A Review of USAA Car Insurance, Policy Options & Military Benefits

USAA car insurance rates are some of the cheapest on the market, with average rates of only $39 per month for a minimum coverage policy. USAA has strong financial stability and various coverage options, but drivers must be veterans or active military personnel to qualify for USAA auto insurance.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Jan 10, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jan 10, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

USAA car insurance company is one of the best auto insurance companies on the market, with cheap rates and multiple coverage options. We review everything you need to know about USAA, from average USAA car insurance rates to USAA’s customer service ratings.

Read on to see if USAA is right for your car insurance needs. If you want to find cheap car insurance today, enter your ZIP code in our free quote tool to get quotes from companies in your area.

USAA Auto Insurance Rates

Many military personnel rely on USAA auto insurance for auto coverage. USAA is one of the best car insurance options for veterans and military.

Today, United Services Automobile Association (USAA) routinely rings in at either the 5th or 6th largest car insurance provider in the country (alternating that position with Farmers) with direct premiums approaching $8 billion.

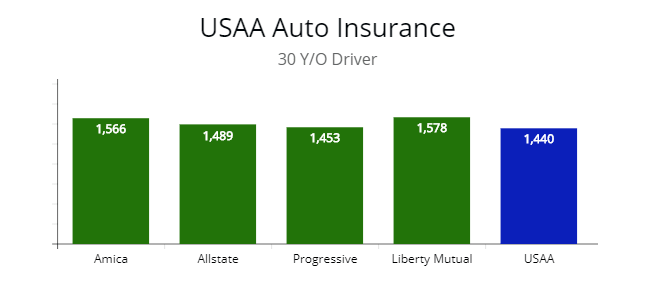

Note: As illustrated above, USAA can offer quotes from 2 to 10% lower than the average premium for a 30-year-old driver. When I compared quotes side-by-side for any driver, no matter the circumstances, USAA was able to beat each competitor 90 percent of the time.

Note: As illustrated above, USAA can offer quotes from 2 to 10% lower than the average premium for a 30-year-old driver. When I compared quotes side-by-side for any driver, no matter the circumstances, USAA was able to beat each competitor 90 percent of the time.

USAA can boast membership and participation by more than 90% of currently active military service personnel.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Maintaining its focus on the men and women who serve or who have served our country and their families, USAA requires certain membership conditions for drivers to access car insurance through them.

Read more: How to Find the Best Auto Insurance for Veterans

Membership in USAA (and therefore access to its products and services) is limited to:

Active, retired, and honorably separated officers and enlisted personnel of the U.S. military

Officer candidates in commissioning programs (Academy, ROTC, OCS/OTS)

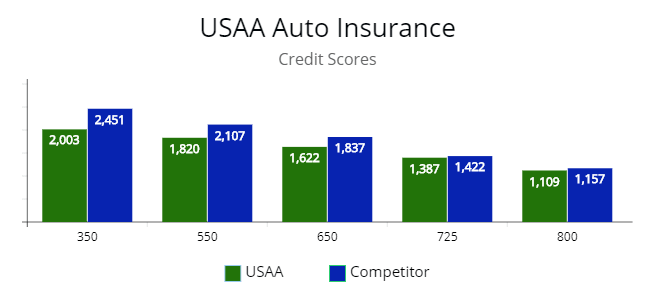

Note: As illustrated above, I compared USAA with a direct competitor and credit scores. I compared each credit score from poor (350) to excellent (800). Every time USAA was able to offer the same coverage for less price. This is good to know if you have poor credit.

Note: As illustrated above, I compared USAA with a direct competitor and credit scores. I compared each credit score from poor (350) to excellent (800). Every time USAA was able to offer the same coverage for less price. This is good to know if you have poor credit.

Adult children of USAA members who have or had a USAA auto or property insurance policy (children under the age of 18 can be added to a parent or legal guardian’s policy and after they turn 18).

Separate policies can be purchased for them, or they can remain on a parent or guardian’s policy until they turn 25 or 26.

Depending on the state where they live and drive and in some circumstances or a full-time student).

Widows, widowers, and former spouses of USAA members have or had a USAA auto or property insurance policy while married.

