Benefits of Adding Roadside Assistance To Your Car Insurance Policy

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

The last thing you want is to get stuck on the side of the road because your car breaks down.

If you have ever gotten a flat tire or couldn’t start your car thanks to a dead battery, then you can definitely relate.

On average, nearly 32 million service calls in the United States for roadside help are recorded each year.

That is why emergency roadside service is essential.

To put it simply, it gives you the peace of mind you want while on the road, regardless of why you’re driving.

Car Insurance Company vs. Separate Roadside Plans

It isn’t a question of most drivers if you should get roadside protection benefits, but where should you buy it from?

You have probably heard of AAA or American Automobile Association, but they aren’t the only service offering roadside benefits.

Below is the slight difference between membership levels offered by insurers and plans with regular AAA services.

| Pros - by insurers | |

|---|---|

| Buying a plan is usually cheaper. | You can buy a plan through your car insurance company for a few dollars month. |

| Same benefits through auto insurance companies as with separate plans. | You get the same benefits buying a roadside assistance plan through your insurer. |

| Cons | |

| Car is covered not the driver | Through your insurer your car is covered not the driver. Unlike AAA where you can use it if you are in your friend's vehicle. |

| Call tracking | Some companies track your calls to determine your rate as a driver. |

Many auto insurance providers, from State Farm and Liberty Mutual to Allstate and Nationwide, offer it as a policy option.

Let’s see if the benefits are right for you and if you should add it to the policy you have with your car insurance carrier.

What is roadside assistance?

Roadside assistance is a 24/7 nationwide service that helps drivers get help in roadside emergencies.

When you use the service, you can count on someone coming to help you when you need it.

The service usually covers the extra costs that it takes to get you back on the road.

Below I’ve outlined some plans offered by insurers, credit cards, and dedicated companies such as Allstate’s Motor Club.

| Company | Cost* | Towing Limit | Policy Limits |

|---|---|---|---|

| Progressive | $14 | 15 miles or nearest repair shop | Service limits vary by policy |

| AAA | $28–$320 | Nearest gas station, AAA-approved repair shop, or preferred mechanic | Limit of 4 service calls per membership year |

| USAA | $12 | Nearest repair shop | Pays up to $100 per occurrence |

| Liberty Mutual | $16 | Nearest repair shop | Limit of 5 service calls per year |

| Carchex | $60–$110 | 25 miles | Limit of 5–unlimited service calls per year, depending on package |

| Allstate Motor Club | $86–$144 | $150–$250 benefit per tow, depending on package | Limit of 3–5 service calls per year, depending on package |

| AARP | $64–$84 | 5 miles with basic package, 100 miles with premium package | Limit of 3–4 service calls per year, depending on package |

| OnStar | $300–$756 | 40 miles or nearest repair shop | Service limits vary by customer and state |

| Credit Card | Variable | Nearest repair shop | Only provides coordination and assistance with obtaining services (cost of services are the responsibility of the customer) |

*Cost is average. It is going to depend on what plan you need. Typically insurer’s plans are basic service package. That is why they cost less than plans from specific companies offering the same benefits. Credit card plans are variable. Chase Sapphire has an excellent plan, but policy coverages are included in the annual fee of $550 per year.

What does roadside assistance cover?

Nearly all providers cover the following services, labor, and some mechanical issues.

–changing a flat tire

A roadside specialist will help you change your flat with your spare tire.

Almost any tire service if you need it.

–jumpstarting a dead battery

Coverage includes getting your car battery jumpstarted, battery service, or having your car towed to a mechanic.

–unlocking your vehicle

If you locked your keys in your car while you have a service package, the company sends someone from a locksmith service to unlock it for you.

–delivering emergency fuel

A representative can bring you fuel if you run out before you can get to a gas station.

-getting your car unstuck (winching or extrication)

If your car is stuck in the snow or a ditch, a roadside specialist can help you get back on the road.

–towing an inoperable car

Will tow your vehicle free of charge to a repair shop or other location within your coverage area (usually 3 to 15 miles).

While most of those services are covered as part of your plan, you should check with your provider or read the fine print for additional fees.

