North Dakota Cheapest Car Insurance Quotes & Best Coverage Options

The North Dakota cheapest car insurance rates can be found at Allied Insurance, where minimum coverage is only an average of $24 per month. However, drivers who want full coverage insurance in North Dakota will find the cheapest full coverage rates at American Family at an average of $97 per month.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Feb 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Feb 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

- Allied Insurance has the cheapest minimum coverage in North Dakota

- American Family has the cheapest full coverage in North Dakota

- Drivers can save on North Dakota insurance by shopping around for quotes

The North Dakota cheapest car insurance rates are at Allied Insurance. Some of the other best auto insurance companies for cheap North Dakota insurance include American Family and State Farm. Read on to learn more about how to find affordable North Dakota auto insurance companies.

Want to jump right into finding cheap auto insurance in North Dakota? Just enter your ZIP code into our free quote comparison tool.

Affordable North Dakota Car Insurance Rates

Comparing a car insurance quote from at least three to five insurance carriers is the best way to make sure you find the best deal to save money monthly.

| Cheapest Car Insurance in North Dakota - Key Takeaways |

|---|

The cheapest North Dakota car insurance options are: The cheapest North Dakota car insurance options are:Cheapest for minimum coverage: Allied Insurance Cheapest for full coverage: American Family (AmFam) Cheapest after an at-fault accident: Grinnell Mutual Insurance Cheapest after a speeding ticket: State Farm Cheapest after a DUI: Progressive Cheapest for poor credit history: Geico Cheapest for young drivers: State Farm For younger drivers with a speeding violation: American Family For younger drivers with an at-fault accident: State Farm |

- North Dakota Cheapest Car Insurance Quotes & Best Coverage Options

This guide will take a closer look at car insurance providers and coverage options available to drivers in North Dakota for various age groups and help you determine which one is best for your individual needs. You should weigh the low cost of cheaper coverage for minimum coverage requirements against the benefits of carrying comprehensive collision coverage for your standard policy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance for Minimum Coverage in North Dakota

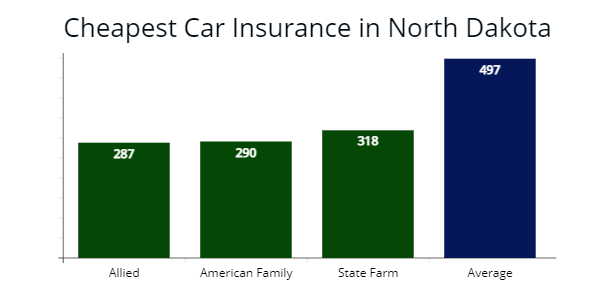

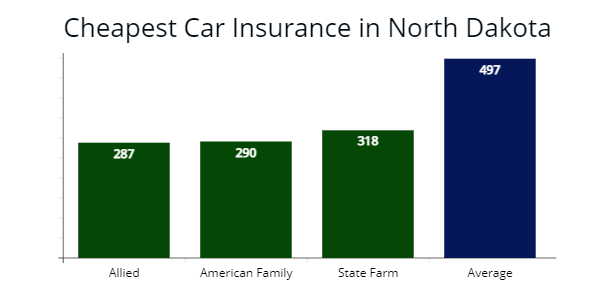

Our recent research found the cheapest auto insurer in North Dakota for minimum liability insurance requirements is Allied Insurance, which provided our agents a $287 per year insurance rate for our sample driver.

The average quote is $497 per year, and Allied’s rate at $287 per year is 43% cheaper, making them the best option for drivers in North Dakota needing minimum liability coverage.

| Auto Insurer | Average annual rate |

|---|---|

| Allied Insurance | $287 |

| American Family | $290 |

| State Farm | $318 |

| USAA | $346 |

| Progressive | $376 |

| Grinnell Mutual | $465 |

| Geico | $517 |

| Nodak Mutual | $623 |

| Auto-Owners Insurance | $741 |

*USAA is for qualified military members, their spouses, and direct family members. Rates may vary depending on driver profiles.

