Car Insurance for a Suspended License Driver: 4 Tips to Getting the Better Rates

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Was your license recently suspended? If so, you’re probably expecting your insurance rates to soar if they haven’t done so already. One of the biggest mistakes that drivers with a suspended license make is thinking that they’re going to pay the same high rate regardless of who their automobile insurance provider is.

Top Reasons for a Suspended Driver License

| Rank | Reason for Suspended License |

|---|---|

| 1 | DUI/DWI |

| 2 | Accumulation of “points” from tickets |

| 3 | Refusal of a BAC test or breathalyzer |

| 4 | Leaving the scene of an accident |

| 5 | Reckless driving or excessive speeding |

| 6 | Failure to respond to a traffic court summons |

While car insurance for drivers with a suspended license is typically more expensive than standard auto insurance, there are things that you can do to have a say in the rate that you’ll be paying for your insurance policy.

Just as with standard car insurance for a licensed driver, the rates for high-risk or suspended license drivers vary according to a number of different factors.

In order to help you get the best rate possible, we’ve compiled a list of tips on how to get the best rate on car insurance for a suspended license driver.

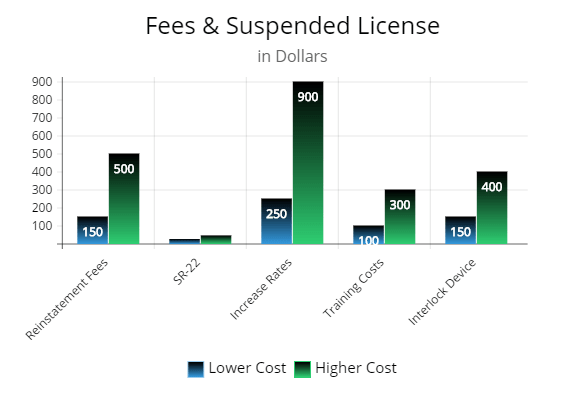

Note: These are typical fees for a driver with a suspended license. Depending on your situation, you can incur some or all of the fees because of your license status.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Shop Around & Keeping Shopping Around for Lower Rates

Whether you have high-risk insurance or standard car insurance, the most efficient way to get the best rates is to shop around. By comparing quotes at least once every few months, you’ll be able to maximize your savings by guaranteeing you get the best rates available to you.

Unlike other industries, loyalty doesn’t always benefit the customer when it comes to car insurance and your current insurer. In fact, loyal customers often pay more, as auto insurers typically offer cheaper car insurance rates to new customers.

By using the quote comparison tool at the top of this page, you’ll be able to find out which providers are offering the best rates on car insurance for a suspended license driver.

All you have to do is type in your zip code, and then answer a few questions honestly. You’ll get rates from the leading auto insurance companies in your area within minutes.

Find the rate that works best for you, and then give that company a call.

States with the Highest Amount of Drivers License Suspended Annually

| State | Annual Suspensions |

|---|---|

| Alabama | 82,293 |

| Arkansas | 40,178 |

| Florida | 240,430 |

| Iowa | 40,898 |

| Michigan | 260,459 |

| Mississippi | 50,107 |

| New Jersey | 310,500 |

| New York | 280,697 |

| Pennsylvania | 190,969 |

| Texas | 24,004 |

| Utah | 70,553 |

| Virginia | 940,000* |

| Washington D.C. | 10,632 |

*The State of Virginia DMV has a class-action lawsuit filed against it.

Note: There are states with higher driver’s license suspended annually. The states listed are higher compared to population size.

