Pros & Cons of Personal Injury Protection (PIP)

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Apr 11, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Apr 11, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Auto accident-related injuries exceed $75 billion annually, but many states offer a way to help pay for bodily injury costs with medical coverage called Personal Injury Protection (PIP) insurance.

In addition to coverage for medical bills, it offers several other powerful benefits as well.

Here are the key takeaways:

| Quick Hits |

|---|

| PIP covers medical expenses for you and your passengers after an accident regardless of fault. |

| It will provide work loss coverage for you and your passengers. |

| Injuries from an automobile accident can result in high costs, making PIP an attractive and powerful add-on to a policy. |

| Twenty-one states offer the coverage, including Washington D.C., and 14 states require all drivers to carry a minimum amount of protection. |

| Depending on the state and coverage limits, it can be expensive. |

What is Personal Injury Protection (PIP)?

Also called no-fault insurance, PIP coverage will cover the cost of treatment for injuries to the driver or passengers if injured due to an automobile accident, no matter who is at fault.

PIP generally covers family members in the household or other people listed on your auto policy and those driving your car with permission.

The robust policy structure makes coverage available immediately instead of waiting for funds from a liability settlement in a not-at-fault accident.

PIP doesn’t limit coverage to auto accidents.

Instead, PIP insurance is more comprehensive, broadly covering injuries caused by an automobile.

For example, if you are injured by an automobile as a pedestrian or riding your bicycle. Or it may apply if you hurt your hand in a car door.

Rules can vary by state, but in many cases, PIP medical coverage applies first, and your health insurance coverage applies once your benefits become exhausted.

In addition to payments for medical expenses, it also covers compensation for lost wages.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What does PIP cover?

Here are some PIP benefits and expenses that it can cover, subject to your auto insurance policy limits.

| Personal Injury Protection Covers |

|---|

| Ambulance fees, emergency services, and medical procedures. |

| Medical treatment, including hospital bills and other medical bills |

| Rehabilitation expenses |

| Prescriptions |

| Wage loss due to auto accidents |

| Home care expenses (household services) house cleaning, lawn care, etc. |

| Child care expenses |

| Funeral expenses |

| Survivor’s loss (Michigan) |

Typically, PIP medical acts as primary coverage for medical care due to an auto accident.

If you have other health coverage, PIP usually applies first, with your health care provider acting as secondary insurance, according to ValuePenguin.

What doesn’t PIP cover?

As a first-party bodily injury-focused coverage,

| PIP does not cover |

|---|

| Property damage liability insurance |

| Bodily injury liability to other drivers. |

| Third-party liability claims associated with an auto accident. |

| Comprehensive coverage |

| Collision coverage |

| Uninsured/underinsured motorist coverage |

| Claims for injuries sustained or due to an accident while being paid to drive. |

The latter is considered business/commercial use of your vehicle and requires either a policy rider or a separate auto policy.

Pros and Cons of PIP for Insurance Policyholders

In some states, you can decline PIP insurance.

In some other states that require it, you can customize your benefit limits.

This offers another way to personalize your coverage and adjust premiums to match your needs.

Here are some key benefits and drawbacks of choosing PIP insurance.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

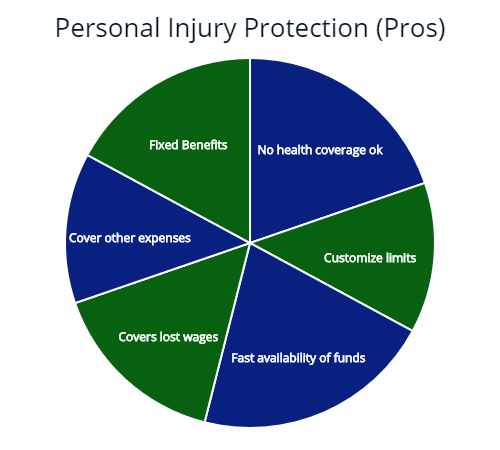

Pros of PIP

– It can pay for medical expenses even if you don’t have health insurance.

Rules can vary, but in most cases where it is part of your policy, PIP medical coverage serves as primary coverage for injuries related to car accidents.

– Customizable limits let you choose the coverage amounts you need.

Each state that offers PIP sets minimum limits, with options to increase limits and customize coverage for other bodily injury-related expenses.

– Ensures prompt availability of funds for medical payments after an accident.

Without PIP, MedPay, or medical benefits, how you pay for medical care can be a big question.

If the other party is at fault, their auto insurer might pay for your medical expenses.

However, this can lead to long delays during which medical costs remain unpaid.

PIP can step in immediately to cover medical services and other accident-related medical expenses.

– Can cover lost wages and other expenses caused by an auto injury.

Accident-related medical expenses represent one part of the cost of auto injuries, but if you’re unable to work, lost wages can add up quickly.

PIP offers wage-loss benefits that can help pay household expenses.

– Can cover other expenses that result from auto injuries.

In many households, an injury might mean that you’ll need a helping hand with some tasks.

The coverage can help cover lawn care costs or housecleaning if an auto-related injury prevents you from doing daily tasks.

– It offers a fixed schedule of benefits.

While you can customize your auto policy coverage, the limits you choose offer an easy-to-understand list of coverage types and limits.

