New Jersey Cheapest Car Insurance & Best Coverage Options

State Farm and Travelers have the best New Jersey cheapest car insurance and best coverage options. State Farm has the cheapest minimum coverage, averaging $35 per month. Drivers who want full coverage, however, will find the cheapest rates at Travelers, where full coverage averages $102 per month.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Jan 10, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jan 10, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

- State Farm has the cheapest New Jersey minimum coverage

- Travelers has the cheapest New Jersey full coverage

- New Jersey drivers will get the best protection from full coverage

Looking for the best New Jersey cheapest car insurance and best coverage options? State Farm has the best minimum coverage in New Jersey, while Travelers has the best full coverage in New Jersey. Read on to learn more about finding the cheapest New Jersey auto insurance coverages and how to save at the best auto insurance companies.

Want to get started on shopping for affordable New Jersey car insurance? Enter your ZIP code into our free quote tool.

Cheapest Car Insurance in New Jersey

Drivers have several options to choose from when purchasing a new auto insurance policy in New Jersey to find the best rates.

| Cheapest Car Insurance in New Jersey - Quick Hits |

|---|

The cheapest New Jersey car insurance options are: The cheapest New Jersey car insurance options are:Cheapest for minimum coverage: State Farm Cheapest for full coverage: Travelers Insurance Cheapest after an at-fault accident: NJM Insurance Cheapest after a speeding ticket: Travelers Cheapest after a DUI: Progressive Cheapest for poor credit history: Geico Cheapest for young drivers: Geico For young drivers with a speeding violation: NJM Insurance For young drivers with an at-fault accident: Geico |

In this New Jersey car insurance guide, you will find comparisons between some of the industry’s best car insurance companies and their best rates to help you save money and find cheap car insurance.

- Car Insurance Rates in New Jersey

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance for Minimum Coverage in New Jersey

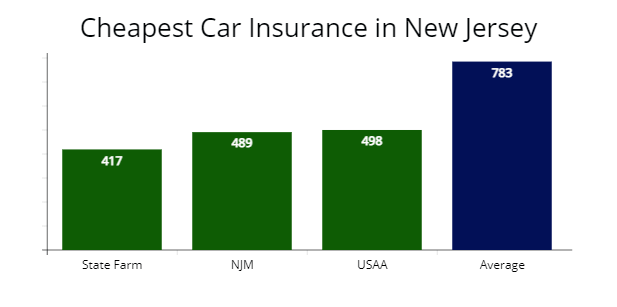

The car insurance company offering the cheapest annual average rates for minimum coverage is State Farm, which provided us a quote at $417 per year or a $34 monthly rate. State Farm’s rate is 47% less expensive than New Jersey’s average of $783 per year, so it is the cheapest car insurance company for a minimum coverage level.

The next best insurance option for coverage in New Jersey is NJM which provided our agents a cheap rate at $489 per year or $294 less per year than average rates.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $417 | $34 |

| New Jersey Manufacturers (NJM) | $489 | $41 |

| USAA | $498 | $42 |

| Geico | $515 | $43 |

| Progressive | $624 | $52 |

| Travelers | $676 | $56 |

| Allstate | $856 | $71 |

| Plymouth Rock | $899 | $75 |

| New Jersey average | $783 | $65 |

*USAA is for qualified military members, their spouses, and direct family members. Your auto insurance rates may vary based on the driver’s profile.

Many New Jersey drivers choose state minimum coverage to stay legal on the road and pay the lowest rates. The difference between the cost of minimum and full coverage policies in New Jersey is $1,096 per year.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Although minimum coverage offers savings and helps many New Jersey drivers stay within their budget, there is always the risk of insufficient protection while driving. You want to thoroughly know your coverage options and your budget.

If a crash occurs while driving in New Jersey and you only have state minimum coverage and the damages you caused exceed your policy limits. In that case, you will be responsible for paying for the remaining damage out of pocket.

Cheapest Full Coverage Car Insurance in New Jersey

The insurance company offering the cheapest rates for full coverage auto insurance in New Jersey is Travelers, which provided our agents a $1,277 yearly rate.

