Cheapest Car Insurance in Massachusetts & Best Coverage Options

Cheap car insurance quotes in Massachusetts can be found at Norfolk & Dedham and Plymouth Rock Insurance. Norfolk & Dedham have the cheapest rates for minimum coverage at an average of $30/mo, while Plymouth Rock Insurance has the cheapest Massachusetts full coverage at an average of $103/mo.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Jan 3, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jan 3, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Norfolk & Dedham and Plymouth Rock Insurance have the best cheap car insurance quotes in Massachusetts. There are also plenty of other best auto insurance companies for cheap Massachusetts car insurance that drivers can get quotes from. Read on to learn about the cheapest companies in Massachusetts.

To find cheap Massachusetts auto insurance quotes today, use our free quote comparison tool to get a jumpstart on savings.

Best Cheap Car Insurance Quotes in Massachusetts

Drivers can find the best coverage in Massachusetts and save more on car insurance premiums by comparing quotes from multiple insurance providers with our comparison study’s best rates.

| Cheapest Car Insurance in Massachusetts - Key Takeaways |

|---|

The cheapest Massachusetts car insurance options are: The cheapest Massachusetts car insurance options are:Cheapest for minimum coverage: Norfolk & Dedham Cheapest for full coverage: Plymouth Rock Cheapest after an at-fault accident: Geico Cheapest after a speeding ticket: Plymouth Rock Cheapest after a DUI: Progressive Cheapest for married drivers: The Hanover Cheapest for young drivers: Geico For young drivers with a speeding violation: Geico For young drivers with an at-fault accident: Geico |

This Massachusetts car insurance guide is the best way to find affordable auto insurance coverage and help you save money regardless of age groups or driving types.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Massachusetts for Minimum Coverage

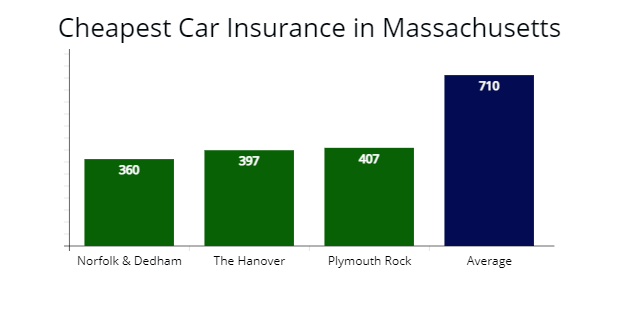

During our auto insurers’ analysis of Massachusetts’s best rates, Norfolk & Dedham provided us a $360 per year or $30 per month rate for the cheapest minimum liability insurance for good drivers in Massachusetts. Norfolk & Dedham’s quote is 50% cheaper than the Massachusetts state average of $710 per year.

| Company | Average annual rate |

|---|---|

| Norfolk & Dedham | $360 |

| The Hanover | $397 |

| Plymouth Rock | $407 |

| Safety Insurance | $416 |

| MetLife | $435 |

| Geico | $551 |

| State Farm | $587 |

| Arbella | $765 |

| Progressive | $824 |

| Travelers | $914 |

*Quotes vary based on driver profiles.

Minimum liability coverage in Massachusetts can ensure you have bodily injury, property damage liability, personal injury protection, and uninsured motorist coverage to stay legal and have the cheapest possible premium. Still, it may not provide you with all the coverage you need if you are involved in an auto accident.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

In the event of an at-fault car accident, state minimum policies will not cover property damage to your car. To avoid expensive repairs, our licensed agents recommend full coverage policies when shopping for Massachusetts auto insurance rates.

Cheapest Full Coverage Car Insurance in Massachusetts

Plymouth Rock offers the cheapest insurance rates for full coverage in Massachusetts for drivers with clean driving records. Plymouth Rock offered our sample driver a $1,236 annual rate or 31% less per year than Massachusetts’s average at $1,747 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Plymouth Rock | $1,236 | $103 |

| Norfolk & Dedham | $1,414 | $117 |

| Geico | $1,456 | $121 |

| Massachusetts average | $1,747 | $145 |

Full coverage policies offer a better coverage level of protection for Massachusetts drivers, which covers property damage to the other driver’s car and your car by adding collision and comprehensive coverage.

