Rhode Island Cheapest Car Insurance & Best Car Insurance Coverage

You can find Rhode Island's cheapest car insurance and best car insurance coverage at USAA, Travelers, and Liberty Mutual. Rhode Island auto insurance at these top RI companies averages at least 20% lower than the state's average rate, depending on a driver's driving record, age, and location.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Jan 30, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jan 30, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

- USAA has the cheapest auto insurance in Rhode Island

- Cheap RI companies for non-military include Travelers and Liberty Mutual

- RI drivers must carry minimum car insurance coverage to drive

Rhode Island’s cheapest car insurance and best car insurance coverage is at USAA, Travelers, and Liberty Mutual. This article will cover the minimum requirements, the best auto insurance companies by age and location, and cost-saving tips to help you lower your monthly coverage rates.

To find affordable Rhode Island car insurance today, enter your ZIP into our free comparison tool.

Cheapest Rhode Island Car Insurance

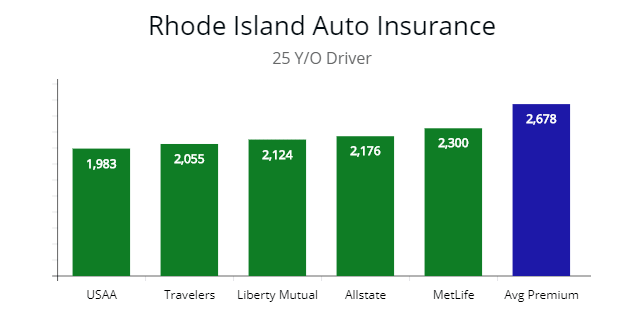

Note: The least expensive insurers by quote for a 25-year-old driver are USAA, Travelers, and Liberty Mutual. Or approximately 21 to 26% lower than the average premium for drivers of similar age and profile. Allstate and MetLife are substantially lower, making both companies worth getting quotes from.

Note: The least expensive insurers by quote for a 25-year-old driver are USAA, Travelers, and Liberty Mutual. Or approximately 21 to 26% lower than the average premium for drivers of similar age and profile. Allstate and MetLife are substantially lower, making both companies worth getting quotes from.

Learn more:

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Minimum Car Insurance Requirements for Rhode Island

Rhode Island uses a tort system that is utilized when settling losses due to auto accidents.

The tort system is where you purchase liability auto insurance that protects “other” drivers where you could be legally bound to answer to if there is considerable damage or medical expenses.

In short, when you purchase your liability policy, you transfer the “liability” under the tort laws to the insurance firm.

For example, the insurer steps into your shoes and pays for damages.

The minimum car insurance requirements for Rhode Islands are as follows:

| Coverage | Rhode Island Minimum Liability Coverage | Recommended Coverage |

|---|---|---|

| Bodily Injury Protection | $25,000 / $50,000 | $100,000 / $300,000 |

| Property Damage | $25,000 | $50,000 |

| Uninsured Motorist* | Optional | $100,000 / $300,000 |

| Comprehensive | Optional | $250 deductible |

| Collision | Optional | $500 deductible |

| Medical Payment | Optional | $5,000 |

*Uninsured Motorist is a requirement unless declined in writing. Typically this is wrapped into liability and property damage coverage.

Note: Approximately 17 percent of drivers are uninsured in the State of Rhode Island. If you are in an automobile accident with an uninsured motorist, you will not be covered if you decided to decline your coverage.

Bodily Injury Liability

Bodily injury liability insurance covers the hospital bills of the driver and passengers of the other automobile.