Below are the cheapest plans offered by insurers:

| Company* | Annual Cost | Towing | Battery | Flat |

|---|---|---|---|---|

| State Farm | $7 - $9 | Unlimited to nearest facility | Yes | Yes |

| USAA | $10 - $14 | 15 miles | Yes | Yes |

| Geico | $12 - $16 | Up to 100 miles | Yes | Yes |

| Farmers | $14 - $18 | 15 miles | Yes | Yes |

| Progressive | $14 - $23 | 15 miles | Yes | Yes |

| Erie | $15 - $20 | 20 miles | Yes | Yes |

| Liberty Mutual | $14 - $20 | Unlimited to nearest facility | Yes | Yes |

*All companies offer fuel delivery for free, but you have to pay for fuel costs.

You may have to pay extra for having your vehicle towed to a repair shop more than 15 miles away, or if your emergency event costs more than $100.

Some emergency roadside service plans also offer added benefits such as trip interruption coverage.

How does roadside assistance work?

Whether you get your coverage from an auto insurance company like Farmers, Liberty Mutual, or Allstate, or a service like AAA, the process for using it for any eligible vehicle is roughly the same.

If you have a flat tire, you broke down, or you locked your keys in your car, you get help by:

1. Using your provider’s dedicated app or make an assistance call to their dedicated roadside help number.

2. Your provider will send a service professional to you.

3. The specialist will help you with your roadside needs.

The worst could be the waiting period after you called in a service request.

So don’t expect immediate service when you use the coverage.

Below I have outlined the average wait times from data I gathered throughout the internet.

| Company | Wait time* |

|---|---|

| USAA | 20 minutes to 1 hour |

| Geico | 20 minutes to 1.5 hours |

| Allstate | 25 minutes to 1 hour |

| Progressive | 30 minutes to 1.5 hours |

| Erie | 30 minutes to 2 hours |

| Liberty Mutual | 30 minutes to 2 hours |

| Farmers | 45 minutes to 1.5 hours |

*Wait times are average. It is going to depend on the time of day. Also, there are numerous occasions of customers complaining it took 6 or more hours for help to arrive. This was for all companies listed above.

How much does roadside assistance cost?

Depending on where you purchase a package, your plan could cost you anywhere from $10 per year to $351 per year.

In most cases, the cheapest way to get the coverage is as an add-on to your auto insurance policy.

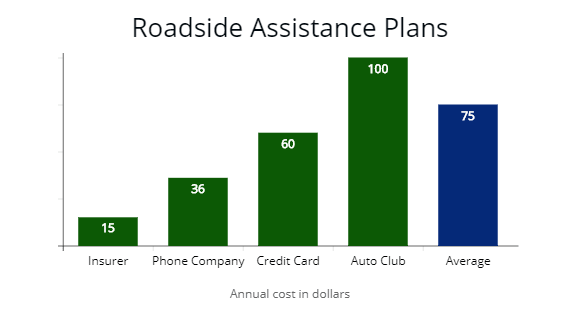

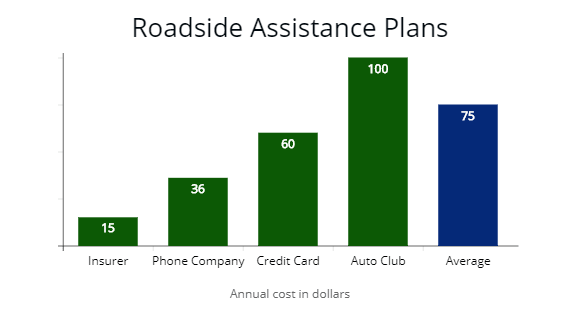

Above is the average cost for a service plan through an insurer, phone company, etc. It is going to depend on the service contract. For example, Verizon charges $3 per month or $36 per year. On the other hand, if you want to use Verizon’s plan without the coverage, it is $90 per tow. Auto clubs and credit card companies have variable fees from time to time. The cost could be higher, depending on the service you use.

Above is the average cost for a service plan through an insurer, phone company, etc. It is going to depend on the service contract. For example, Verizon charges $3 per month or $36 per year. On the other hand, if you want to use Verizon’s plan without the coverage, it is $90 per tow. Auto clubs and credit card companies have variable fees from time to time. The cost could be higher, depending on the service you use.

