Kansas Cheapest Car Insurance & Best Coverage Options

Drivers looking for the Kansas cheapest car insurance policies can find them at Farm Bureau Insurance and American Family. Farm Bureau Insurance is the cheapest for minimum insurance, with average rates of $41/mo, while American Family has the cheapest full coverage rates at an average of $114/mo.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Commercial Lines Coverage Specialist

UPDATED: Nov 29, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Nov 29, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

- Farm Bureau is the cheapest company for Kansas minimum coverage policies

- American Family is the cheapest company for Kansas full coverage policies

- Full coverage in Kansas provides the most financial protection for drivers

Farm Bureau and American Family have some of the Kansas cheapest car insurance policies. Read on to learn more about the best auto insurance companies for cheap car insurance in Kansas. We go over everything you need to know about coverages, companies, and much more.

To start shopping for affordable Kansas car insurance today, enter your ZIP code into our free quote comparison tool.

Best Cheap Car Insurance in Kansas

Carrying insurance in the state of Kansas is mandated by state law. However, who provides your coverage and anything above the liability insurance requirements are a matter of choice.

| Cheapest Car Insurance in Kansas - Key Takeaways |

|---|

The cheapest Kansas car insurance options are: The cheapest Kansas car insurance options are:Cheapest for minimum coverage: Farm Bureau Insurance Cheapest for full coverage: American Family Cheapest after an at-fault accident: State Farm Cheapest after a speeding ticket: American Family Cheapest after a DUI: Progressive Cheapest for poor credit history: Nationwide Cheapest for young drivers: American Family For younger drivers with a speeding violation: Farm Bureau Insurance For younger drivers with an at-fault accident: American Family |

Keep reading to learn how to save money with Kansas car insurance companies in various age groups and how to find the best auto insurance coverage for the most affordable cost.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Kansas for Minimum Coverage

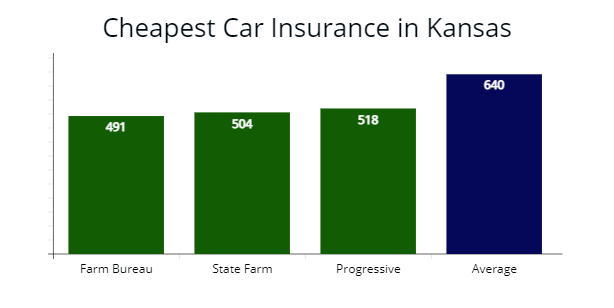

Our agents found that Farm Bureau Insurance offers the cheapest minimum coverage car insurance for Kansas drivers with a good driving record at $491 per year, which is 24% less expensive than the average cost for minimum liability from other car insurance companies in Kansas at $640 per year.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Enter your zip code above to compare cheap auto quotes from the best auto insurers to help you save money.

| Company | Average annual rate |

|---|---|

| USAA | $385 |

| Farm Bureau | $491 |

| State Farm | $504 |

| Progressive | $518 |

| Allstate | $588 |

| American Family | $636 |

| Farmers | $721 |

| Liberty Mutual | $798 |

*USAA is for qualified military members, their spouses, and direct family members. Auto insurance rates vary depending on driver profiles.

We found the most expensive insurance providers for minimum coverage during our rate analysis are Farmers and Liberty Mutual, with an average annual quote of $721 and $798.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

The cheapest car insurance in the state of Kansas is based on several factors. First, you must determine if you want full coverage or the state minimum coverage. Then, you must factor in your vehicle information, age, and driving history.

Minimum coverage is a liability-only policy with bodily injury and property damage liability insurance, including personal injury protection.

Learn more:

- Understanding Full Coverage Car Insurance: What You Need to Know

- Understanding Liability Auto Insurance: What You Need to Know

Cheapest Insurance for Full Coverage in Kansas

American Family offers cheap insurance rates in Kansas at $1,369 per year or $114 per month for full coverage, 28% cheaper than Kansas’ state average rates.

The next best is Progressive, which offers full coverage insurance rates at $1,485 per year or 21% cheaper than average rates.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| American Family | $1,369 | $114 |

| Progressive | $1,485 | $123 |

| State Farm | $1,561 | $130 |

| Kansas average | $1,879 | $156 |

*Your rates may vary when you get a quote.