Read more: Review of Travelers Car Insurance Options; a Comparison With Other Insurers

Traveler’s insurance rate is 33% cheaper than the average $1,879 quote in New Jersey.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Travelers | $1,277 | $106 |

| Geico | $1,354 | $112 |

| State Farm | $1,414 | $117 |

| NJM | $1,471 | $122 |

| Progressive | $1,545 | $128 |

| New Jersey average | $1,879 | $156 |

While full coverage may not be required, it is an excellent coverage option to ensure you will not have to pay for damages out of pocket (learn more: Understanding Full Coverage Car Insurance).

Full coverage includes comprehensive and collision coverage, while state minimum coverage doesn’t.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Collision and comprehensive coverage will pay for property damage to your motor vehicle no matter who is at fault and from cases of inclement weather or accidentally hitting a street sign.

Learn more:

- Understanding Collision Car Insurance Coverage: What You Need to Know

- Understanding Comprehensive Car Insurance Coverage: What You Need to Know

Cheapest Car Insurance with a Speeding Ticket in New Jersey

For drivers with a speeding violation in New Jersey, the cheapest auto insurance is with Travelers, which offered us a quote of $1,355 per year or $112 a month. Traveler’s rate is $964 less expensive than average. Take a look at the table below to see how a traffic ticket can impact your car insurance rates.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Travelers | $1,355 | $112 |

| State Farm | $1,580 | $121 |

| NJM | $1,816 | $151 |

| New Jersey average | $2,319 | $178 |

The amount your auto insurance rates will increase after you receive a speeding ticket will vary based on how fast you were going above the speed limit and how many tickets you have on your driving record.

Our research found the average rate increase after traffic tickets in New Jersey is 19%.

Cheapest Car Insurance in New Jersey with an At-Fault Accident

The cheapest full coverage auto quote for drivers in New Jersey with one at-fault accident is NJM. They provided us a quote at $2,067 annually or 34% cheaper than the average $3,123 rate. Your next best option is State Farm, with a 25% less expensive rate at $2,361 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| NJM | $2,067 | $172 |

| State Farm | $2,361 | $196 |

| Geico | $2,650 | $220 |

| New Jersey average | $3,123 | $260 |

Keep in mind the insurance company that offers the cheapest auto insurance rates after a car accident will vary from one driver to the next. Insurance providers determine your premium cost based on your age, driving history, credit rating, and several other factors (learn more: Understanding How Car Insurance Premiums Are Calculated).

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

While many drivers can save more by choosing New Jersey Manufacturers (NJM), other drivers in New Jersey who have one or more auto accidents on their driving records may save more money by choosing a different company such as State Farm or Geico.

Cheapest Car Insurance with a DUI in New Jersey

The auto insurer with the cheapest auto insurance for drivers in New Jersey with a DUI conviction is Progressive, which provided AutoInsureSavings.org agents a $2,498 quote for full coverage.

Learn more: Progressive Car Insurance Review for Families, Policy Options & Ratings

Progressive’s rate is 37% less expensive than New Jersey’s average of $3,912 per year for a DUI.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $2,498 | $208 |

| Geico | $2,789 | $232 |

| NJM | $2,917 | $224 |

| New Jersey average | $3,912 | $326 |

According to the Department of Law and Public Safety in New Jersey, drivers will pay a $1,000 surcharge for car insurance for three years, and you can expect car insurance rates to increase as much as 52% after being convicted of a DUI, even at the best car insurance companies after a DUI.

You will also have a driver’s license forfeiture (loss of driving privileges) until an ignition interlock device (BAIID) is installed in your motor vehicle and a minimum of six hours at the Intoxicated Driver Resource Center in New Jersey.

Cheapest Car Insurance with Poor Credit in New Jersey

The insurance provider with the cheapest car insurance for drivers in New Jersey with a poor credit score is Geico, with a $1,855 annual rate or $154 per month for our sample 30-year-old male.

NJM is your next cheapest option with a $175 monthly rate or 37% less expensive than the average cost of car insurance in New Jersey for drivers with bad credit.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Geico | $1,855 | $154 |

| NJM | $2,109 | $175 |

| State Farm | $2,568 | $214 |

| New Jersey average | $3,313 | $276 |

Drivers who have a poor or bad credit score are more likely to be at increased risk for car insurance companies in New Jersey, and therefore these providers will increase rates based on these risks. Make sure to pay your credit cards and bills on time to keep your auto insurance rates low with good credit.