Collision coverage pays for damage to your motor vehicle in the event of an auto accident, and comprehensive insurance pays for weather damage, such as from a storm or fallen tree branch or if you accidentally hit an animal.

Learn more:

- Understanding Collision Car Insurance Coverage: What You Need to Know

- Understanding Comprehensive Car Insurance Coverage: What You Need to Know

Cheapest Car Insurance With a Speeding Ticket for Drivers in Massachusetts

AutoInsureSavings insurance agents found Plymouth Rock ($1,560 per year) offers cheaper car insurance in Massachusetts for drivers who have one speeding violation on their driving record. Plymouth Rock’s quote is 28% less expensive or $579 less per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Plymouth Rock | $1,560 | $130 |

| Geico | $1,617 | $134 |

| MetLife | $1,832 | $152 |

| Massachusetts average | $2,139 | $178 |

In Massachusetts, traffic tickets give rate increases by $392 or 19%, but not as much as a driver with an at-fault accident (44%) or DUI violation (58%).

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Insurance with an Auto Accident in Massachusetts

We found Geico offers cheaper car insurance quotes to Massachusetts drivers with one at-fault accident on their driving records with a $1,983 annual rate ($165 per month) for our sample 30-year-old male driver.

Geico’s rate is $659 less per year than Massachusetts’s state average rate of $2,642 or 25% less expensive.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Geico | $1,983 | $165 |

| MetLife | $2,144 | $178 |

| State Farm | $2,359 | $196 |

| Massachusetts average | $2,642 | $220 |

We found car insurance rates increase about 44% after a driver is involved in an accident in Massachusetts during our licensed agent’s analysis. Just one at-fault accident could cause your car insurance rates to increase as much as $895 per year or $75 per month.

Cheapest Car Insurance for People With a DUI in Massachusetts

With a drunk driving (DUI) violation, people in Massachusetts can find affordable car insurance with Progressive with a quote at $2,056 per year for full coverage or a $171 monthly rate for our sample 30- year-old driver.

Progressive’s quote is 36% cheaper than Massachusetts‘s DUI rate of $3,164 annually. You can learn more about Progressive and if its right for you in our Progressive car insurance review.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $2,056 | $171 |

| Geico | $2,371 | $197 |

| The Hanover | $2,617 | $218 |

| Massachusetts average | $3,164 | $263 |

According to the Commonwealth of Massachusetts Mass.gov, a DUI conviction in Massachusetts will cause your car insurance premiums to increase 58%. The DUI will remain on your driving record permanently. Your auto insurance rates increase over the next three to six years, depending on if any bodily injury to people happened during the DUI and the blood alcohol level (BAC).

Cheapest Insurance for Married Drivers in Massachusetts

AutoInsureSavings.org agents recommend The Hanover for married drivers, which provides the least expensive insurance in Massachusetts.

The Hanover’s rate of $1,368 with comprehensive and collision insurance included is 34% less expensive than the average rate for 30-year-old married drivers. And 24% cheaper than what single drivers pay for Massachusetts car insurance.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| The Hanover | $1,368 | $114 |

| Geico | $1,530 | $127 |

| Safety Insurance | $1,671 | $139 |

| Massachusetts average | $2,055 | $171 |

Cheapest Car Insurance for Young Drivers in Massachusetts

Young Massachusetts drivers can find the cheapest full coverage auto insurance rates with Geico, which provided us a $3,918 annual rate or 30% less expensive than Massachusetts’s younger driver average rates.

The Hanover provides the cheapest minimum coverage rates for young or teen drivers at $1,318 per year or 33% lower than average Massachusetts rates.

