New York Cheapest Car Insurance & Best Coverage Options

Utica National and Progressive offer the best New York cheapest car insurance and best coverage options for New York drivers. Minimum coverage at Utica National is an average of $57/mo in New York, while drivers who want cheap full coverage will find it at Progressive for an average of $124/mo.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Jan 10, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jan 10, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

- Utica National has the cheapest minimum coverage in New York

- Progressive has the cheapest full coverage in New York

- Erie, USAA, and State Farm are also economical choices

Looking for the best New York cheapest car insurance and best coverage options? New York drivers will find the cheapest minimum coverage at Utica National. Some of the other best auto insurance companies for cheap New York auto insurance include Erie, Progressive, USAA, and more.

Read on to learn more about affordable New York car insurance. You can also enter your ZIP code into our free quote comparison tool at anytime to get cheap New York auto insurance quotes.

New York Car Insurance Rates

Choosing the right, affordable car insurance company can help you improve your level of coverage while you stay within your budget.

| Cheapest Car Insurance in New York - Quick Hits |

|---|

The cheapest New York car insurance options are: The cheapest New York car insurance options are:Cheapest for minimum coverage: Utica National Cheapest for full coverage: Progressive Cheapest after an at-fault accident: State Farm Cheapest after a speeding ticket: Progressive Cheapest after a DUI: Progressive Cheapest for poor credit history: Geico Cheapest for young drivers: New York Central Mutual (NYCM) For young drivers with a speeding violation: Progressive For young drivers with an at-fault accident: Progressive |

To help you save money and find the best deal on your car insurance premium in New York, we have compared the best rates from several top companies in the auto insurance industry for various types of drivers.

- Car Insurance Rates in New York

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in New York for Minimum Coverage

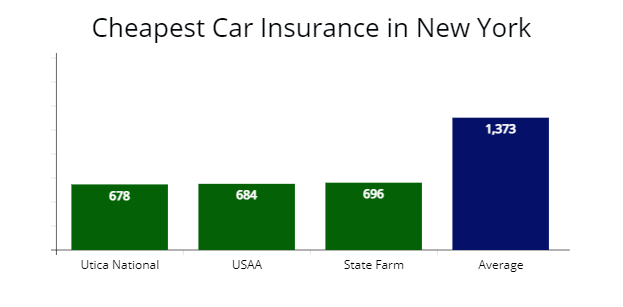

Our agents found that Utica National offers the cheapest minimum coverage car insurance for New York drivers at $678 annually, which is 51% less expensive than the average cost for minimum liability from other car insurance companies in New York at $1,373.

For non-active military members, State Farm is the next cheapest insurance option at $696 or a $58 monthly rate, which is 49% cheaper than the state average.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Utica National | $678 | $56 |

| USAA | $684 | $57 |

| State Farm | $696 | $58 |

| New York Central Mutual | $723 | $61 |

| Geico | $763 | $63 |

| Erie | $766 | $64 |

| Preferred Mutual | $780 | $65 |

| Travelers | $834 | $70 |

| Allstate | $862 | $72 |

| New York average | $1,373 | $114 |

*USAA is for qualified military members, their spouses, and direct family members. Auto insurance policy rates may vary depending on driver profiles.

New York drivers’ can purchase minimum liability requirements for less than $1,000 per year from several providers.

While Utica National and State Farm are the cheapest options for many drivers, we also found that Geico and New York Central Mutual are two good insurance carriers to consider based on our research for drivers who want to save the most money.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Minimum liability insurance policies offer the cheapest auto insurance premiums, which exclude comprehensive and collision coverage.

I often recommend getting full coverage insurance since filing a claim with a minimum coverage policy will often have you paying out-of-pocket expenses. Affordable options can be found by searching for competitive rates online.Daniel Walker Licensed Insurance Agent

Cheapest Full Coverage Car Insurance for Drivers in New York

We found that Progressive offers cheap full coverage car insurance for New York drivers with a quote of $1,489 for an annual premium or 40% cheaper than the average rate (learn more: Progressive Car Insurance Review for Families, Policy Options & Ratings). Erie is the next best option at $1,540 per year or 38% less expensive than New York’s average $2,462 insurance rate.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $1,489 | $124 |

| USAA | $1,511 | $125 |

| Erie | $1,540 | $128 |

| State Farm | $1,580 | $131 |

| Utica National | $1,644 | $137 |

| Geico | $1,750 | $145 |

| New York Central Mutual | $1,843 | $153 |

| Allstate | $1,965 | $163 |

| New York average | $2,462 | $205 |

*USAA is for qualified military personnel, their spouses, and direct family members. Rates may vary depending on driver profiles and zip codes.