Cheapest Car Insurance for Young Drivers in New Jersey

If you are a young driver looking to save money on car insurance, compare quotes with Geico Insurance. They provided our insurance agents a $3,613 quote for those with a clean driving record. Travelers Insurance is 37% cheaper than New Jersey’s young driver rate of $5,102 per year.

State Farm offers the most affordable coverage rate for young drivers’ minimum coverage insurance policies at $1,588 per year or a $102 monthly rate.

Other auto insurers to compare multiple auto insurance quotes for state minimums are Geico and Travelers for young or teen drivers. Both car insurance companies in New Jersey are 31% cheaper than the statewide average rate.

| Insurer | Full coverage | Minimum coverage |

|---|---|---|

| Geico | $3,613 | $1,614 |

| Travelers | $3,767 | $1,780 |

| USAA | $3,817 | $1,489 |

| NJM | $4,038 | $1,976 |

| State Farm | $4,445 | $1,588 |

| Progressive | $5,239 | $1,947 |

| Liberty Mutual | $5,577 | $2,019 |

| Allstate | $8,123 | $2,250 |

| Plymouth Rock | $8,218 | $2,770 |

*USAA is for qualified service members, their spouses, and direct family members. Your auto insurance rates may vary based on the driver’s profile.

Our insurance agents recommend younger drivers go on their parent’s policy to find the most car insurance savings per year. The cost of auto insurance in New Jersey for younger drivers is $5,102 for a standalone policy. Adding the driver to their parent’s policy is more affordable, lowering car insurance costs by $1,200 per year.

Cheapest Car Insurance for Young Drivers with a Speeding Ticket

If you are a teen driver with a speeding violation in your driving history, the cheapest insurance premium is NJM at $4,038 per year or a $336 monthly rate.

NJM’s rate is $1,622 cheaper than New Jersey’s average for young drivers with a speeding violation, or 29% less expensive.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| NJM | $4,038 | $336 |

| Geico | $4,127 | $343 |

| State Farm | $4,466 | $372 |

| New Jersey average | $5,660 | $471 |

Learn more: How much will my auto insurance go up with a speeding ticket?

Cheapest Car Insurance for Young Drivers with a Car Accident

According to AutoInsureSavings.org agent’s study, young New Jersey drivers with one at-fault accident can find the best auto insurance coverage with Geico.

Geico’s rate at $4,413 per year is $3,707 less expensive than the New Jersey average at-fault accident rate of $8,120 for younger drivers.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Geico | $4,413 | $367 |

| NJM | $4,490 | $374 |

| State Farm | $5,911 | $492 |

| New Jersey average | $8,120 | $676 |

Read more: Will car insurance rates increase after an accident?

Best Car Insurance Companies in New Jersey

According to our recent customer survey and the best rates shown in this guide, Allstate, Travelers, and State Farm are three of the best car insurance options if your primary concern is customer service and claims satisfaction.

ValuePeguin had similar results with Allstate as the best for customer service and State Farm as the best auto insurer in New Jersey for claims satisfaction.

| Auto insurer | % of respondents extremely satisfied with recent claim | % of respondents rated customer service as excellent |

|---|---|---|

| Allstate | 76% | 49% |

| Travelers | 75% | 39% |

| State Farm | 74% | 41% |

| Progressive | 71% | 40% |

| Geico | 70% | 35% |

| Plymouth Rock | 67% | 48% |

| NJM | n/a | n/a |

It is important to remember that one driver’s best auto insurance company may not be the best option for another. Many factors help determine how much your auto insurance premium will be.

AutoInsureSavings.org licensed agents also looked at each insurer’s complaint index from the National Association of Insurance Commissioners (NAIC), J.D. Power claims satisfaction score and their A.M. Best financial strength ratings.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Plymouth Rock has the lowest complaint index with NAIC at 0.06, meaning Plymouth Rock received 6% of complaints compared to other auto insurers of equal market share.

Plymouth Rock lacked a J.D. Power claims satisfaction score but had an “A” financial strength rating with A.M. Best.

