Progressive’s Rental Reimbursement Coverage

Progressive's rental reimbursement coverage gives you the option to rent a car worry-free if you get in an accident and need to be without your vehicle for awhile. If you would struggle to be without your car for long periods of time, Progressive rental reimbursement is a great option to consider.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Feb 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Feb 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Most of us have come to rely on our cars, perhaps too much.

If the prospect of being without yours in the aftermath of a serious car accident is troubling, you might want to consider adding an option like rental reimbursement.

While you’re a customer of Progressive, they make it very easy to add this option. Can you get a Progressive rental car after an accident? Does progressive cover rental cars in the case of an accident? If you have Progressive rental car reimbursement, the answer is yes. Progressive’s rental reimbursement coverage is a great benefit to take advantage of just in case you may need a rental car due to an accident.

If you have to rely on your vehicle, rental reimbursement coverage is an excellent option to add to your car insurance policy.

Keeping You on the Road With Progressive’s Rental Reimbursement Coverage

When you add a rental car reimbursement option to your Progressive car insurance policy, they will reimburse you for the cost of renting a car while yours is totaled.

Or inoperable or being repaired from damage due to a valid comprehensive or collision coverage claim.

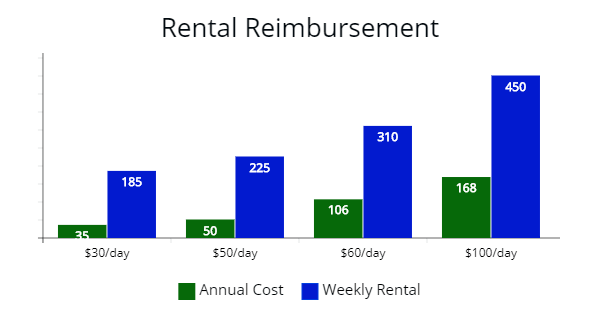

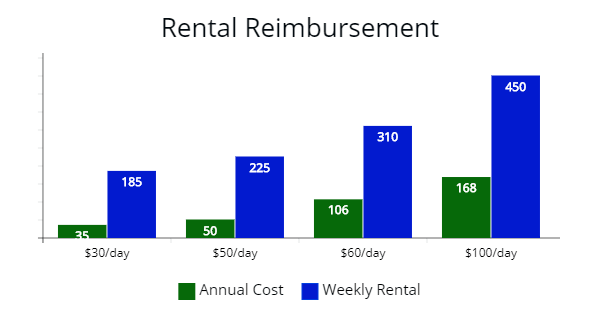

Illustrated above is the annual cost of rental reimbursement coverage to your policy. If you choose the $50 per day option, it would cost approximately $50 per year. On the other hand, if you forego the coverage, then pay out of pocket? It would cost approximately $225 per week from a rental car company.

Illustrated above is the annual cost of rental reimbursement coverage to your policy. If you choose the $50 per day option, it would cost approximately $50 per year. On the other hand, if you forego the coverage, then pay out of pocket? It would cost approximately $225 per week from a rental car company.

Some people get confused and think that rental car coverage is similar to the insurance offered by a rental car company when you rent a car for personal or business purposes.

This is not the case. Progressive rental car insurance is more expensive.

The amount of the reimbursement you receive from Progressive on a rental reimbursement option is determined by the limits you select when you purchase the coverage.

Depending on the state where you live and the other policy options and coverage levels you have in place with Progressive, you can get daily limits ranging from $25 to $50 for up to 30 days of rental car use.

The majority of Progressive rental car reimbursement policies come with a 30/30 limit ($30-per day for 30 days), and these limits are for each incident or claim over the course of your policy’s term.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Progressive Rental Reimbursement Coverage is Not a Stand-alone Option

One thing to be aware of when considering adding rental reimbursement coverage to your Progressive car insurance.

You will have to have either comprehensive or collision coverage in place before you can add this option.

Many insurance companies require you to have both collision and comprehensive coverage to be sold rental car reimbursement.

With Progressive rental car reimbursement insurance, you can select one or the other.

If you think you may want to add rental Progressive reimbursement to your Progressive car insurance policy, familiarize yourself with either collision or comprehensive coverage.

Collision coverage helps to pay for any repairs your car will need after an accident where you collide with another car or an object or suffer a rollover.

Comprehensive covers repairs from damage caused by non-collision events like fires and floods, theft or vandalism, and severe weather.

I have examples listed below:

- Collision with a vehicle

- Crashing into a stop sign

- Accidentally hitting an animal.