Under the minimum needed bodily injury liability coverage, the insurance firm will cover up to $25,000 for a single person and up to $50,000 for multiple passengers for a single-car accident

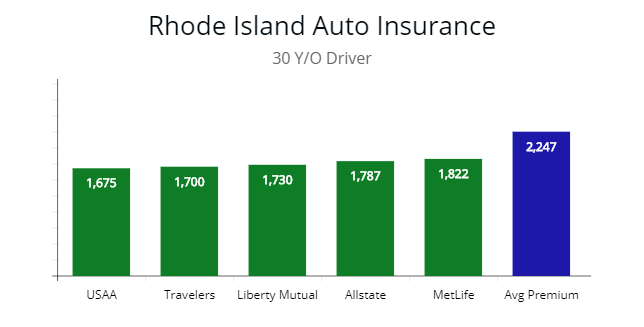

Note: For a 30-year-old driver, the cheapest options for drivers are with USAA, Travelers, and Liberty Mutual. Each queried at $1,675, $1,700, and $1,730 respectfully for full coverage. All three carriers are 24 to 26% lower than the median quote of $2,247.

Note: For a 30-year-old driver, the cheapest options for drivers are with USAA, Travelers, and Liberty Mutual. Each queried at $1,675, $1,700, and $1,730 respectfully for full coverage. All three carriers are 24 to 26% lower than the median quote of $2,247.

Property Damage Liability

Property damage liability covers repairs to private and public property like a business, guard rails, road signs, and the other driver’s vehicle.

Minimum Property damage liability coverage will make allowances for a maximum payout of $25,000 per accident.

The set limit would be 25/50/25. In layman’s terms, it is the minimum liability coverage, and the maximum payout in thousands the policy will cover if you have purchased the minimum liability.

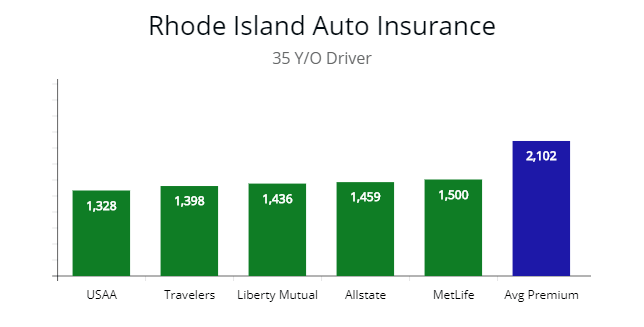

Note: The average premium for a 35-year-old driver in Rhode Island is $2,102 per year. Affordable insurers by lowest quote are with USAA, Travelers, and Liberty Mutual. I queried each at $1,328, $1,398, and $1,436 per year for full coverage. Or approximately 31 to 36% lower than the average premium.

Note: The average premium for a 35-year-old driver in Rhode Island is $2,102 per year. Affordable insurers by lowest quote are with USAA, Travelers, and Liberty Mutual. I queried each at $1,328, $1,398, and $1,436 per year for full coverage. Or approximately 31 to 36% lower than the average premium.

Uninsured Motorist Protection (UM)

Other coverage required (can be a decline in writing) when driving in Rhode Island is Uninsured Motorist Protection (UM).

Learn more: What Is Uninsured Motorist Coverage?

The state has a high density of drivers, and as many as two out of ten drivers at any given time are uninsured in the state.

If you get “only” the minimum liability coverage, you can decline to purchase uninsured motorist protection.

What is covered with Uninsured Motorist Protection?

UM, this will cover you in the event you are in an accident with an uninsured motorist.

In other words, uninsured motorist protection covers what the other driver should have had for minimum coverage in an automobile accident.

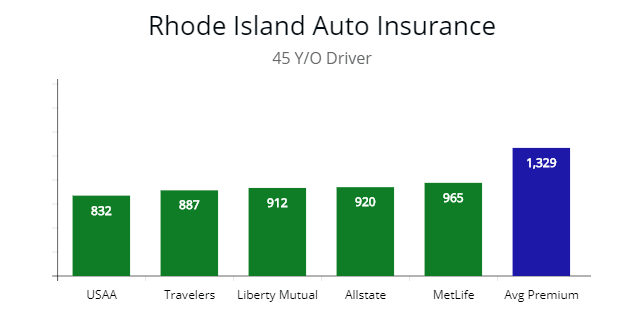

Note: A 45-year-old driver can find the least expensive quotes with USAA, Travelers, and Liberty Mutual. Each queried at $832, $887, and $912 per year for full coverage. Or approximately 31 to 37% lower than the median quote for similar age drivers. Both Allstate and MetLife are competitive with quotes at $920 and $965, respectfully.