Cons of Personal Injury Protection Insurance

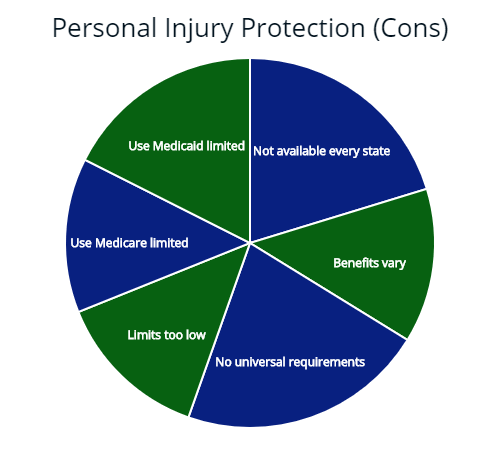

– It isn’t available in all states.

– Benefits can also vary by state.

While an individual auto insurance company can’t decide whether to offer PIP in no-fault states, the schedule of benefits can vary from one no-fault state to another regardless of provider.

There are no universal requirements.

– It increases insurance premiums when compared to simpler MedPay options.

Because PIP offers more expansive benefits and broader policy limits, PIP can cost more than MedPay.

– Minimum limits may be too low to be practical.

While not necessarily a con, you should be aware of minimum limits and consider higher limits if needed.

When shopping for insurance, check the coverage limits for PIP and other coverage types.

Insurance quotes may be using a minimum level of coverage, but you can customize many parts of your policy, including PIP.

– Medicaid or Medicare can’t be used as primary coverage in some states where PIP is required.

New Jersey, for example, disallows this. Michigan is an exception, however, allowing Medicaid recipients to opt-out of PIP coverage.

Each state governs insurance rules within the state — and can change those rules.

Reach out to your insurer, agent, or state insurance commissioner to learn more about current rules for your state.

Outside the question of pros and cons, many states that require PIP are also no-fault states.

In no-fault law, your ability to sue for damages due to an auto-related injury may be limited (also called limited tort).

You may be able to add this option (full tort) to your policy but expect higher premiums.

However, lawsuits’ restriction isn’t necessarily married to choosing PIP because you can choose full tort in some no-fault states.

Should I choose PIP or MedPay?

MedPay, also called medical payments coverage, is more limited in what it covers.

MedPay coverage includes medical expenses related to an auto accident as well as funeral expenses.

However, MedPay does not address other potential losses, such as lost wages or household expenses to help cover child care, etc.

The state in which you live determines which coverage types are available.

For example, in New Jersey or Michigan, PIP medical is your only choice for your accident-related medical bills.

MedPay is not available in these states, but PIP is required (in most cases).

A more important focus is on choosing the right amount of coverage for auto-related medical bills.

Insurance quotes often use the state-minium coverage level to keep quote prices lower.

This policy structure may or may not be the best fit for your needs, but you can customize coverage options for many parts of your insurance policy.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Which states require PIP?

Each state regulates insurance rules within its borders, so state requirements vary — and can change, according to NerdWallet.

14 states require it as part of auto insurance coverage, but the amount varies.

| States that require PIP | Minimum Coverage Required | No-Fault or Tort Laws |

|---|---|---|

| Delaware | $15,000 per person $30,000 per accident $5,000 funeral expenses | Tort |

| Florida | $10,000 per person | No-Fault |

| Hawaii | $10,000 per person | No-Fault |

| Kansas | $4,500 per person for medical expenses $4,500 for rehab expenses $2,000 funeral expenses $900 per month for disability/loss of income $25 per day for in-home expenses | No-Fault |

| Kentucky | $10,000 required, but can be waived in writing | No-Fault |

| Massachusetts | $8,000 per person | No-Fault |

| Michigan | Requirements vary. Unlimited medical expenses (Recipients of Medicaid services can opt-out.) | No-Fault |

| Minnesota | $20,000 for medical expenses $20,000 for loss of income | No-Fault |

| New Jersey | $15,000 per person $250,000 for severe/permanent injury | No-Fault |

| New York | $50,000 per person $2,000 death benefit 80% of lost income up to $2,000/month $25 per day for services | No-Fault |

| North Dakota | $30,000 per person | No-Fault |

| Oregon | $15,000 per person | Tort |

| Pennsylvania | $5,000 per accident (PIP benefits are called Medical Benefits on your policy.) | No-Fault |

| Utah | $3,000 per person $1,500 per person funeral expenses $3,000 death benefit $250/wk or 85% of lost income (whichever is less) $20 per day for services | No-Fault |

According to The Hartford, several other states make it optional, including:

| Optional PIP | Details |

|---|---|

| Arkansas | Optional |

| Maryland | $2,500 required, but can be waived in writing |

| New Hampshire | Optional |

| South Dakota | Optional |

| Texas | $2,500 required, but can be waived in writing |

| Virginia | Optional |

| Washington | $10,000 required, but can be waived in writing |

| Washington D.C. | Optional |

Even where optional, choosing it as an add-on can be an excellent coverage decision because benefits extend beyond medical services.

Using PIP To Customize Your Insurance Coverage

Personal Injury Protection offers a powerful way to customize your insurance coverage and plan for the unexpected.

Even if your health care provider changes or you lose healthcare coverage, your auto insurance policy can help cover accident-related medical costs.

This robust structure ensures that your auto policy provides a solid foundation for medical coverage and lost wages.

Building on your base coverage, you can customize PIP and other policy options to meet your insurance and family’s needs.

Sources

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Apr 11, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.