Idaho Cheapest Car Insurance & Best Coverage Options

You can find the cheapest car insurance Idaho policies at American National, Auto-Owners, and State Farm. American National’s average quote for a minimum auto insurance policy is 45% cheaper than the Idaho average rate, though rates will vary by driver due to driving records, location, and more.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Nov 28, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Nov 28, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

- American National ($283/year) has the cheapest rate for Idaho minimum coverage

- Auto-Owners Insurance ($940/year) has the cheapest full coverage Idaho insurance

- Having a clean driving record will go a long way to reducing Idaho insurance rates

The cheapest car insurance Idaho policies can be found at companies like American National and Auto-Owners. Our guide goes over everything you need to know about the best auto insurance companies in Idaho and important Idaho insurance details, like what coverages you need to carry.

If you want to get started on shopping for affordable car insurance in Idaho today, enter your ZIP code in our free quote comparison tool.

Affordable Idaho Car Insurance Rates

Want to know how to get the right car insurance coverage at an affordable price? Idahoans can find the best coverage for drivers and save more on car insurance premiums by comparing quotes from multiple insurance providers. Our comparison study looked at both the most affordable rates, as well as the best rates.

| Cheapest Car Insurance in Idaho - Quick Hits |

|---|

The cheapest Idaho car insurance options are: The cheapest Idaho car insurance options are:Cheapest for minimum coverage: American National Cheapest for full coverage: Auto-Owners Cheapest after an at-fault accident: American Family Cheapest after a speeding ticket: American National Cheapest after a DUI: Progressive Cheapest for poor credit history: Auto-Owners Cheapest for young drivers: Geico For young drivers with a speeding violation: Geico For young drivers with an at-fault accident: American Family |

This Idaho car insurance guide is the best way to find affordable coverage and save money regardless of your age or driving type.

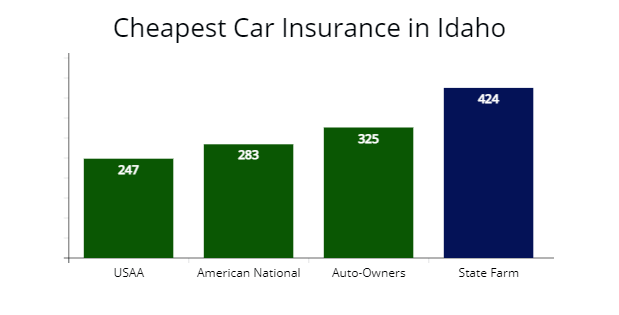

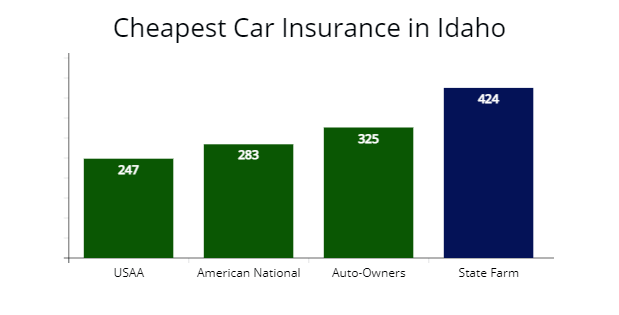

Cheapest Car Insurance in Idaho for Minimum Coverage

During our auto insurers analysis in Idaho, American National provided us a $283 per year or $23 per month rate for the cheapest minimum liability insurance for Idaho drivers with clean driving records. American National’s quote is 45% cheaper than the Idaho average of $512 per year.

| Company | Average annual rate |

|---|---|

| USAA | $247 |

| American National | $283 |

| Auto-Owners | $325 |

| Farmers | $368 |

| State Farm | $424 |

| Geico | $487 |

| Allstate | $510 |

| Travelers | $567 |

| American Family | $599 |

| Average in Idaho | $512 |

*USAA is for qualified military members, their spouses, and direct family members. Your insurance rates may vary based on driver profiles.

