New Mexico Cheapest Car Insurance & Best Coverage Options

New Mexico drivers looking for the best New Mexico cheapest car insurance and best coverage options should shop at Safeco Insurance and State Farm. Safeco Insurance's minimum coverage rates in New Mexico are only $32 per month, and State Farm's New Mexico full coverage rates are only $86 per month.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Jan 10, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jan 10, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

- Safeco Insurance has the cheapest minimum coverage in New Mexico

- State Farm has the cheapest full coverage in New Mexico

- Full coverage from State Farm provides the best protection

State Farm and Safeco Insurance have the best New Mexico cheapest car insurance and best coverage options, with rates well below the state average. To find out more about the best auto insurance companies in New Mexico and what you can do to save on auto insurance, read on.

To get started on finding cheap New Mexico car insurance right away, enter your ZIP code in our free quote tool to quickly get New Mexico auto insurance quotes.

Affordable New Mexico Car Insurance Rates

New Mexico insurance shoppers should compare quotes with the same coverage levels with at least three auto insurance companies to find the best rate and save more on their premiums.

| Cheapest Car Insurance in New Mexico - Quick Hits |

|---|

The cheapest New Mexico car insurance options are: The cheapest New Mexico car insurance options are:Cheapest for minimum coverage: Safeco Insurance Cheapest for full coverage: State Farm Cheapest after an at-fault accident: State Farm Cheapest after a speeding ticket: Progressive Cheapest after a DUI: Progressive Cheapest for poor credit history: Geico Cheapest for young drivers: Farm Bureau Financial For young drivers with a speeding violation: Farm Bureau Financial For young drivers with an at-fault accident: Liberty Mutual |

Enter your Zip Code or use this practical New Mexico cheapest auto insurance guide which is the best way to find top car insurance providers in your area regardless of your driving type.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in New Mexico for Minimum Coverage

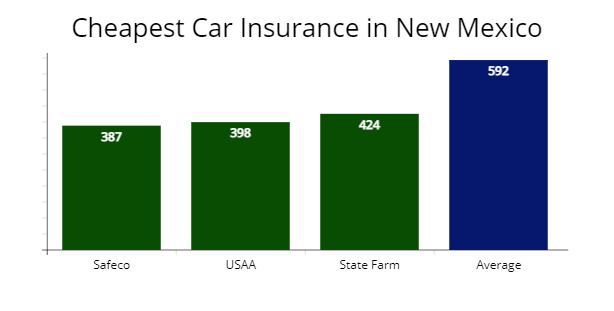

Safeco Insurance offers the lowest minimum coverage rates for New Mexico drivers with a clean driving record, which provided us a $387 annual rate or $205 cheaper than the $592 average quote for our 30-year-old driver.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Suppose you are a military member or a family member of a service member. In that case, your best rates are with USAA, which offered our agents a $398 annual quote or $33 per month for minimum liability coverage (learn more: A Review of USAA Car Insurance, Policy Options & Military Benefits).

| Insurer | Average annual rate |

|---|---|

| Safeco | $387 |

| USAA | $398 |

| State Farm | $424 |

| Progressive | $547 |

| Geico | $611 |

| Allstate | $620 |

| Farmers | $644 |

| Allied | $702 |

*USAA is for qualified military members, their spouses, and direct family members. Your insurance rates may vary based on the driver’s profile.

Uninsured drivers often need to find the lowest rates available. Buying a minimum coverage policy is the cheapest way to meet New Mexico’s car insurance requirements to ensure you stay legal.

State minimums may not have sufficient coverage with the amount of bodily injury and property damage liability you need if you are involved in an auto accident.Daniel Walker Licensed Insurance Agent

A New Mexico state minimum auto policy only covers up to $50,000 per accident in bodily injury liability and $10,000 per accident in property damage liability.

Cheapest Full Coverage Car Insurance in New Mexico

State Farm offers the cheapest car insurance rates for full coverage in New Mexico. State Farm’s $1,030 rate is 34% less expensive than the statewide average of $1,565 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $1,030 | $85 |

| Safeco | $1,081 | $90 |

| Geico | $1,255 | $104 |

| New Mexico average | $1,565 | $130 |

*USAA is for qualified military members, their spouses, and direct family members. Your average rates may vary based on the driver’s profile.

