Wisconsin Cheapest Car Insurance & Best Coverage Options

Erie Insurance has the Winsconsin cheapest car insurance and best coverage options, followed by Travelers. At Erie Insurance, minimum coverage in Wisconsin only averages $29 per month. Wisconsin drivers who want full coverage, however, will find cheap rates at Travelers for an average of $95 per month.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Jan 15, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jan 15, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

- Erie Insurance has the cheapest minimum coverage in WI

- Travelers has the cheapest full coverage in WI

- All Wisconsin drivers need to carry WI auto insurance

Looking for the Wisconsin cheapest car insurance and best coverage options? The best auto insurance companies for cheap Wisconsin car insurance are Erie Insurance and Travelers.

Read on to learn more about affordable Wisconsin auto insurance, and enter your ZIP code into our free quote tool at any time to get quotes.

Affordable Wisconsin Car Insurance Rates

Wisconsin insurance shoppers should compare quotes with the same coverage levels with at least three auto insurance companies to find the cheapest rates and save more on their premiums.

| Cheapest Car Insurance in Wisconsin - Quick Hits |

|---|

The cheapest Wisconsin car insurance options are: The cheapest Wisconsin car insurance options are:Cheapest for minimum coverage: Erie Insurance Cheapest for full coverage: Travelers Insurance Cheapest after an at-fault accident: Travelers Cheapest after a speeding ticket: Erie Cheapest after a DUI: Progressive Cheapest for poor credit history: American Family Cheapest for young drivers: American Family For young drivers with a speeding violation: Erie For young drivers with an at-fault accident: American Family |

Enter your Zip Code or use this practical Wisconsin auto insurance guide which is the best way to find top car insurance providers at an affordable price in your area regardless of your driving type.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in Wisconsin for Minimum Coverage

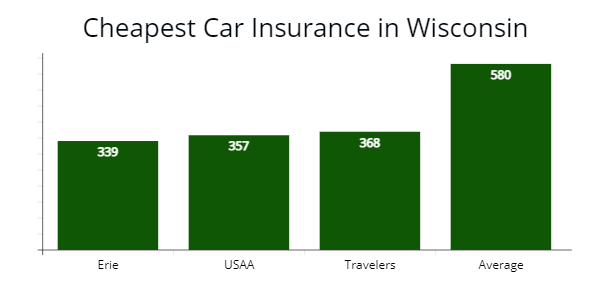

Erie Insurance offers the lowest minimum coverage rates for Wisconsin drivers with a clean record, which provided us a $339 annual rate or $241 cheaper than the $580 average price quoted for our 30-year-old driver.

Learn more: A Review of Erie Auto Insurance & Policy Options

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Suppose you are a military member or a family member of a service member. In that case, the best car insurance options for veterans and military are with USAA, which offered our agents a $357 annual quote or $30 per month for minimum liability coverage (read more: A Review of USAA Car Insurance, Policy Options & Military Benefits).

| Insurer | Average annual rate |

|---|---|

| Erie | $339 |

| USAA | $357 |

| Travelers | $368 |

| American Family | $453 |

| State Farm | $488 |

| Progressive | $517 |

| Geico | $545 |

| Partners Mutual | $591 |

| Auto-Owners Insurance | $612 |

| Allstate | $643 |

| Wisconsin average | $580 |

*USAA is for qualified military members, their spouses, and direct family members. Your insurance rates may vary based on the driver’s profile.

Buying a minimum coverage level car insurance policy is the cheapest way to meet Wisconsin’s minimum insurance requirements to ensure you stay legal.

State minimums may not have sufficient coverage with the amount of bodily injury and property damage liability you need if you are involved in an auto accident. For this reason, it is recommended to look at other optional coverage if your financial situation will allow for it, as cheap car insurance isn't always worth it if you're still left paying a large amount out of pocket in case of an incident.Dani Best Licensed Insurance Producer

A Wisconsin state minimum auto policy only covers up to $50,000 per accident in bodily injury liability and $10,000 per accident in property damage liability.

