If You Don’t Own a Vehicle? What are the Advantages of Buying 3rd Party Rental Car Coverage?

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Zach Fagiano

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Licensed Insurance Broker

UPDATED: Mar 15, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Mar 15, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

So, you’re about to head out on the road trip adventure of a lifetime, but there’s just one problem – you need to get a car; or, you don’t want to use your own.

Ever since moving out of your parent’s house, you’ve relied on public transit, but the temptation of the open road had become too much to resist. A car rental agency can solve this problem easily. However, before you head down to your local office, you should take a moment and pause.

Since you don’t currently have an auto insurance policy, you’ll need to buy your own before hitting the road.

Many people have a credit card company which offers personal auto insurance. What most do not realize is if you do decided to use the credit card coverage, the credit card agreement usually requires you ro pay all damages upfront before you can file a claim.

Companies that rent vehicles have their own in-house policies, but they have issues when compared to the product third party providers have to offer.

What are the advantages of buying third-party rental car insurance? We’ll discuss them at length in today’s blog post.

Unlike using your credit card, it is included at booking, and the claims process is much easier if you need to file one.

Why Consider Third-Party Rental Car Insurance

The purpose of rental car insurance is to help you mitigate any costs in the event there is rental vehicle damage. While you could use a personal policy or a credit card, a third-party policy could be more beneficial for you.

For example, when renting a vehicle out to customers, agents will often present customers with a CDW (collision damage waiver) or an LDW (loss damage waiver). This sounds reasonable to many, as they realize their auto insurance only covers their own vehicle, or as a non-owner of a vehicle, they correctly realize they need to be covered in the event of theft or an accident.

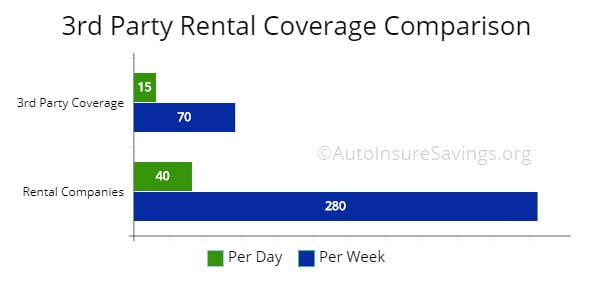

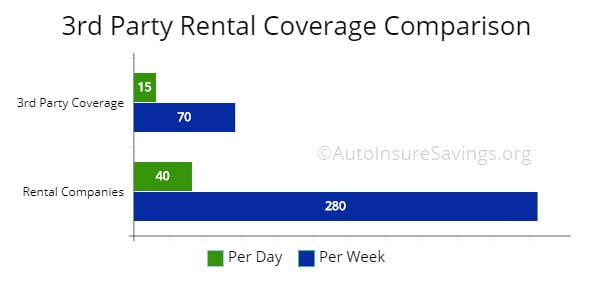

However, the cost of buying such a policy can be quite steep, as many rental agents price their policies well above the per-rental days cost they pay to their insurance company.

Note: As illustrated, if you do decide to go with a rental company, the cost can be quite expensive. With a third party, you can reduce this from 1/4 to 1/3 of the price. Keep this in mind and plan ahead the next time you need a rental.

Note: As illustrated, if you do decide to go with a rental company, the cost can be quite expensive. With a third party, you can reduce this from 1/4 to 1/3 of the price. Keep this in mind and plan ahead the next time you need a rental.

Some companies charge as much as $30 per day – this can be more than the per day cost to rent the actual vehicle. Thankfully, you are not legally bound to purchase insurance directly from agencies.As long as you bring in proof that you are already covered by a third-party insurer, you can drive off the lot with the car you have reserved.

When you get your car rental coverage for damage from a company like Bonzah, not only will you pay less due to the lack of mark-up over the insurance policy the rental company already holds, but you’ll benefit from the competition present on the open market.

When companies compete against each other to give the consumer the lowest possible price, you win. It’s as simple as that.

It Offers more Comprehensive Rental Car Coverage

Not only can CDW and LDW rental coverages offered by car rental companies be ungodly expensive, but they tend to offer a bare minimum.

In some U.S. states, minimum liability can go as low as $25,000 – given the cost of healthcare and the litigious nature of Americans, that amount could be insufficient even in a minor fender bender accident (damage to the bumper + whiplash + obscene hospital charges will clean you out).

When you opt for a third-party policy, you can buy into liability plans which cover up to $2,000,000 or more for a fraction of the cost of an in-house plan purchased at the counter of a rental car agency.

