How To Find & How Much is Car Insurance With a Suspended License?

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: May 2, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: May 2, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

If you have had a few tickets or at-fault accidents and your driver’s license has been suspended, you may be wondering how you can get car insurance coverage and how much it will cost without the hassle.

Getting Car Insurance With a Suspended License

It can be more challenging to navigate your car insurance with a suspended license, but you have options.

| Suspended License - Key Takeaways |

|---|

| According to our research, the average monthly car insurance rate increase for drivers with a suspended license is $130. |

| Having a suspended driver’s license can make it more challenging to get car insurance, but not impossible. |

| If you have a license suspension, you may be able to apply for a conditional license to restore limited driving privileges to your workplace, school, or other essential responsibilities. |

| Shopping around and comparing car insurance rates is especially important with a suspended license. |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Apply for a Restricted or Conditional License

If your license has been suspended, you may be able to apply for a hardship license, which is also called a restricted or conditional license.

A conditional driver’s license has some driving privileges but with limitations.

This type of license is meant to give the individual the ability to get to work, school, or other essential responsibilities, like picking up children.

If you need an auto insurance policy with a restricted license, you may be limited to Non-Standard Car Insurance carriers specializing in insuring high-risk drivers, according to Insurance.com.

Non-standard auto insurance companies are illustrated below with cost differences.

| Insurance Company | Non-standard Insurance | Standard Car Insurance |

|---|---|---|

| Direct Auto | $2,653 | $1,471 |

| Kemper | $2,970 | $1,748 |

| GAINSCO | $2,831 | $1,506 |

| The General | $2,777 | $1,759 |

| Founders Insurance | $3,028 | $1,937 |

Rate analysis from Quadrant Information Services. Your rates will vary by zip code.

The individual with the suspended license must apply for the hardship license and show cause for why they need it.

They must agree to the conditions that accompany the hardship license, such as when they may drive and where they may go.

If the reason for the license suspension is a drug or alcohol-related charge, one condition of the hardship license may be to install an Interlock Ignition Device (IID) on the vehicle.

This is a device the driver blows into before the car can be started – a blood alcohol content over the legal limit will disable the car.

In some states, like Arizona, the DMV will automatically send a restricted permit to eligible drivers a few weeks after the suspension begins.

You still need to meet the state’s liability insurance coverage requirements, but the automatic permit may make it a more straightforward process.

How Much is Car Insurance With a Suspended License Violation?

Auto insurance rates tend to be higher for drivers with suspended licenses as they are considered higher-risk drivers.

But this does not mean you have to accept the rate of the first car insurance company you contact.

You can find cheaper car insurance rates if you have a license suspension, but you will need to shop around and consider other carriers to find the best insurance rate.

The average monthly rate increase for drivers with a license suspension is $130 per month, as illustrated below.

| State | Monthly Insurance Premium | Insurance with License Suspension |

|---|---|---|

| Arizona | $127 | $261 |

| California | $165 | $311 |

| Florida | $215 | $348 |

| Illinois | $116 | $253 |

| Louisiana | $196 | $342 |

| Michigan | $175 | $393 |

| New York | $208 | $350 |

| Ohio | $83 | $196 |

| Pennsylvania | $114 | $243 |

| Texas | $164 | $295 |

| Washington D.C. | $140 | $276 |

Rate analysis from Quadrant Information Services. Your car insurance quotes will vary by zip code.

Compare car insurance quotes by zip code of non-standard carriers at AutoInsureSavings for guidance.

It can be helpful to shop often – a higher than average provider may be able to offer you a more reasonable car insurance premium in six months.

Make sure to push for any discounts you are eligible for and consider how much coverage you purchase.

If you typically carry high limits, you might consider lower limits during the suspension period while not driving, according to ValuePenguin.

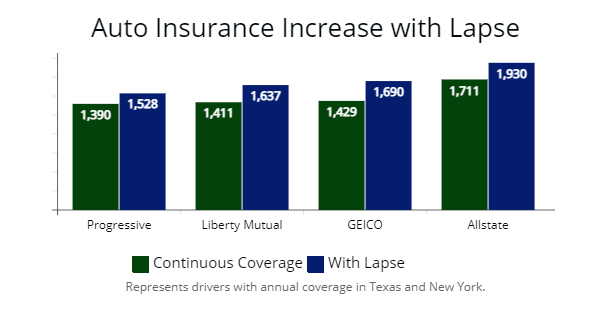

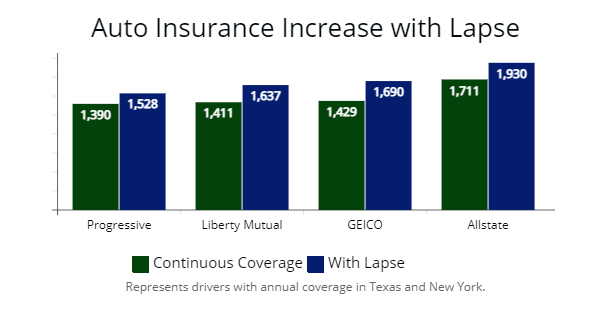

According to EverQuote, if you have a current insurance policy and your license was suspended, you shouldn’t cancel your car insurance coverage. If so, you will have a gap in coverage, as illustrated above. With a gap, your rates will skyrocket when you shop for car insurance, particularly with large insurers such as Geico or Allstate. Your rates will vary by zip code.

