New Hampshire Cheapest Car Insurance & Best Coverage Options

Travelers and Progressive have New Hampshire's cheapest car insurance and best coverage options. Drivers who want minimum coverage will find the cheapest average rate at Travelers for $32/mo. NH drivers who want full coverage, though, will find the cheapest rate at Progressive for an average of $82/mo.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Jan 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jan 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Want New Hampshire’s cheapest car insurance and best coverage options? Start with Travelers and Progressive for the cheapest rates for minimum and full coverage. Read on to learn more about the best auto insurance companies for cheap NH car insurance.

To find the cheapest car insurance in NH right away, enter your ZIP code into our free quote comparison tool.

Affordable New Hampshire car insurance rates

Drivers have several options to choose from when purchasing a new auto insurance policy in New Hampshire.

| Cheapest Car Insurance in New Hampshire - Quick Hits |

|---|

The cheapest New Hampshire car insurance options are: The cheapest New Hampshire car insurance options are:Cheapest for minimum coverage: Travelers Cheapest for full coverage: Progressive Cheapest after an at-fault accident: State Farm Cheapest after a speeding ticket: Progressive Cheapest after a DUI: Progressive Cheapest for poor credit history: Geico Cheapest for young drivers: Allstate For young drivers with a speeding violation: Progressive For young drivers with an at-fault accident: Progressive |

In this New Hampshire auto insurance guide, you will find comparisons between some of the industry’s best car insurance companies and their rates for various drivers.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Who has the cheapest car insurance for minimum coverage in New Hampshire?

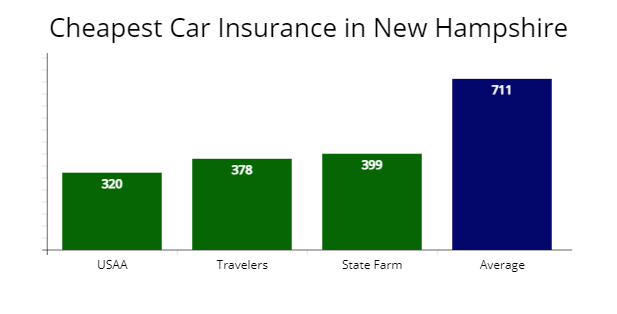

The car insurance company offering the cheapest annual average rates for minimum coverage is Travelers, which provided us a quote at $378 per year or a $31 monthly rate.

Learn more: Review of Travelers Car Insurance Options; a Comparison With Other Insurers

Traveler’s rate is 47% less expensive than New Hampshire’s average of $711 per year.

For military members or a family member of a service member, USAA has the best car insurance options for veterans and military members, with a $320 quote for a 30-year-old driver. Learn more about USAA in our review of USAA car insurance.

| Company | Average annual rate |

|---|---|

| USAA | $320 |

| Travelers | $378 |

| State Farm | $399 |

| Geico | $423 |

| Progressive | $476 |

| Concord Group | $498 |

| Nationwide | $552 |

| Allstate | $659 |

| MetLife | $796 |

| Hanover | $985 |

*USAA is for qualified military members, their spouses, and direct family members. Your rates may vary based on the driver’s profile.

Many drivers choose state minimum coverage to stay legal on the road and pay the lowest rates. The difference between the cost of minimum and full coverage insurance in New Hampshire is $1,272 per year.

Although minimum liability coverage offers savings and helps many drivers stay within their budget, there is always the risk of insufficient protection while driving.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

If a crash occurs while you only have state minimum liability coverage and the damages you caused exceed your policy limits. In that case, you will be responsible for paying for the remaining damage out of your pocket.

Who has the cheapest full coverage car insurance in New Hampshire?

The insurance company offering the lowest rates for full coverage auto insurance in New Hampshire is Progressive, which provided our agents a $980 yearly rate.

