Different Cars, Different Premiums: How Vehicle Types Affect Insurance Rates & What to do About it!

The type of car you drive, and the age of that vehicle, will affect your insurance rates. Learn how.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Apr 11, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Apr 11, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Drivers may be aware of their auto insurance rate and its relation to their age and road habits, but the vehicle itself also plays a major part.

Insurance agents can’t properly insure a driver unless they have a specific vehicle’s information.

In fact, one driver could have starkly different premiums when they drive various car models.

It’s important for drivers to understand how the type of vehicle you own will affect your personalized insurance rate. Understanding this will allow you to find the best coverage.

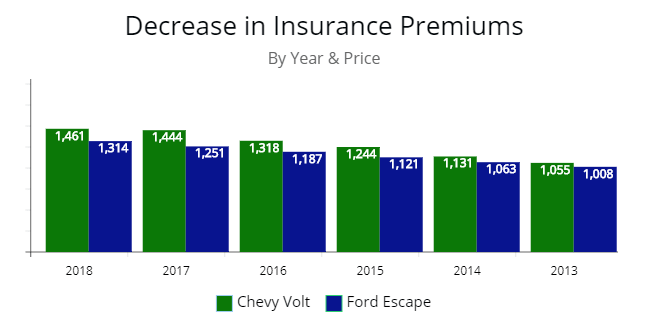

Note: In the illustration above the price difference between two vehicles, the Chevy Volt & Ford Escape is $147 per year. After 5 years the price difference is only $47. Something to consider when you are buying a new or old vehicle. Each are 24% to 29% cheaper to insure after 5 years.

Note: In the illustration above the price difference between two vehicles, the Chevy Volt & Ford Escape is $147 per year. After 5 years the price difference is only $47. Something to consider when you are buying a new or old vehicle. Each are 24% to 29% cheaper to insure after 5 years.

Vehicle Age Consideration

In most states, the vehicle’s age plays a huge part in determining coverage costs.

A brand new car is more expensive to replace or repair, for example, so these vehicles have high premiums.

In contrast, a 10-year old car will have a much lower insurance premium because it has less overall value.

Ideally, drivers with relatively old cars will benefit from lower premiums.

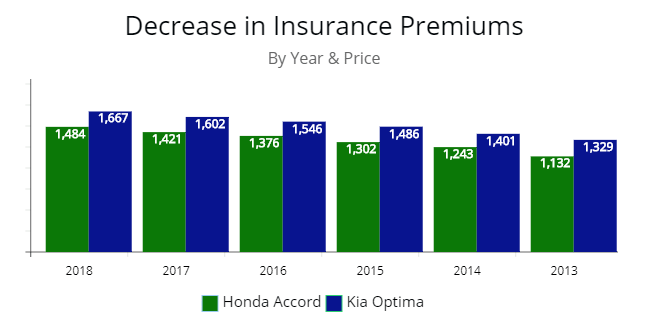

Note: In this illustration the Honda and Kia vary $183 in price in 2018 and $197 in 2013 when I queried for quotes. Another reason to be sure to get quote on any vehicle before purchase. You may find out the cost to insure it may be much higher than expected.

Note: In this illustration the Honda and Kia vary $183 in price in 2018 and $197 in 2013 when I queried for quotes. Another reason to be sure to get quote on any vehicle before purchase. You may find out the cost to insure it may be much higher than expected.

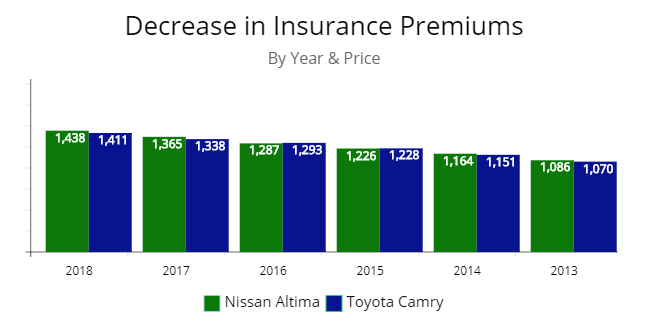

Different Type Vehicles & Premium Price by Age

Below I have a table list of popular cars by make and model. I put a couple of hybrid model vehicles which are the Chevy Volt and the Kia Optima.

