Oklahoma Cheapest Car Insurance & Best Car Insurance Coverage

USAA has Oklahoma's cheapest car insurance and best car insurance coverages, with insurance rates that average at least 20% lower than the OK state average. However, only military and veterans can qualify for USAA, so other choices for affordable insurance in Oklahoma include State Farm and Farmers.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Feb 9, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Feb 9, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- USAA has the cheapest auto insurance in Oklahoma

- Other cheap companies include State Farm and Farmers

- Getting OK quotes is the best way to find the cheapest rate

Looking for Oklahoma’s cheapest car insurance and best car insurance coverage? Some of the best auto insurance companies in OK for cheap coverage are USAA, State Farm, and Farmers, which we go over in more detail in our guide.

To get Oklahoma auto insurance quotes directly, use our free quote tool by entering your ZIP code.

Oklahoma’s Minimum Car Insurance Requirements

| Coverage | Oklahoma Minimum Liability Coverage | Recommended Coverage |

|---|---|---|

| Bodily Injury | $25,000 / $50,000 | $50,000 / $100,000 |

| Property Damage | $25,000 | $25,000 |

| Uninsured Motorist (Bodily Injury) | Optional | 50,000 / 100,000 |

| Uninsured Motorist (Property Damage) | Optional | 25,000 |

| Collision | Optional | $500 deductible |

| Comprehensive | Optional | $500 deductible |

Bodily Injury Liability

All drivers in Oklahoma need to carry liability auto insurance. Each Oklahoma motorist must get at least $25,000 worth of bodily injury liability coverage for injuries to a single person and $50,000 for multiple passengers to pay for medical costs.

Property Damage Liability

Property damage liability covers damage to private and public property like buildings, places of business, traffic lights, and the other person’s vehicle.

The minimum coverage in the state of Oklahoma is $25,000 for repairs per accident.

The set limit for OK is 25/50/25, and it is recommended to get additional coverage for your vehicle if you want to be sure to protect your assets.

Other recommend coverage for your automobile in Oklahoma is uninsured motorist coverage, medical payments coverage, comprehensive car insurance coverage, and collision car insurance coverage.

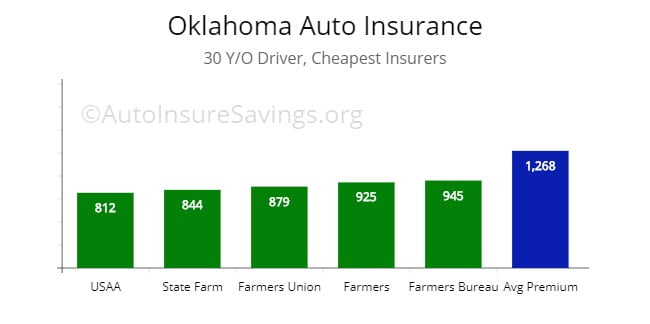

Note: For a 30 y/o driver, the cheapest car insurance options by quote are with State Farm, Farmers Union, and Farmers. Each queried at $844, $879, and $925 per year for full coverage. All three carriers are at least 26% lower than the average premium of $1,268.

Note: For a 30 y/o driver, the cheapest car insurance options by quote are with State Farm, Farmers Union, and Farmers. Each queried at $844, $879, and $925 per year for full coverage. All three carriers are at least 26% lower than the average premium of $1,268.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Auto Insurance Providers in Oklahoma

Below is a table of the cheapest option to the most expensive option for insurers for drivers from 25 to 55 years of age.

When queried for quotes for each age, the least inexpensive are USAA, Oklahoma Farmers Union (known as American Farmers & Ranchers), and State Farm.

Depending on your age and location, each insurer can offer quotes from 21% to 31% lower than the median premium for similar age drivers.

USAA is only available to former military members and their spouses but is one of the best car insurance options for veterans and the military. You can read more about USAA in our USAA review.

Other competitive carriers are Shelter, Farm Bureau, and Allstate.

Each carrier offer quotes from 16% to 27% lower than the “mean” quote for similar age drivers.

With the list of insurers, you have a blend of local, regional, and national companies to help you lower your monthly premium.

