Louisiana Cheapest Car Insurance & Best Coverage Options

Drivers can find the Louisiana cheapest car insurance rates at Louisiana Farm Bureau. The average cost of a minimum auto insurance policy at Louisiana Farm Bureau is just $43 per month. Louisiana drivers who want more protection with a full coverage insurance policy will pay an average of $155 per month.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Jan 4, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jan 4, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

- Louisiana Farm Bureau has the cheapest rates on average for drivers

- Louisiana Farm Bureau’s average rate for minimum coverage is $43/mo

- Louisiana Farm Bureau’s average rate for full coverage is $155/mo

The Louisiana cheapest car insurance policies can be found at Louisiana Farm Bureau. Other affordable companies include Progressive and State Farm. Continue reading to find out which cheap company is best for your needs and budget, as we cover the best auto insurance companies in Louisiana for different drivers.

Want to start shopping for cheap Louisiana car insurance today? Use our free quote comparison tool by entering your ZIP code.

Affordable Louisiana Car Insurance Rates

Choosing the right car insurance company can help you improve your level of coverage while you stay within your budget.

| Cheapest Car Insurance in Louisiana - Key Takeaways |

|---|

The cheapest Louisiana car insurance options are: The cheapest Louisiana car insurance options are:Cheapest for minimum coverage: Louisiana Farm Bureau Cheapest for full coverage: Louisiana Farm Bureau Cheapest after an at-fault accident: Farm Bureau Cheapest after a speeding ticket: Farm Bureau Cheapest after a DUI: Progressive Cheapest for poor credit history: Farm Bureau Cheapest for young drivers: Farm Bureau For younger drivers with a speeding violation: Farm Bureau For younger drivers with an at-fault accident: State Farm |

To help you save money and find the best deal on your car insurance premium in Louisiana, AutoInsureSavings.org has compared the best rates from several top companies in the car insurance industry for various types of drivers and age groups. You can start by entering your zip code to get quotes.

- Louisiana Cheapest Car Insurance & Best Coverage Options

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Louisiana for Minimum Coverage

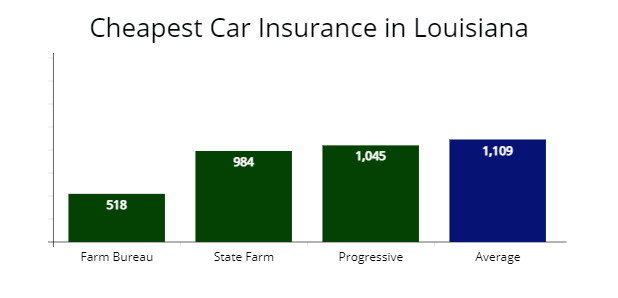

Our agents found that Louisiana Farm Bureau offers the cheapest state minimum coverage car insurance for drivers in Louisiana with good driving records at $518 per year, which is 54% less expensive than the average cost for minimum liability coverage from other auto insurance companies in Louisiana at $1,109 per year.

| Auto Insurer | Average annual rate |

|---|---|

| Louisiana Farm Bureau | $518 |

| USAA | $567 |

| State Farm | $984 |

| Progressive | $1,045 |

| Liberty Mutual | $1,389 |

| Allstate | $1,417 |

| Geico | $1,634 |

*USAA is for qualified military members, their spouses, and direct family members. Auto insurance rates may vary depending on the driver’s profile.

Louisiana drivers can purchase state minimum liability requirements for less than $1,300 per year from several providers.

While Farm Bureau and State Farm are the cheapest options for many Louisiana drivers, we also found that Progressive and Liberty Mutual are two good car insurance carriers to consider based on our research for drivers who want to save the most money.

Read more: Progressive Car Insurance Review for Families, Policy Options & Ratings

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Minimum property damage and bodily injury liability policies are cheaper car insurance premiums, which exclude comprehensive and collision coverage, but AutoInsureSavings.org licensed agents recommend buying full coverage insurance in Louisiana since filing a claim with a minimum coverage insurance policy you could pay out-of-pocket expenses.

Learn more: Understanding Full Coverage Car Insurance: What You Need to Know

Cheapest Full Coverage Car Insurance in Louisiana

We found that Louisiana Farm Bureau offers cheap full coverage car insurance for drivers in Louisiana with a $1,856 per year quote or 34% cheaper than the state average rates.