Full coverage car insurance policies cost more than liability-only policies but offer more asset protection with comprehensive and collision insurance included. Your motor vehicle is protected no matter who or any inclement weather caused the property damage.

Learn more: Benefits of Adding Comprehensive & Collision Coverage & What’s the Difference?

Cheapest Car Insurance With One Speeding Ticket in New Mexico

Progressive offers the cheapest auto insurance rates for New Mexico drivers with one speeding ticket on their driving record (learn more: Progressive Car Insurance Review for Families, Policy Options & Ratings).

Progressive’s $1,417 rate is 22% or $492 less expensive than the statewide average.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $1,417 | $118 |

| State Farm | $1,537 | $128 |

| Geico | $1,621 | $135 |

| New Mexico average | $1,909 | $159 |

According to the Insurance Research Council, your auto insurance rates can increase by $344 per year or 22% with one traffic violation for speeding in New Mexico.

Learn more: How much will my auto insurance go up with a speeding ticket?

Most auto insurers will increase car insurance rates after traffic tickets, so you want to make sure to comparison shop for cheaper insurance coverage after any traffic violation on driving records.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Cheapest Car Insurance in New Mexico With a Car Accident

According to our analysis, State Farm offers the cheapest insurance rates for drivers with one at-fault accident with a $1,859 annual insurance premium for our sample driver.

State Farm’s rate is 25% less expensive than New Mexico’s average ($2,478) insurance premium for drivers with one accident in their driving history.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $1,859 | $154 |

| Progressive | $2,066 | $172 |

| Allstate | $2,370 | $197 |

| New Mexico average | $2,478 | $206 |

Getting into an at-fault accident may cause a rate hike of 37% or $913 per year, showing the importance of shopping for cheaper auto insurance if you have a change on your driving record.

To make sure you get the best rates, be sure to compare quotes with at least three car insurance companies after a car accident.

Cheapest Car Insurance With a DWI in New Mexico

New Mexico drivers with DWI offenses on their driving records can find the cheapest car insurance with Progressive, which provided our insurance agents a quote at $2,247 per year or a $187 monthly rate for full coverage.

Read more: The Best Car Insurance Companies After a DUI

The average annual rate for drivers with DWI offenses is $2,955, making Progressive’s rate is 24% cheaper than New Mexico’s average DWI rate.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $2,247 | $187 |

| Dairyland | $2,368 | $197 |

| State Farm | $2,841 | $236 |

| New Mexico average | $2,955 | $246 |

According to the National Highway Traffic and Safety Administration (NHTSA), car insurance premiums in the state increase by 48% on average for drivers with driving while intoxicated violations (DWI’s).

You will not need an SR-22, but a court may order an ignition interlock device (BAIID) installed in your motor vehicle for at least 90 days, depending on the severity of the DWI offense.

Dairyland offers insurance quotes 20% cheaper at $2,398 per year, while State Farm’s rate of $2,841 is 4% less expensive than the DWI offense average or $2,955.

Cheapest Car Insurance for Drivers With Poor Credit in New Mexico

Geico provides the cheapest insurance for drivers with poor credit in New Mexico with a $1,876 rate for full coverage or 20% less expensive than the average bad credit rate of $2,318 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Geico | $1,876 | $156 |

| State Farm | $2,038 | $169 |

| Farm Bureau Financial | $2,166 | $180 |

| New Mexico average | $2,318 | $193 |

AutoInsureSavings.org analysis shows drivers who have a poor credit score will pay 33% more for auto insurance coverage. And drivers with poor credit are more likely to file a claim or get involved in an at-fault accident. For that reason, their car insurance costs are higher than average. Make sure to maintain good credit scores to ensure your car insurance rates won’t increase at renewal.

Cheapest Car Insurance for Young Drivers in New Mexico

We found young New Mexico drivers looking for the cheapest full coverage auto insurance is with Farm Bureau Financial, which provided our agents a $3,712 annual quote or 34% less expensive than our sample young driver’s average rates.

USAA is the best car insurance option for younger drivers who qualify, which offered AutoInsureSavings’ agents a $3,048 annual rate for full coverage insurance.

