Texas Cheapest Car Insurance & Best Coverage Options

Fred Loya Insurance and Mercury Insurance have the best Texas cheapest car insurance and best coverage options. Fred Loya Insurance has the cheapest minimum coverage in Texas at an average of $45 per month, while Mercury Insurance has the cheapest Texas full coverage at an average of $94 per month.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Jan 12, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jan 12, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

- Fred Loya Insurance minimum coverage is 40% cheaper than the Texas average

- Mercury Insurance’s full coverage is 51% cheaper than the Texas average

- Full coverage gives Texas drivers the most protection in an accident

Want the best Texas cheapest car insurance and best coverage options? Fred Loya Insurance and Mercury Insurance are two of the best auto insurance companies in Texas for affordable rates and coverage options.

Continue reading to learn more about the best car insurance in Texas. You can also enter your ZIP code into our free quote tool at any time to get quotes for cheap car insurance in Texas.

Affordable Texas Car Insurance Rates

Texas insurance shoppers should compare quotes with the same insurance coverage level with at least three insurance companies to find the most affordable rates and save more on their auto insurance premiums.

| Cheapest Car Insurance in Texas - Key Takeaways |

|---|

The cheapest Texas car insurance options are: The cheapest Texas car insurance options are:Cheapest for minimum coverage: Fred Loya Insurance Cheapest for full coverage: Mercury Insurance Cheapest after an at-fault accident: Fred Loya Insurance Cheapest after a speeding ticket: State Farm Cheapest after a DUI: Mercury Insurance Cheapest for poor credit history: Geico Cheapest for young drivers: State Farm For younger drivers with a speeding violation: Mercury Insurance For younger drivers with an at-fault accident: State Farm |

Enter your Zip Code or use this practical Texas auto insurance guide which is the best way to find top car insurance providers in your area regardless of driving type or age groups.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Texas for Minimum Coverage

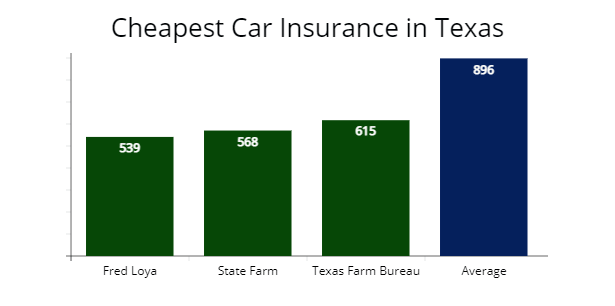

Fred Loya Insurance offers the cheapest minimum coverage rates for drivers in Texas with a good driving record, which provided us a $539 per year rate or $357 cheaper than the $896 average rates for our 30-year-old sample driver.

Suppose you are a military member or a family member of military personnel. In that case, your best insurance rates are with USAA, which offered our agents a $457 per year quote or $38 per month for minimum liability coverage (learn more: A Review of USAA Car Insurance, Policy Options & Military Benefits). USAA is one of the best car insurance options for veterans and military members.

Cheapest Texas auto insurance companies for minimum coverage, by price

| Insurance company | Average annual premium |

|---|---|

| USAA | $457 |

| Fred Loya Insurance | $539 |

| State Farm | $568 |

| Texas Farm Bureau | $615 |

| Elephant | $689 |

| Mercury | $728 |

| Nationwide | $839 |

| Geico | $910 |

| Allstate | $1,047 |

| Liberty Mutual | $1,243 |

*USAA is for qualified military members, their spouses, and direct family members. Your auto insurance rates may vary based on driver profiles.

Buying a minimum coverage policy is the cheapest way to meet Texas car insurance requirements to ensure you stay legal.

State minimums may not have sufficient coverage with the amount of bodily injury and property damage you need if you are involved in an auto accident.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

A state minimum auto policy only covers up to $60,000 per accident in bodily injury coverage and $25,000 per accident in property damage liability.

Cheapest Full Coverage Car Insurance in Texas

Mercury Insurance offers the cheapest insurance rates for Texas drivers with full coverage. Mercury’s $1,130 per year rate is 51% less expensive than state average rates of $2,267 per year.

Cheapest Texas car insurance companies for full coverage, by price

| Insurance company | Annual cost | Monthly cost |

|---|---|---|

| Mercury Insurance | $1,130 | $94 |

| Fred Loya Insurance | $1,165 | $97 |

| Texas Farm Bureau | $1,244 | $103 |

| State Farm | $1,287 | $107 |

| USAA | $1,317 | $109 |

| Elephant | $1,680 | $140 |

| Geico | $2,056 | $171 |

| Liberty Mutual | $2,317 | $193 |

| Dairyland | $2,865 | $238 |

| Texas average | $2,267 | $188 |

A full-coverage policy costs more than liability-only policies but offers more asset protection with comprehensive and collision insurance included. Your motor vehicle is protected no matter who is at fault or any inclement weather caused the damage, such as hurricanes.

Cheapest Car Insurance in Texas with a Speeding Ticket

State Farm offers the cheapest auto insurance quotes for drivers in Texas with speeding tickets on their driving record. State Farm’s $1,328 per year rate is 49% or $1,245 less expensive than state average rates.

Cheapest Texas car insurance companies for full coverage after a speeding ticket, by price

| Insurance company | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $1,328 | $110 |

| Fred Loya Insurance | $1,389 | $115 |

| Texas Farm Bureau | $1,467 | $122 |

| Mercury Insurance | $1,576 | $131 |

| USAA | $1,624 | $135 |

| Geico | $2,090 | $174 |

| Elephant | $2,128 | $177 |

| Allstate | $2,890 | $240 |

| Dairyland | $3,278 | $273 |

| Texas average | $2,573 | $214 |

According to the Texas Department of Insurance, your auto insurance rates can increase by $306 per year or 12% with one traffic violation for speeding.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Most auto insurers will increase insurance rates after traffic tickets, so you want to make sure to shop around for cheaper insurance companies after any traffic violation on driving records (learn more: How a Traffic Ticket Can Impact Your Car Insurance Rates).

Cheapest Car Insurance in Texas With a Car Accident

According to our analysis, Fred Loya Insurance offers the cheapest auto insurance rates for drivers in Texas with an accident history with a $1,516 per year car insurance premium for our sample driver.

Fred Loya’s rate is 49% less expensive than Texas average rates ($2,917 per year) for drivers with one accident in their driving history.

Cheapest Texas auto insurance companies for full coverage after an accident, by price

| Auto Insurers | Annual cost | Monthly cost |

|---|---|---|

| Fred Loya Insurance | $1,516 | $126 |

| State Farm | $1,987 | $165 |

| Mercury Insurance | $2,080 | $173 |

| USAA | $2,126 | $177 |

| Geico | $2,365 | $197 |

| Texas Farm Bureau | $2,754 | $228 |

| Elephant | $3,180 | $265 |

| Dairyland | $3,372 | $281 |

| Allstate | $4,543 | $378 |

| Texas average | $2,917 | $243 |

Will car insurance rates increase after an accident? Getting into an at-fault accident may cause a rate increase of 33% or $650 per year over three years, showing the importance of shopping for cheaper auto insurance if you have a change on your driving record.

To make sure you get the best rates, be sure to shop around and compare auto insurance quotes with at least three car insurance companies after a car accident.

