Indiana Cheapest Car Insurance & Best Insurance Options

Indiana drivers have several options to choose from when looking for Indiana cheapest car insurance, although Erie is the number one company for cheap Indiana car insurance. Erie's minimum auto insurance policies average only $26/mo, and Erie's full coverage insurance policies average only $89/mo.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Dec 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Dec 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

- Erie has the cheapest Indiana car insurance rates on average

- Erie’s minimum coverage costs an average of $26 per month

- Erie’s full coverage costs an average of $89 per month

The Indiana cheapest car insurance can be found at Erie. Other cheap companies include USAA, Travelers, and more. To find which cheap Indiana car insurance company is right for you, keep reading to learn about the best auto insurance companies in Indiana.

Want to find cheap car insurance rates in Indiana right away? Enter your ZIP code into our free quote comparison tool to get started.

Affordable Indiana Car Insurance Rates

Drivers in Indiana have several options to choose from when looking for affordable and reliable car insurance companies.

| Cheapest Car Insurance in Indiana - Key Takeaways |

|---|

The cheapest Indiana car insurance options are: The cheapest Indiana car insurance options are:Cheapest for minimum coverage: Erie Insurance Cheapest for full coverage: Erie Cheapest after an at-fault accident: State Farm Cheapest after a speeding ticket: Auto-Owners Cheapest after a DUI: Progressive Cheapest with poor credit history: Geico Cheapest for young drivers: Erie For younger drivers with a speeding violation: Erie For younger drivers with an at-fault accident: Erie |

This excellent Indiana auto insurance guide will help you find the best car insurance premiums and save money for drivers in various categories and age groups.

- Car Insurance Rates in Indiana

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Indiana for Minimum Coverage

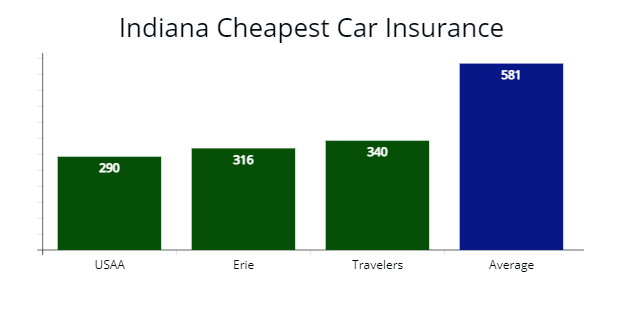

Our licensed insurance agents found Erie Insurance offers the cheapest rates for minimum coverage car insurance in Indiana for drivers with good driving records with a $316 yearly quote or $26 monthly rate during our comparison shopping analysis.

Read more: A Review of Erie Auto Insurance & Policy Options

The average Indiana state minimum rate is $581 per year, and Erie’s quote is $265 cheaper or 46% less expensive than average rates.

Cheapest Indiana car insurance companies for minimum coverage, by price

| Auto Insurer | Average Annual Rate |

|---|---|

| USAA | $290 |

| Erie | $316 |

| Travelers | $340 |

| Auto-Owners | $367 |

| State Farm | $412 |

| Geico | $487 |

| American Family | $519 |

| Progressive | $538 |

| Allstate | $640 |

*USAA is for qualified military members, their spouses, and direct family members. Your average rates may vary based on the driver’s profile.

While drivers in Indiana can enjoy lower insurance rates by taking out a minimum coverage policy, you may not have all the coverage you need to cover the cost of repairs if your motor vehicle is involved in a severe crash.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Therefore, it is good to compare the rates with multiple car insurance providers with full coverage policies in Indiana that offer first-party coverage above state requirements, which pays to replace or repair your vehicle in an accident.

Cheapest Full Coverage Car Insurance For Drivers in Indiana

Our agents found Erie offers the cheapest auto insurance option with a quote at $1,064 per year or $88 per month for affordable full coverage rates.

Erie’s rate is 34% less expensive than Indiana’s average rate of $1,592 annually or $528 less per year.

Cheapest Indiana car insurance companies for full coverage, by price

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Erie Insurance | $1,064 | $88 |

| Travelers | $1,237 | $103 |

| Auto-Owners | $1,318 | $109 |

| Indiana average | $1,592 | $132 |

The average cost for full coverage auto insurance for drivers in Indiana is $1,592 per year or $132 per month. The difference between the average price of minimum coverage and a policy with comprehensive and collision insurance in Indiana is $1,011.