State Farm is the next best option at $2,326 per year or 17% less expensive than Louisiana’s average $2,786 insurance rate.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Louisiana Farm Bureau | $1,856 | $154 |

| State Farm | $2,326 | $193 |

| Progressive | $2,537 | $211 |

| Louisiana average | $2,786 | $232 |

*USAA is for qualified military personnel, their spouses, and direct family members. Rates may vary by zip code and depending on driver profiles.

The average driver in Louisiana paying for full coverage insurance is $232 per month. Drivers can find cheaper auto policies by comparing top car insurance providers’ rates like those listed here.

Cheapest Car Insurance in Louisiana with a Speeding Ticket

Our licensed agents found Louisiana Farm Bureau offers the cheapest auto insurance rates for drivers in Louisiana with a speeding violation at $2,178 per year or a $181 monthly rate. Farm Bureau‘s quote is 37% lower than the Louisiana average rates of $3,432 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Louisiana Farm Bureau | $2,178 | $181 |

| State Farm | $2,822 | $235 |

| Progressive | $2,941 | $245 |

| Louisiana average | $3,432 | $286 |

Average rates increase by $646 per year after a moving violation in Louisiana. Car insurance companies use traffic tickets to assess risk; having one or more tickets on your driving record indicates you are riskier to the insurer than drivers with a clean driving history.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

According to the Louisiana Office of Motor Vehicles (OMV), if you receive too many moving violations, you can receive a driver’s license suspension and a car insurance company rate increase by 19% until the traffic violation falls off your driving record in three years.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Louisiana with an At-Fault Accident

Louisiana Farm Bureau offers the most affordable car insurance rates for drivers with a recent at-fault accident in Louisiana, with annual car insurance premiums as low as $2,531 per year. That is $2,010 less than state average rates, or 44% cheaper drivers pay for coverage in Louisiana.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Louisiana Farm Bureau | $2,532 | $211 |

| Progressive | $3,067 | $255 |

| Liberty Mutual | $3,736 | $311 |

| Louisiana average | $4,542 | $378 |

Progressive and Liberty Mutual are auto insurance companies that offer lower than state average rates for many drivers in Louisiana who have an accident on their record.

According to the Louisiana Department of Insurance (LDI), an auto accident will remain on your motor vehicle record for three years, along with an average insurance rate increase of 39% per year.

Cheapest Car Insurance With a DUI in Louisiana

Progressive offers the cheapest insurance rates in Louisiana for drivers with a DUI/DWI in their driver history at $3,065 per year. The average rate for drivers with a DUI in Louisiana is $5,021, and Progressive’s best rates are 39% lower than other auto insurance companies.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $3,065 | $255 |

| State Farm | $3,521 | $293 |

| Safeway Insurance Co. | $3,619 | $301 |

| Louisiana average | $5,021 | $418 |

Louisiana drivers with a DUI (called a DWI or OWI locally) can expect to see their auto insurance rates increase by as much as 45%, with a possible driver’s license suspension with a court-approved driver improvement program.

That is why it is essential to shop around to find a car insurance provider that offers the most affordable rates after a DUI offense. Our agents recommend Louisiana drivers with a drunk driving infraction take a defensive driving course to lower auto insurance premiums.

Cheapest Car Insurance in Louisiana with Poor Credit

Louisiana Farm Bureau offers the cheapest auto insurance rates for Louisiana drivers who have a poor credit history. Farm Bureau’s rates are $2,317 per year for our sample 30-year-old male driver or 39% less per year.

Progressive and State Farm are two insurance companies with a less expensive option offering their best rates in the Bayou State, 19% lower than the state’s $3,465 average rates.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Louisiana Farm Bureau | $2,317 | $193 |

| Progressive | $2,650 | $220 |

| State Farm | $2,826 | $235 |

| Louisiana average | $3,465 | $288 |

Those who have a bad credit score in Louisiana may see that their insurance rates are higher than average. For most people, poor credit score insurance rates are 20% higher than those with good credit scores, according to the Insurance Information Institute (III.org)

Make sure to pay your bills, student loans, and credit cards on time to save money on Louisiana car insurance premiums.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance for Young Drivers in Louisiana

Louisiana Farm Bureau offers the cheapest insurance rates for younger drivers in Louisiana with clean driving records, with an average of $3,517 per year for full coverage car insurance.