Military members, their spouses, or family members qualify for cheaper car insurance through USAA. Buying minimum coverage insurance requirements at $346 per year through USAA is 31% less expensive than state average rates at $497 per year. Learn more about USAA insurance in our review of USAA car insurance.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Cheapest Full Coverage Car Insurance in North Dakota

If you are interested in having extra coverage options in North Dakota while you are on the road, the cheapest full coverage rates are with American Family at $1,165 per year or $97 per month.

Read more: Understanding Full Coverage Car Insurance

Quotes from this car insurance carrier are 36% less expensive than North Dakota’s average rates of $1,814 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| American Family | $1,165 | $97 |

| State Farm | $1,281 | $106 |

| Geico | $1,444 | $120 |

| North Dakota average | $1,814 | $151 |

*Your rates may vary when you get quotes.

Full coverage car insurance for North Dakota drivers costs more than triple the minimum coverage insurance costs.

While full coverage does cost more due to the higher car insurance rates, having collision and comprehensive coverage along with liability coverage provides much better protection and peace of mind to drivers.Dani Best Licensed Insurance Provider

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Our agents recommend full coverage insurance for North Dakota drivers to protect their vehicle and the other drivers. Collision coverage pays for damage to your vehicle no matter who is at fault. And comprehensive insurance pays for non-collision damage, such as from hitting a traffic sign and property damage from poor weather conditions.

Learn more:

Cheapest Car Insurance With a Speeding Ticket in North Dakota

The best insurance rate for drivers with speeding tickets in North Dakota is State Farm, which offered us a quote at $1,437 per year or $119 per month for full coverage. The average cost of insurance for drivers in North Dakota with a speeding ticket is $2,248, but State Farm is $811 cheaper.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $1,437 | $119 |

| Geico | $1,625 | $135 |

| Allied Insurance | $1,753 | $146 |

| North Dakota average | $2,248 | $187 |

Not sure how a traffic ticket can impact your car insurance rates? Traffic tickets will cause your auto insurance rates to increase regardless of coverage levels. According to the North Dakota Insurance Department, most drivers expect rate increases by 20% on average for traffic violations in the Peace Garden State.

Cheapest Car Insurance in North Dakota With Car Accidents

Drivers in North Dakota with one at-fault accident on their driving record should consider Grinnell Mutual Insurance, the cheapest auto insurance company, which provided our insurance agents with a quote at $1,830 per year or $152 per month.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Grinnell Mutual | $1,830 | $152 |

| Geico | $2,016 | $168 |

| Allied Insurance | $2,369 | $197 |

| North Dakota average | $2,784 | $232 |

The average cost of car insurance for drivers in North Dakota with an accident history is $2,784 per year or $152 per month. Grinnell Mutual’s rate for those with an auto accident is 35% cheaper than state average rates.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Will car insurance rates increase after an accident? One at-fault accident on your driving record in North Dakota, you can expect your car insurance rates to go up by 35% over three years. Depending on the severity of the car accident, you may receive a license suspension, or if caught driving without insurance, penalties increase, according to North Dakota’s Department of Transportation.

Cheapest Car Insurance With a DUI in North Dakota

North Dakota’s least expensive car insurance provider for drivers in North Dakota with a DUI is Progressive during our agent’s research.

Learn more: Progressive Car Insurance Review for Families, Policy Options & Ratings

Progressive’s quote of $1,965 per year or $163 per month is 37% less expensive than average rates and $276 less than the next best option State Farm.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $1,965 | $163 |

| State Farm | $2,241 | $186 |

| Geico | $2,830 | $235 |

| North Dakota average | $3,072 | $256 |

Drivers in North Dakota caught driving under the influence (DUI) are expected to pay car insurance premiums 41% more than drivers who have clean driving records.

Read more: The Best Car Insurance Companies After a DUI

According to North Dakota’s Department of Transportation (NDDOT), after a DUI, drivers in North Dakota will have a driver’s license suspension for 91 to 180 days and have an addiction treatment program evaluation.