The next best car insurance for teens can be found at MetLife, at $1,374 per year.

| Insurer | Full coverage | Minimum coverage |

|---|---|---|

| Geico | $3,918 | $1,474 |

| The Hanover | $4,460 | $1,318 |

| Safety Insurance | $4,857 | $1,827 |

| MetLife | $5,175 | $1,374 |

| Travelers | $5,361 | $2,270 |

| State Farm | $5,417 | $2,361 |

| Progressive | $5,980 | $2,530 |

| Arbella | $6,233 | $2,419 |

| Plymouth Rock | $8,257 | $2,583 |

| Massachusetts average | $5,545 | $1,956 |

*Quotes vary based on driver profiles.

According to the Insurance Information Institute (III.org), your age correlates with safe driving habits. Statistically, the younger you are, the higher likelihood you will be in a car accident.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

According to the National Highway Traffic Safety Administration (NHTSA), auto insurers account for this risk factor by charging higher insurance rates for inexperienced drivers. As you gain more driving experience, your rates should decrease as you age.

Read more: The Best Car Insurance for New Drivers: A Comprehensive Guide

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Insurance for Young Drivers with Speeding Tickets

Teen drivers with speeding tickets in Massachusetts can find the cheapest quotes with Geico. Average auto insurance costs with Geico are $4,033 per year for full coverage or 32% less expensive than Massachusetts‘s average speeding ticket rate for younger drivers.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Geico | $4,033 | $336 |

| MetLife | $5,284 | $440 |

| Liberty Mutual | $5,965 | $497 |

| Massachusetts average | $5,889 | $490 |

Cheapest Insurance for Young Drivers with an At-fault Accident

Inexperienced Massachusetts drivers with a recent at-fault accident can find the best car insurance with Geico with a $4,984 quote for full coverage insurance.

Geico’s at-fault accident rate for young drivers is 25% cheaper than Massachusetts‘s average rate of $6,570 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Geico | $4,984 | $415 |

| MetLife | $5,737 | $478 |

| Progressive | $6,428 | $535 |

| Massachusetts average | $6,570 | $547 |

Best Auto Insurance Companies in Massachusetts

Based on customer service and claims satisfaction, Massachusetts’s best car insurance companies are Travelers Insurance and Progressive.

If customer service is a priority with a low amount of complaints based on NAIC’s index, we recommended Travelers as the best auto insurer in Massachusetts.

| Insurer | % respondents extremely satisfied with recent claim | % respondents rated customer service as excellent |

|---|---|---|

| Travelers | 74% | 60% |

| Progressive | 73% | 54% |

| State Farm | 71% | 49% |

| Allstate | 71% | 48% |

| Arbella | 70% | 44% |

| Geico | 68% | 42% |

Buying cheap insurance helps Massachusetts insurance shoppers save money, but insurance companies with poor customer service or claims handling sometimes are not worth the extra savings in your bank account.

AutoInsureSavings licensed agents collected information on Massachusetts’s car insurance companies from the National Association of Insurance Commissioners (NAIC), J.D. Powers, and A.M. Best’s financial strength ratings.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

The insurance companies with the lowest NAIC complaint index ratio based on the market share are Travelers (0.65), Progressive (0.67), and Arbella (0.69). All three insurers have a complaint index of less than one (1.00), the national average.

| Insurer | NAIC Complaint Index | J.D. Power claims satisfaction score | AM Best Financial Strength Rating |

|---|---|---|---|

| Travelers | 0.65 | 861 | A++ |

| Progressive | 0.67 | 856 | A+ |

| Arbella | 0.69 | n/a | A |

| Plymouth Rock | 0.74 | n/a | A- |

| Geico | 0.76 | 871 | A++ |

| State Farm | 0.78 | 869 | A+ |

| The Hanover | 0.81 | n/a | A |

| Safety Insurance | 0.94 | n/a | A |

| MetLife | 1.13 | n/a | A |

While you shop around for car insurance companies in The Bay State, several factors contribute to your insurance cost. Your driver profile, type of vehicle, and age can impact your total monthly or annual insurance premium.

