Review of Ameriprise Car Insurance & Comparison

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Feb 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Feb 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

As of 2020, American Family Insurance has acquired Ameriprise Financial Auto & Home insurance services.

If you want a quote from Ameriprise, you may use Costco car insurance coverage for Costco members but offered through American Family, their parent company.

While Ameriprise Financial has been around since 1894, it has only recently been getting recognition as a leading provider of personal insurance products like auto and home.

It has quietly improved its rankings as a reliable, affordable, and customer-favorite in the field of standard car insurance coverage, better known for its full range of financial planning and investing services.

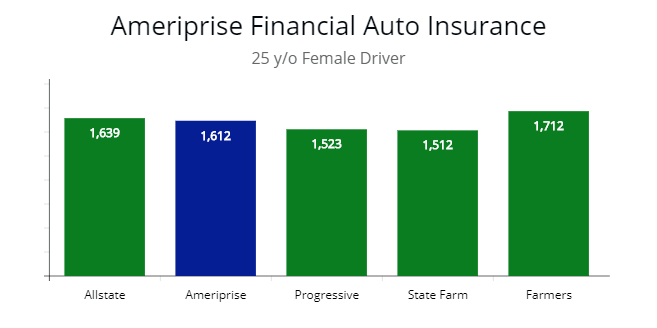

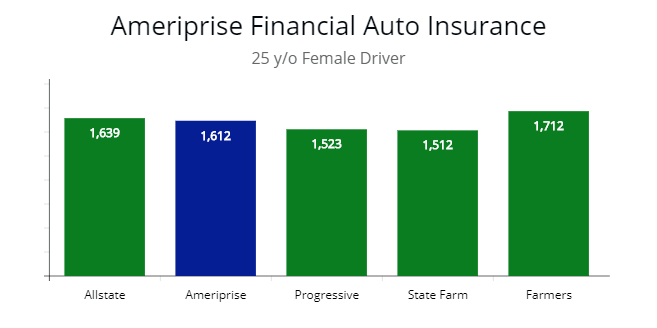

Note: In this instance, Ameriprise is more expensive than Progressive and State Farm but cheaper than Allstate and Farmers. When I queried for quotes, this was about average for prices.

In the most recent combined J.D. Power & Associates and A.M. Best survey of similar carriers, Ameriprise car insurance earned 85 of a possible 100 points, putting it ahead of much larger car insurance companies like The Hartford and MetLife.

And are reported by consumers to have a good claims process.

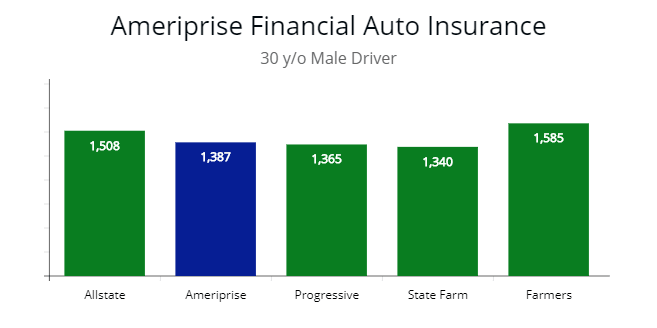

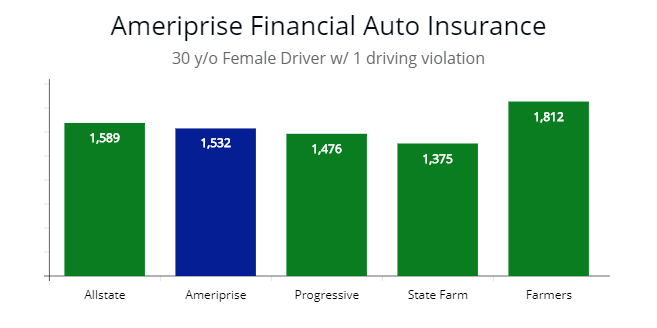

Comparing Ameriprise Car Insurance Rates

Below I obtained quotes for drivers from 25 to 55 years of age with various profiles.

