Connecticut Cheapest Car Insurance & Best Coverage Options

You can find Connecticut's cheapest car insurance and best coverage options at Travelers and State Farm. Travelers has the cheapest minimum coverage in Connecticut at an average of $51/mo, while State Farm has the cheapest full coverage in Connecticut for those who want more protection at an average of $126/mo.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Feb 7, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Feb 7, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

- Travelers has the cheapest minimum coverage in CT

- State Farm has the cheapest full coverage in CT

- All CT drivers must carry minimum coverage

Connecticut’s cheapest car insurance and best coverage options are at Travelers and State Farm. Our guide goes over everything you need to know about the best auto insurance companies in CT for affordable insurance.

To find quotes for cheap CT insurance right away, enter your ZIP in our free tool.

Affordable Connecticut Car Insurance Rates

Choosing the right car insurance company can help you improve your level of coverage while you stay within your budget. You want to ensure that you’re able to get the cheapest option and find the lowest rates, and comparing multiple providers can assist you with that.

| Cheapest Car Insurance in Connecticut - Key Takeaways |

|---|

The cheapest Connecticut car insurance options are: The cheapest Connecticut car insurance options are:Cheapest for minimum coverage: Travelers Insurance Cheapest for full coverage: State Farm Cheapest after an at-fault accident: State Farm Cheapest after a speeding ticket: Geico Cheapest after a DUI: Progressive Cheapest for poor credit history: Geico Cheapest for young drivers: Geico For younger drivers with a speeding violation: Nationwide For younger drivers with an at-fault accident: Nationwide |

To help you save money and find the best deal on your car insurance premium in Connecticut, AutoInsureSavings.org has compared the best rates from several top companies in the insurance industry for various types of drivers and age groups.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Connecticut for Minimum Coverage

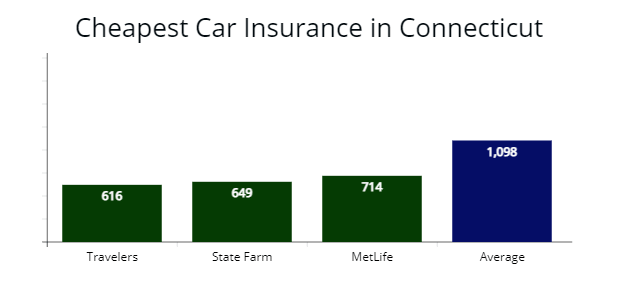

Our agents found that Travelers Insurance is the cheapest company when it comes to offering state minimum coverage car insurance for drivers in Connecticut with a clean driving record at $616 per year, which is 46% less expensive than the average cost for minimum liability coverage from other auto insurance companies in Connecticut at $1,098 per year (learn more about Travelers in our Travelers review).

| Auto Insurer | Average annual rate |

|---|---|

| Travelers | $616 |

| State Farm | $649 |

| USAA | $670 |

| MetLife | $714 |

| Geico | $824 |

| Nationwide | $958 |

| Allstate | $1,040 |

| Progressive | $1,221 |

| Amica | $1,532 |

*USAA is for qualified military members, their spouses, and direct family members. Auto insurance rates may vary depending on the driver’s profile. Learn more in our USAA review.

Connecticut drivers can purchase state minimum liability requirements for less than $700 per year from several providers.

While Travelers and State Farm are the cheapest options for many Connecticut drivers, we also found that MetLife and Geico are two good insurance carriers to consider based on our research for drivers who want to save the most money.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Minimum property damage and bodily injury liability policies are cheaper car insurance premiums, which exclude comprehensive and collision coverage, but AutoInsureSavings.org licensed agents recommend buying full coverage car insurance in Connecticut since filing a claim with a minimum coverage insurance policy you could pay out-of-pocket expenses.

Cheapest Full Coverage Car Insurance in Connecticut

We found that State Farm offers cheap full coverage for drivers in Connecticut with a $1,517 per year quote or 37% cheaper than the state average rates.

MetLife is the next best option at $1,664 per year or 31% less expensive than Connecticut’s average $2,387 insurance rate.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $1,517 | $126 |

| MetLife | $1,664 | $138 |

| Geico | $1,983 | $165 |

| Connecticut average | $2,387 | $198 |

*USAA is for qualified military personnel, their spouses, and direct family members. Rates may vary depending on driver profiles and zip codes.