On average, you will pay at most $15 per period for the service through your insurance provider.

If you opt to get the service through AAA, you will pay anywhere from $60 per year for a basic membership to $351 per year, depending on your coverage level.

If you purchased a warranty plan when you bought your car, the service was probably included.

Card companies frequently offer pay-as-you-go emergency roadside services, but this option is probably the most expensive.

When you use the service through credit card issuers like Visa, you might have to pay as much as $60 per call.

Do I need roadside assistance?

Short answer: Yes, the roadside assistance benefit is worth the cost for peace of mind alone.

Long answer:

Yes, but there are some things you should consider before purchasing the service through an insurance provider such as Geico or Allstate or a service like AAA.

If you recently bought a car and signed up for a warranty plan, you should determine if that plan already includes the bonuses.

If it does, then it is not worth buying the same service through another provider. You want to be sure to that you aren’t paying for duplicate coverage.

You should also consider

The age of your vehicle

In most cases, newer cars won’t need AAA road service or insurance plans because they are less prone to breaking down.

Ultimately they don’t need as much maintenance as an older vehicle.

If your car is at least 10 years old, then buying the service is a no brainer.

Vehicles in this category break down twice as often.

That means you are more likely to have a roadside emergency with an older car.

The length of your daily commute

The longer you are on the road, the more likely you will deal with emergencies requiring outside help.

If your commute is longer than ten to fifteen miles each way, you will want the peace of mind that comes with the optional service.

Given that the average rate to tow a car costs $109 alone, the coverage’s minimal cost is worth it.

It is not a question of whether you should buy it, but rather, who should you buy it from?

Where can I buy roadside assistance?

As a car owner and driver, you can get the service in a variety of ways.

You can get the service from your car maker as part of an extended warranty or from credit card companies.

Or an organization like AAA or Costco, or your car insurance service provider.

Extended warranties

If you purchased an extended warranty, like HondaCare, you probably already have roadside assistance and other car repair benefits with your new or certified vehicle.

The only caveat is the warranty is limited to that specific vehicle, such as a certified pre-owned warranty when buying a used car.

Below are top companies offering plans:

| Warranty Company* | Best For | Cost | Maximum Term |

|---|---|---|---|

| Endurance | Motorists looking for a direct warranty administrator | $350 to $700 per year | 15 Years |

| CARCHEX** | Motorists that want to buy from a well-established brand | $59.95 per year | 10 Years |

| CarShield | Owners of specialty or used vehicles | $80+ per month | 8 Years |

| Protect My Car | Owners looking for long and flexible payment terms | $58 to $90 per month | 10 Years |

*I’ve included warranty companies which are different from clubs or companies. With them, you have to have a warranty to get the coverage.

**CARCHEX is the only warranty company offering eligible services at $59.95 per year.

I wouldn’t recommend buying an extended warranty for roadside protection benefits alone, as there are far more affordable options and it just isn’t worth the expense.

However, if you already planned on buying an extended limited warranty to cover large dollar repairs in the future, then having a membership card is a bonus in that scenario.

Credit Card Companies

Credit card issuers like Visa or American Express frequently offer their customers pay-as-you-go roadside assistance services.

While this option may be beneficial if you don’t already have the service, it can be costly, so it is important to weigh your options.

For example, Visa charges up to $60 each time the service is used, which can be a lot of money when you are in an emergency.

American Express once offered emergency roadside coverage for free to its members.

However, it has since dropped that benefit, to the dismay of many drivers.

Membership Club Services

You have probably heard of AAA or AARP, some of the largest and most well-known service clubs around.

When you join one of those full-service clubs, you will gain free access to their services.

While the cost of membership of those clubs is more expensive than what you’d pay your insurance provider for your covered vehicle, their service quality is usually excellent.

Buyer’s clubs like Costco frequently offer roadside emergency services as part of their membership.

Your insurance provider

Nearly every insurance company offers emergency road service coverage as an add-on option to your policy.

If you’re looking for who has the cheapest roadside assistance service, then buying it through your auto policy is your best option.

You should be aware of exclusions and restrictions when getting the service through an insurance provider like Geico or Liberty Mutual.

Collision and comprehensive coverage are required

If you drive an older vehicle, you may have opted to forgo collision and comprehensive coverage to save money on car insurance.