NJM Insurance has a 0.08 NAIC’s complaint index rating, with J.D. Power claims score of 909, with an “A+” financial strength rating with A.M. Best. If a low price and excellent customer service is a priority, our insurance agents recommend NJM Insurance.

| Insurer | NAIC complaint index | J.D. Power Claims Satisfaction | AM Best Rating |

|---|---|---|---|

| Plymouth Rock | 0.06 | n/a | A |

| NJM Insurance | 0.08 | 909 | A+ |

| Travelers | 0.26 | 861 | A++ |

| Allstate | 0.27 | 876 | A+ |

| State Farm | 0.30 | 881 | A++ |

| Progressive | 0.40 | 856 | A+ |

| Geico | 0.76 | 871 | A++ |

All New Jersey car insurance companies had financial strength ratings of “A” or better from AM Best, which means each company had “excellent” or “superior” financial strength to cover insurance claims.

All New Jersey car insurance companies had financial strength ratings of “A” or better from AM Best, which means each company had “excellent” or “superior” financial strength to cover insurance claims.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Average Car Insurance Cost by City in New Jersey

Your zip code is a factor car insurance companies in New Jersey use to determine your rate, as well as credit scores, coverage levels, driving records, and type of motor vehicle.

Depending on driver profiles and zip code, full coverage car insurance rates can vary by $826 per year in New Jersey. Auto insurers will charge more for coverage in large urban cities with more car accidents and higher auto theft rates.

Cheapest Auto Insurance in Newark, NJ

Newark drivers can find the cheapest car insurance coverage for their motor vehicle with Travelers, which provided our agents a $1,618 annual quote or $134 per month for a full coverage policy.

Travelers’ quote is 40% less expensive than the $2,614 citywide average rate.

| Newark Company | Average Premium |

|---|---|

| Travelers | $1,618 |

| State Farm | $1,825 |

| NJM Insurance | $1,941 |

| Newark average | $2,614 |

Cheapest Auto Insurance in Jersey City, NJ

Jersey City drivers can look to NJM Insurance for the cheapest coverage rates, with a quote at $1,567 per year with full coverage insurance. NJM’s rate is 40% cheaper than Jersey City’s $2,583 average rates for similar driver profiles.

| Jersey City Company | Average Premium |

|---|---|

| NJM Insurance | $1,567 |

| State Farm | $1,712 |

| Geico | $1,845 |

| Jersey City average | $2,583 |

Cheapest Auto Insurance in Paterson, NJ

AutoInsureSavings.org licensed agents found auto insurance premiums are cheaper with State Farm for Paterson, New Jersey residents at $1,437 per year or $119 per month. State Farm’s rate is 37% less expensive than Paterson’s average rate of $2,248 annually.

| Paterson Company | Average Premium |

|---|---|

| State Farm | $1,437 |

| NJM Insurance | $1,511 |

| Geico | $1,710 |

| Paterson average | $2,248 |

Cheapest Auto Insurance in Elizabeth, NJ

Drivers in Elizabeth can get cheap auto insurance with Travelers Insurance, which provided our licensed agents a $1,533 annual rate for a full coverage policy with $100,000 in liability insurance. Travelers’ quote is 34% less expensive than the average $2,294 yearly rate in Elizabeth.

| Elizabeth Company | Average Premium |

|---|---|

| Travelers Insurance | $1,533 |

| NJM | $1,580 |

| Geico | $1,646 |

| Elizabeth average | $2,294 |

Cheapest Auto Insurance in Lakewood, NJ

Lakewood drivers can find the cheapest auto insurance coverage policy with Geico, which offered us a $1,597 annual rate for our sample 30-year-old male driver. Geico’s car insurance rate is $722 less annually than Lakewood’s average of $2,319 per year.

| Lakewood Company | Average Premium |

|---|---|

| Geico | $1,597 |

| Liberty Mutual | $1,714 |

| NJM Insurance | $1,766 |

| Lakewood average | $2,319 |

Cheapest Auto Insurance in Woodbridge, NJ

In Woodbridge, drivers will find the cheapest insurance rates with NJM Insurance, which provided our agents a $1,317 annual quote for a 30-year-old driver with full coverage. NJM’s $109 monthly rate is 42% less expensive than Woodbridge’s $2,259 average.