It is always best to shop around and compare plans to find a Massachusetts car insurance company with the cheapest rates with excellent customer service ratings.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Average Car Insurance Cost by City in Massachusetts

We collected insurance quotes from Massachusetts zip codes from top auto insurance companies and found rates can vary by $370 by zip code and city.

Your zip code in The Bay State is one of many risk factors auto insurers use to set your auto insurance quotes. Other factors include your marital status, type of vehicle, age, and liability insurance.

Cheapest Auto Insurance in Boston, MA

Drivers in Boston can find the best auto insurance rates with Travelers, which provided us a quote at $1,463 per year for a full coverage insurance policy.

Learn more: Review of Travelers Car Insurance Options; a Comparison With Other Insurers

Travelers’ rate is 24% cheaper than Boston’s insurance rate of $1,987 per year.

| Boston Company | Average Premium |

|---|---|

| Travelers | $1,463 |

| Geico | $1,580 |

| Safety Insurance | $1,633 |

| Boston average | $1,987 |

Cheapest Auto Insurance in Worcester, MA

AutoInsureSavings’ agents found Geico is the cheapest liability car insurance company for people in Worcester. They provided us a $1,411 per year rate for full coverage, 25% less expensive than Worcester’s average rates at $1,866.

| Worcester Company | Average Premium |

|---|---|

| Geico | $1,411 |

| Travelers | $1,486 |

| Progressive | $1,629 |

| Worcester average | $1,866 |

Cheapest Auto Insurance in Springfield, MA

Springfield drivers can find the best full coverage insurance policy with MetLife, which provided us a quote at $1,398 per year or $116 per month. MetLife’s insurance quote is 26% cheaper than average rates for 30-year-old drivers in Springfield.

| Springfield Company | Average Premium |

|---|---|

| MetLife | $1,398 |

| Geico | $1,451 |

| State Farm | $1,672 |

| Springfield average | $1,870 |

Cheapest Auto Insurance in Cambridge, MA

Through research, we found the cheapest auto insurance in Cambridge is Geico, with a $118 monthly rate or $1,417 per year. Geico’s rate is 24% less expensive than Cambridge’s average rates of $1,841 per year.

| Cambridge Company | Average Premium |

|---|---|

| Geico | $1,417 |

| State Farm | $1,586 |

| Liberty Mutual | $1,749 |

| Cambridge average | $1,841 |

Cheapest Auto Insurance in Lowell, MA

Lowell, Massachusetts drivers can find the cheapest auto insurance quotes with Arbella, which provided our agents a $1,548 rate per year for our 30-year-old driver. Arbella’s quote is 17% less expensive than Lowell’s average rates.

| Lowell Company | Average Premium |

|---|---|

| Arbella | $1,548 |

| Progressive | $1,634 |

| State Farm | $1,641 |

| Lowell average | $1,844 |

Cheapest Auto Insurance in Brockton, MA

Drivers in Brockton looking for cheaper car insurance rates should get quotes from Arbella, which offered our agents a $1,479 annual rate for full coverage with $500 deductibles with collision and comprehensive coverage. Arbella’s rate is 24% less expensive than Brockton’s average rates of $1,930 per year.

