Ohio Cheapest Car Insurance & Best Car Insurance Options

You can find Ohio's cheapest car insurance and best car insurance options at Westfield, where minimum coverage is an average of $34 per month. The next cheapest options in Ohio are Erie and State Farm, as their average minimum coverage rates are only slightly above Westfield's average rates.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Automatio...

Insurance Operations Specialist

UPDATED: Jan 29, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jan 29, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

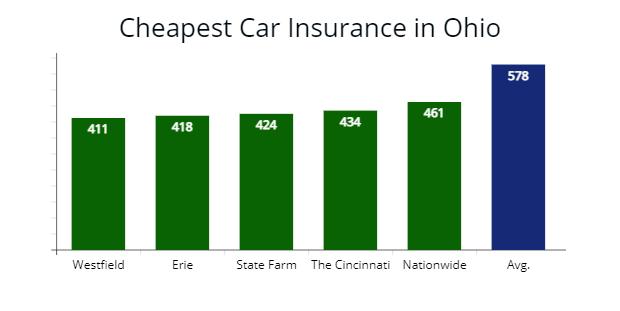

Westfield has Ohio’s cheapest car insurance and best car insurance options, followed by Erie and State Farm, as all have rates below the Ohio average. Continue reading to learn more about the best auto insurance companies in Ohio, as well as what coverages you should carry, cheapest cities, and more.

To find the cheapest insurance in Ohio today, use our free quote tool to get quotes immediately.

Who has the cheapest car Insurance in Ohio?

How do you choose the best way to get Ohio auto insurance for your needs and your budget? In this article, we will help you save money and find cheap car insurance by making good policy decisions with confidence.

- Car Insurance Rates in Ohio

The most affordable company with the best coverage in Ohio is Westfield, with a $411 quote for minimum coverage. The next cheapest insurer is Erie, with a price quote of $418 per year (read more about Erie in our review of Erie auto insurance).

The most expensive insurers across Ohio are Farmers and Allstate car insurance, with minimum coverage policies costing $729 annually. Both carriers are 25% more than the cheapest auto insurance company in Ohio. This is just one example of why it is important to do comparison shopping with at least three to five companies before buying coverage. Browsing with comparative purposes allows you to find the best deal.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ohio Cheapest Car Insurance

The cost of an auto policy is arguably the most significant consideration when shopping for an affordable option from an insurance carrier.

An average driver with a good driving history and clean record will find the best coverage rates with Westfield, Erie, and State Farm for minimum auto coverage. We quoted our profiled driver $476 per year on average, or about 18% cheaper than the Ohio average insurance for drivers of $578 per year.

As part of our comparison shopping study, we compared 15 different insurance companies for a 30-year-old driver.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

The illustration below ranks Ohio car insurance companies from the least to most expensive for minimum coverage limits.

| Company | Average Annual Rate |

|---|---|

| Westfield | $411 |

| Erie | $418 |

| State Farm | $424 |

| Geico | $430 |

| The Cincinnati | $434 |

| Nationwide | $461 |

| Western Reserve | $487 |

| Atlantic States | $500 |

| Travelers | $516 |

| Liberty Mutual | $542 |

| Progressive | $631 |

| American Family | $665 |

| The Hartford | $687 |

| Farmers | $721 |

| Allstate | $779 |

*Depending on location, your rates may vary when you get a personalized quote. Your quotes will reflect your driver profile. To find the best rate, make sure to compare at least three quotes from different companies with the same coverage levels.

The price difference between full coverage and minimum coverage insurance policy in Ohio is $1,014.

Liability-only insurance is the state requirement, but this coverage leaves your vehicle unprotected from damages in the event of a storm or an at-fault accident.

Learn more: Understanding Liability Auto Insurance

The risk in carrying state minimum limits is that they may not be enough if you are involved in an accident with a high-value vehicle or involved in an accident with multiple cars.