Company 25 Y/O (Average Premium) 30 Y/O 45 Y/O 55 Y/O

USAA $1,112 $812 $635 $487

Geico $1,132 $832 $654 $499

State Farm $1,143 $844 $676 $521

Oklahoma Farmers Union $1,165 $879 $680 $543

Farmers $1,221 $925 $695 $554

OK Farm Bureau $1,236 $945 $723 $576

Shelter $1,265 $987 $743 $580

Allstate $1,276 $1,032 $764 $589

Mercury $1,311 $1,045 $786 $598

Safe Auto $1,432 $1,132 $843 $611

MetLife $1,521 $1,237 $879 $632

Two other carriers which are often overlooked in Oklahoma are Safe Auto and Mercury. Safe Auto and Mercury and not as well known in Oklahoma.

At times, each carrier can offer substantially lower quotes than the average insurance premiums. Both Safe Auto and Mercury do reasonably well for drivers with a history of traffic violations (read more: How a Traffic Ticket Can Impact Your Car Insurance Rates).

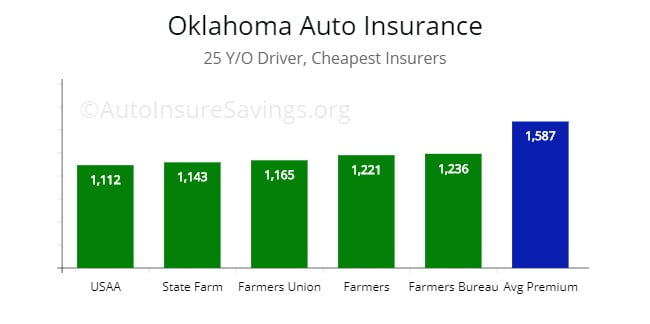

Note: For a 25-year-old driver, the best options by price are with USAA, State Farm, and Farmers Union. Each carrier is at least 26% lower than the average premium of $1,587 per year. USAA is available to military, former military, and their spouses. Other competitive options are with Farmers and Farmers Union. Both offer quotes at $1,221 and $1,236 per year for full coverage.

Note: For a 25-year-old driver, the best options by price are with USAA, State Farm, and Farmers Union. Each carrier is at least 26% lower than the average premium of $1,587 per year. USAA is available to military, former military, and their spouses. Other competitive options are with Farmers and Farmers Union. Both offer quotes at $1,221 and $1,236 per year for full coverage.

Uninsured Motorist Protection

Uninsured motorist protection is going to cover members of your family, passengers of your car for personal injuries caused by an uninsured motorist or hit-and-run driver.

UM, coverage does “not” pay for damage to your car.

If you want the damage to your car to be covered, then you would need collision coverage.

Collision coverage will protect you in the event another driver hits you, or you hit an object.

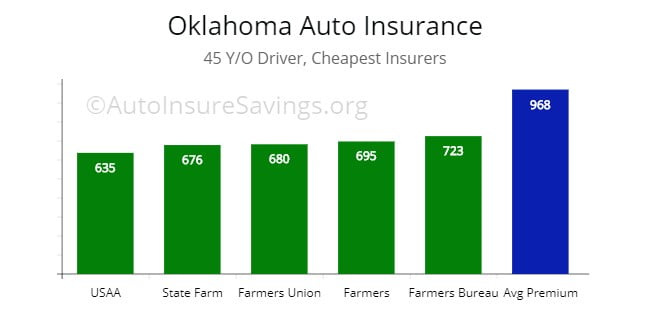

Note: For a 45-year-old driver, the quotes clustered between $635 and $723. To get cheaper coverage start with State Farm, American Farmers & Ranchers, and Farmers. We queried each at $676, $680, and $695 respectively per year for full coverage. All three carriers are nearly 30% lower than the average premium price of $968.

Note: For a 45-year-old driver, the quotes clustered between $635 and $723. To get cheaper coverage start with State Farm, American Farmers & Ranchers, and Farmers. We queried each at $676, $680, and $695 respectively per year for full coverage. All three carriers are nearly 30% lower than the average premium price of $968.

Comprehensive, Collision, & Medical Payments

Comprehensive and collision coverage will cover all other “non-collision” accidents like natural disasters such as tornadoes or stolen cars.