According to EverQuote, if you have a current insurance policy and your license was suspended, you shouldn’t cancel your car insurance coverage. If so, you will have a gap in coverage, as illustrated above. With a gap, your rates will skyrocket when you shop for car insurance, particularly with large insurers such as Geico or Allstate. Your rates will vary by zip code.

SR-22 Insurance

The SR-22 is a form or certificate of financial responsibility required in most states if you are considered a higher-risk driver – perhaps following an at-fault accident with injuries or a ticket for a DUI, multiple traffic violations, or reckless driving.

| Car Insurance Companies for SR-22 |

|---|

| Nationwide |

| Dairyland |

| State Farm |

| Infinity |

| 21st Century |

The SR-22 is proof of insurance to your state’s DMV that you have sufficient insurance or financial responsibility to be a responsible driver.

To obtain SR-22 insurance, you will need to have a policy, and then your car insurance carrier can file the SR-22 with your DMV.

The SR-22 form is added by endorsement to your existing auto policy, so you must maintain car insurance coverage while on it. The SR-22 usually lasts three to five years.

What happens if you get in a wreck with a suspended license?

If you are driving while your license is suspended or revoked and get caught, it could result in a felony charge.

It is a serious charge and could affect your ability to get a driver’s license or car insurance in the future, as well as a result of fines and penalties.

What happens if your car is not insured?

Having auto insurance is compulsory in most states. Not carrying the state’s minimum limits could result in fines, fees, license suspension or revocation, or the impounding of your vehicle.

Keep in mind that penalties differ from state to state. It can also be more difficult to get car insurance in the future after a period of uninsured time or after a policy lapse.

Frequently Asked Questions (FAQ)

What should you do with auto insurance after a license suspension?

After your license is suspended, you may be tempted to cancel your auto insurance since you cannot drive. Still, you should consider that carefully as it can be more expensive and more challenging to get a policy later after a lapse in coverage. Your current auto insurance company may cancel your auto policy, so shopping around for a new car insurance carrier and a better rate is essential.

Can I lower my car insurance if my license is suspended?

Yes. If you carry higher than the state minimum, you could consider lowering your coverage for a lower premium when you are not driving.

However, if you already have minimum limits, you may not be able to reduce your car insurance further.

Another car insurance option is to list a family member or spouse as the primary driver on your insurance policy to avoid higher rates.

How long does a suspension affect car insurance?

A suspension will typically impact your insurance rates for three years.

Can you register a car with a suspended license?

It depends on your state, but you may still register and own a motor vehicle with a suspended license in many states. In Ohio, for example, your ability to register a car is not impacted by a suspended license. In Virginia, however, when your license is suspended, so is your vehicle registration.

What is the difference between a suspended or revoked license?

A suspended license is one that has been taken away for a period determined by the Department of Motor Vehicles. Sometimes they may suspend a driver’s license indefinitely or for an open-ended period.

When the suspension is over, the driver may apply for reinstatement by meeting specific criteria.

A revoked license is one that has been taken away forever by the DMV.

Some revocation reasons could include old age or a medical condition, but it could also be because of excessive DWI infractions or tickets.

If your license is revoked, in some instances, you may be able to take action to apply for a new license, such as paying fines or resolving tickets.

How to Learn More

To learn more about getting car insurance with a suspended license, contact our insurance agents today at AutoInsureSavings.org.

Our licensed professionals will be happy to answer any questions you have.

Our licensed professionals will be happy to answer any questions you have.

Or enter your zip code at the top of the page.

Methodology

| AutoInsureSavings.org collects insurance quotes from the state's largest car insurance companies for a 40-year-old male or female motorist for our driver profile. Each driver has a clean driving record, and we applied good driver, anti-theft, and homeowner discounts. Insurance quotes for each insurer are via Quadrant Information Services. Our methodology's motor vehicle is a 2018 Honda Accord. Each has liability insurance, collision, and comprehensive coverage. We retrieved auto insurance quotes with full coverage for motorists with moving violations from insurance rate data in this instance. |

External Links & References

https://law.lis.virginia.gov/section46.2-391.1/

https://azdot.gov/motor-vehicles/driver-services/license-reinstatement/restricted-driver-permits

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Daniel Walker

Licensed Insurance Agent

Daniel Walker graduated with a BS in Administrative Management in 2005 and has run his family’s insurance agency, FCI Agency, for over 15 years (BBB A+). He is licensed as an insurance agent to write property and casualty insurance, including home, life, auto, umbrella, and dwelling fire insurance. He’s also been featured on sites like Reviews.com and Safeco. To ensure our content is accura...

Licensed Insurance Agent

UPDATED: May 2, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.