Mississippi Cheapest Car Insurance & Best Coverage Options

Travelers has the Mississippi cheapest car insurance for minimum coverage. At Travelers, the average Mississippi rate for minimum insurance is only $32 per month. However, Mississippi drivers who prefer full coverage policies will find the cheapest rate at Mississippi Farm Bureau at $119 per month.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Jan 10, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jan 10, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Looking for the Mississippi cheapest car insurance rates? Mississippi drivers will find the cheapest rates at Travelers and Mississippi Farm Bureau, but since rates vary by driver, the cheapest average companies may not be the cheapest for everyone. To find a full list of the best auto insurance companies by driver record in Mississippi, read on.

Want to find cheap car insurance in Mississippi right away? Enter your ZIP code into our free quote comparison tool.

Affordable Mississippi Car Insurance Rates

The best way drivers in Mississippi can save more on car insurance premiums is by comparing personalized quotes by zip code from multiple insurers with the lowest rates from our insurance study.

| Cheapest Car Insurance in Mississippi - Key Takeaways |

|---|

The cheapest Mississippi car insurance options are: The cheapest Mississippi car insurance options are:Cheapest for minimum coverage: Travelers Insurance Cheapest for full coverage: Mississippi Farm Bureau Cheapest after an at-fault accident: Mississippi Farm Bureau Cheapest after a speeding ticket: State Farm Cheapest after a DUI: Travelers Insurance Cheapest with poor credit history: Geico Cheapest for young drivers: Travelers Insurance For younger drivers with a speeding violation: ALFA Insurance For younger drivers with an at-fault accident: Mississippi Farm Bureau |

- Car Insurance Rates in Mississippi

Check out this useful guide on Mississippi auto insurance to help you find the best rates and get more details on the average rates from leading insurance providers for various age groups.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Mississippi for Minimum Coverage

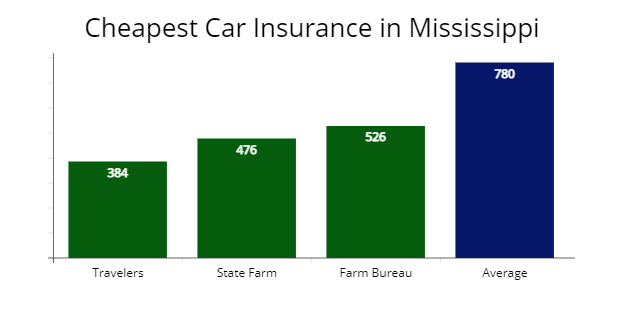

Our agents found that Travelers Insurance has the most affordable annual rates for drivers in Mississippi, with a $384 per year quote for minimum coverage for our sample 30-year-old male driver.

Read more: Review of Travelers Car Insurance Options; a Comparison With Other Insurers

The average Mississippi rate for minimum liability insurance policies is $780 per year, and Travelers’ rate is $396 cheaper or 51% less expensive.

| Insurer | Average annual rate |

|---|---|

| USAA | $317 |

| Travelers | $384 |

| State Farm | $476 |

| Mississippi Farm Bureau | $526 |

| Alfa | $648 |

| Nationwide | $662 |

| Allstate | $770 |

| Progressive | $840 |

| Geico | $873 |

*USAA is for qualified military members, their spouses, and direct family members. Your rates may be different based on the driver’s profile.

Drivers in Mississippi who only want a minimum coverage policy can drive legally for less by switching to one of the cheapest insurance companies illustrated above.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Cheapest Full Coverage Car Insurance in Mississippi

Mississippi Farm Bureau offers cheap full coverage car insurance in Mississippi for those with good driving records, with a quote at $1,428 per year or $119 per month for affordable full coverage rates. Farm Bureau’s rate is 31% less expensive than Mississippi’s average rates of $2,068 per year.

| Auto insurer | Annual cost | Monthly cost |

|---|---|---|

| Mississippi Farm Bureau | $1,428 | $119 |

| State Farm | $1,470 | $122 |

| ALFA | $1,733 | $144 |

| Mississippi average | $2,068 | $172 |

The average cost of full coverage in Mississippi is $172 per month or $2,068 annually. Full coverage insurance, which includes comprehensive and collision coverage, reimburses you for property damage to your vehicle no matter who is at fault.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

AutoInsureSavings.org licensed agents to suggest drivers in The Magnolia State who own a newer vehicle or worth more than $3,000 should consider a full coverage insurance policy to guarantee they won’t pay out of pocket if an auto accident occurs that leaves their car totaled.

