Montana Cheapest Car Insurance & Best Coverage Options

Montana drivers who want to find the Montana cheapest car insurance and best coverage options should look at Safeco and State Farm. Safeco has the cheapest minimum Montana coverage at an average of $21/mo. State Farm has the least expensive full coverage insurance in Montana at an average of $85/mo.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Feb 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Feb 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

- Safeco Insurance has the cheapest minimum insurance in Montana

- Safeco’s rates are 50% less expensive than the Montana average

- State Farm has the cheapest full coverage in Montana

The Montana cheapest car insurance and best coverage options are at Safeco and State Farm, as both companies’ average rates are over 30% below the state average. Shopping at the best auto insurance companies for cheap car insurance in Montana will help drivers keep rates low, as well as understanding what coverages Montana drivers should carry.

If you want to jump right into comparison Montana auto insurance quotes, enter your ZIP code into our free quote comparison tool to get started.

Affordable Montana Car Insurance Rates

Montana drivers can save more on car insurance premiums by comparing multiple car insurance providers’ quotes with our agents’ cheapest insurance rate recommendations from this rate analysis.

Learn more: 12 Hacks & Simple Strategies to Get the Cheapest Car Insurance

| Cheapest Car Insurance in Montana - Quick Hits |

|---|

The cheapest Montana car insurance options are: The cheapest Montana car insurance options are:Cheapest for minimum coverage: Safeco Insurance Cheapest for full coverage: State Farm Cheapest after an at-fault accident: State Farm Cheapest after a speeding ticket: Progressive Cheapest after a DUI: Progressive Cheapest for poor credit history: Geico Cheapest for young drivers: Allstate For young drivers with a speeding violation: Allstate For young drivers with an at-fault accident: State Farm |

This practical Montana auto insurance guide will help you find the best car insurance options that will help you save money regardless of your driving type.

Or enter your Zip Code to begin comparison shopping for Montana’s best auto insurance quotes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Who has the cheapest car insurance in Montana for minimum coverage?

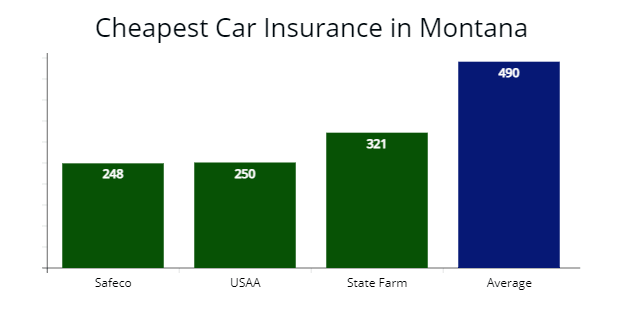

Safeco Insurance offers the lowest minimum coverage rates for Montana drivers, which provided us a $248 annual rate or $242 cheaper than the $490 average quote for our 30-year-old driver.

If you are a military member or a family member of a service member, your best rates are with USAA, which offered our agents a $250 annual quote for minimum liability coverage (read more: A Review of USAA Car Insurance, Policy Options & Military Benefits).

| Company | Average Annual Rate |

|---|---|

| Safeco | $248 |

| USAA | $250 |

| State Farm | $321 |

| Geico | $367 |

| Progressive | $439 |

| Farmers | $576 |

| Liberty Mutual | $723 |

| Allstate | $810 |

*USAA is for qualified military members, their spouses, and direct family members. Your insurance rates may vary based on the driver’s profile.

Remember, while minimum auto insurance coverage can ensure you stay legal and have the lowest possible premium. Liability-only may not provide you with the amount of bodily injury and property damage liability you need if you are involved in an auto accident.

Learn more: Understanding Liability Auto Insurance: What You Need to Know

A Montana state minimum auto policy only covers up to $50,000 in bodily injury liability and $20,000 in property damage liability.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

The cheap liability insurance rates offered may differ slightly, depending on your age, zip code, driving history, and a variety of other factors.

What’s the cheapest full coverage car insurance in Montana?

