Alaska Cheapest Car Insurance & Best Car Insurance Coverage

Allstate and State Farm have Alaska's cheapest car insurance and best car insurance coverage. Drivers who want the bare minimum coverage will find the cheapest rate at Allstate for an average of $35/mo. AK drivers who want full coverage will find the best rates at State Farm for an average of $109/mo.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tonya Sisler

Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywri...

Content Team Lead

UPDATED: Jan 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jan 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

- Allstate has the cheapest AK minimum coverage

- State Farm has the cheapest AK full coverage

- All Alaska drivers need minimum coverage to drive

Looking for Alaska’s cheapest car insurance and best car insurance coverage? The best auto insurance companies in Alaska for cheap car insurance are Allstate and State Farm.

Read on to learn more about the best auto insurance in Alaska and you can enter your ZIP code at any time in our free quote tool to get started on finding affordable Alaska car insurance quotes.

Affordable Alaska Car Insurance Rates

Comparing quotes from at least three to five insurance companies is the best way to make sure you find the best deals to save money monthly.

| Cheapest Car Insurance in Alaska - Quick Hits |

|---|

The cheapest Alaska car insurance options are: The cheapest Alaska car insurance options are:For minimum coverage: Allstate For full coverage: State Farm After an at-fault accident: Umialik After a speeding ticket: Umialik After a DUI: Progressive For poor credit history: Geico For young drivers: Umialik For young drivers with one accident: Allstate For young drivers with speeding violation: Umialik |

In this guide, we will take a closer look at car insurance providers available to Alaska drivers and help you determine which one is best for your individual needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Alaska for Minimum Coverage

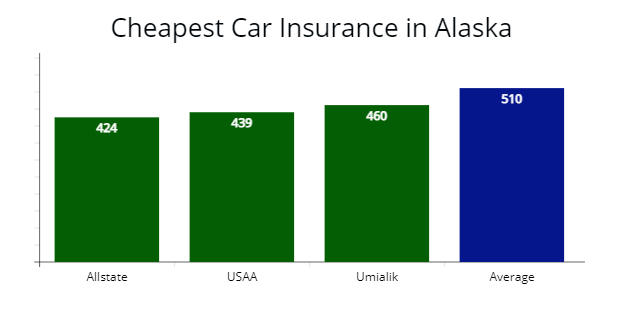

Our recent comparison shopping study found the cheapest auto insurer for minimum liability insurance requirements is Allstate, which provided our agents a $424 rate for our sample driver.

The average quote is $520 per year, and Allstate’s rate at $424 per year is 19% cheaper, making them the best option for Alaska drivers needing minimum liability insurance.

| Company | Average annual rate |

|---|---|

| Allstate | $424 |

| USAA | $439 |

| Umialik | $460 |

| State Farm | $465 |

| Geico | $490 |

| Progressive | $516 |

| Liberty Mutual | $541 |

*USAA is for qualified military members, their spouses, and direct family members. Rates may vary depending on driver profiles.

Military members, their spouses, or family members qualify for cheaper car insurance through USAA, which has the best car insurance options for veterans and military members. Buying minimum coverage insurance requirements at $439 annually through USAA is 16% less expensive than the state average $520 rate (learn more: A Review of USAA Car Insurance, Policy Options & Military Benefits).

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Cheapest Full Coverage Car Insurance in Alaska

If you are interested in having an extra layer of protection while you are on the road, the cheapest full coverage rates are with State Farm at $1,311 annually or $109 per month.

Quotes from this insurance carrier are 19% less expensive than Alaska’s average of $1,612.

| Insurer | Cost per year | Cost per month |

|---|---|---|

| State Farm | $1,311 | $109 |

| Umialik | $1,367 | $113 |

| Allstate | $1,547 | $129 |

| Alaska average | $1,612 | $134 |

*Your rates may vary when you get quotes.

Full coverage car insurance in Alaska costs, on average, more than three times the amount that minimum coverage insurance costs.