Cheapest Insurance With a Speeding Ticket in Mississippi

The best Mississippi auto insurance company for drivers with a speeding ticket on driving records is State Farm, which has average annual premium costs of $1,627 per year. We found State Farm’s rate is 31% cheaper than Mississippi’s mean speeding violation rate of $2,340 per year.

| Auto insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $1,627 | $135 |

| ALFA | $1,780 | $148 |

| Geico | $2,025 | $168 |

| Mississippi average | $2,340 | $195 |

According to the Insurance Information Institute (III.org), drivers in Mississippi can expect their car insurance rates to increase by an average of 21% after receiving a traffic violation. The rate increase depends on how fast you were going and how many speeding tickets you already have on your driving record in Mississippi (learn more: How a Traffic Ticket Can Impact Your Car Insurance Rates).

Cheapest Insurance in Mississippi With a Car Accident

Drivers in Mississippi with an at-fault accident on driving records can still save on their car insurance rates with Mississippi Farm Bureau, which offers a $156 monthly rate or 37% cheaper than Mississippi’s average rates.

We suggest comparing auto insurance quotes with ALFA to get the best price, which provided us a $170 monthly rate for drivers with an at-fault accident.

| Auto insurer | Annual cost | Monthly cost |

|---|---|---|

| Mississippi Farm Bureau | $1,873 | $156 |

| ALFA | $2,041 | $170 |

| State Farm | $2,388 | $199 |

| Mississippi average | $2,964 | $247 |

Wondering will car insurance rates increase after an accident? Just one at-fault accident on your record in Mississippi can significantly increase your car insurance premium. Our research found that the difference between average auto insurance premiums for a driver with a good driving record than a driver with one accident is $896 per year.

Cheapest Insurance Coverage in Mississippi With a DUI

According to our rate analysis, Travelers is one of the best car insurance companies after a DUI for Mississippi drivers, with a $2,470 per year rate or $205 per month.

Travlers’ rate is 30% less expensive than Mississippi’s average insurance premium for drivers with a DUI in their driving history.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Travelers Insurance | $2,470 | $205 |

| State Farm | $2,566 | $213 |

| Geico | $2,832 | $236 |

| Mississippi average | $3,512 | $292 |

A DUI is a severe offense that can cause numerous consequences for a Mississippi policyholder. According to the Mississippi Driver Service (DPS), a driver will have an average insurance rate increase of 39% and have a 30 day to one-year license suspension with mandatory SR-22 insurance and a minimum 10-hour defensive driving course (learn more: How To Find & How Much is Car Insurance With a Suspended License?).

Cheapest Car Insurance with Poor Credit in Mississippi

Drivers with a poor credit score in Mississippi can find the best and cheap auto insurance with Geico, which provided our agents a $2,154 per year rate for full coverage car insurance. Geico’s rate is 19% lower than average rates for 30-year-old drivers.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Geico | $2,154 | $179 |

| State Farm | $2,257 | $188 |

| Mississippi Farm Bureau | $2,379 | $198 |

| Mississippi average | $2,639 | $219 |

Your credit history in Mississippi can have an impact on how much you pay for car insurance.

Credit scores are among the many factors that car insurance companies consider when providing you with a quote. It is found that drivers who have poor credit pay more for insurance, file more claims, and are involved in more accidents than drivers who have a good credit score.Dani Best Licensed Insurance Producer

If you have a poor credit score, check out our guide to auto insurance companies that don’t check credit.

