Liberty Mutual Car Insurance Is A Favorite Among A Growing Number Of Drivers

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Feb 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Feb 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Since its founding in 1912, the insurance company Liberty Mutual has consistently grown to expand the insurance products and services it offers in the United States today.

Additionally, Liberty Mutual is the nation’s third-largest property and casualty provider (based on direct premium) and the seventh-largest auto premium provider, with just under five percent of the nation’s market share.

Next time you want to compare quotes and providers, you may want to include Liberty Mutual in your cast of options

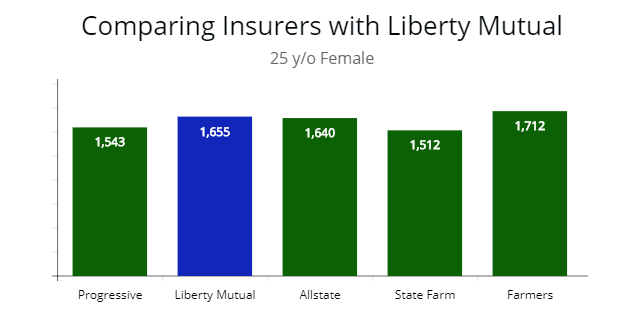

Note: For a 25 y/o female driver Liberty Mutual was the 4th cheapest carriers out of all that I queried. For more information please see table below.

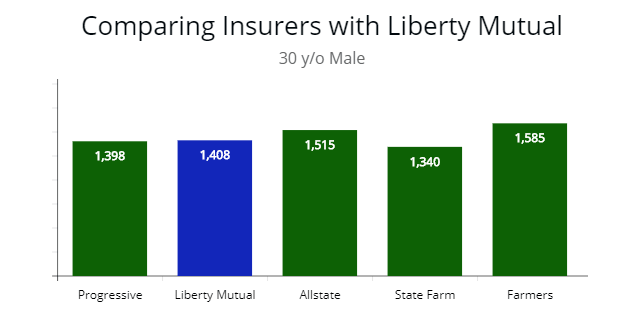

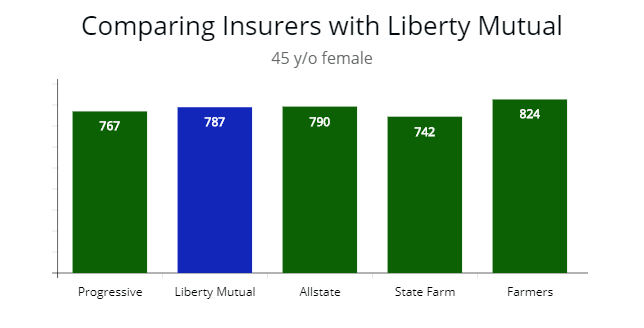

Comparing Liberty Mutual to Top Insurers by Driver Profile & Stats

To provide an idea of an average auto policy, we’ve obtained a wide range of insurance quotes for each of the driver profiles in the table below. We did this to give you an overview of Liberty Mutual insurance compared to other auto insurance companies.

While there is a wide variety of other insurers, however, we thought it would be best to compare them against similar insurers.

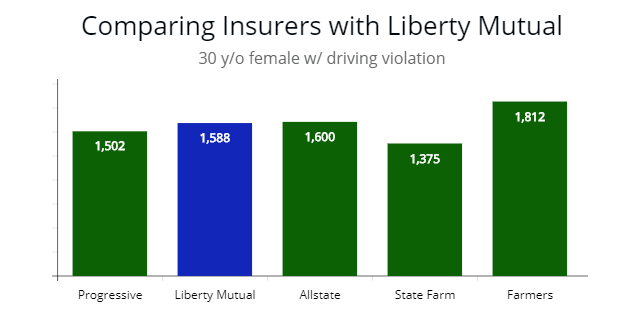

For younger drivers quotes came back a little higher than most of the insurers.

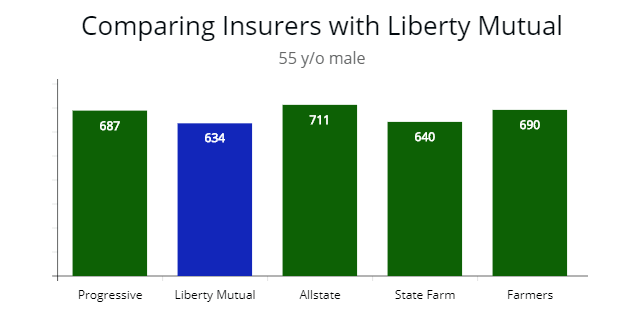

For older drivers, Liberty is competitive against any insurer.