Either option will come with a deductible you can select, and the limits of coverage depend on the current market value of the car you are insuring.

In fact, it might be a good idea to familiarize yourself with all of Progressive’s car insurance options.

The Cost of Progressive Rental Reimbursement Coverage

Rental reimbursement coverage through Progressive is surprisingly affordable.

Depending on the state where you live and the full array of coverage options you have on your existing policy, you can add rental reimbursement coverage for as little as $9 in additional premium over the term of your actual insurance policy.

Bear in mind, though, that if you don’t have either collision or comprehensive coverage, you will have to factor in the cost of adding one of these types of coverage.

The cost of comprehensive or collision coverage will be determined by the value of the car you are insuring and the amount of the deductible you choose.

The higher the deductible you select, the less expensive the coverage will be.

If you and your family depend on reliable transportation, consider adding an option like rental reimbursement to your Progressive car insurance policy.

Especially if you are a single-car family.

Because if your car stays in the shop after an accident, it’s unlikely you’ll be able to carpool with Flo.

Estimated Cost of Progressive Reimbursement Compared

Below is a table of various companies offering rental reimbursement compared with Progressive.

The cost can range from $1.44 to $15 per month.

Adding this option to your policy would be well worth the nominal monthly fee.

| Company | Reimbursement Coverage | Monthly Rate |

|---|---|---|

| Allstate | $25/day ($600 max per incident) | $1.44 |

| $50/day ($1,200 max per incident) | $2.88 | |

| 80% of the rental cost/per day ($1,500 max per incident) | $1.75 | |

| Progressive | $30/day and ($900 max per incident) | $2.89 |

| $50/day and ($1,500 max per incident) | $4.12 | |

| Esurance | $30/day ($900 max per incident) | $4.44 |

| $40/day ($1,200 max per incident) | $5.58 | |

| Nationwide | $30/day ($900 max per incident) | $3.85 |

| $40/day ($1,200 max per incident) | $5.77 | |

| $50/day ($1,500 max per incident) | $7.24 | |

| $60/day ($1,800 max per incident) | $8.89 | |

| $75/day ($2,250 max per incident) | $12.32 | |

| $100/day ($3,000 max per incident) | $14.93 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Progressive’s Rental Reimbursement Coverage: Frequently Asked Questions

When can you use Progressive’s rental reimbursement coverage?

Rental reimbursement can be used while your vehicle is being repaired after an accident. Not for routine maintenance or repair.

What coverage am I required to have to add Progressive’s rental reimbursement coverage?

Most auto insurance companies require you to have comprehensive and collision coverage to add rental reimbursement to your policy.

Should I get Progressive’s rental reimbursement coverage?

When you get into an accident, your policy will cover damages but won’t cover a rental vehicle. If you would like to have this option, you will need to add rental reimbursement to your policy. You can get a Progressive rental car after an accident as long as you have Progressive reimbursement coverage.

Can I get Progressive’s rental reimbursement coverage after an accident?

You are going to need the coverage before you have an accident. In some instances, you can get rental coverage from an at-fault driver. It will depend on the state and the circumstances.

Isn’t it cheaper to rent a car?

It depends on the type of rental vehicle. If you get a small economy car, a weekly rental will cost $80 to $150 per week. A mid-size sedan may cost $300 per week.

What’s the difference between rental car insurance and personal auto insurance?

Rental car insurance is an optional insurance policy you can buy from a rental agency that covers your liability for injuries to others or damage to their property, damage you cause to the rental vehicle, and medical expenses for you and your passengers if you’re in an accident.

Do I even need rental car insurance?

In most instances, rental car insurance overlaps with your personal auto insurance policy and you won’t need to pay for duplicate coverage. There may be situations where adding rental car insurance is worthwhile, so it’s important to review your personal auto coverages. If you don’t have a personal auto policy, you will need to purchase liability coverage through the rental car company.

Progressive’s Rental Reimbursement Coverage: Final Thoughts

Before you buy the rental company’s insurance, you should consider what coverage you may already have through your personal car insurance.

With Progressive’s rental car reimbursement coverage, daily limits are typical $40-$60 and coverage lasts for a total of 30 days.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Brandon Frady

Licensed Insurance Agent

Brandon Frady has been a licensed insurance agent and insurance office manager since 2018. He has experience in ventures from retail to finance, working positions from cashier to management, but it wasn’t until Brandon started working in the insurance industry that he truly felt at home in his career. In his day-to-day interactions, he aims to live out his business philosophy in how he treats hi...

Licensed Insurance Agent

UPDATED: Feb 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.