Those who qualify for USAA benefits can get their full coverage auto insurance at just $125 per month for liability, collision, and comprehensive coverage. USAA is one of the best car insurance options for veterans and military members due to its affordable rates and coverage options.

Learn more: A Review of USAA Car Insurance, Policy Options & Military Benefits

The average driver in New York paying for full coverage insurance is $2,462 or $205 per month. Drivers can find cheaper auto policies by comparing top car insurance providers’ rates like those listed here.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Cheapest Car Insurance For Drivers in New York with a Speeding Ticket

Our licensed agents found Progressive offers the cheapest auto insurance quotes for drivers in New York with a speeding violation at $2,287 per year or a $190 monthly rate. And Erie’s quote at $2,470 per year is 16% lower than average, making them the next cheapest option for New York drivers (learn more: A Review of Erie Auto Insurance & Policy Options).

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $2,287 | $190 |

| Erie | $2,470 | $205 |

| State Farm | $2,480 | $206 |

| New York Central Mutual | $2,590 | $215 |

| New York average | $2,930 | $244 |

In New York, speeding tickets can add anywhere from 3 to 11 points to your driving record. If you speed more than 40 miles per hour over the limit, you will have 11 points added.

According to the New York Department of Motor Vehicles (DMV), if you receive six or more points within 18 months, you will need to pay the New York Driver Responsibility Assessment fee that costs at least $100 to reinstate your driver’s license, along with higher insurance rates.

Cheapest Car Insurance for Drivers in New York with a Car Accident

State Farm offers the most affordable rates for drivers with a recent at-fault accident, with annual premiums as low as $2,854. That is $834 less than the average amount drivers pay ($3,688) for coverage in New York.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $2,854 | $237 |

| New York Central Mutual | $3,076 | $256 |

| Progressive | $3,311 | $275 |

| New York average | $3,688 | $307 |

State Farm, NYCM, and Progressive are insurance companies that offer lower than average rates for many drivers in the state who have an accident on their record.

In New York, a car accident will remain on your motor vehicle record for three years, along with an insurance rate increase. The accident is removed on the first day of January in the fourth year following the car accident.

Cheapest Car Insurance For Drivers in New York With a DUI

Progressive offers the cheapest car insurance rates for drivers with a DUI in their driver history at $2,436 per year. The average rate for drivers with a DUI in New York is $3,893, a savings of $1,457 per year. Take a look at the best car insurance companies after a DUI in New York below.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $2,514 | $209 |

| State Farm | $2,702 | $225 |

| Geico | $3,031 | $252 |

| Liberty Mutual | $3,325 | $277 |

| New York average | $3,893 | $324 |

A DUI driver can expect to see their insurance rate increase by as much as 51%. That is why it is essential to find a car insurance provider that offers the most affordable, cheaper rates.

Cheapest Car Insurance for Drivers in New York with Poor Credit

Geico offers the cheapest auto insurance rates for drivers who have a poor credit history in New York. Their lowest rates are $2,347 per year. State Farm is another inexpensive option with a $2,503 annual rate or 30% lower than the state ($3,539) average rate.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Geico | $2,347 | $195 |

| State Farm | $2,503 | $208 |

| Chubb | $2,854 | $237 |

| Allstate | $3,361 | $280 |

| Utica National | $3,711 | $309 |

| New York average | $3,539 | $294 |

Those who have less than perfect credit may see that their insurance rates are higher than average. For most people, bad credit rates are 60% than those with good or excellent credit scores, according to Insurance Information Institute (III.org).

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Cheapest Car Insurance for Young Drivers in New York

New York Central Mutual (NYCM) offers the cheapest rates for young drivers, with an average premium of $6,475 per year for full coverage car insurance. NYCM also offers less than average costs for minimum coverage at $2,788.

