Mechanical Breakdown Insurance vs. Extended Warranties & Beneficial Add-Ons Explained

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Few things are more frustrating in life than having issues with your vehicle.

And a huge mechanic bill.

Fixing major (and even some minor) mechanical issues with a vehicle can add up quickly.

Car insurance coverage is important if you ever get into an auto accident, but what about mechanical breakdown insurance?

Mechanical breakdown insurance is sometimes confused with “regular” car insurance since they are packaged together.

Read More: Types of Auto Insurance Coverage

How much coverage do you actually need if you have a car prone to mechanical problems?

Is mechanical breakdown car insurance, otherwise known as MBI, worth it?

What’s the difference between a warranty and MBI?

Note: Drivers often confuse mechanical breakdown insurance with a warranty. Both can be fairly expensive. Mechanical breakdown coverage payments will be combined into your policy. The cost could be from $30 to $75 a month. While the warranty is paid upfront and combined with the purchase of your vehicle. The average cost is $1,200.

Note: Drivers often confuse mechanical breakdown insurance with a warranty. Both can be fairly expensive. Mechanical breakdown coverage payments will be combined into your policy. The cost could be from $30 to $75 a month. While the warranty is paid upfront and combined with the purchase of your vehicle. The average cost is $1,200.

Let’s discuss.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

What is an Extended Warranty?

An extended car warranty is offered by new and used car dealerships which usually applies to a mechanical breakdown.

Most people know them as limited or extended warranties.

You may be familiar with a 5-year/50,000 mile and 10-year/100,000 power-train warranty?

This factory warranty is offered by the car manufacturer.

The warranty I am talking about is an extended car warranty which covers problems with a mechanical part not covered by the manufacturer’s warranty.

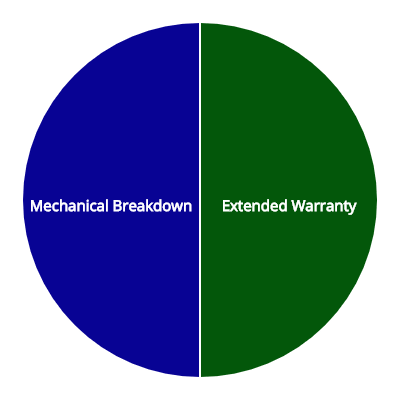

Note: Illustrated above is the repair cost of major components in a vehicle and compared to the cost of MBI over 6 months. Trying to find the cost of MBI is difficult. However, the estimates I was able to get ranged from $800 to $1,500 per year. This would include a $250 deductible.

Note: Illustrated above is the repair cost of major components in a vehicle and compared to the cost of MBI over 6 months. Trying to find the cost of MBI is difficult. However, the estimates I was able to get ranged from $800 to $1,500 per year. This would include a $250 deductible.

What is mechanical breakdown insurance?

Mechanical breakdown coverage or MBI is coverage that pays for mechanical car repairs unrelated to an auto accident.

This coverage option is purchased through your insurer.

Similar to a warranty bought through an auto dealer, MBI pays for a car repair cost beyond the manufacturer’s warranty.

Since insurance companies are regulated by the state, there could be advantages with mechanical breakdown insurance over a warranty.

Listed below are the items covered and not covered by MBI.

| Parts Covered by MBI | Not Covered |

|---|---|

| Engine | Tune-ups |

| Transmission | Oil changes |

| Exhaust | Tire repair or rotation |

| Air conditioning | Damage caused by misuse |

| Electrical Components | Intentional damage |

How does MBI work?

If you’re worried about mechanical issues down the road and you don’t want to pay for it out of pocket, MBI could be an option for you.