Learn more: Understanding Full Coverage Car Insurance: What You Need to Know

Although full coverage is more expensive than a basic insurance policy, the amount you can save over time with comprehensive and collision coverage can help make up the difference since you won’t pay for your vehicle’s property damage from inclement weather or vandalism out of pocket.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Cheapest Car Insurance Coverage in Indiana with Speeding Tickets

With a speeding ticket in their driving history, Indiana drivers can save 33% with Auto-Owners Insurance, which has average annual premium costs of $1,316 per year.

We found Auto-Owners’ rate is $620 cheaper than Indiana’s mean speeding violation rate of $1,936 per year.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Auto-Owners | $1,316 | $109 |

| State Farm | $1,472 | $122 |

| Erie Insurance | $1,490 | $124 |

| Indiana average | $1,936 | $161 |

In Indiana, drivers pay an average of $1,936 per year for their car insurance or an 18% rate increase if they have traffic tickets on their driving records.

Therefore, it is good to choose an auto insurance company that offers the lowest rates for drivers with speeding tickets, even if you do not currently have one on your driving record.

Cheapest Car Insurance with an Auto Accident in Indiana

Drivers needing coverage in Indiana with one at-fault car accident on their driving records can get cheaper auto insurance with State Farm, which provided our agents a $1,643 yearly rate or 35% less expensive than Indiana’s average accident rate for full coverage.

Our agents suggest comparing insurance quotes with Auto-Owners and Erie to find the best rates since their quotes are 33% cheaper for an at-fault accident in Indiana.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| State Farm | $1,643 | $136 |

| Auto-Owners | $1,875 | $156 |

| Erie Insurance | $1,944 | $162 |

| Indiana average | $2,515 | $209 |

We found the average cost of coverage can increase by 37% in Indiana with an at-fault accident during AutoInsureSavings.org analysis.

The average auto insurance premium difference for a driver with a clean driving history than a driver with one accident is $923 per year.

Cheapest Car Insurance With a DUI in Indiana

Progressive offers the cheapest DUI coverage rates for drivers in Indiana with a $1,845 annual premium or $153 per month during our rate analysis. You can learn more about the company in our Progressive car insurance review.

Progressive’s rate is 34% less expensive than Indiana’s average car insurance premiums for a driver with a DUI in their driving history.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Progressive | $1,845 | $153 |

| Erie Insurance | $2,036 | $169 |

| Travelers | $2,417 | $201 |

| Indiana average | $2,780 | $231 |

Drivers who receive a DUI/OWI conviction in Indiana can expect their insurance to go up by as much as 43% per year, along with a temporary driver’s license suspension, a required SR-22 form, and a required ignition interlock device (IID) installed in their motor vehicle.

Read more: The Best Car Insurance Companies After a DUI

According to the State of Indiana, drivers may be required to take a defensive driving course after a DUI violation within 90 days of the infraction.

Cheapest Car Insurance for Drivers With Poor Credit in Indiana

Drivers in Indiana with bad credit can find the cheapest auto insurance with Geico, with an annual $1,968 rate for full coverage. Geico’s rate is 16% less expensive than the state average of $2,329.

Additional car insurance companies with better than average rates for drivers with poor credit are Travelers and State Farm.

Both auto insurers offer monthly rates at $179 and $181 for a 30-year-old driver or 7% lower than average.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Geico | $1,968 | $164 |

| Travelers | $2,152 | $179 |

| State Farm | $2,174 | $181 |

| Indiana average | $2,329 | $194 |

The average cost of car insurance for drivers in Indiana with a poor credit score is $2,329 per year, or 34% higher than drivers with a good credit score. Car insurance companies will often look at your credit report’s details to determine what your insurance rate should be. Make sure to pay your credit cards, student loans, and bills on time to keep car insurance rates low.

Cheapest Car Insurance Coverage in Indiana for Young Drivers

During our insurance agent’s comparison analysis, young Indiana drivers or college students with good driving records can find the best car insurance for teens at Erie Insurance with a $3,141 full coverage rate.

Young driver’s next best option is State Farm for full coverage, which provided our agents a $3,537 per year rate.

| Auto insurer | Full Coverage | Minimum Coverage |

|---|---|---|

| Erie | $3,141 | $860 |

| State Farm | $3,537 | $1,048 |

| USAA | $3,628 | $794 |

| Auto-Owners | $4,180 | $1,583 |

| Geico | $4,253 | $1,041 |

| American Family | $5,529 | $1,825 |

| Progressive | $5,672 | $1,473 |

| Allstate | $6,279 | $2,066 |

| Indiana average | $4,560 | $1,328 |

*USAA is for qualified military members, their spouses, and direct family members. Your average rates may vary based on the driver’s profile.