Cheapest Car Insurance For Drivers with Poor Credit in North Dakota

According to our analysis, the North Dakota car insurance company offering the best rates with poor credit is Geico.

Geico’s quote of $1,951 per year is 32% less expensive than state average rates of $2,857 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Geico | $1,951 | $162 |

| State Farm | $2,038 | $169 |

| Auto-Owners Insurance | $2,316 | $193 |

| North Dakota average | $2,857 | $238 |

According to the Insurance Information Institute, even if you are a good driver in North Dakota, your credit report and credit score can increase car insurance rates by 37%. That’s because many auto insurance companies look at a person’s ability to pay off their debts, credit cards, or student loans to reflect their ability to make their monthly car insurance payments.

Cheapest Car Insurance for Young Drivers in North Dakota

Want the best car insurance for new drivers in North Dakota? Our analysis found that State Farm is the cheapest insurance company for young drivers in North Dakota looking for full coverage insurance. Our insurance agents received a rate of $3,603 per year from State Farm, which is 26% more affordable than North Dakota state average rates.

Teen drivers looking for affordable minimum coverage in North Dakota should consider American Family at $938 per year and Allied Insurance at $987 per year. Both car insurance companies are 28% cheaper than the average $1,326 North Dakota auto insurance rate.

| Insurer | Full coverage | Minimum coverage |

|---|---|---|

| USAA | $3,176 | $1,081 |

| State Farm | $3,603 | $1,048 |

| American Family | $3,654 | $938 |

| Allied Insurance | $3,727 | $987 |

| Grinnell Mutual | $3,965 | $1,126 |

| Auto-Owners Insurance | $4,180 | $1,435 |

| Geico | $4,768 | $1,851 |

| Progressive | $5,348 | $2,216 |

| Liberty Mutual | $6,328 | $1,421 |

| North Dakota average | $4,843 | $1,326 |

*USAA is for qualified military members, their spouses, and direct family members. Your insurance rates may vary based on the driver’s profile.

Our agents recommend a teen driver in North Dakota carry full coverage insurance and be added to an adult or parent’s policy to save the most money, while avoiding expensive policies. Adding high school or college students to their parent’s insurance policy is $1,460 in annual savings and up to 30% if they qualify for a good student discount with “B” average grades.

Cheapest Car Insurance for Young Drivers in North Dakota with a Speeding Ticket

Young or teen drivers in North Dakota who have a speeding violation will find affordable insurance rates American Family (AmFam), which provided us a quote at $3,813 per year or 32% less expensive than state average rates.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| American Family | $3,813 | $317 |

| State Farm | $4,037 | $336 |

| Geico | $4,941 | $411 |

| North Dakota average | $5,539 | $461 |

Cheapest Car Insurance for Young Drivers in North Dakota with an Auto Accident

Young North Dakota drivers with an at-fault accident can get cheaper insurance rates by getting insurance coverage from State Farm with a quote at $4,121 per year or $343 per month, 36% less than average rates.

The next best coverage option is American Family, quoted at $4,467 per year or 31% less expensive than a typical teen driver rate with a car accident in their driver history.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $4,121 | $343 |

| American Family | $4,467 | $372 |

| Grinnell Mutual Insurance | $4,659 | $388 |

| North Dakota average | $6,430 | $535 |

Best Car Insurance Companies in North Dakota

AutoInsureSavings.org agent’s survey of the best car insurance carriers in North Dakota found Auto-Owners performed the best overall customer service and claims satisfaction. Other best auto policy options based on customer service are American Family and Allied Insurance.