Kansas’ average premium for full coverage insurance is $1,879 per year or $156 per month.

Full coverage policies include comprehensive and collision, which reimburse property damage to your vehicle from car accidents, vandalism, or thefts.

Learn more: Benefits of Adding Comprehensive & Collision Coverage & What’s the Difference?

AutoInsureSavings.org licensed insurance agents recommend drivers in Kansas with newer model vehicles to buy a full coverage policy.

Cheapest Auto Insurance for Drivers in Kansas With Speeding Tickets

Our licensed agents found American Family offers the cheapest rates for Kansas drivers with speeding tickets at $1,745 per year or a $145 monthly rate. American Family’s rate is 24% less expensive than Kansas’ average rates of $2,278 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| American Family | $1,745 | $145 |

| Progressive | $1,849 | $154 |

| State Farm | $1,940 | $161 |

| Kansas average | $2,278 | $190 |

The average car insurance premium for a Kansas driver with a speeding violation is $2,278, or $399 more for auto insurance than a clean record driver.

A minor speeding violation stays on Kansas driving records for 3 years. During those 3 years, the cost of car insurance can increase by 18%. A major violation will remain on your driving record for 5 years.

Cheapest Insurance in Kansas For Drivers with an Accident

State Farm offers the best rate for drivers with a recent at-fault accident in Kansas, with annual auto insurance premiums at $2,154. That is $519 less than the average amount drivers pay ($2,673) for auto insurance coverage in Kansas.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $2,154 | $179 |

| Progressive | $2,199 | $183 |

| American Family | $2,268 | $189 |

| Kansas average | $2,673 | $223 |

The least expensive insurance coverage exists for people with clean driving records. Kansas auto insurance carriers will cover people with an accident. Kansas’ average rate for a person with a car accident on their driving record would be $2,673 per year, over $794 more than the average premium for full coverage.

Cheapest Car Insurance in Kansas for Drivers with a DUI

Progressive offers the cheapest auto insurance rates in Kanas for drivers with a DUI in their driving history at $2,115 per year. The average rate for drivers with a DUI in Kansas is $3,027, and Progressive offers savings of $912 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $2,115 | $176 |

| State Farm | $2,305 | $192 |

| American Family | $2,441 | $203 |

| Kansas average | $3,027 | $252 |

According to the Kansas Department of Transportation, driving under the influence violation in Kansas can raise your car insurance premiums by 66%. DUI offenders in Kansas will have driving privileges suspended for 30 days and restricted for 330 days.

Cheapest Car Insurance in Kansas for Drivers With Poor Credit

Nationwide offers the least expensive insurance premiums for Kansas drivers with a poor credit score. Nationwide provides a savings of over $524 per year or 22% less expensive, with an insurance premium of $2,474 per year.

Progressive is the second cheapest car insurance option at $2,057 per year or 17% cheaper than average Kansas poor credit rates.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Nationwide | $1,950 | $162 |

| Progressive | $2,057 | $171 |

| American Family | $2,166 | $180 |

| Kansas average | $2,474 | $206 |

We found drivers with a bad credit score pay 32% more for coverage in Kansas than those with good credit scores during our rate analysis. Make sure to pay your credit cards and bills on time to find the best rates with Kansas car insurance. And keep an eye on your credit report.

Cheapest Car Insurance in Kansas for Young Drivers

Younger drivers shopping for car insurance can find cheap rates in Kansas with American Family, who provided our agents with a $3,458 annual quote for full coverage. American Family’s rate is 34% cheaper than Kansas’ average younger driver rate of $5,218

Young military members can find the best car insurance with USAA at $3,117 per year for a 20-year-old driver.

| Insurer | Full coverage | Minimum coverage |

|---|---|---|

| USAA | $3,117 | $1,165 |

| American Family | $3,458 | $2,117 |

| State Farm | $3,870 | $1,470 |

| Farm Bureau | $4,148 | $1,388 |

| Allstate | $5,425 | $1,682 |

| Farmers | $5,974 | $2,631 |

| Progressive | $6,327 | $2,549 |

| Kansas average | $5,218 | $1,972 |

*USAA is for qualified service members, their spouses, and direct family members. Rates may vary depending on driver profiles.