The average driver in Connecticut paying for full coverage insurance is $198 per month. Drivers can find cheaper auto policies by comparing top car insurance providers’ rates like those listed here.

Cheapest Car Insurance in Connecticut with a Speeding Ticket

Our licensed agents found Geico offers the cheapest auto insurance rates for drivers in Connecticut with a speeding violation at $1,904 per year or a $158 monthly rate. Geico’s quote is 32% lower than the Connecticut average rates of $2,788 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Geico | $1,904 | $158 |

| Travelers | $2,056 | $171 |

| MetLife | $2,187 | $182 |

| Connecticut average | $2,788 | $232 |

Average rates increase by $401 per year after a moving violation in Connecticut.

Because insurance companies use traffic tickets to assess risk; having one or more tickets on your driving record indicates you are riskier to the insurer and will result in rate increases.Dani Best Licensed Insurance Producer

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

According to the Connecticut Department of Motor Vehicles (DMV), if you receive six points for speeding, you will receive a warning letter and an insurance company rate increase by 15% until the traffic violation falls off your driving record in three years.

Learn more: How a Traffic Ticket Can Impact Your Car Insurance Rates

Cheapest Car Insurance in Connecticut with an At-Fault Accident

State Farm offers the most affordable car insurance rates for drivers with a recent at-fault accident in Connecticut, with annual premiums as low as $2,033 per year. That is $1,646 less than state average rates, or 45% cheaper drivers pay for coverage in Connecticut.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $2,033 | $169 |

| Travelers | $2,146 | $178 |

| Geico | $2,832 | $236 |

| Connecticut average | $3,679 | $306 |

Travelers and Geico are insurance companies that offer lower than state average rates for many drivers in Connecticut who have an accident on their record.

According to the Connecticut DMV, an auto accident will remain on your motor vehicle record for three years, along with an average insurance rate increase of 36%.

Cheapest Car Insurance With a DUI in Connecticut

Progressive offers the cheapest car insurance rates in Connecticut for drivers with a DUI in their driver history at $2,987 per year. The average rate for drivers with a DUI in Connecticut is $4,365, and Progressive’s best rates are 32% lower than other auto insurance companies.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $2,987 | $248 |

| State Farm | $3,348 | $279 |

| Travelers | $3,765 | $313 |

| Connecticut average | $4,365 | $363 |

Connecticut drivers with a DUI can expect to see their auto insurance rates increase by as much as 46%, with a possible driver’s license suspension. That is why it is essential to shop around at the best car insurance companies after a DUI to find one that offers the most affordable rates after a DUI offense. Our agents recommend Connecticut drivers with a drunk driving infraction take a defensive driving course to lower insurance premiums.

Cheapest Car Insurance in Connecticut with Poor Credit

Geico offers the cheapest auto insurance rates for Connecticut drivers who have a poor credit history. Geico’s rates are $1,954 per year for our sample 30-year-old male driver or 39% less per year.

Travelers and MetLife are two insurance companies with a less expensive option offering their best rates in the Constitution State, 31% lower than the state’s $3,176 average rates.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Geico | $1,954 | $162 |

| Travelers | $2,050 | $170 |

| MetLife | $2,211 | $184 |

| Connecticut average | $3,176 | $264 |

Those who have a bad credit score in Connecticut may see that their insurance rates are higher than average. For most people, poor credit score insurance rates are 25% higher than those with good credit scores, according to the Insurance Information Institute (III.org)

Make sure to pay your bills, student loans, and credit cards on time to save money on Connecticut auto insurance premiums.

Cheapest Car Insurance for Young Drivers in Connecticut

Geico offers the cheapest car insurance rates for younger drivers in Connecticut with clean driving records, with an average premium of $4,971 per year for full coverage car insurance.

For less than average costs for minimum coverage, younger drivers should choose MetLife and Geico, which offered our licensed agents a $2,368 and $2,465 per year quote or 20% less per year than Connecticut average rates.

