Review of Travelers Car Insurance Options; a Comparison With Other Insurers

In our review of Travelers' car insurance options, we found that while Travelers' average rates can be more expensive than other companies' rates, it has a good selection of coverages to choose from. Minimum coverage is an average of $90/mo at Travelers, while full coverage is an average of $229/mo.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Feb 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Feb 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Want to explore Travelers’ insurance options? Our review of Travelers’ car insurance options goes over everything you need to know about the company, from its insurance options and ratings to how to get the right car insurance coverage.

To get affordable car insurance quotes from companies in your area, enter your ZIP in our free quote tool.

Travelers Compared to Other Companies

Below is a table that I queried for drivers from 25 to 55 years of age.

I did this to see how Travelers are compared through a spectrum of ages from each carrier.

The state I used to get quotes in Rhode Island.

If you decide to get quotes for your own comparison, please realize Rhode Island is one of the more expensive states for an auto policy.

I found drivers with no traffic violation Travelers is a little more expensive than other comparable insurers.

For young drivers, they are competitive but can be 10% higher than direct competitors.

Older drivers should have no issue getting a low quote or policy from them.

Particularly any which have a good or excellent driving record.

| Driver Profile | Travelers | Progressive | Allstate | Farmers | State Farm |

|---|---|---|---|---|---|

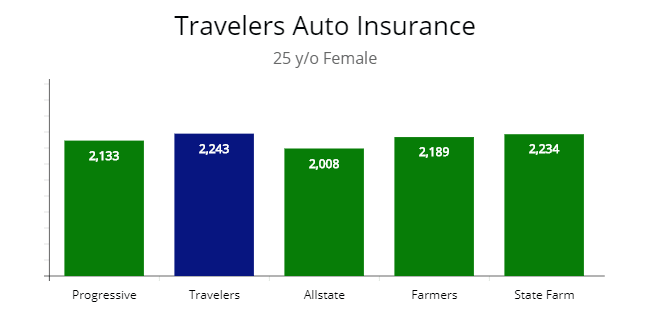

| 25 y/o female | $2,243 | $2,133 | $2,008 | $2,189 | $2,234 |

| 25 y/o male | $2,412 | $2,367 | $2,012 | $2,311 | $2,432 |

| 30 y/o female | $1,823 | $1,744 | $1,790 | $1,802 | $1,832 |

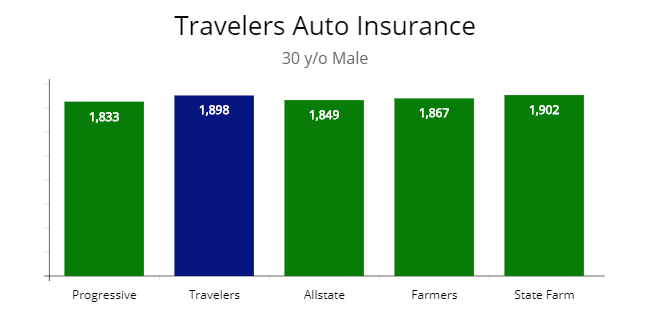

| 30 y/o male | $1,898 | $1,833 | $1,849 | $1,867 | $1,902 |

| 25 y/o male (1 driving violation) | $2,611 | $2,500 | $2,432 | $2,554 | $2,621 |

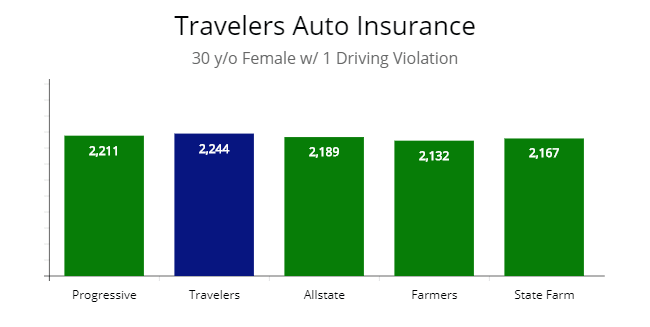

| 30 y/o female (1 driving violation) | $2,244 | $2,211 | $2,189 | $2,132 | $2,167 |