A teen driver who recently received their driver’s license or has been driving for less than five years is a high-risk driver.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

They tend to get more traffic tickets and have more accidents. The cost to insure a Kansas driver under 21 is significantly higher than insuring a driver over 30 with a clean driving record.

Cheapest Insurance for Young Drivers with Speeding Tickets

Young or teen drivers in Kansas should compare auto insurance quotes with Farm Bureau with a speeding ticket in their driving history. Farm Bureau provided our agents a quote at $4,190 per year or $349 per month.

Farm Bureau’s rates are 28% less expensive than average rates for young Kansas drivers.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Farm Bureau | $4,190 | $349 |

| American Family | $4,315 | $359 |

| State Farm | $4,471 | $372 |

| Kansas average | $5,783 | $481 |

Cheapest Car Insurance for Young Drivers in Kansas with an Accident

According to our licensed agent’s rate analysis, younger drivers with an at-fault accident can find the cheapest car insurance quotes with American Family, with an average cost of $4,211 annually or $350 per month.

American Family’s insurance rate is 34% less expensive than Kansas’ $6,329 average rate for younger drivers with an at-fault accident.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| American Family | $4,211 | $350 |

| State Farm | $4,840 | $403 |

| Geico | $5,566 | $463 |

| Kansas average | $6,329 | $527 |

Best Auto Insurance Companies in Kansas

If we use the NAIC complaint index, J.D. Powers claims satisfaction study, and the average price for state minimum and full coverage, American Family (AmFam) is the best auto insurer in Kansas.

Sometimes getting the most affordable auto insurer isn’t the best for quality customer service for Kansas drivers. Depending on your assets and situation, you may need to compare insurance companies with higher than average customer service and satisfaction standards.

| Group | % respondents overall satisfied with recent claim | %respondents rated customer service as excellent |

|---|---|---|

| American Family (AmFam) | 86% | 50% |

| USAA | 78% | 62% |

| State Farm | 73% | 46% |

| Allstate | 72% | 47% |

| Farmers Insurance | 71% | 38% |

| Progressive | 74% | 34% |

According to ValuePenguin, AmFam received the highest customer satisfaction ratings for Kansas car insurance. AmFam also received the highest satisfaction ratings from its customers for both claims satisfaction and the lowest NAIC complaint index of 0.45, well below the national average of 1.00.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

If we take the National Association of Insurance Commissioners (NAIC) complaint index, J.D. Power claims satisfaction score, and A.M. Best financial strength ratings, the results are similar.

| Insurer | NAIC complaint index | J.D. Power claims satisfaction score | AM Best financial strength rating |

|---|---|---|---|

| American Family | 0.45 | 862 | A |

| Farmers | 0.49 | 872 | A |

| Progressive | 0.60 | 856 | A+ |

| Allstate | 0.63 | 876 | A+ |

| State Farm | 0.66 | 881 | A++ |

Farmers Insurance (0.49), Progressive (0.60), and AmFam (0.45) are the best-rated insurers with excellent financial strength, have a complaint ratio below the national average of 1.00 which means all three car insurance companies have fewer complaints relative to their market share.

Average Car Insurance Costs by City in Kansas

Auto insurers use your zip code and many factors to determine your Kansas car insurance costs, as well as your credit score, marital status, type of motor vehicle, and past driving history. If you live in Kansas’s more urban areas, there is a higher chance of auto theft or being in an auto accident. Insurance companies will increase rates to account for such risk.

Cheapest Car Insurance in Wichita, KS

Drivers in Wichita can find the most affordable coverage with Farm Bureau Insurance with a $1,350 annual rate for our 30-year-old sample driver. A $1,350 quote from Farm Bureau is 39% cheaper than Wichita’s average car insurance rates.

| Wichita Company | Average Premium |

|---|---|

| Farm Bureau | $1,350 |

| AmFam | $1,467 |

| State Farm | $1,531 |

| Wichita average | $2,184 |

Cheapest Car Insurance in Overland Park, KS

Overland Park, KS residents, can find cheaper insurance coverage with AmFam, who provided our licensed agents a quote at $1,381 per year or a $115 monthly rate. AmFam is 27% less expensive than average rates in Overland Park, Kansas.

