USAA Car Insurance With Roadside Assistance Can Protect You And Your Family On The Road

USAA Roadside Assistance is one of the services USAA offers to the military and veteran families it serves. This can be a great service to have just in case you have a roadside emergency and want to save yourself some stress.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Feb 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Feb 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

If you or a member of your family served this country through active military duty, you may be aware of the country’s sixth largest car insurance provider, United Services Automobile Association (USAA). They offer lots of car insurance options including USAA roadside assistance.

USAA started out as a company providing affordable car insurance to military families and veterans and has grown to include a wide range of insurance and financial products and services.

The company routinely ranks high on annual consumer surveys for its dedication to customer service.

The USAA roadside service coverage is just another great product that they offer. It’s something you may want to take advantage of just in case you need to use the USAA tow service.

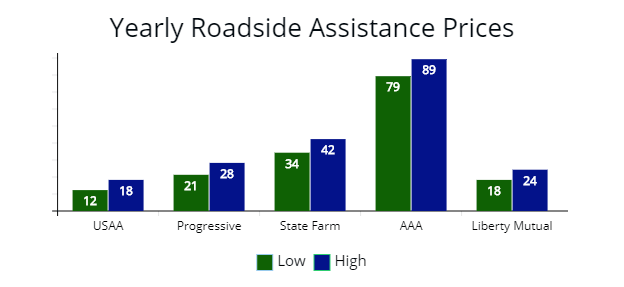

Note: Illustrated above are low and high prices for roadside assistance plans offered by USAA, Progressive, State Farm, AAA, and Liberty Mutual. USAA, Progressive, and Liberty Mutual have similar plans, however, USAA offers the lowest price. I included AAA since they are the major player in the roadside arena. AAA’s service is exceptional, but at higher cost.

Note: Illustrated above are low and high prices for roadside assistance plans offered by USAA, Progressive, State Farm, AAA, and Liberty Mutual. USAA, Progressive, and Liberty Mutual have similar plans, however, USAA offers the lowest price. I included AAA since they are the major player in the roadside arena. AAA’s service is exceptional, but at higher cost.

Membership Respects and Rewards Your Service

USAA offers membership to those in uniform as a way of honoring that service.

The company also acknowledges the contributions of family members by allowing membership to be handed down to children. Membership in USAA is open to:

-

Active, retired and honorably separated officers and enlisted personnel of the U.S. military

-

Officer candidates in commissioning programs (Academy, ROTC, OCS/OTS)

-

Adult children of USAA members who have or had a USAA auto or property insurance policy.

-

(Children must be 18 years or older to be eligible for USAA membership and purchase products in their own name. Children under the age of 18 can be listed as family members on their eligible parents’ auto policies.)

-

-

Widows, widowers and former spouses of USAA members who have or had a USAA auto or property insurance policy while married.

-

(USAA means legally-recognized former and surviving spouses of members and makes no distinction between opposite or same sex spouses/partners.)

-

(Certain USAA products, including investments, financial planning and life insurance are available to the public.)

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

USAA Roadside Assistance Compared to Other Companies

Below is a table to compare USAA’s roadside assistance plans with other major companies.

I put AAA in the list to compare since they are the dominate player in the roadside assistance coverage category.

With AAA you do get great service, but the cost is much higher.

With other companies USAA easily stacks up against any of them, but at a lower price.

| USAA | Progressive | State Farm | AAA | Liberty Mutual | |

|---|---|---|---|---|---|

| Yearly Cost | $12-18 | $25 | $41 | $79 | $18 |

| Towing | Nearest | 15 miles | Nearest | 7 miles | 100 miles |

| On-Site Mechanical Adjustment | Free if possible | 1 hr | 1 hr | Free if possible | 1 hr |

| Winching/ Extrication | Free if reachable from road | 100 ft | Free if reachable from road | Free if reachable from road | Free if reachable from road |