Cheapest Car Insurance in Texas with a DUI

Drivers in Texas with DUI offenses on their driving records can find the cheapest insurance with Mercury, which provided our insurance agents a quote at $2,047 per year or a $170 monthly rate for full coverage.

Learn more: The Best Car Insurance Companies After a DUI

The average annual rate increase for drivers with DUI violations is $1,411 per year, making Mercury’s rate 45% cheaper than Texas’s average DUI rate.

Cheapest Texas auto insurance companies for full coverage after a DUI, by price

| Insurance company | Annual cost | Monthly cost |

|---|---|---|

| Mercury Insurance | $2,047 | $170 |

| Fred Loya Insurance | $2,156 | $180 |

| USAA | $2,423 | $201 |

| Dairyland | $3,278 | $273 |

| Geico | $3,543 | $295 |

| State Farm | $3,648 | $304 |

| Texas Farm Bureau | $3,936 | $328 |

| Elephant | $4,461 | $371 |

| Allstate | $5,380 | $448 |

| Texas average | $3,678 | $306 |

According to the Insurance Information Institute, car insurance premiums increase by 39% on average for Texas drivers with driving while intoxicated violations (DUI’s).

Along with higher car insurance rates, the Texas Department of Transportation states you may have a suspended driver’s license for up to one year, a required ignition interlock device (IID), required defensive driving course, and fines up to $6,000 after a DUI infraction in Texas.

Learn more: What Every DUI Offender That Needs Car Insurance Should Know

Cheapest Car Insurance in Texas for Drivers With Poor Credit

Geico provides the cheapest insurance for drivers with a poor credit score in Texas with a $1,976 per year rate for full coverage or 26% less expensive than the average bad credit rate increase in Texas of $2,657 per year.

Cheapest Texas auto insurance companies for drivers with poor credit, by price

| Auto Insurers | Annual cost | Monthly cost |

|---|---|---|

| Geico | $1,976 | $164 |

| State Farm | $2,054 | $171 |

| Fred Loya Insurance | $2,088 | $174 |

| USAA | $2,143 | $178 |

| Mercury Insurance | $2,437 | $203 |

| Texas Farm Bureau | $2,519 | $209 |

| Dairyland | $2,985 | $249 |

| Elephant | $3,521 | $293 |

| Allstate | $3,863 | $321 |

| Texas average | $2,657 | $221 |

AutoInsureSavings.org analysis shows Texas drivers who have a poor credit score will pay on average 16% more for car insurance premiums. And drivers with poor credit are more likely to file a claim or get involved in an at-fault accident than drivers with a good credit score.

For that reason, their auto insurance costs are higher than average. Make sure to maintain good credit scores, pay credit cards and student loans on time to ensure your car insurance rates won’t increase at renewal.

Cheapest Car Insurance in Texas for Young Drivers

We found young Texas drivers looking for the cheapest full coverage insurance is with State Farm Insurance, which provided our agents a $3,865 per year quote or 26% less expensive than our sample young driver’s average insurance rates in Texas.

USAA is the best car insurance option for younger drivers who qualify, which offered AutoInsureSavings’ agents a $2,476 per year rate for full coverage car insurance.

The cheapest state minimum coverage in Texas for teenage drivers is Mercury Insurance, which offered us a quote at $1,587 per year or 23% cheaper than average rates. The next best car insurance for teens is Texas Farm Bureau, with a $1,634 per year rate for minimum liability coverage.

Cheapest Texas auto insurance companies for young drivers, by price

| Auto Insurer | Full coverage | Minimum coverage |

|---|---|---|

| USAA | $2,476 | $954 |

| State Farm | $3,865 | $1,652 |

| Fred Loya Insurance | $3,916 | $1,976 |

| Geico | $4,164 | $2,240 |

| Mercury | $4,287 | $1,587 |

| Texas Farm Bureau | $4,891 | $1,634 |

| Dairyland | $5,329 | $2,388 |

| Allstate | $6,481 | $2,390 |

| Nationwide | $7,128 | $3,287 |

| Liberty Mutual | $8,328 | $4,265 |

| Texas average | $5,132 | $2,041 |

*USAA is for qualified military members, their spouses, and direct family members. Your insurance rates may be different based on driver profiles.

Statistics show a teen driver is more prone to car accidents than older experience drivers, making car insurance rates higher. Our licensed agents recommend younger drivers in Texas buy full coverage auto insurance policies to have motor vehicle coverage in an auto accident as an added layer of protection.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

It is best to shop around to find an insurance company that offers the cheapest insurance rates for young or teen drivers in the Lone Star State, such as State Farm, Mercury Insurance, or Texas Farm Bureau, to cut down on your car insurance costs.

Cheapest Car Insurance for Young Drivers with a Speeding Ticket

Young Texas drivers with a speeding violation should look to Mercury for the best car insurance for new drivers with a speeding ticket in Texas. Mercury’s average car insurance cost is $4,276 per year or $1,360 less per year for car insurance policies in Texas with comprehensive and collision coverage for young drivers.

Learn more: How much will my auto insurance go up with a speeding ticket?

Cheapest insurance companies in Texas for young drivers with a speeding ticket

| Auto Insurer | Annual cost | Monthly cost |

|---|---|---|

| Mercury Insurance | $4,276 | $356 |

| State Farm | $4,380 | $365 |

| Fred Loya Insurance | $4,587 | $382 |

| Geico | $5,180 | $431 |

| Texas Farm Bureau | $5,535 | $461 |

| Texas average | $5,639 | $470 |

Cheapest Car Insurance for Young Drivers with an At-Fault Accident

Young drivers in Texas with an accident history can find the best auto insurance premiums with State Farm, which provided our agents a $4,870 per year rate for full coverage insurance.

State Farm’s at-fault accident rate is 26% cheaper than Texas’s average rates of $6,540 per year for teen drivers with an accident.

| Auto Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $4,870 | $405 |

| Mercury Insurance | $4,937 | $411 |

| Fred Loya Insurance | $5,176 | $431 |

| Geico | $5,879 | $489 |

| Texas Farm Bureau | $6,187 | $515 |

| Texas average | $6,540 | $545 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Car Insurance Companies in Texas

AutoInsureSavings.org team of licensed insurance agents rated the best car insurance companies in Texas by customer satisfaction, surveys, J.D. Powers claims satisfaction score, A.M. Best, and the National Association of Insurance Commissioners (NAIC) complaint index.

We found that Allstate and USAA are the best insurance companies based on excellent customer service, claims satisfaction, and NAIC’s complaint index.

AutoInsureSavings.org licensed agents had similar results from their recent Texas car insurance customer survey, with Allstate and USAA scoring 91% with customers in claims satisfaction.

| Company | % respondents satisfied with recent claim | % respondents rated customer service excellent |

|---|---|---|

| Allstate | 91% | 67% |

| USAA | 91% | 71% |

| Nationwide | 89% | 53% |

| State Farm | 82% | 69% |

| Farmers Insurance | 80% | 54% |

| Geico | 76% | 60% |

| Dairyland | 71% | 63% |

| Progressive | 65% | 45% |

| Texas Farm Bureau Insurance | 64% | 71% |

| Fred Loya Insurance | 53% | 61% |

Our licensed insurance agents also collected information on each insurance company in Texas from the NAIC, J.D. Power, and A.M. Best’s financial strength ratings.