Note: A 45-year-old driver can find the least expensive quotes with USAA, Travelers, and Liberty Mutual. Each queried at $832, $887, and $912 per year for full coverage. Or approximately 31 to 37% lower than the median quote for similar age drivers. Both Allstate and MetLife are competitive with quotes at $920 and $965, respectfully.

If you have an accident with an uninsured driver, after payment for damages, your insurance company is likely to sue the other driver for the money paid to you because of negligence.

Other optional coverage to consider is comprehensive car insurance coverage, collision car insurance coverage, medical payments coverage, rental reimbursement coverage, and towing and labor cost coverage.

Cheapest Auto Insurance Companies in Rhode Island

Below is a list of insurers from the cheapest to the most expensive for drivers from 25 to 55.

When I compiled the data, it is only for the lowest price.

The table does not take into consideration consumer ratings, etc.

The three least expensive carriers are USAA, Travelers, and Liberty Mutual.

All three average 23 to 33% lower than the median quote for a driver with good driving history.

USAA only offers coverage for the military and their spouses.

If USAA were not included in the list, the next would be Allstate.

Quotes from Allstate are 20 to 23% lower than the statewide average premium.

Amica and MetLife are two carriers to put on your bucket list to get quotes.

Both carriers can offer quotes from 19 to 25% cheaper than the “mean” quote for similar age drivers.

Quincy Mutual and Encompass are competitive in many cities across Rhode Island.

Both insurers can offer quotes from 14 to approximately 20% lower than the median rate for similar age drivers.

With the list, you have eight carriers that can offer substantially lower premiums.

And you have a blend of regional and national companies to find a policy to fit your needs and budget.

Cheapest Auto Insurance Companies in Rhode Island

Below is a list of insurers from the cheapest to the most expensive for drivers from 25 to 55.

When I compiled the data, it is only for the lowest price.

The table does not take into consideration consumer ratings, etc.

The three least expensive carriers are USAA, Travelers, and Liberty Mutual.

All three average 23 to 33% lower than the median quote for a driver with good driving history.

USAA only offers coverage for the military and their spouses.

If USAA were not included in the list, the next would be Allstate.

Quotes from Allstate are 20 to 23% lower than the statewide average premium.

Amica and MetLife are two carriers to put on your bucket list to get quotes.

Both carriers can offer quotes from 19 to 25% cheaper than the “mean” quote for similar age drivers.

Quincy Mutual and Encompass are competitive in many cities across Rhode Island.

Both insurers can offer quotes from 14 to approximately 20% lower than the median rate for similar age drivers.

With the list, you have eight carriers that can offer substantially lower premiums.

And you have a blend of regional and national companies to find a policy to fit your needs and budget.

| Rhode Island Company | Average Rate 25 Y/O | 30 Y/O | 35 Y/O | 45 Y/O | 55 Y/O |

|---|---|---|---|---|---|

| USAA* | $1,983 | $1,675 | $1,328 | $832 | $632 |

| Travelers | $2,055 | $1,700 | $1,398 | $887 | $645 |

| Liberty Mutual | $2,124 | $1,730 | $1,436 | $912 | $631 |

| Allstate | $2,176 | $1,787 | $1,459 | $920 | $647 |

| Geico | $2,276 | $1,803 | $1,498 | $935 | $678 |

| MetLife | $2,300 | $1,822 | $1,500 | $965 | $687 |

| Amica | $2,321 | $1,855 | $1,512 | $972 | $700 |

| Cal Casualty | $2,476 | $1,900 | $1,537 | $1,055 | $709 |

| Quincy Mutual | $2,522 | $1,943 | $1,548 | $1,087 | $745 |

| Encompass | $2,698 | $2,074 | $1,600 | $1,165 | $765 |

| Nationwide | $2,750 | $2,128 | $1,621 | $1,180 | $780 |

| National Grange Mutual | $2,796 | $2,255 | $1,743 | $1,254 | $811 |

| Peerless | $3,006 | $2,290 | $1,769 | $1,276 | $812 |

*USAA covers only families and their children affiliated with the Military and Armed Forces. A spouse or person previously in the Armed Services may be able to get insurance through USAA.

