Arkansas Cheapest Car Insurance & Best Coverage Options

State Farm and Travelers have Arkansas' cheapest car insurance and best coverage options. The cheapest minimum AR insurance is at State Farm for an average of $32/mo, while Arkansas drivers who want AR full coverage will find the cheapest insurance rates at Travelers for an average of $126/mo.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Feb 7, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Feb 7, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

- State Farm has the cheapest minimum coverage in Arkansas

- Travelers has the cheapest full coverage in Arkansas

- Military and veterans will find the cheapest rates at USAA

Arkansas’ cheapest car insurance and best coverage options can be found at Travelers and State Farm. Read on to learn more about the best auto insurance companies for affordable car insurance in Arkansas, ways to save, and more.

To find cheap car insurance in Arkansas today, use our tool to compare rates.

Arkansas Car Insurance Rates

Choosing the right car insurance company can help you improve your level of coverage while you stay within your budget.

| Cheapest Car Insurance in Arkansas - Quick Hits |

|---|

The cheapest Arkansas car insurance options are: The cheapest Arkansas car insurance options are:Cheapest for minimum coverage: State Farm Cheapest for full coverage: Travelers Insurance Cheapest after an at-fault accident: State Farm Cheapest after a speeding ticket: Southern Farm Bureau Cheapest after a DUI: Progressive Cheapest for poor credit history: Geico Cheapest for young drivers: Southern Farm Bureau For young drivers with a speeding violation: Geico For young drivers with an at-fault accident: Southern Farm Bureau |

To help you save money and find the best deal on your car insurance premium in Arkansas, we have compared the best rates from several top companies in the auto insurance industry for various types of drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Arkansas for Minimum Coverage

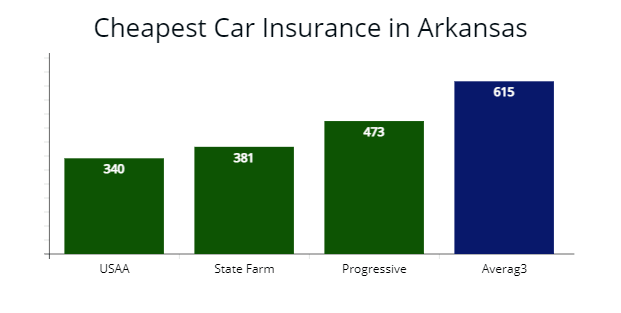

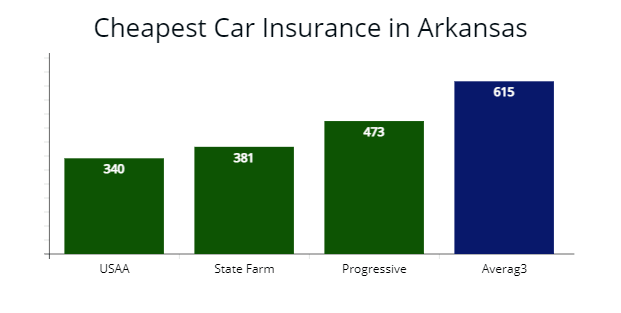

Our agents found that State Farm offers the cheapest minimum coverage car insurance for Arkansas drivers with good driving records at $381 annually, which is 39% less expensive than the average cost for minimum liability from other car insurance companies in Arkansas at $615.

For non-active military members, Progressive is the next cheapest insurance option at $473 or a $39 monthly rate, which is 23% cheaper than the state average. You can learn more in our Progressive car insurance review.

| Company | Average annual rate | Monthly rate |

|---|---|---|

| USAA | $340 | $28 |

| State Farm | $381 | $32 |

| Progressive | $473 | $39 |

| Travelers | $480 | $40 |

| Geico | $483 | $40 |

| Southern Farm Bureau | $511 | $43 |

| Farmers Insurance | $659 | $55 |

| Allstate | $703 | $58 |

| Liberty Mutual | $716 | $60 |

| Nationwide | $799 | $66 |

*USAA is for qualified military members, their spouses, and direct family members. Rates may vary depending on driver profiles.

Arkansas drivers’ can purchase minimum liability requirements for less than $700 per year from several providers.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

While State Farm and Progressive are the cheapest options for many drivers, we also found that Travelers and Geico are two good insurance carriers to consider based on our research for drivers who want to save the most money.

Learn more: Review of Travelers Car Insurance

Minimum liability policies are cheaper car insurance premiums, which exclude comprehensive and collision coverage, but AutoInsureSavings.org licensed agents recommend getting full coverage insurance in Arkansas since filing a claim with a minimum coverage auto insurance policy, you could pay out-of-pocket expenses.

