Auto Insurance Rates By State; Least & Most Expensive to Insure

Most think it’s quite unfair for a driver to pay twice the amount for a car insurance premium in one state versus another.

While most people know your age and driving history determines how much you pay for car insurance.

Another chief factor is the state you reside in.

According to the National Association of Insurance Commissioners, average car insurance costs vary by state based on regulations, while car insurers give you a price quote based on those differences.

And one state may have higher instances of claims history and higher minimum coverage requirement levels while another doesn’t.

- Car Insurance Rates Near You

Note: States at the top of the graph have an average car insurance rate of $2,000+ for a full coverage type of policy. The bottom states have an average policy price of $1,000. If you live in Michigan, Louisiana, or Florida, you will pay more than double for auto insurance costs than in Maine, Iowa, or Ohio.

Note: States at the top of the graph have an average car insurance rate of $2,000+ for a full coverage type of policy. The bottom states have an average policy price of $1,000. If you live in Michigan, Louisiana, or Florida, you will pay more than double for auto insurance costs than in Maine, Iowa, or Ohio.

This, too, will affect how much you will pay for car insurance costs.

Below we have laid out the average policy by state according to Business Insider.

Read on, so you have an idea of what you will pay for an auto insurance policy in the area of the country you reside for the best financial protection.

And to reduce your annual expenses, increase financial literacy, which can have a major impact on your premium price year after year.

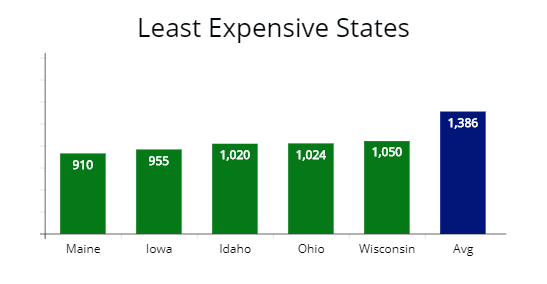

Which States Have The Least Expensive Car Insurance?

The states with the lowest car insurance rate are Maine, Iowa, Idaho, and Ohio.

Year over year premiums for each state is going up.

However, each of the 4 states has an average annual premium of around $950.

Which is nearly 35% lower than a nationwide average of nearly $1,400.

Below is a list of the least expensive states:

| Cheapest States | Total Premium | Liability | Collision | Comprehensive |

|---|---|---|---|---|

| Maine | $910 | $569 | $206 | $135 |

| Iowa | $955 | $580 | $230 | $145 |

| Idaho | $1,020 | $596 | $274 | $150 |

| Ohio | $1,024 | $603 | $269 | $152 |

| Wisconsin | $1,050 | $628 | $262 | $160 |

| Vermont | $1,065 | $638 | $262 | $165 |

| Virginia | $1,121 | $687 | $265 | $169 |

| North Carolina | $1,158 | $700 | $272 | $186 |

| Hawaii | $1,265 | $735 | $334 | $196 |

| New Hampshire | $1,348 | $789 | $358 | $201 |

Maine

The average annual rate for Maine is $910.

One of the primary reasons is that Maine has a low number of uninsured drivers and a low number of underinsured drivers.

Further, there is less population density, less congestion, and fewer likelihood drivers will file claims.

If you have a good driving record and live in Maine, you will pay less for a premium than other drivers throughout the U.S.

Below are national and regional insurers offering annual rates for drivers at 30 and 45-years old.

| Company | 30 Year Old | 45 Year Old |

|---|---|---|

| Patriot | $1,188 | $723 |

| Progressive | $1,243 | $764 |

| Vermont Mutual | $1,265 | $801 |

Iowa

Drivers in Iowa will pay approximately 30% less for car insurance than the average national premium.

Iowa motorists with a good driving history can pay $955 per year for common minimum coverage levels.

The biggest contributing factor for low premiums in Iowa is the large rural to urban ratio.

If you have fewer drivers driving on congested roads at the end of the day, you have fewer accidents.