State Farm offers the cheapest car insurance rates for full coverage in Montana. State Farm’s $1,019 rate ($84 per month) is 32% less expensive than the statewide average of $1,493 per year.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| State Farm | $1,019 | $84 |

| USAA | $1,054 | $87 |

| Safeco | $1,138 | $94 |

| Geico | $1,250 | $104 |

| Progressive | $1,432 | $119 |

| Liberty Mutual | $1,742 | $145 |

| Montana average | $1,493 | $124 |

*USAA is for qualified military members, their spouses, and direct family members. Your average rates may vary based on the driver’s profile.

Full coverage policies offer more protection than liability-only. You have motor vehicle insurance from vandalism, fallen tree branches, or auto theft with collision and comprehensive coverage.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

AutoInsureSavings.org agents recommend getting full coverage insurance if your vehicle is worth more than your comprehensive and collision coverage plus your deductibles.

Learn more: Understanding Full Coverage Car Insurance: What You Need to Know

Cheapest Car Insurance With One Speeding Ticket in Montana

Progressive offers the cheapest auto insurance rates for Montana drivers with one speeding violation on their driving records.

Learn more: Progressive Car Insurance Review for Families, Policy Options & Ratings

Progressive’s $1,570 rate for full coverage is 24% or $478 less expensive than the statewide average.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Progressive | $1,570 | $120 |

| State Farm | $1,743 | $145 |

| Geico | $1,965 | $163 |

| Montana average | $2,048 | $170 |

Wondering how a traffic ticket can impact your car insurance rates? If caught speeding in Montana, your insurance rates can go up to $279 per year or 18%. The amount that your rate increases can also depend on how fast you were going over the speed limit.

Most auto insurers will increase car insurance rates after traffic tickets. Still, some insurers increase insurance rates more than others, which is an essential reason to comparison shop for cheaper insurance coverage.Dani Best Licensed Insurance Producer

Progressive has minimum coverage requirements for Montana drivers. Like most states, Montana requires drivers to carry at least the state-mandated minimum levels of insurance.

Who has the cheapest car insurance in Montana with a car accident?

According to our rate analysis, State Farm offers the cheapest rates for Montana drivers with one auto accident with a $1,932 annual insurance premium or $161 per month for our sample driver.

State Farm’s rate is 33% less expensive than Montana’s average insurance premium for drivers with one accident in their driving history.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| State Farm | $1,932 | $161 |

| Progressive | $2,057 | $171 |

| Geico | $2,341 | $195 |

| Montana average | $2,877 | $240 |

Montana drivers with an accident history typically pay around $2,877 per year on their car insurance premiums.

Wondering will car insurance rates increase after an accident? We found average rates increase about 49% after a driver is involved in an at-fault accident. In other words, just one accident could cause your rate to go up as much as $1,384 per year in Montana compared to those with a clean driving record.

What’s the cheapest car insurance with a DUI in Montana?

Montana residents with driving under the influence (DUI) convictions on their driving records, can find the cheapest car insurance with Progressive, which provided our insurance agents a quote at $2,446 per year or a $203 monthly rate for our 30-year-old sample driver.

Read more: The Best Car Insurance Companies After a DUI

Progressive’s rate is 26% cheaper than Montana’s average DUI rate.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Progressive | $2,446 | $203 |

| State Farm | $2,638 | $219 |

| Geico | $3,133 | $241 |

| Montana average | $3,264 | $271 |

After receiving a DUI citation, car insurance premiums go up 55% on average in Montana. A DUI will remain on your driving record for three years, and the Montana Department of Motor Vehicles (DMV) will report your conviction to your insurance company during that time.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

You will also be required to file an SR-22 form to prove you have minimum liability coverage and get an ignition interlock device (IID) installed in your motor vehicle.

What’s the cheapest car insurance for drivers with poor credit in Montana?

Our agents found that the Geico Insurance Agency provides the cheapest insurance for drivers with poor credit in Montana. Geico’s $1,763 rate with collision and comprehensive insurance is 27% less expensive than the average rate for 30-year-old drivers with bad credit scores.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Geico | $1,763 | $146 |

| State Farm | $2,021 | $168 |

| Allstate | $2,362 | $196 |

| Montana average | $2,510 | $209 |

Statistics show that drivers who have a bad or poor credit rating will be more likely to file a claim, be caught for speeding, or get involved in an at-fault accident. For that reason, their car insurance costs are higher.

