What is Car Storage Insurance? And Do I Need Insurance For a Car in Storage?

There is no specific kind of auto insurance known as "storage car insurance", but there are lots of options for keeping insurance for a car in storage if it's being unused.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zach Fagiano

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Licensed Insurance Broker

UPDATED: May 2, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: May 2, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

We all understand that car insurance is essential. But what if you have a vehicle in storage? Do you need insurance for a car in storage if it’s a motor vehicle you are not using?

Don’t make the mistake of thinking that the storage company is providing you with insurance.

Insurance for a Car in Storage Explained

| Storage Insurance – Key Takeaways |

|---|

| Storage car insurance is also known as Parked Car Insurance, and Geico, Allstate, USAA, and many other auto insurers offer Comprehensive-Only Coverage as a Storage Protection Plan. |

| If you plan to put your vehicle in storage, you do not need to cancel your current car insurance policy. Your car is still at risk of damage or theft while it is in storage. |

| Having the minimal amount of car insurance coverage on your car while you keep it in storage will prevent you from having a lapse in your coverage that could otherwise show up on your insurance history and affect your future car insurance rates. |

| It is legal to drop liability insurance on a car that isn't driven or parked on public roads. And if you cancel your registration and turn in your license plates to the Department of Motor Vehicles (DMV). |

There are several reasons why you may have your car in a self-storage unit or garage.

Whatever your reason may be, it is likely you have questions about or might consider whether you should keep your auto insurance coverage on your car if you are not driving for an extended period of time.

| Why You May Need Car Storage Insurance |

|---|

| You have a classic or hobby car you work on for a few months before you drive it. |

| You have a sports car or utility truck you only drive during certain months of the year. |

| You have inherited a vehicle from a family estate or inheritance but don't plan to drive it. |

| You have a vacation home with an automobile meant only for that location. |

| You are a military member about to go on deployment. |

Suppose you are already paying auto insurance premiums for the car you drive daily or a second car for a family member.

In that case, it probably seems like a waste of money to pay for an additional car insurance policy for a vehicle that you never use.

But there are some benefits and car insurance options you might consider to cover insurance for a stored car.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Why do I need auto insurance a stored car?

Even if you do not plan to drive your car, there is still a risk that it could be damaged while your car is in storage.

Car insurance can still provide you with auto coverage against theft, vandalism, fire, flooding, or property damage caused by falling objects.

If you decide to cancel your car insurance policy for your stored car, and your vehicle becomes damaged while in storage, it may require you to pay for the repairs out of pocket.

All car insurance policies include similar coverages, but some coverages are optional, and some are required by state law.

While you may not feel you require personal injury protection or uninsured/underinsured motorist coverage, it is a good idea to keep comprehensive coverage while your car is in a rental storage unit.

Should any of your property kept in a storage unit or locker be damaged by a covered event, self-storage insurance would pay to replace the damaged items.

| Comprehensive-Only Car Insurance Protects Against |

|---|

| Theft |

| Vandalism |

| Hail/lightning |

| Damage from animals |

| Damage caused by weather |

Comprehensive coverage will cover the cost of any vehicle damage that occurs while you are not driving it.

You may require an auto insurance policy on your stored car if you are still paying off the loan on it, however.

Your lien-holder might require you to keep car insurance on that vehicle until your loan is paid off, even if you do not plan on driving it for a while.

Is there a specific kind of insurance for a car in storage?

You will need comprehensive insurance.

While you have your automobile in a rental storage unit, you want to make sure to protect it against theft or damage caused by fire, flood, vandalism, falling objects, or any other type of damage that could occur while your car is parked.

It is a common misconception that if your car is damaged in your garage, it will be covered by your homeowner’s insurance policy. But that is not true.

Instead, it would help if you made sure to have comprehensive coverage to pay for damages to the vehicle in most cases.

What is storage car insurance?

Truth be told…There isn’t a coverage known as car storage insurance.

That is just a term used in the industry to describe the minimal amount of car insurance coverage people take out for their stored cars.

Another unofficial name for it is called parked car insurance. Again, not a real coverage name.

For instance, there is no specific USAA storage unit insurance for a vehicle. There is no Geico car storage insurance. But there are options for car storage insurance with Geico and most other insurance companies.

Because you are no longer driving your car, you do not need certain forms of car insurance that you would need if you had your car on the road.

Most car insurance providers will give you the option to drop certain car insurance types such as bodily injury and only take out comprehensive only coverage.

| Insurance Company | Comprehensive Insurance Cost* |

|---|---|

| Geico Insurance | $187 |

| Allstate Insurance | $198 |

| State Farm Insurance | $211 |

| Liberty Mutual Insurance | $234 |

| Progressive Insurance | $229 |

*Cost of a comprehensive car insurance policy with a $500 deductible. Your results will vary by zip code when you get car insurance quotes.

That will enable you to continue to protect your car from accidental damage or theft, even if it is in storage.

If you cannot drop liability insurance or uninsured motorist coverage, you may still reduce that coverage down to the minimum amount with many car insurance providers.

How does storage car insurance or comprehensive coverage work?