Cheapest Car Insurance Coverage in Mississippi for Young Drivers

During our comparison analysis, young Mississippi drivers or college students can get the cheapest insurance with Travelers, which provided us a $2,980 per year rate for full coverage insurance.

Young or teen drivers who need minimum coverage should compare quotes with Travelers, Mississippi Farm Bureau, and State Farm.

Read more: The Best Car Insurance for New Drivers: A Comprehensive Guide

Farm Bureau offers the cheapest minimum liability coverage rate at $1,417 per year for teen drivers, while Travelers Insurance is $1,469 per year, and State Farm’s insurance rate is $1,582 per year.

| Auto insurer | Full coverage | Minimum coverage |

|---|---|---|

| USAA | $2,463 | $950 |

| Travelers | $2,980 | $1,469 |

| Mississippi Farm Bureau | $3,245 | $1,417 |

| ALFA | $3,673 | $1,859 |

| Geico | $4,271 | $2,044 |

| State Farm | $4,387 | $1,582 |

| Nationwide | $5,264 | $2,302 |

| Allstate | $6,272 | $2,466 |

| Progressive | $8,328 | $3,251 |

| Mississippi average | $5,863 | $2,172 |

*USAA is for qualified military members, their spouses, and direct family members. Your rates may be different based on the driver’s profile.

Young or teen drivers needing coverage in Mississippi will pay more 58% more for their car insurance premium regardless of what company they choose.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

According to the National Highway Traffic Safety Administration (NHTSA), drivers in a younger age group are at a higher risk than older and more experienced drivers.

Our licensed agents recommend a teen driver join their parent’s full coverage policy or have an adult family member as a primary policyholder to get the best car insurance for teens at the most affordable rate.

Cheapest Car Insurance for Young Drivers with Speeding Tickets

Young drivers in Mississippi with traffic tickets should look to ALFA Insurance to get the best auto insurance rates. The average car insurance cost from ALFA is $3,670 per year for full coverage.

ALFA’s speeding ticket rate is 44% cheaper than the $6,514 average rates in Mississippi for younger drivers.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| ALFA Insurance | $3,670 | $305 |

| Travelers Insurance | $3,948 | $329 |

| Mississippi Farm Bureau | $4,080 | $340 |

| Mississippi average | $6,514 | $542 |

Cheapest Insurance for Young Drivers in Mississippi with a Car Accident

The cheapest insurance coverage for younger drivers with an accident in Mississippi is Farm Bureau, which provided our agents a $320 monthly rate for full coverage or $281 per month less than Mississippi’s average rates at $601 per month.

The next cheapest option is Travelers Insurance, with a $355 monthly car insurance rate or 41% less expensive than Mississippi’s average auto insurance quotes.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Mississippi Farm Bureau | $3,840 | $320 |

| Travelers Insurance | $4,262 | $355 |

| State Farm | $4,777 | $398 |

| Mississippi average | $7,218 | $601 |

Best Car Insurance Companies in Mississippi

AutoInsureSavings.org licensed agents found the Mississippi Farm Burea and ALFA insurance companies offer some of the most affordable rates with excellent customer satisfaction and good financial strength to various Mississippi drivers.

ValuePenguin surveyed with similar insurance company results:

| Insurer | % respondents satisfied with recent claim | % respondents rated customer service as excellent |

|---|---|---|

| USAA | 79% | 62% |

| Nationwide | 77% | 53% |

| State Farm | 74% | 46% |

| Travelers Insurance | 74% | 59% |

| ALFA Insurance | 73% | 53% |

| Progressive | 74% | 44% |

| Allstate | 72% | 47% |

| Mississippi Farm Bureau | 71% | 52% |

If you are in the market for a new auto insurance policy and are only concerned about the price, these two auto insurance companies in Mississippi offer some of the state’s best auto insurance rates.