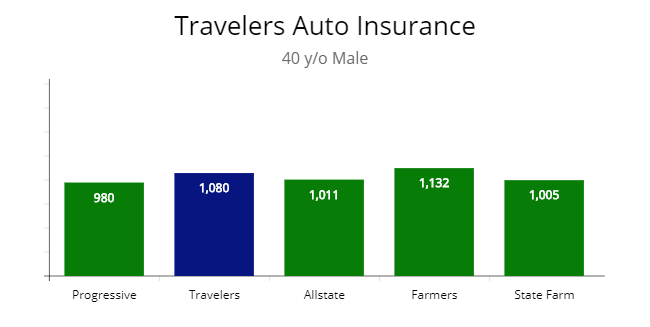

| 40 y/o male | $1,080 | $980 | $1,011 | $1,132 | $1,005 |

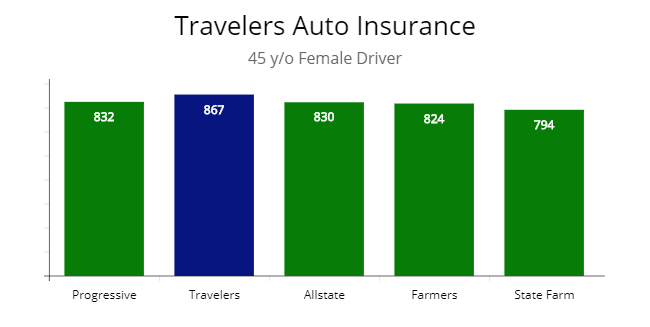

| 45 y/o female | $867 | $832 | $830 | $824 | $794 |

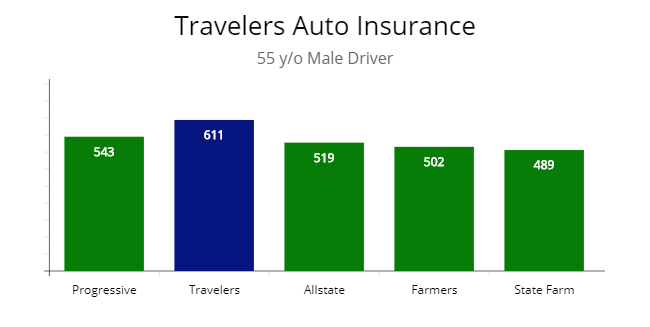

| 55 y/o male | $611 | $543 | $519 | $502 | $489 |

| 55 y/o female | $398 | $467 | $511 | $437 | $390 |

If you and your family are about to renew your current premium coverage, it might be worth your time to include Travelers in your considerations.

Note: When I queried for quotes, Travelers is the 4th cheapest or the 2nd most expensive at $1,898. State Farm was the only carrier higher at $1,902 for a 30-year old male driver. This was interesting since the carriers are all less than $100 in quote comparison of each other. Making all of them worth getting quotes from, including Travelers.

Note: When I queried for quotes, Travelers is the 4th cheapest or the 2nd most expensive at $1,898. State Farm was the only carrier higher at $1,902 for a 30-year old male driver. This was interesting since the carriers are all less than $100 in quote comparison of each other. Making all of them worth getting quotes from, including Travelers.

Learn more:

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Travelers’ Car Insurance Coverage Options

Like most leading providers, Travelers lets you build a policy around the standard coverage options.

You can choose from among these standard options and pick your levels and limits of coverage (keeping in mind the requirements of your state minimum coverage):

- Bodily injury liability

- Property damage liability

- Collision car insurance coverage

- Comprehensive car insurance coverage

- Medical payments coverage

- Uninsured motorist coverage

- Underinsured motorist coverage

In a handful of states with no-fault laws and requirements, Travelers offers an upgrade to medical payments coverage with a full array of personal injury protection (PIP) coverage options.

Note: As I mentioned in the article, Travelers is slightly higher in price when querying for drivers with a driving violation. In this instance, they are the most expensive for a 30-year-old female at $2,244. Farmers is the cheapest at $2,132.

Note: As I mentioned in the article, Travelers is slightly higher in price when querying for drivers with a driving violation. In this instance, they are the most expensive for a 30-year-old female at $2,244. Farmers is the cheapest at $2,132.