Below is a list of companies offer and the low plus high-end costs.

As you can see for some the cost can be exceedingly high.

| Coverage | What does it cover? | Typical Cost | What will your policy cover? |

|---|---|---|---|

| Supplemental Liability Coverage | Increases your liability coverage up to $1 million | $10 to $20/day | Personal liability (If you own a car you should have this) |

| Collision Damage Waiver / Loss Damage Waiver | Waives your responsibility for damage to or theft of the rental car | $11 to $49/day | Comprehensive and collision (If you have full coverage you probably have this) |

| Personal Accident | Provides medical and accidental death benefits if you or your passengers are injured or killed in an accident | $4 to $8/day | Personal injury protection and health insurance (Many states require this) |

| Personal Effects Coverage | Reimburses you for any personal property that is stolen from a rental vehicle | $2.50 to $7/day | Homeowners or renters coverage |

| Total | $27.50 to $84/day |

What’s more, CDW and LDW policies are often narrow in scope – in some cases, these policies are no fault – that is to say, the policy will pay for the other driver’s expenses, but not yours.

In other words, they only cover collision, leaving you to pay out of pocket for your medical expenses.

Conversely, third-party policies often cover a wide slate of expenses, including the value of goods lost in an accident.

Before adding a policy to your virtual shopping cart, read the fine print so you’ll know exactly what a policy does and does NOT cover.

In most cases, though, they go much further than the standard policy offered by your agent, making a third-party insurer the superior choice.

The Claims Process is Quick and Efficient

You can be the best driver on the road, but it doesn’t matter if the guy behind you is checking their phone and rear-ends you at a stoplight.

Sometimes, accidents happen even when we do nothing wrong.

If you opt to take third-party insurance over your rental agents, know that you’ll have to deal with the charges they make upfront.

Most credit card collision is secondary, meaning it pays only what you can’t first recover from other insurance, and you may not want to risk a big hit on your regular auto insurance for damage to a rental.

For this reason, make sure you keep plenty of room on your card or have enough cash in your checking account to pay them off initially.

Then, keep all the documentation stemming from these charges, copy every receipt, the rental contract, and anything else relevant to the case, and open a claim with your insurance company.

Send it in, and within a short period of time, you should receive a check that will cover all the costs you incur upfront.

It can be a pain in the rear at the start, but even when the worst-case scenario comes to pass, you’ll pay far less than if you were to agree to the egregious terms set out by the CDW/LDW policies, especially when you consider how little they cover in the first place.

Liability Coverage Options & Financial Benefits

Third-party insurance policies offer the best deal for consumers (and it’s not even close)

When you total up both the upfront costs and how much you can expect to pay should something bad happen, holders of third-party insurances tend to come out ahead in both instances?

Rental car companies charge insane amounts of money for policies that barely meet state or provincial minimums while limiting coverage to specific types of damage.

On the other hand, third party insurance providers do not have the luxury of having a ‘captive audience’. This is typically because they compete for customers on the open market with other companies.

This means that not only will you pay a lot less per day for coverage, but it provides a much bigger payout should you get into an accident, and covers a wider slate of damages.

Having to cover rental car company damages upfront is the only drawback, but it is one that quickly disappears once you open a claim and submit documentation of the expenses you incurred.

Top Companies Offering Primary Coverage

What some drivers do not realize is using your own auto policy when renting a vehicle is a cheap way to go. However, if you do have to file a claim your premiums are probably going to go up. Even if the accident wasn’t your fault. If you have 3rd party policy you would not have to be concerned about this.

All the companies below are primary coverage so they will pay out before your own insurer does.

| Company | Cost | Primary Coverage |

|---|---|---|

| Bonzah | Approximately $8.00 per day | It will pay out before your own policy. |

| Allianz | Approximately $9.00 per day | It will pay out before your own insurer. |

| Insure My Rental Car | Approximately $8.00 per day | You will not need to use your own insurer. |

Final Thoughts on Finding Rental Vehicle Insurance Coverage

Have you opted for third-party insurance over rental car company policies in the past?

What was your experience?

References

https://www.consumeraffairs.com

https://www.iii.org/article/rental-car-insurance

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Zach Fagiano

Licensed Insurance Broker

Zach Fagiano has been in the insurance industry for over 10 years, specializing in property and casualty and risk management consulting. He started out specializing in small businesses and moved up to large commercial real estate risks. During that time, he acquired property & casualty, life & health, and surplus lines brokers licenses. He’s now the Senior Vice President overseeing globa...

Licensed Insurance Broker

UPDATED: Mar 15, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.