Learn more: Progressive Car Insurance Review for Families, Policy Options & Ratings

Progressive’s insurance rate is 30% cheaper than the average $1,385 quote in New Hampshire.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $980 | $81 |

| Geico | $1,040 | $86 |

| State Farm | $1,167 | $97 |

| Nationwide | $1,210 | $100 |

| Liberty Mutual | $1,516 | $126 |

| USAA | $986 | $82 |

| Average rates | $1,385 | $115 |

*USAA is for qualified military members, their spouses, and direct family members. Your rates may vary based on the driver’s profile.

While full coverage may not be required, it is an excellent insurance option to ensure you will not have to pay for damages out of pocket.

Full coverage includes comprehensive and collision coverage, while the state minimum coverage policy doesn’t.

If your car is worth more than 10% of your combined deductibles, it is recommended to buy full auto insurance coverage.Daniel Walker Licensed Insurance Agent

Collision and comprehensive coverage will pay for property damage to your motor vehicle no matter who is at fault and from natural disasters such as tree branches falling on your car.

Learn more:

- Understanding Collision Car Insurance Coverage: What You Need to Know

- Understanding Comprehensive Car Insurance Coverage: What You Need to Know

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

What’s the cheapest car insurance with a speeding ticket in New Hampshire?

For drivers with a speeding violation, the cheapest auto insurer is Progressive, which offered us a quote of $1,432 per year or $119 a month. Progressive’s rate is $699 less expensive than average.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $1,432 | $119 |

| State Farm | $1,640 | $136 |

| Geico | $1,855 | $154 |

| Average rates | $2,131 | $177 |

The amount your auto insurance rates will rise after you receive a speeding ticket will vary based on how fast you were going above the speed limit and how many tickets you have on your driving record.

Wondering how much will my auto insurance go up with a speeding ticket? Our research found the average rate increase after traffic tickets in New Hampshire is 22%.

Who has the cheapest car insurance in New Hampshire with a car accident?

The cheapest full coverage auto quote for drivers with one at-fault accident is State Farm. They provided us a quote at $2,123 annually or 27% cheaper than the average $2,875 rate. Your next best option is Auto-Owners with a 23% less expensive rate at $2,235 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $2,123 | $176 |

| Auto-Owners | $2,235 | $186 |

| Geico | $2,547 | $212 |

| Average rates | $2,875 | $239 |

Keep in mind the insurance company that offers the cheapest rates will vary from one driver to the next. Insurance providers determine your premium cost based on your age, driving history, credit rating, and several other factors.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

While many drivers can save more by choosing State Farm, other drivers who have one or more auto accidents on their driving records may save more money by choosing a different company such as Geico or Auto-Owners.

Who has the cheapest car insurance with a DUI in New Hampshire?

The auto insurer with the cheapest auto insurance for drivers with a DUI conviction in New Hampshire is Progressive, which provided AutoInsureSavings.org agents a $2,432 quote for full coverage.

Learn more: The Best Car Insurance Companies After a DUI

Progressive’s rate is 31% less expensive than New Hampshire’s average of $3,519 per year for a DUI.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $2,432 | $202 |

| Geico | $2,870 | $239 |

| Auto-Owners | $3,030 | $252 |

| Average rates | $3,519 | $293 |

According to the New Hampshire Department of Safety (Division of Motor Vehicles), drivers can expect their car insurance rates to go up as much as 83% after being convicted of a DUI.

You will also be required to file for SR-22 insurance for the next three years, possible loss of driving privileges, a required ignition interlock device installed in your motor vehicle, along with higher than average rates.

Who has the cheapest car insurance with poor credit in New Hampshire?

The insurance provider with the most affordable car insurance for drivers with poor credit or a low credit score is Geico Insurance Agency, with a $1,573 annual rate or $131 per month for our sample 30-year-old. Travelers is your next cheapest option with a $136 monthly rate or 37% less expensive than average.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Geico | $1,573 | $131 |

| Travelers | $1,634 | $136 |

| Progressive | $1,789 | $149 |

| Average rates | $2,563 | $213 |

Drivers who have poor credit or bad credit scores are more likely to be an increased risk for insurance companies, and therefore these providers will raise their rates based on these risks.

Therefore, it is essential that drivers who want to save more on their car insurance take the time to check their credit reports and rating.