The cheapest for state minimum coverage is Farm Bureau, which offered us a quote at $1,631 per year or 17% cheaper for young or teen drivers. The next best car insurance for teens is Allstate Insurance, with a $1,670 annual rate for liability insurance.

| Insurer | Full coverage | Minimum coverage |

|---|---|---|

| USAA | $3,048 | $1,582 |

| Farm Bureau Financial | $3,712 | $1,631 |

| Geico | $3,895 | $2,047 |

| Safeco | $4,466 | $2,285 |

| State Farm | $4,850 | $1,842 |

| Allstate | $6,231 | $1,670 |

| Farmers | $6,532 | $2,628 |

| New Mexico average | $5,572 | $1,946 |

*USAA is for qualified military members, their spouses, and direct family members. Your insurance rates may vary based on the driver’s profile.

Statistics show drivers under 25 are more prone to car accidents than older experience drivers, making car insurance costs higher. Our licensed agents recommend young or teen drivers to buy full coverage policies, so their motor vehicle is covered in an auto accident.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

It is best to find a company that offers the cheapest car insurance rates for young or teen drivers in the Land of Enchantment, such as Farm Bureau Financial or Allstate Insurance, to cut down on your insurance costs.

Learn more: The Best Car Insurance for New Drivers: A Comprehensive Guide

Cheapest Car Insurance for Young Drivers with a Speeding Ticket

Young New Mexico drivers with one speeding violation should look to Farm Bureau Financial for the cheapest insurance coverage. The average car insurance cost from Farm Bureau is $4,012 annually or $1,980 less per year for auto insurance policies with collision and comprehensive coverage.

Farm Bureau’s speeding ticket rate is 33% less expensive than the average $498 monthly rate for younger drivers. Take a look below to see how a traffic ticket can impact your car insurance rates.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Farm Bureau Financial | $4,012 | $334 |

| Geico | $4,677 | $390 |

| Liberty Mutual | $5,739 | $478 |

| New Mexico average | $5,980 | $498 |

Cheapest Car Insurance for Young Drivers with an At-Fault Accident

Inexperienced drivers in New Mexico with one at-fault accident can find the best car insurance with Liberty Mutual, which provided our agents a $5,739 annual rate ($478 per month) for full coverage insurance.

Liberty Mutual’s at-fault accident rate is 18% cheaper than New Mexico’s teen driver accident rate of $6,994 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Liberty Mutual | $5,739 | $478 |

| State Farm | $5,861 | $488 |

| Geico | $6,638 | $553 |

| Average in New Mexico | $6,994 | $582 |

Learn more: Will car insurance rates increase after an accident?

Best Auto Insurance Companies in New Mexico

AutoInsureSavings.org team of licensed insurance agents rated the best car insurance companies in New Mexico by customer service and surveys, J.D. Powers claims satisfaction score, A.M. Best, and the National Association of Insurance Commissioners (NAIC) complaint index.

We found that USAA, Allstate, Farmers Insurance are the best insurers based on excellent customer service, claims satisfaction, and NAIC’s complaint index.

ValuePenguin found similar results from their recent New Mexico customer survey, except State Farm, which had high customer service ratings, but lower (0.66) on NAIC’s complaint index behind Farm Bureau Financial and Farmers Insurance.

| Group | % respondents extremely satisfied with recent claim. | % respondents rated customer service as excellent. |

|---|---|---|

| USAA | 78% | 62% |

| State Farm | 73% | 46% |

| Allstate | 72% | 47% |

| Farmers | 71% | 38% |

| Progressive | 74% | 34% |

| Geico | 64% | 42% |

| Farm Bureau Financial | N/A | N/A |

Our licensed insurance agents also collected information on each auto insurance company in New Mexico from the NAIC, J.D. Power, and A.M. Best’s financial strength ratings.

The car insurance company with the lowest NAIC complaint ratio (0.19) is Farmers Insurance. Farm Bureau’s complaint index is below the national average of 1.00 at 0.43.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

The NAIC’s complaint ratio compares the number of complaints an auto insurer has based on its market share in New Mexico. Any car insurance provider below 1.00 is better than the national average.