For young drivers’ state minimum coverage, State Farm offers cheap auto insurance quotes at $2,867 per year or 18% less expensive than other car insurance companies in New York. Take a look at the best car insurance for teens below.

| Insurer | Full coverage | Minimum coverage |

|---|---|---|

| New York Central Mutual (NYCM) | $6,480 | $2,790 |

| USAA | $6,647 | $2,834 |

| Progressive | $7,189 | $3,047 |

| State Farm | $7,790 | $2,894 |

| Geico | $8,247 | $3,905 |

| Liberty Mutual | $8,404 | $4,034 |

| Travelers | $8,944 | $4,123 |

| Allstate | $9,147 | $3,439 |

| New York average | $7,539 | $3,477 |

Young or teen drivers that need coverage in New York can save more by comparing auto insurance costs like those shown above. Drivers who choose NYCM can save as much a 16% on their insurance premiums, which can be substantial savings for young drivers and their parents.

Learn more: The Best Car Insurance for New Drivers: A Comprehensive Guide

Cheapest Car Insurance for Young Drivers with a Speeding Ticket

During our comparison shopping study, our agents found young drivers needing coverage in New York with a speeding violation on their driving record can get cheaper insurance rates with Progressive at $6,832 per year or $569 monthly rate, which is 17% less expensive than the average.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $6,832 | $569 |

| NYCM | $7,268 | $605 |

| Geico | $8,386 | $698 |

| Average in New York | $8,124 | $677 |

Learn more: How much will my auto insurance go up with a speeding ticket?

Cheapest Car Insurance for Young Drivers with a Car Accident

Young New York drivers with an at-fault car accident on their driving record can find the cheapest full coverage auto insurance with Progressive, which provided us a quote at $7,241 per year or 21% lower than a similar driver profile rate.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $7,241 | $603 |

| Erie | $7,749 | $645 |

| Geico | $8,628 | $719 |

| Average in New York | $9,036 | $753 |

Best Auto Insurance Companies in New York

Several great insurance companies choose from coverage in New York, based on their price, customer service and support, and coverage level.

ValuePenguin did a survey and found the overall best car insurance company is USAA, with high marks from current policyholders. If you are not eligible for USAA, the next best options are State Farm and Allstate based on customer service.

| Company | % of respondents extremely satisfied with recent claim | % who rated customer service as excellent |

|---|---|---|

| USAA | 78% | 62% |

| State Farm | 73% | 46% |

| Allstate | 72% | 47% |

| Progressive | 74% | 34% |

| Geico | 64% | 42% |

| Travelers | 19% | 33% |

| NYCM | n/a | n/a |

AutoInsureSavings.org team of licensed insurance agents compared complaints by each auto insurer using the National Association of Insurance Commissioners complaint index. Using the complaint index (best ratio of complaints to market share) from NAIC, the best car insurers are Travelers and New York Central Mutual (NYCM).

Using J.D. Power’s claims satisfaction survey, the best insurance providers are USAA and State Farm.

| Insurer | NAIC complaint index | J.D. Power claims satisfaction | AM Best rating |

|---|---|---|---|

| Travelers | 0.09 | 861 | A++ |

| NYCM | 0.19 | n/a | A |

| Allstate | 0.63 | 876 | A+ |

| State Farm | 0.66 | 881 | A++ |

| Progressive | 0.76 | 856 | A+ |

| USAA | 0.97 | 890 | A++ |

| Geico | 1.01 | 871 | A++ |

| Allstate | 1.07 | 876 | A+ |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Average Cost of Car Insurance by City in New York

Auto insurers use your zip code to determine your New York auto insurance rate, as well as your credit score, marital status, and past driving history. The average cost of insurance for drivers in New York is $2,412 per year or $201 per month. During our comparison shopping study, we found the cheapest insurers by city.

You can find the best Long Island auto insurance here.

Find Brooklyn auto insurance here.