It is a good idea for drivers to keep a close eye on their credit scores and report. If you notice any mistakes on your credit report, you should take care of them promptly to ensure the issues do not cause your car insurance rates to increase.

Who has the cheapest car insurance for young drivers in Montana?

We found young Montana drivers can find the cheapest full coverage auto insurance with Allstate during our rate analysis, which provided our agents a $3,245 annual rate or 47% less expensive than our sample driver’s average rates.

Younger military members will find the best insurance coverage with USAA, with the lowest rate at $3,133 per year.

The cheapest for state minimum coverage is State Farm, which offered us a quote at $1,160 or a $96 monthly rate. The next best option for younger drivers is the Geico Insurance Agency, with a $1,289 annual rate for liability-only insurance.

| Insurer | Full Coverage | Minimum Coverage |

|---|---|---|

| USAA | $3,133 | $1,043 |

| Allstate | $3,245 | $1,327 |

| State Farm | $3,467 | $1,160 |

| Geico | $4,645 | $1,289 |

| Progressive | $5,344 | $1,659 |

| Farmers | $6,765 | $2,036 |

| Montana average | $5,849 | $1,625 |

*USAA is for qualified military members, their spouses, and direct family members. Your insurance rates may vary based on the driver’s profile.

Drivers under 25 will have higher insurance premiums regardless of what car insurance company they choose or where they reside. Because they have less experience on the road than older drivers, they are automatically at a higher risk for auto insurance companies.

Therefore, it is best to find a company that offers the cheapest insurance rates for young or teen drivers in Big Sky Country, such as Allstate or State Farm, to cut down on your insurance costs.

Who has the cheapest car insurance for young drivers with a speeding ticket?

Young Montana drivers caught speeding should look to Allstate for the cheapest insurance coverage premiums. The average insurance cost from Allstate is $3,412 per year for full coverage.

Allstate’s speed violation rate is 47% less expensive than the $6,340 average rate for young drivers in Montana.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Allstate | $3,412 | $284 |

| State Farm | $3,680 | $306 |

| Geico | $4,941 | $411 |

| Montana average | $6,340 | $528 |

Learn more: How much will my auto insurance go up with a speeding ticket?

What’s the cheapest car insurance for young drivers with an at-fault accident?

Young inexperienced drivers in Montana with a recent at-fault accident can find the best car insurance coverage options with State Farm, which provided our agents a $3,670 rate for full coverage insurance.

State Farm’s at-fault accident quote is 46% cheaper than the statewide teen driver accident rate of $6,744 per year.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| State Farm | $3,670 | $305 |

| Allstate | $3,941 | $328 |

| Geico | $6,124 | $510 |

| Montana average | $6,744 | $562 |

Best Auto Insurance Companies in Montana

AutoInsureSavings.org team of licensed insurance agents rated the best car insurance companies in Montana by customer satisfaction surveys and the National Association of Insurance Commissioners (NAIC) complaint index.

We found that USAA, Allstate, State Farm are the best insurers based on excellent customer service and claims satisfaction.

ValuePenguin found similar results from their recent Montana customer survey.

| Company | % respondents extremely satisfied recent claim | % respondents rated customer service as excellent |

|---|---|---|

| USAA | 78% | 62% |

| State Farm | 73% | 46% |

| Allstate | 72% | 47% |

| Progressive | 74% | 34% |

| Geico | 65% | 42% |

| Farmers | n/a | n/a |

Buying cheap car insurance helps Montanans’ insurance shoppers save money and put the extra in their savings account. But paying cheaper rates to get poor customer service is not worth the low cost.

While it is good to find a car insurance company that offers affordable rates, other things such as customer service rating or range of coverage options should be considered when making your decision.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Our licensed agents also collected reputable information on each auto insurance company in Montana from the NAIC, J.D. Power, and A.M. Best’s financial strength ratings.