| Car Locksmith | √ | √ | √ | $100 | $50 |

| Flat Tire Service | √ | √ | √ | √ | √ |

| Jump Start | √ | √ | √ | √ | √ |

| Fuel Delivery | √ | √ | √ | √ | √ |

| Battery Delivery & Installation | N/A | N/A | N/A | √ | N/A |

| Emergency Electric Vehicle Charging | √ | N/A | N/A | √ | √ |

USAA Roadside Assistance is a Coverage Option Worth Serious Consideration

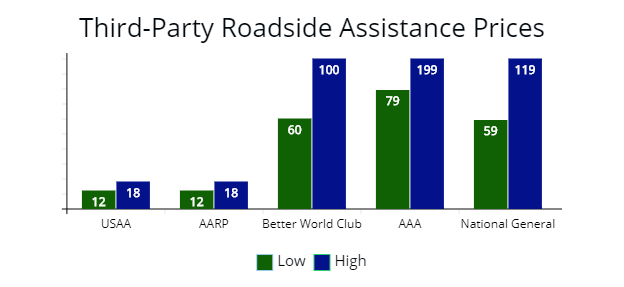

Note: Illustrated above are third-party roadside assistance plans compared to USAA. All of them offer great service particularly Better World Club, AAA, and National General Motor Club. However, the cost is substantially higher. AARP is competitive with USAA’s prices, but to qualify you have to be 50 years of age or older.

Note: Illustrated above are third-party roadside assistance plans compared to USAA. All of them offer great service particularly Better World Club, AAA, and National General Motor Club. However, the cost is substantially higher. AARP is competitive with USAA’s prices, but to qualify you have to be 50 years of age or older.

USAA roadside service coverage is an optional product that is automatically offered to any member of USAA who buys a car insurance policy.

If you are not offered the coverage or elect not to purchase this option USAA at the beginning of your policy period, you can always add the policy to your account at a later date.

It’s an option you should take some time to consider.

It’s referred to as the USAA Towing & Labor option and with all you have to do is call the USAA roadside assistance number and you will get the following benefits:

-

Emergency jumpstart service – if your battery fails, help can be just around the corner as USAA will dispatch a mechanic or other service provider who can give you an emergency boost and get you back on the road

-

Emergency fuel delivery – if you run out of gas or other vital fluids for your car, a mechanic or other service provider will be sent to you with enough of whatever fluid you need to get you to the next service station

-

Emergency lockout service – if you lock your car keys inside your vehicle, emergency locksmith services will be sent to open your or fashion a replacement key if yours is lost or damaged beyond use

-

Emergency tire service – if your tire goes flat or bursts while you are driving, a mechanic or appropriate service provider will come out and change or replace the tire

-

Emergency USAA towing service – if your car breaks down and needs to be towed, your USAA roadside assistance plan will pay to have it towed to the nearest repair shop with USAA towing services.

Accessing any of these services is easy.

Just call the USAA roadside assistance phone number on the back of your USAA car insurance towing and labor coverage card and a service/dispatch operator will assess your need and contact the appropriate service provider to come to your aid whether you need to file a totaled car claim or something else.

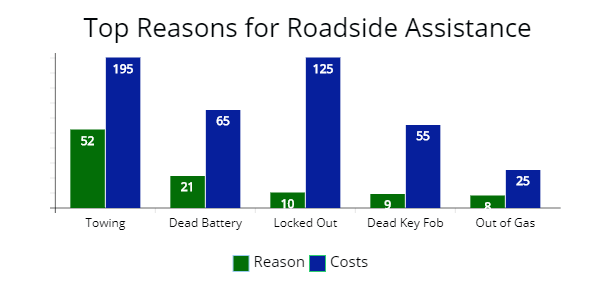

Note: The primary reason drivers get roadside assistance is for towing, dead battery, locked out, dead key fob, and running out of gas. Getting a flat tire is not one since most anyone can change the old tire with the spare and get to the auto shop if needed. I have include the typical costs associated with towing, dead battery, etc which is illustrated in blue.

Note: The primary reason drivers get roadside assistance is for towing, dead battery, locked out, dead key fob, and running out of gas. Getting a flat tire is not one since most anyone can change the old tire with the spare and get to the auto shop if needed. I have include the typical costs associated with towing, dead battery, etc which is illustrated in blue.

Compare the Cost of Other Programs to USAA Roadside Assistance

If you’ve considered roadside assistance coverage through an auto club or an association like AAA, you might want to compare what other clubs or insurers charge to what you will pay.

On average, drivers who are insured with USAA will pay between $12-$15 to add this option to an annual policy.

You won’t have to join an auto club or association where you may be charged annual or even monthly dues in addition to your car insurance premium.

When making cost comparisons, you should also consider what not having an option like towing and labor could cost you down the road.

When you consider that even a short tow can easily cost you in excess of $100, or what a mechanic might charge you and your family if you breakdown in a strange city, it seems quite reasonable to take advantage of USAA roadside service.

(Note: the intent of this article is informational only. The author has no affiliation with USAA or any other car insurance provider.)

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Feb 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.