Cheapest Full Coverage Car Insurance in Ohio

The cheapest company for full coverage in Ohio is State Farm, with an annual $1,077 rate. The next best auto insurance companies for a full coverage policy are Nationwide and Westfield.

The cheapest full coverage auto insurers average $1,165 in annual car insurance costs or a 27% discount to the Ohio average premium.

The term “full coverage” is used to describe coverage that protects you and your car in the event of an accident. Full coverage car insurance includes bodily injury and property damage liability with comprehensive and collision.

The cheapest rates for full coverage will be subject to several factors, including the insured vehicle type.

However, the average driver can expect to see the cheapest car insurance rates from:

| Company | Annual Rate | Monthly Rate |

|---|---|---|

| State Farm | $1,077 | $90 |

| Nationwide | $1,121 | $93 |

| Westfield | $1,176 | $98 |

| Geico | $1,193 | $100 |

| Erie | $1,239 | $103 |

| The Cincinnati | $1,315 | $109 |

| Grange | $1,549 | $129 |

| Progressive | $1,623 | $135 |

| Ohio Average | $1,592 | $132 |

If you are financing or leasing your vehicle, you will need at least the state minimum liability insurance and comprehensive and collision coverage.

If you want to insure your vehicle from damage fully in Ohio, the best way is to consider full coverage and higher liability limits.Brandon Frady Licensed Insurance Agent

Collision car insurance coverage will cover damages sustained to your auto in the event of an accident – whether you are at fault or not.

Comprehensive car insurance coverage applies if your vehicle is damaged due to events such as a storm or an animal’s impact. At times, a full coverage policy may include medical payments coverage or MedPay.

Cheapest Car Insurance in Ohio with Car Accidents

ar accidents and traffic violations will often cause your auto insurance rates to increase.

Simultaneously, a traffic violation calls into question your safe driving habits and makes you appear more likely to be involved in an accident.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

We identified the cheapest companies with one at-fault accident as State Farm, Westfield, and Nationwide.

Together, the three cheapest insurers average $1,765 or 28% cheaper than Ohio’s average accident insurance rate of $2,421.

The most expensive auto insurers are Grange and Progressive, with quotes at $2,578 and $2,732 for Ohio drivers with one at-fault accident.

With such a large difference in costs, it highlights the importance of comparing multiple car insurance quotes before buying coverage.

| Auto Insurer | Rate with no accident history | Rate with accident history |

|---|---|---|

| State Farm | $1,077 | $1,310 |

| Westfield | $1,176 | $1,519 |

| Nationwide | $1,121 | $1,769 |

| Erie | $1,239 | $1,900 |

| Geico | $1,193 | $1,926 |

| Grange | $1,549 | $2,311 |

| Progressive | $1,623 | $2,421 |

| Allstate | $1,814 | $2,513 |

Cheapest Car Insurance with a Speeding Ticket

Depending on the severity, a speeding ticket can increase your auto insurance rates by 22% in Ohio. Your average cost of auto insurance is likely to increase from $1,592 to an annual cost of $1,942.

If you are an Ohio driver shopping for the cheapest coverage with traffic tickets on your record, we recommend looking to Westfield then State Farm for full coverage insurance.

Westfield’s premium is $400 cheaper than the average rate, and State Farm is $364 cheaper than the state average.

| Company | Annual Cost | Monthly Cost |

|---|---|---|

| Westfield | $1,539 | $128 |

| State Farm | $1,586 | $132 |

| Geico | $1,677 | $139 |

| Erie | $1,743 | $145 |

| Nationwide | $1,892 | $157 |

| Ohio average | $1,942 | $161 |

Cheapest Car Insurance Companies with a DUI

A more serious violation, such as an operating under the influence (OUI) charge, may create challenges when finding affordable auto insurance coverage.

We found the average rates for full coverage go up nearly 59% during our comparison shopping analysis, from $1,592 to $2,531.

A DUI or OUI charge could cause your insurance rates to more than double.

If you are charged with a DUI, your car insurer will more than likely consider you a high-risk driver.