Cheapest Full Coverage Car Insurance for Drivers in Arkansas

We found that Travelers offers cheap full coverage insurance for Arkansas drivers with a $1,514 annual quote or 21% cheaper than the average rate.

State Farm is the next best option at $1,613 per year or 16% less expensive than Arkansas’ average $1,911 insurance rate.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Travelers | $1,514 | $126 |

| State Farm | $1,613 | $134 |

| Southern Farm Bureau | $1,765 | $147 |

| Arkansas average | $1,911 | $159 |

*USAA is for qualified military personnel, their spouses, and direct family members. Rates may vary depending on driver profiles and zip codes.

The average driver in Arkansas paying for full coverage insurance is $1,911 or $159 per month. Drivers can find cheaper auto policies by comparing top car insurance providers’ rates like those listed here.

Cheapest Car Insurance For Drivers in Arkansas with a Speeding Ticket

Our licensed agents found Southern Farm Bureau offers the cheapest auto insurance rates for Arkansas drivers with a speeding violation at $1,833 per year or a $152 monthly rate.

And State Farm’s quote at $1,927 per year is 19% lower than average, making them the next cheapest option for Arkansas drivers.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Southern Farm Bureau | $1,833 | $152 |

| State Farm | $1,927 | $160 |

| Geico | $2,041 | $170 |

| Arkansas average | $2,370 | $197 |

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

According to the Arkansas Department of Finance (DFA), if you receive fourteen or more points within 36 months, you will receive a notice of a driver’s license suspension with a loss of driving privileges.

Insurance companies in Arkansas use traffic tickets to assess risk; having points on your driving record indicates you are riskier to the insurer than drivers with a clean record.Daniel Walker Licensed Insurance Agent

Learn more about tickets and points in our article on how a traffic ticket can impact your car insurance rates.

Cheapest Car Insurance for Drivers in Arkansas with a Car Accident

State Farm offers the most affordable rates for drivers with a recent at-fault accident in Arkansas, with annual premiums as low as $2,157. That is $722 less than the average amount drivers pay ($2,879) for coverage in Arkansas.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $2,157 | $179 |

| Geico | $2,380 | $198 |

| Liberty Mutual | $2,641 | $220 |

| Arkansas average | $2,879 | $240 |

State Farm, Geico, and Liberty Mutual are insurance companies that offer lower than average rates for many drivers in Arkansas who have an accident on their record.

Learn more: 5 Tips to Get Cheap Car Insurance after an Accident

According to the Arkansas Insurance Department, a car accident will remain on your motor vehicle record for three years, along with an average insurance rate increase of 30%.

Cheapest Car Insurance For Drivers in Arkansas With a DUI

Progressive is one of the best car insurance companies after a DUI. It offers the cheapest insurance rates in Arkansas for drivers with a DUI in their driver history at $2,378 per year. The average rate for drivers with a DUI in Arkansas is $3,523, and Progressive offers savings of $1,145 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $2,378 | $198 |

| State Farm | $2,519 | $209 |

| Southern Farm Bureau | $3,131 | $260 |

| Arkansas average | $3,523 | $293 |

A DUI driver can expect to see their insurance rate increase by as much as 46%. That is why it is essential to find a car insurance provider that offers the most affordable rates.

Cheapest Car Insurance for Drivers in Arkansas with Poor Credit

Geico offers the cheapest auto insurance rates for drivers who have a poor credit history in Arkansas. Their lowest rates are $1,911 per year.

State Farm is another inexpensive option with a $2,017 annual rate or 16% lower than the state $2,360 average rate.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Geico | $1,911 | $159 |

| State Farm | $2,017 | $168 |

| Nationwide | $2,234 | $186 |

| Arkansas average | $2,360 | $196 |

Those who have bad credit in Arkansas may see that their insurance rates are higher than average. For most people, bad credit rates are 60% than those with good credit scores, according to Insurance Information Institute. Make sure to pay your bills and credit cards on time to save money on your Arkansas auto insurance premium.

Cheapest Car Insurance for Young Drivers in Arkansas

Southern Farm Bureau offers the cheapest rates for young drivers with good driving records, with an average premium of $3,121 per year for full coverage car insurance.