Military personnel or immediate family members of armed forces members can get cheaper car insurance rates with USAA. Insurance rates with USAA are $36 less expensive than American National and 52% less per year than the average cost of minimum coverage in Idaho.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Minimum liability coverage can ensure you stay legal and have the cheapest possible premium. Still, it may not provide you with all the coverage you need if you are involved in an accident.

Learn more: Auto Insurance Coverage Explained: Complete Guide to Policies and Terms

In the event of an at-fault car accident, state minimum policies will not cover property damage to your car. Our licensed agents recommend full coverage policies when shopping for Idaho auto insurance to avoid expensive repairs.

Cheapest Full Coverage Car Insurance in Idaho

Auto-Owners offers the cheapest car insurance rates for full coverage in Idaho drivers with clean driving records. Auto-Owners offered our sample driver a $940 annual rate or 28% less per year than Idaho’s average at $1,294 per year.

| Insurer | Cost per year | Cost per month |

|---|---|---|

| Auto-Owners | $940 | $78 |

| American National | $1,032 | $86 |

| USAA | $1,085 | $90 |

| Farmers | $1,347 | $112 |

| State Farm | $1,468 | $122 |

| Geico | $1,536 | $128 |

| Average in Idaho | $1,294 | $107 |

*USAA is for qualified military members, their spouses, and direct family members. Your insurance rates may vary based on driver profiles.

Full coverage policies offer a better coverage level of protection, which covers property damage to the other driver’s car and your car by adding collision and comprehensive coverage.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Collision coverage pays for damage to your motor vehicle in the event of an auto accident, and comprehensive insurance pays for inclement weather damage, such as from a storm or fallen tree branch or if you accidentally hit an animal.

Cheapest Car Insurance With a Speeding Ticket for Drivers in Idaho

AutoInsureSavings insurance agents found American National ($1,147 per year) offers the cheapest insurance coverage in Idaho for drivers who have one speeding violation on their driving record. American National’s quote is 28% less expensive or $444 less per year.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| American National | $1,147 | $95 |

| State Farm | $1,250 | $104 |

| Auto-Owners | $1,286 | $107 |

| Idaho average | $1,591 | $132 |

In Idaho, traffic tickets will increase your rates by $297 or 23%, but not as much as a driver with an at-fault accident (43%) or DUI violation (51%).

Cheapest Car Insurance With a Car Accident for Drivers in Idaho

We found American Family offers cheap auto insurance quotes to Idaho drivers with one at-fault accident on their driving records with a $1,687 annual rate ($140 per month) for our sample 30-year-old driver.

American Family’s rate is $560 less per year than Idaho’s average rate of $2,247 or 25% less expensive.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| American Family | $1,687 | $140 |

| State Farm | $1,814 | $151 |

| Auto-Owners | $1,961 | $163 |

| Idaho average | $2,247 | $187 |

We found insurance rates increase about 43% after a driver is involved in an at-fault accident in Idaho during our licensed agent’s analysis. Just one at-fault accident could cause your car insurance rate to go up as much as $953 per year.

Cheapest Car Insurance for People With a DUI in Idaho

With a drunk driving (DUI) violation, people in Idaho can find the cheapest car insurance with Progressive with a quote at $1,980 per year for full coverage or a $165 monthly rate for our sample driver. Progressive’s quote is 25% cheaper than Idaho’s DUI rate of $2,613 annually.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Progressive | $1,980 | $165 |

| Geico | $2,341 | $195 |

| Liberty Mutual | $2,594 | $216 |

| Idaho average | $2,613 | $217 |

According to the Idaho Department of Insurance, a DUI conviction in Idaho will cause your car insurance premiums to increase 51%. The DUI will remain on your driving record for three years, and the Idaho Transportation Department will report your conviction to your insurance company during that time.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

In most instances, your car insurance company will file an SR-22 form to the Idaho Department of Motor Vehicles (DMV). Most drivers with a DUI in Idaho will have a 45-day driver’s license suspension, and an Idaho Judge may require you to install an ignition interlock device (BAIID) on your motor vehicle for 90 days.