And you will have fewer motorists filing claims, which means lower premiums.

| Company | 30 Year Old | 45 Year Old |

|---|---|---|

| Western National | $1,188 | $732 |

| Progressive | $1,217 | $770 |

| Hastings Mutual | $1,243 | $824 |

Idaho

Idaho’s average premium is approximately $1,020 per year.

Or nearly 28% lower than the national average.

Idaho benefits from low premiums since the uninsured motorist rate is only 8%.

And, according to research, a large percentage of drivers in Idaho are 55 and up.

In the largest city, Boise, an affordable car insurance premium will be slightly higher.

On the other hand, Boise drivers have shorter commutes, which means they drive less, which means lower premiums.

Below are quotes for drivers residing in Boise.

| Company | 30 Year Old | 45 Year Old |

|---|---|---|

| American National | $1,231 | $754 |

| Progressive | $1,268 | $798 |

| State Farm | $1,299 | $802 |

| Mutual Enumclaw | $1,312 | $821 |

Ohio

Ohio’s average premium is $1,024 and unusually low compared to the rest of the U.S.

One of the biggest factors in Ohio’s tort-based insurance score system.

A tort system is the opposite of a no-fault state where one driver is found at fault, and their insurer pays the medical fees.

Essentially there is a lack of a safety net.

And because of this, the car insurance rate is lower in Ohio.

According to The Ohio Department of Insurance, they focus on protecting the consumers.

Below are annual rates for drivers with a clean record:

| Company | 30 Year Old | 45 Year Old |

|---|---|---|

| Erie | $1,188 | $711 |

| The Cincinnati | $1,265 | $746 |

| Westfield | $1,349 | $789 |

| State Farm | $1,358 | $800 |

Wisconsin

A Wisconsin annual rate is lower than average, with a premium of $1,050.

The rural areas of Wisconsin bring down rates for drivers with insurer’s competition.

Note: States with the least expensive policies cluster at or near $1,000. Or over 30% lower than the national average premium price of $1,386.

Note: States with the least expensive policies cluster at or near $1,000. Or over 30% lower than the national average premium price of $1,386.

While cities such as Milwaukee see an increase in premiums.

Only liability insurance is required with uninsured motorist protection.

If you reside in the rural areas of the state, you will pay low premiums.

And if you live in or near big cities, such as Milwaukee, you’ll get much higher premiums.

Below are car insurance quotes from local and national insurers in Wisconsin.

| Company | 30 Year Old | 45 Year Old |

|---|---|---|

| Progressive | $1,012 | $689 |

| Partners Mutual | $1,089 | $715 |

| Pekin | $1,165 | $765 |

For illustrative purposes, here are quotes for a 30 and 45-year-old driver profile in Milwaukee:

| Company | 30 Year Old | 45 Year Old |

|---|---|---|

| Progressive | $1,365 | $845 |

| Partners Mutual | $1,450 | $923 |

| Pekin | $1,523 | $1,004 |

The difference between urban is the rural areas of Wisconsin are approximately 30%.

There will be different prices based on the insurance profile, such as; men or women, a previous driving violation, a policy discount, homeowner, or members in your family that drive.

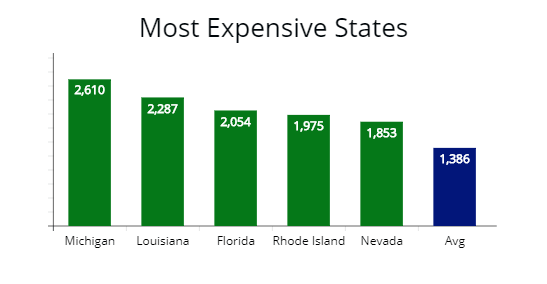

Which States Have The Highest Car Insurance?

The states with the highest rates are Michigan, Louisiana, Florida, and Rhode Island.

Michigan is a no-fault state, which means each driver can recover damages or injuries via their own insurer.

Louisiana has a high number of uninsured drivers and the tendency to get damage from floods and hurricanes.

Florida is expensive since there are more than 20% of drivers drive uninsured.