| Overland Park Company | Average Premium |

|---|---|

| American Family | $1,381 |

| Farm Bureau Insurance | $1,419 |

| Geico | $1,647 |

| Overland Park average | $2,190 |

Cheapest Car Insurance in Kansas City, KS

Kansas City drivers can find cheap insurance with Farm Bureau, who offered us a quote at $1,463 annually or a $121 monthly rate with $500 deductibles for comprehensive and collision insurance. Farm Bureau’s insurance quote is 35% cheaper than Kansas City’s average rates at $2,247 per year.

| Kansas City Company | Average Premium |

|---|---|

| Farm Bureau Insurance | $1,463 |

| Progressive | $1,585 |

| State Farm | $1,692 |

| Kansas City average | $2,247 |

Cheapest Car Insurance in Olathe, KS

Drivers with clean driving history in Olathe, KS, can find the cheapest auto insurance quotes with Farm Bureau, with quotes at $1,391 per year and 31% less expensive than the average Olathe rate.

| Olathe Company | Average Premium |

|---|---|

| Farm Bureau | $1,391 |

| Progressive | $1,464 |

| Geico | $1,577 |

| Olathe average | $2,011 |

Cheapest Auto Insurance in Topeka, KS

AutoInsureSavings.org licensed agents found that Topeka’s cheapest insurance rate is with Progressive, who provided us a quote at $1,336 per year for full coverage or 36% lower than average rates for people in Topeka, Kansas.

| Topeka Company | Average Premium |

|---|---|

| Progressive | $1,336 |

| AmFam | $1,416 |

| Geico | $1,482 |

| Topeka average | $2,057 |

Cheapest Auto Insurance in Lawrence, KS

Residents of Lawrence, KS, can find cheap auto insurance with Progressive with a quote at $1,306 per year or a $108 monthly rate for a full coverage insurance policy, which is 35% less expensive than the average $1,979 Lawrence rate.