Ask for Discounts if Available & Check Competitors Too

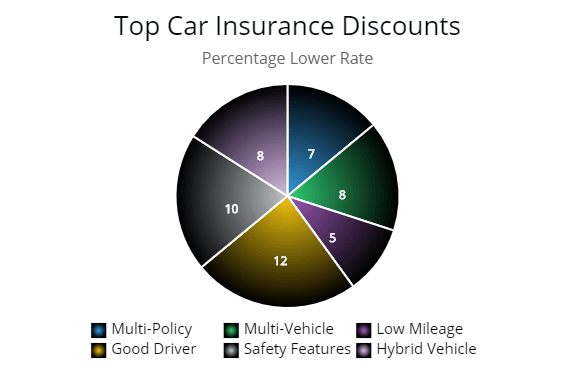

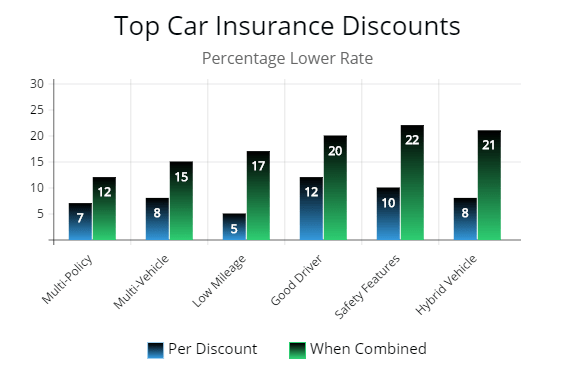

Whether you decide to switch to the company offering the lowest rate on car insurance for suspended drivers, or you opt to stay with your current insurance provider, another easy way to get cheaper rates is to ask about discounts.

Most car insurance companies offer discounts, regardless of the kind of auto policy you have. While high-risk drivers with a suspended license won’t qualify for as many discounts as drivers with a clean driving record, there are still many opportunities for potential savings.

From employers and membership organizations to defensive driving classes that promote safety when operating motor vehicles, you’d be surprised at the many different ways you can secure a discount from your car insurance provider.

Downgrade Your Car if Feasible or Lower Coverage on Your Current Vehicle

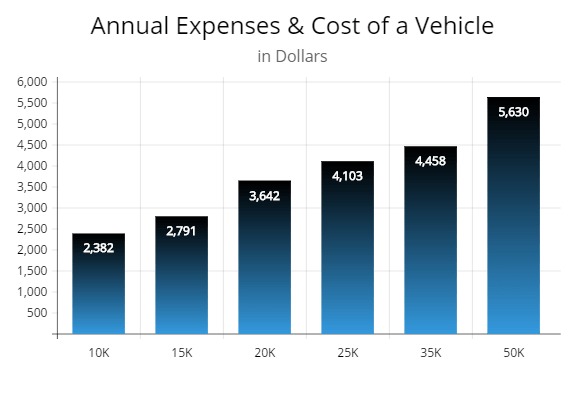

Believe it or not, the best way to get the best rates on car insurance for a suspended license driver is to use the same tactics you’d use if you had standard auto insurance. By downgrading your car to one that is more reliable and less expensive, you’ll be able to cut your insurance premium by a significant amount.

Note: Typical expenses include repairs, insurance, and gas. Normally, when the value of the vehicle goes up the expenses usually do. As illustrated by the graph you could slash your expenses by downgrading a vehicle.

The truth is that you’re unable to legally drive with your suspended license, and your high-end luxury vehicle or sports car isn’t doing anything for you at the moment. It really only makes sense to get a more reliable, older used vehicle for insurance purposes. You can always add your high-end car back onto your auto insurance policy when you re-qualify for standard insurance.

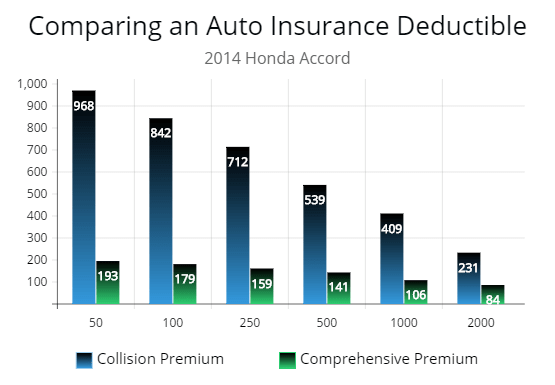

Note: As illustrated by the graph you pay less when you have a higher deductible. This is another way to lower your rates. Be sure to consult with an insurance agent before you do.

Communicate with Your Insurance Carrier to Find Better Options

Perhaps the best and most important thing you can do to get the best rates as a suspended license driver is to stay in close contact with your auto insurance provider. Keep them informed about the status of your suspension.

If the end date for your suspension is near, make sure that your insurance provider knows that information as well.

The better informed they are, the quicker they will be to transition you back to standard insurance.

By staying in close contact with your insurance provider and a local DMV, you’ll also be able to keep informed on the different options that are available to you.

Whether it’s the latest discount or rate-reduction offer, the more often you communicate with your auto insurance provider, the better the chance of you getting the best rate possible.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.