Cheapest Car Insurance for Drivers With Poor Credit in Idaho

AutoInsureSavings.org agents recommend Auto-Owners, which provides the cheapest insurance for Idaho drivers with poor credit history. Auto-Owners’ rate of $1,316 with comprehensive and collision insurance included is 31% less expensive than the average rate for 30-year-olds.

| Insurer | Annual Cost | Monthly Cost |

|---|---|---|

| Auto-Owners | $1,316 | $109 |

| Geico | $1,481 | $123 |

| State Farm | $1,651 | $137 |

| Idaho average | $1,890 | $157 |

Auto insurers in Idaho use your credit score when setting your auto insurance rate, plus a variety of other risk factors. Idaho drivers with bad credit pay 32% more for auto insurance per year ($596 annually) or $1,788 over three years than those with good credit.

Make sure to keep an eye on your credit report and credit score, any mistakes on your credit report may cause your auto insurance rates to increase.

Cheapest Car Insurance for Young Drivers in Idaho

Young Idaho drivers can find the cheapest full coverage auto insurance with Geico, which provided us a $3,745 annual rate or 22% less expensive than Idaho’s younger driver average rates.

Drivers under 25 who qualify can get affordable insurance coverage with USAA, which offered our agents an annual rate of $3,781 for full coverage and $1,088 for minimum coverage.

Geico also provides the cheapest minimum coverage rates for young or teen drivers at $1,131 per year or 24% lower than average Idaho rates.

The next best option for young Idahoans for state minimum is Allstate, at $1,462 per year.

| Insurer | Full coverage | Minimum coverage |

|---|---|---|

| Geico | $3,754 | $1,131 |

| USAA | $3,781 | $1,098 |

| Auto-Owners | $3,980 | $1,327 |

| American National | $4,127 | $1,561 |

| American Family | $4,256 | $1,984 |

| State Farm | $4,431 | $2,035 |

| Farmers | $5,047 | $2,326 |

| Allstate | $5,541 | $1,462 |

*USAA is for qualified military members, their spouses, and direct family members. Your insurance rates may vary based on your driver profile.

According to the Insurance Information Institute (III.org), your age correlates with safe driving habits. Statistically, the younger you are, the higher likelihood you will be in a car accident.

Auto insurers account for this risk factor by charging higher insurance rates for inexperienced drivers, according to the National Highway Traffic Safety Administration (NHTSA). As you gain more driving experience, your rates should decrease as you get older.

Cheapest Car Insurance for Younger Drivers with Speeding Tickets

Younger drivers who receive a ticket for speeding in Idaho can find the cheapest auto insurance quotes with Geico. The average insurance cost with Geico is $3,951 per year for full coverage or 29% less expensive than Idaho’s average speed violation rate for young drivers.

| Insurer | Cost per year | Cost per month |

|---|---|---|

| Geico | $3,951 | $329 |

| Auto-Owners | $4,343 | $361 |

| State Farm | $4,941 | $411 |

| Idaho average | $5,517 | $459 |

Cheapest Car Insurance for Young Drivers with an At-fault Accident

Inexperience Idaho drivers with a recent at-fault accident can find the best car insurance with American Family with a $4,371 quote for full coverage insurance.

American Family’s at-fault accident rate for young drivers is 27% cheaper than Idaho’s average rate of $5,967 per year.

| Insurer | Cost per year | Cost per month |

|---|---|---|

| American Family | $4,371 | $364 |

| Auto-Owners | $4,486 | $373 |

| Geico | $5,267 | $438 |

| Idaho average | $5,967 | $497 |

Best Auto Insurance Companies in Idaho

Based on customer service and claims satisfaction, Idaho’s best car insurance companies are Auto-Owners, USAA, and American Family.

If customer service is a priority, we recommended Auto-Owners as the best auto insurer in Idaho.