Young or teen drivers looking for the most affordable minimum coverage auto policy should go with Erie Insurance, which provided us an $860 quote or 36% lower than Indiana’s average of $1,328 per year.

Additional auto insurers offering cheaper than average minimum coverage rates for young drivers in Indiana are Geico and State Farm, with quotes at $1,041 and $1,048 or at least 22% cheaper.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Young or adolescent drivers have higher car insurance rates in Indiana due to their lack of experience and a higher risk of being involved in a car accident. According to the State of Indiana (IN.gov), vehicle crashes are the leading cause of death among teen drivers in Indiana.

Read more:

One of the best ways for younger drivers to get cheaper auto insurance rates is by adding a young or teen driver to their parent’s policy.

Cheapest Car Insurance for Young Drivers with Speeding Tickets

With a speeding violation in their driver history, younger drivers in Indiana should look to Erie for cheap auto insurance.

Erie’s annual rate of $3,520 per year or $293 per month is 30% cheaper than the average $4,989 rate for full coverage in Indiana.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Erie Insurance | $3,520 | $293 |

| State Farm | $3,961 | $330 |

| USAA | $4,035 | $336 |

| Indiana average | $4,989 | $415 |

Cheapest Car Insurance for Young Drivers with an At-Fault Accident

The cheapest auto insurance coverage for younger drivers with one at-fault accident in Indiana is Erie, which provided our agents a $318 monthly rate for full coverage or 33% less expensive than the state average.

The next cheapest insurance option is State Farm, with a $373 monthly rate or 21% less expensive than the average at-fault accident rate for younger people.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Erie Insurance | $3,823 | $318 |

| State Farm | $4,487 | $373 |

| USAA | $4,518 | $376 |

| Indiana average | $5,639 | $469 |

Best Auto Insurance Companies in Indiana

Our licensed agent’s research found USAA and Auto-Owners are car insurance companies in Indiana offering some of the best full coverage auto insurance rates with quality customer service and sound financial strength ratings for various Indiana drivers.

Suppose you want to find the best car insurance company with customer service and claims handling. In that case, USAA is the best option where 78% of customers are satisfied with a recent claim, according to ValuePenguin’s recent survey.

| Company | % respondents satisfied with recent claim | % respondents rated customer service as excellent |

|---|---|---|

| USAA | 78% | 62% |

| Auto-Owners | 76% | 53% |

| State Farm | 73% | 46% |

| Allstate | 72% | 47% |

| Progressive | 74% | 34% |

| Geico | 64% | 42% |

| Travelers | 19% | 33% |

We used the National Association of Insurance Commissioners (NAIC) complaint index to find the best auto insurer in an alternative approach.

The car insurance company with the lowest complaint index ratio in Indiana is Auto-Owners Insurance with 0.42, with 1.00 being the national average. American Family’s ratio is 0.44, well below the national average, and Geico’s is 0.57.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Auto-Owners has 890 out of 1,000 ratings with J.D. Power’s claims satisfaction survey. Still, they have an “A++” financial strength ratings with A.M. Best, while American Family has an “A” financial strength ratings and an 862 J.D. Power claims satisfaction ratings.

If you are shopping for the cheapest car insurance in Indiana with quality coverage and excellent customer service, we recommend either Auto-Owners Insurance, USAA, or American Family.

| Insurer | NAIC Complaint Index | J.D. Power claims satisfaction score | AM Best Financial Strength Rating |

|---|---|---|---|

| Auto-Owners | 0.42 | 890 | A++ |

| American Family | 0.44 | 862 | A |

| Geico | 0.57 | 871 | A++ |

| State Farm | 0.66 | 881 | A++ |

| Allstate | 0.71 | 876 | A+ |

| Progressive | 0.90 | 856 | A+ |

| USAA | 0.96 | 890 | A++ |

| Erie | 1.10 | 880 | A+ |

*NAIC complaint ratio index, the lower the number, the better. Auto-Owners has an index of 0.42 complaints based on market share, while American Family’s is 0.44. Both car insurers are well below the national average of 1.00.

Average Car Insurance Cost by City in Indiana

AutoInsureSavings.org licensed agents surveyed multiple insurance companies across Indiana cities and found the average cost of Indiana car insurance is $1,592 per year.