Cheapest Full Coverage Car Insurance in Wisconsin

Travelers Insurance offers the cheapest car insurance rates for full coverage in Wisconsin.

Read more: Review of Travelers Car Insurance Options; a Comparison With Other Insurers

Travelers’ $1,141 rate is 29% less expensive than the statewide average of $1,596 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Travelers | $1,141 | $95 |

| Erie | $1,330 | $110 |

| American Family | $1,415 | $117 |

| Wisconsin average | $1,596 | $133 |

*USAA is for qualified military members, their spouses, and direct family members. Your average rates may vary based on the driver’s profile.

A full coverage car insurance policy costs more than liability-only policies but offers more asset protection with comprehensive and collision insurance included. Your motor vehicle is protected no matter who or any inclement weather caused the property damage.

Cheapest Car Insurance With One Speeding Ticket in Wisconsin

Erie offers the cheapest auto insurance rates for Wisconsin drivers with one speeding violation on their driving record. Erie’s $1,390 rate is 26% or $485 less expensive than the statewide average. Below, you can see how a traffic ticket can impact your car insurance rates in WI.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Erie | $1,390 | $115 |

| American Family | $1,517 | $126 |

| State Farm | $1,543 | $128 |

| Wisconsin average | $1,875 | $156 |

According to Wisconsin’s Department of Transportation, your auto insurance rates can increase by $279 per year or 15% with one traffic violation for speeding.

Learn more: How much will my auto insurance go up with a speeding ticket?

Most auto insurers will increase car insurance rates after traffic tickets, so you want to make sure to comparison shop for cheaper insurance coverage after any traffic violation on driving records.

Cheapest Car Insurance in Wisconsin With a Car Accident

According to our analysis, Travelers offers the cheapest insurance rates for drivers with one at-fault accident with a $1,675 annual insurance premium for our sample driver.

Travelers’ rate is 23% less expensive than Wisconsin’s average ($2,170) insurance premium for drivers with one accident in their driving history.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Travelers | $1,675 | $139 |

| Erie | $1,871 | $155 |

| State Farm | $1,956 | $163 |

| Wisconsin average | $2,170 | $180 |

Will car insurance rates increase with an accident? Yes, getting into an at-fault accident may cause a rate hike of 27% or $574 per year, showing the importance of shopping for cheaper auto insurance if you have a change on your driving record.

To make sure you get the best rates, be sure to compare quotes with at least three car insurance companies after a car accident.

Cheapest Car Insurance With a DUI in Wisconsin

Wisconsin drivers with DUI offenses on their driving records can find the cheapest car insurance with Progressive, which provided our insurance agents a quote at $1,951 per year or a $162 monthly rate for full coverage.

The average annual rate for drivers with DUI violations is $2,714, making Progressive’s rate 29% cheaper than Wisconsin’s average DUI rate.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $1,951 | $162 |

| Erie | $2,265 | $188 |

| Travelers | $2,580 | $215 |

| Wisconsin average | $2,714 | $226 |

According to Mothers Against Drunk Driving (MADD), car insurance premiums in the state increase by 42% on average for drivers with driving while intoxicated violations (DUI’s).

According to Wisconsin DOT, you will need an SR-22. A Judge may order an ignition interlock device (BAIID) installed in your motor vehicle for 90 to 180 days, depending on the DUI offense’s severity.

Cheapest Car Insurance for Drivers With Poor Credit in Wisconsin

American Family (AmFam) provides the cheapest insurance for drivers with poor credit in Wisconsin with a $1,470 rate for full coverage or 17% less expensive than the average bad credit rate of $1,759 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| American Family | $1,470 | $122 |

| Geico | $1,599 | $123 |

| Progressive | $1,741 | $145 |

| Wisconsin average | $1,759 | $146 |

AutoInsureSavings.org analysis shows drivers who have a poor credit score will pay 10 to 16% more for auto coverage. Drivers with poor credit are more likely to file a claim or get involved in an at-fault accident.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

For that reason, their car insurance costs will not come at the lowest rates. Make sure to maintain good credit scores and pay credit cards on time to ensure that affordable rates for car insurance is what you see.