Rhode Island, a System of Tort

It is important to realize that if you reside in Rhode Island, you are under their tor system.

Since the state is small, there is a good chance you could be in a state which is “no-fault.”

If you are involved in an accident in the “no-fault” state, you will revert to that system and not RI’s tort.

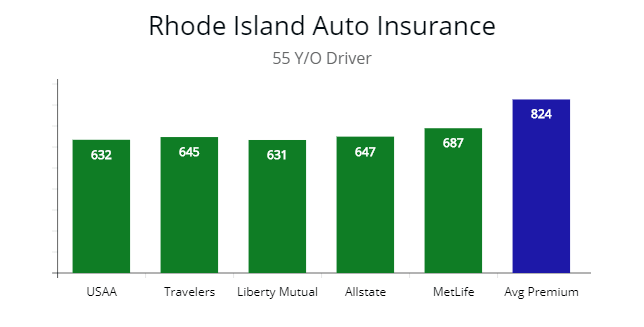

Note: For a 55-year-old, the quotes clustered between $632 and $687. Liberty Mutual and USAA are the cheapest with quotes at $631 and $632, respectfully. Both carriers are 24% cheaper than the median quote for similar age drivers.

Note: For a 55-year-old, the quotes clustered between $632 and $687. Liberty Mutual and USAA are the cheapest with quotes at $631 and $632, respectfully. Both carriers are 24% cheaper than the median quote for similar age drivers.

Common policy packages for motorists in RI

-

-

Bodily Injury Liability – 100,000/300,000

-

Property Damage Liability – 50,000

-

Uninsured Motorist Protection – 100,000/300,000

-

Comprehensive Coverage – $250 deductible

-

Collision Coverage – $500 deductible

-

Medical Payment Coverage – $5,000

-

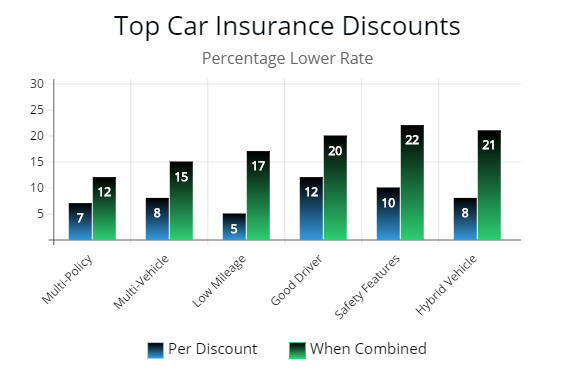

Available Discounts

When you are looking for quotes in Rhode Island, you want to be sure you can get all the available discounts.

Some of the discounts which are available in the state:

- Multi-vehicle policy

- Good Student

- Anti-theft devices

- Driver Education Courses

- Low Mileage

- Dividends – Not considered discounts, but dividend pay-outs can be applied to a premium.

- Multi-policy – If you are going to insure your home and vehicle.

- Good driver and renewal discount

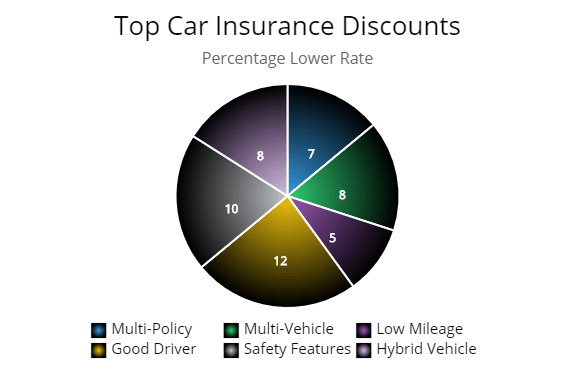

Note: When discounts are combined, you received a higher percentage drop in rates. Your discount will vary with your company, driver history, and other influential factors. As illustrated by the graph, good driver history and safety are higher savings.