When you know you will not have your car on the road for an extended period, you might consider speaking with your insurance agent about car insurance policy options.

You may be leaving home for several weeks or months, going on vacation, or visiting relatives in another state.

While you may not want to pay the full amount for your car insurance coverage during this time, you do not want to endure a lapse in your insurance history.

Keep in mind; you also don’t want to leave your car unprotected from damages while it is not in use.

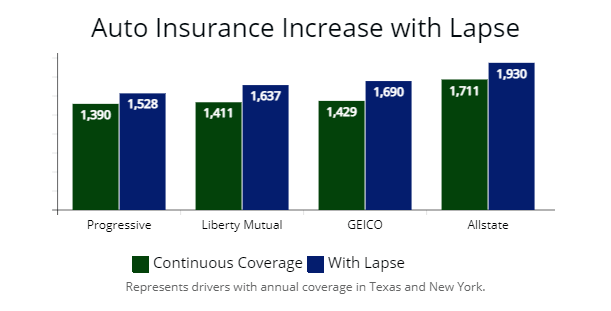

Illustration of auto insurance quotes with continuous coverage and with a lapse. Canceling your auto insurance creates a lapse and puts most drivers in a high-risk category with car insurance companies, resulting in higher premiums. Your results will vary when you get car insurance quotes.

Illustration of auto insurance quotes with continuous coverage and with a lapse. Canceling your auto insurance creates a lapse and puts most drivers in a high-risk category with car insurance companies, resulting in higher premiums. Your results will vary when you get car insurance quotes.

Storage insurance for a car or comprehensive insurance can help you avoid any lapse in coverage as you continue to protect your car from any damages it may endure.

It is possible you could reduce the amount of car insurance you currently have on your vehicle by eliminating unnecessary options like uninsured motorists, liability, and collision.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

When to Buy Insurance for Car in Storage

There are several instances where you may be required to switch to stored car insurance or Comprehensive Only insurance.

Many car owners put their vehicles in storage if they own multiple cars.

Some will do so if they own a sports car they do not want to drive during winter months or an antique vehicle that is too valuable to have out in the sun or rain for a long period of time.

If you have a car you are considering selling and want to protect it from accidental damage. You may want to keep it in storage until you find the right buyer.

It is essential to contact your agent or car insurance provider when you decide to place your vehicle in storage and choose to reinstate coverage.

Even if you are only taking the car out for a quick drive around the block, you should contact your agent before doing so.

You do not want to end up getting involved in a severe crash with no auto insurance coverage.

Insurance for a Car in Storage: Frequently Asked Questions (FAQs)

How do I prepare a car for long-term storage?

It would be best if you did several things to protect your car while it is in storage. Here are a few tips for storing your car safely.

— Keep it covered. Storing your car inside a garage is the best way to keep it safe, but if that’s not possible, you can also use a weatherproof car cover or consider renting a public storage unit.

— Change the oil. If you are storing your car for more than 30 days, you should consider getting the oil changed. That’s because used engine oil contains contaminants that can cause damage to your engine.

— Fill up the tank. Another tip for long-term storage. Add a fuel stabilizer and topping off your tank will prevent moisture from accumulating inside and keep your seals from drying out.

— Do not use the parking brake. If your brake pads are in contact with the rotors for too long, they could fuse. Instead of using the parking brake, consider buying a tire stopper to prevent the car from moving.

What happens if you drop full coverage insurance on a financed car?

If you decide to drop comprehensive and collision insurance on a car you still owe money on; it is considered a violation of your finance contract.

This action could cause serious issues with your loan. The lender may be able to place single interest coverage, also known as force-placed insurance, on your car and add that insurance premium to your loan amount.

It is best to speak with your auto lender before you drop any car insurance on your stored car to determine the consequences.

Do I need to follow the state’s minimum insurance coverage when getting insurance for a car in storage?

When you have your car in storage, it is not required that you follow your state’s minimum insurance requirements. This may involve different options for stored car insurance.

You are allowed not to have liability coverage on your vehicle as long as the car is not parked on a public road or driven, and if you cancel the registration and turn in your license plates.

Can you keep an uninsured car in your driveway?

It might be possible to keep your car parked in your driveway and not your garage until you obtain insurance coverage, or it may be illegal, insurance wise.

Depends on the laws in your state. Although the insurance law varies from one state to the next, there shouldn’t be any problem if you own the land.

However, if you are renting the land, you will need to have permission from your landlord.

Can I temporarily suspend insurance for a car in storage?

Yes, you can temporarily suspend your car insurance.

Remember that you will need to add yourself back to the auto policy when you start to drive the car once again.

Failure to add yourself or the car back on your car insurance policy could result in denial of any future car insurance claims.

While it is rare to suspend car insurance temporarily, it can provide you with a financial benefit if you place your car in storage for an extended period.

To learn more about needing car insurance coverage if your car is in storage, contact the insurance agents at AutoInsureSavings.org.

Or make sure to enter your zip code for free car insurance quotes.

Our licensed professionals will be happy to answer any questions you have.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Zach Fagiano

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Licensed Insurance Broker

UPDATED: May 2, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.