Below is a table with the median car insurance rate and the breakdown of common coverage levels.

| Expensive States | Total Premium | Liability | Collision | Comprehensive |

|---|---|---|---|---|

| Michigan | $2,610 | $1,787 | $558 | $265 |

| Louisiana | $2,287 | $1,479 | $548 | $260 |

| Florida | $2,054 | $1,296 | $518 | $240 |

| Rhode Island | $1,975 | $1,211 | $556 | $208 |

| Nevada | $1,853 | $1,094 | $547 | $212 |

| Kentucky | $1,811 | $1,090 | $521 | $200 |

| Texas | $1,765 | $1,054 | $512 | $199 |

| New York | $1,690 | $1,002 | $495 | $193 |

| Delaware | $1,672 | $1,053 | $429 | $190 |

| California | $1,648 | $985 | $467 | $196 |

Michigan

Michigan has the highest premiums in the nation, with an average price of over $2,600 per year, even with a competitive market.

Depending on where you live, your premium can vary drastically in Michigan.

According to Benzinga, the average insurance in Detroit is nearly $500 per month, while in Marquette, the average monthly premium is $130.

The primary driver for Michigan’s high premiums is the no-fault status.

This means each motorist can recover losses from their own insurer no matter who is at fault.

Plus, each motorist is required to have personal injury protection or PIP.

Note: Illustrated above are the most expensive states to buy any policy with an average a $2,000+ annual cost from an auto insurance carrier. Compared to the national average premium of $1,386, Nevada is 50% more, and Michigan is nearly double or 100% higher.

Note: Illustrated above are the most expensive states to buy any policy with an average a $2,000+ annual cost from an auto insurance carrier. Compared to the national average premium of $1,386, Nevada is 50% more, and Michigan is nearly double or 100% higher.

Statistically, drivers in rural areas pay far less, while drivers in urban cities, such as Detroit, pay exorbitantly high for a car insurance policy.

Below are quotes for 30 and 45-year-old motorists:

| Provider | 30 Year Old | 45 Year Old |

|---|---|---|

| MetLife | $2,890 | $1,879 |

| Hastings Mutual | $3,045 | $1,963 |

| Chubb | $3,169 | $2,148 |

Louisiana

The average premium in Louisiana is $2,287, which is almost double the national average.

There are a high number of uninsured motorists amounting to almost 20%.

In turn, this drives up premiums for legal drivers.

According to Nola.com, 40% of Louisiana drivers carry minimum liability coverage or only property damage liability and bodily injury liability.

Another factor driving up premiums is the tendency and conditions for hurricanes and floods in the region.

Below are sample quotes from the cheapest car insurers in Louisiana:

| Provider | 30 Year Old | 45 Year Old |

|---|---|---|

| Southern Farm Bureau | $1,900 | $1,123 |

| State Farm | $1,986 | $1,184 |

| Progressive | $2,098 | $1,239 |

| State Auto | $2,251 | $1,452 |

Florida

Florida is another state with an uninsured motorist coverage issue.

According to Autolist, 25% of drivers in Florida drive uninsured.

Depending on where you live, the Sunshine State is congested in many regions.

In Miami and Coral Gables, you will pay $220 per month for a premium, while in Bonifay, a premium is only $60 per month.

If you live in urban areas, your premium can be nearly three times the annual cost in Florida’s rural areas.

Another factor driving up premiums is the extreme weather conditions from hurricanes and flooding.

In the table below are sample quotes of the least expensive insurers in Florida:

| Company | 30 Year Old | 45 Year Old |

|---|---|---|

| Florida Farm Bureau | $1,840 | $1,068 |

| USAA* | $1,985 | $1,154 |

| Travelers | $2,125 | $1,312 |

*USAA is reserved for military members, their spouses, and families.

Rhode Island

Rhode Island is ranked #4 in the nation when it comes to expensive car insurance premiums.

The main thing in Rhode Island’s rising insurance costs is the high number of claims.

Also, there are “body shop” laws passed, which are increasing the cost of premiums.