The insurance company with the lowest NAIC complaint ratio (0.45) is Farmers Insurance, but notably is Allstate Insurance (0.63). Both insurers have a complaint ratio below one (1.00).

| Insurer | NAIC complaint index | J.D. Power Claims Satisfaction | AM Best Rating |

|---|---|---|---|

| Farmers | 0.45 | 872 | A |

| Allstate | 0.63 | 876 | A+ |

| Travelers | 0.65 | 861 | A++ |

| State Farm | 0.66 | 881 | A++ |

| Progressive | 0.67 | 856 | A+ |

| USAA | 0.68 | 890 | A++ |

| National General | 0.80 | 815 | A- |

| Liberty Mutual | 1.00 | 870 | A |

| Geico | 1.01 | 871 | A++ |

| Mountain West Farm Bureau | 2.08 | n/a | B++ |

The NAIC’s complaint ratio compares the number of complaints a car insurer has based on its market share. The national average is 1.00. Any car insurance provider below 1.00 is better than the national average.

USAA has the highest J.D. Power claims satisfaction score of 890, and Allstate is second with a claims satisfaction score of 876.

A.M. Best financial strength ratings are a grade describing the financial health of an auto insurer. “A” is excellent financial strength, while “A+” or better is superior.

While comparison shopping for car insurance companies in Montana, it is essential to remember that several risk factors contribute to your premium cost. Your age, driving history, and even your credit rating can positively or negatively impact your total monthly or annual cost.

Therefore, it is always best to compare plans to find the best company that offers the lowest rate for you with excellent customer service.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Average Car Insurance Costs by City in Montana

We collected insurance quotes from Montana zip codes from top insurance companies and found average rates can vary by city and zip code. The price difference can be $336 per year, with the lowest auto policy in Ulm ($1,319) and the highest rate is in Missoula ($1,655).

Still, your Montana rate is based not only on your location but credit score, type of vehicle, liability limits, marital status, or any lapse in auto insurance coverage.

The average cost of auto insurance in Montana is $42 per month, or $502 per year, for a minimum coverage policy.

Cheapest Car Insurance in Billings, MT

Drivers in Billings can find the cheapest insurance quotes with USAA, which provided our agents a $1,162 per year rate for full coverage. USAA’s quote is 30% less expensive ($481 in savings) than the average Billings’ rate at $1,643.

| Billings Company | Average Premium |

|---|---|

| USAA | $1,162 |

| Safeco | $1,234 |

| State Farm | $1,447 |

| Billings average | $1,643 |

Cheapest Car Insurance in Missoula, MT

Missoula residents can look to Safeco for the cheapest coverage rates, with a quote at $1,148 per year or a $95 monthly rate with collision and comprehensive insurance. Safeco’s rate is 31% cheaper than Missoula’s $1,655 average rates for similar driver profiles.

| Missoula Company | Average Premium |

|---|---|

| Safeco | $1,148 |

| State Farm | $1,360 |

| Geico | $1,526 |

| Missoula average | $1,655 |

Cheapest Car Insurance in Great Falls, MT

Great Falls drivers can find the cheapest full coverage insurance policy with State Farm, which offered us a $1,233 annual rate. State Farm’s car insurance rate is 25% less expensive than Great Falls’s average or $392 yearly savings.

| Great Falls Company | Average Premium |

|---|---|

| State Farm | $1,233 |

| USAA | $1,240 |

| Progressive | $1,496 |

| Great Falls average | $1,625 |

Cheapest Car Insurance in Bozeman, MT

The cheapest auto insurance rates AutoInsureSavings.org found in Bozeman is Geico, with a $1,136 per year rate for a full coverage auto policy. Geico’s quote is 29% less expensive than Bozeman’s average rate of $1,578 per year. Safeco is the next best option with a $1,208 annual cost.