| Woodbridge Company | Average Premium |

|---|---|

| NJM Insurance | $1,317 |

| Geico | $1,469 |

| Plymouth Rock | $1,715 |

| Woodbridge average | $2,259 |

Average Car Insurance Cost for All Cities

| City | Annual Premium Cost | City | Annual Premium Cost |

|---|---|---|---|

| Newark | $2,614 | Robbinsville | $2,059 |

| Jersey City | $2,583 | Phillipsburg | $1,788 |

| Paterson | $2,248 | Hopatcong | $1,830 |

| Elizabeth | $2,294 | Fairview | $1,927 |

| Lakewood | $2,319 | Hammonton | $1,891 |

| Edison | $2,347 | Metuchen | $2,093 |

| Woodbridge | $2,259 | Collingswood | $2,177 |

| Toms River | $2,300 | Highland Park | $2,314 |

| Hamilton township | $1,788 | Saddle Brook | $1,814 |

| Clifton | $2,076 | Middlesex | $2,184 |

| Trenton | $2,318 | Roselle Park | $1,915 |

| Brick | $1,830 | Verona | $2,030 |

| Camden | $2,316 | Berkeley Heights | $2,308 |

| Cherry Hill | $1,847 | New Providence | $1,788 |

| Passaic | $1,891 | Harrison | $1,830 |

| Union City | $2,222 | Oakland | $2,076 |

| Old Bridge | $1,927 | Ridgefield Park | $2,300 |

| Franklin township | $2,184 | Clinton | $2,165 |

| Middletown | $2,306 | Pennsville | $2,312 |

| Bayonne | $1,788 | Florence | $1,847 |

| East Orange | $1,814 | Woolwich | $2,030 |

| Gloucester | $2,228 | Woodland Park | $1,915 |

| North Bergen | $1,830 | Cedar Grove | $1,927 |

| Vineland | $2,076 | Edgewater | $1,788 |

| Union township | $1,948 | Ringwood | $2,306 |

| Jackson | $2,030 | Lumberton | $1,891 |

| Piscataway | $2,215 | Eatontown | $1,814 |

| New Brunswick | $2,155 | Somerville | $2,184 |

| Irvington | $2,184 | Hasbrouck Heights | $1,847 |

| Wayne | $2,303 | Red Bank | $2,030 |

| Hoboken | $1,788 | Bordentown | $1,927 |

| West New York | $2,267 | Upper | $1,915 |

| Parsippany-Troy Hills | $1,814 | Freehold borough | $1,830 |

| Howell | $1,891 | Glen Rock | $1,788 |

| Perth Amboy | $2,313 | Wanaque | $2,076 |

| Plainfield | $2,306 | Florham Park | $2,304 |

| Bloomfield | $2,301 | Wallington | $1,891 |

| Washington township | $2,165 | River Edge | $2,323 |

| East Brunswick | $1,830 | Bellmawr | $2,306 |

| West Orange | $1,847 | Haddonfield | $2,184 |

| South Brunswick | $1,897 | Guttenberg | $2,030 |

| Evesham | $1,927 | Gloucester City | $1,814 |

| Bridgewater | $1,788 | Ridgefield | $1,830 |

| Hackensack | $2,076 | Beachwood | $1,915 |

| Monroe township | $2,323 | Ocean City | $1,847 |

| Sayreville | $2,184 | Westwood | $2,306 |

| Manchester | $2,311 | East Hanover | $1,788 |

| Egg Harbor | $1,814 | Pompton Lakes | $2,183 |

| Linden | $2,311 | Franklin Lakes | $2,165 |

| Berkeley | $2,030 | Wantage | $1,788 |

| North Brunswick | $2,308 | West Caldwell | $1,830 |

| Mount Laurel | $2,317 | Totowa | $1,897 |

| Kearny | $1,847 | Little Ferry | $2,030 |

| Teaneck | $2,076 | Waterford | $2,311 |

| Marlboro | $2,326 | East Greenwich | $1,814 |

| Manalapan | $2,382 | Millstone | $1,927 |

| Hillsborough | $1,847 | Pine Hill | $2,184 |

| Winslow | $1,915 | Hillsdale | $2,076 |

| Montclair | $2,317 | Somers Point | $2,323 |

| Atlantic City | $1,897 | Chatham | $2,165 |