USAA has the highest J.D. Power claims satisfaction score of 890, and State Farm is second with a claims satisfaction score of 881.

| Insurer | NAIC Complaint Index | J.D. Power claims satisfaction score | AM Best Financial Strength Rating |

|---|---|---|---|

| Farmers | 0.19 | 872 | A |

| Farm Bureau Financial | 0.43 | n/a | A |

| Allstate | 0.63 | 876 | A+ |

| State Farm | 0.66 | 881 | A++ |

| Progressive | 0.67 | 856 | A+ |

| USAA | 0.68 | 890 | A++ |

| Geico | 1.01 | 871 | A++ |

A.M. Best financial strength ratings are a grade describing an auto insurer’s financial health and their ability to pay out claims.

While comparison shopping for car insurance companies in New Mexico, it is essential to remember that several risk factors contribute to your premium cost. Your age, driving history, and even your credit rating can influence your total monthly or annual cost.

It is always best for New Mexico drivers to compare car insurance plans to find the best company that offers the lowest insurance rate.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Average Car Insurance Costs by City in New Mexico

We collected insurance quotes from New Mexico zip codes from top insurance companies and found average rates can vary by $357. The lowest auto policy is in Gallina ($1,398), and the highest rate is in Albuquerque ($1,755). Typically, you will pay higher rates if you live in urban cities rather than the state’s rural areas.

Your New Mexico rate is based not only on your zip code but the type of vehicle, liability limits, marital status, plus a variety of other risk factors.

Cheapest Car Insurance in Albuquerque, NM

In Albuquerque, drivers can find the cheapest insurance quotes with Safeco Insurance, which provided AutoInsureSavings.org agents a rate of $1,162 annually or $90 per month. Safeco’s quote is 39% less expensive than the average Albuquerque rate at $1,755.

| Albuquerque Company | Average Premium |

|---|---|

| Safeco | $1,076 |

| State Farm | $1,151 |

| USAA | $1,210 |

| Albuquerque average | $1,755 |

Cheapest Car Insurance in Las Cruces, NM

Las Cruces drivers can look to State Farm for the cheapest coverage rates, with a quote at $1,156 per year with full coverage insurance. State Farm’s rate is 36% cheaper than Las Cruces’ $1,655 average rates for similar driver profiles.

| Las Cruces Company | Average Premium |

|---|---|

| State Farm | $1,146 |

| Geico | $1,382 |

| Liberty Mutual | $1,525 |

| Las Cruces average | $1,803 |

Cheapest Car Insurance in Rio Rancho, NM

Rio Rancho drivers can find the cheapest full coverage insurance policy with USAA, which offered us a $986 annual rate for our sample 30-year-old driver. USAA’s car insurance rate is $625 less annually than Rio Rancho’s average of $1,611 per year.

| Rio Rancho Company | Average Premium |

|---|---|

| USAA | $986 |

| Geico | $1,127 |

| Allied | $1,384 |

| Rio Rancho average | $1,611 |

Cheapest Car Insurance in Santa Fe, NM

The cheapest auto insurance rate our insurance agents found in Santa Fe is Safeco, with a $1,048 per year rate for a full coverage auto policy. Safeco’s quote is 40% less expensive than Santa Fe’s average rate of $1,729 per year. Both State Farm and Geico offer insurance quotes in Santa Fe at least 10% lower than the citywide average.

| Santa Fe Company | Average Premium |

|---|---|

| Safeco | $1,048 |

| State Farm | $1,260 |

| Geico | $1,564 |

| Santa Fe average | $1,729 |

Cheapest Car Insurance in Roswell, NM

Drivers in Roswell can get cheap auto insurance with Allied Insurance, which provided our licensed agents a $1,126 annual rate for a full coverage policy with $100,000 in liability insurance. Allied’s quote is 32% less expensive than the average $1,637 yearly rate in Roswell.

| Roswell Company | Average Premium |

|---|---|

| Allied | $1,126 |

| Geico | $1,367 |

| Liberty Mutual | $1,585 |

| Roswell average | $1,637 |

Cheapest Car Insurance in Farmington, NM

Farmington’s least expensive car insurance policy is with Progressive, which offered us a quote at $1,138 yearly for full coverage with $500 deductibles for comprehensive and collision insurance. Progressive’s full coverage quote is 33% cheaper than Farmington’s average $1,700 rate for 30-year-old drivers.

