Car Insurance with an Accident History: How to Lower Your Rates

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Apr 12, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Apr 12, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

A history of accidents usually means one thing: higher car insurance rates.

The more accidents you’re involved in, the worse off you’ll be when it comes time to pay your insurance premium.

However, by asking the right questions and taking the necessary and proper actions, you may be able to keep any potential rate increases to a minimum, or even lower your car insurance rates.

For most insurance providers, your accident history is a good indicator of how risky you will be to insure.

However, your history doesn’t tell the whole story.

That means that you won’t necessarily see the standard rate hike if you’re able to show that you’re a safe driver.

You might need high-risk car insurance if either you are considered high risk.

So what should you do to keep your rates down?

We’ve put together a list of steps to help you find cheap car insurance despite your auto accident history.

Evaluate your situation

There isn’t a one-size-fits-all solution for getting cheap car insurance with an accident history.

Everybody’s situation is different.

That means that what worked for your neighbor may not necessarily work for you.

1. Before you contact your car auto insurance company, do your research.

Determine whether you were at fault for any of your accidents.

If you weren’t at fault, then there’s a good chance you’ll be able to fight any rate hikes.

2. Prepare copies of any accident reports you might have, and then contact your insurance company.

Explain to them that you have proof that you were not at fault for any of the accidents, and as such, you shouldn’t be punished with higher rates.

3. If you were deemed to be at fault for at least one of the accidents listed in your history, you may have a bit more trouble getting the cheap car insurance that you want.

4. Most insurance providers will reevaluate your rate after a few years without a traffic violation.

5. Not every “high-risk driver” has a bad driving record.

However, that doesn’t mean it is impossible for you to get lower auto insurance rates.

Top Causes of Car Accidents

| Rank | Cause of Accident |

|---|---|

| 1 | Distracted Driving |

| 2 | Speeding |

| 3 | Drunk Driving |

| 4 | Reckless Driving |

| 5 | Rain |

| 6 | Running Red Lights |

| 7 | Running Stop Signs |

| 8 | Teenage Drivers |

| 9 | Night Driving |

| 10 | Design Defects |

| 11 | Unsafe Lane Changes |

| 12 | Wrong-Way Driving |

| 13 | Improper Turns |

| 14 | Tailgating |

| 15 | Driving Under the Influence of Drugs |

| 16 | Ice |

| 17 | Snow |

| 18 | Road Rage |

| 19 | Potholes |

| 20 | Drowsy Driving |

| 21 | Tire Blowouts |

| 22 | Fog |

| 23 | Deadly Curves |

| 24 | Animal Crossings |

Look for discounts

One of the best ways to lower your car insurance rates, regardless of your accident history, is to ask for discounts.

Most auto insurance providers have affiliations with various organizations and businesses.

Check to see if your employer has a website that lists which companies offer you discounts on your car insurance.

If your employer doesn’t have such a database, contact your insurance provider and ask if they have an agreement with them.

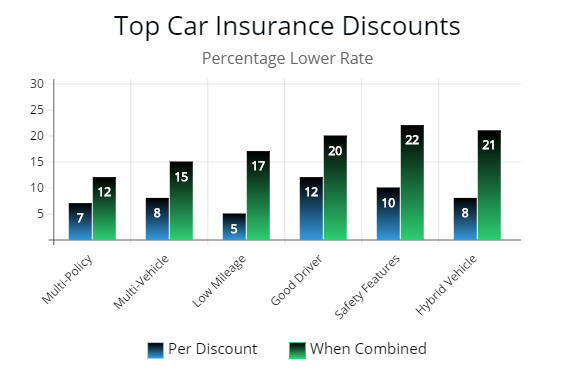

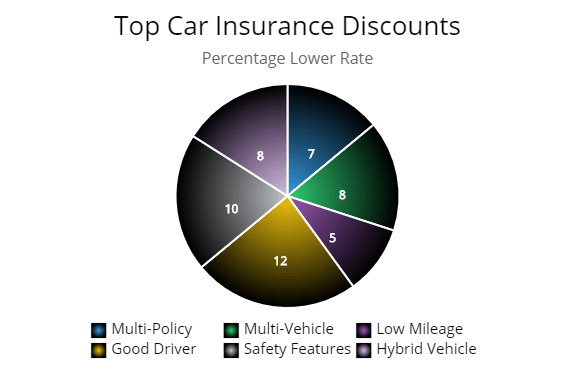

Top Car Insurance Discounts Illustrated

Note: Your percentage of discounts will vary with insurance company, driver history, and other influential factors.

Don’t stop with your employer. Ask your insurance provider if there are any organizations for which members qualify for a monthly discount.

While AAA and AARP are the best known organizations that offer their members discounts, there are plenty of others nationwide.

Remember, there are a variety of discounts

Discounts aren’t limited to just employers and organizations.

Most auto insurance companies offer other discounts that might help reduce the percentage hike you’ll face with an accident history.