ValuePenguin conducted a recent customer survey, which had similar results.

| Company | % respondents extremely satisfied with recent claim | % respondents with customer service as excellent |

|---|---|---|

| Auto-Owners | 100% | 67% |

| USAA | 78% | 62% |

| American Family | 86% | 50% |

| State Farm | 73% | 46% |

| Allstate | 72% | 47% |

| Farmers | 71% | 38% |

| Geico | 64% | 42% |

| Farm Bureau Insurance | n/a | n/a |

Buying cheap insurance helps Idahoan’s insurance shoppers save money, but companies with poor customer service or claims handling sometimes are not worth the extra savings in your bank account.

Finding affordable auto insurance companies in Idaho that offers the cheapest premium can be good. Other things such as customer service rating, claims satisfaction, and driver discounts are good to consider when deciding.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

AutoInsureSavings licensed agents collected information on car insurance companies in Idaho from the National Association of Insurance Commissioners (NAIC), J.D. Powers, and A.M. Best’s financial strength ratings.

The insurance companies with the lowest NAIC complaint index ratio is Farmers (0.00), Farm Bureau Insurance of Idaho (0.26), and Auto-Owners (0.42). All three insurers have a complaint index ratio of less than one (1.00).

| Insurer | NAIC Complaint Index | J.D. Power Claims Satisfaction Score | AM Best Financial Strength Rating |

|---|---|---|---|

| Farmers | 0.00 | 872 | A |

| Farm Bureau | 0.26 | n/a | A- |

| Auto-Owners | 0.42 | 890 | A++ |

| American Family | 0.44 | 862 | A |

| Allstate | 0.63 | 876 | A+ |

| State Farm | 0.66 | 881 | A++ |

| USAA | 0.68 | 890 | A++ |

| Geico | 1.01 | 871 | A++ |

NAIC’s complaint ratio compares the numbers of complaints based on the market share of the car insurer. The national average is 1.00. Any auto insurance provider below 1.00 is better than the national average.

Auto-Owners ratio is 0.42 with a J.D. Power’s claims satisfaction score of 890 out of a possible score of 1,000 with “A++” financial strength ratings with AM Best.

American Family’s complaint ratio is only 0.44, scoring 842 with J.D. Powers auto claims process, and “A” financial strength rating with AM Best.

While comparing Idaho car insurance companies, several factors contribute to your insurance cost. Your driving history, type of vehicle, age, and even your credit rating can impact your total monthly or annual insurance premium.

It is always best to compare plans to find an Idaho auto insurance company with the cheapest rates with excellent customer service ratings.

Average Car Insurance Cost by City in Idaho

We collected insurance quotes from Idaho zip codes from top auto insurance companies, and found rates can vary by $313 by zip code and city. The least expensive auto policy is in Riggins ($1,114 per year), and the most expensive average auto policy is in Boise ($1,427 per year).

Your zip code is one of many risk factors auto insurers use to set your auto insurance rate. Other factors include your marital status, credit history, age, liability limits, and vehicle type.

Cheapest Car Insurance in Boise, ID

Drivers in Boise can find the best coverage rates with Auto-Owners, which provided us a quote at $971 annually for a full coverage insurance policy. Auto-Owners’ rate is 32% cheaper than Boise’s yearly insurance rate of $1,427 per year.

| Boise Company | Average Premium |

|---|---|

| Auto-Owners | $971 |

| American National | $1,055 |

| Farmers | $1,273 |

| Boise average | $1,427 |

Cheapest Car Insurance in Meridian, ID

AutoInsureSavings’ agents found Farmers is the cheapest insurance company for people in Meridian. They provided us a $1,160 annual rate for full coverage, 16% less expensive than Meridian’s yearly average rate of $1,375.