Listed below are sample quotes from insurers:

| Company | 30 Year Old | 45 Year Old |

|---|---|---|

| USAA | $1,724 | $935 |

| State Farm | $1,800 | $944 |

| Travelers | $1,869 | $1,054 |

| Liberty Mutual | $1,978 | $1,150 |

Premiums in Rhode Island are increasing by 8% per year.

Nevada

Nevada has exorbitantly high premiums, with an average cost of $1,853.

According to studies, the reason is the high amount of luxury vehicles, sports cars, and claim frequency.

Another factor is the cost of settlements.

Attorney’s litigate in Nevada and get high settlements; this, in turn, increases premiums.

And if you live in or near Las Vegas, expect your average premium to skyrocket to $2,300 per year.

Below are rates for motorists from the least expensive insurers in Nevada:

| Company | 30 Year Old | 45 Year Old |

|---|---|---|

| Allied | $1,456 | $989 |

| Progressive | $1,590 | $1,080 |

| Capital | $1,625 | $1,158 |

And if you live in Las Vegas, expect to pay over 30% more for your car insurance rates.

As per the quotes below:

| Company | 30 Year Old | 45 Year Old |

|---|---|---|

| Allied | $1,800 | $1,255 |

| Progressive | $1,965 | $1,312 |

| Capital | $2,053 | $1,387 |

Average Cost of Car Insurance

The average cost of an auto insurance premium in the U.S. is approximately $1,400 per year, according to NerdWallet.com.

The table below includes all states with the average cost for a driver profile with a clean driving history.

A primary factor for insurers to decide your rate is your location.

As you may have read, a premium in Michigan is nearly double the average price of $1,400 in the U.S.

Below you find each state from the most to least expensive:

| State | Average Premium | State | Average Premium |

|---|---|---|---|

| Michigan | $2,610 | Oregon | $1,501 |

| Louisiana | $2,287 | New Mexico | $1,487 |

| Florida | $2,054 | Kansas | $1,480 |

| Rhode Island | $1,975 | West Virginia | $1,476 |

| Nevada | $1,853 | Wyoming | $1,476 |

| Kentucky | $1,811 | Alabama | $1,463 |

| Texas | $1,765 | Nebraska | $1,459 |

| New York | $1,690 | Pennsylvania | $1,450 |

| Delaware | $1,672 | South Carolina | $1,441 |

| California | $1,648 | North Dakota | $1,430 |

| Colorado | $1,620 | Massachusetts | $1,411 |

| New Jersey | $1,618 | Tennessee | $1,402 |

| Arizona | $1,600 | Washington | $1,379 |

| Oklahoma | $1,586 | Alaska | $1,351 |

| Connecticut | $1,570 | Indiana | $1,349 |

| Georgia | $1,550 | New Hampshire | $1,348 |

| Missouri | $1,543 | Hawaii | $1,265 |

| Utah | $1,540 | North Carolina | $1,158 |

| Montana | $1,540 | Virginia | $1,121 |

| Maryland | $1,539 | Vermont | $1,065 |

| South Dakota | $1,530 | Wisconsin | $1,050 |

| Illinois | $1,519 | Ohio | $1,024 |

| Minnesota | $1,511 | Idaho | $1,020 |

| Arkansas | $1,509 | Iowa | $955 |

| Mississippi | $1,508 | Maine | $910 |

Your rate will be decided by many other factors, such as your age and automobile type you drive.

If you want cheap auto insurance rates, it is important to take advantage of factors insurers use to lower your overall premium.

Vehicle Type

Though you may live in an expensive or cheaper state, the type of car you drive can substantially impact your annual auto insurance premium, according to the Insurance Information Institute.

For example, if you live in Michigan, the cost to insure a Honda Civic is $3,094, while a BMW 640i cost over $4,100.

Below are sample quotes of each vehicle for and rates for drivers in Michigan:

| Honda Civic EX | BMW 640i | GMC Yukon | |

|---|---|---|---|

| 30 Year Old | $3,046 | $4,180 | $2,674 |

| 45 Year Old | $2,278 | $3,287 | $1,895 |

As you can see, if you switch from driving a BMW to Chevy Yukon or Honda, you can save over $1,500 per year in Michigan.

