Vermont Cheapest Car Insurance & Best Coverage Options

Drivers looking for the Vermont cheapest car insurance and best coverage options will find them at Safeco and Nationwide. Safeco has the cheapest Vermont minimum coverage, averaging $34/mo, while Vermont drivers looking for full coverage will find the cheapest rates at Nationwide at an average of $110/mo.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Jan 15, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jan 15, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

- Safeco is the best Vermont auto insurance company for cheap minimum coverage

- Nationwide is the best Vermont company for cheap full coverage

- Getting Vermont car insurance quotes will help drivers find the best deal

Vermont drivers looking for the Vermont cheapest car insurance and best coverage options should get quotes from Safeco and Nationwide. Read on to learn more about the best auto insurance companies in Vermont for cheap coverage, as well as other important information about affordable Vermont car insurance.

To jump right into finding cheap Vermont car insurance quotes, enter your ZIP code in our free quote tool.

Affordable Vermont Car Insurance Rates

Vermont drivers can save more on car insurance premiums by comparing quotes from multiple insurers with the lowest rates from our insurance study.

| Cheapest Car Insurance in Vermont - Quick Hits |

|---|

The cheapest Vermont car insurance options are: The cheapest Vermont car insurance options are:Cheapest for minimum coverage: Safeco Cheapest for full coverage: Nationwide Cheapest after an at-fault accident: Nationwide Cheapest after a speeding ticket: Concord Group Cheapest after a DUI: State Farm Cheapest for poor credit history: Geico Cheapest for young drivers: Progressive For young drivers with a speeding violation: Concord Group For young drivers with an at-fault accident: State Farm |

Check out this useful guide on Vermont car insurance for more details on the average rates from leading insurance providers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Vermont for Minimum Coverage

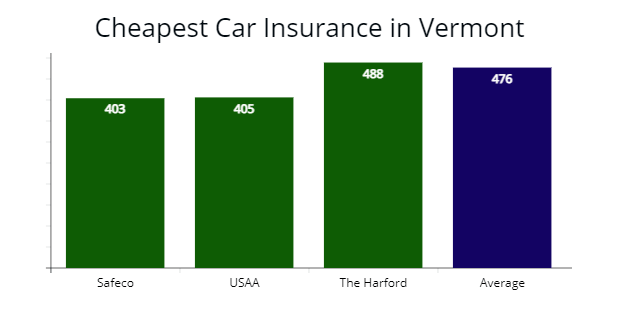

Our agents found that Safeco Insurance has the most affordable annual averages for Vermont drivers, with a $403 quote for minimum coverage for our sample 30-year-old.

The average Vermont rate for minimum liability insurance policies is $476 per year, and Safeco’s rate is $73 cheaper or 16% less expensive.

| Company | Average annual rate |

|---|---|

| Safeco | $403 |

| USAA | $405 |

| The Hartford | $488 |

| State Farm | $573 |

| Vermont Mutual | $610 |

| Allstate | $637 |

| Nationwide | $670 |

| Concord Group | $682 |

| MetLife | $704 |

*USAA is for qualified military members, their spouses, and direct family members. Your rates may vary based on the driver’s profile.

Drivers in Vermont who only want minimum coverage can drive legally for less by switching to one of the cheapest insurance companies illustrated above.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Cheapest Full Coverage Car Insurance in Vermont

Nationwide offers the cheapest insurance option with a quote at $1,317 per year or $109 per month for affordable full coverage rates. Nationwide’s rate is 22% less expensive than Vermont’s average rate of $1,679 annually.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Nationwide | $1,317 | $109 |

| Concord Group | $1,380 | $115 |

| State Farm | $1,416 | $118 |

| Geico | $1,483 | $123 |

| Vermont average | $1,679 | $139 |

The average cost of full coverage auto insurance in Vermont is $139 per month or $1,679 annually.

Read more: Understanding Full Coverage Car Insurance: What You Need to Know

Full coverage insurance can cost as much as three times more than the average car insurance premiums for a minimum liability policy.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

AutoInsureSavings.org licensed agents to suggest drivers who own a vehicle under 10 years old or worth more than $3,000 should consider a full coverage insurance policy to guarantee they will receive the benefits they need when an auto accident occurs that leaves their car totaled.