| Bozeman Company | Average Premium |

|---|---|

| Geico | $1,136 |

| Safeco | $1,208 |

| State Farm | $1,324 |

| Bozeman average | $1,578 |

Cheapest Car Insurance in Butte, MT

Drivers in Butte can get cheap auto insurance with Safeco, which provided our licensed professionals a $1,067 annual rate for a $50,000 liability policy with comprehensive and collision insurance. Safeco’s quote is 31% less expensive than the average premium ($1,528) in Butte.

| Butte Company | Average Premium |

|---|---|

| Safeco | $1,067 |

| USAA | $1,116 |

| Progressive | $1,285 |

| Butte average | $1,528 |

Cheapest Car Insurance in Helena, MT

Helena’s least expensive insurance policy is with USAA, which offered us a quote at $1,142 per year for full coverage. If you don’t qualify for USAA’s coverage, your next cheapest insurance option in Helena is Safeco, with a $1,316 annual rate for equal coverage levels as USAA.

| Helena Company | Average Premium |

|---|---|

| USAA | $1,142 |

| Safeco | $1,316 |

| State Farm | $1,447 |

| Helena average | $1,603 |

Average Car Insurance Cost for All Cities in Montana

| City | Annual Premium Cost | City | Annual Premium Cost |

|---|---|---|---|

| Billings | $1,643 | Lincoln | $1,521 |

| Missoula | $1,655 | Poplar | $1,524 |

| Great Falls | $1,625 | Ennis | $1,546 |

| Bozeman | $1,578 | Sheridan | $1,564 |

| Butte-Silver Bow | $1,528 | St. Ignatius | $1,613 |

| Helena | $1,603 | Harlem | $1,328 |

| Kalispell | $1,546 | Pioneer Junction | $1,560 |

| Havre | $1,617 | Woods Bay | $1,519 |

| Anaconda-Deer Lodge County | $1,589 | Vaughn | $1,528 |

| Belgrade | $1,564 | Wye | $1,549 |

| Miles City | $1,516 | Worden | $1,623 |

| Helena Valley Southeast | $1,524 | Bridger | $1,521 |

| Helena Valley West Central | $1,549 | Philipsburg | $1,511 |

| Lockwood | $1,622 | Clinton | $1,516 |

| Evergreen | $1,511 | Carlton | $1,546 |

| Whitefish | $1,560 | Pray | $1,549 |

| Livingston | $1,603 | Darby | $1,616 |

| Laurel | $1,521 | Troy | $1,557 |

| Sidney | $1,528 | Cascade | $1,524 |

| Lewistown | $1,546 | Victor | $1,603 |

| Orchard Homes | $1,549 | Superior | $1,564 |

| Columbia Falls | $1,516 | Terry | $1,511 |

| Glendive | $1,557 | Culbertson | $1,521 |

| Four Corners | $1,616 | South Hills | $1,528 |

| Polson | $1,511 | Busby | $1,544 |

| Hamilton | $1,524 | Florence | $1,621 |

| Bigfork | $1,568 | Arlee | $1,516 |

| Helena Valley Northwest | $1,600 | Hungry Horse | $1,557 |

| Dillon | $1,521 | Parker School | $1,625 |

| Malmstrom AFB | $1,516 | Muddy | $1,370 |

| Lolo | $1,589 | Havre North | $1,544 |

| Hardin | $1,528 | Fairfield | $1,521 |

| Helena Valley Northeast | $1,628 | Heart Butte | $1,524 |

| Glasgow | $1,611 | Piltzville | $1,549 |

| Shelby | $1,524 | Ulm | $1,319 |

| Big Sky | $1,557 | Jefferson City | $1,598 |

| Deer Lodge | $1,511 | Trego | $1,568 |

| Montana City | $1,544 | Big Sandy | $1,524 |

| North Browning | $1,516 | Hot Springs | $1,528 |

| Wolf Point | $1,521 | Alberton | $1,639 |

| Libby | $1,599 | Valier | $1,412 |

| Conrad | $1,540 | Wheatland | $1,544 |

| Colstrip | $1,549 | Pryor | $1,607 |

| Pablo | $1,511 | Broadus | $1,516 |