Let’s take a look at Maine, the lowest state.

If we use the exact vehicle, the premium drops substantially.

However, the difference in price among cars isn’t as significant either.

Take a look at the sample quotes below:

| Honda Civic EX | BMW 640i | GMC Yukon | |

|---|---|---|---|

| 30 Year Old | $954 | $1,596 | $1,111 |

| 45 Year Old | $629 | $952 | $703 |

In Maine, you have more financial freedom to drive the car you want.

In Michigan, unless you are wealthy, you will choose an automobile based on its features plus the cost to insure it.

Coverage by State

Of course, you want to get a premium, which is lower than the average price.

On the other hand, the insurer you choose to get any policy will determine how much you pay for car insurance coverage in each state.

Below we have itemized the least expensive insurance companies by state.

The auto insurers listed are ones we found offering coverage lower than the average premium.

Your premium is going to be determined by many factors.

| State | First Cheapest | Premium | Second Cheapest | Premium |

|---|---|---|---|---|

| Alabama | ALFA | $1,345 | Allstate | $1,484 |

| Alaska | Umialik | $1,200 | Nationwide | $1,324 |

| Arkansas | Columbia | $1,348 | Southern Farm Bureau | $1,420 |

| Arizona | Ameriprise | $1,154 | Progressive | $1,188 |

| California | Geico | $1,535 | Unitrin | $1,630 |

| Colorado | Colorado Farm Bureau | $1,588 | Grange | $1,670 |

| Connecticut | Unitrin | $1,490 | Middlesex | $1,558 |

| Delaware | Geico | $1,597 | Grange | $1,632 |

| Florida | Farm Bureau | $1,876 | 21st Century | $1,932 |

| Georgia | Country Financial | $1,732 | Allstate | $1,793 |

| Hawaii | Progressive | $1,080 | Allstate | $1,130 |

| Idaho | Grange | $890 | Geico | $915 |

| Illinois | Erie | $1,388 | The Cincinnati | $1,432 |

| Indiana | Erie | $1,344 | The Cincinnati | $1,400 |

| Iowa | Pekin | $811 | Progressive | $840 |

| Kansas | Geico | $1,257 | Farm Bureau | $1,326 |

| Kentucky | The Cincinnati | $1,634 | Kentucky Farm Bureau | $1,688 |

| Louisiana | Southern Farm Bureau | $1,980 | Allstate | $2,087 |

| Maine | Patriot | $800 | Vermont Mutual | $823 |

| Maryland | Erie | $1,328 | Penn National | $1,452 |

| Massachusetts | Plymouth Rock | $1,390 | Geico | $1,455 |

| Michigan | Chubb | $2,455 | Hastings Mutual | $2,530 |

| Minnesota | Farm Bureau Mutual | $1,410 | Western National | $1,532 |

| Mississippi | ALFA | $1,376 | Unitrin | $1,380 |

| Missouri | Farmers | $1,390 | Auto-Owners | $1,425 |

| Montana | Progressive | $1,210 | Esurance | $1,245 |

| Nebraska | American Family | $1,029 | Geico | $1,086 |

| Nevada | Allied | $1,788 | Oregon Mutual | $1,790 |

| New Hampshire | Commerce | $1,056 | Nationwide | $1,095 |

| New Jersey | Penn National | $1,467 | NJM | $1,487 |

| New Mexico | Geico | $1,235 | Allied | $1,362 |

| New York | Erie | $1,550 | Geico | $1,575 |

| North Carolina | Nationwide | $980 | Geico | $1,010 |

| North Dakota | Allied | $1,231 | North Star | $1,276 |

| Ohio | Erie | $893 | Grange | $915 |

| Oklahoma | Oklahoma Farm Bureau | $1,400 | Shelter | $1,455 |

| Oregon | Grange | $1,277 | Esurance | $1,344 |

| Pennsylvania | NJM | $1,299 | Erie | $1,342 |

| Rhode Island | Esurance | $1,655 | Grange | $1,700 |

| South Carolina | Southern Farm Bureau | $1,233 | Nationwide | $1,276 |

| South Dakota | Unitrin | $1,365 | Farmers | $1,414 |

| Tennessee | Erie | $1,203 | Utica National | $1,259 |