Read more: Understanding Full Coverage Car Insurance: What You Need to Know

While many drivers may instantly turn away from taking out full coverage due to the higher rates, others appreciate the peace of mind and reassurance they receive by having collision and comprehensive coverage along with their liability coverage.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Full coverage insurance will protect your vehicle from accidents caused by inclement weather or an animal, such as a moose. You may also want to get uninsured motorist coverage in Alaska for extra protection from uninsured drivers.Daniel Walker Licensed Insurance Agent

Cheapest Car Insurance With a Speeding Ticket in Alaska

The best coverage rate for drivers with one speeding violation is Umialik, which offered us a quote at $1,409 annually. The average cost of insurance for Alaskans with a speeding ticket is $1,780, but Umialik is $371 cheaper.

| Insurer | Cost per year | Cost per month |

|---|---|---|

| Umialik | $1,409 | $117 |

| Geico | $1,570 | $130 |

| Allstate | $1,727 | $143 |

| Alaska average | $1,780 | $148 |

Traffic tickets will cause your rates to increase regardless of your coverage level. In Alaska, most drivers can expect their rates to go up by 13% on average.

Learn more: How much will my auto insurance go up with a speeding ticket?

Cheapest Car Insurance in Alaska With a Car Accident

In Alaska, drivers with one at-fault accident on their driving record should consider the cheapest insurance company Umialik which provided our insurance agents with a quote at $1,548 annually or $129 per month.

In Alaska, the average cost of car insurance after being involved in an accident is $2,280 per year or $190 per month. Umialik’s rate for those with a car accident is 33% cheaper than average.

Your next cheapest option is Allstate, with a $1,970 rate or nearly $300 less than average.

Will car insurance rates increase after an accident? Yes, once you have an at-fault accident on your driving record in Alaska, you can expect your car insurance rates to go up by 32%, according to the Insurance Information Institute (III.org).

That is because insurance companies see accidents as a sign of increased risk, and many will consider you a high-risk driver until the accident is no longer on your record.

Cheapest Car Insurance With a DUI in Alaska

During our agent’s research, the auto insurance provider to check out is Progressive for drivers with a DUI.

Read more: Progressive Car Insurance Review for Families, Policy Options & Ratings

Progressive’s quote of $159 per month is 26% less expensive than average and $227 less than the next best option Allstate.

| Insurer | Cost per year | Cost per month |

|---|---|---|

| Progressive | $1,910 | $159 |

| Allstate | $2,137 | $178 |

| Umialik | $2,452 | $204 |

| Alaska average | $2,568 | $214 |

In Alaska, drivers who have been caught driving under the influence are expected to pay car insurance premiums that are 41% more than drivers who have clean driving records. After a DUI, Alaska drivers’ average insurance cost is $2,568 per year, or a rate increase to $214 per month. Registering for a defensive driving course is the best way to lower your insurance cost after a DUI offense, as well as shopping at the best car insurance companies after a DUI.

Cheapest Car Insurance For Drivers with Poor Credit

According to our research, the Alaskan insurance company offering the best rates with poor credit is Geico.

Geico’s quote of $1,599 per year is 15% less expensive than the $1,873 average premium.

| Insurer | Cost per year | Cost per month |

|---|---|---|

| Geico | $1,599 | $133 |

| Allstate | $1,659 | $138 |

| State Farm | $1,780 | $148 |

| Alaska average | $1,873 | $156 |

Even if you are a safe driver, your credit report and score can harm how much your car insurance rates will be. That’s because many companies look at a person’s ability to pay off their debts as a reflection of their ability to make their monthly car insurance payments.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

If you have bad credit, you will likely pay as much as 33% more for car insurance premiums in Alaska than those with good credit.

Cheapest Car Insurance for Young Drivers in Alaska

Our comparison study found that Umialik is the cheapest auto insurance company for young drivers in Alaska. Our insurance agents received a low rate of $3,354 annually from Umialik or $279 a month, which is 32% more affordable than Alaska’s state average rate.

| Insurer | Full coverage | Minimum coverage |

|---|---|---|

| Umialik | $3,354 | $1,348 |

| State Farm | $3,793 | $1,567 |

| USAA | $4,149 | $1,874 |

| Geico | $4,311 | $1,903 |

| Allstate | $5,129 | $1,377 |

| Liberty Mutual | $5,560 | $1,943 |

| Progressive | $6,128 | $2,243 |

| Alaska average | $4,871 | $1,875 |

Teen drivers looking for affordable minimum coverage in Alaska should consider Umialik ($1,348) and Allstate ($1,377). Both auto insurers are 27% cheaper than the average $1,875 Alaska auto insurance rate.