Note: As illustrated by the graph, your biggest savings are a good driver and safety features. If combined with other discounts, your savings are greater.

Best Auto Insurance Companies by Consumer Rating, Rate Change, & Complaints

Below is a list of the best auto insurance companies by consumer rating, complaints, and rate change over an 18-month period.

It is important to realize insurers with a higher amount of written premiums will have more complaints.

Particularly for national companies, such as Travelers, Liberty Mutual, or Allstate.

This is to be expected.

Any rate change over a 12 to 18-month period of 1% to 3% is normal.

If you get a traffic violation, your premium rate can spike significantly, such as 20% or more.

The best option for the lowest annual rates possible is to maintain a clean driving history.

And do not file unnecessary claims.

All data compiled is from AM Best, JD Power & Associates, and the Insurance Information Institute (III.org).

Consumer rating data is compiled from reputable online sources to get an average.

| Company | Written Premiums | Rate Change < 18 Months | # of Complaints | Consumer Rating out of 5 Stars |

|---|---|---|---|---|

| Allstate | $13,357,922 | +2.1% | 14 | 4.3 |

| 21st Century | $1,422,311 | +2.6% | 8 | 4.1 |

| Farmers | $8,587,276 | +2.3% | 7 | 4.4 |

| MetLife | $11,629,575 | +3.7% | 4 | 4.2 |

| Hartford | $3,112,894 | +2.2% | 0 | 4.2 |

| Liberty Mutual | $54,277,577 | +2.0% | 13 | 4.4 |

| USAA | $39,743,829 | +1,8% | 4 | 4.6 |

| Progressive | $116,721,621 | +2.0% | 9 | 4.3 |

| Travelers | $24,232,765 | +2.2% | 1 | 4.5 |

| EMC | $1,985,548 | +2.8% | 7 | 3.9 |

| Allied | $2,428,437 | +2.7% | 3 | 4.1 |

| MiddleOak | $1,532,990 | +3.8% | 3 | 3.9 |

| Providence Mutual Fire | $10,337,228 | +1.9% | 3 | 4.1 |

| Amica | $82,552,511 | +2.9% | 3 | 3.9 |

| Harleysville | $3,126,476 | +3.5% | 0 | 3.9 |

| Nationwide | $47,186,516 | +2.9% | 22 | 3.9 |

| Esurance | $13,576,321 | +2.7% | 2 | 4.2 |

| Geico | $87,615,729 | +2.2% | 21 | 4.3 |

| National General | $2,573,327 | +2.1% | 3 | 3.9 |

| Safeco | $1,523,338 | +2.4% | 1 | 3.8 |

| The General | $2,109,732 | +4.1% | 5 | 3.7 |

Rhode Island Auto Insurance Rates by City

Below I have compiled a list of cities with population and average quote.

Your policy price can vary by city or zip code (read more: Understanding How Car Insurance Premiums Are Calculated).

Your best option is to get quotes to find savings.

If you want a more detailed comparison of larger cities in Rhode Island, please see below