Medical payments are other optional coverage, and many believe they do not need a health insurance policy.

If you have medical payment on your policy, it will cover the deductible for the health insurance policy.

Your health insurance coverage may not extend to all passengers, so it may be a good idea to consider this coverage type.

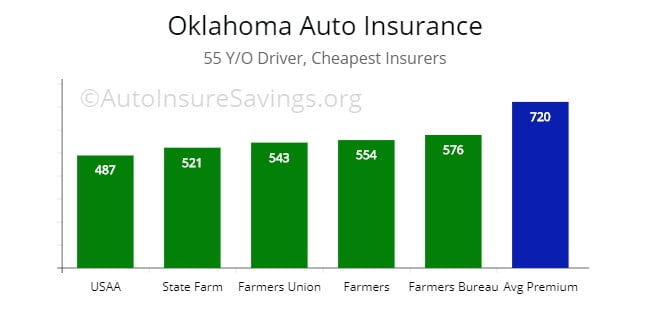

Note: A 55 y/o driver can find quotes clustering from $487 to $576, an $89 variance. The cheapest car insurance can be found with State Farm, American Farmers & Ranchers, and Farmers. Each queried at $521, $543, and $554 respectfully per year for full coverage. Or approximately 22% lower than the average premium of $720.

Note: A 55 y/o driver can find quotes clustering from $487 to $576, an $89 variance. The cheapest car insurance can be found with State Farm, American Farmers & Ranchers, and Farmers. Each queried at $521, $543, and $554 respectfully per year for full coverage. Or approximately 22% lower than the average premium of $720.

Best Insurers by Written Premiums, Rate Change, and Consumer Rating

Each of the insurers in the study is included in the list below.

The data includes the number of written premiums, rate change, consumer rating, and the number of complaints.

Out of all the carriers, none had an unusual amount of complaints.

The rate change over the course of 12 to 18 months is normal.

However, if you get a traffic violation during your auto policy term, you can get a spike in insurance rates.

And years after, depending on the violation.

The amount of written premium is included to verify established insurers in the state of Oklahoma.

The data compiled is from JP Power & Associates, AM Best, and the III.org.

Consumer rating data is compiled from reputable online sources to get an average.

| Company | Direct Written Premiums | Rate Change < 18 Months | # of Complaints | Consumer Rating out of 5 Stars |

|---|---|---|---|---|

| State Farm | $3,382,869 | +3.3% | 2 | 4.3 |

| CSAA | $1,257,076 | +3.9% | 3 | 4.4 |

| Travelers | $1,087,743 | +3.2% | 6 | 4.4 |

| USAA | $1,656,032 | +2.7% | 4 | 4.6 |

| Liberty Mutual | $3,652,576 | +2.8% | 3 | 4.4 |

| Allstate | $2,132,680 | +2.9% | 1 | 4.2 |

| Shelter | $1,324,432 | +2.9% | 2 | 4.1 |

| Progressive | $5,032,435 | +3.5% | 8 | 4.2 |

| Oklahoma Farm Bureau Mutual | $5,832,765 | +3.6% | 3 | 3.8 |

| Nationwide | $1,654,547 | +2.9% | 1 | 4.2 |

| Farmers | $2,555,657 | +3.7% | 11 | 4.3 |

| American Family | $845,478 | +2.9% | 9 | 4.0 |

| Geico | $2,532,387 | +3.7% | 2 | 4.4 |

| Safeco | $822,458 | +3.7% | 5 | 4.2 |

Driving without Insurance – fines and penalties

- $250 fine and/or 30 days in jail, plus suspension of license and registration if no accident is involved.

- If an accident is involved – $344 fine and/or 30 days in jail, plus suspension of license and registration.

- Drivers will be required to pay a $30 reinstatement fee.

- If you fail to provide proof of insurance to the police officer, your vehicle can be impounded on the spot, and your license and registration are forfeited until you provide proof.

Average Premium by Oklahoma City

The average premium by the city in Oklahoma is in the list below. We found the larger, more populated cities have slighter higher premiums, most likely due to the higher occurrence of automobile accidents and other factors.