Our agents recommend young adults carry full coverage insurance. Still, if you have limited insurance provider options or your vehicle is worth less than $3,000, a minimum liability policy may be the best way to save more on car insurance.

It is estimated that young drivers pay as much as $3,000 more for their car insurance than adult drivers in Alaska.

Cheapest Car Insurance for Young Drivers with a Speeding Ticket

If under the age of 21 in Alaska, drivers with a speeding violation will find cheap rates with Umialik, which provided us a quote at $299 per month or 19% less expensive than the state average rate. State Farm proved to be affordable Alaska insurance at $3,900 per year for full coverage.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Umialik | $3,598 | $299 |

| State Farm | $3,900 | $325 |

| Geico | $4,922 | $410 |

| Alaska average | $4,437 | $369 |

Read more: How a Traffic Ticket Can Impact Your Car Insurance Rates

Cheapest Car Insurance for Young Drivers with an Auto Accident

Young Alaskans with an at-fault accident can avoid a significant rate increase by getting auto insurance coverage from Allstate Insurance with a quote at $3,978 annually or 27% cheaper.

Learn more: Allstate Car Insurance for College Students

The next best coverage option is Umialik, quoted at $4,259 per year or 22% less expensive than a typical rate for teen drivers with an accident in their driver history.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Allstate | $3,978 | $331 |

| Umialik | $4,259 | $354 |

| State Farm | $4,983 | $415 |

| Alaska average | $5,430 | $452 |

Best Auto Insurance Companies in Alaska

According to ValuePenguin’s survey of car insurance companies in Alaska, USAA performed the best overall customer service, and JD Power claims satisfaction. If not eligible for a USAA membership, your best auto policy options are Allstate and State Farm for larger national companies and Umialik for a regional company.

We studied data to help you make excellent coverage choices and insurance decisions during our comparison shopping study of Alaska’s best auto insurers. The data we use is from the National Association of Insurance Commissioners (NAIC), J.D. Power’s customer satisfaction survey, and AM Best financial strength ratings.

| Insurer | NAIC Complaint Index | J.D. Power claims satisfaction score | AM Best Financial Strength Rating |

|---|---|---|---|

| Allstate | 0.63 | 876 | A+ |

| State Farm | 0.66 | 881 | A++ |

| USAA | 0.68 | 890 | A++ |

| Progressive | 0.67 | 856 | A+ |

| Geico | 1.01 | 871 | A++ |

| Umialik | 0.00 | n/a | A+ |

*NAIC complaint index, the lower, the better, JD Power’s claims satisfaction study, the higher, the better, AM Best Ratings, A+ is “excellent,” and A++ is “superior” financial strength.

State Farm and Allstate are two insurers performing best with NAIC’s complaint index. Both scored less than one (1), with lower than average complaints based on their market share. Both car insurers have excellent JD Power claims satisfaction scores.

Deciding on the best insurance company in Alaska is not a simple task. That is because the factors that make one company the best for one driver may make them the worst choice for another. Finding the best auto insurance rates for you will depend on a wide variety of factors like your age, your driving history, where you live, and your vehicle’s make or model, to name a few. Alaskan drivers with a clean record will typically see more options from the cheapest companies

Below is a recent customer satisfaction and claims service study performed by ValuePenguin.

| Company | % respondents extremely satisfied with recent claim | % respondents rated customer service as excellent |

|---|---|---|

| USAA | 78% | 62% |

| State Farm | 73% | 46% |

| Allstate | 72% | 47% |

| Progressive | 74% | 34% |

| Geico | 64% | 42% |

| Umialik | N/A | N/A |

Your best resource for finding the most affordable and cheap car insurance rates in Alaska is insurance quote comparison websites like AutoInsureSavings.org. You can find many useful articles and guides on which car insurance company is the best and offers the most beneficial coverage options for various drivers in different categories.