And USAA does recognize same-sex marriages and legally recognized partnerships for this eligibility requirement.

USAA Products Available to the General Public

There are certain USAA products, including investments, financial planning services, and life insurance products available to the general public.

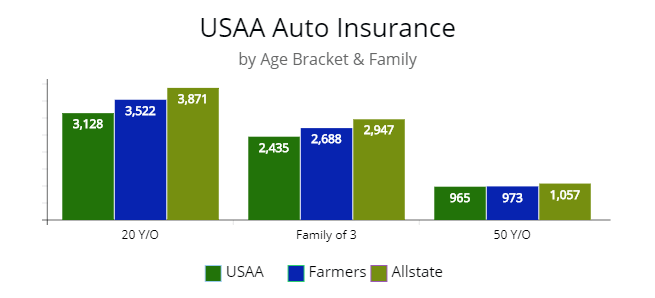

Note: Illustrated above is the average cost of a premium by price for USAA, Farmers, and Allstate. I compared a 20-year-old driver, a family of three, and a 50-year-old driver. Farmers and Allstate are 10% to 30% more expensive than USAA’s price in each instance.

Note: Illustrated above is the average cost of a premium by price for USAA, Farmers, and Allstate. I compared a 20-year-old driver, a family of three, and a 50-year-old driver. Farmers and Allstate are 10% to 30% more expensive than USAA’s price in each instance.

USAA Auto Insurance Rates by Violation Compared to Competitors

Below is a table comparing USAA’s average premium to national competitors by price.

I have included a speeding ticket, reckless driving, DUI, and an automobile accident with less than $1,000 and greater than $1,000 in damage.

| Violation* | USAA Premium | Farmers | Allstate | Liberty Mutual |

|---|---|---|---|---|

| Speeding ticket | $1,206 | $1,265 | $1,476 | $1,532 |

| Reckless driving | $1,447 | $1,578 | $1,654 | $1,711 |

| DUI/DWI | $1,951 | $2,132 | $2,321 | $2,539 |

| At-fault accident (damage < $1,000) | $1,032 | $1,121 | $1,237 | $1,411 |

| At-fault accident (damage > $1,000) | $1,332 | $1,417 | $1,538 | $1,699 |

*Your rates can vary depending on the state you reside in.

USAA Policy Options

USAA is licensed to offer car insurance in all 50 states, the District of Columbia, and our territorial land.

It also offers unique coverage for established military outposts where service personnel are on extended deployment.

Drivers and car owners can build USAA policies using most of the standard coverage options, including:

– Bodily injury liability coverage

– Property damage liability coverage

– Collision coverage

– Comprehensive coverage

– Personal injury protection (PIP) coverage

– Medial payments & extended benefits coverage

– Uninsured/underinsured motorist bodily injury coverage

– Uninsured/underinsured motorist property damage coverage

– Roadside assistance

– Rental reimbursement

– Accident forgiveness

While USAA does not, generally speaking, offer GAP car insurance or loan/lease payoff options, it does offer that endorsement for drivers and car owners who live in the state of Washington.

If you have a loan on your vehicle you can ask if the finance company offers GAP insurance.

Note: Illustrated above is the average premium from USAA for a teenage driver. And up to a 50-year-old driver. In each instance, USAA offered quotes from 6% to 25% lower than a direct competitor such as Farmers or Allstate.

Note: Illustrated above is the average premium from USAA for a teenage driver. And up to a 50-year-old driver. In each instance, USAA offered quotes from 6% to 25% lower than a direct competitor such as Farmers or Allstate.

They are also routinely reviewing and upgrading the coverage options they can offer state-by-state.

It’s always a good idea to check in with them from time to time to see what is available in your state.

USAA Generous Discounts

By focusing on a targeted group (military personnel and their families), USAA can maintain solid control over the prices and premiums it has to charge its members.

Even beyond the generous rates members will find, USAA offers an impressive range of discounts that members can apply to reduce their annual premium.

While not all discounts will be available in every state, USAA members can apply for discounts on premium for their car insurance coverage.