We studied data to help you find the best coverage choices and insurance decisions during our analysis of North Dakota’s best auto insurance companies. The data we use is from the National Association of Insurance Commissioners (NAIC), J.D. Power’s customer satisfaction survey, and AM Best financial strength ratings.

| Insurer | NAIC Complaint Index | J.D. Power Claims Satisfaction | A.M. Best Financial Strength Rating |

|---|---|---|---|

| Allied Insurance | 0.39 | 815 | A- |

| Auto-Owners | 0.44 | 890 | A++ |

| American Family | 0.45 | 862 | A |

| Progressive | 0.60 | 856 | A+ |

| State Farm | 0.66 | 881 | A++ |

| Progressive | 0.67 | 856 | A+ |

| Liberty Mutual | 0.78 | 864 | A |

| Nodak Mutual | 0.80 | n/a | A |

| Allstate | 1.07 | 876 | A+ |

*NAIC complaint index, the lower, the better, JD Power’s claims satisfaction study, the higher, the better, AM Best Ratings, A+ is “excellent,” and A++ is “superior” financial strength.

Allied Insurance (0.39) and Auto-Owners (0.44) perform best with NAIC’s complaint index. Both scored less than the national average of 1.00 with lower than average complaints based on their market share.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Deciding on the best car insurance company in North Dakota is not a simple task. That is because the risk factors that make one car insurance company the best for one driver may make them the worst choice for another. Finding the best auto insurance rates for you will depend on many factors like your age, your driving history, where you live, and your vehicle’s make or model, to name a few.

A recent insurance survey from ValuePenguin reached similar results for North Dakota car insurance carriers. And often, cheap car insurance won’t be the only factor you’ll consider when looking at the cost of coverage.

| Insurer | % respondents extremely satisfied with recent claim | % respondents rated customer service as excellent |

|---|---|---|

| Auto-Owners | 94% | 67% |

| American Family (AmFam) | 86% | 50% |

| Allied | 81% | 67% |

| USAA | 78% | 62% |

| Nodak Mutual | 77% | 60% |

| Progressive | 74% | 34% |

| State Farm | 73% | 46% |

| Geico | 64% | 42% |

| Liberty Mutual | 72% | 58% |

Your best resource for finding the most affordable car insurance rates in North Dakota is an insurance quote comparison tool like AutoInsureSavings.org.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Average Car Insurance Costs by City in North Dakota

Auto insurers in North Dakota use your zip code to calculate your insurance rate, as well as many other risk factors such as marital status, credit score, type of vehicle, and driving history. Your rates can vary by $413 or more, depending on your zip code in North Dakota.

AutoInsureSavings.org licensed insurance agents analyzed cities with the cheapest insurance coverage in North Dakota.

Cheapest Car Insurance in Fargo, ND

Fargo’s cheapest insurance is with Allied Insurance, which provided our agents a $1,187 per year quote with a $500 deductible for comprehensive and collision insurance. Allied’s rate is 35% less expensive than the $1,823 per year Fargo average rates.

| Fargo Company | Average Premium |

|---|---|

| Allied | $1,187 |

| State Farm | $1,231 |

| Geico | $1,489 |

| Fargo average | $1,823 |

Cheap Auto Insurance in Bismarck, ND

Bismarck’s least expensive auto insurance is with AmFam, which offered us a $1,032 per year rate for our sample 30-year-old driver with full coverage. AmFam’s quote is 43% cheaper than the Bismarck average rates of $1,793 per year.

| Bismarck Company | Average Premium |

|---|---|

| American Family | $1,032 |

| Grinnell Mutual | $1,165 |

| State Farm | $1,170 |

| Bismarck average | $1,793 |

Cheapest Auto Insurance in Grand Forks, ND

Cheaper car insurance coverage in Grand Forks can be found with State Farm, which offered our agents a $954 per year quote for a full coverage policy. State Farm’s rate is 42% less expensive than Grank Fork’s average rates of $1,639 per year.

| Grand Forks Company | Average Premium |

|---|---|

| State Farm | $954 |

| Nodak Mutual | $1,076 |

| Geico | $1,261 |

| Grand Forks average | $1,639 |

Cheapest Auto Insurance in Minot, ND

Affordable auto insurance coverage in Minot, North Dakota, is with Geico providing the best rate at $987 per year for a full coverage policy. Geico’s $82 a month rate is 43% less expensive than average rates for Minot residents.