| Meridian Company | Average Premium |

|---|---|

| Farmers | $1,160 |

| American National | $1,201 |

| State Farm | $1,366 |

| Meridian average | $1,375 |

Cheapest Car Insurance in Nampa, ID

Nampa drivers can find the best full coverage insurance policy with State Farm, which provided us a $1,271 annual rate per year of $105 per month. State Farm’s insurance quote is 10% cheaper than average rates for 30-year-old drivers in Nampa.

| Nampa Company | Average Premium |

|---|---|

| State Farm | $1,271 |

| Auto-Owners | $1,290 |

| Geico | $1,363 |

| Nampa average | $1,399 |

Cheapest Car Insurance in Idaho Falls, ID

Through research, we found the cheapest auto insurance in Idaho Falls is Auto-Owners with an $85 monthly rate or $1,022 per year, while State Farm offers a $1,314 quote, and Liberty Mutual offers a $1,381 rate per year.

| Idaho Falls Company | Average Premium |

|---|---|

| Auto-Owners | $1,022 |

| State Farm | $1,314 |

| Liberty Mutual | $1,381 |

| Idaho Falls average | $1,376 |

Cheapest Car Insurance in Pocatello, ID

Pocatello drivers can find the cheapest auto insurance with Geico, which provided our agents a $1,277 average rate per year for our 30-year-old driver. Geico’s quote is 10% less expensive than Pocatello’s average rates.

| Pocatello Company | Average Premium |

|---|---|

| Geico | $1,277 |

| Auto-Owners | $1,319 |

| State Farm | $1,389 |

| Pocatello average | $1,410 |

Cheapest Car Insurance in Caldwell, ID

Drivers in Caldwell looking for cheaper car insurance rates should get quotes from Auto-Owners, which offered our agents a $1,013 annual rate for full coverage. Auto-Owners’ rate is 28% less expensive than Caldwell’s average rates of $1,393 per year.