Make sure to look for any is mistakes on your credit report and check into any claims that you do not recognize or have already been paid off.

We found that New Hampshire drivers with poor credit pay, on average, 102% more than drivers with average credit.

What’s the cheapest car insurance for young drivers in New Hampshire?

If you are a young driver looking to save money on car insurance, compare quotes with Travelers Insurance. They provided our insurance agents a $3,433 quote for those with a clean driving record. Travelers is 43% cheaper than New Hampshire’s rate of $5,983.

Allstate offers the most affordable coverage rate for young drivers’ minimum coverage insurance policies at $1,235 per year or a $102 monthly rate.

Read more: The Best Car Insurance for New Drivers: A Comprehensive Guide

Other auto insurers to compare multiple car insurance quotes for state minimums are Travelers and Auto-Owners for young or teen drivers. Both companies are 38% cheaper than the statewide average rate.

| Company | Full coverage | Minimum coverage |

|---|---|---|

| Travelers | $3,433 | $1,249 |

| Auto-Owners | $3,654 | $1,285 |

| USAA | $3,712 | $1,333 |

| State Farm | $3,904 | $1,582 |

| Geico | $4,232 | $1,873 |

| Progressive | $4,765 | $1,964 |

| Nationwide | $5,238 | $2,054 |

| Allstate | $6,674 | $1,235 |

| MetLife | $7,295 | $2,743 |

| Hanover | $7,785 | $2,984 |

| New Hampshire average | $5,983 | $2,049 |

*USAA is for qualified service members, their spouses, and direct family members. Your rates may vary based on the driver’s profile.

Our research found that car insurance for young drivers can be three times more expensive than older drivers’ insurance, approximately $2,500 more expensive.

According to statistics, because younger drivers get into more auto accidents, insurance companies will significantly raise their rates.

Who has the cheapest car Insurance for young drivers with a speeding Ticket?

If you are a teen driver with a speeding violation in your driving history, the cheapest insurance premium is Progressive at $4,765 per year or a $397 monthly rate.

Progressive’s rate is $1,479 cheaper than New Hampshire’s average for young drivers with a speeding violation, or 24% less expensive.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $4,765 | $397 |

| State Farm | $4,983 | $415 |

| Geico | $5,237 | $436 |

| Average rates | $6,244 | $520 |

The cheapest car insurance for young drivers with a car accident?

According to a comparison-shopping study, young New Hampshire drivers with one at-fault accident can find the best insurance coverage with Progressive.

Progressive’s rate at $4,877 per year is $1,892 less expensive than the New Hampshire average at-fault accident rate of $6,769 for younger drivers.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $4,877 | $406 |

| State Farm | $5,632 | $469 |

| Geico | $5,943 | $495 |

| Average rates | $6,769 | $564 |

Best Auto Insurance Companies in New Hampshire

According to our research and the rates shown in this guide, Geico, Travelers, State Farm, and Progressive are four of the best car insurance options if your primary concern is the price.

According to ValuePeguin’s customer satisfaction survey, Auto-Owners is the best auto insurer in New Hampshire.

| Company | % of respondents extremely satisfied with recent claim | % of respondents rated customer service as excellent |

|---|---|---|

| Auto-Owners | 100% | 67% |

| USAA | 78% | 62% |

| State Farm | 73% | 46% |

| Allstate | 72% | 47% |

| Progressive | 74% | 34% |

| Geico | 64% | 42% |

| Liberty Mutual | 63% | 55% |

| Hanover | n/a | n/a |

| MetLife | n/a | n/a |

It is important to remember that one driver’s best auto insurance company may not be the best option for another. Many factors help determine how much your auto insurance premium will be.

AutoInsureSavings.org licensed agents also looked at each insurer’s complaint index from the National Association of Insurance Commissioners (NAIC), J.D. Power claims satisfaction score, and their financial strength ratings from AM Best.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Auto-Owners has the lowest complaint index with NAIC at 0.18, meaning Auto-Owners received 18% of complaints compared to other auto insurers of equal market share.