Read more: The Best Car Insurance for New Drivers: A Comprehensive Guide

For young drivers state minimum coverage, State Farm offers cheaper than average insurance rates at $2,532 per year or 14% less expensive than other car insurance companies in Connecticut.

| Insurer | Full coverage | Minimum coverage |

|---|---|---|

| USAA | $4,365 | $1,754 |

| Geico | $4,971 | $2,465 |

| Nationwide | $5,268 | $2,975 |

| State Farm | $5,370 | $2,532 |

| MetLife | $6,135 | $2,368 |

| Amica | $7,487 | $3,272 |

| Progressive | $9,329 | $3,753 |

| Allstate | $11,532 | $3,148 |

| Travelers | $12,538 | $4,528 |

| Connecticut average | $6,058 | $2,941 |

*USAA is for qualified military members, their spouses, and direct family members. Rates may vary depending on driver profiles.

Young or teen Connecticut drivers needing coverage can save more by comparing insurance quotes like those shown above. Drivers who choose Geico Insurance can save as much as 18% on their insurance premiums, which can be substantial savings for younger drivers and their parents.

Cheapest Car Insurance for Young Drivers with a Speeding Ticket

During our analysis of auto insurers with the best rates, our agents found teen drivers needing coverage in Connecticut with a speeding ticket on their driving record can get cheaper insurance rates with Nationwide at $5,268 per year or $439 monthly rate, which is 34% less expensive than Connecticut average rates.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Nationwide | $5,268 | $439 |

| State Farm | $5,663 | $471 |

| Geico | $5,987 | $498 |

| Connecticut average | $7,989 | $665 |

Cheapest Car Insurance for Young Drivers with an Auto Accident

Young Connecticut drivers with an at-fault accident on their driving record can find the cheapest full coverage insurance quotes with Nationwide, which provided us a quote at $5,765 per year or 45% lower than the average car insurance rates of a similar driver profile.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Nationwide | $5,765 | $480 |

| Geico | $6,632 | $552 |

| State Farm | $7,071 | $589 |

| Connecticut average | $10,437 | $869 |

Read more: Car Insurance with an Accident History: How to Lower Your Rates

Best Car Insurance Companies in Connecticut

Several great insurance companies to choose from coverage in Connecticut based on their price, customer service and support, and coverage level.

ValuePenguin did a survey and found the overall best car insurance companies in Connecticut are USAA and Nationwide, with high marks from current policyholders for claims satisfaction. If you are not eligible for USAA, State Farm and Amica Insurance are the next best options based on customer service.

| Auto Insurer | % respondents satisfied with recent claim | % respondents rated customer service as excellent |

|---|---|---|

| USAA | 78% | 64% |

| Nationwide | 77% | 53% |

| Amica | 76% | 58% |

| State Farm | 75% | 46% |

| Allstate | 74% | 47% |

| Progressive | 73% | 34% |

| Geico | 64% | 42% |

| Travelers | 62% | 33% |

AutoInsureSavings.org team of licensed insurance agents compared complaints by each insurance company using the National Association of Insurance Commissioners complaint index.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Using the complaint index (best ratio of complaints to market share) from NAIC, the best car insurers are Allstate and Travelers. Both car insurance companies are below the national average of 1.00, with a 0.63 and 0.65 complaint index, respectfully.

| Car Insurer | NAIC Complaint Index | J.D. Power Claims Satisfaction | A.M. Best Rating |

|---|---|---|---|

| Allstate | 0.63 | 876 | A+ |

| Travelers | 0.65 | 861 | A++ |

| State Farm | 0.66 | 881 | A++ |

| Progressive | 0.76 | 856 | A+ |

| Amica | 0.91 | 907 | A+ |

| LIberty Mutual | 0.92 | 870 | A |

| The Hartford | 0.95 | 888 | A+ |

| Geico | 1.01 | 871 | A++ |

| MetLife | 1.24 | 886 | A |

Using J.D. Power’s claims satisfaction survey and the AM Best financial strength ratings, Amice Insurance, MetLife, and Allstate are the best insurance providers.

Average Cost of Car Insurance by City in Connecticut

Auto insurers use your zip code and many risk factors like your credit score, marital status, vehicle type, and past driving history to determine your Connecticut car insurance costs (learn more: How Car Insurance Premiums Are Calculated). The average cost of insurance for Connecticut drivers is $2,387 per year or $198 per month. During our comparison shopping study, we found the cheapest insurers by city.