For less than average costs for minimum coverage, a teen driver should choose Nationwide, which offered our licensed agents a $1,322 per year rate or 20% less per year than Louisiana average rates.

| Auto Insurer | Full coverage | Minimum coverage |

|---|---|---|

| Louisiana Farm Bureau | $3,517 | $1,343 |

| USAA | $3,780 | $1,516 |

| State Farm | $3,976 | $1,867 |

| Nationwide | $4,055 | $1,332 |

| Safeway Insurance Co. | $5,476 | $2,460 |

| Allstate | $6,328 | $2,856 |

| Geico | $6,957 | $3,068 |

| Progressive | $7,124 | $3,236 |

| Louisiana average | $5,128 | $2,984 |

*USAA is for qualified military members, their spouses, and direct family members. Rates may vary by zip code and depending on driver profiles.

Young or teen Louisiana drivers needing coverage can save more by finding the best auto insurance for teens at the above companies.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Drivers who choose Farm Bureau Insurance can save as much as 32% on their car insurance premiums, which can be substantial savings for younger drivers and their parents.

Cheapest Car Insurance for Young Drivers with a Speeding Ticket

During our analysis of auto insurers with the best rates, our agents found teen drivers needing coverage in Louisiana with a speeding ticket on their driving record can get cheaper insurance rates with Farm Bureau at $3,776 per year or $314 monthly rate, which is 39% less expensive than Louisiana average rates.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Farm Bureau | $3,776 | $314 |

| Nationwide | $4,055 | $337 |

| Allstate | $6,328 | $527 |

| Louisiana average | $6,164 | $513 |

Cheapest Car Insurance for Young Drivers with an Auto Accident

Young Louisiana drivers with an at-fault accident on their driving record can find the cheapest full coverage insurance quotes with State Farm, which provided us a quote at $4,054 per year or 52% lower than the average car insurance rates of a similar teen driver profile.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $4,054 | $337 |

| Farm Bureau | $4,170 | $347 |

| Nationwide | $4,973 | $414 |

| Louisiana average | $8,361 | $696 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Best Car Insurance Companies in Louisiana

Several great insurance companies to choose from coverage in Louisiana based on their price, customer service and support, and coverage level.

ValuePenguin did a survey and found the overall best car insurance companies in Louisiana are USAA and Allstate, with high marks from current policyholders for claims satisfaction. If you are not eligible for USAA, Allstate is the next best option based on customer satisfaction.

| Company | % respondents satisfied with recent claim | % respondents rated customer service as excellent |

|---|---|---|

| USAA | 68% | 62% |

| Allstate | 64% | 47% |

| State Farm | 59% | 46% |

| Geico | 56% | 42% |

| Progressive | 51% | 34% |

| Louisiana Farm Bureau | n/a | n/a |

| Safeway | n/a | n/a |

AutoInsureSavings.org team of licensed insurance agents compared complaints by each insurance carrier using the National Association of Insurance Commissioners complaint index.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Using the complaint index (best ratio of complaints to market share) from NAIC, the best car insurers are Louisiana Farm Bureau and State Farm. Both car insurance companies are below the national average of 1.00, with a 0.36 and 0.66 complaint index, respectfully.

| Insurer | NAIC complaint index | J.D. Power claims satisfaction | AM Best rating |

|---|---|---|---|

| Louisiana Farm Bureau | 0.36 | n/a | A+ |

| State Farm | 0.66 | 881 | A++ |

| USAA | 0.68 | 890 | A++ |

| Allstate | 0.71 | 876 | A+ |

| Progressive | 0.86 | 856 | A+ |

| Geico | 1.02 | 871 | A++ |

Using J.D. Power’s claims satisfaction survey and the AM Best financial strength ratings, USAA, State Farm, and Allstate are the best insurance providers.