| Brockton Company | Average Premium |

|---|---|

| Arbella | $1,479 |

| Norfolk & Dedham | $1,511 |

| State Farm | $1,582 |

| Brockton average | $1,930 |

Average Car Insurance Costs for All Cities in Massachusetts

| City | Annual Premium Cost | City | Annual Premium Cost |

|---|---|---|---|

| Boston | $1,987 | Raynham | $1,617 |

| Worcester | $1,866 | Mashpee | $1,670 |

| Springfield | $1,870 | Bedford | $1,638 |

| Cambridge | $1,841 | Uxbridge | $1,699 |

| Lowell | $1,844 | Oxford | $1,649 |

| Brockton | $1,930 | Ipswich | $1,617 |

| New Bedford | $1,711 | Dennis | $1,627 |

| Quincy | $1,679 | Clinton | $1,717 |

| Lynn | $1,722 | Wayland | $1,709 |

| Fall River | $1,638 | Millbury | $1,695 |

| Newton | $1,723 | Kingston | $1,617 |

| Somerville | $1,670 | Charlton | $1,728 |

| Lawrence | $1,737 | Medway | $1,741 |

| Framingham | $1,627 | North Adams | $1,788 |

| Haverhill | $1,617 | Lynnfield | $1,649 |

| Waltham | $1,709 | Medfield | $1,717 |

| Malden | $1,739 | Tyngsborough | $1,695 |

| Plymouth | $1,790 | Palmer | $1,617 |

| Brookline | $1,638 | Rehoboth | $1,670 |

| Medford | $1,723 | Harwich | $1,739 |

| Taunton | $1,719 | Weston | $1,709 |

| Weymouth | $1,784 | Pepperell | $1,700 |

| Chicopee | $1,638 | Spencer | $1,649 |

| Revere | $1,730 | Wrentham | $1,627 |

| Peabody | $1,709 | Norfolk | $1,755 |

| Methuen | $1,670 | Dudley | $1,784 |

| Everett | $1,802 | Carver | $1,580 |

| Arlington | $1,617 | Athol | $1,695 |

| Attleboro | $1,739 | Lunenburg | $1,638 |

| Barnstable | $1,649 | Lakeville | $1,789 |

| Salem | $1,717 | Groton | $1,617 |

| Billerica | $1,627 | Leicester | $1,670 |

| Pittsfield | $1,755 | Nantucket | $1,576 |

| Beverly | $1,599 | Norwell | $1,709 |

| Leominster | $1,617 | Holbrook | $1,804 |

| Westfield | $1,670 | Winchendon | $1,755 |

| Fitchburg | $1,700 | Hanson | $1,649 |

| Woburn | $1,695 | Maynard | $1,717 |

| Holyoke | $1,787 | Acushnet | $1,617 |

| Chelsea | $1,804 | Hull | $1,739 |

| Amherst | $1,709 | Southborough | $1,627 |

| Marlborough | $1,638 | Littleton | $1,670 |

| Shrewsbury | $1,617 | Middleton | $1,723 |

| Braintree | $1,717 | Brewster | $1,649 |

| Natick | $1,811 | Ware | $1,807 |

| Andover | $1,723 | Southwick | $1,617 |

| Watertown | $1,670 | Sturbridge | $1,817 |

| Chelmsford | $1,784 | Townsend | $1,638 |

| Dartmouth | $1,617 | Sutton | $1,695 |

| Randolph | $1,736 | Salisbury | $1,670 |

| Lexington | $1,755 | Freetown | $1,599 |

| Franklin | $1,627 | Blackstone | $1,617 |

| Dracut | $1,649 | Plainville | $1,709 |

| Falmouth | $1,670 | Douglas | $1,717 |

| Tewksbury | $1,804 | Monson | $1,649 |

| Needham | $1,822 | Georgetown | $1,736 |

| North Andover | $1,755 | Rutland | $1,566 |

| Gloucester | $1,695 | Cohasset | $1,804 |

| Norwood | $1,617 | Boxford | $1,627 |

| North Attleboro | $1,638 | Montague | $1,784 |

| Milford | $1,649 | Millis | $1,755 |

| Wellesley | $1,709 | Templeton | $1,717 |

| Agawam Town | $1,617 | Adams | $1,670 |

| Stoughton | $1,713 | Ayer | $1,817 |

| West Springfield | $1,613 | Sterling | $1,590 |

| Northampton | $1,670 | Lancaster | $1,649 |

| Saugus | $1,717 | Hamilton | $1,723 |

| Melrose | $1,736 | West Boylston | $1,695 |

| Burlington | $1,580 | Upton | $1,709 |