Learn more: Understanding How Car Insurance Premiums Are Calculated

Out of the 20 cities, we queried the average premium rate can vary from $799 to nearly $1,200 per year.

If you would like a detailed study of larger cities in Oklahoma, please read further below.

| City | Avg Premium | City | Avg Premium |

|---|---|---|---|

| Ada | $832 | Jenks | $888 |

| Altus | $865 | McAlester | $876 |

| Ardmore | $932 | Muskogee | $987 |

| Bartlesville | $984 | Newcastle | $1,076 |

| Bethany | $1,009 | Owasso | $1,121 |

| Claremore | $897 | Ponca City | $1,107 |

| Del City | $799 | Sand Springs | $985 |

| Duncan | $894 | Sapulpa | $987 |

| El Reno | $955 | Shawnee | $1,031 |

| Elgin | $1,008 | Yukon | $1,062 |

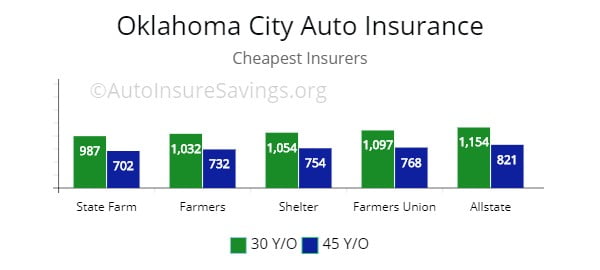

Oklahoma City

To find cheap car insurance in Oklahoma City, start with State Farm, Farmers, and Shelter.

We queried each at $987, $1,032, and $1,054 for a 30-year-old driver.

Which is 29% lower than the mean rate in Oklahoma

All of the insurers illustrated are at least 21% lower than the average policyholder in Oklahoma City.

A 45-year-old can get the best rates with State Farm, Farmers, and Shelter.

They were queried at $702, $732, and $754, respectively, for full coverage.

Or 31% lower than the average premium price for a driver of a similar profile.

| Oklahoma City Company | 30 Y/O | 45 Y/O |

|---|---|---|

| State Farm | $987 | $702 |

| Farmers | $1,032 | $732 |

| Shelter | $1,054 | $754 |

| Oklahoma Farmers Union | $1,097 | $768 |

| Geico | $1,127 | $789 |

| Allstate | $1,154 | $821 |

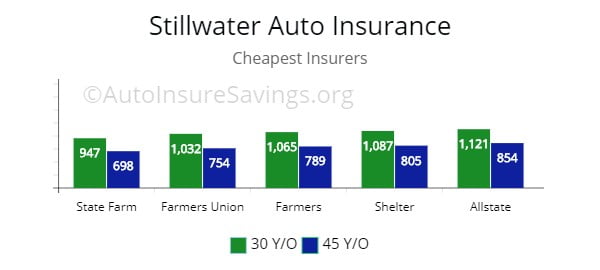

Stillwater

Stillwater can get cheap quotes if they shop in the right place.

Start with State Farm, OK Farmers Union, and Farmers.

Each was queried at $947, $1,032, and $1,065, respectively, for a 30-year-old driver.

All three carriers are 26% lower than the “mean” quote in Stillwater.

A 45-year-old can find the cheapest auto insurance with State Farm, Oklahoma Farmers Union, and Farmers.

Quotes range from $698, $754, and $789 per year for full coverage.

Or nearly 30% lower than the citywide average premium.

Shelter and Allstate are good contenders since they are 25% lower with quotes at $805 and $854.

| Stillwater Company | 30 Y/O | 45 Y/O |

|---|---|---|

| State Farm | $947 | $698 |

| Geico | $986 | $724 |

| Oklahoma Farmers Union | $1,032 | $754 |

| Farmers | $1,065 | $789 |

| Shelter | $1,087 | $805 |

| Allstate | $1,121 | $854 |

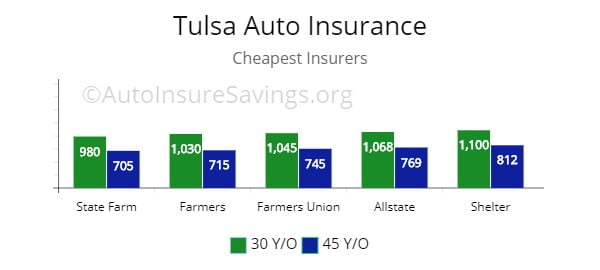

Tulsa

Tulsa residents are frugal shoppers, but getting cheaper auto insurance sometimes seems to be out of reach.