Read more: A Review of USAA Car Insurance, Policy Options & Military Benefits

Average Cost of Car Insurance by City in Louisiana

An insurance carrier will use your zip code and many risk factors like your credit score, marital status, vehicle type, and past driving history to determine your Louisiana car insurance costs. The average cost of insurance for Louisiana drivers is $2,786 per year or $232 per month. During our comparison shopping study, we found the cheapest insurers by city.

Cheapest Car Insurance in New Orleans, LA

New Orleans drivers can shop around and find the cheapest insurance coverage from Farm Bureau Insurance company which provided our agents a $1,890 rate per year for a full coverage auto insurance policy. Farm Bureau’s rate is 35% lower than average rates in New Orleans.

| New Orleans Company | Average Premium |

|---|---|

| Farm Bureau | $1,890 |

| State Farm | $2,433 |

| Progressive | $2,590 |

| New Orleans average | $2,879 |

Cheapest Car Insurance in Baton Rouge, LA

Drivers in Baton Rouge with clean driving history can find the least expensive insurance rate with Safeway Insurance Co. at $1,925 per year for full coverage for our sample 30-year-old driver, 32% below average rates in Baton Rouge.

| Baton Rouge Company | Average Premium |

|---|---|

| Safeway Insurance | $1,925 |

| Farm Bureau | $2,058 |

| State Farm | $2,418 |

| Baton Rouge average | $2,804 |

Cheapest Car Insurance in Shreveport, LA

We found the cheapest auto insurance quotes in Shreveport from Farm Bureau, with a $1,860 quote per year for full coverage with $500 deductibles of collision and comprehensive coverage. Louisiana Farm Bureau’s rate is 33% cheaper than average rates in Shreveport.

| Shreveport Company | Average Premium |

|---|---|

| Farm Bureau | $1,860 |

| State Farm | $1,978 |

| Progressive | $2,254 |

| Shreveport average | $2,754 |

Cheapest Car Insurance in Metairie, LA

Metairie, LA’s cheapest auto insurance rates can be found with Nationwide with a quote at $1,910 per year for our sample 30-year-old driver. Nationwide’s rate is 31% cheaper than Metairie’s average rates.

| Metairie Company | Average Premium |

|---|---|

| Nationwide | $1,910 |

| Progressive | $2,035 |

| Farm Bureau | $2,062 |

| Metairie average | $2,760 |

Cheapest Car Insurance in Lafayette, LA

Lafayette drivers with good driving records can get the cheapest auto insurance coverage with Progressive, which provided our agents a quote at $1,821 per year for our 30-year-old sample driver with a full coverage auto policy. 32% lower than Lafayette’s average rates.

| Lafayette Company | Average Premium |

|---|---|

| Progressive | $1,821 |

| Farm Bureau | $1,943 |

| State Farm | $2,334 |

| Lafayette average | $2,655 |

Cheapest Auto Insurance in Lake Charles, LA

Lake Charles residents needing the cheapest auto coverage for their car should get quotes from Farm Bureau, who provided our insurance agents a rate at $1,568 per year or 37% lower than average rates in New Lake Charles.

| Lake Charles Company | Average Premium |

|---|---|

| Farm Bureau | $1,568 |

| Progressive | $1,740 |

| State Farm | $1,768 |

| Lake Charles average | $2,480 |

Cheapest Car Insurance in Bossier City, LA

Bossier City’s cheapest auto insurance is with Progressive, who provided us a quote at $1,674 per year for a 30-year-old driver with full coverage. Progressive’s rate is 38% less expensive than the average Bossier City rate.