Cheapest Car Insurance for Young Drivers in Wisconsin

We found young Wisconsin drivers looking for the cheapest full coverage auto insurance is with American Family, which provided our agents a $2,916 annual quote or 43% less expensive than our sample young driver’s average rates.

USAA is the best car insurance for new drivers who qualify, which offered AutoInsureSavings’ agents a $3,014 annual rate for full coverage insurance.

The cheapest for state minimum coverage is American Family, which offered us a quote at $874 per year or 55% cheaper for young or teen drivers. The next best option for younger drivers is Erie Insurance, with a $916 annual rate for liability insurance.

| Insurer | Full coverage | Minimum coverage |

|---|---|---|

| American Family | $2,916 | $874 |

| USAA | $3,014 | $693 |

| Erie Insurance | $3,044 | $916 |

| Geico | $3,241 | $1,161 |

| Progressive | $3,667 | $1,316 |

| State Farm | $3,980 | $1,390 |

| Secura | $4,166 | $1,557 |

| Auto-Owners | $4,578 | $1,614 |

| Allstate | $5,373 | $1,180 |

| Wisconsin average | $5,114 | $1,915 |

*USAA is for qualified military members, their spouses, and direct family members. Your insurance rates may vary based on the driver’s profile.

Statistics show drivers under 25 are more prone to car accidents than older experience drivers, making car insurance costs higher. Our licensed agents recommend young or teen drivers to buy full coverage policies, so they have motor vehicle coverage in an auto accident as an added layer of protection.

It is best to find a company that offers the cheapest car insurance rates for young or teen drivers in the Badger State, such as American Family or Erie Insurance, to cut down on your insurance costs.

Cheapest Car Insurance for Young Drivers with a Speeding Ticket

Young Wisconsin drivers with one speeding violation should look to Erie for the cheapest option for insurance coverage. Erie’s average car insurance cost is $3,154 annually or $2,160 less per year for auto insurance policies with comprehensive and collision coverage.

Erie’s monthly speeding ticket rate of $262 is 41% less expensive than the average $442 monthly rate for younger drivers, giving affordable options to a demographic that typically sees higher rates.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Erie | $3,154 | $262 |

| American Family | $3,217 | $268 |

| Geico | $3,743 | $311 |

| Wisconsin average | $5,314 | $442 |

Cheapest Car Insurance for Young Drivers with an At-Fault Accident

Inexperienced drivers in Wisconsin with one at-fault accident can find the best car insurance with American Family, which provided our agents a $3,377 annual rate ($281 per month) for full coverage insurance.

American Family’s at-fault accident rate is 42% cheaper than Wisconsin’s teen driver accident rate of $5,744 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| American Family | $3,377 | $281 |

| Erie | $3,981 | $331 |

| State Farm | $4,413 | $367 |

| Wisconsin average | $5,744 | $478 |

Best Auto Insurance Companies in Wisconsin

AutoInsureSavings.org team of licensed insurance agents rated the best car insurance companies in Wisconsin by customer service and surveys, J.D. Powers claims satisfaction score, A.M. Best, and the National Association of Insurance Commissioners (NAIC) complaint index.

We found that Auto-Owners, USAA, and American Family Insurance are the best insurers based on excellent customer service, claims satisfaction, and NAIC’s complaint index.

ValuePenguin had similar results from their recent Wisconsin customer survey, with Auto-Owners scoring 100% with customers in claims satisfaction. Erie Insurance scores well in customer service ratings but has higher than the national average (1.00) NAIC’s complaint index at 1.10.

| Auto Insurer | % extremely satisfied with recent claim | % rated customer service as excellent |

|---|---|---|

| Auto-Owners | 100% | 67% |

| USAA | 78% | 62% |

| American Family | 86% | 50% |

| State Farm | 73% | 46% |

| Allstate | 72% | 47% |

| Erie Insurance | 67% | 50% |

| Progressive | 74% | 34% |

| Geico | 64% | 42% |

| Secura | n/a | n/a |

Our licensed insurance agents also collected information on each auto insurance company in Wisconsin from the NAIC, J.D. Power, and A.M. Best’s financial strength ratings.