Auto-Owners had one of the higher J.D. Power claims satisfaction scores at 890, exceeding expectations. If excellent customer service and insurance claims handling is a priority for you, our agents recommend Auto-Owners.

| Insurer | NAIC Complaint Index | J.D. Power claims satisfaction score | AM Best Financial Strength Rating |

|---|---|---|---|

| Auto-Owners | 0.18 | 890 | A |

| Progressive | 0.59 | 856 | A+ |

| Allstate | 0.63 | 876 | A+ |

| State Farm | 0.66 | 881 | A++ |

| USAA | 0.68 | 890 | A++ |

| Amica | 0.91 | 907 | A+ |

| Geico | 1.01 | 871 | A++ |

| Liberty Mutual | 1.32 | 813 | A+ |

| MetLife | 1.24 | 886 | A |

All insurance companies had financial strength ratings of “A” or better from AM Best, which means each company had “excellent” or “superior” financial strength to cover insurance claims.

New Hampshire Auto Insurance Cost by City

Your zip code is a factor insurance companies use to determine your rate, as well as credit scores, driving records, and type of motor vehicle.

Depending on driver profiles and zip code, full coverage car insurance rates can vary by $539 per year. Auto insurers will charge more for coverage in large urban cities with more car accidents and higher auto theft rates.

The Cheapest auto insurance in Manchester, NH?

People in Manchester can find cheap auto insurance with Auto-Owners with a quote 18% cheaper than the Manchester average at $1,311 annually or a $109 monthly rate for full coverage insurance.

| Manchester Company | Average Premium |

|---|---|

| Auto-Owners | $1,311 |

| Travelers | $1,380 |

| State Farm | $1,466 |

| Manchester average | $1,588 |

The cheapest auto insurance in Nashua, NH?

Cheap car insurance in Nashua is with Progressive providing our agents the best rate of $1,160 per year for a full coverage policy. Progressive’s $96 monthly rate is 27% less expensive than the average for residents of Nashua.

| Nashua Company | Average Premium |

|---|---|

| Progressive | $1,160 |

| Travelers | $1,255 |

| Auto-Owners | $1,287 |

| Nashua average | $1,478 |

The Cheapest auto insurance in Concord, NH?

AutoInsureSavings.org licensed agents found car insurance premiums are cheaper with Progressive for Concord residents at $1,187 per year or $98 per month. Progressive’s rate is 23% less expensive than Concord’s average rate of $1,539 annually.

| Concord Company | Average Premium |

|---|---|

| Progressive | $1,187 |

| State Farm | $1,310 |

| Concord Group | $1,468 |

| Concord average | $1,539 |

The cheapest auto insurance in Derry, NH?

Derry drivers can get the cheapest car insurance rates through Travelers with coverage rates at $1,080 per year or 27% lower than the citywide average of $1,470. Auto-Owners is the next best option offering car insurance premiums at $1,136 per year.

| Derry Company | Average Premium |

|---|---|

| Travelers | $1,080 |

| Auto-Owners | $1,136 |

| Concord Group | $1,280 |

| Derry average | $1,470 |

The cheapest auto insurance in Dover, NH?

We found the most affordable coverage for Dover drivers is State Farm, providing a quote of $1,151 per year or 26% less expensive than the average quote. And at $1,279 annually, Auto-Owners is 18% lower than average, making both insurers the best car insurance option.

| Dover Company | Average Premium |

|---|---|

| State Farm | $1,151 |

| Auto-Owners | $1,279 |

| Progressive | $1,354 |

| Dover average | $1,555 |

The cheapest auto insurance in Rochester, NH?

