate for our 30-year-old driver. Their quote for cheap car insurance in Omaha is 30% less expensive than Omaha’s average rates.

| Omaha Company | Average Premium |

|---|---|

| State Farm | $1,424 |

| Geico | $1,568 |

| Progressive | $1,641 |

| Omaha average | $2,032 |

The cheapest auto insurance in Lincoln, NE?

Drivers in Lincoln can find the best cheap car insurance in Lincoln with Geico, which provided us a quote at $1,327 per year or $110 per month for a full coverage insurance policy. Geico’s rate is 32% cheaper than Lincoln’s yearly insurance rate of $1,943 per year.

| Lincoln Company | Average Premium |

|---|---|

| Geico | $1,327 |

| Farm Bureau | $1,478 |

| AmFam | $1,490 |

| Lincoln average | $1,943 |

The cheapest auto insurance in Bellevue, NE?

Our licensed agents found AmFam is the cheapest insurance company in Bellevue, NE. They provided us a $1,047 annual rate for full coverage, 40% less expensive than Bellevue’s yearly average rate of $1,744.

| Bellevue Company | Average Premium |

|---|---|

| AmFam | $1,047 |

| Farm Bureau | $1,233 |

| Geico | $1,471 |

| Bellevue average | $1,744 |

The cheapest auto insurance in Grand Island, NE?

Our research found the cheapest insurance in Grand Island is with Geico, which provided AutoInsureSavings agents a $1,029 per year quote for $100,000 in liability coverage with comprehensive and collision coverage $500 deductibles for 30-year-old drivers in Grand Island.

| Grand Island Company | Average Premium |

|---|---|

| Geico | $1,029 |

| Farm Bureau | $1,256 |

| Farmers Mutual | $1,361 |

| Grand Island average | $1,654 |

The cheapest auto insurance in Fremont, NE?

People in Fremont can find cheap auto coverage with Farmers Mutual of Nebraska, which provided our agents an insurance rate of $1,156 per year for a 30-year-old with full coverage.

| Fremont Company | Average Premium |

|---|---|

| Farmers Mutual | $1,146 |

| Geico | $1,383 |

| Liberty Mutual | $1,410 |

| Fremont average | $1,703 |

The cheapest auto insurance in Norfolk, NE?

Norfolk’s drivers can find the best full coverage insurance policy with Geico, which provided our agents a $1,088 per year rate or $131 per month for $100,000 in liability insurance with collision and comprehensive $500 deductibles. Geico’s quote is 34% cheaper than average rates for 30-year-old drivers in Norfolk, NE.

| Norfolk Company | Average Premium |

|---|---|

| Geico | $1,088 |

| Farm Bureau | $1,216 |

| Liberty Mutual | $1,352 |

| Norfolk average | $1,647 |

The cheapest auto insurance in Columbus, NE?

Drivers in Columbus can find affordable auto insurance coverage with AmFam, which provided AutoInsureSavings agents a $1,031 per year quote for full coverage. AmFam’s car insurance quote is 34% cheaper than Columbus’s average rates.

