Virginia Cheapest Car Insurance Quotes & Best Insurance Options

Virginia Farm Bureau and Erie Insurance have Virginia's cheapest car insurance quotes and best insurance options. VA drivers who want minimum coverage will find the cheapest rate at Virginia Farm Bureau for an average of $32/mo. The cheapest VA full coverage is at Erie Insurance for an average of $87/mo.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Jan 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jan 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Searching for Virginia’s cheapest car insurance quotes and best insurance options? You will find the cheapest rates at Virginia Farm Bureau and Erie Insurance. Continue reading to learn about quotes and coverages from the best auto insurance companies in VA.

To get affordable VA auto insurance quotes right away, enter your ZIP in our free quote tool.

Affordable Virginia Car Insurance Rates

Comparing a car insurance quote from at least three to five insurance carriers is the best way to make sure you find the best deals to save money monthly.

| Cheapest Car Insurance in Virginia - Quick Hits |

|---|

The cheapest Virginia car insurance options are: The cheapest Virginia car insurance options are:Cheapest for minimum coverage: Virginia Farm Bureau Cheapest for full coverage: Erie Insurance Cheapest after an at-fault accident: Erie Cheapest after a speeding ticket: Farm Bureau Cheapest after a DUI: Progressive Cheapest for poor credit history: Nationwide Cheapest for young drivers: Erie For young drivers with a speeding violation: Erie For young drivers with an at-fault accident: Erie |

This guide will take a closer look at car insurance providers available to Virginia drivers and help you determine which one is best for your individual needs.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Virginia for Minimum Coverage

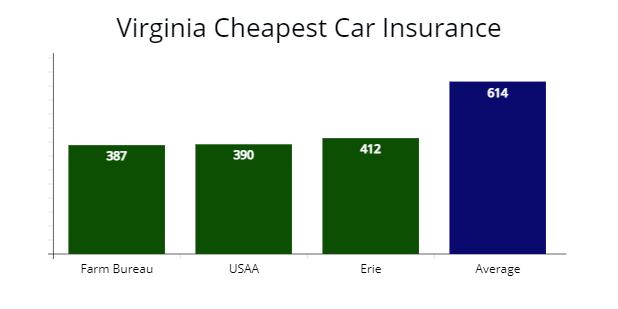

Our recent comparison shopping study found the cheapest auto insurer for minimum liability insurance requirements is Virginia Farm Bureau, which provided our agents a $387 insurance rate for our sample driver.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

The average quote is $614 per year, and Farm Bureau’s rate at $387 per year is 37% cheaper, making them the best option for Virginia drivers needing minimum liability insurance.

| Insurer | Average annual rate |

|---|---|

| Virginia Farm Bureau | $387 |

| USAA | $390 |

| Erie | $412 |

| Geico | $440 |

| State Farm | $476 |

| The Hartford | $513 |

| Allstate | $657 |

| Progressive | $681 |

| Elephant | $721 |

| Nationwide | $794 |

| Travelers | $816 |

| Liberty Mutual | $829 |

| Virginia average | $614 |

*USAA is for qualified military members, their spouses, and direct family members. Rates may vary depending on driver profiles.

Military members, their spouses, or family members qualify for cheaper car insurance through USAA, which has the best car insurance options for veterans. Buying minimum coverage insurance requirements at $390 annually through USAA is 37% less expensive than the state average $614 rate. Learn more in our review of USAA car insurance.

Cheapest Full Coverage Car Insurance in Virginia

If you are interested in having an extra layer of protection while you are on the road, the cheapest full coverage rates are with Erie Insurance at $1,040 annually or $87 per month.

Read more: A Review of Erie Auto Insurance & Policy Options

Quotes from this car insurance carrier are 31% less expensive than Virginia’s average of $1,493.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Erie | $1,041 | $87 |

| Virginia Farm Bureau | $1,130 | $94 |

| State Farm | $1,265 | $105 |

| Virginia average | $1,493 | $124 |

*Your rates may vary when you get quotes.