Please see table below:

| Vehicle | Premium Price 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|

| Chevrolet Volt LT | $1,461 | $1,444 | $1,318 | $1,244 | $1,131 | $1,055 |

| Ford Escape S | $1,314 | $1,251 | $1,187 | $1,121 | $1,063 | $1,008 |

| Honda Accord | $1,484 | $1,421 | $1,376 | $1,302 | $1,243 | $1,132 |

| Kia Optima | $1,667 | $1,602 | $1,546 | $1,486 | $1,401 | $1,329 |

| Nissan Altima 2.5 | $1,438 | $1,365 | $1,287 | $1,226 | $1,164 | $1,086 |

| Toyota Camry LE | $1,411 | $1,338 | $1,293 | $1,228 | $1,151 | $1,070 |

When I did my quote comparison for all of the vehicles it was for a 30 year old male driver. The amount of coverage was the same through all years as I queried for quotes.

Either way this is an illustration to show you how an auto premium drops with the age of the vehicle. And on average the premium price dropped 29% over the 5 year period.

Typically, drivers have full coverage for newer model vehicles and for models 10 years or older some may drop comprehensive and collision coverage.

Which can bring your insurance costs down dramatically.

Note: The premium price for a Nissan and Toyota do not vary by much. Both vehicles are 25% cheaper for the same coverage in 2013. A cost-effective strategy for those in the market for a vehicle would be to buy one 3 to 4 years older. Not only is there savings from depreciation, but savings in the policy price too.

Note: The premium price for a Nissan and Toyota do not vary by much. Both vehicles are 25% cheaper for the same coverage in 2013. A cost-effective strategy for those in the market for a vehicle would be to buy one 3 to 4 years older. Not only is there savings from depreciation, but savings in the policy price too.

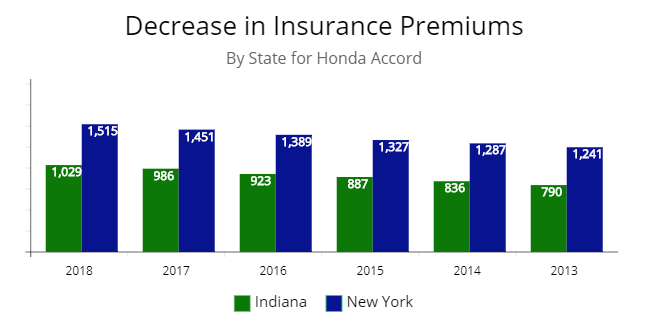

Cost of a Premium by Year Across Various States

Below I wanted to illustrated the decline in average cost of premium by year for various states.

This is for a Honda Accord EX and the decline in premium price went down approximately 25% plus or minus 3% for each state.

Therefore it was not only a thing for a insurer, but the same approximate percentage will go down in your premium no matter the state you reside.

| State | 2018 Honda Accord | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|

| Indiana | $1,029 | $986 | $923 | $887 | $836 | $790 |

| New York | $1,515 | $1,451 | $1,389 | $1,327 | $1,287 | $1,241 |

| North Carolina | $1,240 | $1,196 | $1,134 | $1,100 | $1,043 | $987 |

| Pennsylvania | $1,541 | $1,476 | $1,412 | $1,370 | $1,326 | $1,279 |

| Tennessee | $1,434 | $1,370 | $1,331 | $1,276 | $1,204 | $1,152 |

| Wisconsin | $1,222 | $1,154 | $1,087 | $1,030 | $984 | $911 |

The only thing which will change is the price since each premium is may be higher or lower depending on the state.

For example, the cost a premium in New York was $1,515 while in Indiana the same Honda Accord was only $1,029.

Note: In the illustration above each state, Indiana and New York, have the approximate decrease in insurance quotes year by year. It is 24% lower in Indiana and 19% lower for NY after 5 years. The difference would be the price. The price is higher in New York for coverage for a Honda Accord than in Indiana.

Note: In the illustration above each state, Indiana and New York, have the approximate decrease in insurance quotes year by year. It is 24% lower in Indiana and 19% lower for NY after 5 years. The difference would be the price. The price is higher in New York for coverage for a Honda Accord than in Indiana.

Crash Ratings and Insurance Coverage

Consumers may have heard about yearly vehicle crash ratings being published for all to see, but they may not realize how important they are.

In fact, strong crash ratings for one model over another also influences insurance rates.

For example, a vehicle that lacks strong crash ratings requires a larger insurance premium.

If this car is in an accident, it will probably sustain a lot of damage with high costs to repair it.

Vehicles with Good, Acceptable, & Poor Crash Ratings

In the table below I have provided the same 6 vehicles which I queried for quotes.

I have included another vehicle, the 2016 Audi A4. It was a vehicle which received a “Poor” crash rating for driver-side crash-worthiness.