You will be associated with other high-risk drivers, and your rates will be calculated within this “risk pool.”

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

If you are considered a high-risk driver or have a history of DUI, you may be able to find affordable coverage with non-standard companies through The General or Safe Auto.

Learn more: The Best Car Insurance Companies After a DUI

We strongly recommend that standard companies are State Farm and Progressive for those with a DUI in their driver history.

State Farm charges $1,744 annually for a DUI on record, or 32% cheaper than Ohio’s average DUI rate. Progressive offers quotes at $1,904 or 25% lower than other insurers for similar driver profiles (read more: Progressive Car Insurance Review).

| Company | Annual Cost | Monthly Cost |

|---|---|---|

| State Farm | $1,744 | $145 |

| Progressive | $1,904 | $158 |

| Geico | $2,270 | $189 |

| Safe Auto | $2,300 | $191 |

| The General | $2,411 | $200 |

| Ohio average | $2,531 | $210 |

Cheapest Car Insurance for Young Drivers in Ohio

A young driver is someone under the age of 25.

Due to their lack of driving experience, young drivers are thought to be at an increased risk of being involved in a car accident. Therefore, their rates are higher than older drivers.

We found the average annual cost of full coverage car insurance in Ohio for an 18-year-old in high school is $5,190 or 326% more than our sample 30-year-old of $1,592.

The best car insurance for teens is at Geico, where teens will pay $3,183 annually or $265 monthly.

But, Erie and Travelers are competitive with Geico in their pricing for teens with minimum coverage. With Erie, teenagers will pay an annual rate of $1,460 or $121 monthly for minimum coverage.

Western Reserve and Travelers are a close second in car insurance rates for drivers under the age of 25, offering quotes at $1,613 and $1,688 for minimum coverage, which is 15% cheaper than Ohio’s average rate for an 18-year-old (read more: Review of Travelers Car Insurance Options).

Average Monthly Rates for Young Drivers in Ohio

| Company | Full Coverage | Minimum Coverage |

|---|---|---|

| Geico | $265.25 | $123.08 |

| Erie | $280.83 | $121.66 |

| State Farm | $309.25 | $133.41 |

| Western Reserve | $365.91 | $140.66 |

| Travelers | $371.66 | $134.41 |

| Westfield | $352.58 | $146.75 |

| Grange | $366.66 | $161.91 |

| Nationwide | $408.58 | $175.16 |

| Allstate | $498.66 | $182.58 |

| Ohio average | $432.55 | $169.41 |

Cheapest Companies for Young Drivers with a Speeding Ticket

Erie has the most affordable rates for young drivers in Ohio with a speeding ticket on their record.

Full coverage insurance costs $3,727 annually, which is 39% cheaper than Ohio’s average rate of $6,100.

Teen driver’s average insurance rates increase by 24% with a speeding ticket.

A minimum coverage policy for a young driver will increase by 18% with a speeding ticket.

Average Monthly Rates for Young Drivers with a Speeding Ticket in Ohio

| Company | Monthly Cost |

|---|---|

| Erie | $310.00 |

| Geico | $328.00 |

| State Farm | $375.00 |

| Ohio average | $508.00 |

Our licensed insurance experts recommend teen drivers get full coverage. Teens get into more accidents than adult drivers.

Though a minimum coverage policy is thousands of dollars cheaper annually, it could cost more if a teen driver gets into an accident and their parents have to pay out of pocket.

We recommend teen drivers to stay on their parent’s policy as long as possible. And take advantage of good student and student-away-from-home discounts.

Cheapest Car Insurance with Poor Credit

The cheapest car insurance in Ohio for drivers with poor credit are Geico and Nationwide.

The average full coverage auto insurance rate for motorists with poor credit is $2,219 per year. In comparison, a driver with good credit will pay $1,592 annually. And Ohio drivers with excellent credit will pay $1,087 per year.