Full coverage car insurance in Virginia costs, on average, more than three times the amount that minimum coverage insurance costs.

While many drivers may instantly turn away from taking out full coverage due to the higher car insurance rates, others appreciate the peace of mind and reassurance they receive by having collision and comprehensive coverage along with their liability coverage.

Learn more:

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

The State Corporation Commission (SCC) of Virginia recommends full coverage insurance to protect your vehicle from inclement weather accidents such as hurricanes. You may want to get uninsured motorist coverage in Virginia for extra protection.

Cheapest Car Insurance With a Speeding Ticket in Virginia

The best coverage rate for drivers with one speeding violation is Farm Bureau, which offered us a quote at $1,198 annually. The average cost of insurance for Virginians with a speeding ticket is $1,769, but Farm Bureau is $571 cheaper.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Virginia Farm Bureau | $1,198 | $99 |

| Erie | $1,261 | $105 |

| Geico | $1,477 | $123 |

| Virginia average | $1,769 | $147 |

Traffic tickets will cause your auto insurance rates to increase regardless of your coverage level. In Virginia, most drivers expect rate increases by 16% on average for traffic violations.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Virginia With a Car Accident

In Virginia, drivers with one at-fault accident on their driving record should consider Erie, the cheapest auto insurance company, which provided our insurance agents with a quote at $1,437 annually or $119 per month.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Erie Insurance | $1,437 | $119 |

| Farm Bureau | $1,580 | $131 |

| State Farm | $1,812 | $151 |

| Virginia average | $2,254 | $187 |

In Virginia, the average cost of car insurance after being involved in an accident is $2,254 per year or $187 per month. Erie’s rate for those with a car accident is 37% cheaper than average.

Your next cheapest option is Farm Bureau, with a $1,580 rate or $674 less than average.

Once you have an at-fault accident on your driving record in Virginia, you can expect your car insurance rates to go up by 34%, according to the Insurance Information Institute (III.org).

That is because insurance companies see accidents as a sign of increased risk, and many will consider you a high-risk driver until the accident is no longer on your driving record.

Cheapest Car Insurance With a DUI in Virginia

During our agent’s research, the auto insurance provider in Virginia to check out is Progressive for drivers with a DUI. Learn more about Progressive in our Progressive car insurance review.

Progressive’s quote of $151 per month is 28% less expensive than average and $158 less than the next best option Erie Insurance.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $1,813 | $151 |

| Erie | $1,971 | $164 |

| Farm Bureau | $2,022 | $168 |

| Virginia average | $2,484 | $207 |

In Virginia, drivers caught driving under the influence are expected to pay car insurance premiums 40% more than drivers who have clean driving records. After a DUI, Virginia drivers’ average insurance cost is $2,484 per year or a rate increase to $207 per month. Registering for a defensive driving course is the best way to lower your insurance cost after a DUI offense, as well as shopping at the best car insurance companies after a DUI.

Cheapest Car Insurance For Drivers with Poor Credit in Virginia

According to our research, the Virginian auto insurance company offering the best rates with poor credit is Nationwide.

Nationwide’s quote of $1,230 per year is 35% less expensive than the $1,891 average premium.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Nationwide | $1,230 | $102 |

| Geico | $1,276 | $106 |

| State Farm | $1,421 | $118 |

| Virginia average | $1,891 | $157 |

Even if you are a safe driver, your credit report and score can harm how much your car insurance rates will be. That’s because many companies look at a person’s ability to pay off their debts or credit cards to reflect their ability to make their monthly car insurance payments.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

If you have bad credit, you will likely pay as much as 22% more for car insurance premiums in Virginia than those with good credit.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance for Young Drivers in Virginia

Our comparison study found that Erie has the best car insurance for teens in Virginia. Our insurance agents received a low rate of $2,644 annually from Erie or $220 a month, which is 50% more affordable than Virginia’s state average rate.

