Best Car Insurance for Ford F-150 – How Much to Insure it?

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jan 20, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jan 20, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

The Ford F-150 is widely considered the definitive All-American pickup truck.

Not only is it the best-selling vehicle in the United States, but it is rated as the most popular vehicle of all-time.

It is affordable to purchase, maintain, and repair.

Plus, highway safety reports are excellent.

It also has a reputation for being insanely reliable.

One of the most overlooked benefits of owning a Ford F-150 is that full coverage rates are quite a bit cheaper than the average vehicle.

How Much to Insure Ford F-150?

Depending on the trim level, you can expect to pay somewhere near its average rate of $1,329 per year for full coverage on your new Ford F-150.

That average rate breaks down to approximately $110 per month.

| F-150 Trim | Premium | Sticker Price |

|---|---|---|

| XL | $1,329 | $28,745 |

| XLT | $1,378 | $34,760 |

| Lariat | $1,456 | $42,750 |

| King Ranch | $1,563 | $52,990 |

| Platinum | $1,721 | $55,220 |

| Limited | $1,963 | $67,735 |

| Raptor | $1,569 | $53,455 |

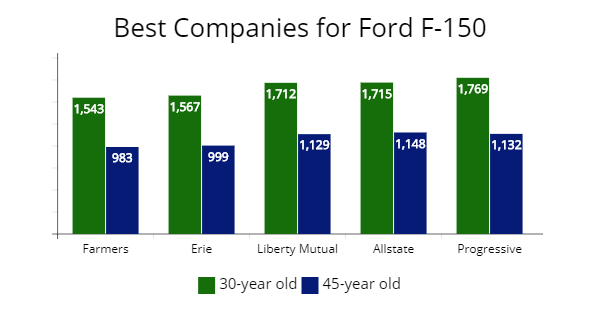

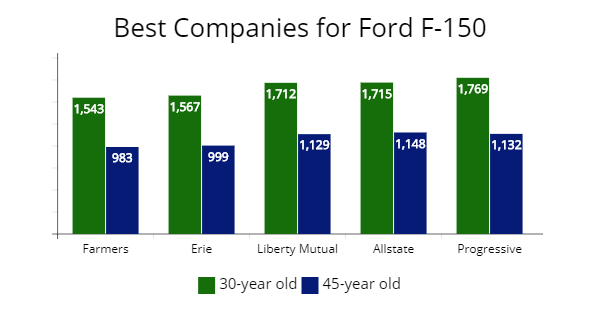

I have found the best coverage for F-150 owners are Erie and Farmers.

Both companies consistently offer quotes 20% cheaper than competitors.

The disadvantage to Erie is they only offer coverage in 12 states.

Other insurers nearly as competitive are Geico, State Farm, and Liberty Mutual.

All three insurers offer quotes 14% lower than the average insurance premium for drivers of similar ages and profiles.

| Company | Premium 30-year old* | 45-year old* |

|---|---|---|

| Farmers | $1,543 | $983 |

| Erie | $1,567 | $999 |

| State Farm | $1,645 | $1,052 |

| Geico | $1,659 | $1,055 |

| Liberty Mutual | $1,712 | $1,129 |

| Allstate | $1,715 | $1,148 |

| Progressive | $1,769 | $1,132 |

| USAA | $1,780 | $1,087 |

| Travelers | $1,832 | $1,213 |

| Elephant | $1,850 | $1,221 |

| Auto-Owners | $1,948 | $1,251 |

| Hartford | $1,957 | $1,187 |

| Mercury | $2,012 | $1,311 |

| Ameriprise | $2,145 | $1,476 |

*Will depend on driver risk profile such as driving record and location.

How do auto insurance rates on the Ford F-150 compare to rates on other pickup trucks?

The Ford F-150, regardless of trim level, ranks as one of the top five cheapest pickup trucks to insure.

Below is a list of the 10 most popular trucks, according to J.D. Power.

| Truck | Premium |

|---|---|

| Ford F-150* | $1,329 |

| GMC Sierra 1500 | $1,460 |

| Ford F-Series Super Duty | $1,580 |

| Toyota Tundra | $1,620 |

| Toyota Tacoma | $1,704 |

| Ram 1500 | $1,776 |

| Ram Heavy Duty | $1,812 |

| Chevrolet Silverado 1500 | $1,920 |

| Chevrolet Colorado | $1,932 |

*Base model. If you purchase a different F-150 trim, you will pay more for a premium. Premiums are determined more on the cost to replace rather than safety ratings.

Due to its popularity, there is no shortage of parts.

That plays a role in keeping the pickup at a low cost for insurers.

Additionally, safety features like pre-collision assist help to reduce the number of accidents involving the Ford F-150.