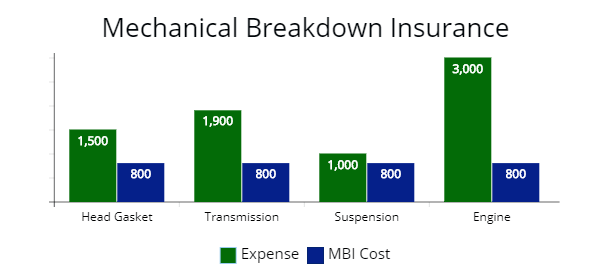

Note: Illustrated above is the average cost to repair components on your vehicle. If you are looking for coverage through a warranty or MBI, you want to be sure you are covered for big-ticket items.

Note: Illustrated above is the average cost to repair components on your vehicle. If you are looking for coverage through a warranty or MBI, you want to be sure you are covered for big-ticket items.

MBI covers expensive repairs that are not covered under your warranty and are not a result of an accident.

For example, you find out you need to replace your brakes or brake pad.

MBI should cover it.

Depending on the insurance company you get a policy, you could be covered for steering, air conditioning, and fuel system repairs.

Policy requirements vary from company to company, but in most cases an insurance plan is limited to vehicles with less than 100,000 miles and less than 7 years old.

Listed below are insurance companies offering MBI plans.

They are limited with the mileage.

Plus, Progressive and USAA use a third-party company which is more akin to a warranty, in my opinion.

| Company | Term | Deductible | ||

|---|---|---|---|---|

| Mercury | Up to seven years and 100,000 miles | $250 - $500 | ||

| Progressive (Warranty Direct) | Up to seven years and 100,000 miles | $250 - $500 | ||

| Geico | Up to 15 months old and with less than 15,000 miles. | $250 | ||

| USAA (Assurant Solutions) | 10 years old or newer with less than 115,000 mile | $250 - $500 |

It is difficult to find out the cost for protection for each insurance company.

USAA through Assurant doesn’t say and neither does Progressive’s WarrantyDirect company.

According to ValuePenguin, they could find a quote for $30 with a $250 deductible. I don’t believe this one.

While the Wall Street Journal says the coverage goes from $75 up to $400 per year.

Personally, I think the cost, if you include the deductible, would be from $800 to $1,500 per year.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

How does an extended warranty work?

Dealerships may also offer you an option to purchase a warranty for additional coverage for repairs and replacements.

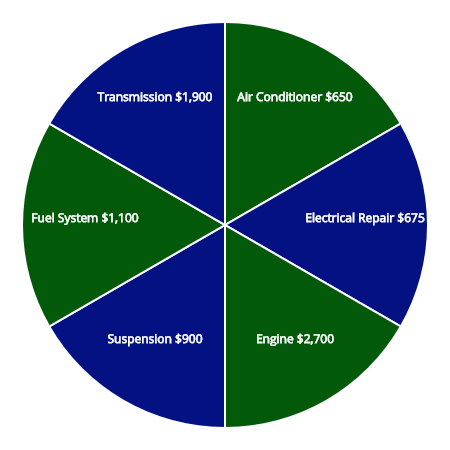

Note: A warranty could be an expensive gamble. Particularly if you never use it. Illustrated above are common vehicle repairs and the average cost a warranty.

Note: A warranty could be an expensive gamble. Particularly if you never use it. Illustrated above are common vehicle repairs and the average cost a warranty.

This, of course, extends for a certain period of time or set number of miles.

Some go all the way up to five years or 60,000 miles.

Depending on your warranty, you may have to take your vehicle to a specific licensed repair shop.

The cost of this type of additional warranty varies depending on the dealership and the model of the vehicle – but the average warranty extension is about $1,200.

Below are the advantages and disadvantages of an extended car warranty.

| Advantages | Disadvantages |

|---|---|

| Tailor extended warranty to fit specific needs. | Extended warranties are expensive. |

| Cover costly repairs and technology. | Extended warranties don't cover all repairs. |

| Dealers take care of paperwork and payment. | Limited access to approved repair shops. |

Mechanical Breakdown Insurance vs Extended Warranty

While a warranty can give you peace of mind (especially if you are purchasing a vehicle with a low reliability rating), it is still fairly expensive.