Teen drivers looking for affordable minimum coverage in Virginia should consider Erie ($1,128) and Geico ($1,287). Both auto insurers are 33% cheaper than the average $1,911 Virginia auto insurance rate.

| Insurer | Full coverage | Minimum coverage |

|---|---|---|

| USAA | $2,170 | $1,099 |

| Erie Insurance | $2,644 | $1,128 |

| State Farm | $3,190 | $1,412 |

| Geico | $3,437 | $1,287 |

| Virginia Farm Bureau | $3,904 | $1,316 |

| Progressive | $5,365 | $1,876 |

| Nationwide | $5,981 | $2,311 |

| Travelers | $6,233 | $2,722 |

| Allstate | $6,945 | $1,559 |

| Virginia average | $5,237 | $1,911 |

*USAA is for qualified military members, their spouses, and direct family members. Your insurance rates may vary based on the driver’s profile.

Our agents recommended a teen driver in Virginia carry full coverage insurance.

The most cost-effective option for teen auto insurance is for young drivers to join their parents' auto insurance policy.Brandon Frady Licensed Insurance Agent

Still, if you have limited insurance providers option, or your vehicle worth less than $3,000, a minimum liability policy may be the best way to save more on car insurance.

Cheapest Car Insurance for Young Drivers with a Speeding Ticket

If under the age of 21 in Virginia, drivers with a speeding violation will find cheaper insurance rates with Erie, which provided us a quote at $264 per month or 43% less expensive than the state average rate. Geico proved affordable Virginia insurance at $3,577 per year ($298 monthly) for full coverage.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Erie | $3,170 | $264 |

| Geico | $3,577 | $298 |

| State Farm | $3,619 | $301 |

| Virginia average | $5,563 | $463 |

Cheapest Car Insurance for Young Drivers with an Auto Accident

Young Virginians with an at-fault accident can avoid significant rate increases by getting auto insurance coverage from Erie Insurance with a quote at $3,416 annually or 43% cheaper.

The next best coverage option is Geico, quoted at $3,794 per year or 33% less expensive than a typical teen driver rate with a car accident in their driver history.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Erie | $3,416 | $284 |

| Geico | $3,794 | $316 |

| State Farm | $3,825 | $318 |

| Virginia average | $5,935 | $494 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Auto Insurance Companies in Virginia

AutoInsureSavings.org agents survey of car insurance carriers in Virginia found USAA performed the best overall customer service and JD Power claims satisfaction. If not eligible for a USAA membership, your best auto policy options Virginia Farm Bureau, Nationwide, and Progressive.

We studied data to help you make excellent coverage choices and insurance decisions during our comparison shopping study of Virginia’s best auto insurers. The data we use is from the National Association of Insurance Commissioners (NAIC), J.D. Power’s customer satisfaction survey, and AM Best financial strength ratings.

| Auto Insurer | NAIC Complaint Index | J.D. Power claims satisfaction score | AM Best Financial Strength Rating |

|---|---|---|---|

| Virginia Farm Bureau | 0.00 | n/a | A |

| Travelers | 0.00 | 861 | A++ |

| Progressive | 0.36 | 856 | A+ |

| Nationwide | 0.64 | 876 | A+ |

| State Farm | 0.66 | 881 | A++ |

| USAA | 0.68 | 890 | A++ |

| Allstate | 0.71 | 876 | A+ |

| Geico | 1.01 | 871 | A++ |

| Erie | 1.10 | 880 | A+ |

*NAIC complaint index, the lower, the better, JD Power’s claims satisfaction study, the higher, the better, AM Best Ratings, A+ is “excellent,” and A++ is “superior” financial strength.