We also used data from the National Association of Insurance Commissioners (NAIC), J.D. Power’s claims satisfaction survey, and each car insurance company’s financial strength ratings from A.M. Best.

| Insurer | NAIC Complaint Index | J.D. Power Claims Satisfaction | A.M. Best Financial Strength Rating |

|---|---|---|---|

| Mississippi Farm Bureau | 0.06 | n/a | A+ |

| Progressive | 0.18 | 856 | A+ |

| ALFA Insurance | 0.40 | n/a | A |

| Travelers Insurance | 0.51 | 796 | A+ |

| State Farm | 0.66 | 881 | A++ |

| USAA | 0.68 | 890 | A++ |

| Allstate | 0.71 | 876 | A+ |

| Nationwide | 0.79 | 876 | A+ |

| Liberty Mutual | 1.00 | 870 | A |

| Geico | 1.01 | 871 | A++ |

NAIC complaint ratio looks at the number of complaints of the best car insurance company based on market share.

The lower the complaint ratio, the better. It is an indication of the quality of the car insurance carrier’s customer service and claims satisfaction.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

In this instance, the car insurance carrier who rated the best based on a low amount of complaints is Mississippi Farm Bureau with 0.06, which is lower than the national average of 1.00. USAA has the best J.D. Power claims satisfaction score at 890 out of 1,000.

Read more: A Review of USAA Car Insurance, Policy Options & Military Benefits

When you have more information about what each car insurance provider has to provide you with, it will be easier for you to narrow down your choices and make an informed decision on the best auto insurance company in Mississippi is the best option for you.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Average Car Insurance Costs by City in Mississippi

Your zip code in Mississippi is a significant factor in your average auto insurance rates, along with driver profiles, including driving record, marital status, type of motor vehicle, and coverage levels.

Typically, densely populated areas, high crime areas, or poor road conditions tend to have expensive auto insurance rates.

AutoInsureSavings.org car insurance experts did a study on the most populous Mississippi cities.

Cheapest Auto Insurance in Jackson, MS

Jackson drivers can find the cheapest insurance with State Farm who provided our agents a $1,680 per year rate for our 30-year-old driver. State Farm’s quote is 34% less expensive than Jackson’s average rates.

| Jackson insurance | Average Premium |

|---|---|

| State Farm | $1,680 |

| Mississippi Farm Bureau | $1,724 |

| Travelers Insurance | $1,884 |

| Jackson average | $2,532 |

Cheapest Auto Insurance in Hattiesburg, MS

Drivers in Hattiesburg can find the best coverage rates with Mississippi Farm Bureau, which provided us a quote at $1,612 per year for a full coverage insurance policy. Farm Bureau’s rate is 35% cheaper than Hattiesburg’s yearly insurance rate of $2,460 per year.

| Hattiesburg insurance | Average Premium |

|---|---|

| Mississippi Farm Bureau | $1,612 |

| ALFA Insurance | $1,670 |

| Travelers Insurance | $1,816 |

| Hattiesburg average | $2,460 |

Cheapest Auto Insurance in Biloxi, MS

Our licensed agents found ALFA Insurance is the cheapest insurance company in Biloxi, MS. They provided us a $1,571 annual rate for full coverage, 36% less expensive than Biloxi’s yearly average rate of $2,427.

| Biloxi insurance | Average Premium |

|---|---|

| ALFA Insurance | $1,571 |

| State Farm | $1,658 |

| Geico | $1,732 |

| Biloxi average | $2,427 |

Cheapest Auto Insurance in Tupelo, MS

Our research found the cheapest insurance in Tupelo is with Mississippi Farm Bureau, which provided AutoInsureSavings agents a $1,589 per year quote for $100,000 in liability coverage with comprehensive and collision coverage $500 deductibles for 30-year-old drivers in Tupelo.