| Caldwell Company | Average Premium |

|---|---|

| Auto-Owners | $1,013 |

| Geico | $1,271 |

| State Farm | $1,311 |

| Caldwell average | $1,393 |

Average Car Insurance Costs for All Cities in Idaho

| City | Annual Premium Cost | City | Annual Premium Cost |

|---|---|---|---|

| Boise | $1,427 | Athol | $1,239 |

| Meridian | $1,375 | Moyie Springs | $1,270 |

| Nampa | $1,399 | Dover | $1,214 |

| Idaho Falls | $1,376 | Hauser | $1,239 |

| Pocatello | $1,410 | Teton | $1,363 |

| Caldwell | $1,393 | Horseshoe Bend | $1,337 |

| Coeur d'Alene | $1,388 | Mullan | $1,239 |

| Twin Falls | $1,214 | Kooskia | $1,269 |

| Post Falls | $1,339 | Ririe | $1,374 |

| Lewiston | $1,226 | Downey | $1,271 |

| Rexburg | $1,317 | Notus | $1,401 |

| Eagle | $1,247 | Carey | $1,269 |

| Moscow | $1,273 | Hayden Lake | $1,198 |

| Kuna | $1,342 | Smelterville | $1,214 |

| Ammon | $1,329 | Dubois | $1,226 |

| Chubbuck | $1,239 | Juliaetta | $1,199 |

| Hayden | $1,216 | Roberts | $1,337 |

| Mountain Home | $1,374 | Clark Fork | $1,266 |

| Blackfoot | $1,158 | Melba | $1,214 |

| Garden City | $1,322 | Deary | $1,273 |

| Jerome | $1,400 | Paris | $1,247 |

| Burley | $1,226 | New Meadows | $1,344 |

| Star | $1,266 | Craigmont | $1,401 |

| Sandpoint | $1,341 | Georgetown | $1,239 |

| Hailey | $1,214 | Lewisville | $1,311 |

| Rathdrum | $1,247 | Mackay | $1,266 |

| Middleton | $1,345 | Richfield | $1,206 |

| Payette | $1,273 | Pierce | $1,374 |

| Emmett | $1,411 | Firth | $1,214 |

| Rupert | $1,270 | Dayton | $1,401 |

| Preston | $1,147 | Nezperce | $1,239 |

| Weiser | $1,206 | Weston | $1,226 |

| Fruitland | $1,300 | Grand View | $1,247 |

| Shelley | $1,214 | Idaho City | $1,138 |

| Buhl | $1,370 | Weippe | $1,266 |

| American Falls | $1,311 | Lava Hot Springs | $1,205 |

| Rigby | $1,401 | Eden | $1,337 |

| Kimberly | $1,239 | Riggins | $1,114 |

| St. Anthony | $1,247 | Fairfield | $1,214 |

| Gooding | $1,226 | Basalt | $1,266 |

| McCall | $1,140 | Mud Lake | $1,311 |

| Heyburn | $1,257 | Culdesac | $1,143 |

| Grangeville | $1,403 | Bancroft | $1,206 |

| Salmon | $1,214 | Winchester | $1,247 |

| Soda Springs | $1,200 | Arimo | $1,370 |

| Orofino | $1,311 | Declo | $1,226 |

| Filer | $1,173 | Dietrich | $1,401 |

| Ketchum | $1,337 | Cambridge | $1,239 |

| Wendell | $1,206 | Newdale | $1,214 |

| Homedale | $1,150 | Kendrick | $1,273 |

| Bonners Ferry | $1,226 | Bliss | $1,257 |

| Montpelier | $1,247 | Parker | $1,311 |

| St. Maries | $1,156 | Clifton | $1,140 |

| Dalton Gardens | $1,401 | Hollister | $1,382 |

| Bellevue | $1,239 | Rockland | $1,104 |

| Spirit Lake | $1,273 | Tetonia | $1,226 |

| Iona | $1,370 | Albion | $1,247 |

| Victor | $1,214 | Island Park | $1,206 |

| Malad City | $1,257 | Worley | $1,178 |

| Parma | $1,337 | Bovill | $1,239 |

| Kellogg | $1,117 | Irwin | $1,257 |

| Aberdeen | $1,311 | Castleford | $1,401 |

| Priest River | $1,133 | Stites | $1,214 |

| Driggs | $1,401 | Swan Valley | $1,239 |

| Wilder | $1,247 | East Hope | $1,273 |

| Pinehurst | $1,206 | Harrison | $1,214 |

| Osburn | $1,226 | Bloomington | $1,370 |

| New Plymouth | $1,411 | Malta | $1,311 |

| Shoshone | $1,154 | Peck | $1,206 |

| Sun Valley | $1,339 | Oldtown | $1,158 |

| Sugar City | $1,273 | Onaway | $1,361 |

| Paul | $1,239 | Wardner | $1,381 |

| Marsing | $1,370 | Fernan Lake Village | $1,247 |

| Kamiah | $1,257 | Crouch | $1,233 |

| Hansen | $1,206 | Moore | $1,109 |

| Glenns Ferry | $1,247 | Ferdinand | $1,226 |

| Ucon | $1,403 | Murtaugh | $1,273 |

| Lapwai | $1,233 | Midvale | $1,370 |

| Ponderay | $1,311 | Donnelly | $1,257 |

| Ashton | $1,214 | St. Charles | $1,233 |

| Challis | $1,337 | Acequia | $1,247 |

| Plummer | $1,402 | Elk River | $1,408 |

| Cascade | $1,370 | Tensed | $1,405 |

| Genesee | $1,226 | Minidoka | $1,214 |

| Cottonwood | $1,380 | Huetter | $1,233 |

| Grace | $1,254 | Leadore | $1,206 |

| Troy | $1,273 | Hamer | $1,366 |

| Inkom | $1,247 | Hope | $1,254 |

| Arco | $1,214 | White Bird | $1,296 |

| Greenleaf | $1,226 | Stanley | $1,247 |

| Hagerman | $1,233 | Butte City | $1,353 |

| Council | $1,388 | Reubens | $1,214 |

| Kootenai | $1,337 | Placerville | $1,353 |

| McCammon | $1,206 | Oxford | $1,273 |

| Franklin | $1,233 | State Line | $1,379 |

| Potlatch | $1,254 | Spencer | $1,214 |

| Hazelton | $1,296 | Atomic City | $1,325 |

| Oakley | $1,254 | Drummond | $1,226 |

