5 Tips to Get Cheap Car Insurance after an Accident

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

As if the minutes, hours, and days following a major accident aren’t bad enough, there’s a real possibility that you’ll be subjected to more disheartening news when it comes time to renew your car insurance policy.

As if the minutes, hours, and days following a major accident aren’t bad enough, there’s a real possibility that you’ll be subjected to more disheartening news when it comes time to renew your car insurance policy.

Your auto insurance company may use your accident as an excuse to label you as a high-risk driver, regardless of who was determined to be at fault. Depending on your accident history you may be able to challenge your insurance provider’s decision and maintain the same low rate auto policy that you paid prior to renewal. If you were not determined to be at fault, then you’ll have a good chance of winning such a case.

If the accident was, in fact, considered to be your fault, you’ll probably have little to no chance of convincing your insurance provider to keep your insurance premiums where they were. However, there are still some things that you can do to ensure that you still get cheap car insurance after an accident.

By taking advantage of the advice provided in these three tips, you’ll be able to keep your auto insurance rates low, no matter who was at fault.

1) Eliminate comprehensive coverage for the time being

One of the easiest ways to ensure that you still have cheap car insurance after an accident is to drop comprehensive coverage from your policy. While taking such an action could make you slightly more vulnerable, it will help reduce your monthly premium to the lowest rate that you’re looking to get.

Although you will have cut out the comprehensive coverage from your existing auto insurance policy, for the time being, you can always re-add it later after you’ve got at least 6-12 months without another accident or driving infraction.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

2) Make adjustments to your coverage

Eliminating comprehensive coverage is not the only option you have to keep your car insurance rates down after an accident. By making additional adjustments to your coverage levels, you could see your annual premium drop even further. By changing the following coverage limits, you’ll be able to put a nice dent in the amount you’re required to pay each month:

-

Deductible

By raising your deductible from $250 to $500, or $500 to $1000, you’ll be able to cut your rates.

-

Bodily injury liability

By reducing the amount of bodily injury liability coverage you should see a nice drop as well.

Bodily injury coverage pays medical expenses for you and your passengers.

-

Property damage liability

Much like bodily injury liability, a reduction in property damage liability will help you save on your auto insurance premium.

Before making any adjustments to your coverage, it is best that you weigh the pros and cons of each. While saving with cheap car insurance may seem enticing, you’ll first want to make sure that you still have adequate insurance coverage for your basic needs.

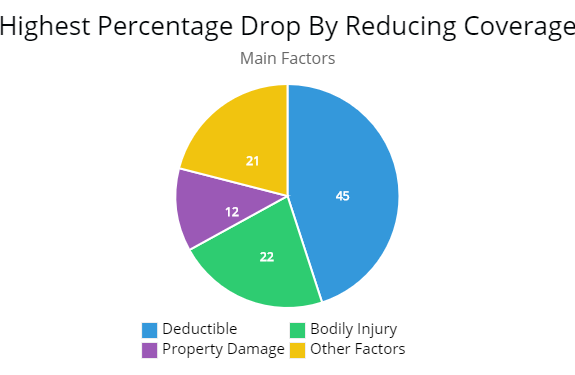

Graph – Main factors to affordable auto insurance after a car accident

Note 1: After an accident your insurance rates can skyrocket. One of the best ways to mitigate the increase in rates is to raise your deductible as indicated by the graph.

*Other Factors would include any available discounts or shopping for lower insurance rates.

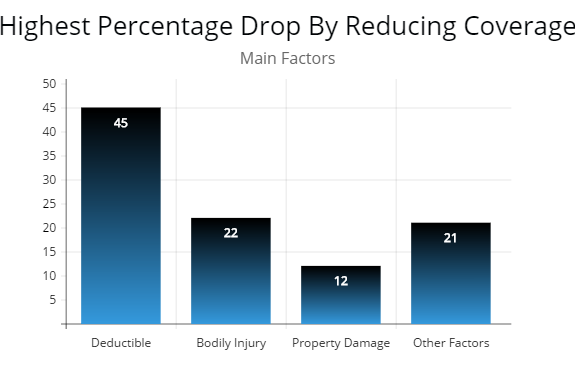

Graph 2

This second illustration gives you more of an idea of how much you can lower your rates simply by raising your deductible. However, you take on more risk. It is better to have insurance with a higher deductible than no insurance at all.

*Other Factors would include any available discounts or shopping for lower insurance rates.

3) Don’t report the accident

While this option won’t help you if you had an accident months earlier, it is definitely something you may want to consider in the future. Before you go and call the insurance company to report a minor accident, it might be in your best interest to first get an estimate on the damages from a trusted local auto body shop.

If the vehicle damage is only a few hundred dollars more than your deductible, then it may not be worth filing an accident claim. After all, the amount you’d pay due to the increase in your car insurance would probably surpass the amount you would have paid if you just came out of pocket.

Obviously, this won’t be an option if your car was totaled, but it is often the best thing to do with fairly minor accidents.

States with the highest average premium increase after an accident

Click on any link for Minimum State Coverage

| State | Percentage Increase | Avg. Yearly Premium |

|---|---|---|

| California | 85% | $1,962 |

| Massachusetts | 82% | $1,604 |

| New Jersey | 76% | $1,905 |

| Minnesota | 62% | $1,360 |

| Florida | 61% | $1,830 |

| Washington | 56% | $1,499 |

| Texas | 53% | $1,620 |

| North Carolina | 52% | $1,060 |

Note: Every driver is a case by case with their insurance company. Your premium may or may not rise after an accident.

States with the lowest average premium rate hike

Click on any link for Minimum State Coverage

| State | Percentage Increase | Avg Yearly Premium |

|---|---|---|

| Michigan | 19% | $2,551 |

| Maryland | 22% | $1,810 |

| Montana | 24% | $2,013 |

| Idaho | 26% | $1,053 |

| Oklahoma | 31% | $1,568 |

| Mississippi | 36% | $1,385 |

| Wyoming | 37% | $1,541 |

4) Maximize driver discounts

There are tens, if not hundreds of possible driver discounts offered by most car insurance companies. If you have not yet taken advantage of the insurance discounts available to you, then now is as good a time as any. Contact your insurance company and find out what kind of discounts you may qualify for with your current policy.

Some of the more common discounts include multi-car discounts and good student discounts, be sure to consider the discounts that each company on your shortlist offers and figure the discount into the rate payments.

Depending on your situation, you may receive a discount for any of the following reasons:

-

Employment at a company that has an agreement with your car insurance provider

-

Membership in an organization that has an agreement with your car insurance provider

-

Taking a defensive-driving course following your accident

To find out what discount options are available to you, contact your auto insurance provider. Even if discounted car insurance is not immediately available after an accident, you may still qualify for rate reductions in the future.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

5) Shop around

Even if your car insurance provider offers you some options to get cheap car insurance after an accident, you should still consider what other coverage options are out there. Shopping around for an auto insurance discount could help cut your monthly premium by as much as 20% or more while allowing you to maintain your current auto coverage.

Here at AutoInsureSavings, we make it easy to compare car insurance quotes. When you enter your zip code in our quote comparison tool at the top of the page, and then honestly answer a few quick questions, you’ll be provided with quotes from the leading auto insurance companies in your local area. That means you’ll be able to see which provider is offering you the cheapest car insurance after your accident.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.