Learn more: The Best Car Insurance for Teens

Southern Farm Bureau also offers less than average costs for minimum coverage at $1,214 per year.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

For young drivers’ state minimum coverage, State Farm offers cheap auto insurance rates at $1,345 per year or 37% less expensive than other car insurance companies in Arkansas.

| Insurer | Full coverage | Minimum coverage |

|---|---|---|

| USAA | $2,477 | $1,036 |

| Southern Farm Bureau | $3,121 | $1,214 |

| State Farm | $3,658 | $1,345 |

| Geico | $4,111 | $1,670 |

| Travelers | $4,761 | $1,925 |

| Farmers | $5,354 | $2,230 |

| Progressive | $5,873 | $2,413 |

| Nationwide | $6,321 | $2,981 |

| Allstate | $8,320 | $2,121 |

| Arkansas average | $6,589 | $2,115 |

*USAA is for qualified military members, their spouses, and direct family members. Rates may vary depending on driver profiles.

Young or teen driver that needs coverage in Arkansas can save more by comparing auto insurance costs like those shown above. Drivers who choose Southern Farm Bureau can save as much a 53% on their car insurance premiums, which can be substantial savings for young drivers and their parents.

Cheapest Car Insurance for Young Drivers with a Speeding Ticket

During our comparison shopping study, our agents found young drivers needing coverage in Arkansas with traffic violations on their driving record can get cheaper insurance rates with Geico at $4,111 per year or $342 monthly rate, which is 40% less expensive than the average.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Geico | $4,111 | $342 |

| Southern Farm Bureau | $4,314 | $359 |

| State Farm | $4,672 | $389 |

| Arkansas average | $6,811 | $567 |

Cheapest Car Insurance for Young Drivers with a Car Accident

Young Arkansas drivers with an at-fault car accident on their driving record can find the cheapest full coverage auto insurance quotes with Southern Farm Bureau, which provided us a quote at $4,314 per year or 48% lower than a similar driver profile rate.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Southern Farm Bureau | $4,314 | $359 |

| Geico | $4,866 | $405 |

| State Farm | $4,918 | $409 |

| Arkansas average | $7,430 | $619 |

Best Auto Insurance Companies in Arkansas

Several great insurance companies to choose from coverage in Arkansas based on their price, customer service and support, and coverage level.

ValuePenguin did a survey and found the overall best car insurance company is USAA, with high marks from current policyholders. If you are not eligible for USAA, the next best options are Nationwide and Progressive based on customer service.

| Auto Insurer | % extremely satisfied with recent claim | % reporting excellent customer service |

|---|---|---|

| USAA | 79% | 63% |

| Nationwide | 78% | 56% |

| Progressive | 75% | 34% |

| State Farm | 74% | 45% |

| Allstate | 74% | 46% |

| Farmers | 70% | 35% |

| Geico | 66% | 41% |

| Southern Farm Bureau | n/a | n/a |

The AutoInsureSavings.org team of licensed insurance agents compared complaints by each auto insurer using the National Association of Insurance Commissioners complaint index.

Using the complaint index (best ratio of complaints to market share) from NAIC, the best car insurers are Southern Farm Bureau and Farmers Insurance.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Using J.D. Power’s claims satisfaction survey and A.M. Best’s financial strength ratings, the best insurance providers are USAA and State Farm. USAA is one of the best car insurance options for veterans (read more in our USAA review).

| Insurer | NAIC Complaint Index | J.D. Power claims satisfaction | AM Best rating |

|---|---|---|---|

| Southern Farm Bureau | 0.27 | n/a | A+ |

| Farmers | 0.49 | 872 | A |

| Shelter Mutual | 0.51 | n/a | A |

| Geico | 0.57 | 871 | A++ |

| Nationwide | 0.64 | 876 | A+ |

| State Farm | 0.66 | 881 | A++ |

| Progressive | 0.67 | 856 | A+ |

| USAA | 0.68 | 890 | A++ |

| Allstate | 0.71 | 876 | A+ |

Average Cost of Car Insurance by City in Arkansas

Auto insurers use your zip code and many factors to determine your Arkansas car insurance costs, as well as your credit score, marital status, and past driving history.

Read more: Understanding How Car Insurance Premiums Are Calculated

The average cost of insurance for drivers in Arkansas is $1,911 per year or $159 per month. During our comparison shopping study, we found the cheapest insurers by city.