Average Car Insurance Costs by City in Alaska

Auto insurers use your zip code to calculate your rate, as well as your marital status, credit score, and driving history. Your rates can vary by $300 or more, depending on your location in Alaska.

As an example, Anchorage’s average rate is $1,920 per year, while auto insurance rates in Ketchikan are $1,301, over a $600 variance.

AutoInsureSavings.org licensed agents did a comparison study of cities in Alaska.

Cheapest Car Insurance in Anchorage, AK

Alaskan drivers who live in Anchorage can find the cheapest insurance coverage for their motor vehicle with Allstate, which provided our agents a $1,549 annual quote or $129 per month for a full coverage auto insurance policy.

Allstate’s quote is 33% less expensive than the $1,920 citywide average rate.

| Anchorage Company | Average Premium |

|---|---|

| Allstate | $1,549 |

| Geico | $1,693 |

| Progressive | $1,782 |

| Anchorage average | $1,920 |

Cheapest Car Insurance in Ketchikan, AK

In research, we found the most affordable coverage for Ketchikan drivers is Umialik, providing a quote of $1,124 per year or 14% less expensive than the average quote. At $1,261 annually, State Farm is 4% lower than average, making both insurers the better car insurance option.

| Ketchikan Company | Average Premium |

|---|---|

| Umialik | $1,124 |

| State Farm | $1,261 |

| Progressive | $1,437 |

| Ketchikan average | $1,301 |

Cheapest Auto Insurance in Sitka, AK

AutoInsureSavings.org licensed agents’ research found coverage from Allstate Insurance costs cheaper for residents of Sitka. Allstate’s $97 monthly rate is 27% less expensive than the citywide average of $1,621 per year of $135 a month.

| Sitka Company | Average Premium |

|---|---|

| Allstate | $1,168 |

| Umialik | $1,346 |

| Geico | $1,472 |

| Sitka average | $1,621 |

Cheapest Auto Insurance in Badger, AK

Affordable coverage in Badger is with Allstate providing the best rate at $1,046 annually for a full coverage policy. Allstate’s $87 a month rate is 23% less expensive than average for residents of Badger.

Zipcodes in Badger, located near Fairbanks, pay slightly more for insurance coverage than those residing in a zip code within the city of Fairbanks.