| Tupelo insurance | Average Premium |

|---|---|

| Mississippi Farm Bureau | $1,589 |

| State Farm | $1,646 |

| Travelers Insurance | $1,711 |

| Tupelo average | $2,538 |

Cheapest Auto Insurance in Meridian, MS

People in Meridian can find cheap auto coverage with Mississippi Farm Bureau, which provided our agents an insurance rate of $1,476 per year for a 30-year-old with full coverage.

| Meridian insurance | Average Premium |

|---|---|

| Mississippi Farm Bureau | $1,476 |

| State Farm | $1,539 |

| Travelers Insurance | $1,612 |

| Meridian average | $2,370 |

Cheapest Auto Insurance in Olive Branch, MS

Olive Branch drivers can find the best full coverage insurance policy with State Farm, which provided our agents a $1,431 per year rate with $100,000 in liability insurance with collision and comprehensive $500 deductibles. State Farm’s quote is 38% cheaper than average rates for 30-year-old drivers in Olive Branch.

| Olive Branch insurance | Average Premium |

|---|---|

| State Farm | $1,431 |

| ALFA Insurance | $1,480 |

| Mississippi Farm Bureau | $1,558 |

| Olive Branch average | $2,283 |

Cheapest Car Insurance in Oxford, MS

Drivers in Oxford can find affordable auto insurance coverage with State Farm, which provided AutoInsureSavings agents a $1,463 per year quote for full coverage. State Farm’s auto insurance quote is 40% cheaper than Oxford’s average rates.