Cheapest Car Insurance in Bridgeport, CT

Bridgeport, Connecticut drivers can shop around and find the cheapest insurance coverage from Travelers insurance company which provided our agents a $1,734 rate per year for a full coverage auto insurance policy. Travelers’ rate is 39% lower than average rates in Bridgeport.

| Bridgeport Company | Average Premium |

|---|---|

| Travelers | $1,734 |

| Geico | $1,850 |

| MetLife | $1,963 |

| Bridgeport average | $2,815 |

Cheapest Car Insurance in New Haven, CT

Drivers in New Haven, CT, with clean driving history, can find the least expensive insurance rate with Geico at $1,727 per year for full coverage for our sample 30-year-old driver, 37% below average rates in New Haven, Connecticut.

| New Haven Company | Average Premium |

|---|---|

| Geico | $1,727 |

| State Farm | $1,874 |

| Liberty Mutual | $2,166 |

| New Haven average | $2,719 |

Cheapest Car Insurance in Stamford, CT

We found the cheapest auto insurance quotes in Stamford, CT, from Geico, with a $1,888 quote per year for full coverage with $500 deductibles of collision and comprehensive coverage. Geico’s rate is 33% cheaper than average rates in Stamford.

| Stamford Company | Average Premium |

|---|---|

| Geico | $1,888 |

| Travelers | $1,971 |

| Nationwide | $2,253 |

| Stamford average | $2,784 |

Cheapest Car Insurance in Hartford, CT

For Hartford’s cheapest auto insurance rates, our agents recommend Travelers with a quote at $1,712 per year for our sample 30-year-old driver. Travelers’ rate is 38% cheaper than Hartford CT’s average rates.

| Hartford Company | Average Premium |

|---|---|

| Travelers | $1,712 |

| Geico | $1,840 |

| State Farm | $2,035 |

| Hartford average | $2,726 |

Cheapest Car Insurance in Waterbury, CT

Waterbury, Connecticut drivers with clean driving records can get the cheapest auto insurance coverage with Travelers, which provided our agents a quote at $1,691 per year for our 30-year-old sample driver with a full coverage auto policy.

| Waterbury Company | Average Premium |

|---|---|

| Travelers | $1,691 |

| Nationwide | $1,809 |

| Geico | $1,874 |

| Waterbury average | $2,435 |

Cheapest Auto Insurance in New Britain, CT

New Britain residents needing the cheapest auto coverage for their car should get quotes from Geico, who provided our insurance agents a rate at $1,530 per year or 33% lower than average rates in New Britain.

| New Britain Company | Average Premium |

|---|---|

| Geico | $1,530 |

| MetLife | $1,678 |

| Nationwide | $1,771 |

| New Britain average | $2,264 |

Cheapest Car Insurance in West Hartford, CT

West Hartford’s cheapest auto insurance is with Travelers, who provided us a quote at $1,703 per year for a 30-year-old driver with full coverage. Travelers’ rate is 37% less expensive than the average West Hartford rate.