| Fort Lee | $1,788 | Bound Brook | $1,915 |

| Monroe | $2,323 | Lincoln Park | $2,300 |

| Belleville | $2,076 | Manville | $1,897 |

| Galloway | $1,830 | Southampton | $1,788 |

| Ewing | $1,814 | Ventnor City | $1,847 |

| Pennsauken | $2,030 | Kinnelon | $1,830 |

| Freehold | $2,184 | River Vale | $1,915 |

| Fair Lawn | $2,315 | Waldwick | $2,030 |

| Lawrence township | $1,847 | Colts Neck | $1,788 |

| Willingboro | $2,165 | Woodbury | $1,814 |

| Garfield | $2,249 | Burlington city | $2,076 |

| Princeton | $1,915 | Keansburg | $1,847 |

| Long Branch | $1,814 | Maywood | $2,244 |

| City of Orange | $1,897 | East Rutherford | $2,165 |

| Deptford | $1,927 | Mount Holly | $2,215 |

| Westfield | $2,241 | Hackettstown | $1,830 |

| Livingston | $1,788 | Washington | $1,814 |

| Rahway | $2,225 | Leonia | $1,897 |

| Voorhees | $2,317 | Ocean township | $1,915 |

| Mount Olive | $1,830 | Pittsgrove | $2,184 |

| Lacey | $2,208 | Brigantine | $2,317 |

| Nutley | $1,847 | Chatham borough | $1,788 |

| Englewood | $2,165 | Pitman | $2,208 |

| West Windsor | $2,337 | South Amboy | $1,927 |

| Millville | $1,814 | Wood-Ridge | $1,830 |

| Neptune | $1,915 | Park Ridge | $2,030 |

| Bergenfield | $2,317 | Matawan | $2,340 |

| Stafford | $1,897 | Cresskill | $1,847 |

| East Windsor | $1,788 | Edgewater Park | $2,323 |

| Pemberton | $2,076 | Westampton | $2,165 |

| Bernards | $2,184 | Audubon | $1,830 |

| Ocean | $1,911 | Clayton | $1,788 |

| Paramus | $1,830 | Long Hill | $1,897 |

| West Milford | $2,323 | Closter | $2,184 |

| Mahwah | $2,076 | Mansfield | $1,814 |

| Hamilton | $2,030 | Plumsted | $2,311 |

| Wall | $1,897 | Montvale | $2,165 |

| Randolph | $1,788 | North Haledon | $1,911 |

| Ridgewood | $1,927 | Boonton town | $2,317 |

| Cliffside Park | $1,847 | Absecon | $1,788 |

| Rockaway | $2,165 | Bogota | $2,323 |

| Maplewood | $1,897 | Runnemede | $2,165 |

| Bridgeton | $2,329 | Haledon | $1,927 |

| Lodi | $2,076 | Lopatcong | $2,208 |

| Scotch Plains | $1,788 | Spotswood | $2,165 |

| Cranford | $2,184 | Upper Saddle River | $1,830 |

| South Plainfield | $1,911 | Kenilworth | $1,814 |

| Carteret | $2,030 | Northfield | $1,788 |

| Medford | $1,814 | Oradell | $2,030 |

| Montgomery | $2,127 | Bloomingdale | $1,847 |

| Plainsboro | $2,328 | Bedminster | $1,897 |

| Roxbury | $2,323 | Byram | $1,911 |

| Barnegat | $1,788 | Caldwell | $2,208 |

| Burlington | $2,127 | Newton | $2,184 |

| Lyndhurst | $2,322 | West Long Branch | $2,127 |

| Morris | $1,830 | Raritan borough | $1,788 |

| Vernon | $1,911 | Riverside | $2,030 |

| Raritan | $2,208 | Hardyston | $1,830 |

| Hillside | $1,847 | Chester | $1,897 |

| Summit | $2,184 | Carneys Point | $1,814 |

| Lower | $2,312 | Butler | $1,927 |

| Roselle | $1,788 | Bernardsville | $2,076 |

| North Plainfield | $2,127 | Fanwood | $2,030 |

| Montville | $1,814 | Emerson | $1,911 |

| West Deptford | $1,949 | Glen Ridge | $1,788 |

| Little Egg Harbor | $1,927 | New Hanover | $1,847 |

| Jefferson | $2,338 | Berlin borough | $1,830 |

| Palisades Park | $2,348 | North Hanover | $2,127 |