| Lawrence Company | Average Premium |

|---|---|

| Progressive | $1,306 |

| Farm Bureau | $1,375 |

| Allstate | $1,616 |

| Lawrence average | $1,979 |

Average Cost of Insurance for All Cities in Kansas

| City | Annual Premium Cost | City | Annual Premium Cost |

|---|---|---|---|

| Wichita | $2,184 | Sabetha | $1,760 |

| Overland Park | $2,190 | Clearwater | $1,836 |

| Kansas City | $2,247 | South Hutchinson | $1,793 |

| Olathe | $2,011 | Cherryvale | $1,817 |

| Topeka | $2,057 | Cimarron | $1,843 |

| Lawrence | $1,979 | Halstead | $1,877 |

| Shawnee | $1,894 | Eureka | $1,843 |

| Manhattan | $1,890 | Council Grove | $1,858 |

| Lenexa | $1,836 | Moundridge | $1,760 |

| Salina | $1,914 | Anthony | $1,895 |

| Hutchinson | $1,827 | Holcomb | $1,875 |

| Leavenworth | $1,760 | Herington | $1,856 |

| Leawood | $2,037 | Fredonia | $1,817 |

| Dodge City | $1,817 | Oakley | $1,793 |

| Garden City | $1,914 | Seneca | $1,836 |

| Emporia | $1,843 | Neodesha | $1,871 |

| Derby | $2,014 | Ellinwood | $1,890 |

| Junction City | $1,871 | Ellis | $1,911 |

| Prairie Village | $1,817 | Marion | $1,760 |

| Gardner | $1,904 | Wellsville | $1,856 |

| Hays | $2,055 | Cheney | $1,843 |

| Pittsburg | $2,065 | Plainville | $1,836 |

| Liberal | $1,694 | WaKeeney | $1,850 |

| Newton | $1,817 | Belleville | $1,871 |

| Great Bend | $1,760 | Humboldt | $1,793 |

| Andover | $1,684 | Syracuse | $1,890 |

| McPherson | $1,738 | Caney | $1,904 |

| El Dorado | $1,817 | Minneapolis | $1,692 |

| Ottawa | $1,871 | Douglass | $1,760 |

| Winfield | $1,682 | Lakin | $1,836 |

| Lansing | $1,903 | North Newton | $1,793 |

| Arkansas City | $1,871 | Horton | $1,850 |

| Merriam | $1,904 | Medicine Lodge | $1,817 |

| Haysville | $1,760 | Edgerton | $1,890 |

| Atchison | $1,793 | Oswego | $1,986 |

| Parsons | $1,817 | Westwood | $1,686 |

| Mission | $1,682 | Hill City | $1,760 |

| Coffeyville | $1,890 | Oberlin | $1,850 |

| Augusta | $1,760 | Ogden | $1,836 |

| Chanute | $1,843 | Leoti | $1,903 |

| Independence | $1,871 | Osborne | $1,793 |

| Park City | $1,903 | Ness City | $1,674 |

| Bel Aire | $1,986 | Wathena | $1,760 |

| Wellington | $1,760 | Elkhart | $1,890 |

| Bonner Springs | $1,850 | McConnell AFB | $1,683 |

| Fort Scott | $1,903 | Stockton | $1,682 |

| Valley Center | $1,911 | Kinsley | $1,817 |

| Roeland Park | $1,986 | Belle Plaine | $1,760 |

| Pratt | $1,836 | Conway Springs | $1,793 |

| Spring Hill | $1,908 | Smith Center | $1,850 |

| Eudora | $1,760 | Sedgwick | $1,871 |

| Fort Riley | $1,871 | Meade | $1,793 |

| Abilene | $1,986 | Erie | $1,843 |

| De Soto | $1,911 | Carbondale | $1,890 |

| Mulvane | $2,075 | Riley | $1,904 |

| Basehor | $1,986 | St. Francis | $1,986 |

| Ulysses | $1,890 | Sublette | $1,871 |

| Paola | $1,817 | Pleasanton | $1,760 |

| Colby | $1,682 | Inman | $1,836 |

| Tonganoxie | $1,871 | Silver Lake | $1,843 |

| Iola | $1,986 | St. John | $1,890 |

| Concordia | $1,760 | Arma | $1,817 |

| Wamego | $1,992 | Yates Center | $1,986 |

| Baldwin City | $1,793 | Harper | $1,850 |

| Maize | $1,871 | Oskaloosa | $1,682 |

| Russell | $1,850 | Towanda | $1,902 |

| Edwardsville | $1,904 | Colwich | $1,760 |

| Louisburg | $1,986 | Lincoln Center | $1,912 |

| Goddard | $1,682 | Rossville | $1,836 |

| Goodland | $1,760 | Blue Rapids | $1,890 |

| Osawatomie | $1,817 | Chetopa | $1,903 |

| Hugoton | $1,843 | McLouth | $1,793 |

| Rose Hill | $1,836 | Pomona | $1,999 |

| Clay Center | $1,817 | La Crosse | $1,850 |

| Baxter Springs | $1,871 | Chapman | $1,843 |

| Scott City | $1,890 | Hoxie | $1,682 |

| Fairway | $1,986 | Grandview Plaza | $1,904 |

| Larned | $1,904 | La Cygne | $1,760 |

| Hesston | $1,682 | Auburn | $1,682 |

| Beloit | $1,684 | Solomon | $1,887 |

| Mission Hills | $1,793 | Haven | $1,817 |

| Lyons | $1,760 | Plains | $1,617 |

| Oaklawn-Sunview | $1,843 | Highland | $1,900 |

| Frontenac | $1,817 | Altamont | $1,850 |

| Lindsborg | $1,890 | Johnson City | $1,760 |

| Marysville | $1,903 | Buhler | $1,836 |

| Holton | $1,888 | Atwood | $1,997 |

| Garnett | $1,817 | Greeley County | $1,986 |

| Hiawatha | $1,760 | Mound City | $1,871 |

| Columbus | $1,990 | Peabody | $1,890 |

| Ellsworth | $1,836 | Oxford | $1,793 |

| Kingman | $1,850 | Satanta | $1,760 |

| Galena | $1,890 | Washington | $1,843 |

| Hoisington | $1,908 | Lyndon | $1,817 |

| Hillsboro | $1,922 | Valley Falls | $1,836 |

| Osage City | $1,760 | Victoria | $1,988 |

| Norton | $1,793 | Galva | $1,850 |

| Kechi | $1,817 | Nickerson | $1,907 |

| St. Marys | $1,871 | Benton | $1,760 |

| Girard | $1,843 | Caldwell | $1,901 |

| Sterling | $1,817 | Jetmore | $1,859 |

| Phillipsburg | $1,850 | Wakefield | $1,836 |

| Burlington | $1,760 | Enterprise | $1,793 |

Minimum Car Insurance Requirements in Kansas

Drivers in Kansas must carry the state minimum requirements for car insurance for vehicle registration. State law mandates drivers have at least $25,000 per person and up to $50,000 per accident of bodily injury liability coverage. They also require at least $25,000 per accident of property damage liability coverage.