The car insurance company with the lowest NAIC complaint ratio (0.00) is Secura Insurance. Secura’s complaint index is below the national average of 1.00 at 0.00.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Secura is a regional car insurance company founded in 1900 that we recommend comparing quotes to help Wisconsin residents find lower rates and save money.

The NAIC’s complaint ratio compares the number of complaints an auto insurer has based on its market share in Wisconsin. Any car insurance provider below 1.00 is better than the national average.

Auto-Owners and USAA have the highest J.D. Power claims satisfaction scores of 890 each, and Erie Insurance and State Farm have 880 and 881, respectfully.

| Insurer | NAIC Complaint Index | J.D. Power claims satisfaction score | AM Best Financial Strength Rating |

|---|---|---|---|

| Secura | 0.00 | n/a | A |

| Auto-Owners | 0.42 | 890 | A++ |

| American Family | 0.45 | 862 | A |

| State Farm | 0.66 | 881 | A++ |

| Progressive | 0.61 | 856 | A+ |

| USAA | 0.68 | 890 | A++ |

| Allstate | 0.71 | 876 | A+ |

| Geico | 1.02 | 871 | A++ |

| Erie | 1.10 | 880 | A+ |

A.M. Best financial strength ratings are a grade describing an auto insurer’s financial health and their ability to pay out claims.

While comparison shopping for car insurance companies in Wisconsin, it is essential to remember that several risk factors contribute to your premium cost. Your age, driving experience and even your credit rating can influence your total monthly or annual cost.

It is always best for Wisconsin drivers to compare car insurance plans to find the best company that offers the lowest insurance rate.

Average Car Insurance Costs by City in Wisconsin

We collected insurance quotes from Wisconsin zip codes from top insurance companies and found average rates can vary by $374. The lowest auto policy is in Oshkosh ($1,299), and the highest rate is in Madison ($1,673). Typically, you will pay higher rates if you live in urban cities rather than the state’s rural areas.

Your Wisconsin rate is based not only on your zip code but the type of vehicle, liability limits, marital status, plus a variety of other risk factors (learn more: Understanding How Car Insurance Premiums Are Calculated).

Cheapest Car Insurance in Milwaukee, WI

In Milwaukee, drivers can find the cheapest insurance quotes with Erie Insurance. Erie provided AutoInsureSavings.org agents a rate of $1,215 annually or $101 per month with $100,000 in liability insurance and $500 deductibles for comprehensive and collision coverage.

Erie’s quote is 25% less expensive than the average Milwaukee rate at $1,612.

| Milwaukee Company | Average Premium |

|---|---|

| Erie | $1,215 |

| State Farm | $1,379 |

| Liberty Mutual | $1,588 |

| Milwaukee average | $1,612 |

Cheapest Car Insurance in Madison, WI

Madison drivers can look to Travelers for the cheapest coverage rates, with a quote at $1,243 per year with full coverage insurance. Travelers’ rate is 26% cheaper than Madison’s $1,673 average rates for similar driver profiles.

| Madison Company | Average Premium |

|---|---|

| Travelers | $1,243 |

| State Farm | $1,386 |

| American Family | $1,408 |

| Madison average | $1,673 |

Cheapest Car Insurance in Green Bay, WI

Green Bay drivers can find the cheapest full coverage insurance policy with Erie Insurance, which offered us a $1,197 annual rate for our sample 30-year-old driver with comprehensive and collision $500 deductibles and uninsured motorist coverage.

Erie’s car insurance rate is $443 less annually than Green Bays’ average of $1,640 per year.

| Green Bay Company | Average Premium |

|---|---|

| Erie | $1,197 |

| American Family | $1,317 |

| Liberty Mutual | $1,576 |

| Green Bay average | $1,640 |

Cheapest Car Insurance in Kenosha, WI

Our insurance agents’ cheapest auto insurance rate found in Kenosha is Travelers, with a $1,090 per year rate for a full coverage auto insurance policy. Travelers’ quote is 32% less expensive than Kenosha’s average rate of $1,598 per year.