| Lakeside | $1,524 | Belt | $1,521 |

| Red Lodge | $1,640 | Joliet | $1,540 |

| Columbus | $1,600 | The Silos | $1,549 |

| Stevensville | $1,521 | Ponderosa Pines | $1,524 |

| East Missoula | $1,568 | Circle | $1,516 |

| Townsend | $1,628 | White Haven | $1,511 |

| Malta | $1,544 | St. Marie | $1,557 |

| Lame Deer | $1,511 | Spokane Creek | $1,625 |

| Clancy | $1,524 | Lodge Grass | $1,603 |

| Crow Agency | $1,540 | Jordan | $1,622 |

| Ronan | $1,549 | Batavia | $1,511 |

| Frenchtown | $1,606 | Coram | $1,521 |

| Choteau | $1,557 | Beaver Creek | $1,619 |

| Plentywood | $1,375 | Fortine | $1,549 |

| Roundup | $1,516 | Fromberg | $1,544 |

| Baker | $1,629 | Huntley | $1,568 |

| Three Forks | $1,521 | Finley Point | $1,524 |

| Sun Prairie | $1,619 | Lindisfarne | $1,396 |

| King Arthur Park | $1,540 | Rocky Boy's Agency | $1,603 |

| Eureka | $1,511 | Azure | $1,543 |

| Big Timber | $1,549 | East Glacier Park Village | $1,516 |

| West Glendive | $1,580 | Kila | $1,521 |

| South Browning | $1,543 | Martin City | $1,540 |

| Manhattan | $1,521 | Turah | $1,557 |

| Fort Belknap Agency | $1,540 | Ekalaka | $1,511 |

| Fort Benton | $1,617 | Sunburst | $1,580 |

| East Helena | $1,511 | Boneau | $1,543 |

| Forsyth | $1,524 | Sangrey | $1,640 |

| Bonner-West Riverside | $1,557 | Stanford | $1,521 |

| Thompson Falls | $1,516 | South Glastonbury | $1,549 |

| Seeley Lake | $1,610 | Frazer | $1,511 |

| Harlowton | $1,540 | St. Pierre and Evaro | $1,524 |

| Scobey | $1,580 | Simms | $1,543 |

| Helena Flats | $1,511 | Wineglass | $1,612 |

| Chester | $1,521 | Wilsall | $1,557 |

| Somers | $1,641 | Plevna | $1,516 |

| Absarokee | $1,603 | Nashua | $1,543 |

| Chinook | $1,549 | Starr School | $1,580 |

| Plains | $1,540 | Brockton | $1,383 |

| Helena West Side | $1,524 | Turtle Lake | $1,521 |

| Churchill | $1,559 | Lodge Pole | $1,644 |

| White Sulphur Springs | $1,632 | Reed Point | $1,643 |

| Corvallis | $1,516 | Belfry | $1,549 |

| Marion | $1,600 | Yaak | $1,557 |

| Ashland | $1,521 | Roberts | $1,604 |

| Pinesdale | $1,588 | Denton | $1,524 |

| Browning | $1,511 | Charlo | $1,516 |

| West Yellowstone | $1,557 | Bear Dance | $1,588 |

| Hays | $1,524 | Clyde Park | $1,600 |

| Black Eagle | $1,549 | Riverbend | $1,511 |

| Whitehall | $1,516 | Emigrant | $1,521 |

| Fairview | $1,616 | Dutton | $1,543 |

| Shepherd | $1,603 | Hysham | $1,552 |

| Gallatin Gateway | $1,543 | Savage | $1,524 |

| Gardiner | $1,427 | Lewistown Heights | $1,540 |

| Boulder | $1,521 | Willow Creek | $1,516 |

What are the minimum auto insurance coverage requirements in Montana?

For minimum coverage, we looked at rates that reflect the minimum requirements in Montana.

Commissioner of Securities and Insurance requires all Montana drivers to have the minimum liability limits:

| Liability | Minimum coverage |

|---|---|

| Bodily injury liability | $25,000 per person / $50,000 per accident |

| Property damage liability | $20,000 per accident |

A minimum auto insurance policy has at least $25,000 of bodily injury liability per person and $50,000 per accident, and a minimum of $20,000 property damage liability per accident.