Look to Geico if you are comparison shopping with a poor credit score. Average rates from Geico are $1,732 annually. Consider Nationwide since they offer lower than average insurance costs at $1,921 per year for motorists with poor credit.

Both auto insurers are $423 cheaper than the next best insurers State Farm and Erie. Or $175 cheaper than the state average rate.

Average Monthly Rates for Drivers with Poor Credit in Ohio

| Company | Monthly Cost |

|---|---|

| Geico | $144 |

| Nationwide | $160 |

| Erie | $177 |

| Ohio average | $184 |

Geico and Nationwide are likely to be your most competitive auto insurance options if you have less than perfect credit.

Still, it is recommended that you get multiple car insurance quotes to compare.

Before you worry too much about the impact your credit score has on your policy, understand that the credit-based insurance score uses elements of your credit score to predict the likelihood that you may have an accident.

Ohio laws provide some consumer protection regarding credit-based insurance scores.

Your credit score may not be the sole factor in determining coverage rates.

Ohio’s Department of Insurance provides additional information on credit-based insurance scores.

Cheapest Car Insurance for Married Drivers

Auto insurance companies lower premiums for married drivers since; statistically, they are less prone to accidents.

In Ohio, our analysis found that married drivers pay an average rate of $1,329 annually or $263 less per year what a single driver pays for car insurance in Ohio.

Married drivers can reduce average rates more through car insurance discounts with multi-car and multi-policy options.

State Farm offers the best average rates for married couples. Our analysis shows that married couples pay $976 annually or $81 per month. The next cheapest insurer for married drivers is Nationwide, with average rates at $1,043 per year.

Average Monthly Rates for Married Drivers in Ohio

| Company | Monthly Cost |

|---|---|

| State Farm | $81.00 |

| Nationwide | $87.00 |

| Erie | $90.00 |

| Liberty Mutual | $92.00 |

| Ohio average | $110.00 |

Best Car Insurance Companies in Ohio

According to the Insurance Information Institute (III.org), the cost of auto insurance is one of the most important factors to consider when quoting an insurance policy; you should also look at the insurance providers themselves.

The auto insurance policy is a contract between the vehicle owner – and operator – and the insurance company.

This contract will determine what is covered in the event of an accident, and the insurance company will control how that coverage is applied.

National Association of Insurance Commissioners (NAIC) provides a list of the top insurance companies with the lowest complaint ratio. If you use the complaint ratio index from NAIC, Ohio’s best car insurance companies are Auto-Owners, Grange, and Nationwide.

Written Premiums in Ohio

| Auto Insurer | Written Premiums | Complaint ratio |

|---|---|---|

| Auto-Owners | $2,528,464.92 | 0.07% |

| Grange | $19,421,575.00 | 0.10% |

| Nationwide | $36,480,122.17 | 0.37% |

| Progressive | $57,656,489.25 | 0.41% |

| Geico | $25,684,549.50 | 0.57% |

| Cincinnati | $11,038,132.50 | 0.60% |

| Allstate | $36,171,254.33 | 0.63% |

| Erie | $3,869,768.08 | 0.65% |

| State Farm | $86,795,789.92 | 0.66% |

| Farmers | $12,884,860.83 | 0.66% |

| Liberty Mutual | $16,337,201.75 | 0.68% |

| Westfield | $12,384,591.25 | 0.76% |

| Motorists Mutual | $6,971,063.00 | 0.84% |

| Safe Auto | $4,747,168.83 | 2.17% |

The complaint index ratio represents the number of complaints an insurance company receives compared to its total number of written premiums.

When looking for affordable and quality coverage, these two companies, Auto-Owners and Grange, are worth considering for more than just their competitive rates and a low number of complaints based on NAIC’s index.

Both companies are regionally trusted and are likely to provide higher quality service to support the rationale for slightly higher insurance premiums.

Cheapest Car Insurance Costs by City in Ohio

Here is a list of the city’s average rate for drivers that need car insurance in Ohio and how they compared to other towns. The smaller cities in the table are for motorists with full coverage. Typically, the smaller the town, the cheaper the rates.