Both Erie ($1,165) and Geico ($1,430) offer insurance quotes for a full policy with uninsured motorists coverage in Kenosha at least 9% lower than the citywide average.

| Kenosha Company | Average Premium |

|---|---|

| Travelers | $1,090 |

| Erie | $1,165 |

| Geico | $1,430 |

| Kenosha average | $1,598 |

Cheapest Car Insurance in Racine, WI

Drivers in Racine can get cheap auto insurance with State Farm, which provided our licensed agents a $1,050 annual rate for a full coverage insurance policy with $100,000 in liability insurance. State Farm’s quote is 31% less expensive than the average $1,518 yearly rate in Racine.

| Racine Company | Average Premium |

|---|---|

| State Farm | $1,050 |

| American Family | $1,137 |

| Partners Mutual | $1,355 |

| Racine average | $1,518 |

Cheapest Car Insurance in Appleton, WI

Appleton’s least expensive car insurance policy is with Erie, which offered us a quote at $980 per year for full coverage with $500 deductibles for comprehensive and collision coverage. Erie’s full coverage quote is 34% cheaper than Appleton’s average $1,480 rate for 30-year-old drivers.

| Appleton Company | Average Premium |

|---|---|

| Erie | $980 |

| American Family | $1,063 |

| Partners Mutual | $1,321 |

| Appleton average | $1,480 |

Average Car Insurance Cost for All Cities in Wisconsin

| City | Annual Premium Cost | City | Annual Premium Cost |

|---|---|---|---|

| Milwaukee | $1,612 | Union Grove | $1,416 |

| Madison | $1,673 | Summit | $1,339 |

| Green Bay | $1,640 | Mayville | $1,353 |

| Kenosha | $1,598 | Dodgeville | $1,370 |

| Racine | $1,518 | Bloomfield | $1,347 |

| Appleton | $1,480 | Bayside | $1,393 |

| Waukesha | $1,468 | Ohatchee Lake | $1,422 |

| Eau Claire | $1,444 | Lake Wisconsin | $1,359 |

| Oshkosh | $1,299 | Oconto | $1,430 |

| Janesville | $1,437 | Saukville | $1,418 |

| West Allis | $1,470 | Clintonville | $1,437 |

| La Crosse | $1,500 | Viroqua | $1,339 |

| Sheboygan | $1,359 | Mauston | $1,410 |

| Wauwatosa | $1,418 | Prairie du Sac | $1,500 |

| Fond du Lac | $1,337 | French Island | $1,347 |

| New Berlin | $1,480 | East Troy | $1,515 |

| Wausau | $1,347 | Medford | $1,526 |

| Brookfield | $1,353 | Prescott | $1,359 |

| Menomonee Falls | $1,524 | West Milwaukee | $1,370 |

| Greenfield | $1,437 | Mosinee | $1,418 |

| Beloit | $1,526 | Baldwin | $1,347 |

| Oak Creek | $1,339 | Marshall | $1,479 |

| Franklin | $1,347 | Chilton | $1,393 |

| Sun Prairie | $1,370 | Rochester | $1,494 |

| Manitowoc | $1,410 | North Hudson | $1,437 |

| West Bend | $1,347 | Lancaster | $1,353 |

| Fitchburg | $1,526 | Kiel | $1,337 |

| Mount Pleasant | $1,359 | Stanley | $1,519 |

| Stevens Point | $1,393 | Merton | $1,410 |

| Superior | $1,337 | Horicon | $1,526 |

| Neenah | $1,418 | Combined Locks | $1,505 |

| Caledonia | $1,353 | Omro | $1,370 |

| Muskego | $1,479 | Pulaski | $1,339 |

| De Pere | $1,437 | Bloomer | $1,518 |

| Mequon | $1,526 | Black River Falls | $1,418 |

| Watertown | $1,410 | Sauk City | $1,337 |

| South Milwaukee | $1,494 | Wrightstown | $1,530 |