Virginia Farm Bureau and Travelers Insurance are two insurers performing best with NAIC’s complaint index. Both scored less than the national average of 1.00 with lower than average complaints based on their market share. Travelers Insurance has an excellent J.D. Power claims satisfaction score of 861, while Farm Bureau isn’t rated.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Deciding on the best car insurance company in Virginia is not a simple task. That is because the factors that make one car insurance company the best for one driver may make them the worst choice for another. Finding the best auto insurance rates for you will depend on a wide variety of factors like your age, your driving history, where you live, and your vehicle’s make or model, to name a few.

A recent insurance survey from ValuePenguin reached similar results for Virginia car insurance carriers.

| Company | % extremely satisfied with recent claim | % rated customer service as excellent |

|---|---|---|

| USAA | 78% | 62% |

| Nationwide | 78% | 53% |

| State Farm | 73% | 46% |

| Allstate | 72% | 47% |

| Erie | 67% | 50% |

| Progressive | 74% | 34% |

| Geico | 64% | 42% |

| Travelers | 63% | 33% |

| Virginia Farm Bureau | n/a | n/a |

Your best resource for finding the most affordable car insurance rates in Virginia is insurance quote comparison websites like AutoInsureSavings.org.

You can find many useful articles and guides on which car insurance company is the best and offers the most beneficial coverage options for various drivers in different categories.

Average Car Insurance Costs by City in Virginia

Auto insurers use your zip code to calculate your insurance rate, as well as your marital status, credit score, and driving history. Your rates can vary by $585 or more, depending on your location in Virginia.

AutoInsureSavings.org licensed insurance agents did a comparison study of cities with the cheapest insurance coverage in Virginia.

Cheapest Car Insurance in Virginia Beach, VA

Virginia Beach drivers can find the cheapest auto insurance coverage for their motor vehicle with Erie, which provided our agents a $1,119 annual quote or $86 per month for a full coverage policy.

Erie’s quote is 39% less expensive than the $1,832 citywide average rate.

| Virginia Beach Company | Average Premium |

|---|---|

| Erie | $1,119 |

| USAA | $1,160 |

| State Farm | $1,343 |

| Virginia Beach average | $1,832 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Norfolk, VA

In research, we found the most affordable insurance coverage for Norfolk drivers is USAA, providing a quote of $1,012 per year or 45% less expensive than average rates. At $1,254 annually, Erie is 33% lower than average, making both insurers the better car insurance option.

| Norfolk Company | Average Premium |

|---|---|

| USAA | $1,012 |

| Erie | $1,254 |

| Farm Bureau | $1,461 |

| Norfolk average | $1,856 |

Cheapest Auto Insurance in Chesapeake, VA

AutoInsureSavings.org licensed agents’ research found coverage from Nationwide Insurance costs cheaper for residents of Chesapeake. Nationwide’s $87 monthly rate is 42% less expensive than the citywide average insurance rate of $1,768 per year or $147 a month.

| Chesapeake Company | Average Premium |

|---|---|

| Nationwide | $1,043 |

| State Farm | $1,097 |

| Geico | $1,213 |

| Chesapeake average | $1,768 |

Cheapest Auto Insurance in Arlington, VA

Affordable insurance coverage in Arlington is with Farm Bureau providing the best rate at $1,335 annually for a full coverage policy. Farm Bureau’s $111 a month rate is 31% less expensive than average for Arlington residents.

| Arlington Company | Average Premium |

|---|---|

| Farm Bureau | $1,335 |

| Geico | $1,471 |

| State Farm | $1,515 |

| Arlington average | $1,932 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Richmond, VA

Drivers in Richmond can get cheap auto insurance with Erie Insurance, which provided our licensed agents a $1,116 annual rate for a full coverage policy with $100,000 in liability insurance. Erie’s quote is 41% less expensive than the average $1,882 yearly rate in Richmond.