Your zip code in Indiana is a significant factor that can influence your car insurance rates, along with your credit score, driver profile, marital status, type of motor vehicle, and coverage levels.

Cheapest Auto Insurance in Indianapolis, IN

AutoInsureSavings.org licensed agents found Erie is the cheapest car insurance carrier for drivers in Indianapolis. They provided us a $1,235 per year rate for full coverage, 29% less expensive than Indianapolis’ yearly average rate of $1,732.

| Indianapolis Company | Average Premium |

|---|---|

| Erie Insurance | $1,235 |

| Travelers | $1,418 |

| Auto-Owners | $1,476 |

| Indianapolis average | $1,732 |

Cheapest Auto Insurance in Fort Wayne, IN

Fort Wayne drivers can find the cheapest full coverage insurance policy with State Farm, which provided our agents a $1,189 per year rate for our sample 30-year-old. State Farm’s insurance quote is 33% cheaper than average car insurance rates for similar driver profiles in Fort Wayne, IN.

| Fort Wayne Company | Average Premium |

|---|---|

| State Farm | $1,189 |

| Travelers | $1,360 |

| Erie | $1,381 |

| Fort Wayne average | $1,753 |

Cheapest Auto Insurance in Evansville, IN

Drivers in Evansville can find cheap auto insurance policies with State Farm, which provided us a $1,154 per year rate for our sample 30-year-old driver with full coverage. State Farm’s quote is 32% cheaper than Evansville’s $1,720 average rates.

| Evansville Company | Average Premium |

|---|---|

| State Farm | $1,154 |

| Auto-Owners | $1,268 |

| Geico | $1,417 |

| Evansville average | $1,720 |

Cheapest Auto Insurance in South Bend, IN

South Bend residents looking for the best auto insurance policies should get quotes from Erie, which provided our insurance agents a $1,128 per year rate for a 30-year-old driver with $100,000 in liability insurance and a $500 deductible for collision and comprehensive.

Erie’s car insurance quote is $588 less per year than South Bend’s average annual rate of $1,716.

| South Bend Company | Average Premium |

|---|---|

| Erie Insurance | $1,128 |

| Auto-Owners | $1,235 |

| Geico | $1,492 |

| South Bend average | $1,716 |

Cheapest Auto Insurance in Fishers, IN

Our agents found the cheapest auto insurance in Fishers, IN, with Auto-Owners, with a $1,045 per year rate for a full coverage policy with $500 deductibles for comprehensive and collision insurance. Auto-Owners’ quote is 38% less expensive than Fishers’ $1,664 average rates.

| Fishers Company | Average Premium |

|---|---|

| Auto-Owners | $1,045 |

| Travelers | $1,219 |

| USAA | $1,264 |

| Fishers average | $1,664 |

Cheapest Auto Insurance in Gary, IN

Gary drivers can find the cheapest car insurance with Erie, which provided our agents a $1,159 per year rate with $100,000 in liability insurance and $500 deductibles for collision and comprehensive insurance. Erie’s $95 monthly rate is 35% less expensive than Gary’s $1,763 average rates.