Cheapest Insurance With a Speeding Ticket in Vermont

Vermont drivers with a speeding ticket on their driving record can save more with Concord Group, which has average annual premium costs of $1,490 per year. We found Concord’s rate is 22% cheaper than Vermont’s mean speeding violation rate of $1,899 annually.

Take a look at the table below to see how a traffic ticket can impact your car insurance rates in Vermont.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Concord Group | $1,490 | $124 |

| Safeco | $1,563 | $130 |

| State Farm | $1,682 | $140 |

| Vermont average | $1,899 | $158 |

According to the Insurance Information Institute (III.org), Vermont drivers can expect their car insurance rates to increase by an average of 19% after receiving a traffic violation. The amount your average rates will rise depends on how fast you were going and how many speeding violations you already have on your driving record.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Vermont With a Car Accident

Drivers in Vermont with an at-fault accident on their driving records can still save on their car insurance rates with Nationwide, which offers a $170 monthly rate or 21% cheaper than Vermont’s average.

To get the best price, we suggest comparing insurance quotes with State Farm, which provided us a $186 monthly rate for drivers with an at-fault accident.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Nationwide | $2,048 | $170 |

| State Farm | $2,236 | $186 |

| Concord Group | $2,290 | $190 |

| Vermont average | $2,572 | $214 |

Just one at-fault accident on your record in Vermont can significantly increase your car insurance premium. Our research found that the difference between the average premium for a driver with a clean driving history than a driver with one accident is $705.

Cheapest Insurance With a DUI in Vermont

According to our rate analysis, State Farm offers the cheapest coverage rates for Vermont drivers with a DUI with a $2,411 annual premium or $200 per month.

State Farm’s rate is 20% less expensive than Vermont’s average insurance premium for drivers with a DUI in their driving history.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $2,411 | $200 |

| Nationwide | $2,524 | $210 |

| Geico | $2,733 | $228 |

| Vermont average | $2,993 | $249 |

A DUI is a severe offense that can cause numerous consequences for a Vermont policyholder. Along with their insurance rates going up by 55%, the driver could also have a temporary driver’s license restriction. The Vermont Department of Motor Vehicles recommends taking a defensive driving course to lower insurance costs.

Cheapest Car Insurance With Poor Credit in Vermont

Vermont drivers with poor credit can get the most affordable insurance rates with Geico, which provided our agents a $127 monthly rate for full coverage car insurance.

The next cheapest insurance options are State Farm and Liberty Mutual for drivers with poor credit, and both auto insurers are 20% less expensive with a $141 and $155 per month rate, respectfully.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Geico | $1,530 | $127 |

| State Farm | $1,694 | $141 |

| Liberty Mutual | $1,864 | $155 |

| Vermont average | $2,304 | $192 |

Your credit history can have an impact on how much you pay for car insurance. Credit scores are among the many factors that car insurance companies consider when providing you with a quote.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

It is found that drivers who have poor credit will often file more claims and be involved in more accidents than drivers who have good credit.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance Coverage in Vermont for Young Drivers

During our comparison shopping study, young Vermont drivers or college students can get the cheapest auto insurance coverage with Progressive, which provided us a $3,876 annual rate for full coverage.

Young or teen drivers who need minimum coverage should compare quotes with Allstate, Travelers, and Progressive.

Read more:

- Allstate Car Insurance for College Students

- Progressive Car Insurance Review for Families, Policy Options & Ratings

- Review of Travelers Car Insurance Options

Allstate offers the cheapest minimum liability coverage rate at $1,127 per year for adolescent drivers, while Travelers is $1,200 per year, and Progressive’s rate is $1,299 annually.

All three car insurers are 14% cheaper than Vermont’s state minimum liability rate for younger drivers.

| Insurer | Full coverage | Minimum coverage |

|---|---|---|

| Progressive | $3,876 | $1,299 |

| USAA | $3,956 | $1,123 |

| Concord Insurance | $4,130 | $1,538 |

| Nationwide | $4,462 | $1,749 |

| State Farm | $4,844 | $1,342 |

| Geico | $5,139 | $1,444 |

| Liberty Mutual | $5,428 | $1,624 |

| Allstate | $5,832 | $1,127 |

| Travelers | $6,032 | $1,200 |

| Vermont average | $5,235 | $1,510 |

Young or teen drivers needing coverage in Vermont will pay more for their car insurance premium regardless of what company they choose.