| Richmond Company | Average Premium |

|---|---|

| Erie Insurance | $1,116 |

| State Farm | $1,309 |

| Virginia Farm Bureau | $1,418 |

| Richmond average | $1,882 |

Cheapest Car Insurance in Newport News, VA

The cheapest auto insurance rate our insurance agents found in Newport News is State Farm, with a $967 per year rate for a policy with collision and comprehensive coverage. State Farm’s quote is 39% less expensive than Newport New’s average rate of $1,579 per year.

| Newport News Company | Average Premium |

|---|---|

| State Farm | $967 |

| Geico | $1,055 |

| Liberty Mutual | $1,260 |

| Newport News average | $1,579 |

Cheapest Car Insurance in Alexandria, VA

Alexandria drivers can find the cheapest full coverage insurance policy with Erie, which offered us a $1,180 annual rate for our sample 30-year-old driver. Erie’s car insurance rate is $669 less annually than Alexandria’s average of $1,849 per year.

| Alexandria Company | Average Premium |

|---|---|

| Erie Insurance | $1,180 |

| State Farm | $1,354 |

| Nationwide | $1,552 |

| Alexandria average | $1,849 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Average Insurance Cost for All Cities in Virginia

| City | Annual Premium Cost | City | Annual Premium Cost |

|---|---|---|---|

| Virginia Beach | $1,832 | Mantua | $1,359 |

| Norfolk | $1,856 | North Springfield | $1,374 |

| Chesapeake | $1,768 | Lexington | $1,367 |

| Arlington | $1,932 | Sandston | $1,403 |

| Richmond | $1,882 | Crozet | $1,347 |

| Newport News | $1,579 | Woodlake | $1,403 |

| Alexandria | $1,849 | Bellwood | $1,448 |

| Hampton | $1,812 | Potomac Mills | $1,359 |

| Roanoke | $1,767 | Belle Haven CDP | $1,403 |

| Portsmouth | $1,622 | Belmont | $1,395 |

| Suffolk | $1,578 | Strasburg | $1,437 |

| Lynchburg | $1,602 | Bedford | $1,367 |

| Centreville | $1,455 | Galax | $1,374 |

| Dale City | $1,511 | Buena Vista | $1,374 |

| Reston | $1,367 | Carrollton | $1,478 |

| Harrisonburg | $1,403 | South Run | $1,347 |

| Leesburg | $1,386 | Pimmit Hills | $1,468 |

| Ashburn | $1,359 | Aquia Harbour | $1,553 |

| Tuckahoe | $1,347 | Bensley | $1,367 |

| McLean | $1,437 | Bridgewater | $1,395 |

| Charlottesville | $1,600 | Chamberlayne | $1,403 |

| Lake Ridge | $1,553 | Massanetta Springs | $1,437 |

| Blacksburg | $1,367 | Fort Lee | $1,478 |

| Annandale | $1,448 | Crosspointe | $1,347 |

| Burke | $1,374 | Marion | $1,386 |

| Linton Hall | $1,403 | Covington | $1,359 |

| Manassas | $1,639 | Dulles Town Center | $1,437 |

| Danville | $1,528 | Emporia | $1,448 |

| Marumsco | $1,395 | Dumfries | $1,367 |

| Mechanicsville | $1,347 | Richlands | $1,478 |

| Oakton | $1,386 | Big Stone Gap | $1,374 |

| Fair Oaks | $1,582 | Woodstock | $1,496 |

| Springfield | $1,367 | Ettrick | $1,437 |

| South Riding | $1,359 | Kings Park | $1,553 |

| Petersburg | $1,478 | Quantico | $1,347 |

| Sterling | $1,496 | Orange | $1,386 |