| Columbus Company | Average Premium |

|---|---|

| AmFam | $1,031 |

| Farm Bureau | $1,090 |

| Geico | $1,246 |

| Columbus average | $1,555 |

Average Insurance Cost for All Cities in Nebraska

| City | Annual Premium Cost | City | Annual Premium Cost |

|---|---|---|---|

| Omaha | $2,032 | Neligh | $1,510 |

| Lincoln | $1,943 | Sutherland | $1,540 |

| Bellevue | $1,744 | Woodland Park | $1,555 |

| Grand Island | $1,654 | Oakland | $1,575 |

| Kearney | $1,716 | Wakefield | $1,674 |

| Fremont | $1,703 | Wymore | $1,584 |

| Hastings | $1,510 | Arlington | $1,590 |

| Norfolk | $1,647 | Sutton | $1,533 |

| North Platte | $1,624 | Albion | $1,604 |

| Columbus | $1,555 | Springfield | $1,510 |

| Papillion | $1,631 | Atkinson | $1,567 |

| La Vista | $1,567 | Fullerton | $1,622 |

| Scottsbluff | $1,608 | Ravenna | $1,640 |

| South Sioux City | $1,617 | Wood River | $1,656 |

| Beatrice | $1,661 | Plainview | $1,555 |

| Chalco | $1,604 | Grant | $1,636 |

| Lexington | $1,510 | North Bend | $1,584 |

| Gering | $1,555 | Arapahoe | $1,590 |

| Alliance | $1,622 | Alma | $1,510 |

| York | $1,636 | Wisner | $1,567 |

| Blair | $1,533 | Burwell | $1,622 |

| McCook | $1,661 | Ceresco | $1,675 |

| Ralston | $1,670 | Creighton | $1,604 |

| Nebraska City | $1,690 | Battle Creek | $1,661 |

| Seward | $1,584 | Pender | $1,555 |

| Crete | $1,604 | Terrytown | $1,636 |

| Sidney | $1,510 | Louisville | $1,668 |

| Plattsmouth | $1,670 | Friend | $1,680 |

| Schuyler | $1,555 | Cambridge | $1,510 |

| Chadron | $1,590 | Elm Creek | $1,533 |

| Wayne | $1,622 | Crawford | $1,584 |

| Holdrege | $1,668 | Kenesaw | $1,555 |

| Offutt Air Force Base | $1,510 | Laurel | $1,622 |

| Gretna | $1,636 | Shelton | $1,672 |

| Ogallala | $1,555 | Tilden | $1,661 |

| Wahoo | $1,584 | Bennet | $1,510 |

| Aurora | $1,661 | Red Cloud | $1,567 |

| Falls City | $1,567 | Harvard | $1,555 |

| Waverly | $1,668 | Stromsburg | $1,587 |

| Cozad | $1,587 | Pawnee City | $1,604 |

| Fairbury | $1,611 | Bayard | $1,636 |

| O'Neill | $1,533 | Genoa | $1,590 |

| Broken Bow | $1,510 | Franklin | $1,587 |

| Gothenburg | $1,622 | Randolph | $1,670 |

| Auburn | $1,661 | Henderson | $1,510 |

| West Point | $1,555 | Yutan | $1,612 |

| Central City | $1,571 | Macy | $1,622 |

| David City | $1,636 | Blue Hill | $1,555 |

| Minden | $1,681 | Benkelman | $1,567 |

| Valley | $1,683 | Loup City | $1,661 |

| Valentine | $1,587 | Waterloo | $1,668 |

| Kimball | $1,614 | Doniphan | $1,533 |

| Madison | $1,590 | Osceola | $1,636 |

| Ashland | $1,510 | Utica | $1,587 |

| Hickman | $1,555 | Cairo | $1,510 |

| Milford | $1,659 | Ponca | $1,668 |

| St. Paul | $1,510 | Weeping Water | $1,675 |

| Ord | $1,622 | Hemingford | $1,555 |

| Gibbon | $1,636 | Peru | $1,677 |

| Syracuse | $1,567 | Emerson | $1,616 |

| Geneva | $1,668 | Eagle | $1,655 |

| Dakota City | $1,659 | Humphrey | $1,622 |

| Pierce | $1,587 | Minatare | $1,510 |

| Imperial | $1,618 | Bloomfield | $1,590 |

| Superior | $1,533 | Fort Calhoun | $1,570 |

| Bennington | $1,590 | Osmond | $1,656 |

| Wilber | $1,555 | Chappell | $1,587 |

| Tekamah | $1,616 | Crofton | $1,555 |

| Mitchell | $1,651 | Boys Town | $1,636 |

| Gordon | $1,510 | Humboldt | $1,590 |

| Ainsworth | $1,629 | Oshkosh | $1,624 |

| Bridgeport | $1,569 | Elwood | $1,510 |

| Tecumseh | $1,587 | Axtell | $1,533 |

| Hartington | $1,555 | Deshler | $1,623 |

| Stanton | $1,533 | Curtis | $1,567 |

| Hebron | $1,512 | Rushville | $1,522 |

What are the minimum car insurance requirements in Nebraska?

For financial responsibility, Nebraska state laws require all car insurance policies to have bodily injury liability, property damage liability coverage, uninsured motorist, and underinsured motorist coverage with the following liability limits:

| Liability insurance | Minimum coverage |

|---|---|

| Bodily injury liability coverage | $25,000 per person / $50,000 per accident |

| Property damage liability coverage | $25,000 per accident |

| Uninsured / Underinsured motorist bodily injury | $25,000 per person / $50,000 per accident |

Our agents recommend full coverage insurance with higher liability limits for most drivers in Nebraska with a clean driving record, including comprehensive and collision coverage with $500 or lower deductibles.