| Texas | Texas Farm Bureau | $1,555 | Esurance | $1,598 |

| Utah | Allstate | $1,376 | Geico | $1,425 |

| Vermont | Geico | $890 | Concord | $899 |

| Virginia | Chubb | $914 | Nationwide | $955 |

| Washington | Capital | $1,125 | Grange | $1,187 |

| West Virginia | Pekin | $1,076 | Western National | $1,122 |

| Wisconsin | Erie | $987 | Esurance | $1,058 |

| Wyoming | Progressive | $1,122 | Allstate | $1,189 |

The type and coverage limits will influence your premium.

For example, the difference between full coverage (comprehensive insurance and collision) and minimum property damage liability and bodily injury liability will be significant.

Many states require you to have personal injury protection or PIP coverage amounts and medical payments.

This, too, will influence your final premium.

Further below, we will explain personal injury protection and medical payments, common coverage levels.

Personal Injury Protection (PIP)

Personal injury protection, sometimes called PIP, is the portion of your policy that provides medical expenses and work-loss coverage for you and your passengers in the event of a vehicle accident.

PIP covers you no matter who is at fault.

Here are items PIP will cover:

- Medical bills

- Surgical fees

- Lost wages

- Rehabilitation fees

And if you live in any states below, you will be required to carry PIP along with liability:

| State | PIP Coverage |

|---|---|

| Florida | $10,000 |

| Hawaii | $10,000 |

| Kansas | Varies |

| Kentucky | $10,000 |

| Massachusetts | $8,000 |

| Michigan | Unlimited |

| Minnesota | $40,000 |

| New Jersey | $15,000 |

| New York | $50,000 |

| North Dakota | $30,000 |

| Pennsylvania | $5,000 |

| Utah | $3,000 |

As you can see, many expensive states to insure a vehicle are on the list.

Since you must carry PIP in the listed states, your overall car insurance premium will be higher than average.

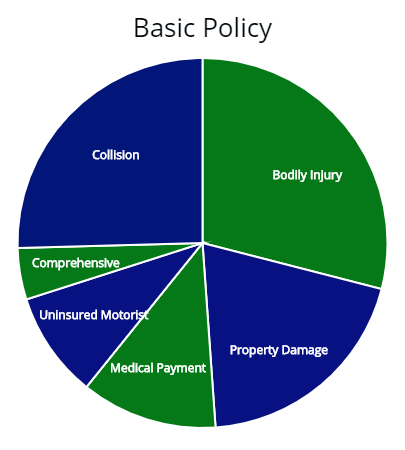

Note: Illustrated above is a breakdown of a policy. The area we are referencing too is the “medical payment” part of the policy. Some states require you have medical payment (MedPay) or personal injury protection (PIP). If you are required by your state to carry either coverage, it makes up a significant portion of your policy. And, in turn, raising your car insurance premium.

Note: Illustrated above is a breakdown of a policy. The area we are referencing too is the “medical payment” part of the policy. Some states require you have medical payment (MedPay) or personal injury protection (PIP). If you are required by your state to carry either coverage, it makes up a significant portion of your policy. And, in turn, raising your car insurance premium.

Next, we will explain medical payments coverage and the slight difference from PIP.

Medical Payments Coverage

Medical payments coverage, sometimes called MedPay, is intended to cover medical costs in the event of an accident, no matter who is at fault.

Normally, your health insurance will pay for the necessary medical benefits and expenses.

MedPay will “fill in the gaps” for cases where there are low limits or high deductibles.

The difference between MedPay and PIP is Personal Injury Protection takes it a step further and covers lost wages where MedPay doesn’t.

MedPay coverage is required in the following states:

- Pennsylvania

- Maine

- New Hampshire

Medical payments cost less than PIP for the same protection.