| West Falls Church | $1,448 | Bluefield | $1,367 |

| Fredericksburg | $1,604 | King George | $1,395 |

| Short Pump | $1,374 | Bealeton | $1,421 |

| Winchester | $1,347 | Luray | $1,359 |

| Cave Spring | $1,367 | Rocky Mount | $1,557 |

| Salem | $1,421 | Falmouth | $1,448 |

| Herndon | $1,359 | Spotsylvania | $1,478 |

| Staunton | $1,386 | Enon | $1,403 |

| Chantilly | $1,546 | South Hill | $1,347 |

| Woodlawn CDP | $1,403 | Woodbridge | $1,395 |

| Tysons | $1,568 | Berryville | $1,374 |

| West Springfield | $1,448 | Bethel Manor | $1,359 |

| Bailey's Crossroads | $1,550 | Hayfield | $1,478 |

| Lincolnia | $1,347 | Stafford | $1,367 |

| Fairfax | $1,421 | Tazewell | $1,386 |

| Hopewell | $1,359 | Verona | $1,514 |

| Rose Hill | $1,544 | County Center | $1,347 |

| Christiansburg | $1,386 | Loch Lomond | $1,546 |

| Waynesboro | $1,369 | Lake Land'Or | $1,403 |

| Chester | $1,374 | University Center | $1,478 |

| McNair | $1,395 | Norton | $1,448 |

| Brambleton | $1,367 | Mount Hermon | $1,359 |

| Montclair | $1,559 | Broadway | $1,347 |

| Lorton | $1,386 | Shenandoah Farms | $1,421 |

| Neabsco | $1,558 | Clifton Forge | $1,374 |

| Cherry Hill | $1,347 | Colonial Beach | $1,508 |

| Meadowbrook | $1,403 | Southern Gateway | $1,395 |

| Franconia | $1,546 | Altavista | $1,367 |

| Sudley | $1,359 | Blackstone | $1,527 |

| Culpeper | $1,448 | Pantops | $1,478 |

| Franklin Farm | $1,367 | Cloverdale | $1,421 |

| Merrifield | $1,386 | West Point | $1,347 |

| Idylwood | $1,472 | Blue Ridge | $1,560 |

| Bon Air | $1,347 | North Shore | $1,386 |

| Burke Centre | $1,511 | Lebanon | $1,403 |

| Buckhall | $1,374 | Dahlgren | $1,519 |

| Radford | $1,395 | Shenandoah | $1,347 |

| Laurel | $1,562 | Wise | $1,508 |

| Kingstowne | $1,472 | Chincoteague | $1,367 |

| Colonial Heights | $1,562 | Lake Wilderness | $1,359 |

| Gainesville | $1,347 | Elkton | $1,448 |

| Hybla Valley | $1,403 | Daleville | $1,386 |

| Manassas Park | $1,374 | Oak Grove | $1,359 |

| Fort Hunt | $1,347 | Grottoes | $1,395 |

| Bristol | $1,546 | Amherst | $1,421 |

| Bull Run | $1,367 | Windsor | $1,403 |

| Groveton | $1,448 | Hillsville | $1,386 |

| Vienna | $1,562 | Pearisburg | $1,395 |

| Highland Springs | $1,472 | Merrimac | $1,347 |

| Wolf Trap | $1,600 | Timberville | $1,374 |

| East Highland Park | $1,386 | Dublin | $1,367 |

| Glen Allen | $1,511 | Waverly | $1,562 |

| Front Royal | $1,403 | Massanutten | $1,448 |

| Williamsburg | $1,347 | Chase City | $1,421 |

| Great Falls | $1,374 | Lovettsville | $1,546 |

| Hollins | $1,359 | Matoaca | $1,386 |

| Kings Park West | $1,395 | Gloucester | $1,562 |

| Stone Ridge | $1,587 | Crewe | $1,347 |

| Falls Church | $1,367 | Saltville | $1,403 |

| Brandermill | $1,508 | Fairlawn | $1,472 |

| Broadlands | $1,386 | Ferrum | $1,359 |

| Huntington | $1,347 | Crimora | $1,421 |

| Timberlake | $1,448 | Ravensworth | $1,546 |

| Newington | $1,562 | Stephens City | $1,508 |