The car insurance company with the lowest NAIC complaint ratio is Farmers Insurance, with a 0.14 complaint ratio compared to their market share and below the national average of 1.00. The stand out is Fred Loya Insurance, with a 1.71 complaint index, well above the national average of 1.00.

| Company | NAIC complaint index | J.D. Power claims satisfaction | AM Best rating |

|---|---|---|---|

| Farmers Insurance | 0.14 | 812 | A- |

| Chubb | 0.23 | 810 | A++ |

| Progressive | 0.34 | 848 | A+ |

| Nationwide | 0.34 | 820 | A+ |

| Geico | 0.35 | 846 | A++ |

| Texas Farm Bureau Insurance | 0.36 | 866 | A- |

| Allstate | 0.63 | 832 | A+ |

| State Farm | 0.66 | 844 | A |

| USAA | 0.68 | 878 | A++ |

| MetLife | 0.77 | 813 | A |

| Liberty Mutual | 0.79 | 837 | A |

| Dairyland (Sentry Insurance) | 0.88 | n/a | A+ |

| Fred Loya Insurance | 1.71 | n/a | NR |

The NAIC’s complaint ratio compares the number of complaints an auto insurer has based on the Texas market share. Any car insurance provider below 1.00 is better than the national average.

USAA and Texas Farm Bureau have the highest J.D. Power claims satisfaction scores of 878 and 866, respectfully.

A.M. Best financial strength ratings are a grade describing an auto insurer’s financial health and their ability to pay out claims.

While comparison shopping for car insurance companies in Texas, it is essential to remember that many factors contribute to your premium cost. Your age, your driving experience, and even your credit score can influence your total monthly cost.Dani Best Licensed Insurance Producer

It is always best for drivers in Texas to compare car insurance plans to find the best company that offers the lowest insurance rate.

Average Cost of Car Insurance by City in Texas

We collected insurance quotes from Texas zip codes from top insurance companies and found average rates can vary by $803 per year. Typically, you will pay higher insurance rates if you live in urban cities rather than the state’s rural areas. Your Texas insurance rate is based not only on your zip code but also on the type of vehicle, driver history, liability coverage limits, marital status, and many other risk factors.

Cheapest Car Insurance in Houston, TX

Drivers in Houston, Texas, can find the cheapest insurance quotes with Texas Farm Bureau, which provided AutoInsureSavings.org agents a rate of $1,639 per year with $500 deductibles for comprehensive and collision coverage. Texas Farm Bureau’s quote is 42% less expensive than Houston’s average rates, making it the best cheap car insurance in Houston.

| Houston Company | Average Premium |

|---|---|

| Texas Farm Bureau | $1,639 |

| State Farm | $1,883 |

| Fred Loya Insurance | $1,948 |

| Houston average | $2,819 |

Cheapest Car Insurance in San Antonio, TX

Drivers in San Antonio can look to Mercury for the cheapest auto quotes, with a rate of $1,598 per year with full coverage insurance. Mercury’s rate is 41% cheaper than San Antonio’s $2,743 average rates for 30-year-old drivers.

| San Antonio Company | Average Premium |

|---|---|

| Mercury Insurance | $1,598 |

| State Farm | $1,810 |

| Geico | $2,043 |

| San Antonio average | $2,743 |

Cheapest Car Insurance in Dallas, TX

Good drivers in Dallas, Texas, can find the cheapest full coverage with Fred Loya Insurance, which offered us a $1,653 per year rate for our sample 30-year-old driver with comprehensive and collision $500 deductibles. Fred Loya’s car insurance rate is $1,149 less per year than Dallas’s average rates of $2,802 per year.

| Dallas Company | Average Premium |

|---|---|

| Fred Loya Insurance | $1,653 |

| Texas Farm Bureau | $1,956 |

| State Farm | $2,241 |

| Dallas average | $2,802 |

Cheapest Car Insurance in Austin, TX

Our insurance agents found the cheapest auto insurance rate in Austin, Texas, is Mercury, with a $1,576 per year rate for a full coverage auto insurance policy. Mercury’s quote is 43% less expensive than Austin’s average rates.

| Austin Company | Average Premium |

|---|---|

| Mercury Insurance | $1,576 |

| Texas Farm Bureau | $1,647 |

| State Farm | $1,875 |

| Austin average | $2,730 |

Cheapest Auto Insurance in Fort Worth, TX

Drivers in Fort Worth can get cheaper auto insurance with State Farm, which provided our licensed agents a $1,479 per year rate for a full coverage insurance policy with $100,000 in liability insurance. State Farm’s quote is 44% less expensive than the average rates in Fort Worth, Texas.

| Fort Worth Company | Average Premium |

|---|---|

| State Farm | $1,470 |

| Texas Farm Bureau | $1,577 |

| Geico | $2,048 |

| Fort Worth average | $2,617 |

Cheapest Auto Insurance in El Paso, TX

Good drivers in El Paso, Texas, can find the least expensive auto insurance policy with Fred Loya, which offered us a $1,317 per year rate for our sample 30-year-old male driver. Fred Loya’s full coverage quote is 48% cheaper than El Paso, TX average rates.

| El Paso Company | Average Premium |

|---|---|

| Fred Loya | $1,317 |

| Texas Farm Bureau | $1,511 |

| State Farm | $1,637 |

| El Paso average | $2,511 |

Cheapest Car Insurance in Arlington, TX

Drivers in Arlington can shop around and get cheap auto insurance with Texas Farm Bureau, which provided our licensed agents a $1,586 annual rate for a full coverage policy with $100,000 in liability insurance. Farm Bureau’s quote is 42% less expensive than the average rates in Arlington, TX.