| Pleasant Prairie | $1,502 | Seymour city | $1,347 |

| Germantown | $1,488 | Peshtigo | $1,393 |

| Howard | $1,337 | Waterloo | $1,410 |

| Middleton | $1,479 | Barron | $1,359 |

| Fox Crossing | $1,339 | Ellsworth | $1,418 |

| Onalaska | $1,370 | Howards Grove | $1,589 |

| Cudahy | $1,505 | Brodhead | $1,353 |

| Marshfield | $1,347 | Tomahawk | $1,437 |

| Menasha | $1,410 | Thiensville | $1,337 |

| Wisconsin Rapids | $1,359 | Ladysmith | $1,418 |

| Ashwaubenon | $1,526 | Boscobel | $1,370 |

| Oconomowoc | $1,513 | New Holstein | $1,339 |

| Menomonie | $1,337 | Brillion | $1,410 |

| Beaver Dam | $1,511 | Yorkville | $1,505 |

| Kaukauna | $1,370 | Lodi | $1,494 |

| Bellevue | $1,526 | Algoma | $1,359 |

| River Falls | $1,393 | Arcadia | $1,410 |

| Weston | $1,437 | Paddock Lake | $1,337 |

| Hartford | $1,418 | Genoa City | $1,347 |

| Salem Lakes | $1,353 | Johnson Creek | $1,479 |

| Whitewater | $1,339 | Oostburg | $1,370 |

| Pewaukee | $1,410 | Lake Delton | $1,437 |

| Greendale | $1,359 | Sherwood | $1,339 |

| Chippewa Falls | $1,500 | Kewaunee | $1,526 |

| Whitefish Bay | $1,418 | Lake Wissota | $1,505 |

| Allouez | $1,370 | Wisconsin Dells | $1,393 |

| Hudson | $1,337 | Walworth | $1,494 |

| Waunakee | $1,513 | Amery | $1,347 |

| Shorewood | $1,404 | Oconto Falls | $1,437 |

| Stoughton | $1,339 | Somerset | $1,359 |

| Verona | $1,479 | Hortonville | $1,370 |

| Glendale | $1,513 | Hayward | $1,337 |

| Plover | $1,359 | Winneconne | $1,353 |

| Suamico | $1,393 | Bohners Lake | $1,479 |

| Fort Atkinson | $1,404 | Juneau | $1,526 |

| Platteville | $1,347 | Como | $1,494 |

| Baraboo | $1,370 | Mineral Point | $1,393 |

| Harrison | $1,418 | Williams Bay | $1,404 |

| Brown Deer | $1,337 | Mondovi | $1,339 |

| Port Washington | $1,437 | Fennimore | $1,505 |

| Richfield | $1,526 | Spooner | $1,347 |

| Grafton | $1,353 | Nekoosa | $1,512 |

| Cedarburg | $1,516 | Wales | $1,359 |

| Little Chute | $1,404 | Maine | $1,370 |

| Waupun | $1,393 | Luxemburg | $1,337 |

| Two Rivers | $1,370 | Delavan Lake | $1,393 |

| Burlington | $1,339 | Belleville | $1,526 |

| Sussex | $1,347 | Lomira | $1,430 |

| Monroe | $1,418 | Deerfield | $1,479 |

| Marinette | $1,337 | Osceola | $1,525 |

| Portage | $1,359 | New Lisbon | $1,494 |

| Oregon | $1,500 | Poynette | $1,353 |

| DeForest | $1,347 | Tainter Lake | $1,404 |

| Elkhorn | $1,505 | Westby | $1,337 |

| Holmen | $1,517 | Fredonia | $1,370 |

| Sparta | $1,499 | Darlington | $1,430 |

| St. Francis | $1,393 | Dousman | $1,541 |

| Reedsburg | $1,522 | North Prairie | $1,339 |

| Tomah | $1,337 | Neillsville | $1,528 |

| Hartland | $1,339 | Belgium | $1,393 |

| Merrill | $1,479 | Cuba City | $1,486 |

| Hobart | $1,430 | Cumberland | $1,347 |

| New Richmond | $1,370 | Brice Prairie | $1,359 |

| Shawano | $1,404 | Shorewood Hills | $1,337 |

| Sturgeon Bay | $1,526 | Park Falls | $1,494 |

| McFarland | $1,353 | Abbotsford | $1,507 |

| Plymouth | $1,339 | Schofield | $1,404 |

| Rice Lake | $1,370 | Wautoma | $1,418 |