I recommend that Vermont teen drivers go on their parent's policy or have an adult family member on their policy to save money.Dani Best Licensed Insurance Producer

Inexperienced drivers are at a higher risk than older and more experienced drivers, according to the National Highway Traffic Safety Administration (NHTSA).

Cheapest Car Insurance for Young Drivers with a Speeding Ticket

Young Vermont drivers with a speeding violation should look to Concord Group to get the best rates. The average insurance cost from Concord is $4,039 per year for full liability coverage insurance.

Learn more: How much will my auto insurance go up with a speeding ticket?

Concord’s speed violation rate is 33% cheaper than the $5,495 average in Vermont for younger drivers.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Concord Group | $4,039 | $310 |

| State Farm | $4,944 | $412 |

| Progressive | $5,022 | $418 |

| Vermont average | $5,495 | $457 |

Cheapest Car Insurance for Young Drivers in Vermont with a Car Accident

The cheapest auto insurance coverage for younger drivers with an accident in Vermont is State Farm, which provided our agents a $434 monthly rate for full coverage or $80 less than Allstate’s rate at $514 per month.

The next cheapest option is Concord, with a $448 monthly rate or 10% less expensive than Vermont’s average quote.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $5,213 | $434 |

| Concord Insurance | $5,376 | $448 |

| Geico | $5,832 | $486 |

| Allstate | $6,172 | $514 |

| Vermont average | $5,743 | $478 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Car Insurance Companies in Vermont

AutoInsureSavings.org licensed agents found that Concord Group, Geico, and State Farm offers some of the most affordable rates with excellent customer service and good financial strength to various Vermont drivers.

ValuePenguin surveyed with similar insurance company results:

| Company | % respondents extremely satisfied recent claim | % respondents rated customer service as excellent |

|---|---|---|

| USAA | 78% | 62% |

| Nationwide | 78% | 53% |

| State Farm | 73% | 46% |

| Allstate | 72% | 47% |

| Progressive | 74% | 34% |

| Geico | 64% | 42% |

| Concord Group | N/A | N/A |

If you are in the market for a new car insurance policy and are only concerned about the price, these three companies offer some of the state’s best insurance rates.

We also used data from the National Association of Insurance Commissioners (NAIC), J.D. Power’s claims satisfaction survey, and each car insurance company’s financial strength rating from AM Best.

| Company | NAIC complaint index | J.D. Power claims satisfaction | AM Best rating |

|---|---|---|---|

| Concord | 0.18 | n/a | A+ |

| Nationwide | 0.37 | 876 | A+ |

| Allstate | 0.63 | 876 | A+ |

| Travelers | 0.65 | 861 | A++ |

| State Farm | 0.66 | 881 | A++ |

| Progressive | 0.67 | 856 | A+ |

| Safeco | 0.67 | 870 | A |

| MetLife | 0.68 | 886 | A+ |

| Liberty Mutual | 0.92 | 870 | A |

| Geico | 1.01 | 871 | A++ |

| Vermont Mutual | 1.11 | n/a | A+ |

NAIC complaint ratio looks at the number of complaints of the best car insurance company based on market share.

The lower the complaint ratio, the better. It is an indication of the quality of the insurance carrier’s customer service and claims satisfaction.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

In this instance, the insurance carrier who rated the best based on a low amount of complaints is Concord Insurance Group.

When you have more information about what each company has to provide you with, it will be easier for you to narrow down your choices and make an informed decision on the best auto insurance company in Vermont is the best option for you.

Average Car Insurance Costs by City in Vermont

Your zip code in Vermont is a significant factor in your average auto insurance rates, along with your credit score, driving record, marital status, type of motor vehicle, and coverage levels.

Read more: Understanding How Car Insurance Premiums Are Calculated

Typically, densely populated areas, high crime areas, or poor road conditions tend to have expensive auto insurance rates.

AutoInsureSavings.org insurance experts did a study on the most populous Vermont cities.