I did this to give you an overview and perspective of Ameriprise to other financial carriers.

Note: For a 30 y/o male driver, they are competitive with all insurers. Prices are approximately 10% higher than the average price. In this instance, the insurance premium price was slightly higher than the state average in Idaho.

Across the board, for all ages, they are competitive. For this Ameriprise Auto Insurance review, when I queried for quotes, I did not take into consideration auto insurance discounts.

Most of the time, Ameriprise car insurance is slightly higher than its competitors.

However, with awesome financial strength rating, customer reviews and customer satisfaction ratings, they may be slightly better overall.

| Driver Profile | Ameriprise | Progressive | Allstate | Farmers | State Farm |

|---|---|---|---|---|---|

| 25 y/o female | $1,612 | $1,523 | $1,639 | $1,712 | $1,512 |

| 25 y/o male | $1,922 | $1,865 | $2,012 | $2,004 | $1,903 |

| 30 y/o female | $1,323 | $1,223 | $1,432 | $1,521 | $1,240 |

| 30 y/o male | $1,387 | $1,365 | $1,508 | $1,585 | $1,340 |

| 25 y/o male (1 driving violation) | $2,211 | $2,176 | $2,237 | $2,554 | $2,106 |

| 30 y/o female (1 driving violation) | $1,532 | $1,476 | $1,589 | $1,812 | $1,375 |

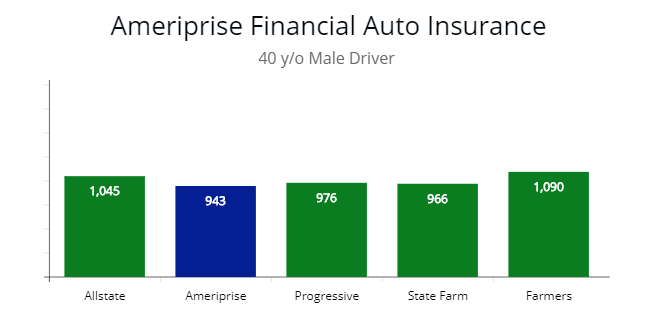

| 40 y/o male | $943 | $976 | $1,045 | $1,090 | $966 |

| 45 y/o female | $769 | $756 | $790 | $824 | $742 |

| 55 y/o male | $626 | $682 | $711 | $690 | $640 |

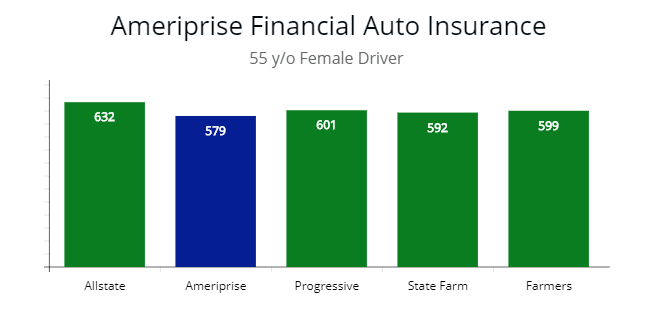

| 55 y/o female | $579 | $601 | $632 | $599 | $592 |

Generous with the Discounts

Ameriprise Insurance seems to be carving out a strong niche in key coverage options due to the numerous and generous discounts they offer customers.

Customers can apply for car insurance discounts in general categories linked to car features, driving habits and styles, and depth of involvement with Ameriprise.

Note: When comparing quotes with a driver with traffic offenses, the quotes were in line with the normal increase in an auto premium. In this instance, Farmers shot up, and State Farm appeared to be a little lower even though I compared the same driver profile with all insurers.

Some of the standard discounts you can get with an Ameriprise Insurance plan include:

– Member discounts – if you are an Ameriprise Financial services client, you are eligible for an exclusive discount just for choosing Ameriprise auto and/or home.

(Not available for drivers in Massachusetts, New York, or Tennessee.)