| Moorestown | $1,911 | Haddon Heights | $1,949 |

| Pleasantville | $2,317 | Chesterfield | $1,788 |

| Millburn | $2,127 | Fairfield | $2,184 |

| Secaucus | $2,076 | Maurice River | $1,814 |

| Elmwood Park | $1,830 | Mansfield township | $1,911 |

| Hazlet | $1,949 | Upper Deerfield | $1,897 |

| Glassboro | $1,847 | Buena Vista | $2,127 |

| Morristown | $2,183 | Dunellen | $2,205 |

| Hawthorne | $2,188 | Midland Park | $1,830 |

| Sparta | $2,317 | Palmyra | $1,847 |

| Maple Shade | $1,830 | Green Brook | $1,788 |

| Point Pleasant | $2,183 | Keyport | $2,314 |

| Aberdeen | $2,076 | Milltown | $1,927 |

| Washington township | $2,184 | Stratford | $1,949 |

| Rutherford | $1,911 | Upper Freehold | $1,814 |

| Middle | $2,127 | Tabernacle | $1,830 |

| Hopewell township | $1,927 | Mountainside | $2,317 |

| Dover | $2,348 | Rumson | $2,076 |

| Tinton Falls | $2,173 | Allendale | $2,205 |

| Dumont | $1,788 | Linwood | $1,911 |

| Springfield township | $1,830 | Barrington | $1,814 |

| Lindenwold | $1,897 | North Caldwell | $1,847 |

| Harrison town | $2,205 | Washington borough | $2,127 |

| Wyckoff | $1,788 | Wharton | $1,949 |

| Holmdel | $2,323 | Shamong | $1,830 |

| Denville | $1,903 | Washington township | $2,184 |

| Delran | $2,076 | Rockaway borough | $1,927 |

| New Milford | $2,183 | Dennis | $1,911 |

| South Orange | $1,847 | Carlstadt | $2,317 |

| Franklin | $2,319 | Lebanon | $2,076 |

| Cinnaminson | $2,089 | Fairfield | $2,363 |

| Madison | $1,830 | Watchung | $1,911 |

| South River | $2,205 | Hainesport | $1,903 |

| Readington | $1,788 | Margate City | $1,847 |

| Clark | $1,814 | Eastampton | $2,089 |

| Warren | $1,927 | Andover | $2,205 |

| North Arlington | $1,911 | Mullica | $1,788 |

| Asbury Park | $1,949 | Logan | $1,903 |

| Pequannock | $1,830 | Jamesburg | $2,323 |

| Mantua | $2,076 | Old Tappan | $1,967 |

| Ramsey | $1,847 | Paulsboro | $1,788 |

| Tenafly | $2,184 | Fair Haven | $1,814 |

| Weehawken | $1,788 | Prospect Park | $2,089 |

| Haddon | $1,949 | Little Silver | $1,911 |

| Little Falls | $2,089 | Roseland | $1,927 |

| Branchburg | $1,903 | Woodcliff Lake | $2,089 |

| Hanover | $1,814 | Manasquan | $1,847 |

Minimum Auto Insurance Requirements in New Jersey

People who buy a basic policy in New Jersey must maintain financial responsibility with the minimum liability requirements with bodily injury liability and property damage liability, including personal injury protection (PIP).

| Liability coverage | Minimum requirements |

|---|---|

| Bodily injury liability | $15,000 per person and $30,000 per accident |

| Property damage liability | $5,000 per accident |

| Personal injury protection (PIP) | $15,000 per person and $30,000 per accident |

While you may have a car insurance policy with minimum coverage limits, AutoInsureSavings.org licensed agents recommend getting higher liability limits for more liability protection with a full coverage policy. According to the Department of Banking and Insurance in New Jersey, we recommend getting uninsured motorist coverage since the uninsured motorist rate is 14.9%.