Our experts compared insurance rates for larger cities in Ohio further below.

Average Local Auto Insurance Rates in Ohio

| City | Monthly Insurance Rate | City | Monthly Insurance Rate |

|---|---|---|---|

| Albany | $84.25 | Huber Heights | $123.92 |

| Amherst | $133.25 | Kent | $125.75 |

| Antwerp | $115.50 | Kettering | $129.25 |

| Arcadia | $115.83 | Lakewood | $132.50 |

| Ashtabula | $124.00 | Lancaster | $115.58 |

| Athens | $133.33 | Lima | $115.83 |

| Aurora | $127.50 | Lorain | $125.83 |

| Avon | $124.00 | Lucasville | $118.17 |

| Avon Lake | $135.00 | Mansfield | $117.67 |

| Barberton | $127.00 | Marion | $126.75 |

| Bay Village | $133.33 | Massillon | $127.67 |

| Beachwood | $142.50 | Mechanicsburg | $98.00 |

| Beavercreek | $84.08 | Medina | $139.08 |

| Bedford | $135.25 | Mentor | $121.67 |

| Bedford Heights | $135.00 | Miamisburg | $119.17 |

| Bellefontaine | $135.00 | Milford | $131.67 |

| Bellevue | $117.50 | Middletown | $129.17 |

| Bexley | $115.83 | Newwark | $120.92 |

| Blue Ash | $135.75 | North Olmstead | $94.92 |

| Broadview Heights | $126.67 | Northfield | $120.75 |

| Brooklyn | $135.42 | North Royalton | $124.83 |

| Brook Park | $133.17 | Norwood | $145.83 |

| Brunswick | $120.42 | Oxford | $129.50 |

| Bucyrus | $124.92 | Parma | $125.83 |

| Campbell | $145.00 | Piqua | $119.17 |

| Cedarville | $88.00 | Reynoldsburg | $109.75 |

| Canton | $130.83 | Rocky River | $120.83 |

| Centerville | $130.83 | Sandusky | $115.33 |

| Circleville | $94.33 | Shaker Heights | $145.83 |

| Chillicothe | $129.17 | Sidney | $120.75 |

| Clarksburg | $90.08 | Solon | $129.83 |

| Cleveland Heights | $146.58 | South Euclid | $145.83 |

| Cleves | $102.50 | Springboro | $125.83 |

| Clifton | $97.75 | Springfield | $127.00 |

| Concord | $133.17 | Stow | $133.42 |

| Conneaut | $146.67 | Streetsboro | $145.83 |

| Cuyahoga Falls | $119.83 | Strongsville | $118.42 |

| Dalton | $126.67 | Sylvania | $126.67 |

| Delaware | $128.67 | Tallmadge | $125.00 |

| Dublin | $138.33 | Thornville | $110.67 |

| East Cleveland | $148.58 | Trotwood | $137.50 |

| Eastlake | $127.50 | Troy | $120.00 |

| Edgerton | $112.58 | Uhrichsville | $116.25 |

| Englewood | $138.33 | Upper Arlington | $136.58 |

| Elyria | $117.42 | Vandalia | $123.08 |

| Euclid | $105.58 | Wadsworth | $145.83 |

| Fairborn | $125.92 | Warren | $135.83 |

| Fairfield | $106.83 | Waverly | $101.33 |

| Findlay | $117.58 | West Chester | $133.25 |

| Forest Park | $138.33 | Westerville | $144.00 |

| Frankfort | $90.83 | Westlake | $145.83 |

| Fremont | $126.75 | Wickliffe | $125.92 |

| Gahanna | $135.00 | Willoughby | $123.17 |

| Garfield Heights | $143.42 | Willowick | $122.92 |

| Green | $116.25 | Williamsburg | $131.33 |

| Greenwich | $98.00 | Worthington | $145.83 |

| Grove City | $116.58 | Worthington | $103.17 |

| Hilliard | $141.67 | Xenia | $101.17 |

| Hinckley | $114.67 | Zanesville | $116.83 |

Cheapest Car Insurance in Columbus, OH

During our analysis, we found the cheapest insurance companies in Columbus, OH, to be Erie, The Cincinnati, and Geico, as illustrated below.