| Bossier City Company | Average Premium |

|---|---|

| Progressive | $1,674 |

| Farm Bureau | $1,699 |

| State Farm | $2,057 |

| Bossier City average | $2,681 |

Average Auto Insurance Costs for All Cities in Louisiana

| City | Annual premium cost | City | Annual premium cost |

|---|---|---|---|

| New Orleans | $2,879 | Stonewall | $2,488 |

| Baton Rouge | $2,804 | Blanchard | $2,513 |

| Shreveport | $2,754 | Boutte | $2,563 |

| Metairie | $2,760 | Sunset | $2,539 |

| Lafayette | $2,655 | Homer | $2,584 |

| Lake Charles | $2,480 | Natalbany | $2,682 |

| Bossier City | $2,681 | Norco | $2,931 |

| Kenner | $2,476 | Delhi | $2,663 |

| Monroe | $2,429 | Poydras | $2,672 |

| Alexandria | $2,499 | Lockport | $2,488 |

| Houma | $2,320 | Arcadia | $2,519 |

| Prairieville | $2,488 | Westminster | $2,553 |

| Marrero | $2,364 | Lake Providence | $2,564 |

| New Iberia | $2,564 | Kinder | $2,586 |

| Laplace | $2,519 | Lake Arthur | $2,590 |

| Central | $2,539 | Brusly | $2,564 |

| Slidell | $2,553 | Many | $2,594 |

| Terrytown | $2,715 | Bawcomville | $2,687 |

| Chalmette | $2,690 | Sterlington | $2,697 |

| Ruston | $2,687 | Pearl River | $2,488 |

| Harvey | $2,488 | Haynesville | $2,700 |

| Hammond | $2,709 | Mathews | $2,728 |

| Shenandoah | $2,564 | Abita Springs | $2,729 |

| Sulphur | $2,386 | Coushatta | $2,712 |

| Bayou Cane | $2,687 | Colfax | $2,499 |

| Estelle | $2,700 | Bourg | $2,690 |

| Natchitoches | $2,726 | New Llano | $2,717 |

| Gretna | $2,729 | Chauvin | $2,742 |

| Zachary | $2,539 | Belle Rose | $2,747 |

| Opelousas | $2,750 | Erath | $2,519 |

| Thibodaux | $2,662 | Milton | $2,690 |

| Pineville | $2,742 | Baldwin | $2,488 |

| Luling | $2,754 | Fort Polk North | $2,713 |

| Belle Chasse | $2,488 | Amelia | $2,553 |

| Baker | $2,747 | Erwinville | $2,564 |

| Youngsville | $2,519 | Pierre Part | $2,742 |

| River Ridge | $2,752 | Lakeshore | $2,726 |

| Crowley | $2,553 | Benton | $2,942 |

| West Monroe | $2,747 | Garyville | $2,700 |

| Mandeville | $2,499 | Lafourche Crossing | $2,488 |

| Minden | $2,713 | Montegut | $2,690 |

| Abbeville | $2,488 | Kentwood | $2,747 |

| Broussard | $3,044 | Montz | $2,564 |

| Bogalusa | $2,687 | Delcambre | $2,750 |

| Claiborne | $2,564 | Ossun | $2,539 |

| Bayou Blue | $2,700 | Henderson | $2,729 |

| Destrehan | $2,742 | Basile | $2,747 |

| Gardere | $2,729 | Zwolle | $2,519 |

| Morgan City | $2,747 | Independence | $2,742 |

| Moss Bluff | $2,667 | St. Francisville | $2,687 |

| DeRidder | $2,519 | Golden Meadow | $2,564 |

| Gonzales | $2,753 | Cecilia | $2,700 |

| Raceland | $2,726 | Bayou L'Ourse | $2,499 |

| Jefferson | $2,519 | North Vacherie | $2,553 |

| Covington | $2,687 | Logansport | $2,713 |

| Bastrop | $2,747 | Rosepine | $2,488 |

| Woodmere | $2,690 | Livingston | $2,729 |

| Eunice | $2,539 | White Castle | $2,726 |

| Waggaman | $2,553 | Iota | $2,747 |

| Jennings | $2,488 | Bayou Gauche | $2,742 |

| Timberlane | $2,729 | Lafitte | $2,519 |

| Denham Springs | $2,700 | Port Sulphur | $2,687 |

| Harahan | $2,519 | Edgard | $2,488 |

| Fort Polk South | $2,564 | Port Barre | $2,750 |

| Carencro | $2,488 | Cottonport | $2,742 |

| Lacombe | $2,499 | Olla | $2,700 |

| Merrydale | $2,687 | Duson | $2,747 |

| Scott | $2,747 | Maurice | $2,750 |

| Reserve | $2,726 | Clinton | $2,668 |

| Westwego | $2,713 | Labadieville | $2,754 |

| Prien | $2,750 | Jonesville | $2,539 |

| Oak Hills Place | $2,564 | Minorca | $2,729 |

| Breaux Bridge | $2,758 | Des Allemands | $2,488 |

| Donaldsonville | $2,742 | Sorrento | $2,744 |

| Rayne | $2,519 | Cade | $2,687 |

| Old Jefferson | $2,488 | Oak Grove | $2,750 |

| Oakdale | $2,539 | Ringgold | $2,499 |

| Eden Isle | $2,553 | Simmesport | $2,747 |