| Gary Company | Average Premium |

|---|---|

| Erie Insurance | $1,150 |

| Travelers | $1,328 |

| State Farm | $1,462 |

| Gary average | $1,763 |

Average Car Insurance Cost for All Cities in Indiana

| City | Annual insurance cost | City | Annual insurance cost |

|---|---|---|---|

| Indianapolis | $1,732 | Anderson | $1,637 |

| Fort Wayne | $1,753 | Elkhart | $1,643 |

| Evansville | $1,720 | Mishawaka | $1,661 |

| South Bend | $1,716 | Lawrence | $1,654 |

| Carmel | $1,648 | West Lafayette | $1,672 |

| Fishers | $1,664 | Columbus | $1,512 |

| Bloomington | $1,680 | Jeffersonville | $1,654 |

| Hammond | $1,712 | Westfield | $1,700 |

| Gary | $1,763 | Portage | $1,726 |

| Lafayette | $1,643 | New Albany | $1,600 |

| Muncie | $1,659 | Richmond | $1,618 |

| Noblesville | $1,589 | Merrillville | $1,476 |

| Terre Haute | $1,439 | Goshen | $1,498 |

| Kokomo | $1,624 | Valparaiso | $1,505 |

| Greenwood | $1,590 | Plainfield | $1,417 |

| Michigan City | $1,602 | South Whitley | $1,565 |

| Granger | $1,546 | Rossville | $1,523 |

| Crown Point | $1,593 | Bristol | $1,582 |

| Schererville | $1,476 | Brookston | $1,740 |

| East Chicago | $1,490 | Bass Lake | $1,621 |

| Hobart | $1,616 | Haubstadt | $1,599 |

| Marion | $1,565 | New Paris | $1,439 |

| Zionsville | $1,505 | Hamilton | $1,476 |

| Brownsburg | $1,417 | Redkey | $1,484 |

| Franklin | $1,622 | Dale | $1,636 |

| Munster | $1,712 | Nashville | $1,647 |

| Highland | $1,523 | Cannelton | $1,505 |

| Greenfield | $1,582 | New Pekin | $1,417 |

| La Porte | $1,632 | Koontz Lake | $1,609 |

| Clarksville | $1,476 | Markle | $1,649 |

| Seymour | $1,652 | Brooklyn | $1,632 |

| Shelbyville | $1,599 | Farmland | $1,484 |

| Logansport | $1,660 | Owensville | $1,565 |

| Avon | $1,439 | Shelburn | $1,476 |

| St. John | $1,655 | Odon | $1,523 |

| Vincennes | $1,677 | Palmyra | $1,609 |

| New Castle | $1,505 | Rome City | $1,658 |

| Huntington | $1,417 | Lake Holiday | $1,676 |

| New Haven | $1,476 | Fairview Park | $1,582 |

| Griffith | $1,484 | Mulberry | $1,622 |

| Crawfordsville | $1,523 | Parker City | $1,505 |

| Dyer | $1,690 | Geneva | $1,439 |

| Lebanon | $1,565 | Remington | $1,417 |

| Jasper | $1,632 | Grabill | $1,484 |

| Frankfort | $1,693 | Sweetser | $1,476 |

| Warsaw | $1,622 | Jonesboro | $1,599 |

| Beech Grove | $1,505 | Ladoga | $1,523 |

| Chesterton | $1,439 | Morristown | $1,609 |

| Bedford | $1,417 | Cayuga | $1,695 |

| Connersville | $1,476 | Borden | $1,484 |

| Auburn | $1,582 | Warren | $1,641 |

| Cedar Lake | $1,609 | Mentone | $1,658 |

| Washington | $1,679 | Wanatah | $1,417 |

| Speedway | $1,523 | Thorntown | $1,565 |

| Lake Station | $1,676 | Westport | $1,476 |

| Madison | $1,641 | Monroeville | $1,677 |

| Martinsville | $1,476 | Galveston | $1,505 |

| Peru | $1,622 | Kingsford Heights | $1,681 |

| Greensburg | $1,565 | Worthington | $1,685 |

| Yorktown | $1,625 | Patoka | $1,439 |

| Greencastle | $1,599 | Akron | $1,476 |

| Wabash | $1,476 | Oxford | $1,609 |

| Plymouth | $1,484 | Sunman | $1,658 |

| Danville | $1,685 | Farmersburg | $1,670 |

| Bluffton | $1,505 | Converse | $1,523 |

| Decatur | $1,677 | Ogden Dunes | $1,582 |

| Mooresville | $1,681 | North Webster | $1,625 |

| Lowell | $1,484 | Lynn | $1,688 |

| Kendallville | $1,641 | Trafalgar | $1,505 |

| Columbia City | $1,439 | Morocco | $1,681 |

| Sellersburg | $1,417 | Long Beach | $1,622 |

| Princeton | $1,688 | Waynetown | $1,677 |

| Angola | $1,582 | Culver | $1,476 |

| Elwood | $1,609 | Greenville | $1,484 |

| Brazil | $1,417 | Clayton | $1,565 |

| Whitestown | $1,523 | Walton | $1,599 |

| Charlestown | $1,505 | Wolcott | $1,685 |

| Tell City | $1,670 | Oolitic | $1,476 |

| Bargersville | $1,565 | Russiaville | $1,484 |