| Arlington Company | Average Premium |

|---|---|

| Texas Farm Bureau | $1,586 |

| State Farm | $1,729 |

| Geico | $2,043 |

| Arlington average | $2,703 |

Average Car Insurance Cost for All Cities in Texas

| City | Average annual premium | City | Average annual premium |

|---|---|---|---|

| Houston | $2,819 | Brownsville | $2,498 |

| San Antonio | $2,743 | McKinney | $2,513 |

| Dallas | $2,802 | Frisco | $2,623 |

| Austin | $2,730 | Pasadena | $2,582 |

| Fort Worth | $2,617 | Killeen | $2,253 |

| El Paso | $2,511 | Mesquite | $2,471 |

| Arlington | $2,703 | McAllen | $2,283 |

| Corpus Christi | $2,439 | Midland | $2,291 |

| Plano | $2,667 | Denton | $2,118 |

| Laredo | $2,435 | Waco | $2,215 |

| Lubbock | $2,291 | Carrollton | $2,005 |

| Irving | $2,480 | Round Rock | $2,387 |

| Garland | $2,517 | Abilene | $2,054 |

| Amarillo | $2,399 | Pearland | $2,398 |

| Grand Prairie | $2,474 | Odessa | $2,118 |

| Sugar Land car insurance | $2,253 | Cross Mountain car insurance | $2,361 |

| Beaumont car insurance | $2,283 | Doolittle car insurance | $2,215 |

| Richardson car insurance | $2,316 | Llano car insurance | $2,324 |

| The Woodlands car insurance | $2,376 | Poteet car insurance | $2,331 |

| College Station car insurance | $2,118 | Piney Point Village | $2,316 |

| Lewisville car insurance | $2,412 | Sonora car insurance | $2,377 |

| Tyler car insurance | $2,309 | Karnes City car insurance | $2,054 |

| Wichita Falls car insurance | $2,377 | Clifton car insurance | $2,283 |

| League City car insurance | $2,215 | Kenedy car insurance | $2,005 |

| Allen car insurance | $2,331 | Mabank car insurance | $2,291 |

| San Angelo auto insurance | $2,291 | Spearman auto insurance | $2,316 |

| Edinburg auto insurance | $2,361 | Winnsboro auto insurance | $2,253 |

| Conroe auto insurance | $2,324 | West Orange auto insurance | $2,054 |

| Bryan auto insurance | $2,118 | Hollywood Park auto insurance | $2,324 |

| Mission auto insurance | $2,253 | Edcouch auto insurance | $2,316 |

| Longview auto insurance | $2,283 | West Lake Hills auto insurance | $2,331 |

| Atascocita auto insurance | $2,054 | Reno auto insurance | $2,215 |

| New Braunfels car insurance | $2,291 | Paloma Creek car insurance | $2,118 |

| Pharr car insurance | $2,324 | Citrus City car insurance | $2,309 |

| Baytown car insurance | $2,316 | Balcones Heights car insurance | $2,365 |

| Flower Mound car insurance | $2,331 | Sonterra car insurance | $2,118 |

| Cedar Park car insurance | $2,361 | Lavon car insurance | $2,291 |

| Temple car insurance | $2,005 | Agua Dulce car insurance | $2,253 |

| Missouri City | $2,324 | Mauriceville | $2,324 |

| Georgetown | $2,377 | Big Lake | $2,283 |

| North Richland Hills | $2,215 | Cactus | $2,331 |

| Mansfield | $2,253 | Bullard | $2,316 |

| Victoria | $2,283 | El Cenizo city | $2,324 |

| Harlingen | $2,118 | Panorama Village | $2,361 |

| Rowlett | $2,291 | Shepherd | $2,054 |

| San Marcos | $2,309 | Haskell | $2,316 |

| Pflugerville | $2,324 | Laguna Vista | $2,005 |

| Spring | $2,412 | Oak Ridge North | $2,377 |

| Euless | $2,054 | Clarksville | $2,291 |

| Port Arthur | $2,331 | San Saba | $2,118 |

| Leander | $2,361 | Hideaway | $2,192 |

| Grapevine | $2,291 | Waller | $2,283 |

| DeSoto | $2,377 | Olney | $2,309 |

| Galveston | $2,324 | Grand Saline | $2,412 |

| Wylie | $2,118 | Oak Trail Shores | $2,253 |

| Bedford | $2,192 | Annetta | $2,054 |

| Texas City | $2,283 | Bishop | $2,354 |

| Cedar Hill | $2,253 | Brazoria | $2,331 |

| Keller | $2,357 | Howe | $2,291 |

| Little Elm | $2,331 | Needville | $2,054 |

| Burleson | $2,309 | Double Oak | $2,118 |

| Haltom City | $2,005 | Kemah | $2,192 |

| Rockwall | $2,291 | Henrietta | $2,283 |

| Channelview | $2,324 | Wimberley | $2,377 |

| The Colony | $2,283 | Canadian | $2,331 |

| Kyle | $2,118 | Edgecliff Village | $2,005 |

| Sherman | $2,377 | Castroville | $2,309 |

| Coppell | $2,354 | Abernathy | $2,192 |

| Huntsville | $2,331 | Chandler | $2,283 |

| Schertz | $2,291 | Salado | $2,005 |

| Weslaco | $2,192 | Indian Hills | $2,324 |

| Friendswood | $2,412 | Early | $2,118 |

| Duncanville | $2,054 | Blue Mound | $2,253 |

| Lancaster | $2,005 | Hamilton | $2,291 |

| Farmers Branch | $2,253 | Combes | $2,331 |

| Hurst | $2,291 | Reno city | $2,354 |

| Mission Bend | $2,309 | Nocona | $2,377 |

| Rosenberg | $2,283 | Lopezville | $2,464 |

| San Juan | $2,324 | South Alamo | $2,283 |

| Texarkana | $2,488 | Stanton | $2,005 |

| Del Rio | $2,377 | Taft | $2,192 |

| Lufkin | $2,118 | Lake Cherokee | $2,054 |

| Waxahachie | $2,464 | Springtown | $2,412 |

| La Porte | $2,331 | Barton Creek | $2,253 |

| Deer Park | $2,291 | Ozona | $2,324 |

| Socorro | $2,005 | DeCordova | $2,118 |

| Nacogdoches | $2,354 | Stamford | $2,309 |

| Copperas Cove | $2,253 | Fairfield | $2,192 |

| Southlake | $2,283 | McLendon-Chisholm | $2,291 |

| Weatherford | $2,412 | Schulenburg | $2,331 |

| Harker Heights | $2,118 | Grape Creek | $2,005 |

| Cleburne | $2,464 | Overton | $2,054 |

| Midlothian | $2,291 | Rancho Viejo | $2,377 |

| Eagle Pass | $2,354 | Shenandoah | $2,283 |

| Cibolo | $2,309 | Ranger | $2,464 |

| Seguin | $2,324 | West | $2,118 |

| Big Spring | $2,192 | Winters | $2,291 |

| Greenville | $2,277 | Shady Shores | $2,412 |

| Lake Jackson | $2,377 | Seagraves | $2,253 |

| Converse | $2,464 | Fritch | $2,277 |

| Colleyville | $2,005 | Troy | $2,309 |

| Alvin | $2,253 | South Padre Island | $2,324 |

| West Odessa | $2,291 | Seymour | $2,377 |

| Cloverleaf | $2,309 | Refugio | $2,354 |

| Sachse | $2,118 | Rosita | $2,005 |

| Kingsville | $2,331 | Winnie | $2,277 |

| Canyon Lake | $2,054 | Santa Rosa | $2,377 |

| Hutto | $2,192 | Onalaska | $2,331 |

| Balch Springs | $2,357 | Woodville | $2,291 |