If you are in the market, start with State Farm, Farmers, and Oklahoma Farmers Union.

Each was queried at $980, $1,030, and $1,045, respectively, for a 30-year-old.

Which is 29% lower than the state average.

And 24% lower than the average policyholder in the city of Tulsa.

A 45-year-old driver can get low rates with State Farm and Farmers.

Quotes range from $705 and $715, respectively, per year for full coverage.

Which is 35% lower than the mean quote with the city.

And 28% lower than the average policyholder in the city of Tulsa.

| Tulsa Company | 30 Y/O | 45 Y/O |

|---|---|---|

| Geico | $965 | $694 |

| State Farm | $980 | $705 |

| Farmers | $1,030 | $715 |

| Oklahoma Farmers Union | $1,045 | $745 |

| Allstate | $1,068 | $769 |

| Shelter | $1,100 | $812 |

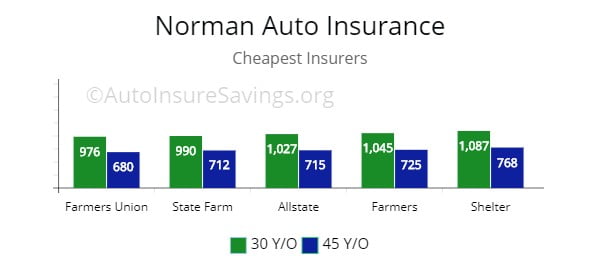

Norman

Drivers in Norman can get cheap auto insurance by getting quotes from Oklahoma Farmers Union, State Farm, and Allstate.

Each was queried at $976, $990, and $1,027 for a 30-year-old per year.

Which is 27% lower than the mean rate within Norman.

Farmers and Shelter are 23% lower than average, making it worthwhile to get quotes from them too.

A 45-year-old can find the lowest prices with OK Farmers Union, State Farm, and Allstate.

Each queried at $680, $712, and $715 per year for full coverage.

All three at 30% lower than the state average and 26% lower than the citywide average premium.

| Norman Company | 30 Y/O | 45 Y/O |

|---|---|---|

| Geico | $945 | $667 |

| Oklahoma Farmers Union | $976 | $680 |

| State Farm | $990 | $712 |

| Allstate | $1,027 | $715 |

| Farmers | $1,045 | $725 |

| Shelter | $1,087 | $768 |

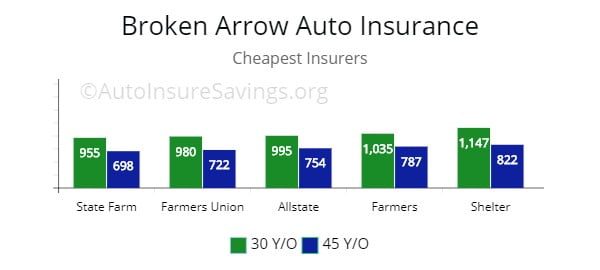

Broken Arrow

For drivers to find cheap car insurance in Broken Arrow, start with State Farm, Oklahoma Farmers Union, and Allstate.

Each was queried at $955, $980, and $995, respectively, for a 30-year-old driver.

Which is 28% lower than the average policyholder in Broken Arrow.

With quotes clustering between $955 and $1,147, the variance is nearly 20% making it important to compare quotes.

A 45-year-old can find the best prices with State Farm and OK Farmers Union.

Quotes start at $698 and $722, respectively, per year for full coverage.