Cheapest Car Insurance in Little Rock, AR

Little Rock drivers can shop around and get the cheapest insurance coverage from Travelers, which provided our agents a $1,713 rate per year for a full coverage auto policy. Travelers’ rate is 24% lower than average.

| Little Rock Company | Average Premium |

|---|---|

| Travelers | $1,713 |

| Farm Bureau | $1,798 |

| Liberty Mutual | $2,041 |

| Little Rock average | $2,244 |

Cheapest Car Insurance in Fort Smith, AR

Drivers living in Fort Smith with a clean driving history can find the least expensive coverage rate with Farm Bureau at $1,668 per year for full coverage for a 30-year-old driver.

| Fort Smith Company | Average Premium |

|---|---|

| Farm Bureau | $1,668 |

| State Farm | $1,815 |

| Progressive | $1,933 |

| Fort Smith average | $2,230 |

Cheapest Car Insurance in Fayetteville, AR

We found the least expensive auto insurance quotes in Fayetteville come from State Farm or 29% lower with a $1,571 quote per year.

| Fayetteville Company | Average Premium |

|---|---|

| State Farm | $1,571 |

| Geico | $1,649 |

| Farm Bureau | $1,670 |

| Fayetteville average | $2,187 |

Cheapest Car Insurance in Springdale, AR

To find Springdale’s best coverage rates, our agents recommend Geico Insurance with a quote at $1,590 for our sample 30-year-old driver. Geico’s rate is 28% cheaper than Springdale’s average.

| Springdale company | Average Premium |

|---|---|

| Geico | $1,590 |

| Progressive | $1,616 |

| Nationwide | $1,854 |

| Springdale average | $2,204 |

Cheapest Car Insurance in Jonesboro, AR

In Jonesboro, drivers with clean records can get cheap auto insurance with Travelers, who provided us a quote at $1,603 per year for a 30-year-old sample driver.

| Jonesboro company | Average Premium |

|---|---|

| Travelers | $1,603 |

| Geico | $1,727 |

| Progressive | $1,800 |

| Jonesboro average | $2,219 |

Cheapest Car Insurance in North Little Rock

North Little Rock residents needing the cheapest auto coverage for a car should get quotes from Travelers, who provided AutoInsureSavings.org agents a rate at $1,582 per year or 29% lower than average.

| North Little Rock company | Average Premium |

|---|---|

| Travelers | $1,582 |

| Geico | $1,657 |

| State Farm | $1,703 |

| North Little Rock average | $2,200 |

Cheapest Car Insurance in Hot Springs, AR

Hot Springs cheapest auto insurance is with Geico, who provided us a quote at $1,520 per year for a 30-year-old driver with full coverage. Geico’s rate is 21% less expensive than the average Hot Springs rate.