Below are advanced safety features for the F-150:

| Driver Air Bag | 4-Wheel ABS | Daytime Running Lights |

| Passenger Air Bag | 4-Wheel Disc Brakes | Integrated Turn Signal Mirrors |

| Front Head Air Bag | Brake Assist | Traction Control |

| Front Side Air Bag | Electronic Stability Control | Pretensioners |

These features help to keep it in a low-risk category, making full coverage more affordable for drivers.

Along with exceptional safety features, the F-150 has really cool smart features, making it one of the road’s safest vehicles.

| Ford Co-Pilot360 | 8 Inch LCD Productivity Screen |

| BLIS with Trailer Coverage | Military grade aluminum alloy body |

| 360-Degree camera with split-view display | FordPass Connect |

Why am I paying more than the average rate to insure my Ford F-150?

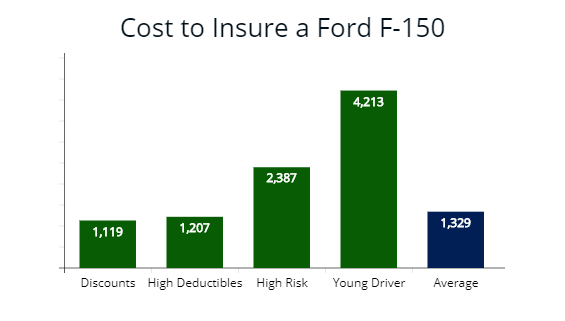

While the average annual rate for full coverage on a Ford F-150 is $1,329, the actual rate you pay for car insurance rates may differ.

Insurers calculate a customer’s rate based on a variety of factors.

How much you pay for a premium depends primarily on your driving record. As illustrated, if you have a good driving record and apply discounts, you will pay less than average. If you are a high risk or a young driver, you will pay above the average auto insurance rate for an F-150.

How much you pay for a premium depends primarily on your driving record. As illustrated, if you have a good driving record and apply discounts, you will pay less than average. If you are a high risk or a young driver, you will pay above the average auto insurance rate for an F-150.

If you feel that you are paying too much for coverage on your pickup truck, it is worth getting a few quotes to compare rates.

What factors influence Ford F-150 insurance rates?

The rate that you pay for coverage on your F-150 depends on the following factors:

– The driver’s age

Teen drivers can expect to pay as much as three times the average rate for a premium on their Ford F-150.

The average rate for teen drivers is nearly $5,000.

Teen drivers pay more because they are more likely to file damage claims.

| Factors that influence a Ford F-150 premium | |

|---|---|

| Age | Location |

| Driving history | Gender |

| Credit Score | Insurance history |

| Driving experience | Annual mileage |

| Marital status | Claims history |

| Coverage level | Vehicle |

| Vehicle ownership status (owned or financed) | Discount options |

Illustrated above are the factors determining how much you will pay for a premium if you purchase a Ford F-150. If it’s new or used, how old is the truck? where do you live? How much is your deductible for comprehensive coverage? All factors can either increase or decrease your premium cost, including your credit history and/or credit score.

That is just as true for pickup trucks like the Ford F-150 as it is for cars.

Fortunately, the massive price hike on rates for teenagers disappears quickly as they get older.

The cost of a premium on an F-150 is cut nearly in half once a driver hits 20-years old.

At age 30, Ford F-150 drivers will pay more than 50% less for coverage than they did at age 20.

– The driver’s driving record

To put it simply, high-risk drivers pay more for car insurance rates because they have fewer and more costly options.

| Driving Record | Premium |

|---|---|

| Good Record | $1,329 |

| Poor Record | $2,387 |

| DUI | $2,985 |

If you have a DUI conviction or multiple moving violations on your driving record, you are guaranteed to pay as much as double the average rate for a premium on your Ford F-150.

– New versus used

You will pay more for coverage on a new F-150.

The actual cost value of a new vehicle is more than a used vehicle.

That means companies will have to pay more for a damage claim involving a new Ford F-150.

That is why a new pickup truck will cost more to insure than its used counterpart.

– The age of the Ford F-150

On average, the older the pickup truck, the less you will for a premium.

That is not the case, however, for the first five years of ownership.

| Ford F-150 Year | Premium |

|---|---|

| 2020 | $1,329 |

| 2019 | $1,265 |

| 2018 | $1,203 |

| 2017 | $1,197 |

In my analysis of rates on the F-150, I found that nearly every insurer charged more every year until year five.

After the fifth year, the premium cost on Ford F-150s dropped by almost $150 across the board.

– The driver’s home state and city

Not too long ago, there was some uproar among Ford F-150 drivers about how different their premiums were on their truck.

A brief investigation into the wildly different premium costs showed that the wide range was due to each driver’s location.