| Somers | $1,359 | Denmark | $1,536 |

| Delavan | $1,393 | Chetek | $1,423 |

| Pewaukee village | $1,496 | Pardeeville | $1,429 |

| Monona | $1,494 | Lake Wazeecha | $1,339 |

| Mukwonago | $1,337 | Kohler | $1,479 |

| Jefferson | $1,347 | Adams | $1,370 |

| Lake Geneva | $1,404 | Cedar Grove | $1,353 |

| Sheboygan Falls | $1,423 | Eagle | $1,339 |

| Ashland | $1,528 | Colby | $1,404 |

| Kronenwetter | $1,370 | Clinton | $1,393 |

| Ripon | $1,520 | Hammond | $1,359 |

| Antigo | $1,534 | Redgranite | $1,428 |

| Hales Corners | $1,359 | New Glarus | $1,337 |

| Altoona | $1,511 | Washburn | $1,533 |

| Rhinelander | $1,500 | Cameron | $1,514 |

| Delafield | $1,347 | St. Croix Falls | $1,370 |

| Mount Horeb | $1,404 | Crandon | $1,423 |

| Windsor | $1,393 | Ixonia | $1,526 |

| Jackson | $1,370 | Roberts | $1,540 |

| Cottage Grove | $1,339 | Lake Ripley | $1,347 |

| New London | $1,337 | Fall River | $1,428 |

| Kimberly | $1,479 | Mazomanie | $1,393 |

| Lake Hallie | $1,499 | Campbellsport | $1,404 |

| Fox Point | $1,423 | Butler | $1,359 |

| Sturtevant | $1,526 | Spencer | $1,521 |

| Rib Mountain | $1,353 | Browns Lake | $1,337 |

| Elm Grove | $1,370 | King | $1,497 |

| Twin Lakes | $1,428 | Cornell | $1,339 |

| Waupaca | $1,359 | Wind Point | $1,347 |

| Lake Mills | $1,393 | Trempealeau | $1,370 |

| Prairie du Chien | $1,339 | Palmyra | $1,404 |

| Milton | $1,511 | Port Edwards | $1,423 |

| Edgerton | $1,369 | Weyauwega | $1,516 |

| Waterford | $1,505 | Durand | $1,479 |

| Slinger | $1,494 | Osseo | $1,353 |

| Berlin | $1,423 | Whiting | $1,428 |

| Wind Lake | $1,337 | West Baraboo | $1,490 |

| Evansville | $1,404 | Darien | $1,359 |

| Rothschild | $1,428 | Randolph | $1,339 |

| Tichigan | $1,347 | Galesville | $1,426 |

| North Fond du Lac | $1,444 | Fox Lake | $1,353 |

| Columbus | $1,429 | Spring Green | $1,370 |

| Bristol | $1,337 | Random Lake | $1,393 |

| Richland Center | $1,370 | Eagle River | $1,404 |

| West Salem | $1,353 | Sharon | $1,339 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Minimum Auto Insurance Coverage Requirements in Wisconsin

According to the Office of the Commissioner of Insurance, all Wisconsin drivers must have the minimum liability limits:

| Liability | Minimum coverage |

|---|---|

| Bodily injury liability | $25,000 per person and $50,000 per accident |

| Property damage liability | $10,000 per accident |

| Uninsured motorists bodily injury | $25,000 per person and $50,000 per accident |

Wisconsin requires drivers to carry uninsured motorist coverage since the uninsured rate is 14.3%, according to the Insurance Information Institute (III.org).

AutoInsureSavings.org agents also recommend higher liability limits with collision and comprehensive coverage. You will be responsible for the extra costs in an at-fault auto accident if the cost of bodily injury and property damage exceed liability limits.

To learn more about Wisconsin’s most affordable car insurance options, enter your zip code or contact the auto insurance experts at AutoInsureSavings.org.