| Oxford insurance | Average Premium |

|---|---|

| State Farm | $1,463 |

| ALFA Insurance | $1,492 |

| Mississippi Farm Bureau | $1,577 |

| Oxford average | $2,411 |

Average Insurance Cost for All Cities in Mississippi

| City | Annual insurance cost | City | Annual insurance cost |

|---|---|---|---|

| Jackson | $2,532 | Byhalia | $1,993 |

| Gulfport | $2,589 | Bay Springs | $2,016 |

| Southaven | $2,428 | Rosedale | $1,965 |

| Hattiesburg | $2,460 | Itta Bena | $1,932 |

| Biloxi | $2,427 | Ecru | $2,074 |

| Tupelo | $2,538 | Moorhead | $2,052 |

| Meridian | $2,370 | Nellieburg | $2,133 |

| Olive Branch | $2,283 | Collinsville | $2,204 |

| Greenville | $2,308 | Bruce | $2,179 |

| Horn Lake | $2,419 | Ackerman | $1,993 |

| Oxford | $2,411 | Port Gibson | $1,965 |

| Pearl | $2,218 | Vardaman | $2,156 |

| Madison | $2,346 | Mantachie | $2,227 |

| Starkville | $2,190 | Friars Point | $2,074 |

| Clinton | $2,137 | Como | $1,932 |

| Ridgeland | $2,285 | Fayette | $2,052 |

| Columbus | $2,074 | Monticello | $2,260 |

| Brandon | $2,291 | Wade | $2,269 |

| Vicksburg | $2,139 | Robinhood | $2,329 |

| Pascagoula | $2,016 | Sharon | $2,156 |

| Laurel | $1,993 | Walls | $2,358 |

| Gautier | $2,290 | Caledonia | $2,052 |

| Ocean Springs | $1,932 | Lambert | $2,227 |

| Hernando | $1,965 | Hurley | $2,284 |

| Clarksdale | $2,351 | Terry | $2,294 |

| Long Beach | $2,133 | Cleary | $1,993 |

| Natchez | $2,227 | De Kalb | $1,965 |

| Corinth | $2,259 | Hillsboro | $2,179 |

| Greenwood | $1,993 | Goodman | $2,074 |

| D'Iberville | $2,269 | Brooksville | $2,159 |

| Moss Point | $2,204 | Mississippi Valley State University | $1,932 |

| Bay St. Louis | $1,965 | DeLisle | $2,052 |

| McComb | $2,254 | Mount Olive | $1,993 |

| Grenada | $2,179 | Helena | $2,246 |

| Canton | $2,293 | Saucier | $2,016 |

| Brookhaven | $2,246 | Prentiss | $2,260 |

| Cleveland | $2,188 | Conehatta | $2,329 |

| Byram | $2,052 | Tunica | $2,158 |

| Yazoo City | $1,932 | Walnut | $2,227 |

| Picayune | $2,317 | Raleigh | $2,341 |

| West Point | $2,329 | Derma | $2,297 |

| Petal | $2,269 | Sunflower | $2,321 |

| Indianola | $2,052 | Blue Mountain | $2,156 |

| Flowood | $1,993 | Duck Hill | $1,965 |

| New Albany | $2,074 | Crenshaw | $2,131 |

| Booneville | $2,179 | Coffeeville | $2,204 |

| Gulf Hills | $2,260 | Pickens | $1,993 |

| Diamondhead | $2,016 | Gloster | $2,269 |

| St. Martin | $1,965 | Mooreville | $2,179 |

| Senatobia | $2,133 | Woodville | $2,227 |

| Holly Springs | $1,993 | Jonestown | $2,298 |

| Batesville | $2,351 | Rawls Springs | $2,156 |

| Philadelphia | $2,227 | Leakesville | $1,932 |

| Richland | $2,052 | Richton | $2,329 |

| Gulf Park Estates | $2,340 | Alcorn State University | $2,168 |

| Amory | $2,052 | Elliott | $1,993 |

| Latimer | $2,204 | Stonewall | $2,204 |

| Kosciusko | $2,364 | Inverness | $2,074 |

| West Hattiesburg | $2,270 | Toomsuba | $2,016 |

| Waveland | $2,299 | Plantersville | $2,179 |

| Louisville | $1,932 | Big Point | $2,246 |

| Pontotoc | $2,204 | Pearlington | $2,260 |

| Columbia | $1,993 | Walnut Grove | $1,965 |

| Pass Christian | $2,016 | Algoma | $2,156 |

| Forest | $2,351 | Beaumont | $2,352 |

| Aberdeen | $2,309 | North Tunica | $1,993 |

| Ripley | $2,133 | Scooba | $2,269 |

| Saltillo | $2,074 | Renova | $1,932 |

| Vancleave | $2,329 | Burnsville | $2,227 |

| Waynesboro | $2,382 | Boyle | $1,965 |

| Carthage | $1,993 | Crowder | $2,351 |

| Crystal Springs | $2,368 | Kilmichael | $2,074 |

| Ellisville | $2,179 | Utica | $2,204 |

| Wiggins | $1,965 | Polkville | $1,993 |

| Florence | $2,159 | Weir | $2,016 |

| Winona | $2,052 | Sherman | $2,246 |

| Magee | $2,344 | Liberty | $2,310 |

| Pearl River | $2,260 | Isola | $2,179 |

| University | $1,932 | Falkner | $2,349 |