The company routinely ranks well with numerous surveys, and it has grown to take its place among the top ten providers in the country.

Note: When I queried for quotes for a 25-year-old female driver, Travelers was the most expensive at $2,243. The cheapest was Allstate at $2,008, followed by Progressive at $2,133. They are slightly higher (about 4%) than their competitors but would be worth a 25 y/o driver to get quotes.

Note: When I queried for quotes for a 25-year-old female driver, Travelers was the most expensive at $2,243. The cheapest was Allstate at $2,008, followed by Progressive at $2,133. They are slightly higher (about 4%) than their competitors but would be worth a 25 y/o driver to get quotes.

Other Coverages at Travelers

Besides the standard coverage provisions needed to build a car insurance plan, Travelers offers some options to supplement coverage that may fit nicely into your personal or family driving needs.

You can add these options to your plan:

- GAP insurance

- Towing and labor cost coverage

- Rental reimbursement or extended travel expenses coverage

In some states, Travelers must add some or all of these options to any full package policy, while in other states, these optional plans have some limits on levels and availability.

Be sure to consult with your Travelers representative to see what’s available in your state.

Note: When querying for quotes, there was a variance of over $150 for a 40-year-old male driver. In this instance, Travelers is the 4th cheapest at $1,080. Or $52 less than Farmers at $1,132. With such a large variance in quotes, it would be smart to compare quotes from insurers, particularly if you can find $150 or more in savings.

Note: When querying for quotes, there was a variance of over $150 for a 40-year-old male driver. In this instance, Travelers is the 4th cheapest at $1,080. Or $52 less than Farmers at $1,132. With such a large variance in quotes, it would be smart to compare quotes from insurers, particularly if you can find $150 or more in savings.

Comparison of Quotes – Arizona

I decided to compare quotes of companies from a couple of states. Arizona is one of them to see how Travelers stacks up against its competitors.

For a 30-year-old driver with a traffic violation, Travelers was the 2nd cheapest at $789, while Esurance was the lowest quote at $687.

A family of 4 has quotes clustering between $900 and $1,100.

Again, Travelers is the 2nd cheapest with Esurance offering the lowest quote.

A 55-year-old with a good driving record can find low quotes between $300 and $500.

The cheapest insurer for the older driver is State Farm at $335, followed by Travelers at $367.

In the state of Arizona, they are competitive for drivers through a range of profiles.

Read more: Arizona Cheapest Car Insurance & Best Coverage Options

When I made the quote comparison, I did not take into consideration discounts.

Unless otherwise noted, each driver had a good driving history and fair credit.

| Company | 30 Y/O male, minor traffic violation | Family of 4 | Senior 55 Y/O Married |

|---|---|---|---|

| Travelers | $1,890 | $912 | $367 |

| State Farm | $1,955 | $1,010 | $335 |

| Esurance | $1,755 | $867 | $465 |

| Farmers | $1,879 | $1,097 | $437 |

| 21st Century | $1,811 | $1,067 | $492 |

Note: Comparison was made with a 2010 Honda Accord and 2011 Toyota Camry

Comparison of Rates in Ohio

In Ohio, the quotes are significantly higher than in Arizona.

For a 25-year-old female driver, Travelers is the 4th cheapest or the 2nd most expensive.

However, you would like to put it.

When I was comparing younger drivers, I noted Travelers is less competitive and more competitive with older drivers about 40 years and up.

Which is to be expected since they prefer less risk and not more.

If so, they charge a lot more for a policy.

For a 35-year old they are the 2nd cheapest at $1,383.

Farmers offered the lowest quote at $1,324 or about $60 less.

An older male driver who is married Travelers offers the lowest quote at $691.

Again I wanted to make a note that Travelers is very competitive for older drivers.

Top carriers, such as them, mitigate risk by doing so.

It is not to say a younger driver should not get a policy through them.

When I was querying for quotes, I did discount any of them.