| Minot Company | Average Premium |

|---|---|

| Geico | $987 |

| USAA | $990 |

| Grinnell Mutual | $1,270 |

| Minot average | $1,704 |

Cheap Auto Insurance in West Fargo, ND

Drivers in West Fargo can get cheaper insurance with Allied Insurance, which provided our licensed insurance agents an $1,167 per year rate for a full coverage policy with $100,000 in liability limits. Allied’s quote is 36% less expensive than the average rates of $1,799 in West Fargo.

| West Fargo Company | Average Premium |

|---|---|

| Allied Insurance | $1,167 |

| State Farm | $1,226 |

| Geico | $1,453 |

| West Fargo average | $1,799 |

Cheapest Car Insurance in Dickinson, ND

In Dickinson, North Dakota, our agents found the most affordable insurance rate is Grinnell Mutual Insurance, with a $965 per year rate for a policy with collision and comprehensive coverage. Grinnell Mutual’s quote is 41% less expensive than Dickinson’s average rates of $1,614 per year.

| Dickinson Company | Average Premium |

|---|---|

| Grinnell Mutual Insurance | $965 |

| Nodak Mutual | $1,034 |

| State Farm | $1,181 |

| Dickinson average | $1,614 |

Average Car Insurance Cost for All Cities in North Dakota

| City | Annual premium cost | City | Annual premium cost |

|---|---|---|---|

| Fargo | $1,823 | Ashley | $1,319 |

| Bismarck | $1,793 | Argusville | $1,420 |

| Grand Forks | $1,639 | Turtle Lake | $1,390 |

| Minot | $1,704 | Leeds | $1,422 |

| West Fargo | $1,799 | Edgeley | $1,353 |

| Williston | $1,587 | Mandaree | $1,439 |

| Dickinson | $1,614 | East Dunseith | $1,523 |

| Mandan | $1,319 | Berthold | $1,560 |

| Jamestown | $1,559 | Glenburn | $1,563 |

| Wahpeton | $1,518 | Reile's Acres | $1,523 |

| Devils Lake | $1,566 | Ray | $1,582 |

| Watford City | $1,490 | Fessenden | $1,542 |

| Valley City | $1,590 | Pembina | $1,563 |

| Minot AFB | $1,408 | Forman | $1,523 |

| Grafton | $1,573 | Wyndmere | $1,547 |

| Lincoln | $1,390 | Emerado | $1,473 |

| Beulah | $1,582 | Green Acres | $1,590 |

| Horace | $1,353 | Buxton | $1,319 |

| Rugby | $1,551 | McClusky | $1,523 |

| Grand Forks Air Force Base | $1,473 | Kulm | $1,505 |

| Casselton | $1,585 | Stanton | $1,408 |

| Stanley | $1,573 | Drake | $1,565 |

| Hazen | $1,534 | Logan | $1,511 |

| New Town | $1,563 | Maddock | $1,353 |

| Belcourt | $1,473 | McVille | $1,390 |

| Carrington | $1,408 | Scranton | $1,582 |

| Oakes | $1,523 | Finley | $1,573 |

| Bottineau | $1,319 | Strasburg | $1,588 |

| Lisbon | $1,590 | South Heart | $1,473 |

| Langdon | $1,516 | Neche | $1,505 |

| Mayville | $1,532 | Gladstone | $1,573 |

| Harvey | $1,565 | Manvel | $1,523 |

| Garrison | $1,390 | Arthur | $1,588 |

| Hillsboro | $1,582 | Reynolds | $1,563 |

| Bowman | $1,523 | Hoople | $1,390 |

| Park River | $1,573 | Tower City | $1,319 |

| Burlington | $1,532 | Fairmount | $1,408 |

| New Rockford | $1,473 | Bowbells | $1,582 |

| Washburn | $1,353 | Max | $1,565 |

| Larimore | $1,505 | Four Bears Village | $1,523 |

| Velva | $1,563 | Halliday | $1,532 |

| Rolla | $1,588 | Sawyer | $1,473 |

| Fort Totten | $1,573 | Medina | $1,534 |

| Ellendale | $1,319 | Lansford | $1,505 |

| Shell Valley | $1,408 | Westhope | $1,532 |

| Crosby | $1,582 | Leonard | $1,588 |