| West Hartford Company | Average Premium |

|---|---|

| Travelers | $1,703 |

| Geico | $1,830 |

| State Farm | $2,006 |

| West Hartford average | $2,683 |

Average Auto Insurance Costs for All Cities in Connecticut

| City | Annual premium cost | City | Annual premium cost |

|---|---|---|---|

| Bridgeport | $2,815 | Windsor Locks | $2,043 |

| New Haven | $2,719 | Derby | $2,168 |

| Stamford | $2,784 | Coventry | $2,095 |

| Hartford | $2,726 | Stafford Springs | $2,074 |

| Waterbury | $2,435 | Plymouth | $2,061 |

| Norwalk | $2,510 | Griswold | $2,285 |

| Danbury | $2,346 | East Windsor | $2,208 |

| New Britain | $2,264 | Granby | $2,172 |

| West Hartford | $2,683 | Somers | $2,043 |

| Greenwich | $2,116 | Winchester | $2,177 |

| Fairfield | $2,043 | Canton | $2,195 |

| Hamden | $2,128 | Weston | $2,116 |

| Bristol | $2,428 | Old Saybrook | $2,074 |

| Meriden | $2,061 | Prospect | $2,160 |

| Manchester | $2,095 | Burlington | $2,186 |

| West Haven | $2,074 | Woodbury | $2,206 |

| Milford | $2,128 | Hebron | $2,074 |

| Stratford | $2,160 | Putnam | $2,223 |

| East Hartford | $2,186 | Thompson | $2,225 |

| Middletown | $2,206 | Portland | $2,186 |

| Wallingford | $2,074 | Redding | $2,160 |

| Enfield | $2,223 | East Haddam | $2,128 |

| Southington | $2,225 | Woodbridge | $2,043 |

| Shelton | $2,229 | Brooklyn | $2,061 |

| Norwich | $2,074 | Haddam | $2,095 |

| Groton | $2,160 | Litchfield | $2,231 |

| Trumbull | $2,225 | Woodstock | $2,160 |

| Glastonbury | $2,074 | Middlebury | $2,186 |

| Torrington | $2,116 | Thomaston | $2,206 |

| Naugatuck | $2,186 | Easton | $2,074 |

| Newington | $2,128 | Old Lyme | $2,223 |

| Vernon | $2,043 | Durham | $2,206 |

| Cheshire | $2,160 | Lebanon | $2,160 |

| Windsor | $2,061 | Westbrook | $2,043 |

| East Haven | $2,186 | New Hartford | $2,116 |

| Branford | $2,095 | Essex | $2,225 |

| Westport | $2,074 | Killingworth | $2,128 |

| Newtown | $2,118 | Marlborough | $2,223 |

| New Milford | $2,128 | Beacon Falls | $2,043 |

| New London | $2,160 | Willington | $2,231 |

| Wethersfield | $2,043 | Bethany | $2,074 |

| South Windsor | $2,186 | Harwinton | $2,095 |

| Mansfield Center | $2,223 | Columbia | $2,200 |

| Farmington | $2,206 | East Granby | $2,116 |

| Ridgefield | $2,095 | North Stonington | $2,160 |

| Simsbury | $2,242 | Canterbury | $2,061 |

| North Windham | $2,223 | Bolton | $2,186 |

| North Haven | $2,043 | Preston | $2,206 |

| Guilford | $2,074 | Deep River | $2,128 |

| Watertown | $2,186 | Middlefield | $2,225 |

| Darien | $2,061 | Lisbon | $2,223 |

| Bloomfield | $2,160 | Ashford | $2,043 |

| Berlin | $2,116 | Chester | $2,095 |

| New Canaan | $2,244 | Pomfret | $2,074 |

| Rocky Hill | $2,128 | Salem | $2,061 |

| Southbury | $2,206 | Sterling | $2,186 |

| Bethel | $2,223 | Barkhamsted | $2,116 |

| Monroe | $2,095 | Sherman | $2,225 |

| Waterford | $2,043 | Salisbury | $2,128 |

| Montville | $2,074 | Washington | $2,206 |

| Ansonia | $2,061 | Bethlehem | $2,248 |

| East Lyme | $2,128 | North Canaan | $2,160 |

| Wilton | $2,116 | Andover | $2,043 |

| Stonington | $2,160 | Sprague | $2,223 |

| Avon | $2,095 | Goshen | $2,074 |

| Madison | $2,074 | Kent | $2,061 |

| Plainville | $2,206 | Sharon | $2,225 |

| Killingly | $2,128 | Bozrah | $2,116 |

| Brookfield | $2,217 | Voluntown | $2,186 |

| Wolcott | $2,043 | Lyme | $2,169 |

| Seymour | $2,186 | Chaplin | $2,074 |

| Ellington | $2,128 | Morris | $2,043 |

| Colchester | $2,116 | Roxbury | $2,206 |

| Suffield | $2,160 | Hartland | $2,211 |

| Plainfield | $2,061 | Hampton | $2,095 |

| Ledyard | $2,074 | Franklin | $2,186 |

| Tolland | $2,206 | Bridgewater | $2,128 |

| North Branford | $2,007 | Eastford | $2,116 |

| New Fairfield | $2,217 | Norfolk | $2,188 |

| Orange | $2,043 | Scotland | $2,074 |

| Cromwell | $2,182 | Colebrook | $2,160 |

| Oxford | $2,116 | Warren | $2,061 |

| Clinton | $2,095 | Cornwall | $2,130 |

| East Hampton | $2,060 | Canaan | $2,043 |

Minimum Requirements for Connecticut Car Insurance

Connecticut drivers must have a minimum amount of liability insurance requirements in their insurance policies to follow state laws and financial responsibility.

Along with standard liability coverage, drivers in Connecticut need uninsured motorist coverage, which covers you in the event of an auto accident with an uninsured motorist.