Cheapest Auto Insurance in Burlington, VT

Burlington drivers can find the cheapest auto insurance with Nationwide Insurance who provided our agents a $1,315 average rate per year for our 30-year-old driver. Nationwide’s quote is 24% less expensive than Burlington’s average rates.

| Burlington Company | Average Premium |

|---|---|

| Nationwide | $1,315 |

| Concord Group | $1,366 |

| State Farm | $1,520 |

| Burlington average | $1,730 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Auto Insurance in Essex, VT

Drivers in Essex can find the best coverage rates with Concord, which provided us a quote at $1,286 annually or $107 per month for a full coverage insurance policy. Concord’s rate is 27% cheaper than Essex’s yearly insurance rate of $1,747 per year.

| Essex Company | Average Premium |

|---|---|

| Concord Group | $1,286 |

| Nationwide | $1,411 |

| Geico | $1,636 |

| Essex average | $1,747 |

Cheapest Auto Insurance in Colchester, VT

Our licensed agents found Vermont Mutual is the cheapest insurance company for people in Colchester. They provided us a $1,302 annual rate for full coverage, 22% less expensive than Colchester’s yearly average rate of $1,660.

| Colchester Company | Average Premium |

|---|---|

| Vermont Mutual | $1,302 |

| Nationwide | $1,344 |

| State Farm | $1,531 |

| Colchester average | $1,660 |

Cheapest Auto Insurance in Rutland, VT

Our research found the cheapest auto insurance in Rutland is with Concord, Nationwide, and Geico. Concord is the most affordable, with a $103 monthly rate or $1,237 per year, while Nationwide offers a $1,470 quote, and Geico offers a $1,572 rate per year.

| Rutland Company | Average Premium |

|---|---|

| Concord Group | $1,237 |

| Nationwide | $1,470 |

| Geico | $1,572 |

| Rutland average | $1,690 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Auto Insurance in Bennington, VT

People in Bennington can find cheap auto coverage with State Farm, which provided our agents a low annual insurance rate of $1,217 per year for a 30-year-old with full coverage. The next most affordable option is Nationwide, with an annual $1,350 per year or $112 monthly rate.

| Bennington Company | Average Premium |

|---|---|

| State Farm | $1,217 |

| Nationwide | $1,350 |

| Safeco | $1,451 |

| Bennington average | $1,648 |

Cheapest Auto Insurance in Brattleboro, VT

Brattleboro drivers can find the best full coverage insurance policy with Nationwide, which provided our agents a $1,382 annual rate per year of $115 per month. Nationwide’s insurance quote is 22% cheaper than average rates for 30-year-old drivers in Brattleboro.