| Farmington Company | Average Premium |

|---|---|

| Progressive | $1,138 |

| Geico | $1,415 |

| Safeco | $1,438 |

| Farmington average | $1,700 |

Average Car Insurance Cost for All Cities in New Mexico

| City | Annual Premium Cost | City | Annual Premium Cost |

|---|---|---|---|

| Albuquerque | $1,755 | Laguna | $1,521 |

| Santa Fe | $1,729 | Lake Arthur | $1,482 |

| Las Cruces | $1,803 | Lakewood | $1,486 |

| Roswell | $1,637 | Las Vegas | $1,478 |

| Farmington | $1,700 | Lea County | $1,498 |

| Taos | $1,655 | Lemitar | $1,528 |

| Carlsbad | $1,690 | Lincoln | $1,492 |

| Hobbs | $1,598 | Lindrith | $1,525 |

| Gallup | $1,567 | Loco Hills | $1,518 |

| Ruidoso | $1,603 | Lordsburg | $1,482 |

| Rio Rancho | $1,611 | Los Alamos | $1,486 |

| Alamogordo | $1,478 | Los Ojos | $1,518 |

| Abiquiu | $1,498 | Lovington | $1,546 |

| Acoma | $1,482 | Los Lunas | $1,557 |

| Alcalde | $1,516 | Malaga | $1,478 |

| Alto | $1,492 | Mayhill | $1,501 |

| Amalia | $1,550 | Medanales | $1,533 |

| Anthony | $1,518 | Mescalero | $1,567 |

| Arroyo Hondo | $1,482 | Mesilla Park | $1,498 |

| Arroyo Seco | $1,486 | Mesilla | $1,482 |

| Artesia | $1,573 | Mesquite | $1,492 |

| Aztec | $1,501 | Milan | $1,549 |

| Bayard | $1,510 | Mimbres | $1,518 |

| Bent | $1,492 | Montezuma | $1,510 |

| Bernalillo | $1,498 | Mora | $1,478 |

| Blanco | $1,544 | Moriarty | $1,486 |

| Bloomfield | $1,527 | Mountainair | $1,563 |

| Bluewater | $1,518 | Mule Creek | $1,478 |

| Bosque | $1,549 | Nageezi | $1,492 |

| Buckhorn | $1,492 | Navajo Dam | $1,498 |

| Buena Vista | $1,555 | New Laguna | $1,501 |

| Canjilon | $1,559 | Nogal | $1,546 |

| Capitan | $1,529 | Ohkay Owingeh | $1,518 |

| Carrizozo | $1,486 | Ojo Caliente | $1,492 |

| Carson | $1,501 | Ojo Feliz | $1,442 |

| Casa Blanca | $1,478 | Organ | $1,482 |

| Catron County | $1,492 | Orogrande | $1,559 |

| Cebolla | $1,498 | Paguate | $1,527 |

| Cedar Crest | $1,546 | Pecos | $1,478 |

| Cerrillos | $1,444 | Pena Blanca | $1,486 |

| Cerro | $1,518 | Penablanca | $1,498 |

| Chacon | $1,510 | Penasco | $1,492 |

| Chama | $1,482 | Picacho | $1,501 |

| Chamberino | $1,492 | Pinehill | $1,482 |

| Chamisal | $1,501 | Pinon | $1,546 |

| Chaparral | $1,478 | Placitas | $1,518 |

| Chimayo | $1,498 | Polvadera | $1,521 |

| Church Rock | $1,486 | Ponderosa | $1,546 |

| Claunch | $1,510 | Prewitt | $1,440 |

| Cleveland | $1,484 | Pueblo Of Acoma | $1,478 |

| Cliff | $1,527 | Quay County | $1,498 |

| Cloudcroft | $1,482 | Questa | $1,486 |

| Clovis | $1,548 | Radium Springs | $1,456 |

| Cochiti Pueblo | $1,518 | Rainsville | $1,492 |

| Colfax County | $1,559 | Ramah | $1,482 |

| Conchas Dam | $1,492 | Ranchos De Taos | $1,501 |

| Continental Divide | $1,446 | Red River | $1,510 |

| Cordova | $1,478 | Regina | $1,546 |

| Corona | $1,498 | Rehoboth | $1,518 |

| Corrales | $1,482 | Ribera | $1,492 |

| Costilla | $1,455 | Rincon | $1,542 |

| Counselor | $1,478 | Rociada | $1,498 |

| Coyote | $1,486 | Roosevelt County | $1,479 |

| Crown Point | $1,482 | Rowe | $1,478 |

| Crownpoint | $1,510 | Ruidoso Downs | $1,532 |