In Rochester, drivers will find the cheapest car insurance policy rates with Progressive, which provided our agents a $1,038 annual quote for a 30-year-old driver with full coverage. Progressive’s $86 monthly rate is 30% less expensive than Rochester’s $1,477 average.

| Rochester Company | Average Premium |

|---|---|

| Progressive | $1,038 |

| Auto-Owners | $1,127 |

| Concord Group | $1,402 |

| Rochester average | $1,477 |

Average car insurance cost for all cities:

| City | Annual Premium Cost | City | Annual Premium Cost |

|---|---|---|---|

| Acworth | $1,240 | Langdon | $1,357 |

| Albany | $1,295 | Lebanon | $1,252 |

| Alexandria | $1,321 | Lee | $1,345 |

| Allenstown | $1,252 | Lempster | $1,295 |

| Alstead | $1,349 | Lincoln | $1,365 |

| Alton | $1,344 | Lisbon | $1,321 |

| Amherst | $1,295 | Litchfield | $1,252 |

| Andover | $1,357 | Littleton | $1,349 |

| Antrim | $1,345 | Londonderry | $1,355 |

| Ashland | $1,250 | Loudon | $1,295 |

| Atkinson | $1,321 | Lyman | $1,365 |

| Auburn | $1,343 | Lyme | $1,250 |

| Barnstead | $1,365 | Lyndeborough | $1,345 |

| Barrington | $1,371 | Madbury | $1,240 |

| Bartlett | $1,295 | Madison | $1,314 |

| Bath | $1,240 | Manchester | $1,588 |

| Bedford | $1,250 | Marlborough | $1,252 |

| Belmont | $1,314 | Marlow | $1,365 |

| Bennington | $1,345 | Mason | $1,250 |

| Benton | $1,349 | Meredith | $1,290 |

| Berlin | $1,249 | Merrimack | $1,355 |

| Bethlehem | $1,240 | Middleton | $1,345 |

| Boscawen | $1,250 | Milan | $1,276 |

| Bow | $1,252 | Milford | $1,249 |

| Bradford | $1,357 | Milton | $1,314 |

| Brentwood | $1,290 | Monroe | $1,240 |

| Bridgewater | $1,249 | Mont Vernon | $1,199 |

| Bristol | $1,343 | Moultonborough | $1,249 |

| Brookfield | $1,333 | Nashua | $1,478 |

| Brookline | $1,219 | Nelson | $1,252 |

| Campton | $1,240 | New Boston | $1,295 |

| Canaan | $1,314 | New Castle | $1,321 |

| Candia | $1,355 | New Durham | $1,290 |

| Canterbury | $1,249 | New Hampton | $1,240 |

| Carroll | $1,320 | New Ipswich | $1,314 |

| Center Harbor | $1,299 | New London | $1,343 |

| Charlestown | $1,365 | Newbury | $1,249 |

| Chatham | $1,252 | Newfields | $1,355 |

| Chester | $1,290 | Newington | $1,365 |

| Chesterfield | $1,249 | Newmarket | $1,349 |

| Chichester | $1,355 | Newport | $1,252 |

| Claremont | $1,343 | Newton | $1,249 |

| Clarksville | $1,240 | North Hampton | $1,290 |

| Colebrook | $1,302 | Northfield | $1,314 |

| Columbia | $1,325 | Northumberland | $1,343 |

| Concord | $1,539 | Northwood | $1,302 |

| Conway | $1,365 | Nottingham | $1,249 |

| Cornish | $1,290 | Orange | $1,365 |

| Croydon | $1,349 | Orford | $1,357 |

| Dalton | $1,314 | Ossipee | $1,325 |

| Danbury | $1,249 | Pelham | $1,240 |

| Danville | $1,255 | Pembroke | $1,274 |

| Deerfield | $1,340 | Peterborough | $1,290 |

| Deering | $1,249 | Piermont | $1,285 |

| Derry | $1,470 | Pittsburg | $1,340 |

| Dorchester | $1,302 | Pittsfield | $1,355 |

| Dover | $1,555 | Plainfield | $1,249 |

| Dublin | $1,365 | Plaistow | $1,366 |

| Dummer | $1,240 | Plymouth | $1,255 |

| Dunbarton | $1,357 | Portsmouth | $1,290 |

| Durham | $1,249 | Randolph | $1,302 |

| East Kingston | $1,325 | Raymond | $1,310 |

| Easton | $1,255 | Richmond | $1,240 |

| Eaton | $1,249 | Rindge | $1,349 |

| Effingham | $1,331 | Rochester | $1,477 |