Average Monthly Auto Insurance Rates in Columbus Ohio

| Columbus Company | Average Rate |

|---|---|

| Erie | $94.75 |

| The Cincinnati | $99.17 |

| Geico | $102.58 |

| Columbus Average | $114.17 |

Cheapest Car Insurance in Cleveland, OH

If you are shopping for car insurance in Cleveland, we recommend getting quotes from Erie, Grange, and The Cincinnati, as illustrated below.

Average Monthly Rates for Auto Insurance in Cleveland Ohio

| Cleveland Company | Average Rate |

|---|---|

| Erie | $144.42 |

| Grange | $158.42 |

| The Cincinnati | $168.17 |

| Cleveland average | $162.33 |

Cheapest Car Insurance in Cincinnati, OH

In Cincinnati, we recommend you to get insurance quotes from State Farm, Grange, and Erie. Each is 20% cheaper than the average Cincinnati rate for good drivers.

Average Monthly Rates for Auto Insurance in Cincinnati Ohio

| Cincinnati Company | Average Premium |

|---|---|

| State Farm | $110.58 |

| Grange | $121.67 |

| Erie | $134.25 |

| Cincinnati average | $144.25 |

Cheapest Car Insurance in Toledo, OH

In Toledo, comparison shoppers should put State Farm, Geico, and Erie to get quotes to save money. All three insurance carriers are at least 10% cheaper than the Toledo average rate.

Average Monthly Rates for Auto Insurance in Toledo Ohio

| Toledo Company | Average Premium |

|---|---|

| State Farm | $108.58 |

| Geico | $118.92 |

| Erie | $126.33 |

| Toledo average | $144.92 |

Cheapest Car Insurance in Akron, OH

Akron, Ohio drivers, should take a look at Grange, Erie, and Frankenmuth. All three carriers’ insurance quotes are more than 19% lower than the average Akron rate for good drivers.

Average Monthly Rates for Auto Insurance in Akron Ohio

| Akron Company | Average Premium |

|---|---|

| Grange | $107.50 |

| Erie | $122.92 |

| Frankenmuth | $131.83 |

| Akron average | $145.00 |

Cheapest Car Insurance in Dayton, OH

To find cheaper auto insurance coverage in Dayton, our experts recommend getting quotes from Geico, Erie, and Progressive. All three auto insurers can offer quotes over 16% better than the average Dayton premium.

Average Monthly Auto Insurance Rates for a 30 Year Old in Dayton Ohio

| Dayton Company | Monthly Rates for 30 Year Old |

|---|---|

| Geico | $108.25 |

| Erie | $117.58 |

| Progressive | $131.58 |

| Dayton average | $136.67 |

Cheapest Car Insurance in Youngstown, OH

Youngstown, Ohio drivers, should look at State Farm, Erie, and Geico to save money on their car insurance. Each insurer offers coverage 17% cheaper than the average Youngstown premium.

Average Monthly Rates for Auto Insurance in Youngstown Ohio

| Youngstown Company | Average Premium |

|---|---|

| State Farm | $119.92 |

| Erie | $132.25 |

| Geico | $142.00 |

| Youngstown average | $157.50 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ohio Minimum Auto Insurance Coverage Requirements

Ohio’s minimum liability car insurance requirements are 25/50/25, as illustrated below.

Ohio Minimum Car Insurance Requirements

| Coverage | Ohio Minimum Liability Requirements | ||

|---|---|---|---|

| Bodily injury (BI) | $25 | 000 per person/$50 | 000 per accident |

| Property Damage (PD) | $25000.00 | ||

| Uninsured Motorist Bodily Injury | Optional | ||

| Uninsured Motorist Property Damage | Optional |

The Final Word on Affordable Ohio Car Insurance

Your auto insurance should be more than just a legal requirement in the state of Ohio.