Find Bronx auto insurance here.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Cheapest Car Insurance in Albany, NY

Albany drivers can get the most affordable auto insurance coverage from Erie, which provided our agents a $1,752 rate per year for a full coverage policy. Their rate is 35% lower than average.

| Albany Company | Average Premium |

|---|---|

| Erie | $1,752 |

| State Farm | $1,801 |

| Allstate | $2,136 |

| Albany average | $2,680 |

Cheapest Car Insurance in Buffalo, NY

Drivers living in Buffalo with a clean driving history can find the least expensive coverage rate with State Farm at $1,759 per year for full coverage for a 30-year-old driver.

| Buffalo Company | Average Premium |

|---|---|

| State Farm | $1,759 |

| Erie | $1,837 |

| NYCM | $1,943 |

| Buffalo average | $2,636 |

Cheapest Car Insurance in Rochester, NY

The cheapest auto insurance we found in Rochester comes from New York Central Mutual or 32% lower with a $1,856 quote per year.

| Rochester Company | Average Premium |

|---|---|

| NYCM | $1,856 |

| State Farm | $1,932 |

| Erie | $2,046 |

| Rochester average | $2,702 |

Cheapest Car Insurance in Syracuse, NY

To find Syracuse’s best coverage rates, our agents recommend Erie Insurance with a quote at $1,699 for our sample 30-year-old driver. Erie’s rate is 34% cheaper than Syracuse’s average.

| Syracuse Company | Average Premium |

|---|---|

| Erie | $1,699 |

| NYCM | $1,858 |

| Geico | $1,990 |

| Syracuse average | $2,583 |

Cheapest Car Insurance in Ithaca, NY

In Ithaca, drivers can get the cheapest insurance coverage with State Farm, who provided us a quote at $1,814 per year for a 30-year-old sample driver.

| Ithaca Company | Average Premium |

|---|---|

| State Farm | $1,814 |

| Liberty Mutual | $1,964 |

| Geico | $2,036 |

| Ithaca average | $2,713 |

Cheapest Car Insurance in Yonkers, NY

Yonkers residents insuring a motor vehicle with the cheapest coverage should get quotes from Geico, who provided AutoInsureSavings.org agents a rate at $1,946 per year or 28% lower than average.

| Yonkers Company | Average Premium |

|---|---|

| Geico | $1,946 |

| NYCM | $2,037 |

| Allstate | $2,217 |

| Yonkers average | $2,670 |

Cheapest Car Insurance in New Rochelle, NY

New Rochelle’s cheapest auto insurance is with Progressive, who provided us a quote at $1,722 per year for a 30-year-old driver with full coverage. Progressive’s rate is 29% less expensive than the average New Rochelle rate.