– Safe driving – go for an extended period of time driving accident-free, and Ameriprise will extend a discount on your premium renewal.

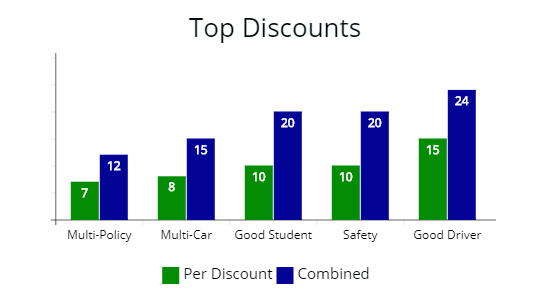

In some cases, it requires three years of accident-free driving, and in other states, it requires five years of accident-free, but you receive credit for driving accident-free with any previous insurer. Note: Above are typical discounts offered through Ameriprise Insurance. To get more of a discount on your premium, try combining them. When it comes to the vehicle itself, safety features have the most impact on discounts. Of course, your best bet is to have a good driving history.

Note: Above are typical discounts offered through Ameriprise Insurance. To get more of a discount on your premium, try combining them. When it comes to the vehicle itself, safety features have the most impact on discounts. Of course, your best bet is to have a good driving history.

– Safety – if your car has safety features like anti-lock brakes, air bags, and automatic seatbelts, or if it includes anti-theft devices, you may be eligible for additional discounts.

– Good student – if you have younger drivers who are in school and maintain good grades (a “B” average or better), you can get a discount to offset the added cost of insuring a younger driver.

– Education – younger drivers who are in college or who recently graduated from college can also apply for additional discounts.

– Multi-vehicle – add more than one car or a truck, or even a motorcycle, and you could qualify for Ameriprise’s multiple vehicle discounts. Note: For a 40-year-old driver, I found the premium prices cluster near $1,000 plus or minus about $50 to $90. I was surprised to find Ameriprise offered the lowest quote out of all the insurers illustrated. Each of them is 8 to 12% lower than typical quotes.

Note: For a 40-year-old driver, I found the premium prices cluster near $1,000 plus or minus about $50 to $90. I was surprised to find Ameriprise offered the lowest quote out of all the insurers illustrated. Each of them is 8 to 12% lower than typical quotes.

– Loyalty – add another financial level of service product to your package, and you could qualify for a loyalty discount.

The multi-policy discount is one of the more generous ones as it could net you as much as a 14 percent reduction on your premium alone.

– Not available to drivers in Alabama, California, Georgia, Hawaii, North or South Carolina.

– Tenure – if you stay insured with Ameriprise for three years or more, you may earn its tenure discount.

Others include:

- Defensive driver

- Roadside assistance

- Credit card benefits

- Rental car protection

- GAP insurance

- Windshield repair

- Car replacement

There are optional coverages like Personal Injury Protection (PIP), a glass repair deductible waiver, underinsured motorist coverage, and rental reimbursement.

Below is a list of the percentage discount off your auto policy.

| Rank | Discount | Percentage |

|---|---|---|

| 1 | Good Student | 5 - 30% |

| 2 | Safe Driving | 4 - 20% |

| 3 | Multi-Car Policy | 5 - 15% |

| 4 | Anti-Theft / Safety | 5 - 15% |

| 5 | Loyalty | 5 - 15% |

| 6 | Education | 2 - 7% |

| 7 | Tenure | 0 - 5% |

Note: A 55-year-old female driver can find quotes from $579 to $632 for full coverage. In this instance, a policy with Ameriprise was lower than all the insurers illustrated. When I was querying for quotes, they are substantially more competitive with older drivers than younger ones.

Comparing Coverage in Various Regions

Below is a table I have prepared an auto rate for a 49-year-old female driver.

Depending on the United States region, your premium will vary according to Ameriprise and Consumer Reports.