Car insurance protects you, protects others, and ensures that you always have a car to get you and your family where you need to go.

Finding the best rates and the best coverage requires comparing rates and doing research, but AutoInsureSavings experts are here to help.

To learn more about Ohio’s cheapest car insurance, contact the AutoInsureSavings insurance agency at (855) 233-7818 to help you save. Our licensed professionals will be happy to answer any questions you have.

Methodology

Ohio Auto Insurance Methodology

| AutoInsureSavings | org collects quotes from the state’s largest car insurance companies for a 30-year-old male or female motorist for our driver profile | Each driver has a clean driving record, and we applied a good or safe driver discount | |

| AutoInsureSavings | org collects three to five quotes from each insurer via Quadrant Information Services | ||

| Unless stated, our methodology’s operating vehicle is a 2018 Honda Accord with a paperless, safe driver, and anti-theft discounts | The full coverage policy included: | ||

| $50,000 bodily injury liability per person | |||

| $100,000 bodily injury liability per accident | |||

| $50,000 property damage liability per accident | |||

| $50,000 uninsured motorist coverage per person | |||

| $100,000 uninsured motorist coverage per accident | |||

| Collision coverage with a $500 deductible | |||

| Comprehensive coverage with a $500 deductible | |||

| AutoInsureSavings | org uses rate data from Quadrant Information Services | We sourced quotes from insurer filings that are publicly available for rate comparison |

Frequently Asked Questions

Who has the cheapest minimum coverage in Ohio?

When our licensed insurance experts conducted the analysis, we found the cheapest insurance companies for Ohio’s minimum coverage to be Westfield and Erie. Both insurers can offer coverage 20% cheaper than the average Ohio minimum coverage premium.

Who offers the cheapest full coverage premium in the state of Ohio?

Drivers with good driving records can get the cheapest full coverage from State Farm, Nationwide, and Westfield. All three insurance companies can offer rates 27% cheaper than the average full coverage premium in Ohio.

How much is car insurance per month in Ohio?

Depending on the type of vehicle, a 30-year-old driver with full coverage will pay $135 to $165 a month for a car insurance premium in Ohio.

The same driver will pay from $45 to $85 for liability only.

Do you need to carry full coverage on a financed car in the state of Ohio?

Yes, you will need full coverage from an insurer if you have an auto loan or lease on your motor vehicle.

The lender will require you to carry liability, comprehensive, and collision insurance – sometimes called “full coverage.”

Are there uninsured drivers in Ohio?

An Insurance Research Council study from 2017 suggested that 12.4% of all drivers in Ohio are uninsured.

Many cities in Ohio, such as Canton and Dublin, have a significant number of uninsured motorists.

Uninsured and Underinsured motorist coverage is not required, but it is essential to consider carrying.

What is the best car insurance in Ohio?

Full coverage is the best auto insurance in Ohio, as it financially protects drivers in many accident situations.

Is Ohio a no-fault state?

Ohio is an at-fault state, so whoever caused the accident is responsible for paying for repairs and injuries.

Is Ohio a PIP state?

Ohio does not require PIP.

Is it illegal to drive without car insurance in Ohio?

Yes, all Ohio drivers need to carry car insurance. You can find the cheapest insurance in Ohio by shopping around for quotes.

Is Medpay required in Ohio?

Medpay is an optional auto insurance coverage in Ohio.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michael Leotta

Insurance Operations Specialist

Michael earned a degree in Business Management with an insurance focus, which led to a successful 25-year career in insurance claims operations and support. He possesses a high-level of business acumen across multiple areas of the insurance industry. Over the course of his career, he served in multiple roles supporting claims operations including: Claims Specialist, Claims Trainer, Claim Automatio...

Insurance Operations Specialist

UPDATED: Jan 29, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.