| Liability | Minimum coverage |

|---|---|

| Bodily injury liability | $25,000 per person and $50,000 per accident |

| Property damage liability | $25,000 per accident |

| Uninsured motorist bodily injury | $25,000 per person and $50,000 per accident |

| Personal Injury Protection | $4,500 per person |

Kansas is a no-fault state, so drivers must carry personal injury protection in their car insurance premiums. Below is the minimum amount required by state law in Kansas.

- $4,500/person for medical expenses.

- $900/month for one year for disability/loss of income.

- $25/day for in-home services.

- $2,000 for funeral, burial or cremation expense.

- $4,500 for rehabilitation expense.

AutoInsureSavings.org licensed agents recommend buying coverage with higher liability limits in Kansas if you have multiple assets, such as houses or multiple vehicles.

According to the Insurance Information Institute (III.org), we recommend uninsured motorist coverage since Kansas’s uninsured motorist rate is 7.2%.

Kansas Car Insurance FAQs

Who has the Cheapest Car Insurance in Kanas?

We found the top car insurance companies that offer the lowest Kansas drivers’ average rates are USAA at $32 per month, Farm Bureau at $40 per month, and State Farm at $42 a month for a state minimum insurance policy for a 30-year-old with clean driving history.

How Much is Car Insurance in Kansas per Month?

On average, drivers pay around $54 per month for state minimum coverage in Kansas and $156 per month for full coverage insurance. Based on our research, American Family, at $1,369 per year, is one of the state’s most affordable car insurance companies. Most drivers’ average annual rate is around $640 per year for state minimums and $1,879 annually, including comprehensive and collision coverage.

How Much Is Full Coverage Car Insurance in Kansas?

On average, most drivers in Kansas pay for full coverage insurance is $156 per month or $1,879 per year. Kansas’s top insurance companies that offer the lowest rate for drivers interested in full coverage auto insurance policies include American Family and Progressive. Both insurers provide auto insurance quotes 22% lower than average, depending on your driver profile.

How do I Save on Car Insurance in Kansas?

There are many things drivers can do to help save money on their car insurance rates in Kansas. First, you will need to compare quotes from multiple insurance providers to find the right insurance company that offers the exact level of coverage in Kansas you need at the most affordable price.

Another thing drivers in Kansas can do to help them save more on their car insurance rates is to ask their auto insurance provider about a money-saving driver discount they may be eligible for. Many companies offer car insurance discounts for drivers who have multiple coverage policies with them or drivers who have no prior accidents or violations on their driving records. Consider Usage-Based car insurance, such as American Family’s KnowYourDrive Program. You can get long-term savings up to 20%, depending on your safe driving habits and driver behavior.

To learn more about finding the best rates and car insurance options in Kansas, contact the experts at AutoInsureSavings.org. Our licensed professionals will be happy to answer any questions you have.

Methodology

AutoInsureSavings.org comparison shopping study used a full-coverage auto policy for a 30-year-old driving a 2018 Honda Accord in Kansas with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily liability | $50,000 per person/$100,000 per accident |

| Property damage | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured motorist bodily injury & underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

We used car insurance rates for drivers in Kansas with accident histories, credit scores, and marital status for other rate analyses. We used insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your auto insurance rates will vary when you get quotes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michael Vereecke

Commercial Lines Coverage Specialist

Michael Vereecke is the president of Customers First Insurance Group. He has been a licensed insurance agent for over 13 years. He also carries a Commercial Lines Coverage Specialist (CLCS) Designation, providing him the expertise to spot holes in businesses’ coverage. Since 2009, he has worked with many insurance providers, giving him unique insight into the insurance market, differences in ...

Commercial Lines Coverage Specialist

UPDATED: Nov 29, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.