| City | Avg. Premium | Population | City | Avg. Premium | Population |

|---|---|---|---|---|---|

| Middletown | $1,465 | 16,150 | Jamestown | $1,490 | 5,405 |

| Barrington | $1,678 | 16,310 | Middletown | $1,341 | 16,081 |

| Bristol | $1,754 | 22,954 | Smithfield | $1,349 | 21,430 |

| Manville | $1,698 | 3,221 | Newport | $1,456 | 24,672 |

| Central Falls | $1,819 | 19,376 | North Kingstown | $1,456 | 26,486 |

| Charlestown | $1,627 | 7,827 | North Scituate | $1675 | 10,329 |

| Chepachet | $1,605 | 1,675 | Pascoag | $1,575 | 4,577 |

| Coventry | $1,844 | 35,014 | Pawtucket | $1,913 | 71,148 |

| Cumberland | $2,138 | 33,506 | Peace Dale | $1,484 | 8,487 |

| East Greenwich | $1,755 | 13,146 | Portsmouth | $1,343 | 17,389 |

| East Providence | $1,833 | 47,037 | Tiverton | $2,254 | 15,780 |

| Exeter | $1,679 | 6,425 | Riverside | $1,876 | 18,000 |

| Foster | $1,592 | 4,606 | Rumford | $1,654 | 47,037 |

| Lincoln | $1,358 | 21,105 | Woonsocket | $1,567 | 41,186 |

| Greenville | $1,717 | 8,658 | Westerly | $1,539 | 22,787 |

| Harmony | $1,674 | 1,000 | Warren | $1,245 | 10,611 |

| Harrisville | $1,562 | 1,605 | Wakefield | $1,329 | 8,487 |

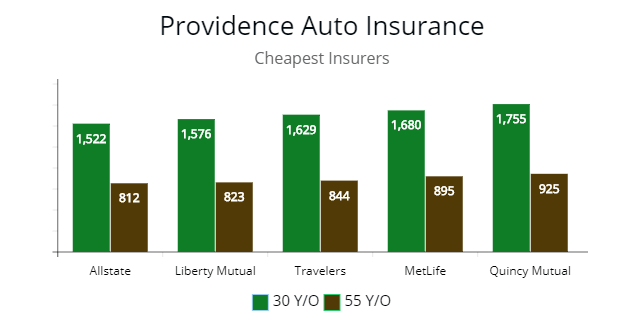

Providence, RI

To get a cheaper premium in Providence, start by getting quotes from Allstate, Liberty Mutual, and Travelers.

I queried each at $1,522, $1,576, and $1,629 respectfully for a 30-year-old driver.

Which is 29% lower than the average premium rate of $2,387 per year.

A 45-year-old can find cheap quotes with Allstate and Liberty Mutual.

Each queried at $1,096 and $1,137 for full coverage.

Or nearly 30% lower than the “mean” quote in Providence.

For a 55-year-old, the quotes clustered between $812 and $925.

With Allstate being the least expensive at $812 per year for full coverage.

Or 26% lower than the average premium of a driver with a similar profile.

| Providence Company | 30 Y/O | 45 Y/O | 55 Y/O |

|---|---|---|---|

| Allstate | $1,522 | $1,096 | $812 |

| Liberty Mutual | $1,576 | $1,137 | $823 |

| Travelers | $1,629 | $1,189 | $844 |

| MetLife | $1,680 | $1,243 | $895 |

| Quincy Mutual | $1,755 | $1,270 | $925 |

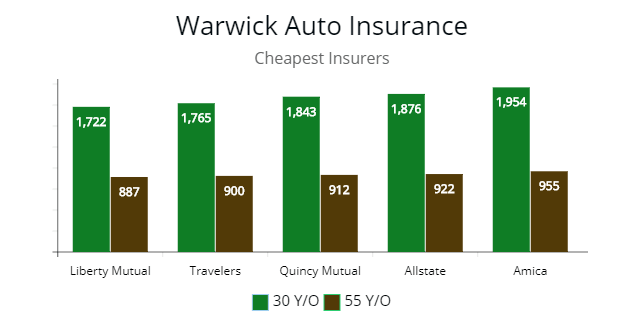

Warwick, RI

To find the cheapest policy in Warwick, start by getting quotes from Liberty Mutual, Travelers, and Quincy Mutual.

I queried each at $1,722, $1,765, and $1,843 for a 30-year-old driver.

Which is 19% lower than the average premium of $1,968 for Liberty and Travelers.

A 45-year-old can find low quotes with Liberty Mutual, Travelers, and Quincy.

Each queried at $1,121, $1,145, and $1,189 respectfully for full coverage.

Or approximately 21% lower than the “mean” premium quote in Warwick.

A 55-year-old can find low rates with Liberty and Travelers.

I queried both at $887 and $900 for full coverage.