| Fulton | $1,993 | Edwards | $2,136 |

| Leland | $2,227 | Sandersville | $2,305 |

| New Hope | $2,357 | Bude | $2,329 |

| Hazlehurst | $2,351 | Thaxton | $2,260 |

| Morton | $2,310 | Metcalfe | $1,965 |

| Mississippi State | $2,074 | Tucker | $1,993 |

| Houston | $2,179 | Heidelberg | $2,269 |

| Tutwiler | $2,052 | Maben | $2,156 |

| Water Valley | $2,016 | Cloverdale | $1,932 |

| Newton | $2,329 | Meridian Station | $2,204 |

| Verona | $1,993 | New Augusta | $2,179 |

| Lucedale | $2,346 | Hickory Flat | $2,133 |

| Beechwood | $2,316 | New Houlka | $2,329 |

| Macon | $2,052 | Ethel and Redwater | $2,351 |

| Collins | $2,246 | Smithville | $1,993 |

| Iuka | $1,965 | Hickory | $2,342 |

| Poplarville | $2,269 | Hatley | $2,227 |

| Mendenhall | $2,179 | Jumpertown | $2,074 |

| Durant | $2,052 | Ashland | $2,016 |

| Guntown | $2,158 | Enterprise | $2,269 |

| Baldwyn | $1,932 | Anguilla | $2,329 |

| Ruleville | $2,260 | Potts Camp | $2,179 |

| Okolona | $1,993 | Mayersville | $1,965 |

| Nicholson | $2,133 | Meadville | $1,932 |

| Lynchburg | $2,204 | State Line | $2,310 |

| Purvis | $2,329 | D'Lo | $2,260 |

| Charleston | $2,322 | Mathiston | $1,993 |

| Hide-A-Way Lake | $2,329 | Vaiden | $2,052 |

| Farmington | $1,965 | Soso | $2,156 |

| Union | $2,248 | New Hamilton | $2,339 |

| Lyman | $1,993 | Courtland | $2,351 |

| Eupora | $2,016 | Standing Pine | $2,329 |

| Bridgetown | $2,074 | Bogue Chitto | $2,052 |

| Kiln | $1,932 | Shuqualak | $2,212 |

| Nettleton | $2,179 | New Hebron | $2,320 |

| Belmont | $2,260 | Myrtle | $2,336 |

| Tunica Resorts | $2,227 | Dumas | $2,179 |

| Magnolia | $2,269 | Noxapater | $1,932 |

| Escatawpa | $2,386 | Beulah | $2,016 |

| Wesson | $2,344 | Benoit | $1,993 |

| Belzoni | $2,208 | Buckatunna | $2,052 |

| Glendale | $2,156 | Crawford | $2,398 |

| Summit | $1,965 | Beauregard | $2,260 |

| Arnold Line | $2,016 | Osyka | $2,360 |

| Rolling Fork | $2,133 | Bentonia | $2,052 |

| Taylorsville | $2,351 | Oakland | $2,074 |

| Hollandale | $2,310 | Foxworth | $2,179 |

| Drew | $2,052 | Tremont | $1,993 |

| Shaw | $2,329 | Sledge | $2,156 |

| Raymond | $2,319 | Lauderdale | $2,138 |

| Quitman | $1,932 | Gunnison | $2,318 |

| Tchula | $2,016 | Lake | $2,052 |

| Sumrall | $1,965 | Clara | $2,310 |

| Decatur | $2,074 | Webb | $2,269 |

| Lumberton | $2,156 | Roxie | $1,932 |

| Sardis | $2,246 | Glen | $2,204 |

| Calhoun City | $1,965 | Tishomingo | $2,227 |

| Shannon | $2,052 | Pope | $2,016 |

| Tylertown | $1,993 | Abbeville | $2,133 |

| Flora | $2,260 | Lyon | $2,273 |

| Coldwater | $2,074 | Cary | $2,246 |

| Lexington | $2,133 | Sidon | $2,052 |

| Kearney Park | $2,156 | Blue Springs | $2,204 |

| Morgantown | $1,932 | Louin | $2,229 |

| Marks | $2,179 | Hamilton | $2,156 |

| Centreville | $2,211 | Cruger | $1,965 |

| Mound Bayou | $2,052 | Silver City | $1,993 |

| Pelahatchie | $2,016 | Holcomb | $2,133 |

| Shelby | $2,178 | Sebastopol | $2,074 |

| Marion | $2,139 | Artesia | $1,932 |

| Columbus AFB | $1,965 | Chunky | $1,993 |

Minimum Car Insurance Requirements in Mississippi

For financial responsibility, Mississippi state laws require all car insurance policies to have bodily injury liability and property damage liability coverage with the following liability limits:

| Liability insurance | Minimum coverage |

|---|---|

| Bodily injury liability coverage | $25,000 per person and $50,000 per accident |

| Property damage liability coverage | $25,000 per accident |

Our agents recommend full coverage insurance with higher liability limits for most drivers in Mississippi with a clean driving record, including uninsured motorist coverage since the uninsured motorist rate is 29.4%, according to the Insurance Information Institute (III.org).