Below are the minimum coverage limits.

| Liability insurance | Minimum requirements |

|---|---|

| Bodily injury liability | $25,000 per person / $50,000 per accident |

| Property damage liability | $25,000 per accident |

| Uninsured / underinsured motorist coverage | $25,000 per person / $50,000 per accident |

AutoInsureSavings.org licensed agents recommend getting higher liability limits of bodily injury liability and property damage liability coverage to cover your assets in the event of an accident.

Our agents recommend most Connecticut drivers carry full coverage with comprehensive and collision coverage and add roadside assistance to protect their vehicle in an unforeseen car accident.

To help you find the right and affordable car insurance options in Connecticut, enter your zip code in our free quote tool.

Methodology

AutoInsureSavings.org collects hundreds of quotes in Connecticut across various zip codes from the largest insurance companies via Quadrant Information Services. Our sample driver profile is a 30-year-old driving a 2018 Honda Accord with good credit. We used a full coverage car insurance policy unless otherwise stated with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily liability | $50,000 per person/$100,000 per accident |

| Property damage | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured/underinsured motorist bodily injury | $50,000 per person/$100,000 per accident |

| Comprehensive and collision | $500 deductible |

When AutoInsureSavings.org quotes a driver with a minimum coverage auto policy, we used the minimum liability limits per Connecticut insurance regulations. We used credit score, marital status, driving history, and accident history for other rate analyses. We used insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your rates may vary when you get quotes.

Sources

– Insurance Information Institute. “Facts + Statistics: Auto insurance.”

– National Highway Traffic Safety Administration. “Fatality Analysis Reporting Center Data.”

– National Association of Insurance Commissioners. “Market Share Reports for Property/Casualty Groups and Insurance Companies.”

– State of Connecticut Insurance Department. “General Insurance Information.”

– State of Connecticut Department of Motor Vehicles. “Insurance Compliance & Frequently Asked Questions.”

– Connecticut DMV. “Connecticut’s Drunk Driving Law.”

Frequently Asked Questions

Who has the cheapest auto insurance in Connecticut?

Travelers Insurance for minimum coverage. Travelers offer some of the best insurance industry rates, with a $616 per year rate for a 30-year-old driver in Connecticut. State Farm at $649 per year and MetLife at $714 per year are two other insurers offering the best rates for drivers needing minimum coverage in Connecticut. The average cost of Connecticut auto insurance is $1,098 per year for state minimum coverage.

Because insurance rates are based on various factors such as vehicle type and credit score, it is best to compare multiple providers’ rates to determine who has the cheapest coverage in Connecticut for you.

How much is car insurance in Connecticut per month?

The average rate for Connecticut auto insurance is $198 per month for a driver who is 30 years old and has full coverage. That is $2,387 per year. Here are some totals for the average monthly car insurance rate for drivers in Connecticut: State Farm: $126 per month, MetLife: $138 per month, and Geico: $165 per month.

How much is full coverage car insurance in Connecticut?

The average cost of full coverage car insurance in Connecticut is $2,387 per year or $198 per month. State Farm’s best rate for full coverage is $1,517 per year or $126 per month for a 30-year-old male driver with a good driving record. MetLife’s rate is $1,664 per year, and Geico’s rate is $1,983 per year, and both are below the state average rates.

How do I save on auto insurance in Connecticut?

There are several things drivers in Connecticut can do to save money on their car insurance costs. We suggest asking your insurance agent about any car insurance discounts you may be eligible for. If you are looking for a new provider, it is best to find one that offers a driving discount to help you save even more. Find out if you are eligible for telematics or usage-based insurance, such as Travelers’ IntelliDrive program, where you could save as much as 30% on your auto insurance premium at renewal.

The car you drive also plays a significant role in your rates, plus driving history and credit rating. Therefore, practicing safe driving habits, maintain good driving records, and keeping a close eye on your credit cards and credit report can lower your car insurance rates.

What is the best car insurance in CT?

The best auto insurance in CT for most drivers is full coverage.

What is the minimum car insurance in CT?

CT drivers must carry liability insurance and uninsured/underinsured motorist insurance.

What happens if I don’t have insurance in CT?

Driving without insurance in CT can result in fines, tickets, and more.

Do I need car insurance in CT?

Yes, all CT drivers need to carry auto insurance to drive.

Is Connecticut a no-fault state?

Connecticut is an at-fault state, so it’s important to carry the right auto insurance coverage on your car.

Is Connecticut a PIP state?

PIP is not required in CT.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Feb 7, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.