Unless otherwise noted, each driver had fair credit and good driving history.

| Company | 25 Y/O Female | 35 Y/O Male | 48 Y/O, Married Man |

|---|---|---|---|

| Travelers | $2,243 | $1,383 | $691 |

| State Farm | $2,234 | $1,514 | $789 |

| Esurance | $1,978 | $1,678 | $812 |

| Farmers | $2,189 | $1,324 | $712 |

| 21st Century | $2,345 | $1,583 | $743 |

Note: Comparison was made with a 2009 Honda Civic and 2011 Toyota Camry

Travelers’ Car Insurance Discounts

To offset your policy’s cost, Travelers offers a variety of discounts you and your family can apply for.

Some of these may seem familiar to you as most other companies offer them.

You may be surprised at some of the other discounts from Travelers, which include:

- Safe driver advantage

- Multi-car

- Accident forgiveness

- Hybrid auto

- Multi-policy, bundling

- New car

- Homeowners

- Pay-in-full

- Buy-early

- Good student

- Driver training

- Student away

One other discount that also helps improve driving skills is the IntelliDrive™ program. The IntelliDrive™ discount is a voluntary program from Travelers that monitors how people drive and rewards safe driving practices with a discount.

You can also use this feature to monitor how a teen driver in your household handles the new responsibility of driving.

Note: For a 45-year old female, Travelers is the most expensive at $867 for full coverage. The variance between prices is relatively low at $73 between the lowest and the highest quote. Another reason, even for older drivers, is to compare to find the most savings in an auto policy.

Note: For a 45-year old female, Travelers is the most expensive at $867 for full coverage. The variance between prices is relatively low at $73 between the lowest and the highest quote. Another reason, even for older drivers, is to compare to find the most savings in an auto policy.

Value and good rankings

In that most recent survey of insurers conducted by MSN/Money Magazine, Travelers earned almost 75 points on the 100-point scale, giving it an overall A+ grade.

In the survey, 66 percent of Travelers customers say they would recommend the insurer to family and friends, and 74 percent say they plan to renew when current policies expire.

In the J.D. Powers & Associates/A.M. Best annual ranking of insurers, Travelers scored 86 points on its 100-point scale.

The company received high marks for financial strength and overall satisfaction from customers.

Ratings

| Metric | Rating |

|---|---|

| A.M. Best | A++ |

| Standard & Poor's | AA |

| NAIC | 1.01 |

| BBB | A+ |

Note: This one came as a surprise, with Travelers the most expensive at $611. State Farm is the cheapest at $489. This is a huge variance of $122 or nearly 20%. Again, another reason to be sure to compare quotes. I am a 55-year-old driver, and it would be well worth finding a huge amount of savings, such as illustrated above.

Note: This one came as a surprise, with Travelers the most expensive at $611. State Farm is the cheapest at $489. This is a huge variance of $122 or nearly 20%. Again, another reason to be sure to compare quotes. I am a 55-year-old driver, and it would be well worth finding a huge amount of savings, such as illustrated above.

Final Word on Traveler’s Car Insurance Options

Travelers has great coverage, but is on the more expensive side. With more than 2,000 companies in the United States licensed and registered to sell a policy, you and your family have many, many options to choose from.

It’s always a good idea to get competing quotes with our free quote tool when the time comes to renew a policy or acquire a new one.

Frequently Asked Questions

Who is cheaper than Travelers insurance?

Some companies that are generally cheaper include Geico, USAA, and State Farm.

Does Geico own Travelers insurance?

No, Geico does not own Travelers.

What is the best rating for Travelers insurance?

Travelers has an A++ rating from A.M. Best.

Is Travelers good about paying claims?

Travelers has an average rating from J.D. Power for customer claims satisfaction.

Does Travelers insurance go up after a claim?

If you are filing a claim due to an at-fault accident, then you will see an increase in rates.

Is Travelers insurance good?

Travelers insurance has good ratings and plenty of insurance options, but its average rates are more expensive.

Does Travelers have accident forgiveness?

Yes, Travelers offers accident forgiveness to qualifying drivers.

Is Geico better than Travelers?

Geico’s average rates tend to be cheaper than Travelers, but the only way to know which company is better for you is to get quotes.

Does Travelers charge to cancel insurance?

You may be charged a small cancellation fee if you cancel before the end of your policy period.

How does Travelers pay claims?

Travelers pays claims through checks.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Feb 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.