| Brattleboro Company | Average Premium |

|---|---|

| Nationwide | $1,382 |

| Concord Group | $1,399 |

| Liberty Mutual | $1,487 |

| Brattleboro average | $1,762 |

Average Insurance Cost for All Cities in Vermont

| City | Annual Premium Cost | City | Annual Premium Cost |

|---|---|---|---|

| Burlington | $1,730 | Swanton village | $1,662 |

| Essex | $1,747 | Sheldon | $1,766 |

| South Burlington | $1,766 | Clarendon | $1,762 |

| Colchester | $1,660 | West Rutland | $1,648 |

| Rutland city | $1,690 | Vernon | $1,660 |

| Bennington | $1,648 | Newbury | $1,683 |

| Brattleboro | $1,762 | Morrisville | $1,589 |

| Milton | $1,600 | Danville | $1,648 |

| Essex Junction | $1,662 | Westford | $1,766 |

| Williston | $1,631 | Grand Isle | $1,660 |

| Hartford | $1,680 | Wallingford | $1,762 |

| Springfield | $1,654 | Bethel | $1,662 |

| Middlebury | $1,660 | Fairfield | $1,654 |

| Barre city | $1,648 | Starksboro | $1,643 |

| Barre | $1,580 | Huntington | $1,598 |

| Shelburne | $1,762 | Guilford | $1,644 |

| Montpelier | $1,644 | Monkton | $1,660 |

| Winooski | $1,766 | Dummerston | $1,673 |

| St. Johnsbury | $1,662 | Moretown | $1,628 |

| St. Albans city | $1,668 | Wolcott | $1,673 |

| Swanton | $1,660 | Ludlow | $1,762 |

| St. Albans | $1,599 | Wilmington | $1,680 |

| Northfield | $1,654 | New Haven | $1,662 |

| Lyndon | $1,644 | Calais | $1,686 |

| Morristown | $1,638 | Alburgh | $1,766 |

| Waterbury | $1,762 | Waitsfield | $1,660 |

| Rockingham | $1,662 | North Bennington | $1,628 |

| Jericho | $1,689 | South Hero | $1,762 |

| Georgia | $1,660 | Proctor | $1,662 |

| Fairfax | $1,619 | Newfane | $1,644 |

| Randolph | $1,662 | Middlesex | $1,654 |

| Castleton | $1,680 | Dorset | $1,660 |

| Hinesburg | $1,673 | Berkshire | $1,662 |

| Stowe | $1,662 | Londonderry | $1,680 |

| Newport city | $1,660 | Warren | $1,690 |

| Derby | $1,698 | Whitingham | $1,673 |

| Manchester | $1,762 | Barnet | $1,637 |

| Richmond | $1,654 | Poultney village | $1,660 |

| Rutland | $1,766 | Corinth | $1,720 |

| Bristol | $1,644 | Burke | $1,762 |

| Cambridge | $1,673 | Lunenburg | $1,654 |

| Charlotte | $1,680 | Franklin | $1,699 |

| Brandon | $1,660 | Johnson village | $1,644 |

| Highgate | $1,720 | Waterford | $1,673 |

| Johnson | $1,654 | Cabot | $1,680 |

| Williamstown | $1,682 | Sharon | $1,660 |

| Hartland | $1,692 | Plainfield | $1,662 |

| Shaftsbury | $1,673 | Troy | $1,766 |

| Pownal | $1,762 | Marshfield | $1,654 |

| Windsor | $1,680 | Lyndonville | $1,710 |

| Norwich | $1,766 | Enosburg Falls | $1,654 |

| Poultney | $1,644 | Lincoln | $1,673 |

| Underhill | $1,660 | Chittenden | $1,677 |

| Chester | $1,662 | Addison | $1,644 |

| Westminster | $1,762 | Danby | $1,710 |

| Bellows Falls | $1,654 | Cavendish | $1,766 |

| Hyde Park | $1,673 | Eden | $1,662 |

| Woodstock | $1,762 | Chelsea | $1,660 |

| Hardwick | $1,658 | Fletcher | $1,762 |

| Royalton | $1,710 | Brookfield | $1,710 |

| Pittsford | $1,644 | Concord | $1,658 |

| Berlin | $1,766 | Irasburg | $1,662 |

| Enosburgh | $1,662 | Marlboro | $1,654 |

| Weathersfield | $1,713 | Woodstock village | $1,766 |

| Barton | $1,654 | Bridport | $1,644 |

| Ferrisburgh | $1,695 | Bolton | $1,728 |

| Richford | $1,710 | Pawlet | $1,719 |

| Bradford | $1,762 | Tunbridge | $1,729 |

| Putney | $1,673 | Orwell | $1,662 |

| Arlington | $1,766 | West Windsor | $1,654 |

| Newport | $1,644 | Mount Holly | $1,766 |

| Vergennes | $1,658 | Brighton | $1,727 |

| Fair Haven | $1,662 | Leicester | $1,673 |

| East Montpelier | $1,762 | Duxbury | $1,658 |

| Thetford | $1,710 | Salisbury | $1,644 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Minimum Auto Insurance Requirements in Vermont

One of the best ways Vermonters can save money is by buying the minimum amount of car insurance. By getting state minimums in Vermont, you can drastically reduce your monthly insurance cost.

Our agents recommend full coverage insurance for most drivers with a clean driving record, including comprehensive and collision coverage.

Below are the minimum coverage limits for Vermont drivers.

| Liability | Minimum coverage |

|---|---|

| Bodily injury liability insurance | $25,000 per person and $50,000 per accident |

| Property damage liability insurance | $10,000 per accident |

| Uninsured motorist coverage bodily injury insurance | $50,000 per person and $100,000 per accident |

| Uninsured motorist coverage property damage insurance | $10,000 per accident |

*must include underinsured motorist coverage.

Not only do our agents recommend adding collision and comprehensive coverage, but we also recommend higher liability limits for most drivers in Vermont.

Learn more:

- Understanding Collision Car Insurance Coverage: What You Need to Know

- Understanding Comprehensive Car Insurance Coverage: What You Need to Know

State minimum coverage in Vermont isn’t enough auto coverage to fully cover the cost of damage in the event of an expensive auto accident or protection against property damage to your motor vehicle.