| Ellsworth | $1,314 | Rollinsford | $1,249 |

| Enfield | $1,355 | Roxbury | $1,331 |

| Epping | $1,290 | Rumney | $1,363 |

| Epsom | $1,249 | Rye | $1,259 |

| Errol | $1,302 | Salem | $1,368 |

| Exeter | $1,310 | Salisbury | $1,290 |

| Farmington | $1,240 | Sanbornton | $1,330 |

| Fitzwilliam | $1,331 | Sandown | $1,249 |

| Francestown | $1,240 | Sandwich | $1,302 |

| Franconia | $1,349 | Seabrook | $1,290 |

| Franklin | $1,259 | Sharon | $1,357 |

| Freedom | $1,290 | Shelburne | $1,355 |

| Fremont | $1,249 | Somersworth | $1,259 |

| Gilford | $1,325 | South Hampton | $1,240 |

| Gilmanton | $1,302 | Springfield | $1,351 |

| Gilsum | $1,330 | Stark | $1,261 |

| Goffstown | $1,359 | Stewartstown | $1,249 |

| Gorham | $1,302 | Stoddard | $1,310 |

| Goshen | $1,240 | Strafford | $1,330 |

| Grafton | $1,351 | Stratford | $1,302 |

| Grantham | $1,249 | Stratham | $1,351 |

| Greenfield | $1,310 | Sugar Hill | $1,359 |

| Greenland | $1,359 | Sullivan | $1,240 |

| Greenville | $1,330 | Sunapee | $1,355 |

| Groton | $1,259 | Surry | $1,249 |

| Hampstead | $1,261 | Sutton | $1,259 |

| Hampton | $1,311 | Swanzey | $1,310 |

| Hampton Falls | $1,359 | Tamworth | $1,325 |

| Hancock | $1,370 | Temple | $1,288 |

| Hanover | $1,302 | Thornton | $1,249 |

| Harrisville | $1,351 | Tilton | $1,355 |

| Hart's Location | $1,240 | Troy | $1,307 |

| Haverhill | $1,355 | Tuftonboro | $1,302 |

| Hebron | $1,249 | Unity | $1,261 |

| Henniker | $1,260 | Wakefield | $1,248 |

| Hill | $1,310 | Walpole | $1,351 |

| Hillsborough | $1,328 | Warner | $1,260 |

| Hinsdale | $1,363 | Warren | $1,240 |

| Holderness | $1,248 | Washington | $1,330 |

| Hollis | $1,261 | Waterville Valley | $1,363 |

| Hooksett | $1,359 | Weare | $1,355 |

| Hopkinton | $1,330 | Webster | $1,310 |

| Hudson | $1,302 | Wentworth | $1,261 |

| Jackson | $1,355 | Westmoreland | $1,302 |

| Jaffrey | $1,351 | Whitefield | $1,328 |

| Jefferson | $1,240 | Wilmot | $1,248 |

| Keene | $1,260 | Wilton | $1,260 |

| Kensington | $1,240 | Winchester | $1,351 |

| Kingston | $1,261 | Windham | $1,302 |

| Laconia | $1,310 | Windsor | $1,240 |

| Lancaster | $1,328 | Wolfeboro | $1,355 |

| Landaff | $1,248 | Woodstock | $1,260 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Minimum Car Insurance Requirements in New Hampshire

In New Hampshire, car insurance is not a requirement, but our licensed agents still recommend buying insurance coverage to protect yourself and your assets. If you are at-fault in an auto accident, you will be held liable for bodily injury and property damages you cause to others or their property.

People who buy an auto policy in New Hampshire must have the minimum coverage liability insurance requirements illustrated below.

| Liability insurance | Minimum coverage |

|---|---|

| Bodily injury liability coverage | $25,000 per person and $50,000 per accident |

| Property damage liability coverage | $25,000 per accident |

| Uninsured/Underinsured bodily injury liability coverage | $25,000 per person and $50,000 per accident |

| Medical payments coverage | $1,000 per accident |

While you may have a car insurance policy with minimum coverage limits, AutoInsureSavings.org licensed agents recommend getting higher liability limits and uninsured motorist coverage with a full coverage policy.