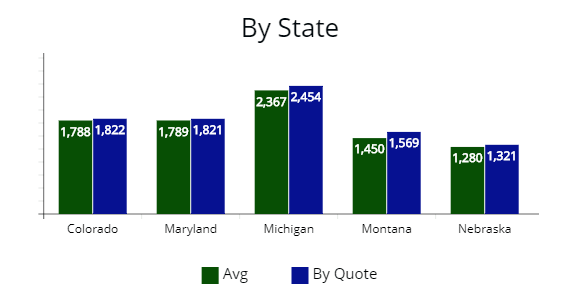

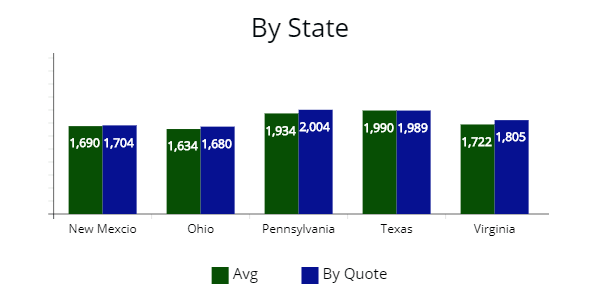

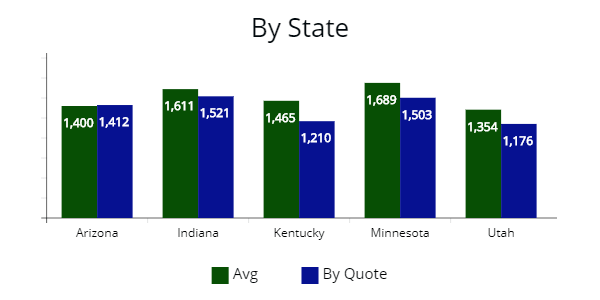

Note: As illustrated, in all 5 states, Ameriprise is slightly more expensive. This seems to be in line when taking them as an average rather than simply getting a specific driver profile quote. A good reason to get a quote from them to see what is offered.

In the example below, premiums are lower in Texas than in Georgia or New York.

On the other hand, compared with other carriers, Ameriprise is competitive in the southern, mid-west, and northern areas.

| 49-Year-Old Female | Atlanta, GA | Fort Worth, TX | New York |

|---|---|---|---|

| Cost Per Month | $154.69 | $63.97 | $133.94 |

| Annual Premium Price | $1,856.28 | $767.64 | $1,607.28 |

| Coverage BIL & PD | $25,000 | $25,000 | $25,000 |

| Uninsured Motorist Coverage | $50,000 | $50,000 | $50,000 |

| Medical Payments | N/A | N/A | $1,000 |

| Comprehensive w/ Deductible | $500 | $500 | $500 |

Comparison & Overall Customer Service Satisfaction

One item to be aware of is the percentage rate hike some insurers give to their customers. As with the greater insurance industry, Ameriprise is not immune to this, either.

The percentage premium rate hike is from 2 to 6% depending on the state you reside in.

Note: Again, in this instance, Ameriprise is higher than the state average for all states except Texas. Taking averages is difficult to do, and the results are skewed. Therefore it is important to get a quote with a specific driving profile or for yourself to find a competitive rate.

Of course, if you get any driving infractions, this amount can be substantially higher.

The reason for this data is to show you hikes are not out of the normal amount, which any insurer would do as standard practice.

Rideshare insurance is not included. According to their website, you should get a commercial auto insurance policy.

For most of the states, they are higher than the state average quote.

This doesn’t mean to get a quote from them, but only when I queried to compare they were slightly higher than the average in the insurance industry.

Many customers prefer them since they have a variety of additional coverage and financial options.

Out of all the states in the list, auto insurance rates were lower in Indiana, Kentucky, and Minnesota.

Below are the states where you can get liability and/or comprehensive coverage through Ameriprise.

However, you can get quotes from Costco car insurance company, owned by American Family Insurance, since they bought Ameriprise auto and home services in 2019.