Below I have outlined common discounts offered by USAA, which I compared to three other top auto insurance companies – Allstate, Farmers, and Liberty Mutual.

| Discount | USAA | Allstate | Farmers | Liberty Mutual |

|---|---|---|---|---|

| Multiple Policies | ✔ | ✔ | ✔ | ✔ |

| Multiple Vehicles | ✔ | ✔ | ✔ | ✔ |

| Good Student | ✔ | ✔ | ✔ | ✔ |

| Anti-Lock Brake System | ✔ | |||

| Air Bags | ✔ | ✔ | ✔ | |

| Anti-Theft Device(s) | ✔ | ✔ | ✔ | ✔ |

| Defensive Driver | ✔ | ✔ | ||

| Good Driver | ✔ | ✔ | ✔ | ✔ |

| Student Away at School | ✔ | ✔ | ||

| Green Vehicles | ✔ | |||

| Affinity Membership Alum | ✔ | ✔ | ||

| Advanced Purchase | ||||

| Pay in Full | ✔ | ✔ | ||

| New Vehicle | ✔ | ✔ | ||

| eSign or ePay | ✔ | ✔ | ||

| Annual Mileage | ✔ | ✔ | ✔ | ✔ |

| Military | ✔ | ✔ | ||

| Homeowner | ✔ | ✔ |

You can receive a special discount if you are classified as a safe driver with Safepilot (learn more: A Comprehensive USAA Safepilot Insurance Review). USAA members can also receive discounts of up to 90% off standard premium if they store a car.

This is a key part of their additional coverage for service men and women, especially if storage is due to a deployment or other military-related event.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

USAA Has Excellent Ratings

While joining USAA has its own incentives as an organization that supports our servicemen, women, and their families, insurance for drivers is one key feature for their members.

The consistent high marks earned by USAA are other impressive reasons to consider them for your insurance and financial investment needs.

| Industry | Rating* | Value |

|---|---|---|

| NAIC | Complaint Index Rating | .88 |

| J.D. Power | Claims Satisfaction Rating | 5 |

| A.M. Best | Financial Strength Rating | A++ (Superior) |

| Moody's Investors Service | Financial Strength Rating | Aaa (Exceptional, highest of 21 possible ratings) |

| Standard & Poor's | Financial Strength Rating | AA+ (Very Strong, second highest of 21 possible ratings) |

*Current as of January 2020

While USAA is much more than an insurance company, combined ratings from A.M. Best and Standard & Poor’s give USAA a perfect score of 100. Customer satisfaction ratings for the company are always high.

The only other major insurance company in the country to earn that rating is Amica.

J.D. Powers & Associates has a five-point scale they use to rate companies, and USAA has earned a five-point rating for several years in a row.

A nationwide survey of state insurance commissioners and departments indicates that few people have complaints about USAA.

The company earns a 4.9 ranking in a consumer complaint survey where 5 is the highest mark given.

The higher the mark, the fewer the complaints from consumers.

If you or your relatives have served this country as a member of the armed services, you owe yourself the opportunity to get some of the best and most affordable coverage you can buy.

Frequently Asked Questions

Why is USAA insurance so cheap?

USAA only sells auto insurance to military members and veterans, so the smaller customer base allows USAA to keep rates affordable.

Can anyone get USAA insurance?

No, only military members, veterans, and their families can get USAA insurance.

Is USAA a good car insurance company?

Yes, USAA is the best provider of car insurance for veterans and military members.

Does USAA raise rates for accidents?

If you caused an accident, you will see an increase in your rates. However, USAA’s average rates are still lower than most companies for drivers with accidents on their record.

Why are my USAA rates so high?

USAA auto insurance rates are usually low, so if your rates are high it is likely because of your driving record, vehicle, and other factors.

Is Progressive or USAA better?

USAA has lower rates than Progressive, so it is usually the better choice of insurance for military and veterans.

Is USAA good at paying claims?

Yes, USAA has good claims satisfaction ratings from customers.

Are USAA and Liberty Mutual the same?

No, USAA and Liberty Mutual are two different auto insurance companies.

Is USAA sold in every state?

Yes, USAA auto insurance is available in every state.

How can I save on USAA auto insurance?

USAA offers plenty of discounts that customers can take advantage of, such as good driver discounts.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Jan 10, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.