| Fresno | $2,321 | Daingerfield | $2,118 |

| University Park | $2,277 | Malakoff | $2,253 |

| Timberwood Park | $2,291 | Trinity | $2,464 |

| Paris | $2,354 | Mount Vernon | $2,523 |

| Watauga | $2,412 | Hooks | $2,054 |

| San Benito | $2,005 | Val Verde Park | $2,192 |

| Denison | $2,309 | Floydada | $2,354 |

| Corsicana | $2,277 | Northlake | $2,464 |

| Fort Hood | $2,118 | Electra | $2,009 |

| Kerrville | $2,192 | La Villa | $2,309 |

| Saginaw | $2,253 | Palmhurst | $2,321 |

| Benbrook | $2,331 | El Lago | $2,118 |

| Marshall | $2,354 | Inez | $2,277 |

| Prosper | $2,253 | Ferris | $2,412 |

| Belton | $2,009 | Freer | $2,331 |

| Corinth | $2,054 | Westworth Village | $2,464 |

| Forney | $2,377 | Lytle | $2,192 |

| Dickinson | $2,321 | Hedwig Village | $2,009 |

| Murphy | $2,412 | Van | $2,291 |

| Stephenville | $2,291 | Las Lomas | $2,377 |

| Plainview | $2,118 | Beach City | $2,054 |

| Universal City | $2,464 | Panhandle | $2,496 |

| Katy | $2,277 | Odem | $2,321 |

| Alamo | $2,309 | Crosby | $2,412 |

| Ennis | $2,192 | Rio Hondo | $2,118 |

| Sienna Plantation | $2,009 | Kirbyville | $2,309 |

| Horizon City | $2,331 | Hallettsville | $2,277 |

| Angleton | $2,412 | Merkel | $2,054 |

| Alice | $2,321 | Glen Rose | $2,009 |

| Bellaire | $2,118 | Tahoka | $2,256 |

| Orange | $2,192 | The Hills | $2,354 |

| Brownwood | $2,291 | Lake Kiowa | $2,331 |

| Brushy Creek | $2,377 | Premont | $2,118 |

| Palestine | $2,256 | George West | $2,309 |

| Terrell | $2,354 | Weimar | $2,291 |

| Bay City | $2,277 | Shallowater | $2,192 |

| South Houston | $2,712 | Escobares | $2,321 |

| White Settlement | $2,464 | Bolivar Peninsula | $2,054 |

| Pampa | $2,009 | Lyford | $2,377 |

| Pecan Grove | $2,350 | Pantego | $2,256 |

| Nederland | $2,037 | Holly Lake Ranch | $2,377 |

| Stafford | $2,118 | Meadowlakes | $2,354 |

| Brenham | $2,331 | Jefferson | $2,009 |

| Portland | $2,256 | Nixon | $2,277 |

| Taylor | $2,307 | Junction | $2,192 |

| Alton | $2,291 | Beverly Hills | $2,393 |

| La Marque | $2,321 | Leonard | $2,331 |

| Mercedes | $2,523 | Cumings | $2,256 |

| Highland Village | $2,294 | Quanah | $2,464 |

| Seagoville | $2,393 | Huntington | $2,118 |

| Gainesville | $2,350 | Pottsboro | $2,350 |

| Cinco Ranch | $2,377 | Arcola | $2,294 |

| Donna | $2,009 | Talty | $2,307 |

| Uvalde | $2,277 | Wyldwood | $2,321 |

| Sulphur Springs | $2,393 | Midway South | $2,037 |

| Mount Pleasant | $2,192 | De Leon | $2,009 |

| Boerne | $2,294 | Hudson Oaks | $2,192 |

| Humble | $2,331 | Pinehurst | $2,377 |

| Live Oak | $2,256 | Ponder | $2,523 |

| Groves | $2,118 | East Bernard | $2,277 |

| West University Place | $2,307 | Llano Grande | $2,350 |

| Buda | $2,316 | West Sharyland | $2,256 |

| Crowley | $2,321 | McQueeney | $2,316 |

| Aldine | $2,009 | Abram | $2,464 |

| Canyon | $2,377 | Whitney | $2,393 |

| Addison | $2,331 | La Blanca | $2,118 |

| Lakeway | $2,037 | Liberty City | $2,192 |

| Mineral Wells | $2,277 | Goliad | $2,009 |

| Kilgore | $2,294 | Corrigan | $2,321 |

| Hereford | $2,316 | Palmer | $2,307 |

| Jacksonville | $2,192 | Mason | $2,377 |

| Hewitt | $2,256 | Eldorado | $2,294 |

| Rio Grande City | $2,307 | Blanco | $2,350 |

| Dumas | $2,321 | Bertram | $2,277 |

| Seabrook | $2,009 | Laughlin AFB | $2,316 |

| Hidalgo | $2,350 | Garfield | $2,192 |

| Andrews | $2,256 | Combine | $2,377 |

| Lockhart | $2,118 | Memphis | $2,009 |

| Levelland | $2,273 | Tool | $2,331 |

| Santa Fe | $2,321 | Hudson Bend | $2,350 |

| Henderson | $2,294 | Sour Lake | $2,118 |

| Rendon | $2,331 | Newton | $2,294 |

| Anna | $2,273 | Shiner | $2,037 |

| Forest Hill | $2,009 | Dalworthington Gardens | $2,192 |

| Royse City | $2,316 | Cooper | $2,464 |

| Beeville | $2,380 | Anahuac | $2,009 |

| Glenn Heights | $2,307 | Fannett | $2,321 |

| Azle | $2,294 | Anson | $2,256 |

| Fate | $2,350 | McCamey | $2,380 |

| Port Neches | $2,523 | Ganado | $2,316 |

| La Homa | $2,192 | Wellington | $2,393 |

| Red Oak | $2,131 | Magnolia | $2,273 |

| Borger | $2,393 | Quitman | $2,380 |

| Lumberton | $2,321 | Honey Grove | $2,331 |

| Athens | $2,009 | Laguna Heights | $2,131 |

| Richmond | $2,256 | Hale Center | $2,175 |

| Gatesville | $2,464 | Fifth Street | $2,307 |

| Leon Valley | $2,316 | Porter Heights | $2,294 |

| Wells Branch | $2,037 | Shadybrook | $2,009 |

| Port Lavaca | $2,464 | Sunray | $2,350 |

| Freeport | $2,273 | Liberty Hill | $2,175 |

| Trophy Club | $2,380 | Jones Creek | $2,321 |

| Tomball | $2,540 | Poth | $2,523 |

| Robinson | $2,131 | Little River-Academy | $2,380 |

| El Campo | $2,464 | Idalou | $2,393 |

| Clute | $2,307 | Goldthwaite | $2,490 |

| Fort Bliss | $2,009 | Olton | $2,131 |

| Robstown | $2,294 | Ingram | $2,256 |

| Roma | $2,321 | Lorena | $2,423 |

| Snyder | $2,331 | Preston | $2,009 |

| Fredericksburg | $2,350 | Franklin | $2,316 |

| Webster | $2,273 | Mart | $2,331 |

| Burkburnett | $2,518 | Shamrock | $2,037 |

| Celina | $2,256 | Gregory | $2,307 |

| Four Corners | $2,316 | St. Hedwig | $2,294 |

| Raymondville | $2,321 | Kountze | $2,273 |

| Galena Park | $2,131 | Monte Alto | $2,256 |

| Bacliff | $2,175 | Jonestown | $2,350 |

| Princeton | $2,464 | Quail Creek | $2,380 |

| Rockport | $2,009 | Old River-Winfree | $2,393 |

| Vidor | $2,307 | Stratford | $2,131 |

| Jacinto City | $2,380 | Linden | $2,321 |

| Sweetwater | $2,331 | Morton | $2,009 |

| Pleasanton | $2,256 | Woodbranch | $2,316 |

| Bellmead | $2,307 | Italy | $2,175 |

| Vernon | $2,294 | Troup | $2,331 |

| Pearsall | $2,273 | Sheldon | $2,350 |

| Selma | $2,131 | Buffalo | $2,256 |

| Manvel | $2,316 | Yorktown | $2,464 |

| Ingleside | $2,321 | Splendora | $2,307 |

| Bonham | $2,009 | Wild Peach Village | $2,273 |

| Pecos | $2,037 | Lake Dunlap | $2,131 |