To get $10,000 in medical payments coverage, you will pay from $4 to approximately $24 per month.

For example, in Maine, the minimum medical payments are $2,000, which will cost $8 a month or thereabouts.

PIP normally has higher required limits and will cost more.

In Florida, PIP is 10 to $15 a month, depending on the deductible.

Frequently Asked Questions

Do I need to compare quotes if I move out of state?

Short answer – yes. Where you live is going to be a big factor insurers use to determine your premium. As part of your financial planning, if you are moving out of state, you want to compare quotes with local, regional, and national insurers in the area you plan to move.

Even if you are making a local move, it is always a good idea to comparison shop with your current insurance provider and others to find the best rate.

Why is my premium higher than my state’s average?

You could have a poor driving history, low credit score, history of claims, a lapse in coverage, expensive car, or you are a younger person.

Location within the state will make a difference.

If you live in an urban city, you are likely to pay more than someone residing in suburban areas.

How expensive or inexpensive your car insurance policy will depend on your driver profile (the factors discussed) and your past driving history.

If you want to reduce your premium, comparison shop, talk to a licensed insurance agent or a financial advisor.

What else can affect my auto policy?

One of the most overlooked items is the insurance credit score when people are shopping for auto insurance.

A poor insurance credit score will affect the price you pay for a premium.

If you take out a loan or use more of your credit line, thereby reducing your overall score, an insurer can raise your premium at renewal.

Depending on state and insurer, the difference between a poor and an excellent credit score can be over 30% on average.

If you reside in California, Hawaii, Massachusetts, or Michigan, credit scores to determine a premium isn’t lawful.

Sources

https://www.michigan.gov/Guide.pdf

https://www.iii.org/article/background-on-no-fault

https://www.dfs.ny.gov/consumers/

Quadrant Information Services

The California Department of Insurance

NAIC data, sourced from S&P Global Market Intelligence

{“@context”:”https://schema.org”,”@type”:”FAQPage”,”mainEntity”:[{“@type”:”Question”,”name”:”Which States Have The Least Expensive Car Insurance?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”The states with the lowest car insurance rate are Maine, Iowa, Idaho, and Ohio. Year over year premiums for each state is going up. However, each of the 4 states has an average annual premium of around $950. Which is nearly 35% lower than a nationwide average of nearly $1,400….Learn More.”}},{“@type”:”Question”,”name”:”Which States Have The Highest Car Insurance?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”The states with the highest rates are Michigan, Louisiana, Florida, and Rhode Island. Michigan is a no-fault state, which means each driver can recover damages or injuries via their own insurer. Louisiana has a high number of uninsured drivers and the tendency to get damage from floods and hurricanes. Florida is expensive since there are more than 20% of drivers drive uninsured….Learn More.”}},{“@type”:”Question”,”name”:”Do I need to compare quotes if I move out of state?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”Short answer – yes. Where you live is going to be a big factor insurers use to determine your premium. As part of your financial planning, if you are moving out of state, you want to compare quotes with local, regional, and national insurers in the area you plan to move. Even if you are making a local move, it is always a good idea to comparison shop with your current insurance provider and others to find the best rate….Learn More.”}},{“@type”:”Question”,”name”:”Why is my premium higher than my state’s average?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”You could have a poor driving history, low credit score, history of claims, a lapse in coverage, expensive car, or you are a younger person. Location within the state will make a difference. If you live in an urban city, you are likely to pay more than someone residing in suburban areas. How expensive or inexpensive your car insurance policy will depend on your driver profile (the factors discussed) and your past driving history. If you want to reduce your premium, comparison shop, talk to a licensed insurance agent or a financial advisor….Learn More.”}},{“@type”:”Question”,”name”:”What else can affect my auto policy?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”One of the most overlooked items is the insurance credit score when people are shopping for auto insurance. A poor insurance credit score will affect the price you pay for a premium. If you take out a loan or use more of your credit line, thereby reducing your overall score, an insurer can raise your premium at renewal. Depending on state and insurer, the difference between a poor and an excellent credit score can be over 30% on average….Learn More. “}}]}