Which is 20% lower than the citywide average premium for a driver of the same age and profile.

| Warwick Company | 30 Y/O | 45 Y/O | 55 Y/O |

|---|---|---|---|

| Liberty Mutual | $1,722 | $1,121 | $887 |

| Travelers | $1,765 | $1,145 | $900 |

| Quincy Mutual | $1,843 | $1,189 | $912 |

| Allstate | $1,876 | $1,245 | $922 |

| Amica | $1,954 | $1,267 | $955 |

| Encompass | $2,087 | $1,300 | $986 |

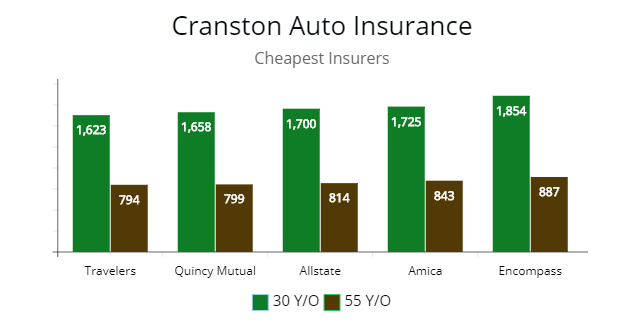

Cranston, RI

If you are in the market for a cheaper premium, start by getting quotes from Travelers and Quincy Mutual.

I queried each at $1,623 and $1,658 for a 30-year-old driver with full coverage.

Both insurers are 22% lower than the citywide average premium of $1,974 per year.

A 45-year-old can find low quotes with Travelers, Quincy, and Allstate.

Each queried at $1,029, $1,086, and $1,143 for full coverage. Which is 20 to 22% lower than the “mean” rate.

A 55-year-old can quotes clustering between $794 and $887.

Travelers is the cheapest at $794 for a full coverage premium.

Or 24% lower than the “mean” quote of $1,055 for a driver of similar age and profile.

| Cranston Company | 30 Y/O | 45 Y/O | 55 Y/O |

|---|---|---|---|

| Travelers | $1,623 | $1,029 | $794 |

| Quincy Mutual | $1,658 | $1,086 | $799 |

| Allstate | $1,700 | $1,143 | $814 |

| Amica | $1,725 | $1,210 | $843 |

| Encompass | $1,854 | $1,243 | $887 |

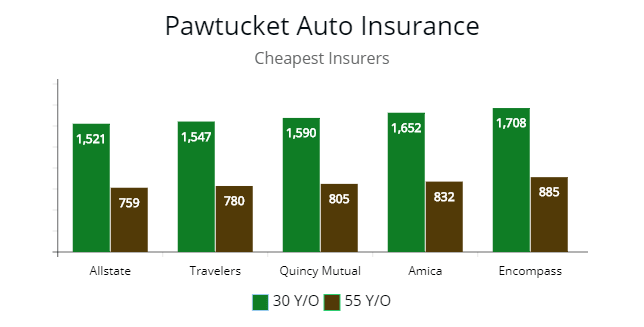

Pawtucket, RI

To find the cheapest car insurance in Pawtucket, start by getting quotes from Allstate, Travelers, and Quincy Mutual.

I queried each at $1,521, $1,547, and $1,590 for a 30-year-old driver.

Which is 22% lower than the citywide “mean” premium rate of $1,870 per year.

A 45-year-old can the lowest quotes with Allstate.

With a quote at $987 for full coverage, this is 23% lower than the average premium.

Travelers is only $22 more at $1,009. While Quincy, I queried at $1,048.

A 55-year-old can cheap quotes with Allstate, Travelers, and Quincy Mutual.

Each queried at $759, $780, and $805 for full coverage.

Which is 24% lower than the “mean” rate for a driver of similar age and profile in Pawtucket.