| Danvers | $1,627 | Halifax | $1,670 |

| Milton | $1,723 | Westminster | $1,617 |

| Bridgewater | $1,784 | Dighton | $1,638 |

| Wakefield | $1,755 | Orange | $1,736 |

| Belmont | $1,649 | Shirley | $1,762 |

| Marshfield | $1,723 | Williamstown | $1,709 |

| Dedham | $1,717 | Rockport | $1,627 |

| Reading | $1,617 | West Bridgewater | $1,804 |

| Walpole | $1,670 | Stow | $1,649 |

| Middleboro | $1,814 | Newbury | $1,618 |

| Easton | $1,627 | Great Barrington | $1,638 |

| Westford | $1,695 | Merrimac | $1,617 |

| Mansfield | $1,736 | Lincoln | $1,762 |

| Hingham | $1,806 | Groveland | $1,670 |

| Acton | $1,811 | Berkley | $1,755 |

| Wilmington | $1,628 | Dalton | $1,811 |

| Canton | $1,709 | Harvard | $1,717 |

| Yarmouth | $1,550 | Topsfield | $1,599 |

| Stoneham | $1,617 | Rowley | $1,695 |

| Winchester | $1,649 | Mattapoisett | $1,558 |

| Wareham | $1,617 | Granby | $1,804 |

| Ludlow | $1,638 | Ashburnham | $1,617 |

| Gardner | $1,810 | Southampton | $1,627 |

| Marblehead | $1,762 | Mendon | $1,599 |

| Sandwich | $1,847 | Dover | $1,736 |

| Hudson | $1,755 | Chatham | $1,638 |

| Bourne | $1,617 | Hopedale | $1,804 |

| Norton | $1,649 | Orleans | $1,717 |

| Sudbury | $1,723 | Lee | $1,762 |

| Concord | $1,670 | Rochester | $1,800 |

| Holden | $1,695 | Boxborough | $1,617 |

| Westborough | $1,736 | Barre | $1,804 |

| Grafton | $1,649 | Manchester-by-the-Sea | $1,627 |

| Scituate | $1,762 | Hadley | $1,709 |

| Winthrop | $1,808 | Bolton | $1,649 |

| Sharon | $1,717 | Wenham | $1,670 |

| Pembroke | $1,617 | Carlisle | $1,755 |

| Somerset | $1,627 | Warren | $1,804 |

| Newburyport | $1,723 | Hampden | $1,695 |

| Rockland | $1,804 | Marion | $1,617 |

| Foxboro | $1,811 | Deerfield | $1,798 |

| Ashland | $1,638 | Lenox | $1,649 |

| South Hadley | $1,807 | Eastham | $1,717 |

| Hopkinton | $1,649 | Paxton | $1,723 |

| Amesbury | $1,816 | North Brookfield | $1,762 |

| Greenfield | $1,717 | Hubbardston | $1,804 |

| Bellingham | $1,617 | Oak Bluffs | $1,627 |

| Webster | $1,695 | West Newbury | $1,638 |

| Southbridge | $1,649 | Boylston | $1,736 |

| Auburn | $1,670 | Avon | $1,617 |

| Northbridge | $1,617 | Edgartown | $1,762 |

| Swansea | $1,709 | Sherborn | $1,830 |

| Abington | $1,801 | Tisbury | $1,717 |

| East Longmeadow | $1,638 | Essex | $1,670 |

| Westwood | $1,755 | West Brookfield | $1,695 |

| Fairhaven | $1,759 | Brimfield | $1,804 |

| Easthampton | $1,787 | Sunderland | $1,788 |

| Westport | $1,801 | Wellfleet | $1,755 |

| Duxbury | $1,844 | Nahant | $1,627 |

| Longmeadow | $1,804 | Princeton | $1,638 |

| North Reading | $1,821 | Brookfield | $1,736 |

| Seekonk | $1,649 | Dunstable | $1,709 |

| Northborough | $1,757 | Hatfield | $1,649 |

| Belchertown | $1,717 | Millville | $1,695 |

| Swampscott | $1,723 | Ashby | $1,627 |

| Holliston | $1,736 | Berlin | $1,670 |

| Wilbraham | $1,638 | Sheffield | $1,617 |

| East Bridgewater | $1,695 | Cheshire | $1,717 |

| Hanover | $1,627 | Hardwick | $1,649 |

Minimum Auto Insurance Coverage Requirements in Massachusetts

According to the Massachusetts Division of Insurance, all drivers must carry the minimum liability insurance requirements, personal injury protection (PIP) of $8,000 per person and per accident, and uninsured motorist coverage.