| Elgin | $2,464 | Eden | $2,175 |

| Manor | $2,393 | San Augustine | $2,524 |

| Fair Oaks Ranch | $2,523 | Kerens | $2,009 |

| Granbury | $2,331 | Bartlett | $2,384 |

| Fulshear | $2,350 | Hackberry | $2,350 |

| Eidson Road | $2,131 | Johnson City | $2,316 |

| Brownfield | $2,294 | Runaway Bay | $2,321 |

| Melissa | $2,307 | Clarendon | $2,331 |

| Lantana | $2,256 | Grandview | $2,131 |

| Commerce | $2,384 | Milam | $2,294 |

| Hondo | $2,273 | Archer City | $2,307 |

| Lamesa | $2,009 | Elmendorf | $2,256 |

| Perryton | $2,350 | Olmos Park | $2,175 |

| Helotes | $2,384 | Marfa | $2,037 |

| Highland Park | $2,319 | Fort Hancock | $2,273 |

| Liberty | $2,316 | Seth Ward | $2,009 |

| San Elizario | $2,294 | Three Rivers | $2,393 |

| Woodway | $2,175 | Gardendale | $2,316 |

| Fairview | $2,256 | Ralls | $2,384 |

| Bastrop | $2,307 | West Tawakoni | $2,294 |

| Wharton | $2,131 | Rhome | $2,350 |

| Heath | $2,273 | Iowa Colony | $2,393 |

| Dalhart | $2,331 | Shoreacres | $2,256 |

| Graham | $2,009 | Edgewood | $2,319 |

| Kirby | $2,350 | Lone Star | $2,131 |

| Whitehouse | $2,384 | Crosbyton | $2,273 |

| Fort Stockton | $2,464 | Albany | $2,331 |

| Alamo Heights | $2,294 | Hubbard | $2,009 |

| West Livingston | $2,037 | Vinton | $2,175 |

| Hillsboro | $2,350 | Van Horn | $2,393 |

| Roanoke | $2,316 | Bayou Vista | $2,307 |

| Cuero | $2,319 | Buna | $2,384 |

| Sanger | $2,464 | Roman Forest | $2,482 |

| Kennedale | $2,273 | Baird | $2,294 |

| Aransas Pass | $2,009 | Collinsville | $2,319 |

| Cleveland | $2,256 | Krugerville | $2,316 |

| Richland Hills | $2,331 | Seven Points | $2,331 |

| Lake Dallas | $2,393 | Menard | $2,350 |

| Paloma Creek South | $2,256 | Westwood Shores | $2,009 |

| Bridge City | $2,384 | South Point | $2,175 |

| Dayton | $2,131 | Bells | $2,384 |

| Jersey Village | $2,307 | Brackettville | $2,393 |

| Hitchcock | $2,316 | Uvalde Estates | $2,131 |

| Lucas | $2,331 | Moody | $2,350 |

| Lampasas | $2,319 | Juarez | $2,037 |

| Los Fresnos | $2,273 | Southside Place | $2,331 |

| Highlands | $2,294 | Briarcliff | $2,316 |

| Hornsby Bend | $2,009 | Somerset | $2,175 |

| Hempstead | $2,037 | Queen City | $2,273 |

| River Oaks | $2,350 | Emory | $2,256 |

| Monahans | $2,175 | Pinewood Estates | $2,294 |

| Seminole | $2,384 | Haslet | $2,009 |

| Floresville | $2,316 | Blossom | $2,307 |

| Jasper | $2,256 | Whitewright | $2,464 |

| Navasota | $2,331 | Siesta Acres | $2,319 |

| Gonzales | $2,464 | Waskom | $2,316 |

| Joshua | $2,131 | Lakeside town | $2,273 |

| Mexia | $2,307 | Ivanhoe | $2,331 |

| Kaufman | $2,294 | Oak Leaf | $2,384 |

| Crystal City | $2,523 | Lockney | $2,131 |

| La Feria | $2,316 | Lake Bryan | $2,393 |

| Murillo | $2,350 | Benavides | $2,294 |

| Elsa | $2,009 | Bangs | $2,037 |

| Providence Village | $2,307 | Hamlin | $2,384 |

| Kingsland | $2,319 | Pelican Bay | $2,175 |

| Homestead Meadows South | $2,331 | Rosebud | $2,316 |

| Lago Vista | $2,393 | Hico | $2,009 |

| Decatur | $2,273 | Holland | $2,256 |

| Prairie View | $2,523 | Montgomery | $2,331 |

| Bee Cave | $2,175 | Grapeland | $2,464 |

| Silsbee | $2,294 | Wallis | $2,319 |

| Lacy-Lakeview | $2,256 | Quinlan | $2,350 |

| Willis | $2,316 | Bartonville | $2,294 |

| Marble Falls | $2,131 | Caddo Mills | $2,307 |

| Carthage | $2,009 | Palm Valley | $2,393 |

| Kermit | $2,319 | Charlotte | $2,464 |

| Sunnyvale | $2,384 | Bruceville-Eddy | $2,131 |

| Scenic Oaks | $2,037 | Sabinal | $2,009 |

| Bridgeport | $2,350 | Holliday | $2,316 |

| Sealy | $2,273 | Rollingwood | $2,393 |

| Crockett | $2,294 | Meridian | $2,384 |

| Keene | $2,331 | Laguna Park | $2,350 |

| White Oak | $2,256 | Sebastian | $2,175 |

| Iowa Park | $2,319 | Fulton | $2,529 |

| Port Isabel | $2,304 | Big Sandy | $2,384 |

| Burnet | $2,131 | De Kalb | $2,523 |

| Everman | $2,298 | Wheeler | $2,256 |

| Camp Swift | $2,009 | Hughes Springs | $2,273 |

| Pecan Plantation | $2,393 | Pleak | $2,298 |

| Cameron Park | $2,350 | Somerville | $2,304 |

| Childress | $2,316 | Cottonwood Shores | $2,009 |

| Gun Barrel City | $2,464 | La Pryor | $2,319 |

| Pinehurst | $2,273 | Patton Village | $2,331 |

| Lindale | $2,261 | La Grulla | $2,037 |

| Alpine | $2,384 | China Spring | $2,526 |

| Yoakum | $2,393 | Aurora | $2,316 |

| Gladewater | $2,319 | Bovina | $2,131 |

| Slaton | $2,175 | Batesville | $2,261 |

| Littlefield | $2,009 | Woodcreek | $2,384 |

| Savannah | $2,304 | Booker | $2,393 |

| Mila Doce | $2,331 | Orange Grove | $2,464 |

| Progreso | $2,350 | Muenster | $2,384 |

| Mont Belvieu | $2,261 | Olmito | $2,009 |

| Windcrest | $2,298 | Lake Brownwood | $2,273 |

| Luling | $2,393 | Flatonia | $2,319 |

| Muleshoe | $2,316 | Thorndale | $2,304 |

| Edna | $2,037 | Serenada | $2,261 |

| Fabens | $2,273 | Rotan | $2,298 |

| Palmview | $2,131 | Stinnett | $2,175 |

| Hutchins | $2,384 | Ames | $2,350 |

| Zapata | $2,350 | Itasca | $2,316 |

| Lakehills | $2,319 | Elmo | $2,131 |

| Olivarez | $2,298 | Lexington | $2,523 |

| Marlin | $2,009 | Wildwood | $2,384 |

| Lackland AFB | $2,175 | Buchanan Dam | $2,464 |

| Palmview South | $2,261 | Heidelberg | $2,273 |

| Rusk | $2,304 | Claude | $2,393 |

| Carrizo Springs | $2,319 | Josephine | $2,009 |

| Rockdale | $2,331 | Rogers | $2,298 |

| Sinton | $2,316 | Roscoe | $2,331 |

| Nolanville | $2,464 | Gruver | $2,319 |

| Atlanta | $2,384 | Skidmore | $2,316 |

| Cameron | $2,009 | Brookside Village | $2,029 |

| Breckenridge | $2,273 | Lowry Crossing | $2,350 |

| Sansom Park | $2,131 | New Fairview | $2,261 |

| Wake Village | $2,298 | Woodsboro | $2,304 |

| Brookshire | $2,471 | Hawkins | $2,009 |

| Terrell Hills | $2,261 | Naples | $2,175 |

| Willow Park | $2,331 | Timpson | $2,131 |

| Brady | $2,350 | Waelder | $2,273 |