| Cuba | $1,492 | Sacramento | $1,486 |

| Cubero | $1,546 | Salem | $1,527 |

| Curry County | $1,501 | San Acacia | $1,482 |

| De Baca County | $1,441 | San Antonio | $1,546 |

| Dexter | $1,482 | San Cristobal | $1,510 |

| Dixon | $1,486 | San Fidel | $1,443 |

| Dona Ana | $1,498 | San Jose | $1,427 |

| Dulce | San Miguel | $1,482 | |

| Edgewood | $1,478 | San Patricio | $1,492 |

| El Prado | $1,482 | San Rafael | $1,498 |

| El Rito | $1,527 | San Ysidro | $1,486 |

| Elida | $1,518 | Sandia Park | $1,546 |

| Espanola | $1,492 | Santa Clara | $1,482 |

| Fairacres | $1,510 | Santa Cruz | $1,501 |

| Faywood | $1,482 | Santa Teresa | $1,554 |

| Fence Lake | $1,548 | Santo Domingo Pueblo | $1,478 |

| Flora Vista | $1,486 | Sapello | $1,527 |

| Fort Wingate | $1,559 | Serafina | $1,403 |

| Fruitland | $1,501 | Sheep Springs | $1,482 |

| Gallina | $1,398 | Shiprock | $1,486 |

| Gamerco | $1,498 | Sierra County | $1,518 |

| Garfield | $1,446 | Silver City | $1,549 |

| Garita | $1,474 | Socorro | $1,492 |

| Gila | $1,482 | Sunland Park | $1,510 |

| Glencoe | $1,486 | Sunspot | $1,501 |

| Glorieta | $1,549 | Taos | $1,399 |

| Grants | $1,527 | Tererro | $1,555 |

| Guadalupe County | $1,518 | Tesuque | $1,486 |

| Guadalupita | $1,478 | Thoreau | $1,446 |

| Hachita | $1,510 | Tierra Amarilla | $1,498 |

| Hagerman | $1,501 | Tijeras | $1,482 |

| Hanover | $1,492 | Tinnie | $1,416 |

| Harding County | $1,522 | Tohatchi | $1,518 |

| Hatch | $1,482 | Tome | $1,501 |

| Hi Rls Mtn Pk | $1,547 | Torrance County | $1,492 |

| Hidalgo County | $1,429 | Trementina | $1,478 |

| High Rolls Mountain Park | $1,559 | Tres Piedras | $1,510 |

| Holloman Afb | $1,541 | Truchas | $1,522 |

| Holloman Air Force Base | $1,522 | Tularosa | $1,482 |

| Holman | $1,486 | Tyrone | $1,550 |

| Hondo | $1,498 | Union County | $1,592 |

| Hope | $1,482 | Vadito | $1,486 |

| Hurley | $1,501 | Valencia County | $1,498 |

| Ilfeld | $1,492 | Vallecitos | $1,500 |

| Isleta | $1,542 | Vanderwagen | $1,535 |

| Jamestown | $1,518 | Veguita | $1,501 |

| Jemez Pueblo | $1,522 | Velarde | $1,482 |

| Jemez Springs | $1,510 | Villanueva | $1,419 |

| Kenna | $1,486 | Wagon Mound | $1,492 |

| Kewa | $1,564 | Waterflow | $1,539 |

| Kirtland | $1,498 | Watrous | $1,478 |

| La Jara | $1,478 | Weed | $1,522 |

| La Joya | $1,501 | White Rock | $1,486 |

| La Luz | $1,492 | White Sands | $1,528 |

| La Madera | $1,522 | Whites City | $1,510 |

| La Mesa | $1,482 | Youngsville | $1,478 |

| La Plata | $1,514 | Zuni | $1,498 |

Minimum Auto Insurance Coverage Requirements in New Mexico

The Motor Vehicle Department (MVD) requires all New Mexico drivers to have the minimum liability limits:

| Liability | Minimum coverage |

|---|---|

| Bodily injury liability | $25,000 per person / $50,000 per accident |

| Property damage liability | $10,000 per accident |

New Mexico doesn’t require drivers to carry uninsured motorist coverage. However, we recommend drivers to buy uninsured motorist coverage since New Mexico’s uninsured motorist rate is 20.8%, according to the Insurance Information Institute (III.org).