| Liability | Minimum coverage |

|---|---|

| Bodily injury liability | $20,000 per person and $40,000 per accident |

| Property damage liability | $5,000 per accident |

| Uninsured motorist bodily injury | $20,000 per person and $40,000 per accident |

| Personal injury protection (PIP) | $8,000 per person and per accident |

Massachusetts is a no-fault state mandating motorists to carry first-party medical benefits in their auto insurance policies. And uninsured motorist bodily injury coverage is mandated by state law. AutoInsureSavings agents recommend higher bodily injury and property damage liability limits with comprehensive and collision insurance.

To learn more about the most affordable car insurance options or insurance products for drivers in Massachusetts, contact the experts at AutoInsureSavings.org. Our licensed insurance professionals will be happy to answer any questions you have.

Methodology

AutoInsureSavings.org comparison shopping insurance study used a full-coverage auto policy for a 30-year-old driving a 2018 Honda Accord with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person / $100,000 per accident |

| Property damage liability | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured / underinsured motorist bodily injury | $50,000 per person / $100,000 per accident |

| Comprehensive and collision coverage | $500 deductible |

We used insurance rates for drivers with accident histories, credit score, and marital status for other Massachusetts rate analyses. We used car insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your insurance rates may vary when you get quotes.

Sources

– Mass.gov. “Massachusetts law about drunk and drugged driving.”

– National Highway Traffic Safety Administration. “NHTSA FATALITY ANALYSIS REPORTING SYSTEM (FARS).”

-National Association of Insurance Commissioners. “Market Share Reports for Property/Casualty Groups and Insurance Companies.”

Frequently Asked Questions

How do I save on car insurance in Massachusetts?

There are many ways for drivers in Massachusetts to save on their car insurance premiums. You can determine if you are eligible for a money-saving driver discount offered by the car insurance company. Many insurance providers will lower your overall rates if you have multiple policies with them, such as life or home insurance.

Another way to save on your car insurance premium is to practice good driving habits and keep a clean driving record. That will not only keep you and your passengers safe but will also help you avoid auto accidents or traffic violations that could cause rate increases.

How much is full coverage car insurance in Massachusetts?

The average cost of full coverage car insurance in Massachusetts is $1,747 annually or $145 per month. Plymouth Rock’s average rate for full coverage is $1,236 per year or $103 per month. Norfolk & Dedham ($1,414) and Geico ($1,456) are also below the state’s average.

How much is car insurance for drivers in Massachusetts per month?

The average cost for car insurance per month in Massachusetts is $145 or $1,747 per year for full coverage. The average price of a minimum coverage car insurance policy per month is $59 or $710 per year. Plymouth Rock’s full coverage average rate is $103 per month or 31% less expensive, while Norfolk & Dedham offers state minimum policies in Massachusetts at $30 per month or 50% cheaper.

Who has the cheapest car insurance in Massachusetts?

We found the top car insurance companies that offer the lowest Massachusetts drivers’ average rates are Norfolk & Dedham at $30 per month, The Hanover at $34 per month, and Plymouth Rock Insurance at $35 a month for a liability insurance policy for a 30-year-old with clean driving history.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jimmy McMillan

Licensed Insurance Agent

Jimmy McMillan is an entrepreneur and the founder of HeartLifeInsurance.com, an independent insurance brokerage. His company specializes in insurance for people with heart problems. He knows personally how difficult it is to secure health and life insurance after a heart attack. Jimmy is a licensed insurance agent from coast to coast who has been featured on ValientCEO and the podcast Modern Li...

Licensed Insurance Agent

UPDATED: Jan 3, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.