| San Leon | $2,393 | Wolfe City | $2,384 |

| Diboll | $2,029 | Calvert | $2,523 |

| Pecan Acres | $2,316 | Hemphill | $2,331 |

| Center | $2,009 | Cross Roads | $2,261 |

| Briar | $2,384 | Pine Island | $2,298 |

| Anthony | $2,319 | Ranchitos del Norte | $2,304 |

| Post | $2,350 | Valley Mills | $2,316 |

| Doffing | $2,175 | Gorman | $2,471 |

| Bulverde | $2,131 | Boyd | $2,009 |

| McGregor | $2,331 | LaCoste | $2,523 |

| Homestead Meadows North | $2,471 | Elkhart | $2,384 |

| Canutillo | $2,131 | Lakeport | $2,331 |

| Granite Shoals | $2,298 | Newark | $2,131 |

| Livingston | $2,273 | Paducah | $2,304 |

| Gilmer | $2,261 | Stowell | $2,350 |

| Giddings | $2,009 | Tatum | $2,029 |

| Bowie | $2,316 | Rocksprings | $2,393 |

| Krum | $2,384 | Markham | $2,175 |

| Hudson | $2,331 | Stockdale | $2,319 |

| Lake Worth | $2,393 | Lake Medina Shores | $2,471 |

| Denver City | $2,331 | Garrison | $2,009 |

| Primera | $2,131 | Farwell | $2,298 |

| Mathis | $2,471 | Alvord | $2,131 |

| Hunters Creek Village | $2,350 | Bevil Oaks | $2,261 |

| Wolfforth | $2,319 | Lindsay | $2,316 |

| Midway North | $2,304 | Fort Clark Springs | $2,273 |

| Penitas | $2,131 | Emerald Bay | $2,523 |

| Devine | $2,298 | Manchaca | $2,384 |

| Medina | $2,316 | Sundown | $2,471 |

| Parker | $2,009 | Gunter | $2,350 |

| Chula Vista | $2,175 | Plains | $2,131 |

| Rio Bravo | $2,393 | Robert Lee | $2,298 |

| Tulia | $2,029 | Groveton | $2,471 |

| Mineola | $2,471 | Oyster Creek | $2,009 |

| La Grange | $2,384 | Canyon Creek | $2,131 |

| New Boston | $2,393 | Knox City | $2,304 |

| Meadows Place | $2,523 | China Grove | $2,316 |

| Madisonville | $2,009 | Rancho Alegre | $2,331 |

| Pittsburg | $2,261 | Van Vleck | $2,350 |

| Hebbronville | $2,166 | Redland | $2,273 |

| Palacios | $2,298 | Point Venture | $2,304 |

| Hickory Creek | $2,316 | Natalia | $2,261 |

| Perezville | $2,319 | Harper | $2,331 |

| Laureles | $2,131 | Las Quintas Fronterizas | $2,319 |

| Shady Hollow | $2,273 | Bogata | $2,316 |

| Sandy Oaks | $2,350 | Uhland | $2,009 |

| Morgan's Point Resort | $2,331 | Jarrell | $2,131 |

| Castle Hills | $2,331 | Tye | $2,166 |

| Hearne | $2,316 | Danbury | $2,029 |

| Oak Point | $2,393 | Alto | $2,350 |

| Dilley | $2,304 | César Chávez | $2,471 |

| Wilmer | $2,298 | Tenaha | $2,298 |

| Jacksboro | $2,261 | Gholson | $2,384 |

| Coleman | $2,273 | Clear Lake Shores | $2,316 |

| Falfurrias | $2,009 | Muniz | $2,471 |

| Pilot Point | $2,319 | Brownsboro | $2,261 |

| Smithville | $2,393 | Hart | $2,166 |

| Caldwell | $2,131 | Falls City | $2,331 |

| Jourdanton | $2,331 | Boling | $2,350 |

| Groesbeck | $2,350 | Munday | $2,131 |

| Spring Valley Village | $2,384 | Lamar | $2,009 |

| Travis Ranch | $2,029 | Ranchos Penitas West | $2,471 |

| La Joya | $2,316 | Sterling City | $2,319 |

| Cockrell Hill | $2,298 | Iraan | $2,331 |

| Bellville | $2,166 | Redwater | $2,316 |

| Central Gardens | $2,350 | McKinney Acres | $2,029 |

| Hallsville | $2,131 | New Waverly | $2,273 |

| Aledo | $2,261 | Riesel | $2,166 |

| Dimmitt | $2,393 | Spur | $2,131 |

| Comanche | $2,304 | Maud | $2,298 |

| Sullivan City | $2,029 | Chico | $2,471 |

| Cotulla | $2,009 | Berryville | $2,261 |

| Alvarado | $2,273 | East Mountain | $2,384 |

| Crane | $2,316 | Randolph AFB | $2,393 |

| Port Aransas | $2,319 | Copper Canyon | $2,350 |

| Dripping Springs | $2,298 | Anton | $2,009 |

| Argyle | $2,331 | Granger | $2,471 |

| Sparks | $2,393 | Jamaica Beach | $2,029 |

| Horseshoe Bay | $2,316 | Mustang Ridge | $2,304 |

| La Paloma | $2,350 | Lakeside City | $2,298 |

| Nassau Bay | $2,166 | Rosharon | $2,331 |

| Redwood | $2,131 | Siesta Shores | $2,393 |

| San Carlos | $2,009 | Cut and Shoot | $2,273 |

| Presidio | $2,261 | Tornillo | $2,316 |

| San Diego | $2,384 | Von Ormy | $2,471 |

| Whitesboro | $2,393 | Fort Davis | $2,147 |

| Garden Ridge | $2,298 | Lost Creek | $2,481 |

| Bunker Hill Village | $2,029 | Rice | $2,009 |

| Colorado City | $2,331 | Coyote Acres | $2,166 |

| Richwood | $2,304 | Eustace | $2,350 |

| Van Alstyne | $2,319 | Red Lick | $2,298 |

| Ovilla | $2,147 | Wortham | $2,319 |

| West Columbia | $2,471 | Ore City | $2,261 |

| Friona | $2,166 | Tom Bean | $2,147 |

| Justin | $2,316 | Earth | $2,331 |

| Eastland | $2,331 | Powderly | $2,029 |

| Clyde | $2,009 | Warren | $2,166 |

| Barrett | $2,298 | Petersburg | $2,304 |

| Canton | $2,393 | Ransom Canyon | $2,384 |

| Shavano Park | $2,273 | Tiki Island | $2,471 |

| Cisco | $2,319 | Runge | $2,298 |

| Sweeny | $2,350 | Southmayd | $2,331 |

| Eagle Lake | $2,147 | Rio Vista | $2,471 |

| Aubrey | $2,166 | Detroit | $2,480 |

| North Alamo | $2,016 | Cross Plains | $2,147 |

| Comfort | $2,261 | Santa Clara | $2,316 |

| Venus | $2,298 | Coldspring | $2,393 |

| Potosi | $2,384 | Centerville | $2,350 |

| Weston Lakes | $2,304 | Vega | $2,016 |

| Ballinger | $2,331 | Callender Lake | $2,261 |

| Crandall | $2,316 | Aspermont | $2,319 |

| Taylor Lake Village | $2,417 | Joaquin | $2,273 |

| Westway | $2,029 | Sudan | $2,298 |

| Columbus | $2,166 | Arp | $2,427 |

| Scissors | $2,016 | Jewett | $2,316 |

| Elm Creek | $2,147 | Santa Anna | $2,304 |

| Wills Point | $2,273 | Frankston | $2,331 |

| Dublin | $2,350 | China | $2,147 |

| Teague | $2,342 | Cresson | $2,016 |

| Farmersville | $2,331 | Westlake | $2,339 |

| Cienegas Terrace | $2,298 | Kemp | $2,166 |

| Nash | $2,261 | Taft Southwest | $2,336 |

| Godley | $2,316 | Marion | $2,273 |

| Westminster | $2,016 | Sunrise Beach Village | $2,029 |

| Valley View | $2,304 | St. Paul | $2,319 |

| Sam Rayburn | $2,365 | Beckville | $2,166 |

| Bronte | $2,273 | Louise | $2,298 |

| Buchanan Lake Village | $2,147 | Hargill | $2,261 |

| McLean | $2,029 | Miles | $2,016 |