To learn more about the most affordable car insurance options in Nebraska, enter your zip code or get expert advice at AutoInsureSavings.org. Our licensed car insurance professionals will be happy to answer any questions you have.

Methodology

AutoInsureSavings.org comparison shopping study used a full-coverage auto policy for a 30-year-old driving a 2018 Honda Accord with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person / $100,000 per accident |

| Property damage liability | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured / underinsured motorist bodily injury | $50,000 per person / $100,000 per accident |

| Comprehensive and collision coverage | $500 deductible |

We used rates for drivers with an accident history, credit score, and marital status for other Nebraska rate analyses. We used car insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your auto insurance rates may vary when you get quotes.

Nebraska’s residents may experience wind and snowfall damage to their vehicles. Nebraskans may want to add comprehensive coverage to their vehicle to protect it from these natural disasters.

Cheap car insurance in Nebraska will depend on many factors, including your driving history and credit rating.

Sources

– National Highway Traffic Safety Administration (NHTSA). “Traffic Safety Facts.”

– National Association of Insurance Commissioners. “Market Share Reports for Property/Casualty Groups and Insurance Companies.”

– Nebraska Department of Motor Vehicles. “Car Insurance Requirements.”

– Nebraska Department of Insurance. “Insurance Credit Scoring.”

Frequently Asked Questions

Who has the cheapest car insurance coverage in Nebraska?

State Farm offers the most affordable insurance rates to various Nebraska drivers at $340 per year for minimum coverage. USAA is cheap coverage ($347 per year). However, if you are not eligible for their coverage, your next best options for low-priced car insurance are Farmers Mutual of Nebraska ($387 per year) and American Family ($441 per year).

To find out who offers affordable car insurance in Nebraska, you want to make sure to compare rates by getting quotes from top car insurance companies.

How much is the minimum car insurance coverage in Nebraska per month?

The average cost of state minimum car insurance in Nebraska is $517 annually or $43 per month. State Farm’s average rate for minimum coverage is $340 per year or $28 per month. Farmers Mutual of Nebraska ($387 per year) and American Family ($441 per year) are also below the state’s average rates.

How much is full coverage car insurance in Nebraska?

The average cost of full coverage auto insurance in Nebraska is $157 per month or $1,887 per year. Farmers Mutual of Nebraska ($1,365 per year), State Farm ($1,429 per year), and American Family ($1,588 per year) offer full coverage insurance at an average rate lower than the state’s average by 16%.

Full coverage auto insurance costs significantly more than minimum liability insurance, and for that reason, many drivers will choose an auto policy with less coverage to save money. If you have a newer vehicle or are concerned about minimum coverage not providing you with enough protection, you should consider full coverage insurance.

How can I save on Nebraska car insurance?

There are several ways you can save money on your insurance premium costs in Nebraska. Initially, it would be best to compare quotes from multiple providers to determine which car insurance carrier in the area offers the lowest rates for you. After that, you should inquire about a money-saving driver discount provided by each insurance provider you have in mind.

The more car insurance discounts you are eligible for, the more money you can save. Taking time to make sure you have an appropriate coverage level, pay your credit cards and bills on time, and practicing safe driving habits are three more things you can do that will help you save on your Nebraska car insurance rates.

What is the best Nebraska car insurance?

Full coverage in Nebraska provides the best protection to Nebraska drivers.

Is it illegal to drive without insurance in Nebraska?

Yes, all Nebraska drivers need to carry the minimum coverage required by Nebraska auto insurance laws.

Is Nebraska a no-fault state?

Nebraska is an at-fault car insurance state.

What happens if you get pulled over without insurance in Nebraska?

You could face license suspensions, fines, and even jail time. If you don’t have insurance, get Nebraska car insurance quotes to find coverage you can afford and insure yourself right away.

What is the minimum car insurance in Nebraska?

Drivers must carry liability insurance and uninsured motorist insurance to drive.

Is Nebraska a PIP state?

Nebraska does not require drivers to have PIP auto insurance in Nebraska.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

UPDATED: Feb 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.