However, most insurance companies require that coverage to add the extra benefit of roadside assistance to your policy.

That means it might be more affordable to get roadside assistance through an organization like AAA.

It would be best to compare the cost of switching to collision and comprehensive coverage versus the yearly cost of roadside emergency services through AAA.

Only the cars on your plan are covered

Roadside emergency coverage purchased with your auto insurance policy only covers a disabled vehicle listed on your plan.

Service Provider restrictions

Some car insurance companies may restrict you from getting roadside services from their select service providers.

Or they may require you to pay upfront for services and be reimbursed later.

What car insurance companies offer emergency roadside assistance benefits?

The following insurance providers are just some of the many that offer the service as an add-on at competitive rates.

Most of them have GPS location services to find your vehicle too.

You can only use the road assistance benefits 3 to 4 times in a calendar year with most insurers.

Allstate

Includes 24/7 assistance, towing company services, tire changes, battery jump-starts, fuel delivery, lockout services, and winching or extrication.

Allstate also offers the service as part of their Motor Club.

| Allstate | Cost | Policy required |

|---|---|---|

| Membership plans | $79 | No |

| Pay per use | $119 per tow | No |

| Coverage add-on | $25 per vehicle | Yes |

Geico

Geico

Allows customers to request help through their Geico app or by phone.

Includes 24/7 help, tow truck assistance, car battery jump-starts, and flat tire changes.

Also, you can get car lockout help from a local locksmith service.

| Geico* | Cost | Policy required | Comprehensive & collision required? |

|---|---|---|---|

| Coverage add-on | $15 | Yes | Yes |

*With Geico, you can get reimbursed based on policy limits if you paid out of pocket. Also known as a reimbursement consideration.

State Farm

Customers can use the 24/7 State Farm’s membership benefits add-on for emergencies.

Such as towing services, emergency fuel delivery, flat tire changes, lockout assistance from a locksmith service, and jump-starting a dead battery.

What’s not covered?

1. Cost of towing your vehicle outside State Farm’s limits.

2. Labor costs beyond the first hour.

3. Replacement items such as gas or batteries.

Liberty Mutual

Includes roadside assistance in some plans and offers it as an add-on in others.

| Mechanical labor at the breakdown site. |

| Towing to the nearest repair facility if your vehicle is not drivable. |

| Winch or pull if your car is stuck. |

| Locksmith services if you’re locked out or lose a key. |

| Jump starting a dead battery. |

| Tire changes. |

| Fuel delivery. |

The 24/7 service covers emergency fuel delivery, tow truck services, changing flat tires, vehicle door locksmith services, and jump-starting dead batteries at no additional cost.

Sources

https://www.bankrate.com/insurance/car/roadside-assistance/

https://www.consumerreports.org/cars-driving/what-to-consider-when-buying-roadside-assistance-plan/

{“@context”:”https://schema.org”,”@type”:”FAQPage”,”mainEntity”:[{“@type”:”Question”,”name”:”How much does roadside assistance cost?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”Depending on where you purchase a package, your plan could cost you anywhere from $10 per year to $351 per year. In most cases, the cheapest way to get roadside assistance is as an add-on to your auto insurance policy. On average, you will pay at most $15 per period for the service through your insurance provider. If you opt to get the service through AAA, you will pay anywhere from $60 per year for a basic membership to $351 per year, depending on your level of coverage….More“}},{“@type”:”Question”,”name”:”Do I need roadside assistance?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”Short answer: yes, it is worth the cost for peace of mind alone. Long answer: Yes, but there are some things you should consider before purchasing the service through an insurance provider such as Geico or Allstate or a service like AAA. If you recently bought a car and signed up for a warranty plan, you should find out if that plan already includes the added bonuses. If it does, then it is not worth buying the same service through another provider…More“}},{“@type”:”Question”,”name”:”How does roadside assistance work?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”Whether you get your coverage from an auto insurance company like Farmers, Liberty Mutual or Allstate, or a service like AAA, the process for using it for any eligible vehicle is roughly the same. If you have a flat tire, you broke down or you locked your keys in your car, you get help by: 1. Using your provider’s dedicated app or make an assistance call to their dedicated roadside help number….More“}}]}

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.