Our licensed insurance professionals will be happy to answer any questions you have.

Methodology

AutoInsureSavings.org comparison shopping study used a full-coverage auto policy for a 30-year-old driving a 2018 Honda Accord with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person / $100,000 per accident |

| Property damage liability | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured / underinsured motorist bodily injury | $50,000 per person / $100,000 per accident |

| Comprehensive and collision coverage | $500 deductible |

We used insurance rates for drivers with accident histories, credit scores, and marital status for other Wisconsin rate analyses. We used car insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your insurance rates may vary when you get quotes.

Sources

– National Association of Insurance Commissioners. “Market Share Reports for Property/Casualty Groups and Insurance Companies.”

– Wisconsin Department of Transportation. “Minimum Insurance Requirements.”

– Wisconsin DOT. “Proof of Auto Insurance.”

– Insurance Information Institute. “How Much Auto Coverage Do I Need?.”

– MADD.org. “Drunk Driving & Insurance Statistics.”

– National Highway Traffic Safety Administration. “Traffic Safety Facts.”

Frequently Asked Questions

Who has the cheapest Wisconsin car insurance?

Erie Insurance offers the state minimum’s cheapest auto insurance rate at $339 per year. The average annual car insurance premiums for minimum coverage in Wisconsin are $580, and Erie’s premium costs 42% less per year. Other good options for affordable car insurance are Travelers at $368 and American Family at $453 per year.

How much is Wisconsin car insurance per month?

The average car insurance costs $1,596 in Wisconsin for full coverage insurance and $580 per year for state minimum coverage for a 30-year-old driver with a clean driving record.

How much is Wisconsin full coverage car insurance?

The average cost of full coverage car insurance in Wisconsin is $1,596 annually or $133 per month with $100,000 per accident in liability coverage. Travelers’ average rate for full coverage is $1,141 a year or $95 per month or 29% less per year, while Erie’s $1,330 is 17% below Wisconsin’s average.

How can I save on car insurance in Wisconsin?

The best way to save on your insurance premium is to find out from your car insurance provider if you are eligible for a money-saving driver discount offered by the company. Many insurance providers in Wisconsin will lower your overall car insurance rates if you have more than one policy with them, such as life or home insurance policies.

Another way to save on your car insurance premium is to practice safe driving habits and maintain clean driving records. Many auto insurers offer good driving discounts for drivers in Wisconsin that have clean driving records for three to five years. One example is Travelers Insurance which offers good drivers a safe driver discount of up to 10% for three years of good driving and 23% for being accident-free for five years. Not only will you keep and your passengers safe, but it will also help you avoid car accidents or traffic violations that could cause your premium to increase.

What is the best car insurance in Wisconsin?

The best auto insurance in Wisconsin will be a full coverage policy.

Is Wisconsin a no-fault state?

No, Wisconsin is an at-fault state for auto insurance.

Is it illegal to drive without car insurance in Wisconsin?

Yes, all WI drivers need to carry the minimum auto insurance required in WI to drive legally. If you are hesitant to purchase auto insurance because of the cost, make sure to shop around for Wisconsin auto insurance quotes to find the best cheap car insurance in Wisconsin.

Is Wisconsin a PIP state?

No, WI doesn’t require drivers to carry PIP insurance on their Wisconsin auto insurance policies.

What happens if you are caught without car insurance in WI?

Drivers driving without auto insurance in WI can face fines and license suspension.

Is $500 a lot for car insurance?

$500 a year is reasonable, but if you are paying $500 per month, this is very expensive. Make sure to get quotes to find more affordable Wisconsin auto insurance in your area.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Eric Stauffer

Licensed Insurance Agent

Eric Stauffer is an insurance agent and banker-turned-consumer advocate. His priority is educating individuals and families about the different types of insurance coverage. He is passionate about helping consumers find the best coverage for their budgets and personal needs. Eric is the CEO of C Street Media, a full-service marketing firm and the co-founder of ProperCents.com, a financial educat...

Licensed Insurance Agent

UPDATED: Jan 15, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.