| Mount Vernon | $1,472 | New Market | $1,347 |

| Sugarland Run | $1,449 | Pennington Gap | $1,374 |

| Martinsville | $1,403 | Woodlawn | $1,386 |

| Lakeside | $1,540 | Laymantown | $1,367 |

| Newington Forest | $1,359 | Mount Jackson | $1,472 |

| Lansdowne | $1,562 | Victoria | $1,395 |

| Poquoson | $1,347 | Chilhowie | $1,403 |

| Fairfax Station | $1,590 | Lake Holiday | $1,562 |

| Madison Heights | $1,374 | Horse Pasture | $1,421 |

| Dranesville | $1,386 | Tappahannock | $1,448 |

| Wakefield | $1,395 | Marshall | $1,347 |

| Cascades | $1,347 | Raven | $1,359 |

| Manchester | $1,367 | Narrows | $1,374 |

| Lake Monticello | $1,411 | Mason Neck | $1,472 |

| Lowes Island | $1,546 | Moorefield Station | $1,562 |

| Forest | $1,421 | Weyers Cave | $1,347 |

| Wyndham | $1,592 | Gate City | $1,386 |

| New Baltimore | $1,516 | Patrick Springs | $1,395 |

| Warrenton | $1,359 | Prince George | $1,411 |

| Purcellville | $1,450 | Stanley | $1,367 |

| Gloucester Point | $1,347 | Appomattox | $1,421 |

| Lake Barcroft | $1,395 | Rivanna | $1,472 |

| George Mason | $1,516 | Courtland | $1,565 |

| Countryside | $1,386 | Warsaw | $1,347 |

| Yorkshire | $1,367 | Cana | $1,467 |

| Stuarts Draft | $1,374 | Lyndhurst | $1,421 |

| Independent Hill | $1,472 | Castlewood | $1,359 |

| Dunn Loring | $1,347 | Gordonsville | $1,546 |

| Woodburn | $1,411 | Louisa | $1,395 |

| Triangle | $1,421 | Hampden-Sydney | $1,386 |

| Innsbrook | $1,359 | Rural Retreat | $1,347 |

| Pulaski | $1,467 | Shawneeland | $1,472 |

| Seven Corners | $1,395 | East Lexington | $1,374 |

| Dumbarton | $1,562 | Stuart | $1,520 |

| Greenbriar | $1,347 | Weber City | $1,367 |

| Fishersville | $1,555 | Glade Spring | $1,391 |

| University of Virginia | $1,567 | Central Garage | $1,359 |

| Lake of the Woods | $1,386 | Adwolf | $1,411 |

| Fair Lakes | $1,391 | Coeburn | $1,347 |

| Long Branch | $1,472 | Lawrenceville | $1,467 |

| Smithfield | $1,421 | Haymarket | $1,386 |

| Floris | $1,359 | Boswell's Corner | $1,543 |

| Franklin | $1,367 | Shawsville | $1,374 |

| Rockwood | $1,411 | Chatmoss | $1,544 |

| Farmville | $1,374 | Passapatanzy | $1,580 |

| Vinton | $1,347 | Kilmarnock | $1,359 |

| Hollymead | $1,467 | Lake Caroline | $1,391 |

| Loudoun Valley Estates | $1,563 | Plum Creek | $1,472 |

| Laurel Hill | $1,386 | Dayton | $1,347 |

| Fort Belvoir | $1,562 | Exmore | $1,421 |

| Abingdon | $1,470 | Clintwood | $1,367 |

| Wytheville | $1,347 | Hurt | $1,359 |

| South Boston | $1,411 | Appalachia | $1,386 |

| Ashland | $1,367 | Greenville | $1,374 |

| Collinsville | $1,391 | Rustburg | $1,347 |

| Montrose | $1,359 | Chatham | $1,371 |

Minimum Auto Insurance Requirements in Virginia

In the Old Dominion State, drivers are not state-mandated to carry car insurance. Instead, drivers can pay a $500 Uninsured Motorist Fee to the Department of Motor Vehicles (DMV) to drive legally on Virginia roads.