In less populated rural areas, coverage on the Ford F-150 is less expensive.

| Ford F-150 by State* | Premium |

|---|---|

| California | $1,965 |

| Idaho | $1,190 |

| Long Island, New York | $1,870 |

| Ohio | $1,132 |

| New Jersey | $1,832 |

| North Carolina | $1,432 |

| Texas | $1,844 |

| Tennessee | $1,284 |

| Vermont | $1,588 |

| Wisconsin | $1,683 |

*Some states require personal injury protection, slightly increasing the cost of a premium.

On the other hand, coverage is more expensive in areas with a greater population.

That difference is usually due to the truck’s greater likelihood of being damaged with more cars on the road.

Additionally, each state has different structures and mandates that increase the cost of a premium.

That is why it is more expensive to get coverage on a Ford F-150 in Montana than in Ohio.

Other factors to influence your premium:

– Gender – either male or female (females usually pay less for insurance, particularly younger females).

– Annual mileage – how far you drive annually.

– Discounts such as multi-policy, loyalty, or safe driver.

How can I lower my auto insurance coverage?

The easiest and best way to cut your premium cost is to shop around and compare quotes from different providers.

While you might be satisfied with your current coverage, there’s a chance you could pay less by buying coverage elsewhere.

You could also save money on a premium for your Ford F-150 by verifying if you qualify for select discounts.

On average, you can save nearly $550 on good driver discounts if you have a clean driving record.

Lastly, if you own your Ford F-150 outright, you may opt to purchase liability-only or minimum coverage.

By forgoing full coverage, you can save yourself roughly $500 on your premium.

Below, I have outlined how much liability costs for an F-150 and comprehensive and collision coverage cost.

| Ford F-150 Year | Liability Only | Comprehensive | Collision | Total |

|---|---|---|---|---|

| 2020 | $424 | $215 | $690 | $1,329 |

| 2018 | $390 | $201 | $612 | $1,203 |

| 2016 | $386 | $198 | $603 | $1,187 |

If you don’t own your pickup outright because you financed it or have a lease, you’ll have to way until you’ve fully paid off the truck before switching to a liability-only insurance policy.

Who has the best car insurance for a Ford F-150?

Erie consistently beats the competition for the lowest rates on new Ford F-150s.

With Erie, you can expect to pay about $50 to $60 cheaper than the average rate if you have a clean driving record.

Illustrated above is the F-150 price of a premium for 30 and 45-year-old drivers. The most affordable on my list is Farmers, followed by Erie. Erie is offered in 12 states only. Other options are Liberty Mutual, Allstate, and Progressive. It would be smart to get quotes from regional companies such as Elephant and Auto-Owners. Or lesser-known ones such as Safeco.

Illustrated above is the F-150 price of a premium for 30 and 45-year-old drivers. The most affordable on my list is Farmers, followed by Erie. Erie is offered in 12 states only. Other options are Liberty Mutual, Allstate, and Progressive. It would be smart to get quotes from regional companies such as Elephant and Auto-Owners. Or lesser-known ones such as Safeco.

However, it is still worth comparing quotes before signing the dotted line with Erie.

Other providers may offer discounts that will help them beat the rates offered by Erie.

Erie is also an excellent option for F-150s that are more than 2 years old.

However, they are more expensive than the rates offered by Farmers.

Farmer’s Ford F-150 rates are generally $50-$100 cheaper than the quotes I have seen from Erie.

Sources

National Highway Traffic Safety Administration

Quadrant Information Services

Insurance Information Institute (III.org)

https://www.ford.com/trucks/f150/

{“@context”:”https://schema.org”,”@type”:”FAQPage”,”mainEntity”:[{“@type”:”Question”,”name”:”How much to insure Ford F-150?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”Depending on the trim level, you can expect to pay somewhere near its average rate of $1,329 per year for full coverage on your new Ford F-150. That average rate breaks down to approximately $110 per month…More“}},{“@type”:”Question”,”name”:”Why am I paying more than the average rate to insure my Ford F-150?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”While the average annual rate for full coverage on a Ford F-150 is $1,329, the actual rate you pay for a car insurance rate may differ. Insurers calculate a customer’s rate based on a variety of factors….More“}},{“@type”:”Question”,”name”:”Who has the best car insurance for a Ford F-150?”,”acceptedAnswer”:{“@type”:”Answer”,”text”:”Erie consistently beats the competition for the lowest rates on new Ford F-150s. With Erie, you can expect to pay about $50 to $60 cheaper than the average rate if you have a clean driving record. However, it is still worth comparing quotes before signing the dotted line with Erie….More“}}]}

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Michelle Robbins

Licensed Insurance Agent

Michelle Robbins has been a licensed insurance agent for over 13 years. Her career began in the real estate industry, supporting local realtors with Title Insurance. After several years, Michelle shifted to real estate home warranty insurance, where she managed a territory of over 100 miles of real estate professionals. Later, Agent Robbins obtained more licensing and experience serving families a...

Licensed Insurance Agent

UPDATED: Jan 20, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.