They offered coverage in 34 states, but American Family offers it in every state.

| State | % Rate Hike | Average Quote | Ameriprise | Difference | Satisfaction Out of 5 |

|---|---|---|---|---|---|

| Arizona | 3% | $1,400 | $1,412 | +$12 | 4 |

| Arkansas | 2.3% | $1,725 | $1,744 | +$19 | 4.5 |

| California | 4.3% | $2,255 | $2,421 | +$166 | 3 |

| Colorado | 5.1% | $1,788 | $1,822 | +$34 | 4 |

| Idaho | 6% | $1,326 | $1,365 | +$39 | 3 |

| Illinois | 5% | $1,452 | $1,365 | -$87 | 4 |

| Indiana | 2.9% | $1,611 | $1,521 | -90 | 4 |

| Iowa | 6% | $1,322 | $1,411 | +$89 | 3 |

| Kansas | 5.3% | $1,348 | $1,310 | -$38 | 3 |

| Kentucky | 5% | $1,465 | $1,210 | -$255 | 4 |

| Maryland | 5.5% | $1,789 | $1,821 | +$32 | 4 |

| Michigan | 7% | $2,367 | $2,454 | +$87 | 4.5 |

| Minnesota | 6% | $1,689 | $1,521 | -$168 | 4 |

| Missouri | 8% | $1,290 | $1,298 | +$8 | 5 |

| Montana | 4.9% | $1,450 | $1,569 | +$119 | 4.5 |

| Nebraska | 3% | $1,280 | $1,321 | +$41 | 3 |

| Nevada | 4% | $1,587 | $1,600 | +$3 | 4 |

| New Mexico | 5% | $1,690 | $1,704 | +$14 | 4 |

| North Dakota | 6% | $1,590 | $1,490 | -$100 | 4 |

| Ohio | 5% | $1,634 | $1,680 | +$46 | 4 |

| Oklahoma | 4.5% | $1,400 | $1,446 | +$6 | 4 |

| Oregon | 6.4% | $1,890 | $1,900 | +$10 | 3.5 |

| Pennsylvania | 6.7% | $1,943 | $2,004 | +$61 | 3.5 |

| South Dakota | 6% | $1,300 | $1,343 | +$43 | 4 |

| Texas | 5.5% | $1,990 | $1,889 | -$1 | 4 |

| Utah | 4% | $1,354 | $1,400 | +$46 | 3.5 |

| Virginia | 3.8% | $1,722 | $1,805 | +$83 | 4 |

| Washington | 6% | $1,760 | $1,865 | +$105 | 3.5 |

| Wisconsin | 4.7% | $1,654 | $1,689 | +$35 | 3 |

| Wyoming | 6% | $1,319 | $1,344 | +$25 | 3 |

Note: There are a few states Ameriprise is substantially lower such as Kentucky and Minnesota. If you are shopping for insurance coverage options in a certain state, do not let the illustrations inhibit you. Though they are higher than the “average premium,” you could get one substantially lower depending on your driving history and age, particularly if you are an older driver.

Added Benefits

Ameriprise offers its customers some additional benefits that, while not technically discounts on premium, can save them money over the long-term, including.

Some of the standout features are:

– Accident forgiveness – customers who have been accident-free with Ameriprise for at least three years won’t lose their Safe Driving History discount if they experience an at-fault accident.

– Lifetime renewability – as a client, they promise they will not cancel or non-renew your car insurance policy.

– This applies to auto insurance only and is not available to drivers in Maryland or Michigan. It is not extended to policyholders who have major violations or who fail to pay a premium.

As with all insurers, coverage options and discount details vary from state to state and from plan to plan.

Final Thoughts

If you’re in the market for a new policy, you may want to take this list of discount opportunities to a local insurance agent to see if Ameriprise Financial is a good fit for you.

And have additional living expenses from the savings.

Sources

https://www.bankrate.com/insurance/companies/ameriprise/Bankrate.com

J.D. Power’s U.S. auto insurance study

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: Feb 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.