| New Salem | $1,565 | Hope | $1,573 |

| Thompson | $1,319 | Gackle | $1,353 |

| Cavalier | $1,523 | St. Thomas | $1,390 |

| Parshall | $1,588 | Oxbow | $1,532 |

| Mapleton | $1,473 | Tappen | $1,563 |

| Cooperstown | $1,534 | Granville | $1,523 |

| Cando | $1,473 | Dunn Center | $1,408 |

| Gwinner | $1,532 | Abercrombie | $1,319 |

| Hettinger | $1,390 | Hazelton | $1,473 |

| Tioga | $1,573 | Alexander | $1,582 |

| Walhalla | $1,408 | Anamoose | $1,573 |

| Surrey | $1,505 | Munich | $1,534 |

| Beach | $1,582 | Flasher | $1,565 |

| Hankinson | $1,532 | Porcupine | $1,390 |

| Linton | $1,563 | Gilby | $1,582 |

| Belfield | $1,353 | St. John | $1,505 |

| Wishek | $1,573 | Golden Valley | $1,408 |

| Kenmare | $1,523 | Harmon | $1,473 |

| Cannon Ball | $1,532 | Carson | $1,573 |

| Enderlin | $1,319 | Taylor | $1,538 |

| Hebron | $1,534 | Des Lacs | $1,523 |

| Kindred | $1,573 | Grenora | $1,532 |

| Richardton | $1,565 | Aneta | $1,353 |

| Napoleon | $1,563 | Selfridge | $1,319 |

| New England | $1,390 | Kensal | $1,582 |

| Killdeer | $1,473 | Hunter | $1,532 |

| Wilton | $1,408 | White Shield | $1,565 |

| Glen Ullin | $1,582 | Christine | $1,390 |

| Underwood | $1,565 | Sheyenne | $1,564 |

| Hatton | $1,358 | Fordville | $1,534 |

| Rolette | $1,505 | Riverdale | $1,473 |

| Milnor | $1,561 | New Leipzig | $1,566 |

| Drayton | $1,319 | Lignite | $1,569 |

| Harwood | $1,523 | Litchville | $1,563 |

| Steele | $1,534 | Wimbledon | $1,408 |

| LaMoure | $1,582 | Page | $1,319 |

| Minto | $1,567 | Minnewaukan | $1,568 |

| Northwood | $1,565 | Sherwood | $1,523 |

| Mohall | $1,526 | Ruthville | $1,582 |

| Dunseith | $1,353 | Buffalo | $1,505 |

| Mott | $1,390 | Edinburg | $1,510 |

| Elgin | $1,319 | Fort Yates | $1,529 |

| Lakota | $1,473 | Plaza | $1,486 |

| Portland | $1,515 | Michigan City | $1,390 |

| Towner | $1,408 | Rhame | $1,353 |

| Center | $1,398 | Mooreton | $1,582 |

| Lidgerwood | $1,319 | Grandin | $1,364 |

Minimum Car Insurance Requirements in North Dakota

According to the North Dakota Insurance Department, vehicle registration requires all licensed drivers to carry a minimum amount of liability (bodily injury liability and property damage liability), uninsured motorist coverage, and personal injury protection (PIP) in their car insurance policies.

The insurance requirements pay for bodily injury and property damage sustained to other people or motor vehicles. Uninsured motorist coverage (also known as underinsured motorist coverage) pays for accidents with uninsured motorists, and personal injury protection pays for medical expenses to you or other vehicle occupants.

| Liability insurance | State minimum requirements |

|---|---|

| Bodily injury liability | $25,000 per person / $50,000 per accident |

| Property damage liability | $25,000 per accident |

| Uninsured/Underinsured motorist bodily injury insurance | $25,000 per person / $50,000 per accident |

| Personal injury protection (PIP) | $30,000 |

To learn more and find the best car insurance in North Dakota, contact the experts at AutoInsureSavings.org. Our licensed insurance professionals will be happy to answer any questions you have about getting cheap car insurance in North Dakota.