| Nappanee | $1,658 | Morgantown | $1,677 |

| McCordsville | $1,622 | Winslow | $1,439 |

| Lakes of the Four Seasons | $1,625 | St. Paul | $1,505 |

| Huntertown | $1,670 | Brook | $1,609 |

| North Vernon | $1,565 | Goodland | $1,582 |

| Scottsburg | $1,599 | Carthage | $1,523 |

| Dunlap | $1,681 | Grandview | $1,622 |

| Garrett | $1,565 | Ashley | $1,625 |

| Batesville | $1,582 | La Fontaine | $1,484 |

| Notre Dame | $1,677 | Andrews | $1,688 |

| Ellettsville | $1,476 | Jamestown | $1,685 |

| Mount Vernon | $1,439 | Taylorsville | $1,417 |

| Huntingburg | $1,505 | Mexico | $1,641 |

| Rensselaer | $1,670 | Wolcottville | $1,688 |

| Boonville | $1,417 | Atlanta | $1,681 |

| Salem | $1,609 | Otterbein | $1,476 |

| New Whiteland | $1,484 | Shirley | $1,688 |

| Rushville | $1,677 | Hoagland | $1,505 |

| Rochester | $1,641 | Silver Lake | $1,599 |

| Portland | $1,599 | Summitville | $1,565 |

| Westville | $1,625 | Swayzee | $1,658 |

| Hartford City | $1,670 | Shipshewana | $1,582 |

| Bright | $1,476 | Monroe | $1,439 |

| Gas City | $1,505 | Lynnville | $1,484 |

| Cumberland | $1,523 | Topeka | $1,476 |

| North Manchester | $1,622 | Wheatfield | $1,609 |

| Winfield | $1,685 | Kirklin | $1,417 |

| Hidden Valley | $1,565 | Francesville | $1,625 |

| Simonton Lake | Poseyville | $1,677 | |

| Monticello | $1,417 | Memphis | $1,505 |

| Linton | $1,476 | Selma | $1,681 |

| South Haven | $1,599 | Van Buren | $1,688 |

| Alexandria | $1,565 | Montezuma | $1,670 |

| Lawrenceburg | $1,609 | Dugger | $1,484 |

| Tipton | $1,439 | Pierceton | $1,476 |

| Winona Lake | $1,505 | Gaston | $1,658 |

| Cicero | $1,582 | St. Leon | $1,523 |

| Porter | $1,641 | St. Mary of the Woods | $1,685 |

| Whiting | $1,595 | Seelyville | $1,417 |

| Edinburgh | $1,476 | Lake Santee | $1,505 |

| Winchester | $1,417 | Darlington | $1,685 |

| Clinton | $1,688 | Clay City | $1,677 |

| Ligonier | $1,681 | Lakeville | $1,565 |

| Highland | $1,484 | Harmony | $1,476 |

| Fortville | $1,625 | Rosedale | $1,609 |

| Bremen | $1,417 | Milltown | $1,597 |

| Whiteland | $1,658 | Hatfield | $1,439 |

| North Terre Haute | $1,685 | Gosport | $1,582 |

| Greendale | $1,505 | Royal Center | $1,622 |

| Mitchell | $1,565 | Spiceland | $1,417 |

| Pendleton | $1,439 | Millersburg | $1,641 |

| Berne | $1,476 | Avoca | $1,677 |

| Sullivan | $1,523 | Montgomery | $1,484 |

| De Motte | $1,658 | Freelandville | $1,670 |

| Aurora | $1,598 | Tecumseh | $1,505 |

| Roselawn | $1,565 | Laurel | $1,476 |

| Leo-Cedarville | $1,609 | Dublin | $1,523 |

| Melody Hill | $1,417 | Colfax | $1,641 |

| Upland | $1,476 | Sharpsville | $1,625 |

| Austin | $1,582 | Roachdale | $1,681 |

| Hebron | $1,505 | Hymera | $1,439 |

| Paoli | $1,688 | Leesburg | $1,417 |

| Middlebury | $1,484 | Lake Village | $1,565 |

| Knox | $1,641 | Clarks Hill | $1,658 |

| Hanover | $1,677 | Chrisney | $1,476 |

| Smithville-Sanders | $1,685 | Fountain City | $1,622 |

| Pittsboro | $1,417 | Windfall City | $1,688 |

| Chandler | $1,681 | Boswell | $1,609 |

| Ossian | $1,599 | Elberfeld | $1,582 |

| Union City | $1,565 | Shoals | $1,670 |

| Georgetown | $1,677 | Bainbridge | $1,417 |

| Newburgh | $1,523 | Pennville | $1,505 |

| Attica | $1,439 | New Washington | $1,688 |

| Corydon | $1,670 | New Harmony | $1,484 |

| Fort Branch | $1,476 | Town of Pines | $1,658 |

| Bicknell | $1,641 | Zanesville | $1,677 |

| Sheridan | $1,505 | Monroe City | $1,417 |

| Delphi | $1,484 | English | $1,625 |

| Brownstown | $1,582 | Knightsville | $1,476 |

| Syracuse | $1,609 | Medaryville | $1,685 |

| Shorewood Forest | $1,622 | Buffalo | $1,417 |

| Country Squire Lakes | $1,658 | Linden | $1,439 |

| Lagrange | $1,641 | Harrodsburg | $1,565 |

| Heritage Lake | $1,685 | Van Bibber Lake | $1,599 |