| Hot Springs company | Average Premium |

|---|---|

| Geico | $1,520 |

| Farm Bureau | $1,527 |

| State Farm | $1,613 |

| Hot Springs average | $1,906 |

Average Cost of Insurance for All Cities in Arkansas

| City | Annual Premium Cost | City | Annual Premium Cost |

|---|---|---|---|

| Little Rock | $2,244 | Pottsville | $2,032 |

| Fort Smith | $2,230 | Alexander | $1,890 |

| Fayetteville | $2,187 | Elkins | $1,874 |

| Springdale | $2,204 | Corning | $1,906 |

| Jonesboro | $2,219 | DeWitt | $1,929 |

| Rogers | $2,196 | Atkins | $1,922 |

| Conway | $2,082 | Prescott | $1,978 |

| North Little Rock | $2,200 | Leachville | $2,012 |

| Bentonville | $1,998 | Bald Knob | $1,981 |

| Pine Bluff | $2,165 | Mountain View | $1,898 |

| Hot Springs | $1,906 | Dermott | $2,032 |

| Benton | $2,177 | North Crossett | $1,874 |

| Sherwood | $1,890 | Harrisburg | $1,922 |

| Texarkana | $2,134 | Little Flock | $2,012 |

| Russellville | $2,161 | Brinkley | $2,107 |

| Paragould | $1,922 | England | $2,012 |

| Bella Vista | $1,964 | Green Forest | $2,109 |

| Jacksonville | $2,060 | Hamburg | $1,890 |

| Cabot | $2,118 | Bethel Heights | $2,119 |

| West Memphis | $1,898 | Hoxie | $1,922 |

| Searcy | $1,874 | West Fork | $1,906 |

| Van Buren | $2,112 | Goshen | $1,981 |

| Bryant | $2,087 | Horseshoe Bend | $1,939 |

| Maumelle | $2,066 | Charleston | $1,890 |

| El Dorado | $2,032 | Gurdon | $2,100 |

| Siloam Springs | $1,906 | Gassville | $1,964 |

| Hot Springs Village | $1,939 | Clinton | $2,041 |

| Forrest City | $1,981 | Lavaca | $1,874 |

| Centerton | $1,906 | Huntsville | $1,922 |

| Blytheville | $2,022 | Bono | $2,012 |

| Harrison | $2,084 | Lake City | $1,967 |

| Marion | $1,890 | Lincoln | $1,898 |

| Mountain Home | $1,922 | Prairie Creek | $1,939 |

| Magnolia | $2,066 | Elm Springs | $2,032 |

| Camden | $2,047 | Holiday Island | $1,922 |

| Malvern | $1,939 | Calico Rock | $1,890 |

| Helena | $1,964 | Marked Tree | $2,012 |

| Batesville | $1,981 | Lake Village | $2,022 |

| Arkadelphia | $1,874 | Carlisle | $2,066 |

| Hope | $2,063 | Bull Shoals | $2,041 |

| Clarksville | $2,022 | Cave City | $1,898 |

| Monticello | $1,939 | Lake Hamilton | $1,906 |

| Greenwood | $1,922 | Fairfield Bay | $1,890 |

| Lowell | $2,032 | Danville | $1,964 |

| Stuttgart | $2,012 | Augusta | $1,874 |

| Beebe | $2,112 | Earle | $2,032 |

| Wynne | $2,022 | Eudora | $2,066 |

| Newport | $1,898 | Dover | $1,922 |

| Trumann | $1,906 | Tuckerman | $2,041 |

| Heber Springs | $1,890 | Salem | $1,981 |

| Farmington | $1,964 | Judsonia | $2,012 |

| Osceola | $2,066 | Mayflower | $2,063 |

| Morrilton | $1,874 | Melbourne | $1,916 |

| De Queen | $2,032 | Lamar | $1,898 |

| Pocahontas | $2,106 | Glenwood | $1,890 |

| East End | $2,063 | Salem CDP | $1,941 |

| Prairie Grove | $1,981 | Eureka Springs | $1,960 |

| Alma | $2,032 | Rector | $2,066 |

| Pea Ridge | $1,906 | Murfreesboro | $2,032 |

| Warren | $2,117 | Bay | $2,026 |

| Mena | $1,941 | McAlmont | $2,063 |

| Greenbrier | $1,916 | Decatur | $1,874 |

| Berryville | $1,890 | Stamps | $1,960 |

| Walnut Ridge | $2,041 | Lepanto | $1,906 |

| White Hall | $1,898 | Wrightsville | $2,012 |

| Ward | $2,026 | McCrory | $2,066 |

| Gibson | $1,981 | Kensett | $1,890 |

| Cherokee Village | $2,065 | Smackover | $1,941 |

| Crossett | $2,119 | Monette | $1,987 |

| Barling | $2,016 | Greenland | $2,041 |

| Sheridan | $1,906 | Star City | $2,026 |

| Rockwell | $2,063 | Marshall | $1,996 |

| Dardanelle | $1,874 | Redfield | $2,066 |

| Haskell | $1,960 | Mulberry | $1,898 |

| Piney | $1,941 | Des Arc | $2,032 |

| Vilonia | $1,890 | Hampton | $1,916 |

| Nashville | $2,064 | Clarendon | $1,906 |

| Ashdown | $2,026 | Flippin | $2,012 |

| Cave Springs | $2,073 | Perryville | $2,041 |

| Lonoke | $1,987 | Mansfield | $1,874 |

| Dumas | $2,032 | Hazen | $1,916 |

| Southside | $1,898 | Diaz | $1,960 |

| Gentry | $2,026 | Cedarville | $2,072 |

| Fordyce | $1,906 | Rison | $1,987 |

| Booneville | $2,066 | Hughes | $2,032 |

| Shannon Hills | $2,012 | Coal Hill | $2,041 |

| McGehee | $2,078 | Marvell | $2,068 |

| Johnson | $1,874 | Marmaduke | $1,941 |

| Tontitown | $2,069 | Waldo | $1,906 |

| Ozark | $1,960 | Avilla | $1,890 |

| Piggott | $2,032 | Ola | $1,898 |

| Marianna | $1,916 | Sulphur Springs CDP | $2,041 |

| Landmark | $1,874 | Wooster | $2,026 |

| Paris | $1,987 | West Crossett | $2,012 |

| Waldron | $1,998 | Yellville | $2,032 |

| Gravette | $1,890 | Ash Flat | $1,960 |

| Manila | $1,906 | Kibler | $1,898 |

| Austin | $1,941 | Mineral Springs | $1,916 |

| Brookland | $2,032 | Midway | $1,906 |

| Gosnell | $1,898 | Mount Ida | $1,874 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Minimum Requirements for Arkansas Car Insurance