Methodology

AutoInsureSavings.org comparison shopping study used a full-coverage auto policy for a 30-year-old driving a 2018 Honda Accord with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily liability | $50,000 per person/$100,000 per accident |

| Property damage | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured motorist bodily injury & underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

We used insurance rates for drivers with accident histories, credit scores, and marital status for other North Dakota rate analyses. We used insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your auto insurance rates may vary when you get quotes.

Sources

– Insurance Information Institute. “Facts + Statistics: Auto Insurance.”

– North Dakota State Government. “Young Drivers.”

– National Highway Traffic Safety Administration. “Traffic Safety Facts.”

– National Association of Insurance Commissioners. “Market Share Reports for Property/Casualty Groups and Insurance Companies.”

– North Dakota Insurance Department, “Insurance 101.”

– North Dakota Transportation Department. “Insurance Requirements.”

Frequently Asked Questions

Who has the cheapest car insurance in North Dakota?

We found the top car insurance companies that offer the lowest North Dakota driver’s average rates are Allied at $287 per year, American Family at $290 per year, and State Farm at $318 per year for a state minimum coverage policy for a 30-year-old with clean driving history.

How much is car insurance in North Dakota per month?

On average, drivers pay around $41 per month for state minimum coverage in North Dakota and $151 per month for full coverage insurance. Based on our research, Allied Insurance ($24 per month) is one of the state’s most affordable car insurance companies. Most driver’s average annual rate is around $497 per year ($41 a month) for state minimums and $1,814 per year ($151 a month), including comprehensive and collision coverage.

How much is full coverage car insurance in North Dakota?

On average, most drivers in North Dakota pay for full coverage insurance is $151 per month or $1,814 per year. North Dakota’s top insurance companies that offer the lowest rate for drivers interested in full coverage auto insurance policies include American Family ($1,165 per year), State Farm ($1,281 per year), and Geico ($1,444 per year). All three insurers provide auto insurance quotes 21% lower than average rates, depending on your driver profile.

How can I save on car insurance in North Dakota?

There are many things drivers can do to help save money on their car insurance rates in North Dakota. First, you will need to compare quotes from multiple insurance providers to find the right company that offers the exact level of coverage in North Dakota you need at the most affordable price. Finding the cheapest car insurance rates for your needs will vary depending on your personal situation.

Another thing drivers can do to help them save more on their car insurance rates is ask their auto insurance provider about a money-saving driver discount they may be eligible for. Many companies offer car insurance discounts for drivers who have multiple coverage policies with them or drivers who have no prior accidents or violations on their driving records. Consider Usage-Based car insurance, such as AmFam’s KnowYourDrive program. You can get long-term savings up to 20% at renewal, depending on your safe driving habits. And make sure to maintain a good credit score.

Is it illegal to drive without car insurance in North Dakota?

Yes, it is illegal to drive without insurance in North Dakota. All resident drivers must carry North Dakota’s required minimum coverages.

Is North Dakota a no-fault state?

Yes, North Dakota is a no-fault state, making it important for drivers to have the best North Dakota car insurance for full protection.

What is the penalty for driving without insurance in North Dakota?

Drivers can face fines, license suspension, and even jail time. However, drivers can easily get affordable North Dakota auto insurance by shopping around.

Does North Dakota require uninsured motorist coverage?

Yes, North Dakota car insurance requirements are that all drivers must have uninsured motorist coverage on their policy.

Is North Dakota a hands-free state?

Yes, texting while driving is illegal in North Dakota. Since a ticket for texting can raise rates, drivers who get caught texting will have to shop for North Dakota auto insurance quotes to see if they can get a cheaper rate.

Is $100 a lot for car insurance?

$100 a month for full coverage is normal in North Dakota.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Feb 8, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.