| Fairmount | $1,476 | Holland | $1,677 |

| Butler | $1,681 | West Lebanon | $1,523 |

| Osceola | $1,417 | Carlisle | $1,505 |

| Santa Claus | $1,688 | St. Meinrad | $1,582 |

| Winamac | $1,505 | Marengo | $1,476 |

| Centerville | $1,565 | Waldron | $1,484 |

| Oakland City | $1,688 | Elnora | $1,658 |

| Loogootee | $1,417 | Francisco | $1,565 |

| Middletown | $1,599 | Utica | $1,670 |

| Brookville | $1,625 | Matthews | $1,609 |

| Avilla | $1,641 | Medora | $1,685 |

| Rockville | $1,439 | Lanesville | $1,681 |

| Albion | $1,626 | Oaktown | $1,565 |

| Hope | $1,476 | Fairland | $1,677 |

| Chesterfield | $1,582 | Cynthiana | $1,670 |

| Bloomfield | $1,645 | New Market | $1,658 |

| Grissom AFB | $1,484 | Michigantown | $1,565 |

| Covington | $1,505 | New Salisbury | $1,476 |

| Rockport | $1,629 | Hayden | $1,523 |

| Petersburg | $1,609 | Dana | $1,417 |

| New Palestine | $1,565 | Etna Green | $1,484 |

| Lapel | $1,643 | Camden | $1,688 |

| Spencer | $1,417 | Fillmore | $1,439 |

| Fowler | $1,685 | Hamlet | $1,505 |

| Fremont | $1,476 | Kimmell | $1,625 |

| Knightstown | $1,681 | Lizton | $1,599 |

| Waterloo | $1,658 | West College Corner | $1,582 |

| Ingalls | $1,439 | Paragon | $1,476 |

| Greentown | $1,648 | Orestes | $1,609 |

| West Terre Haute | $1,670 | La Paz | $1,484 |

| Walkerton | $1,505 | Hudson | $1,681 |

| Salt Creek Commons | $1,529 | Coatesville | $1,565 |

| Edgewood | $1,677 | La Crosse | $1,628 |

| Rising Sun | $1,417 | Collegeville | $1,505 |

| Albany | $1,681 | Ridgeville | $1,476 |

| Veedersburg | $1,484 | Kennard | $1,582 |

| Frankton | $1,625 | Elizabethtown | $1,677 |

| North Judson | $1,476 | Parkers Settlement | $1,658 |

| Ferdinand | $1,582 | Claypool | $1,417 |

| Milan | $1,599 | Painted Hills | $1,439 |

| Orleans | $1,599 | Birdseye | $1,649 |

| Williamsport | $1,505 | Burlington | $1,476 |

| Bourbon | $1,565 | Patriot | $1,604 |

| Dunkirk | $1,582 | Hillsboro | $1,505 |

| Versailles | $1,609 | Waveland | $1,670 |

| Kouts | $1,528 | Kewanna | $1,484 |

| Flora | $1,417 | Beverly Shores | $1,685 |

| Burns Harbor | $1,476 | Bunker Hill | $1,565 |

| Jasonville | $1,622 | Milroy | $1,670 |

| Wakarusa | $1,604 | West Baden Springs | $1,658 |

| Hagerstown | $1,484 | Reynolds | $1,417 |

| Trail Creek | $1,439 | Mount Summit | $1,609 |

| New Carlisle | $1,622 | Holton | $1,476 |

| Shadeland | $1,505 | Perrysville | $1,582 |

| Osgood | $1,644 | Amo | $1,604 |

| Southport | $1,565 | Owensburg | $1,658 |

| Henryville | $1,680 | St. Joe | $1,505 |

| Eaton | $1,582 | Cromwell | $1,681 |

| Battle Ground | $1,417 | Wheatland | $1,625 |

| French Lick | $1,476 | Roseland | $1,677 |

| Churubusco | $1,677 | West Point | $1,525 |

| Monon | $1,679 | Advance | $1,484 |

| Lake Dalecarlia | $1,658 | Oldenburg | $1,417 |

| Argos | $1,505 | Spring Grove | $1,439 |

| Cloverdale | $1,604 | Fontanet | $1,565 |

| Crothersville | $1,646 | New Ross | $1,476 |

| Galena | $1,609 | Laketon | $1,505 |

| Tri-Lakes | $1,417 | Lagro | $1,582 |

| Milford | $1,439 | Chalmers | $1,658 |

| Cambridge City | $1,523 | Denver | $1,611 |

| Montpelier | $1,582 | Stockwell | $1,647 |

| Kentland | $1,565 | New Goshen | $1,680 |

| Vevay | $1,484 | Kingman | $1,505 |

| Woodburn | $1,476 | Greens Fork | $1,625 |

| Liberty | $1,692 | Orland | $1,565 |

| Roanoke | $1,626 | Lewisville | $1,641 |

| Prince's Lakes | $1,505 | North Salem | $1,417 |

| Daleville | $1,514 | Somerset | $1,648 |

| Hudson Lake | $1,604 | Wilkinson | $1,484 |

| New Chicago | $1,727 | Burnettsville | $1,613 |

| Harlan | $1,417 | Hartsville | $1,511 |

| Monrovia | $1,565 | Carbon | $1,439 |

| Fish Lake | $1,632 | Manilla | $1,476 |

| Aberdeen | $1,590 | Amboy | $1,505 |

| Arcadia | $1,509 | Clear Lake | $1,547 |