| New Rochelle Company | Average Premium |

|---|---|

| Progressive | $1,722 |

| Geico | $1,811 |

| Allstate | $1,941 |

| New Rochelle average | $2,416 |

Average Cost of Insurance for All Cities in New York

| City | Average annual rate | City | Average annual rate |

|---|---|---|---|

| Manhattan | $2,490 | Queens | $2,519 |

| Albany | $2,680 | Mamakating | $2,431 |

| Alden | $2,422 | Mamaroneck | $2,440 |

| Amherst | $2,463 | Manchester | $2,459 |

| Amsterdam | $2,459 | Manlius | $2,476 |

| Arcadia | $2,440 | Marcellus | $2,422 |

| Attica | $2,480 | Marcy | $2,463 |

| Auburn | $2,431 | Massena | $2,459 |

| Aurora | $2,416 | Mechanicville | $2,448 |

| Avoca | $2,422 | Mendon | $2,440 |

| Avon | $2,463 | Middletown | $2,717 |

| Ballston | $2,476 | Milton | $2,448 |

| Barton | $2,422 | Monroe | $2,416 |

| Batavia | $2,459 | Montgomery | $2,431 |

| Bath | $2,448 | Moreau | $2,476 |

| Beacon | $2,422 | Mount Hope | $2,459 |

| Bedford | $2,440 | Mount Kisco | $2,463 |

| Beekman | $2,448 | Mount Pleasant | $2,198 |

| Beekmantown | $2,431 | Mount Vernon | $2,416 |

| Bethlehem | $2,416 | New Castle | $2,440 |

| Binghamton | $2,474 | New Hartford | $2,609 |

| Blooming Grove | $2,422 | New Paltz | $2,335 |

| Bolton | $2,459 | New Rochelle | $2,416 |

| Boston | $2,455 | New Scotland | $2,431 |

| Brighton | $2,422 | New Windsor | $2,448 |

| Broadalbin | $2,440 | New York | $2,798 |

| Brookhaven | $2,448 | Newburgh | $2,440 |

| Brownville | $2,455 | Newfane | $2,474 |

| Brunswick | $2,422 | Newstead | $2,502 |

| Buffalo | $2,636 | Niagara | $2,327 |

| Cairo | $2,431 | Niagara Falls | $2,480 |

| Cambria | $2,416 | Niskayuna | $2,431 |

| Camillus | $2,440 | North Castle | $2,448 |

| Canandaigua | $2,318 | North Elba | $2,455 |

| Canton | $2,422 | North Greenbush | $2,474 |

| Carmel | $2,455 | North Tonawa | $2,608 |

| Catskill | $2,611 | Norwich | $2,328 |

| Cazenovia | $2,431 | Ogden | $2,440 |

| Cheektowaga | $2,605 | Ogdensburg | $2,422 |

| Chenango | $2,448 | Olean | $2,455 |

| Chester | $2,474 | Oneida | $2,431 |

| Chili | $2,480 | Oneonta | $2,449 |

| Cicero | $2,431 | Onondaga | $2,474 |

| Clarence | $2,440 | Ontario | $2,416 |

| Clarkstown | $2,455 | Orangetown | $2,562 |

| Clay | $2,416 | Orchard Park | $2,440 |

| Clifton Park | $2,449 | Ossining | $2,431 |

| Coeymans | $2,422 | Oswego | $2,455 |

| Cohoes | $2,431 | Owego | $2,218 |

| Colonie | $2,440 | Oyster Bay | $2,474 |

| Concord | $2,292 | Palm Tree | $2,422 |

| Cornwall | $2,449 | Palmyra | $2,480 |

| Cortlandt | $2,147 | Parma | $2,440 |

| Cortlandville | $2,440 | Patterson | $2,455 |

| Corning | $2,416 | Pawling | $2,168 |

| Cortland | $2,198 | Peekskill | $2,416 |

| Coxsackie | $2,422 | Pelham | $2,431 |

| Crawford | $2,431 | Pendleton | $2,279 |

| DeWitt | $2,474 | Penfield | $2,471 |

| Dover | $2,422 | Perinton | $2,440 |

| Dryden | $2,455 | Peru | $2,431 |

| Duanesburg | $2,480 | Phelps | $2,449 |

| Dunkirk | $2,455 | Philipstown | $2,312 |

| East Fishkill | $2,431 | Pittsford | $2,422 |

| East Greenbush | $2,440 | Plattekill | $2,228 |

| East Rochester | $2,416 | Plattsburgh | $2,431 |

| Eastchester | $2,292 | Pleasant Valley | $2,480 |

| Eaton | $2,422 | Pomfret | $2,416 |

| Eden | $2,449 | Pompey | $2,455 |

| Ellicott | $2,416 | Porter | $2,440 |

| Elma | $2,512 | Port Jervis | $2,512 |

| Elmira | $2,431 | Potsdam | $2,454 |

| Erwin | $2,455 | Poughkeepsie | $2,449 |

| Esopus | $2,609 | Putnam Valley | $2,422 |

| Evans | $2,614 | Queensbury | $2,431 |

| Fallsburg | $2,440 | Ramapo | $2,416 |

| Farmington | $2,471 | Red Hook | $2,422 |