Or nearly 30% lower than the average premium within Broken Arrow.

| Broken Arrow Company | 30 Y/O | 45 Y/O |

|---|---|---|

| State Farm | $955 | $698 |

| Oklahoma Farmers Union | $980 | $722 |

| Allstate | $995 | $754 |

| Farmers | $1,035 | $787 |

| Geico | $1,087 | $807 |

| Shelter | $1,147 | $822 |

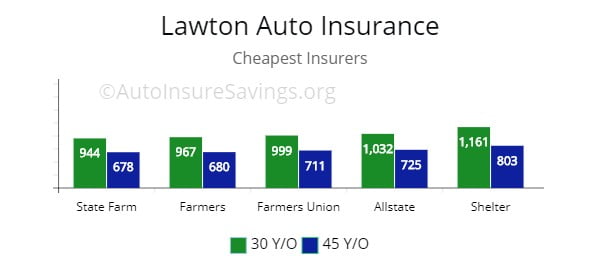

Lawton

If you aren’t getting the lowest premium in Lawton, you will probably be looking in the wrong place.

Start with State Farm, Farmers, and Oklahoma Farmers Union.

Each was queried at $944, $967, and $999 for a 30-year-old driver.

Which is 31% lower than the average premium in Lawton.

Allstate is definitely a worthwhile option, too, with quotes 21% lower than average.

With Shelter, quotes start to spike at $1,161.

A 45-year old can get the lowest prices with State Farm and Farmers.

Each was queried at $678 and $680, respectively, per year for full coverage.

Or 29% lower than the average policyholder in Lawton.

.

| Lawton Company | 30 Y/O | 45 Y/O |

|---|---|---|

| State Farm | $944 | $678 |

| Farmers | $967 | $680 |

| Oklahoma Farmers Union | $999 | $711 |

| Allstate | $1,032 | $725 |

| Geico | $1,055 | $776 |

| Shelter | $1,161 | $803 |

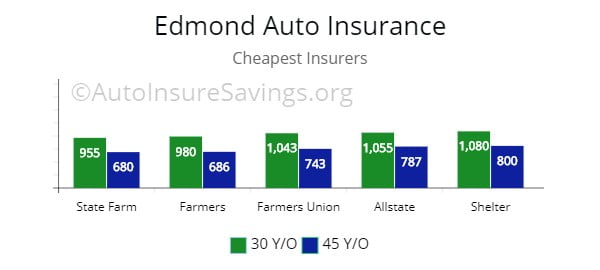

Edmond

Drivers in Edmond can find affordable premiums by getting quotes from State Farm, Farmers, and OK Farmers Union.

Each were queried at $955, $980, $1,043 respectfully for a 30-year-old driver.

Or 26% lower than the average premium price in Edmond.

There is a variance of $125 among all the insurers, making it worth your time to get quotes from all carriers.

A 45-year-old can get the lowest quotes with State Farm and Farmers.

Each was queried at $680 and $686, respectively, per year for full coverage.

Which is 29% lower than the “mean” premium in the city of Edmond.

Allstate and Shelter are 24% lower with quotes at $1,055 and $1,080, respectively.

| Edmond Company | 30 Y/O | 45 Y/O |

|---|---|---|

| State Farm | $955 | $680 |

| Farmers | $980 | $686 |

| Geico | $1,032 | $700 |

| Oklahoma Farmers Union | $1,043 | $743 |

| Allstate | $1,055 | $787 |

| Shelter | $1,080 | $800 |

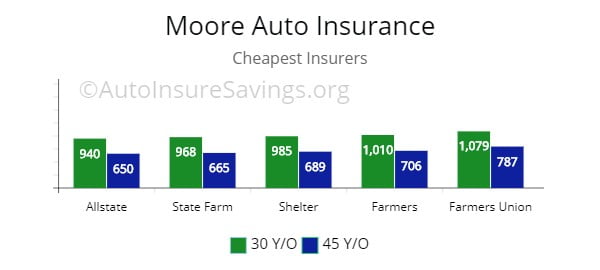

Moore

Drivers in Moore, OK, can get the cheapest car insurance with Allstate, State Farm, and Shelter.

Each queried at $940, $968, and $985 for a 30-year-old driver.

Or nearly 30% lower than the citywide average premium quote in Moore.

With a variance of $140 from all five insurers, it is worth comparing quotes to find the most savings.

A 45-year-old can get the least expensive rates with Allstate, State Farm, and Shelter.

Rates stem from $650, $665, and $689 per year for full coverage.