| Badger Company | Average Premium |

|---|---|

| Allstate | $1,046 |

| Liberty Mutual | $1,157 |

| State Farm | $1,326 |

| Badger average | $1,347 |

Average Insurance Cost for All Cities in Alaska

| City | Annual Premium Cost | City | Annual Premium Cost |

|---|---|---|---|

| Adak | $1,573 | Kupreanof | $1,562 |

| Akhiok | $1,342 | Kwethluk | $1,801 |

| Akiak | $1,736 | Larsen Bay | $1,899 |

| Akutan | $1,295 | Lower Kalskag | $1,342 |

| Alakanuk | $1,562 | Manokotak | $1,548 |

| Aleknagik | $1,533 | Marshall | $1,295 |

| Allakaket | $1,569 | McGrath | $1,573 |

| Ambler | $1,765 | Mekoryuk | $1,533 |

| Anaktuvuk Pass | $1,295 | Mountain Village | $1,542 |

| Anchorage | $1,920 | Napakiak | $1,342 |

| Anderson | $1,562 | Napaskiak | $1,782 |

| Angoon | $1,762 | Nenana | $1,295 |

| Aniak | $1,721 | New Stuyahok | $1,713 |

| Anvik | $1,342 | Newhalen | $1,560 |

| Atka | $1,560 | Nightmute | $1,569 |

| Atqasuk | $1,533 | Nikolai | $1,342 |

| Bethel | $1,732 | Nome | $1,562 |

| Bettles | $1,542 | Nondalton | $1,533 |

| Brevig Mission | $1,672 | Noorvik | $1,560 |

| Buckland | $1,599 | North Pole | $1,643 |

| Chefornak | $1,295 | Nuiqsut | $1,651 |

| Chevak | $1,751 | Nulato | $1,439 |

| Chignik | $1,342 | Nunam Iqua | $1,365 |

| Chuathbaluk | $1,439 | Nunapitchuk | $1,600 |

| Clark's Point | $1,301 | Old Harbor | $1,573 |

| Coffman Cove | $1,712 | Ouzinkie | $1,566 |

| Cold Bay | $1,342 | Palmer | $1,660 |

| Cordova | $1,365 | Pelican | $1,301 |

| Craig | $1,533 | Pilot Point | $1,781 |

| Deering | $1,650 | Pilot Station | $1,542 |

| Delta Junction | $1,803 | Platinum | $1,650 |

| Dillingham | $1,301 | Point Hope | $1,365 |

| Diomede | $1,542 | Port Alexander | $1,295 |

| Eagle River | $1,560 | Port Heiden | $1,439 |

| Edna Bay | $1,439 | Port Lions | $1,301 |

| Eek | $1,566 | Quinhagak | $1,569 |

| Egegik | $1,365 | Ruby | $1,542 |

| Ekwok | $1,567 | Russian Mission | $1,365 |

| Elim | $1,582 | Saint Paul | $1,533 |

| Ester | $1,560 | Sand Point | $1,560 |

| Fairbanks | $1,295 | Savoonga | $1,582 |

| False Pass | $1,650 | Saxman | $1,439 |

| Fort Yukon | $1,742 | Scammon Bay | $1,295 |

| Galena | $1,301 | Selawik | $1,342 |

| Gambell | $1,365 | Seldovia | $1,542 |

| Golovin | $1,295 | Seward | $1,655 |

| Goodnews Bay | $1,533 | Shageluk | $1,301 |

| Grayling | $1,439 | Shaktoolik | $1,567 |

| Gustavus | $1,562 | Shishmaref | $1,562 |

| Holy Cross | $1,301 | Shungnak | $1,686 |

| Homer | $1,566 | Sitka | $1,621 |

| Hoonah | $1,569 | Soldotna | $1,566 |

| Hooper Bay | $1,542 | St. George | $1,301 |

| Houston | $1,365 | St. Mary's | $1,439 |

| Hughes | $1,582 | St. Michael | $1,533 |

| Huslia | $1,301 | Sterling | $1,542 |

| Hydaburg | $1,533 | Tanana | $1,365 |

| Juneau | $1,650 | Teller | $1,647 |

| Kachemak | $1,295 | Tenakee Springs | $1,562 |

| Kake | $1,365 | Thorne Bay | $1,569 |

| Kaktovik | $1,562 | Togiak | $1,295 |

| Kaltag | $1,590 | Toksook Bay | $1,521 |

| Kasaan | $1,301 | Unalakleet | $1,650 |

| Kenai | $1,650 | Unalaska | $1,521 |

| Ketchikan | $1,301 | Upper Kalskag | $1,650 |

| Kiana | $1,562 | Barrow | $1,941 |

| King Cove | $1,650 | Valdez | $1,567 |

| Kivalina | $1,521 | Wainwright | $1,533 |

| Klawock | $1,295 | Wales | $1,562 |

| Kobuk | $1,301 | Wasilla | $1,582 |

| Kodiak | $1,521 | Whale Pass | $1,566 |

| Kotlik | $1,533 | White Mountain | $1,562 |

| Kotzebue | $1,569 | Whittier | $1,590 |

| Koyuk | $1,542 | Wrangell | $1,533 |

Minimum Auto Insurance Requirements in Alaska

In Alaska, all drivers are state-mandated to show proof of insurance when asked by police officers or the Department of Motor Vehicles (DMV).

Any insurance policies sold to an Alaskan vehicle owner must include the minimum amount of bodily injury and property damage liability coverage, as per state requirements.

Bodily injury liability coverage pays for injuries to other drivers in a car accident, while property damage liability covers other vehicles’ damage.