| St. Rose | $2,700 | Lockport Heights | $2,726 |

| Red Chute | $2,742 | Paradis | $2,553 |

| Village St. George | $2,729 | Oberlin | $2,519 |

| St. Gabriel | $2,488 | Woodworth | $2,713 |

| Ponchatoula | $2,726 | Bernice | $2,690 |

| Ville Platte | $2,687 | Charenton | $2,564 |

| Larose | $2,747 | Mansura | $2,729 |

| Meraux | $2,690 | Presquille | $2,488 |

| Galliano | $2,742 | Livonia | $2,687 |

| Franklin | $2,519 | Arnaudville | $2,539 |

| Tallulah | $2,499 | New Sarpy | $2,553 |

| Plaquemine | $2,750 | Hackberry | $2,747 |

| Bridge City | $2,553 | Killian | $2,488 |

| Schriever | $2,750 | Pine Prairie | $2,742 |

| Walker | $2,713 | Sibley | $2,700 |

| Cut Off | $2,687 | Urania | $2,519 |

| Inniswold | $2,488 | Deville | $2,690 |

| Patterson | $2,553 | Lakeview | $2,713 |

| St. Martinville | $2,700 | Elton | $2,687 |

| Gray | $2,564 | Glenmora | $2,729 |

| Leesville | $2,519 | Paulina | $2,499 |

| Brownfields | $2,488 | Wallace | $2,726 |

| Violet | $2,539 | Lawtell | $2,553 |

| Elmwood | $2,747 | Lawtell and Watson | $2,750 |

| Marksville | $2,742 | Gueydan | $2,519 |

| Jeanerette | $2,726 | Vienna Bend | $2,747 |

| Chackbay | $2,713 | Empire | $2,488 |

| Avondale | $2,747 | Paincourtville | $2,564 |

| Addis | $2,553 | Barataria | $2,742 |

| Carlyss | $2,729 | Merryville | $2,700 |

| Grambling | $2,690 | Newellton | $2,726 |

| Jackson | $2,488 | Hayes | $2,539 |

| Port Allen | $2,519 | Ama | $2,742 |

| Springhill | $2,499 | Melville | $2,553 |

| Monticello | $2,687 | Midway | $2,713 |

| Mansfield | $2,539 | Dulac | $2,747 |

| Westlake | $2,564 | Bayou Country Club | $2,488 |

| Winnsboro | $2,519 | Banks Springs | $2,750 |

| Swartz | $2,742 | Albany | $2,687 |

| Berwick | $2,726 | Cullen | $2,747 |

| New Roads | $2,700 | Lemannville | $2,729 |

| Eastwood | $2,488 | Roseland | $2,690 |

| Jonesboro | $2,553 | Fordoche | $2,742 |

| Kaplan | $2,713 | Start | $2,499 |

| Richwood | $2,747 | Lydia | $2,700 |

| Church Point | $2,687 | Cotton Valley | $2,488 |

| Winnfield | $2,690 | Choctaw | $2,519 |

| Amite | $2,729 | Morse | $2,539 |

| Arabi | $2,553 | Catahoula | $2,747 |

| Bayou Vista | $2,519 | Campti | $2,564 |

| Ball | $2,700 | Boyce | $2,687 |

| Vidalia | $2,488 | Leonville | $2,747 |

| Bunkie | $2,687 | Washington | $2,726 |

| Farmerville | $2,499 | Anacoco | $2,553 |

| Franklinton | $2,742 | Choudrant | $2,713 |

| Brownsville | $2,747 | Oil City | $2,519 |

| Vivian | $2,729 | Maringouin | $2,488 |

| Rayville | $2,747 | Folsom | $2,700 |

| Jena | $2,564 | Slaughter | $2,729 |

| Vacherie | $2,519 | Dubach | $2,690 |

| Haughton | $2,539 | Simsboro | $2,594 |

| Ferriday | $2,703 | Krotz Springs | $2,499 |

| Gramercy | $2,726 | Lecompte | $2,488 |

| Vinton | $2,553 | Plain Dealing | $2,687 |

| Grand Point | $2,488 | Marion | $2,714 |

| Hahnville | $2,700 | Wallace Ridge | $2,553 |

| Lutcher | $2,710 | French Settlement | $2,519 |

| Welsh | $2,690 | Estherwood | $2,499 |

| Iowa | $2,488 | St. Joseph | $2,564 |

| Greenwood | $2,553 | Epps | $2,687 |

| Mamou | $2,519 | Moreauville | $2,539 |

| DeQuincy | $2,499 | Reddell | $2,488 |

Minimum Requirements for Louisiana Car Insurance

Louisiana drivers must have a minimum amount of liability insurance requirements in their insurance policies to follow state laws and drive legally.

| Liability insurance | State minimum requirements |

|---|---|

| Bodily injury liability | $15,000 per person / $30,000 per accident |

| Property damage liability | $25,000 per accident |

AutoInsureSavings.org licensed agents recommend getting higher liability limits of bodily injury liability and property damage liability coverage to cover your assets in the event of an accident.