| Menan | $1,353 | Clayton | $1,206 |

| Wallace | $1,214 | Warm River | $1,233 |

Minimum Car Insurance Requirements in Iowa

According to the Idaho Department of Insurance (doi.idaho.gov), all auto insurance policies sold to Idahoans must have the minimum liability limits.

| Liability | Minimum coverage |

|---|---|

| Bodily injury liability | $25,000 per person and $50,000 per accident |

| Property damage liability | $15,000 per accident |

Bodily injury liability coverage covers injuries sustained in a car accident up to $25,000 per person of bodily injury and $50,000 per accident. Property damage liability insurance pays for repairs to personal property up to $15,000 per accident.

We recommend adding uninsured motorist coverage to your auto insurance policy since the uninsured motorist rate is 8.2%, according to the Insurance Information Institute (III.org).

Frequently Asked Questions

Who has the Cheapest Car Insurance Coverage in Idaho?

American National offers the cheapest minimum coverage in Idaho, with average rates of $248 per year. The average annual premium for minimum coverage is $512, and American National’s premium costs 52% less per year.

How Much Is Car Insurance For Drivers in Idaho per Month?

The average cost for car insurance per month in Idaho is $107 or $1,294 per year for full coverage. The average price of a minimum coverage car insurance policy per month is $42 or $512 per year. Auto-Owners’ full coverage average rate is $940 per year or 28% less expensive, while American National offers state minimum policies in Idaho at $283 or 45% cheaper.

How Much Is Full Coverage Car Insurance in Idaho?

The average cost of full coverage car insurance in Idaho is $1,294 annually or $107 per month. Auto-Owners’ average rate for full coverage is $940 a year or $78 per month. American National ($1,032) and USAA ($1,085) are also below the state’s average.

How Much Will my Car Insurance Rise With a Speeding Ticket in Idaho?

You can expect your car insurance rates to increase by 23% or $297 per year after a ticket in Idaho. Most drivers pay around $1,591 annually or $132 monthly for full coverage once they have a traffic ticket on their driving records. The amount it goes up depends on the car insurance company and several other risk factors.

How do I Save on Car Insurance in Idaho?

There are many ways for drivers in Idaho to save on their car insurance premiums. You can determine if you are eligible for a money-saving driver discount offered by the auto insurance company. Many insurance providers will lower your overall rates if you have multi-policies with them, such as life or home insurance.

Another way to save on your car insurance premium is to practice good driving habits and keep a clean driving record. That will not only keep you and your passengers safe but will also help you avoid auto accidents or traffic violations that could cause your premium to increase.

To learn more about the most affordable car insurance options for drivers in Idaho, contact the experts at AutoInsureSavings.org. Our licensed insurance professionals will be happy to answer any questions you have.

Methodology

AutoInsureSavings.org comparison shopping insurance study used a full-coverage auto policy for a 30-year-old driving a 2018 Honda Accord with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person / $100,000 per accident |

| Property damage liability | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured / underinsured motorist bodily injury | $50,000 per person / $100,000 per accident |

| Comprehensive and collision coverage | $500 deductible |

We used insurance rates for drivers with an accident history, credit score, and marital status for other Idaho rate analyses. We used car insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your insurance rates may vary when you get personalized quotes.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tim Bain

Licensed Insurance Agent

Tim Bain is a licensed insurance agent with 23 years of experience helping people protect their families and businesses with the best insurance coverage to meet their needs. His insurance expertise has been featured in several publications, including Investopedia and eFinancial. He also does digital marking and analysis for KPS/3, a communications and marking firm located in Nevada.

Licensed Insurance Agent

UPDATED: Nov 28, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.