| Fenton | $2,416 | Rensselaer | $2,544 |

| Fishkill | $2,449 | Rhinebeck | $2,198 |

| Fort Ann | $2,422 | Richland | $2,440 |

| Frankfort | $2,431 | Ridgeway | $2,419 |

| Fulton | $2,454 | Rochester | $2,702 |

| Gates | $2,512 | Rome | $2,544 |

| Geddes | $2,416 | Rosendale | $2,440 |

| Geneseo | $2,431 | Rotterdam | $2,454 |

| Geneva | $2,422 | Royalton | $2,544 |

| German Flatts | $2,416 | Rye | $2,605 |

| Glen Cove | $2,440 | Salamanca | $2,200 |

| Glens Falls | $2,605 | Salina | $2,454 |

| Glenville | $2,431 | Sand Lake | $2,514 |

| Gloversville | $2,449 | Saratoga | $2,440 |

| Goshen | $2,454 | Saratoga Springs | $2,422 |

| Gouverneur | $2,148 | Saugerties | $2,454 |

| Granby | $2,416 | Scarsdale | $2,431 |

| Grand Island | $2,422 | Schaghticoke | $2,416 |

| Greece | $2,440 | Schenectady | $2,449 |

| Greenburgh | $2,567 | Schodack | $2,604 |

| Greenfield | $2,604 | Schroeppel | $2,440 |

| Groton | $2,198 | Scriba | $2,567 |

| Guilderland | $2,431 | Seneca Falls | $2,602 |

| Halfmoon | $2,449 | Shawangunk | $2,511 |

| Hamburg | $2,454 | Shelby | $2,431 |

| Hamlin | $2,416 | Sherrill | $2,602 |

| Hanover | $2,471 | Smithtown | $2,449 |

| Harrietstown | $2,431 | Sodus | $2,422 |

| Harrison | $2,454 | Somers | $2,416 |

| Hastings | $2,422 | Southeast | $2,440 |

| Haverstraw | $2,440 | Southold | $2,431 |

| Henrietta | $2,581 | Southport | $2,422 |

| Herkimer | $2,422 | Stillwater | $2,581 |

| Highlands | $2,451 | Stony Point | $2,454 |

| Homer | $2,416 | Sullivan | $2,198 |

| Hoosick | $2,449 | Sweden | $2,416 |

| Hornell | $2,422 | Syracuse | $2,583 |

| Horseheads | $2,431 | Thompson | $2,581 |

| Hudson | $2,440 | Tonawanda | $2,451 |

| Hyde Park | $2,598 | Troy | $2,422 |

| Irondequoit | $2,440 | Ulster | $2,431 |

| Ithaca | $2,713 | Union | $2,440 |

| Jamestown | $2,165 | Utica | $2,471 |

| Johnstown | $2,416 | Van Buren | $2,416 |

| Kent | $2,451 | Vestal | $2,198 |

| Kinderhook | $2,422 | Victor | $2,451 |

| Kingsbury | $2,431 | Wallkill | $2,500 |

| Kingston | $2,590 | Walworth | $2,247 |

| Kirkland | $2,440 | Wappinger | $2,431 |

| Lackawanna | $2,198 | Warwick | $2,598 |

| LaGrange | $2,422 | Waterford | $2,451 |

| Lancaster | $2,431 | Waterloo | $2,440 |

| Lansing | $2,471 | Watertown | $2,449 |

| Le Ray | $2,416 | Watervliet | $2,416 |

| Lee | $2,463 | Wawarsing | $2,451 |

| Lenox | $2,469 | Wawayanda | $2,431 |

| Lewisboro | $2,422 | Webster | $2,590 |

| Lewiston | $2,597 | Wellsville | $2,422 |

| Liberty | $2,451 | West Seneca | $2,471 |

| Little Falls | $2,449 | Westmoreland | $2,416 |

| Livonia | $2,431 | Wheatfield | $2,463 |

| Lloyd | $2,416 | White Plains | $2,469 |

| Lockport | $2,440 | Whitestown | $2,595 |

| Lysander | $2,593 | Williamson | $2,431 |

| Macedon | $2,471 | Wilton | $2,416 |

| Malone | $2,422 | Yonkers | $2,670 |

| Malta | $2,440 | Yorktown | $2,469 |

Minimum Requirements for New York Car Insurance

New York drivers are required to have a minimum amount of liability coverage in their auto insurance policies. Below are the minimum coverage limits.

Minimum Requirements for Auto Insurance Coverage in Long Island, NY

| Liability | Minimum coverage |

|---|---|

| Bodily injury liability | $25,000 per person and $50,000 per accident |

| Property damage liability | $10,000 per accident |

| Personal injury protection (PIP) | $50,000 per accident |

| Uninsured motorist bodily injury (UMBI) | $25,000 per person and $50,000 per accident |

AutoInsureSavings.org licensed agents recommend getting higher liability limits of bodily injury and property damage coverage if you have multiple assets or a high-net-worth individual.