Another benefit we found is Liberty will work with those with driver infractions, i.e. not raising your rates too much. As long as they are not major infractions like DUI’s, etc.

| Driver Profile | Liberty Mutual | Progressive | Allstate | Farmers | State Farm |

|---|---|---|---|---|---|

| 25 y/o female | $1,655 | $1,543 | $1,640 | $1,712 | $1,512 |

| 25 y/o male | $1,989 | $1,890 | $2,020 | $2,004 | $1,903 |

| 30 y/o female | $1,356 | $1,287 | $1,435 | $1,521 | $1,240 |

| 30 y/o male | $1,408 | $1,398 | $1,515 | $1,585 | $1,340 |

| 25 y/o male (1 driving violation) | $2,276 | $2,290 | $2,280 | $2,554 | $2,106 |

| 30 y/o female (1 driving violation) | $1,588 | $1,502 | $1,600 | $1,812 | $1,375 |

| 40 y/o male | $955 | $980 | $1,045 | $1,090 | $966 |

| 45 y/o female | $787 | $767 | $790 | $824 | $742 |

| 55 y/o male | $634 | $687 | $711 | $690 | $640 |

| 55 y/o female | $589 | $602 | $632 | $599 | $592 |

Liberty Mutual has All the Standard Options…..plus

Note: When I queried for a 30 y/o male driver the LM quote is comparable to Progressive. About $10 more. In this instance, LM was the 3rd cheapest carrier. See table above.

You can even start evaluating your possible plan using Liberty’s online calculator.

It will show you changes to your coverage costs and premium rates when you select specific levels and coverage limits from the following basic options:

- Bodily injury liability coverage

- Property damage liability insurance

- Medical liability protection

- Collision and comprehensive coverage

- Liberty Mutual is one of a handful of insurers that require you to buy collision and comprehensive coverage as a package. You can’t have one without the other and you will be required to select separate deductibles for each option.

- Uninsured/underinsured motorist coverage

- In some states, Liberty Mutual is able to sell these as separate coverage options and in other states, the two are combined.

Note: I found most all the quotes clustered under $800 for a 45 y/o female. Again, in this instance, LM was the 3rd cheapest insurer. See the table above for more info.

Furthermore, in a number of states that are no-fault, Liberty offers a more robust option to its medical payments coverage, a personal injury protection (PIP) coverage package.

Has many Unique Options Not Found with Other Providers

If you have or decide to move your auto insurance to Liberty, you can also take advantage of some of the unique add-ons and benefits they offer, including:

Accident Forgiveness

If you have a driving record with no claimable incidents or violations going back five years, even if you’ve been insured with another carrier, Liberty won‘t increase your rates after your first accident is covered with them.

Some extreme cases are excluded and some states limit in how far they can extend this, so consulting with your representative on what applies to you is a good idea.

Note: For a female driver with a driving violation Liberty was the 3rd cheapest provider. This was for a speeding ticket over 11 mph over the limit. Liberty Mutual is competitive against other insurers with a driving infraction on your record.

Unlimited Rental Car Coverage

Liberty mutual also provided rental car coverage. If your car is damaged in a covered event and you choose to have it repaired at a shop pre-approved by Liberty Mutual, they can arrange for you to have a rental car for as long as it takes to repair your car. This option is not allowed in New York state and you are limited to the rental agencies with service contracts within your area.)

Note: LM is highly competitive for older drivers. In this instance, LM was the cheapest quote for a 55 y/o male driver with no driver infractions.

New Car Replacement

Now a standard feature on all policies, if your new car is totaled during the first year of ownership and its covered by a LM policy they will pay to replace the car.

With no adjustments for depreciation (again, in some states there are limits to what they can offer and you should consult with your representative to see what applies to you.)

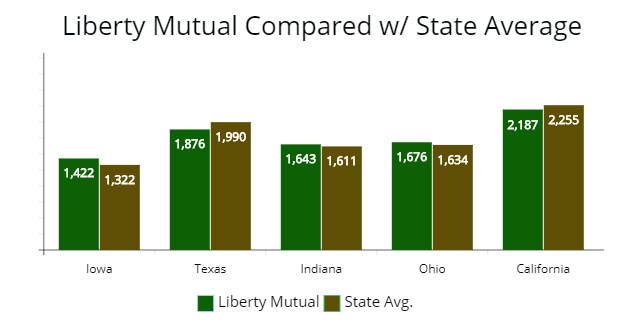

Note: In Texas and California Liberty Mutual is cheaper than the state average. This is when comparing a driver with the same profile and no driving infractions. This includes other carriers which may have offered a policy with less coverage. For top insurers with the same coverage Liberty would be less for all states.

Lifetime Repair Guarantee

If your car is damaged in an incident covered by Liberty Mutual and you have it repaired at a shop approved and recommended by them, you get a lifetime guarantee for the work.