Or approximately 28% lower than the “mean” quote in Moore.

| Moore Company | 30 Y/O | 45 Y/O |

|---|---|---|

| Allstate | $940 | $650 |

| State Farm | $968 | $665 |

| Shelter | $985 | $689 |

| Farmers | $1,010 | $706 |

| Geico | $1,045 | $725 |

| Oklahoma Farmers Union | $1,079 | $787 |

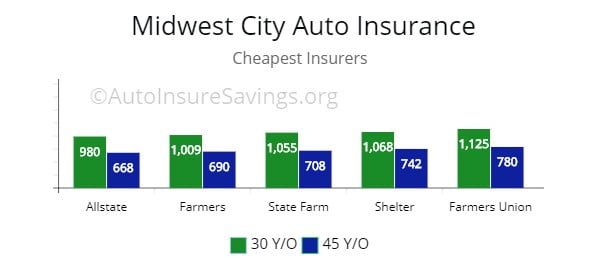

Midwest City

Premium rates in Midwest City are slightly higher than average.

If you want to get cheaper quotes, then start with Allstate, Farmers, and State Farm.

Each were queried at $980, $1,009, and $1,055 for a 30-year-old driver.

Which is 22% lower than the average policyholder in Midwest City.

A 45-year old can find the best prices with Allstate and Farmers.

Each was queried at $668 and $690 per year.

| Midwest City Company | 30 Y/O | 45 Y/O |

|---|---|---|

| Allstate | $980 | $668 |

| Farmers | $1,009 | $690 |

| State Farm | $1,055 | $708 |

| Shelter | $1,068 | $742 |

| Geico | $1,090 | $765 |

| Oklahoma Farmers Union | $1,125 | $780 |

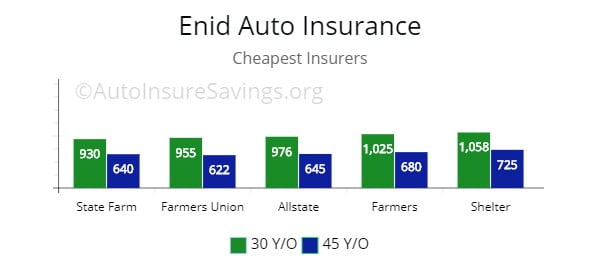

Enid

If you are in the market for cheaper car insurance in Enid, start with State Farm, OK Farmers Union, and Allstate.

Each was queried at $930, $955, and $976 for a 30-year-old driver.

Which is 24% lower than the citywide average premium in Enid.

A 45-year-old can get the best rates with State Farm and OK Farmers Union with quotes at $640 and $622, respectively.

Or nearly 28% lower than the average policyholder within Enid.

| Enid Company | 30 Y/O | 45 Y/O |

|---|---|---|

| State Farm | $930 | $640 |

| Oklahoma Farmers Union | $955 | $622 |

| Allstate | $976 | $645 |

| Farmers | $1,025 | $680 |

| Shelter | $1,058 | $725 |

| Geico | $1,087 | $752 |

To get cheap quotes for Oklahoma auto insurance today, use our free tool.

Frequently Asked Questions

Who has the lowest auto insurance in Oklahoma?

USAA has the cheapest car insurance in Oklahoma.

What is the bare minimum car insurance in Oklahoma?

Drivers must carry liability insurance and uninsured motorist insurance.

Is it illegal to not have car insurance in Oklahoma?

Yes, Oklahoma drivers must carry Oklahoma car insurance to drive.

How much is the average car insurance in Oklahoma?

Minimum coverage is an average of $40/mo in Oklahoma, while full coverage is an average of $137/mo.

How much is full coverage in Oklahoma per month?

Full coverage is an average of $137/mo in OK.

Is Oklahoma a no-fault state?

Oklahoma is an at-fault state for auto insurance.

Is Oklahoma a PIP state?

No, Oklahoma is not a PIP state.

What is the penalty for not having car insurance in Oklahoma?

Fines, suspended licenses, and similar penalties.

How can I save on Oklahoma car insurance?

Shop around for quotes to get cheap auto insurance in Oklahoma. Keeping a clean driving record will also help you keep rates low.

What is the best Oklahoma car insurance?

Full coverage is the best OK auto insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Feb 9, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.