Our agents recommend most motorists carry collision, comprehensive coverage, and uninsured motorist coverage in their policies to make sure they have the best financial protection in the event of an auto accident.

Learn more: Benefits of Adding Comprehensive & Collision Coverage & What’s the Difference?

To learn more about your best car insurance options in New York, get expert advice at AutoInsureSavings.org. Our licensed professionals will help you find the best auto insurance in New York.

Methodology

AutoInsureSavings.org collects hundreds of quotes in zip codes across New York from the largest car insurance companies via Quadrant Information Services. Our sample driver profile is a 30-year-old driving a 2018 Honda Accord with good credit. We used a full coverage insurance policy unless otherwise stated with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily liability | $50,000 per person/$100,000 per accident |

| Property damage | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

When AutoInsureSavings.org quotes a driver with a minimum coverage policy, we used the minimum liability limits per New York insurance regulations. We used credit score, marital status, driving history, and accident history for other rate analyses. We used insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your rates may vary when you get quotes.

Sources

— New York Department of Motor Vehicles. “New York State Insurance Requirements.”

— National Association of Insurance Commissioners (NAIC). “2019 Market Share Reports.”

— National Highway Traffic Safety Administration. “Traffic Safety Facts.”

— Experian. “2019 Consumer Credit Review.”

— New York Department of Motor Vehicles. “Penalties for Alcohol or Drug-related Violations.”

— NOLO. “DUI Laws By State.”

Frequently Asked Questions

Who has the cheapest car insurance for New York drivers?

Utica National for minimum coverage. The company offers some of the best insurance industry rates, with a $678 annual rate for a 30-year-old driver. State Farm ($696) and NYCM ($723) are the two other best options for all drivers needing coverage in New York. The average cost of auto insurance in New York is $1,373 per year. Here is a comparison between the three insurance companies mentioned: Utica National: $678, State Farm: $696, and NYCM: $723.

Because insurance rates are based on various factors, it is best to compare multiple providers’ rates to determine who has the cheapest car insurance coverage in New York for you.

How much is car insurance in New York per month?

The average rate for car insurance in New York is $205 per month for a driver who is 30 years old and has full coverage. That is $2,462 annually. Here are some totals for the average monthly rate of car insurance for drivers in New York. Progressive: $124, USAA: $125, and Erie: $128.

How much is full coverage car insurance in New York?

The average amount for full coverage insurance in New York is $205 monthly. Here are a few more average rates for different types of drivers. Drivers with an accident: $3,688, with a speeding violation: $2,930, with a DUI: $3,893, and drivers with poor credit: $3,539.

How can I save on car insurance in New York?

There are several things drivers in New York can do to save money on their car insurance premiums. We suggest asking your insurance agent about any discounts you may be eligible for. If you are looking for a new car insurance provider, it is best to find one that offers plenty of discounts to help you save even more.

The car you drive also plays a significant role in your rates and your driving history and credit rating. Therefore, practicing safe driving tactics and keeping a close eye on your credit report can lower your car insurance rates.

How much will my car insurance rates rise with a speeding ticket in New York?

In New York, drivers will see their insurance premiums go up as much as 22% after receiving a traffic violation such as a speeding ticket. That amount can vary from driver to driver due to several factors, such as how fast the driver was going when they got the ticket.

As of 2020, the increasing amount for going 31 miles per hour over the limit was 30.7%. Individuals who received a violation for failure to yield saw a rate increase of 22.1%, while drivers who got a ticket for not wearing a seatbelt saw their rates go up 5%.

Why is car insurance so expensive in New York?

Part of the reason that New York auto insurance is so expensive is because New York requires drivers to pay for higher liability limits. We recommend getting plenty of New York car insurance quotes to find the cheapest auto insurance in NY.

What is the best car insurance in New York?

While minimum coverage is the cheapest option, the best auto insurance in New York will be full coverage, as this provides the best protection to NY drivers.

Is it illegal to drive without car insurance in New York?

All NY drivers must carry auto insurance in NY that fulfills New York’s auto insurance laws.

Is New York a no-fault state?

New York is a no-fault state, which is one of the reasons New York car insurance is more expensive.

Is car insurance cheaper in Florida or New York?

Car insurance rates, on average, are more expensive in New York than Florida.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Jan 10, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.