They will even handle all the arrangements, including transportation of you and your vehicle to and from the repair facility.

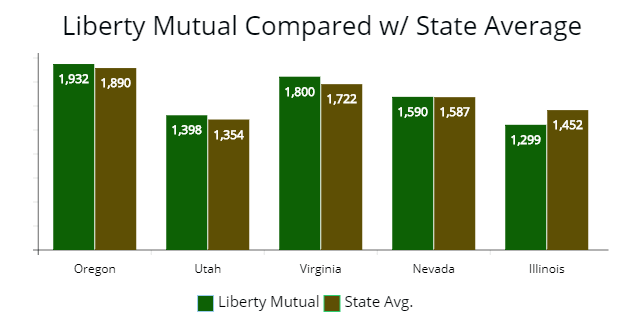

Note: As illustrated, LM was cheaper in the state of Illinois. The other 4 states, Oregon, Utah, Virginia, and Nevada LM is more expensive on average. During my study I found LM to be cheaper than the average rate with highly populated states.

A plethora of Discounts Offered for Maximum Savings

Like all leading vehicle insurance providers, Liberty offers you the opportunity to save by applying for premium policy discounts.

Some may seem familiar to you while others may be new.

| Rank | Discount | Percentage |

|---|---|---|

| 1 | Good Student | 5 - 30% |

| 2 | Mature Driver | 4 - 20% |

| 3 | Multi-Car Policy | 5- 15% |

| 4 | Anti-Theft | 5- 15% |

| 5 | Hybrid Car | 0 - 10% |

| 6 | New Vehicle | 2 - 7% |

| 7 | Payment option savings (E-pay) | 0 - 5% |

| 8 | New Driver | 0 - 10% |

| 9 | New Move | 0 - 5% |

| 10 | New Retiree | 0 - 5% |

| 11 | Early Shopping | 0 - 5% |

| 12 | Occupation Affinity | 0 - 5% |

Liberty Mutual is constantly looking for new ways to help policyholders save money and some of these discounts are a great place to start:

- Multi-policy or bundling discounts

- Good student discounts

- Exclusive group savings

- If you belong to or work for any of the more than 14,000 employers, associations, credit unions, alumni associations, or other groups that are a part of a growing affinity program, you may be eligible for premium savings.

- Payment option savings

- Pay in full or arrange for automatic payment and you could save on your premium.

- New-to-Liberty

- Add a car or switch a car to a policy and enjoy a discount.

- Safety and anti-theft devices discount Hybrid vehicle discounts

- Hybrid vehicle discounts

- Multi-car discounts

- New graduate discounts

- Special savings are offered to new college graduates.

- New move discount

- Move to another area and stick with Liberty and they will help you transfer coverage and offer you a discount.

- New retiree discounts

Some States are Limited in Range & Breadth of Discounts Offered

Liberty Mutual is limited by some states in the full range and breadth of discounts they can offer policyholders.

Be sure you consult with your representative to see just what discounts you are eligible for and be sure your agent works with you to pursue each one that could benefit you.

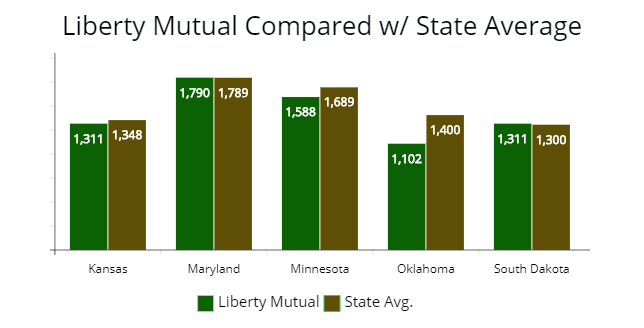

Note: In this instance, LM was cheaper in all of the states except Maryland and South Dakota. Which is negligible and only $1 and $11 respectfully than the average quote. In Oklahoma, LM averaged nearly 20% lower than the average automobile premium.

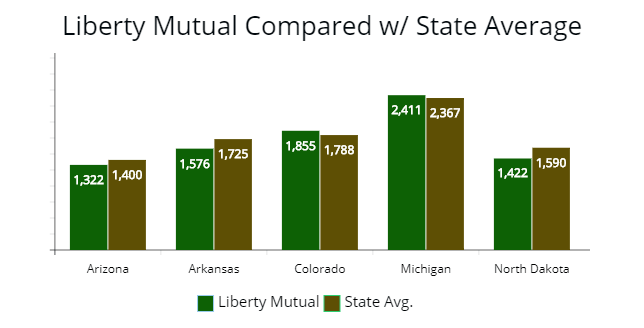

State by State Average Rate Hike, Reviews, & Average Customer Satisfaction

Below is a table list of the average percentage rate hike by primary states which Liberty offers premiums.