Coverage limits for drivers must maintain as follows:

| Liability | Minimum coverage |

|---|---|

| Bodily injury (BI) | $50,000 per person and $100,000 per accident |

| Property damage (PD) | $25,000 per accident |

To learn more and find the best car insurance options in Alaska, contact the experts at AutoInsureSavings.org. Our licensed professionals will be happy to answer any questions you have.

Methodology

AutoInsureSavings.org comparison shopping study used a full-coverage policy for a 30-year-old driving a 2018 Honda Accord with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily liability | $50,000 per person/$100,000 per accident |

| Property damage | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured motorist bodily injury & underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

We used rates for drivers with an accident history, credit score, and marital status for other rate analyses. We used insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your rates may vary when you get quotes.

Sources

–Alaska Department of Commerce, Community, and Economic Development Division of Insurance. “Alaska Consumer Guide to Auto Insurance.”

–Insurance Information Institute. “Auto Rate Setting.”

–National Association of Insurance Commissioners. “Market Share Reports for Property/Casualty Groups and Companies.”

–National Highway Traffic Safety Administration (NHTSA). “(FARS).”

–Insurance Institute for Highway Safety (IIHS.org). “Fatality Facts 2018 State by state.”

Frequently Asked Questions

Who has the cheapest car insurance in Alaska?

After gathering information from various resources, we found the top car insurance companies offer the lowest Alaska drivers’ average rates is Allstate at $35 per month, USAA at $37 per month, and Umialik at $38 a month for a minimum coverage policy for a 30-year-old male with a clean driving history.

How can I save on car insurance in Alaska?

There are many things drivers can do to help save money on their car insurance rates in Alaska. First, you will need to compare quotes from multiple providers to find the right company that offers the exact level of coverage in Alaska you need at the most affordable price.

Another thing drivers can do to help them save more on their car insurance rates is ask their insurance provider about a money-saving driver discount they may be eligible for. Many companies offer discounts for drivers who have multiple policies with them or drivers who have no prior accidents or violations on their driving records.

To learn more about the many things you can do to help save more on your car insurance in Alaska, check out the articles and guides featured at AutoInsureSavings.org.

How much is car insurance in Alaska per month?

The average cost of car insurance in Alaska is $43 per month for minimum coverage in Alaska and $134 per month for full coverage insurance. Based on our research, Umialik is one of the most affordable car insurance companies in the state. Most drivers’ average annual rate is around $460 per year for state minimums and $1,367 annually, including comprehensive and collision coverage.

How much will my car insurance increase with a speeding ticket in Alaska?

For most car insurance customers, their premium will go up by $230 following a speeding citation. That causes their average yearly premium to be around $1,682. However, this is less than the national average for drivers with traffic tickets, which is estimated to be $1,988. Getting a traffic violation is one of the main ways drivers can be classified as high-risk drivers.

How much is full coverage car insurance in Alaska?

On average, most drivers in Alaska pay for full coverage auto insurance is $134 per month or $1,612 per year. The top insurance companies in Alaska who offer the lowest rate for drivers interested in full coverage policies include State Farm, Umialik, and Allstate. All three insurers provide insurance quotes 10% lower than average.

What is the best car insurance in Alaska?

The best auto insurance in Alaska is full coverage, as it protects drivers from accidents caused by weather, animals, and more.

What is the minimum car insurance in Alaska?

Alaska drivers must carry liability insurance in the amount of 50/100/25.

Is it illegal to drive without insurance in Alaska?

Yes, Alaska drivers must have insurance on their vehicles.

Is Alaska a no-fault car insurance state?

Alaska is an at-fault state, so whoever caused the accident is responsible for paying for the damages and injuries of all parties.

Does insurance follow the car or driver in Alaska?

Alaska auto insurance typically follows the vehicle.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tonya Sisler

Content Team Lead

Tonya Sisler has been a technical insurance writer for over five years. She uses her extensive insurance and finance knowledge to write informative articles that answer readers' top questions. Her mission is to provide readers with timely, accurate information that allows them to determine their insurance needs and choose the best coverage. Tonya currently leads a team of 10 insurance copywri...

Content Team Lead

UPDATED: Jan 18, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.