Full coverage includes collision and comprehensive insurance for more protection for property damage to your vehicle.

To learn more about the most affordable car insurance options in New Hampshire, contact the experts at AutoInsureSavings.org. Our licensed professionals will be happy to answer any questions you have.

Methodology

AutoInsureSavings.org comparison shopping study used a full-coverage auto policy for a 30-year-old driving a 2018 Honda Accord with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person / $100,000 per accident |

| Property damage liability | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured / underinsured motorist bodily injury | $50,000 per person / $100,000 per accident |

| Comprehensive and collision coverage | $500 deductible |

We used average rates for drivers with an accident history, credit score, and marital status for other New Hampshire rate analyses. We used insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your rates may vary when you get quotes.

Final Thoughts

Many of the cheapest car insurance companies in New Hampshire also offer discounts to help you save on your car insurance policy There are different types of car insurance discounts depending on your situation.

Sources

– National Highway Traffic Safety Administration. “Traffic Safety Facts.”

– National Association of Insurance Commissioners. “Market Share Reports for Property/Casualty Groups and Companies.”

– Centers for Disease Control and Prevention. “Sobering Facts: Alcohol-Impaired Driving State Fact Sheets.”

– Insurance Information Institute. “Do auto insurance premiums go up after a claim?.”

– New Hampshire Department of Safety Division of Motor Vehicles. “Financial Responsibility – Insurance Requirements.”

Frequently Asked Questions

Who has the cheapest car insurance in New Hampshire?

USAA offers some of the most affordable rates, $320 per year for minimum coverage, to drivers throughout the country, including New Hampshire.

But for drivers who are not eligible for their coverage, Travelers is an excellent alternative option with $378 per year insurance rates. While they are affordable, USAA and Travelers are also top-rated regarding overall customer service and satisfaction.

USAA has a claims satisfaction score of 890 from J.D. Power and an A++ rating from A.M. Best, while Travelers has a score of 838 and an A++ rating.

How much is car insurance in New Hampshire per month?

Our research found the average rate of car insurance in New Hampshire per month is $115. Progressive offers drivers a potential savings of around $34, with an average rate for most drivers with full coverage at $81 monthly.

How much will my car insurance rise with a speeding ticket in New Hampshire?

In New Hampshire, drivers can expect their rates to increase by as much as $285 per year or 22% after receiving a traffic ticket. That is an annual average of $1,670.

The national average rate drivers pay after they receive a speeding violation is $1,727. Drivers in New Hampshire pay around $57 less than that.

How much is full coverage car insurance in New Hampshire?

The average rate for full coverage auto insurance in New Hampshire is $115 per month or $1,385 annually. The cheapest provider we found for full coverage insurance in the state was Progressive. Their average rate for this type of coverage is $81 per month or $980 annually.

How do I save on car insurance in New Hampshire?

There are many different ways to save on car insurance in New Hampshire. The first is to compare insurance rates from top companies in the area. Finding out about a money-saving driver discount you are eligible for is another way. Being a safe driver with a clean driving record, keeping track of your credit report, and taking out multiple life policies or homeowners’ insurance from companies that offer them.

What is the best car insurance in New Hampshire?

Drivers looking for the best car insurance in NH will want to look into full coverage policies from top companies, as full coverage has the best financial safety net for accidents.

Is New Hampshire an at-fault state?

NH is an at-fault state. Whoever caused the accident is responsible for all party’s medical and property damage costs.

Is it illegal to drive without car insurance in New Hampshire?

Yes, drivers must carry the required NH auto insurance.

Is PIP required in New Hampshire?

No, PIP is not required.

What are the penalties for driving without insurance in New Hampshire?

Penalties for driving without NH car insurance can range from fines to jail time, depending on the number of offenses.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Jan 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.