It might be a good idea to take a defensive driving class if you have multiple accidents on your record.

By taking this class, you’ll show your auto insurance provider that you are serious about improving your driving ways and avoiding accidents.

Importance of Being Accident Free

Note: As illustrated by the graph the biggest discount is “good driver”. Although, if you have been in accident, it is best to get discounts available to you then strive for a clean driving record or take a safety driver course to “try” and offset the increase in car insurance rates.

Once you’ve proven yourself to be accident-free for six months to a year, your insurance provider may even offer you additional discounts for being a safe driver.

As with those discounts available to members of select organizations, it is always a good idea to ask your car insurance company about the discounts they have available to their customers.

Top Car Insurance Companies & Discounts Offered

Top Auto Insurance Companies Offering Discounts

| Discount | Travelers | State Farm | Geico | Progressive |

|---|---|---|---|---|

| Multiple policies | x | x | x | x |

| Multivehicle | x | x | x | x |

| Anti-theft | x | x | x | x |

| Anti-lock brakes | x | x | x | |

| Passive restraint | x | x | ||

| Daytime running lights | x | x | ||

| New vehicle | x | x | ||

| 'Green' vehicle | x | |||

| Safe driver/accident-free | x | x | x | x |

| Defensive driver | x | x | x | x |

| Low mileage | x | x | x | |

| Military | x | x | x | |

| Affinity / occupational | x | x | ||

| Full payment | x | x | x | |

| Paperless billing / automatic payment | x | x | x | x |

| Loyalty | x | x | x | |

| Early signing: | x | x | ||

| Good student | x | x | x | x |

| Distant student | x | x | x | |

| Homeowner | x | x | x |

Don’t be afraid to switch providers

In case you haven’t noticed by the countless car insurance commercials and Internet advertisements, insurance companies want your business.

If your car insurance provider is giving you a hard time about your accident history, then perhaps it’s time to bid them farewell, and switch to one that actually wants your business.

It may be difficult to find a car insurance policy that offers the same coverage at the same price prior to an at-fault accident, but you may also discover that other insurance companies offer different discounts and coverage options.

Accident forgiveness may be offered as part of an additional endorsement – or coverage option – for an additional cost.

Been in accident & you need cheaper insurance? Get Quotes

Changing car insurance companies has never been easier.

Even with an accident history, you can still get accurate auto insurance quotes within minutes.

Here at AutoInsureSavings, we’ve made it even easier for you as a customer.

Just enter your zip code in the quote comparison tool at the top of this page, and then honestly answer a few quick questions.

We’ll then provide you with quotes from all the leading car insurance companies in your area.

You’ll be able to see in minutes where you can get the cheapest rates on car insurance with an accident history.

Once you’ve picked out the right provider for your needs, go ahead and sign up for their insurance policy and start saving.

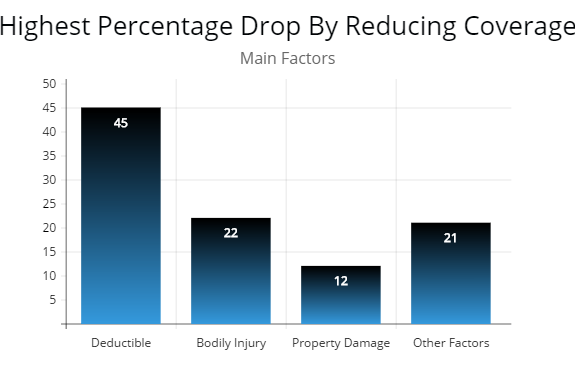

More ways to get lower rates…

Note: As illustrated by the graph, the fastest way to lower your insurance rates is to increase your deductible and lower coverage. If you have been in a car accident and your rates have spiked, then raise your deductible and lower coverage, only if you are comfortable doing so. Also, be sure to consult with an insurance agent.

Raise Your Deductible & Lower Coverage

There are other ways to get lower rates if you don’t mind minimizing your coverage.

By reducing your liability coverage for personal injury and property damage while also raising your deductible, you could cut as much as 20% off your car insurance premium.

In addition, drivers who have a long history of at-fault accidents may face an increase in car insurance rates after a no-fault accident.

Your state can mandate that insurance companies provide auto coverage to these drivers, but beware this coverage is not cheap.

Such adjustments aren’t for everybody, though, so it is important that you evaluate whether you’d be able to get by with such minimal policy coverage in the event of a future accident.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Jeffrey Manola

Licensed Insurance Agent

Jeffrey Manola is an experienced insurance agent who founded TopQuoteLifeInsurance.com and NoMedicalExamQuotes.com. His mission when creating these sites was to provide online consumers searching for insurance with the most affordable rates available. Not only does he strive to provide consumers with the best prices for insurance coverage, but he also wants those on the market for insurance to ...

Licensed Insurance Agent

UPDATED: Apr 12, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.