It is important to note your premium is raised (or lowered) each year depending on circumstances which are not known to me. It is very difficult to retrieve the data for this.

Note: Only in Colorado and Michigan was LM more expensive than the average premium. In Arizona the quotes are 5% cheaper. In Arkansas the quotes are 13% lower than average. In North Dakota the quotes are 12% cheaper than the average premium.

The only data available is the actual rate hike per year. Each state has an average customer satisfaction which includes claims handling.

The biggest factors from customers when determining a satisfaction is price, claims handling, and amount of coverage.

When comparing the average state quote against LM about half are below the average quote while the other half is more.

There are a few states which LM was substantially lower. For states which are higher it was marginal and never more than 5% higher. Nothing out of the ordinary.

| State | Percentage Rate Hike 2017* | State Average Quote | Liberty Mutual Quote | Difference | Rideshare Coverage | Satisfaction Out of 5 |

|---|---|---|---|---|---|---|

| Arizona | 4% | $1,400 | $1,322 | -$78 | Y | 2 |

| Arkansas | 4% | $1,725 | $1,576 | -$149 | N | 3 |

| California | 5% | $2,255 | $2,187 | -$68 | Y | 3 |

| Colorado | 6% | $1,788 | $1,855 | +$67 | N | 3 |

| Idaho | 6% | $1,326 | $1,365 | +$39 | Y | 3 |

| Illinois | 5% | $1,452 | $1,299 | -$153 | Y | 4 |

| Indiana | 4% | $1,611 | $1,643 | +$32 | Y | 4 |

| Iowa | 6% | $1,322 | $1,422 | +$100 | Y | 3 |

| Kansas | 5% | $1,348 | $1,311 | -$37 | Y | 3 |

| Kentucky | 5% | $1,465 | $1,211 | -$254 | N | 4 |

| Maryland | 6% | $1,789 | $1,790 | +$1 | Y | 4 |

| Michigan | 7% | $2,367 | $2,411 | +$44 | Y | 4 |

| Minnesota | 6% | $1,689 | $1,588 | -$101 | Y | 4 |

| Missouri | 8% | $1,290 | $1,155 | -$155 | Y | 3 |

| Montana | 9% | $1,450 | $1,569 | +$119 | Y | 3 |

| Nebraska | 3% | $1,280 | $1,290 | +$10 | Y | 3 |

| Nevada | 4% | $1,587 | $1,590 | +$3 | Y | 4 |

| New Mexico | 5% | $1,690 | $1,700 | +$10 | Y | 4 |

| North Dakota | 6% | $1,590 | $1,422 | -$168 | Y | 4 |

| Ohio | 5% | $1,634 | $1,676 | +$42 | Y | 4 |

| Oklahoma | 6% | $1,400 | $1,102 | -$298 | Y | 4 |

| Oregon | 8% | $1,890 | $1,932 | +$42 | Y | 2 |

| Pennsylvania | 8% | $1,943 | $2,004 | +$61 | N | 2 |

| South Dakota | 6% | $1,300 | $1,311 | +$11 | N | 4 |

| Texas | 6% | $1,990 | $1,876 | -$114 | Y | 4 |

| Utah | 4% | $1,354 | $1,398 | +$44 | Y | 4 |

| Virginia | 8% | $1,722 | $1,800 | +$78 | N | 4 |

| Washington | 6% | $1,760 | $1,843 | +$83 | N | 4 |

| Wisconsin | 7% | $1,654 | $1,689 | +$35 | Y | 3 |

| Wyoming | 6% | $1,319 | $1,332 | +$13 | N | 3 |

Final Thoughts

You will have plenty of options when it comes time for you and your family to acquire or renew your automobile premium.

Next time you’re in the market for some comparison-shopping, consider including Liberty Mutual in your deliberations and you might find yourself a new company.

Sources

https://www.libertymutual.com/

https://www.libertymutual.com/life-insurance/life-assurance-company/financial-strength-ratings

(Note: This article is intended to be informational only and is in now way a solicitation or a promotion. The author has no affiliation with LM or any other provider.)

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeff Root

Licensed Insurance Agent

Jeff is a well-known speaker and expert in insurance and financial planning. He has spoken at top insurance conferences around the U.S., including the InsuranceNewsNet Super Conference, the 8% Nation Insurance Wealth Conference, and the Digital Life Insurance Agent Mastermind. He has been featured and quoted in Nerdwallet, Bloomberg, Forbes, U.S. News & Money, USA Today, and other leading fina...

Licensed Insurance Agent

UPDATED: Feb 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.