MBI could be the better option.

A breakdown policy will cover more parts and systems than a traditional (and some extended) warranties will cover.

It also tends to be less expensive.

Also, it can be added on to your auto policy and paid monthly rather than as a lump sum.

And you are not limited to the licensed repair facility where the vehicle can be taken in for repairs.

Furthermore, you can transfer the policy if you sell the car.

Read Your Warranty Closely

As mentioned previously, if you purchased a new vehicle it should come with a manufacturer’s warranty.

Most of these are good for a few years after the purchase date or for a set number of miles.

Listed below are car manufacturers and the warranties offered.

When you buy a vehicle you should have this at no additional charge.

| Brand | Basic Coverage | Powertrain Coverage | Corrosion Coverage | Roadside Assistance |

|---|---|---|---|---|

| Volkswagen | 6/72,000 | 6/72,000 | 7/100,000 | 3/36,000 |

| Hyundai | 5/60,000 | 10/100,000 | 7/Unlimited | 5/Unlimited |

| Genesis | 5/60,000 | 10/100,000 | 7/Unlimited | 5/Unlimited |

| Mitsubishi | 5/60,000 | 10/100,000 | 7/100,000 | 5/Unlimited |

| Kia | 5/60,000 | 10/100,000 | 5/100,000 | 5/60,000 |

| Jaguar | 5/60,000 | 5/60,000 | 6/Unlimited | 5/60,000 |

| Infiniti | 4/60,000 | 6/70,000 | 7/Unlimited | 4/Unlimited |

| Tesla | 4/50,000 | 8/Unlimited | -- | 4/50,000 |

| Lincoln | 4/50,000 | 6/70,000 | 5/Unlimited | Unlimited |

| Cadillac | 4/50,000 | 6/70,000 | 6/Unlimited | 6/70,000 |

| Buick | 4/50,000 | 6/70,000 | 6/100,000 | 6/70,000 |

| Lexus | 4/50,000 | 6/70,000 | 6/Unlimited | 4/Unlimited |

| Acura | 4/50,000 | 6/70,000 | 5/Unlimited | 4/50,000 |

| Audi | 4/50,000 | 4/50,000 | 12/Unlimited | 4/Unlimited |

| BMW | 4/50,000 | 4/50,000 | 12/Unlimited | 4/Unlimited |

| Mini | 4/50,000 | 4/50,000 | 12/Unlimited | 4/Unlimited |

| Fiat | 4/50,000 | 4/50,000 | 5/Unlimited | 4/Unlimited |

| Volvo | 4/50,000 | 4/50,000 | 12/Unlimited | 4/Unlimited |

| Porsche | 4/50,000 | 4/50,000 | 12/Unlimited | 4/50,000 |

| Land Rover | 4/50,000 | 4/50,000 | 6/Unlimited | 4/50,000 |

| Alfa Romeo | 4/50,000 | 4/50,000 | 5/Unlimited | 4/Unlimited |

| Mercedes | 4/50,000 | 4/50,000 | 4/50,000 | 4/50,000 |

| Smart | 4/50,000 | 4/50,000 | 4/50,000 | 4/50,000 |

| Chevrolet | 3/36,000 | 5/60,000 | 6/100,000 | 5/60,000 |

| GMC | 3/36,000 | 5/60,000 | 6/100,000 | 5/60,000 |

| Chrysler | 3/36,000 | 5/60,000 | 5/100,000 | 5/100,000 |

| Dodge | 3/36,000 | 5/60,000 | 5/100,000 | 5/100,000 |

| Ram | 3/36,000 | 5/60,000 | 5/100,000 | 5/100,000 |

| Ford | 3/36,000 | 5/60,000 | 5/Unlimited | 5/60,000 |

| Jeep | 3/36,000 | 5/60,000 | 5/100,000 | 5/60,000 |

| Honda | 3/36,000 | 5/60,000 | 5/Unlimited | 3/36,000 |

| Mazda | 3/36,000 | 5/60,000 | 5/Unlimited | 3/36,000 |

| Nissan | 3/36,000 | 5/60,000 | 5/Unlimited | 3/36,000 |

| Subaru | 3/36,000 | 5/60,000 | 5/Unlimited | 3/36,000 |

| Toyota | 3/36,000 | 5/60,000 | 5/Unlimited | 2/Unlimited |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Extended Warranties on Used Vehicles