Minimum Auto Insurance Requirements in Texas

According to the Texas Department of Insurance (TDI.Texas.gov), all drivers in Texas must comply with state law and have the minimum bodily injury liability and property damage liability coverage in their car insurance policies for vehicle registration.

Below are the state requirements with minimum coverage limits:

| Liability insurance | Texas state minimum requirements |

|---|---|

| Bodily injury liability | $30,000 per person / $60,000 per accident |

| Property damage liability | $25,000 per accident |

AutoInsureSavings.org insurance agents recommend drivers have higher liability limits with collision and comprehensive coverage or a full coverage auto insurance policy with roadside assistance and medical payments coverage.

Our licensed insurance agents recommend uninsured motorist coverage in Texas since the uninsured motorist rate is 8.3%, according to the Insurance Information Institute (III.org).

You will be responsible for the extra costs in an at-fault auto accident in Texas if the cost of bodily injury and property damage exceeds the liability insurance requirements.

To learn more about Texas’s most affordable car insurance options, enter your zip code or get expert advice at AutoInsureSavings.org.

Our licensed insurance professionals will be happy to answer any questions you have.

Methodology

AutoInsureSavings.org comparison shopping study used a full-coverage auto policy for a 30-year-old driving a 2018 Honda Accord with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person / $100,000 per accident |

| Property damage liability | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured / underinsured motorist bodily injury | $50,000 per person / $100,000 per accident |

| Comprehensive and collision coverage | $500 deductible |

We used insurance rates for Texas drivers with accident histories, credit scores, and marital status for other rate analyses. We used insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your auto insurance rates may vary when you get quotes.

Sources

– Texas Department of Insurance. “Automobile car insurance guide.”

– National Highway Traffic Safety Administration. “Traffic Safety Facts.”

– National Association of Insurance Commissioners. “Market Share Reports for Property/Casualty Groups and Insurance Companies.”

-Texas Department of Public Safety. “Texas Driver Handbook.”

Frequently Asked Questions

How much is minimum coverage in Texas?

The average Texas rate for minimum coverage is $896 per year.

How much is full coverage car insurance in Texas?

The average cost of full coverage car insurance in Texas is $2,267 per year or $188 per month with $100,000 per accident in liability coverage. Mercury’s average rate for full coverage is $1,130 per year or $94 per month or 51% less per year, while Fred Loya’s $1,165 rate is 49% below Texas state average rates.

Who has the cheapest car insurance in Texas?

Fred Loya offers the state minimum’s cheapest auto insurance rate at $539 per year for 30-year-old drivers. The average annual auto insurance premiums for minimum coverage in Texas are $896 per year, and Fred Loya’s premium costs 40% less per year. Other good options for affordable car insurance are State Farm at $568 per year and Texas Farm Bureau at $615 per year.

How much is Texas car insurance per month?

The average car insurance costs $188 per month for full coverage in Texas and $74 per month for state minimum coverage for a 30-year-old driver with a clean driving record.

How do I save on car insurance in Texas?

The best way to get affordable auto insurance in Texas is to find out from your car insurance provider if you are eligible for a money-saving driver discount offered by the company. Many insurance providers in Texas will lower your overall insurance prices if you have more than one policy with them, such as life or home insurance policies. Also, comparison shopping is definitely your friend here.

Another way to save on car insurance premiums is to practice safe driving habits and maintain clean driving records. Many auto insurance companies offer good driving discounts for drivers in Texas that have clean driving records for five years. One example is State Farm, which offers good drivers a safe driver discount of up to 30% through the “Drive Safe & Save” telematics car insurance program. Not only will you keep and your passengers safe, but it will also help you avoid car accidents or traffic violations that could cause your premium to increase.

Is Texas a no-fault state?

Texas is an at-fault auto insurance state.

Why is Texas car insurance so expensive?

The average car insurance cost in Texas is higher due to state factors, such as a large population and frequent crashes. The best way to find affordable car insurance in Texas is to comparison shop.

What happens if you have no car insurance in Texas?

Drivers without Texas auto insurance face fines, suspended licenses, and more.

What is the best Texas auto insurance coverage?

Full coverage auto insurance provides the most protection to Texas drivers.

Is Texas a PIP state?

Yes, Texas auto insurance laws require drivers to carry PIP insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brad Larson

Licensed Insurance Agent

Brad Larson has been in the insurance industry for over 16 years. He specializes in helping clients navigate the claims process, with a particular emphasis on coverage analysis. He received his bachelor’s degree from the University of Utah in Political Science. He also holds an Associate in Claims (AIC) and Associate in General Insurance (AINS) designations, as well as a Utah Property and Casual...

Licensed Insurance Agent

UPDATED: Jan 12, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.