AutoInsureSavings.org agents also recommend higher liability limits with collision and comprehensive insurance. You may pay more for insurance coverage, but a full coverage insurance policy ultimately will save money if you get into a costly auto accident.

To learn more about New Mexico’s most affordable car insurance options, enter your zip code or contact the auto insurance experts at AutoInsureSavings.org.

Our licensed insurance professionals will be happy to answer any questions you have.

Methodology

AutoInsureSavings.org comparison shopping study used a full-coverage auto policy for a 30-year-old driving a 2018 Honda Accord with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person / $100,000 per accident |

| Property damage liability | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured / underinsured motorist bodily injury | $50,000 per person / $100,000 per accident |

| Comprehensive and collision coverage | $500 deductible |

We used insurance rates for drivers with accident histories, credit scores, and marital status for other New Mexico rate analyses. We used car insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your insurance rates may vary when you get quotes.

Sources

– Motor Vehicle Department of New Mexico. “Car Insurance.”

– Rocky Mountain Insurance Information Association. “Uninsured Motorists, Driving Without Car Insurance.”

– National Highway Traffic and Safety Administration. “DWI Insurance Report.”

Frequently Asked Questions

Who has the cheapest car insurance in New Mexico?

Safeco Insurance offers the state minimum’s cheapest auto insurance rate at $387 per year. The average annual premium for minimum coverage in New Mexico is $592, and Safeco’s premium costs 35% less per year. Other good options for affordable car insurance are USAA at $398, State Farm at $424, and Progressive at $547 per year.

How much is New Mexico car insurance per month?

The average car insurance costs $1,565 in New Mexico for full coverage insurance and $592 per year for state minimum coverage for a 30-year-old driver with a clean driving record.

How much is full coverage New Mexico car insurance?

The average cost of full coverage car insurance in New Mexico is $1,565 annually or $130 per month with $100,000 per accident in liability coverage. State Farm’s average rate for full coverage is $1,030 a year or $85 per month or 34% less per year, while Safeco’s rate of $1,081 is 31% below New Mexico’s average.

How much will my car insurance increase with a speeding ticket in New Mexico?

You can expect your car insurance rates to increase 22% after a speeding violation in New Mexico. Most drivers pay around $1,909 annually for full coverage once they have a ticket on their driving record. Progressive’s rate is only $1,417 annually after one ticket for 30-year-olds.

How can I save on car insurance in New Mexico?

The best way to save on your insurance premium is to find out from your car insurance provider if you are eligible for a money-saving driver discount offered by the company. Many insurance providers in New Mexico will lower your overall car insurance rates if you have more than one policy with them, such as life or home insurance policies.

Another way to save on your car insurance premium is to practice safe driving habits and maintain clean driving records. Many auto insurers offer good driving discounts for drivers in New Mexico that have clean driving records for three years or more. One example is Allstate Insurance which offers good drivers a safe driving bonus. Not only will you keep and your passengers with safe driving, but it will also help you avoid car accidents or traffic violations that could cause your premium to rise.

What is the average cost of car insurance in New Mexico?

New Mexico’s minimum coverage is an average of $592 per year, while full coverage in New Mexico is an average of $1,565 per year.

Is it illegal to drive without car insurance in New Mexico?

Yes, all New Mexico drivers must meet New Mexico auto insurance laws by carrying the required minimum coverage or risk fines, suspended licenses, and more.

Is New Mexico a no-fault state?

New Mexico is an at-fault state, so make sure you carry coverage from the best New Mexico auto insurance company for complete protection.

What is the best car insurance in New Mexico?

The best New Mexico auto insurance will be a full coverage policy, as this provides the most financial protection to drivers.

Is car insurance more expensive in NM?

Car insurance in NM is around the nationwide average, but if you find your rates are expensive, make sure you are comparing quotes to find the best cheap car insurance in New Mexico.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Jan 10, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.