If you buy a car insurance policy in Virginia, state law mandates the policy must meet state minimum bodily injury and property damage liability insurance.

| Minimum car insurance requirements in Virginia | |

|---|---|

| Bodily injury liability insurance | $25,000 per person and $50,000 per accident |

| Property damage liability insurance | $20,000 per accident |

To learn more and find the best car insurance options in Virginia, contact the auto insurance experts at AutoInsureSavings.org. Our licensed insurance professionals will be happy to answer any questions you have.

Methodology

AutoInsureSavings.org comparison shopping study used a full-coverage insurance policy for a 30-year-old driving a 2018 Honda Accord with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily liability | $50,000 per person/$100,000 per accident |

| Property damage | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured motorist bodily injury & underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

We used insurance rates for drivers with accident histories, credit scores, and marital status for other rate analyses. We used insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your auto insurance rates may vary when you get quotes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Sources

– National Association of Insurance Commissioners. “Market Share Reports for Property/Casualty Groups and Insurance Companies.”

– Virginia SCC. “Automobile Insurance.”

– National Highway Traffic Safety Authority. “Traffic Safety Facts.”

– AIPSO. “Virginia Automobile Insurance Plan.”

– Department of Motor Vehicles. “Uninsured Motor Vehicle Fee.”

– NOLO. “DUI Laws by State.”

Frequently Asked Questions

Who has the cheapest car insurance in Virginia?

We found the top car insurance companies that offer the lowest Virginia drivers’ average rates are Virginia Farm Bureau at $32 per month, USAA at $32 per month, and Erie at $34 a month for a state minimum coverage policy for a 30-year-old with a clean driving history.

How much is car insurance in Virginia per month?

On average, drivers pay around $51 per month for state minimum coverage in Virginia and $124 per month for full coverage insurance. Based on our research, Erie Insurance ($1,041 per year) is one of the state’s most affordable car insurance companies. Most drivers’ average annual rate is around $614 per year for state minimums and $1,493 annually, including comprehensive and collision coverage.

How much is full coverage car insurance in Virginia?

On average, most drivers in Virginia pay for full coverage auto insurance is $124 per month or $1,493 per year. The top insurance companies in Virginia that offer the lowest rate for drivers interested in full coverage policies include Erie, Virginia Farm Bureau, and State Farm. All three insurers provide auto insurance quotes 16% lower than average.

How do I save on car insurance in Virginia?

There are many things drivers can do to help save money on their car insurance rates in Virginia. First, you will need to compare quotes from multiple insurance providers to find the right company that offers the exact level of coverage in Virginia you need at the most affordable price.

Another thing drivers can do to help them save more on their car insurance rates is ask their auto insurance provider about a money-saving driver discount they may be eligible for. Many companies offer car insurance discounts for drivers who have multiple policies with them or drivers who have no prior accidents or violations on their driving records.

What is the best car insurance in Virginia?

Full coverage is the best auto insurance in Virginia, as it provides the best financial protection for VA drivers.

Why is car insurance so expensive in Virginia?

Car insurance rates are based on location factors, such as crashes, so if rates are high in your area, make sure you are shopping around for VA auto insurance quotes to get the best deal.

Is Virginia a PIP state?

No, Virginia doesn’t require PIP insurance.

Is Virginia an at-fault state?

Virginia is an at-fault state, so make sure you have at least cheap car insurance in Virginia.

Can you go to jail for driving without insurance in Virginia?

Virginia penalties for driving without insurance are fines and suspended licenses.

Do you need proof of insurance in Virginia?

Yes, you should have proof of insurance kept in your vehicle in Virginia.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Jan 25, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.