| Pawtucket Company | 30 Y/O | 45 Y/O | 55 Y/O |

|---|---|---|---|

| Allstate | $1,521 | $987 | $759 |

| Travelers | $1,547 | $1,009 | $780 |

| Quincy Mutual | $1,590 | $1,048 | $805 |

| Amica | $1,652 | $1,128 | $832 |

| Encompass | $1,708 | $1,176 | $885 |

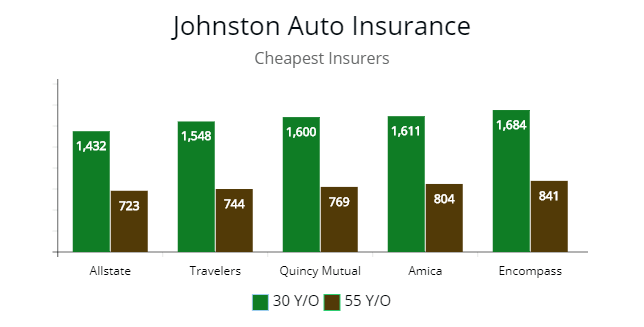

Johnston, RI

If you want to get the least expensive policy, start with Allstate, Travelers, and Quincy Mutual.

I queried each at $1,432, $1,558, and $1,600 for a 30-year-old driver.

Allstate is 25% lower than the “mean” rate. In comparison, Travelers and Quincy Mutual are 20% lower.

It would be smart to get quotes from all carriers illustrated for the most savings.

A 45-year-old can find low rates with Allstate and Travelers.

Each queried at $975 and $990. Both carriers are 25% lower than the median quote for a similar driver.

A 55-year-old can find low quotes with any insurers illustrated.

With quotes clustering between $723 and $841.

Allstate is the cheapest at $723.

Which is 24% lower than the median rate in Johnston.

| Johnston Company | 30 Y/O | 45 Y/O | 55 Y/O |

|---|---|---|---|

| Allstate | $1,432 | $975 | $723 |

| Travelers | $1,548 | $990 | $744 |

| Quincy Mutual | $1,600 | $1,032 | $769 |

| Amica | $1,611 | $1,076 | $804 |

| Encompass | $1,684 | $1,141 | $841 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

The Final Word on Rhode Island Car Insurance

Drivers who have been in just one accident have rates that are 18% more expensive on average than rates for drivers without an accident history.

Drivers should always shop around online or ask their agent for at least three car insurance quotes if they’re looking for affordable auto insurance rates.

By comparison, the average cost of car insurance in Rhode Island overall is $887 per year.

Sources

http://www.dbr.ri.gov/documents

https://dbr.ri.gov/divisions/insurance/

https://www.census.gov/quickfacts/fact

Frequently Asked Questions

Who has the cheapest car insurance in Rhode Island?

Depending on your location, the overall least expensive car insurance companies in Rhode Island are USAA, Travelers, and Liberty Mutual.

Age-dependent, each carrier can offer quotes from 23 to over 33% lower than the median quote for similar-age drivers.

Other insurers to put on your list to get quotes are Allstate, MetLife, and Amica.

Again, depending on your location, each carrier can offer you quotes from 19 to 25% lower than the average premium for similar age drivers.

What minimum coverage is required in Rhode Island?

RI drivers must carry 25/50/25 of liability auto insurance.

What is the best Rhode Island car insurance?

Full coverage is the best choice for RI car insurance.

Is Rhode Island a no-fault state?

Rhode Island is an at-fault state.

Is Rhode Island a PIP state?

Rhode Island auto insurance laws don’t require drivers to carry PIP coverage.

Does insurance follow the car or driver in Rhode Island?

Car insurance typically follows the vehicle.

Can someone else drive my car in Rhode Island?

Yes, someone else can drive your car as long as they have your permission.

Is it illegal to drive without car insurance in Rhode Island?

RI drivers need to carry RI insurance to drive.

What are the penalties for driving without car insurance in Rhode Island?

RI penalties are fines, suspended licenses, and similar penalties.

How can I save on Rhode Island car insurance?

RI drivers can get the cheapest rates by comparing RI auto insurance quotes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Dani Best

Licensed Insurance Producer

Dani Best has been a licensed insurance producer for nearly 10 years. Dani began her insurance career in a sales role with State Farm in 2014. During her time in sales, she graduated with her Bachelors in Psychology from Capella University and is currently earning her Masters in Marriage and Family Therapy. Since 2014, Dani has held and maintains licenses in Life, Disability, Property, and Casualt...

Licensed Insurance Producer

UPDATED: Jan 30, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.