To learn more about the most affordable car insurance options in Mississippi, enter your zip code to find cheap auto insurance in MS.

Methodology

AutoInsureSavings.org comparison shopping study used a full-coverage auto policy for a 30-year-old driving a 2018 Honda Accord with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person / $100,000 per accident |

| Property damage liability | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured / underinsured motorist bodily injury | $50,000 per person / $100,000 per accident |

| Comprehensive and collision coverage | $500 deductible |

We used rates for drivers with an accident history, credit score, and marital status for other Mississippi rate analyses. We used car insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your auto insurance rates may vary when you get quotes.

Frequently Asked Questions

Who has the cheapest auto insurance in Mississippi?

Travelers Insurance offers the most affordable insurance rates to various Mississippi drivers at $384 per year for minimum coverage. USAA is cheap coverage ($317 per year). However, if you are not eligible for their coverage, your next best options for low-priced car insurance are State Farm ($476 per year) and Mississippi Farm Bureau ($526 per year).

To find out who offers affordable car insurance in Mississippi, you want to make sure to compare rates by getting quotes from top car insurance companies.

How much is minimum auto insurance in Mississippi per month?

The average cost of state minimum car insurance in Mississippi is $780 per year or $65 per month. Travelers Insurance average rate for minimum coverage is $384 per year or $32 per month. State Farm’s rate is $39 per month and Mississippi Farm Bureau at $43 per month are also below the state’s average rates.

How much is full coverage auto insurance in Mississippi?

The average cost of car insurance in Mississippi for full coverage is $172 per month or $2,068 per year. Mississippi Farm Bureau at $1,428 per year, State Farm at $1,470 per year, and ALFA Insurance at $1,733 per year offer full coverage insurance at an average rate lower than the state’s average by 17%.

Full coverage auto insurance costs significantly more than minimum liability insurance, and for that reason, many drivers will choose an auto policy with less coverage to save money. If you have a newer vehicle or concerns about minimum coverage not providing you with enough protection, you should consider full coverage insurance.

How can I save on auto insurance in Mississippi?

There are several ways you can save money on your insurance premium costs in Mississippi. Initially, it would be best to compare quotes from multiple providers to determine which car insurance carrier in the area offers the lowest rate for you. After that, you should inquire about a money-saving driver discount provided by each insurance provider you have in mind.

The more car insurance discounts you are eligible for, the more money you can save. Take the time to make sure you have an appropriate comprehensive coverage level, pay your credit cards and bills on time, and practice safe driving habits. These are three more things you can do that will help you save on your Mississippi car insurance rates.

What is the minimum car insurance for the state of Mississippi?

All drivers must carry 25/50/25 of liability insurance in Mississippi.

Is Mississippi car insurance expensive?

Mississippi car insurance is average, but drivers with bad driving records or high-risk drivers will see higher rates. We recommend shopping around to find the best cheap auto insurance in Mississippi.

Is it illegal to drive without auto insurance in Mississippi?

Yes, it is illegal for residents to drive without auto insurance in the state of Mississippi.

Is Mississippi a no-fault auto insurance state?

No, Mississippi is an at-fault auto insurance state, so carrying the best Mississippi auto insurance coverage is important.

Is Mississippi a PIP state?

No, personal injury protection is not required by auto insurance Mississippi laws.

Is Mississippi a hands-free state?

Yes, Mississippi is a hands-free state. This means you can’t use your phone while driving or risk getting a ticket, making getting cheap car insurance in MS harder.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Ty Stewart

Licensed Insurance Agent

Ty Stewart is the founder and CEO of SimpleLifeInsure.com. He started researching and studying about insurance when he got his first policy for his own family. He has been featured as an insurance expert speaker at agent conventions and in top publications. As an independent licensed insurance agent, he has helped clients nationwide to secure affordable coverage while making the process simpl...

Licensed Insurance Agent

UPDATED: Jan 10, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.