In some cases, dealerships will also offer limited or extended warranties for used vehicles, too.

These warranties typically offer minimal coverage and will pay for issues that are directly related to manufacturer errors – not routine maintenance or problems that arise from normal wear and tear.

However, it is a good idea to read over your warranty carefully to see what it covers and what it doesn’t.

This helps you identify where you need to supplement with mechanical breakdown coverage or an extended car warranty.

What about recurring mechanical problems?

However, you might have recurring mechanical issues with your vehicle, you might have a lemon on your hands.

If a vehicle owner has a “lemon”, it means it cannot be fixed by the manufacturer – and no amount of insurance product will cover it.

In this unfortunate scenario, you’ll need to file a lemon claim.

Lemon laws vary from state to state and you will need to prove that you fit the criteria before starting the process.

For example, a lemon law attorney in California, such as Cline APC, will need proof that your vehicle has had at least two repair attempts or that it was out of commission for thirty days within the warranty period.

The attorney will then file a claim with the manufacturer so you can receive either full compensation or have the vehicle replaced.

Used car lemon laws are available to consumers in six states:

- Hawaii

- Massachusetts

- Minnesota

- New Jersey

- New York

- Rhode Island

Each state has used car lemon laws with multiple vehicle classifications for coverage based on age and odometer reading.

Below is a comparison of the six states:

| State - Used Vehicles | Days / Warranty | Miles |

|---|---|---|

| Hawaii | 90 day/5,000 mile | less that 25,000 miles |

| Massachusetts | 90 day/3,750 mile | less than 40,000 miles |

| Minnesota | 60 day/2,500 mile | less than 36,000 miles |

| New Jersey | 90 day/3,000 mile | less than 24,000 miles |

| New York | 90 day/4,000 mile | less than 36,000 miles |

| Rhode Island | 60 day/3,000 mile | less than 36,000 miles |

Understand What the Policies Provide

Many people assume that having an auto insurance policy means that ALL of your car troubles will be covered.

Unfortunately, this is not true in most cases.

Generally, an auto insurance premium is designed to cover repairs in the case of an accident or other types of damage.

Basic insurance policies do not cover mechanical repairs or even normal maintenance.

However, there are different types of policies you can purchase to provide additional coverage.

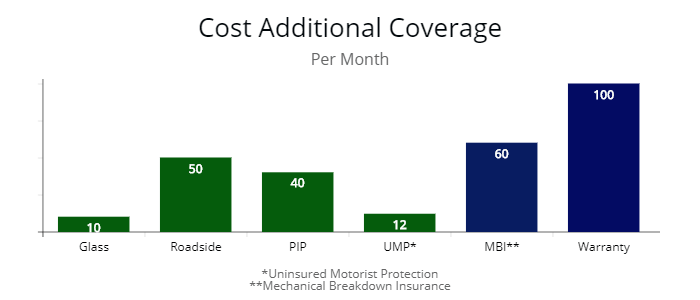

Note: Illustrated above are additional add-ons with MBI and a warranty. (Illustrated in blue). The add-ons are not going to protect your vehicle from a mechanical breakdown. I added them to illustrate how expensive MBI and a warranty are compared to additional coverage. Though the warranty is paid all upfront, I used $1,200 or $100 per month.