Full coverage includes collision and comprehensive insurance for more protection for property damage to your vehicle.

To help you save or learn more about cheaper car insurance companies in New Jersey, contact the car insurance experts at AutoInsureSavings.org. Our licensed insurance professionals will be happy to answer any questions you have.

Methodology

AutoInsureSavings.org comparison shopping study collected insurance rates for various zip codes in New Jersey. We used a full-coverage auto policy with personal injury protection for a 30-year-old driving a 2018 Honda Accord with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person / $100,000 per accident |

| Property damage liability | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured / underinsured motorist bodily injury | $50,000 per person / $100,000 per accident |

| Comprehensive and collision coverage | $500 deductible |

AutoInsureSavings.org used state minimum coverage policies comparing New Jersey car insurance for collecting quotes. We used average rates for other driver profiles in New Jersey with an accident history, credit score, and marital status for other New Jersey rate analyses. We used insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your rates may vary when you get quotes.

Sources

– NJ.gov Office of Attorney General Highway Safety. “Dui Car Insurance & Penalties.”

– New Jersey Department of Banking and Insurance. “Uninsured Motorist Coverage.”

– National Association of Insurance Commissioners. “Market Share Reports for Property/Casualty Groups and Insurance Companies.”

– National Highway Traffic Safety Administration. “Traffic Safety Facts.”

– NJ.gov. “General Auto Insurance Information.”

– Nolo.com. “New Jersey No-Fault Car Insurance.”

Frequently Asked Questions

Who has the cheapest car insurance in New Jersey?

Travelers Insurance offers some of the most affordable rates, $1,277 per year for full coverage in New Jersey. An excellent alternative option is Geico, with $1,354 per year insurance rates. While they are affordable, Travelers and Geico are also top-rated regarding overall customer service and satisfaction.

Travelers have a claims satisfaction score of 861 from J.D. Power and an A++ rating from A.M. Best, while Geico has a score of 871 and an A++ rating.

How much is car insurance in New Jersey per month?

Our research found the average rate of car insurance in New Jersey per month is $65 for state minimum and $1,879 per year for full coverage. State Farm offers drivers in New Jersey a potential savings of around $31 for minimum coverage, and Travelers offers potential savings of $50 monthly for policies with comprehensive and collision coverage.

How much will my car insurance increase after a speeding violation in New Jersey?

In New Jersey, drivers can expect a rate increase by as much as $440 per year or 19% after receiving a traffic ticket. That is an annual average of $2,319.

The national average rate drivers pay after they receive a speeding violation is $1,727. Drivers in New Jersey pay around $592 more than that.

How much is full coverage car insurance in New Jersey?

The average rate for full coverage auto insurance in New Jersey is $156 per month or $1,879 annually. The cheapest provider we found for full coverage insurance in the state is Travelers. Their average rate for this type of coverage is $106 per month or $1,277 annually.

How can I save on car insurance in New Jersey?

There are many different ways to save on New Jersey auto insurance. The first is to compare auto insurance rates from top car insurance companies in the area. Finding out about a money-saving driver discount you are eligible for is another way. Being a safe driver with a clean driving record, keeping track of your credit report, and taking out multiple life policies or homeowners’ insurance from companies that offer them.

What is the best car insurance in New Jersey?

Full coverage car insurance in New Jersey will provide the best protection to New Jersey drivers.

Is it illegal to drive without insurance in New Jersey?

Yes, all drivers need to meet New Jersey’s car insurance requirements to drive.

Is New Jersey a no-fault state?

Yes, New Jersey offers drivers the option to purchase no-fault auto insurance. Make sure to get quotes to get the best cheap car insurance in NJ.

Is NJM cheaper than Geico?

Yes, NJM is cheaper on average than Geico based on our analysis of rates.

Why is NJ car insurance so expensive?

Part of the reason NJ auto insurance is more expensive is that it is a no-fault state, so drivers need to carry higher amounts of liability insurance. Rates are also based on local state factors, such as the number of crashes and weather disasters.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Jan 10, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.