To learn more about the most affordable car insurance options in Vermont, contact the experts at AutoInsureSavings.org. Our licensed professionals will be happy to answer any questions you have.

Methodology

AutoInsureSavings.org comparison shopping study used a full-coverage auto policy for a 30-year-old driving a 2018 Honda Accord with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person / $100,000 per accident |

| Property damage liability | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured / underinsured motorist bodily injury | $50,000 per person / $100,000 per accident |

| Comprehensive and collision coverage | $500 deductible |

We used rates for drivers with an accident history, credit score, and marital status for other Vermont rate analyses. We used insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your rates may vary when you get quotes.

Sources

– Insurance Institute for Highway Safety (IIHS.org). “Fatality Facts 2018 State by state.”

– National Highway Traffic Safety Administration. “Traffic Safety Facts.”

– National Association of Insurance Commissioners. “Market Share Reports for Property/Casualty Groups and Companies.”

-Department of Motor Vehicles, Vermont. “Older Drivers.”

– Centers for Disease Control and Prevention. “Sobering Facts: Alcohol-Impaired Driving State Fact Sheets.”

Frequently Asked Questions

Who has the cheapest car insurance coverage in Vermont?

Safeco offers the most affordable rates to various Vermont drivers at $403 per year for minimum coverage. USAA is cheap coverage ($405 per year). However, if you are not eligible for their coverage, your next best options for low-priced car insurance are The Hartford ($488) and State Farm ($573).

To find out who offers affordable car insurance in Vermont, you want to make sure to compare rates by getting quotes from top car insurance providers.

How much is minimum car insurance coverage in Vermont per month?

The average cost for minimum coverage in the state is just $39 per month or $476 per year. Vermont drivers have some of the most affordable car insurance rates in the country, and they ranked eighth in our recent national cheap car insurance study.

How much is full coverage car insurance in Vermont?

The average cost of full coverage auto insurance in Vermont is $139 per month or $1,679 annually. Concord Group, Nationwide, and State Farm offer full coverage insurance at an average rate lower than the state’s average by 16%.

Full coverage costs significantly more than minimum liability coverage, and for that reason, many drivers will choose an auto policy with less coverage to save money. If you have a newer vehicle or concerns about minimum coverage not providing you with enough protection, you should consider full coverage insurance.

How can I save on car insurance in Vermont?

There are several ways you can save money on your car insurance premium costs in Vermont. Initially, it would be best to compare quotes from multiple providers to determine which company in the area offers the lowest rates for you. After that, you should inquire about a money-saving driver discount provided by each insurance provider you have in mind.

The more car insurance discounts you are eligible for, the more money you can save. Taking time to make sure your credit report is accurate and up to date and practicing safe driving habits are two more things you can do that will help you save on your Vermont car insurance rates.

How much will my car insurance cost rise with a speeding ticket in Vermont?

The average rate increase for a speeding violation in Vermont is 19%. Vermont relies on a point-based system to determine how much a driver’s insurance costs increase from traffic tickets. Minor violations typically cause drivers to receive 2 points, while more severe violations can cause drivers to have 4 points or more added to Vermont driving records.

What is the best car insurance in Vermont?

The best Vermont auto coverage is full coverage, as it provides the most protection to Vermont drivers.

Is Vermont a no-fault state?

Vermont is an at-fault state, so make sure you have the best Vermont auto insurance to protect yourself in an accident fully.

Is Vermont a PIP state?

PIP auto insurance is not required in Vermont, but some drivers may opt to carry it if they wish.

Is it illegal to drive with no car insurance in Vermont?

Yes, all Vermont drivers need to carry at least the minimum liability insurance required in the state of Vermont. Vermont drivers can get Vermont car insurance quotes to get the cheapest Vermont auto insurance policy.

What is the minimum liability insurance in Vermont?

Vermont requires 25/50/10 of liability insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Heidi Mertlich

Licensed Insurance Agent

Heidi works with top-rated insurance carriers to bring her clients the highest quality protection at the most competitive prices. She founded NoPhysicalTermLife.com, specializing in life insurance that doesn’t require a medical exam. Heidi is a regular contributor to several insurance websites, including FinanceBuzz.com, Insurist.com, and Forbes. As a parent herself, she understands the need ...

Licensed Insurance Agent

UPDATED: Jan 15, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.