| Dayton | $1,478 | Richland | $1,484 |

| Dillsboro | $1,439 | Idaville | $1,419 |

Indiana Minimum Auto Insurance Requirements

Drivers in Indiana for vehicle registration must have bodily injury and property damage liability coverage, including uninsured motorist coverage, to be legal and compliant with state law. If you buy an auto insurance policy, below are the minimum coverage limits you must have.

| Liability insurance | Minimum coverage |

|---|---|

| Bodily injury liability | $25,000 per person / $50,000 per accident |

| Property damage liability | $25,000 per accident |

| Uninsured motorist bodily injury | $25,000 per person / $50,000 per accident |

Buying a minimum coverage policy is the most affordable and cheapest insurance option; however, if you are involved in an auto accident, a state minimum insurance policy will not cover property damage to your car.

AutoInsureSavings licensed agents to recommend policyholders in The Hoosier State increase liability limits with uninsured motorist coverage when buying insurance products for additional financial and asset protection.

To learn more about the most affordable car insurance options in Indiana, enter your zip code in our quote comparison tool or get expert advice at AutoInsureSavings.org. Our licensed insurance professionals will be happy to answer any questions you have.

Methodology

AutoInsureSavings.org comparison shopping study used a full-coverage auto policy with a clean driving record for a 30-year-old driving a 2018 Honda Accord with the following coverage limits:

| Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person/$100,000 per accident |

| Property damage liability | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision coverage | $500 deductible |

We used rates for drivers with an accident history, credit score, and marital status for other Indiana rate analyses. We used car insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your rates may vary when you get quotes.

Frequently Asked Questions

Who has the cheapest car insurance in Indiana?

Erie offers the most affordable car insurance rates for those wanting minimum coverage in Indiana, with an annual rate of $316 or $26 per month for 30-year-olds with a good driving record. Erie’s rate is 46% less expensive than the state average of $581. USAA offers state minimum coverage at $290 per year or $24 per month for those who qualify.

How can I save on car insurance in Indiana?

It is best to compare auto insurance quotes with the same coverage level in Indiana from several top insurance companies to find the most affordable rates. Asking your agent or insurance company about money-saving discounts or usage-based insurance can help you lower your overall insurance costs, such as a safe driver or multi-policy discounts from life, rental, or home insurance policies. Keeping an eye on your credit report and maintaining safe driving habits can help you save money on your Indiana auto insurance.

How much is full coverage car insurance in Indiana?

The average cost of full coverage Indiana car insurance is $1,592 per year or $132 per month, including uninsured motorist coverage. The following insurance companies offer cheaper rates than the state’s average: Erie at $1,064, Travelers at $1,237, and Auto-Owners at $1,318 per year for a 30-year-old driver.

How much is car insurance in Indiana per month?

The average cost of car insurance in Indiana is $48 per month for those who want minimum coverage and $132 per month for people with a clean driving record needing full coverage policies. Insurance companies that offer rates less than that per month include Erie, Travelers, and Auto-Owners.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Dec 6, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.