Our agents recommend most Louisiana drivers carry full coverage with comprehensive and collision coverage, uninsured motorist coverage, and roadside assistance to protect their vehicle in an unforeseen car accident.

To help you find the right and affordable car insurance options in Louisiana, contact the insurance experts at AutoInsureSavings.org. The best way is to get started and enter your zip code. Our expert advice will help you find the best answer to any questions you have.

Methodology

AutoInsureSavings.org collects hundreds of quotes in Louisiana across various zip codes from the largest insurance companies via Quadrant Information Services. Our sample driver profile is a 30-year-old driving a 2018 Honda Accord with good credit. We used a full coverage car insurance policy unless otherwise stated with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily liability | $50,000 per person/$100,000 per accident |

| Property damage | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

When AutoInsureSavings.org quotes a driver with a minimum coverage auto policy, we used the minimum liability coverage per Louisiana insurance regulations. We used credit score, marital status, driving history, and accident history for other rate analyses. We used insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your rates may vary by zip code when you get quotes.

Frequently Asked Questions

Which company has the cheapest auto insurance in Lousiana?

Louisiana Farm Bureau for minimum coverage auto insurance. Farm Bureau offers some of the best insurance industry rates, with a $518 per year rate for a 30-year-old driver in Louisiana. State Farm at $984 per year and Progressive at $1,045 per year are two other car insurers offering the best rates for drivers needing minimum coverage in Louisiana. The average cost of Louisiana auto insurance is $1,108 per year for state minimum coverage.

Because insurance rates are based on various factors such as vehicle type and credit score, it is best to compare multiple providers’ rates to determine who has the cheapest coverage in Louisiana for you.

How much is Louisiana car insurance per month?

The average rate for Louisiana auto insurance is $232 per month for a driver who is 30 years old and has full coverage. That is $2,786 per year. Here are some totals for the average monthly car insurance rate for drivers in Louisiana: State Farm: $154 per month, State Farm: $193 per month, and Progressive: $211 per month.

How much is full coverage auto insurance in Louisiana?

The average cost of full coverage car insurance in Louisiana is $2,786 per year or $232 per month. Farm Bureau’s best rate for full coverage is $1,856 per year or $154 per month for a 30-year-old male driver with a good driving record. State Farm’s rate is $2,326 per year, and Progressive’s rate is $2,537 per year, and both are below the state average rates.

How can I save on Louisiana auto insurance?

There are several things drivers in Louisiana can do to save money on their car insurance costs. We suggest asking your insurance agent about any car insurance discounts you may be eligible for. If you are looking for a new provider, it is best to find one that offers a driving discount to help you save even more. Find out if you are eligible for telematics or usage-based insurance, such as Progressive’s Snapshot program, where you could save as much as $145 per year on your auto insurance premium at renewal.

The car you drive also plays a significant role in your rates, plus driving history and credit rating. Therefore, practicing safe driving habits by maintaining good driving records and keeping a close eye on your credit cards and credit report can lower your car insurance rates.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Jan 4, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.