Note: Illustrated above are additional add-ons with MBI and a warranty. (Illustrated in blue). The add-ons are not going to protect your vehicle from a mechanical breakdown. I added them to illustrate how expensive MBI and a warranty are compared to additional coverage. Though the warranty is paid all upfront, I used $1,200 or $100 per month.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Glass Coverage

This coverage will pay for repairs or replacements to the glass on your car, in case your windshield is chipped by a rock or a window is broken.

The table below compares the cost to replace auto glass by vehicle:

| Vehicle Type | Repair (less than 6in crack) | Replace (greater than 6in crack) |

|---|---|---|

| Honda Civic | $99.00 | $299.00 |

| Toyota Camry | $109.00 | $319.00 |

| Mercedes CLA250 | $145.00 | $391.07 |

| Ford Focus | $120.00 | $308.98 |

| Ford F-150 | $115.00 | $249.00 |

Gap Coverage

If your insurance policy will not cover the complete cost of your vehicle if it gets totaled, you might want to consider purchasing gap coverage.

This will provide you with additional insurance to pay off the balance of your car loan.

Excess Wear and Tear

Some insurance companies will allow for excess and normal wear and tear protection to be added on to cover issues that could diminish the value of your vehicle.

This is typically offered only for leased vehicles.

It includes paint damage, surface dent repairs, interior surface rips, tears, and stain cleaning, wheel cover replacement, and tire protection and wear.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Accident Coverage

While states require a set minimum coverage for accidents, you may want to consider additional add-ons to protect yourself in case you are the driver at fault.

Personal injury protection will cover medical expenses for yourself and passengers, even if you are at fault.

Uninsured motorist coverage is also something to consider, in case the other party does not have insurance to pay for damages.

Additional Services

Roadside assistance can save you from the nightmare of being stuck on the side of the road because your engine overheated or a tire blew out.

An insurance company will offer this vehicle service contract option, but they may still include additional fees if your vehicle needs to be towed or if it is located out of the designated service range, such as in a different state.

To get excellent coverage, you may want to join full-service car associations, like AAA and AARP.

Auto clubs for specific vehicle companies like the GM Motor Club are an excellent choice.

Memberships often include free roadside towing and assistance.

Credit Cards & Buyers Clubs

Some services like credit cards and buyer’s clubs (Like Sam’s Club and Costco) offer premium options with roadside assistance or discounts.

This can be a great deal if you already have a membership with one of these companies!

Credit Card Companies Roadside Assistance

| Type | Coverage | Cost |

|---|---|---|

| Mastercard | Towing, Tire Replacement, Fuel Delivery, Jump Start | Billed to your card, typically 3 to 15 dollars. |

| Visa | Towing, Tire Replacement, Lockout, Jump Start, Winching, Fuel Delivery | $59.95 per dispatch |

| American Express | Towing, Tire Replacement, Lockout, Jump Start, Winching, Fuel Delivery | Price Quote |

Consider Purchasing Comprehensive Coverage

You don’t want to think about the hassle of fixing car problems and scraping together the money to do it.

At the end of the day, it is best to be prepared for a worst-case scenario so you have a covered repair.

Many of us, including myself, all had that one vehicle in our life that seems to cause us nothing but trouble.

To avoid issues in the future, do a cost – benefit analysis to be sure mechanical breakdown coverage or a warranty is worth the vehicle service contract to cover major repairs.

Sources

https://www.consumerreports.org/extended-car-warranties-an-expensive-gamble/

https://www.consumeraffairs.com/mechanical-breakdown-insurance.html

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Chris Abrams

Licensed Insurance Agent

Chris is the founder of Abrams Insurance Solutions and Marcan Insurance, which provide personal financial analysis and planning services for families and small businesses across the U.S. His companies represent nearly 100 of the top-rated insurance companies. Chris has been a licensed insurance agent since 2009 and has active insurance licenses in all 50 U.S. states and D.C. Chris works tireles...

Licensed Insurance Agent

UPDATED: Jun 24, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.