Arkansas drivers must have a minimum amount of liability coverage in their auto insurance policies to follow car insurance laws. Below are the minimum coverage limits.

| Liability coverage | Minimum coverage |

|---|---|

| Bodily injury liability insurance | $25,000 per person / $50,000 per accident |

| Property damage liability insurance | $25,000 per person |

AutoInsureSavings.org licensed agents recommend getting higher liability limits of bodily injury liability and property damage liability coverage to cover your assets in the event of an auto accident.

Our agents recommend most motorists carry collision, comprehensive coverage, and uninsured motorist coverage in their Arkansas policies to make sure they have the best financial protection to protect their motor vehicle and assets.

To find the cheapest Arkansas insurance today, use our free tool to compare rates.

Methodology

In searching for the lowest rate, AutoInsureSavings.org collects hundreds of quotes in zip codes across Arkansas from the largest insurance companies via Quadrant Information Services. Our sample driver profile is a 30-year-old driving a 2018 Honda Accord with good credit. We used a full coverage auto insurance policy unless otherwise stated with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily liability | $50,000 per person/$100,000 per accident |

| Property damage | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

When AutoInsureSavings.org quotes a driver with a minimum coverage policy, we used the minimum liability limits per Arkansas insurance regulations. We used credit score, marital status, driving history, and accident history for other rate analyses. We used insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your rates may vary when you get quotes.

Sources

– Insurance Information Institute. “Auto Rate Setting.”

– National Association of Insurance Commissioners. “Market Share Reports for Property/Casualty Groups and Insurance Companies.”

– Arkansas Insurance Department. “Mandatory Coverage in Arkansas.”

– Arkansas Department of Finance. “Safety Responsibility.”

– Centers for Disease Control and Prevention. “Motor Vehicle Safety.”

Frequently Asked Questions

Who has the cheapest auto insurance for Arkansas drivers?

State Farm is the cheapest for minimum coverage. The company offers some of the best insurance industry rates, with a $381 annual rate for a 30-year-old driver. Progressive ($473) and Travelers ($480) are the two other best options for all drivers needing coverage in Arkansas. The average cost of auto insurance in Arkansas is $615 per year for state minimum coverage.

Because insurance rates are based on various factors, it is best to compare multiple providers’ rates to determine who has the cheapest coverage in Arkansas for you.

How much is car insurance in Arkansas per month?

The average rate for car insurance in Arkansas is $159 per month for a driver who is 30 years old and has full coverage. That is $1,911 annually. Here are some totals for the average monthly rate of car insurance for drivers in Arkansas. Travelers: $126 per month, State Farm: $135, and Farm Bureau: $147 per month.

How much is full coverage car insurance in Arkansas?

The average amount for full coverage insurance in Arkansas is $159 monthly. Here are a few more average rates for different types of drivers. Drivers with an accident: $2,879 per year; with a speeding violation: $2,370 per year; with a DUI: $3,523 per year; and drivers with poor credit: $2,360 per year.

How can I save on car insurance in Arkansas?

There are several things drivers in Arkansas can do to save money on their car insurance costs. We suggest asking your insurance agent about any car insurance discounts you may be eligible for. If you are looking for a new provider, it is best to find one that offers plenty of discounts to help you save even more. Consider telematics, such as Travelers Intellidrive, where you could save as much as 30% on your auto insurance premium at renewal.

The car you drive also plays a significant role in your rates, driving history, and credit rating. Therefore, practicing safe driving tactics, maintain good driving records, and keeping a close eye on your credit report can lower your car insurance rates. These will affect your rates for both your liability per person and liability per accident coverage.

What is the best car insurance in Arkansas?

Full coverage policies provide the best protection in Arkansas.

How much car insurance do I need in Arkansas?

You need to carry the minimum auto insurance required in Arkansas.

What happens if you don’t have car insurance in Arkansas?

Driving without car insurance is illegal in Arkansas, so you could face fines, a suspended license, and more.

Is Arkansas a no-fault state?

Arkansas is an at-fault auto insurance state.

Does car insurance follow the car or the driver in Arkansas?

Car insurance usually follows the car, not the driver in Arkansas.

Is Arkansas a PIP state?

PIP is not required in Arkansas.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Feb 7, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.