Montana doesn’t require drivers to carry uninsured motorist coverage (UM). However, we recommend drivers to buy uninsured motorist coverage since Montana’s uninsured motorist rate is 10%, according to the Insurance Research Council.

AutoInsureSavings.org agents also recommend higher liability limits for asset protection. It would be best if you had liability limits matching the value of all your assets to protect yourself in the event of a lawsuit from a car accident.

To learn more about Montana’s most affordable car insurance options, contact the auto insurance experts at AutoInsureSavings.org.

Our licensed professionals will be happy to answer any questions you have.

Methodology

AutoInsureSavings.org comparison shopping study used a full-coverage auto policy for a 30-year-old driving a 2018 Honda Accord with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person / $100,000 per accident |

| Property damage liability | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured / underinsured motorist bodily injury | $50,000 per person / $100,000 per accident |

| Comprehensive and collision coverage | $500 deductible |

We used insurance rates for drivers with an accident history, credit score, and marital status for other Montana rate analyses. We used car insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your insurance rates may vary when you get quotes.

Sources

– National Association of Insurance Commissioners. “Market Share Reports for Property/Casualty Groups and Companies.”

– National Highway Traffic Safety Administration. “Traffic Safety Facts.”

– Montana Department of Justice Motor Vehicle Division. “Driver Licenses.”

– Insurance Information Institute. “What is covered by a basic auto insurance policy?.”

– Montana Department of Justice Motor Vehicle Division. “Insurance and Verification.”

– Insurance Research Council. “One in Eight Drivers Uninsured.”

Frequently Asked Questions

Who has the cheapest car insurance in Montana?

Based on our research, Safeco Insurance ($248 per year) offers the state minimum’s cheapest auto insurance rates. The average annual premium for minimum coverage in Montana is $490 per year, and Safeco’s premium costs 50% less. USAA ($250 per year) is another good option for affordable car insurance for drivers who qualify for their coverage.

How much is Montana car insurance per month?

The average car insurance costs $1,493 in Montana for full coverage insurance and $490 per year for state minimum coverage. That is significantly less than what drivers in other U.S. states pay for their car insurance premium each month. For instance, drivers in other states will pay $645 per year for state minimum car insurance and $1,700 per year for full coverage.

How much is full coverage car insurance in Montana?

The average cost of full coverage car insurance in Montana is $1,493 annually or $124 per month. State Farm’s average rate for full coverage is $1,019 a year or $84 per month. USAA ($1,054) and Safeco ($1,138) are also below the state’s average.

How much will my car insurance rates increase with a speeding ticket in Montana?

You can expect your car insurance rates to go up 18% after a speeding violation in Montana. The amount it goes up depends on the auto insurance company and several other risk factors. Most drivers pay around $1,761 annually for full coverage once they have a ticket on their driving record.

How can I save on car insurance in Montana?

There are many ways for drivers in Montana to save on the best Montana auto insurance. You can find out from your insurance agent if you are eligible for a money-saving driver discount offered by the company. Many insurance providers will lower your overall car insurance rates if you have more than one policy with them, such as homeowners insurance or life insurance.

Another way to save on your car insurance premium is to practice safe driving habits and maintain clean driving records. That will not only keep you and your passengers safe but will also help you avoid car accidents or traffic violations that could cause your premium to rise.

How much is car insurance in Montana?

The average cost of minimum coverage in Montana is $41 per month.

What is the best car insurance in Montana?

Full coverage policies are the best auto insurance in Montana. The cheapest full coverage policies can be found at State Farm.

Is it illegal to drive without Montana car insurance?

Yes, every Montana driver must carry auto insurance on their vehicle. Montana drivers can easily get Montana car insurance quotes to find the cheapest Montana auto insurance.

Is Montana a no-fault state?

Montana is an at-fault car insurance state, so drivers will need to carry the best Montana auto insurance to avoid financial difficulties after an accident they cause.

Is PIP required in Montana?

Montana auto insurance laws don’t require drivers to carry PIP insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Feb 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.