The Chevy Volt and Ford Escape received an “Acceptable” crash rating.

As for as the Audi A4 this would be good information to have since you could get quotes beforehand to see if the premium would be higher for the 2016 model.

The other type of vehicles receive a “Good” rating across the board.

Of course, the Honda, Nissan, and Toyota received a “superior” rating for any collision avoidance system installed.

| Vehicle | Small overlap front Driver-side | Moderate overlap front | Side | Roof strength | Head restraints & seats |

|---|---|---|---|---|---|

| Audi A4 2016 | P (Poor) | G (Good) | G | G | G |

| Chevrolet Volt LT | A (Acceptable) | G | G | G | G |

| Ford Escape S | A | G | G | G | G |

| Honda Accord | G | G | G | G | G |

| Kia Optima | G | G | G | G | G |

| Nissan Altima 2.5 | G | G | G | G | G |

| Toyota Camry LE | G | G | G | G | G |

Note: The safety ratings for each vehicle is for the current year unless other noted, such as the 2016 Audi. The vehicles with excellent safety ratings have a much lower premium over the age (or life) of the vehicle. Something to consider if you would like to save more money over time.

Source: IIHS.org Safety Ratings & State Farm

It is important to note that each insurers has their own method of determining risk for each premium.

Some may charge a higher price for the 2016 Audi A4 and others may not.

Flashy Versus Practical

When drivers purchase that flashy sports car, they’re not normally buying it to display in a garage.

These flashy vehicles are usually driven at excessive speeds with a higher chance of being involved in a crash.

In response, insurers apply high premiums onto flashy cars compared to practical, compact vehicles that are usually driven within local speed limits.

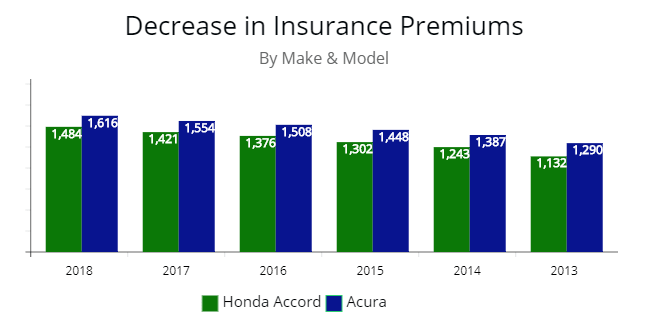

Note: I used this illustration since many claim the Acura is basically the same as the Honda vehicles. Just a little added bonus to the car. Either way, the price difference is significant when you upgrade to a fancier vehicle. The premium price decreases the same year over year for each vehicle however.

Note: I used this illustration since many claim the Acura is basically the same as the Honda vehicles. Just a little added bonus to the car. Either way, the price difference is significant when you upgrade to a fancier vehicle. The premium price decreases the same year over year for each vehicle however.

Premium Price of Higher End Vehicle Compared to a Honda

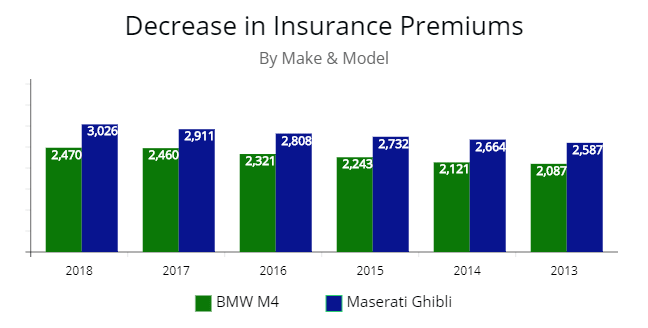

Below I have prepared a table to show the price difference between a Honda Accord and popular top end vehicles such as the BMW M4 or Porsche 911 Turbo.

The premiums for such vehicles are normally twice that of a Honda.

One thing to take into consideration is the price to replace or repair parts for the vehicle.

Normally, consumers may have to get a tailored policy for replacement parts, etc or pay an extremely high premium.

| Vehicle | Premium Price 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|

| Honda Accord | $1,484 | $1,421 | $1,376 | $1,302 | $1,243 | $1,132 |

| Acura 4 Door Sedan 2WD | $1,616 | $1,554 | $1,508 | $1,448 | $1,387 | $1,290 |

| BMW M4 | $2,470 | $2,460 | $2,321 | $2,243 | $2,121 | $2,087 |

| Maserati Ghibli S | $3,026 | $2,911 | $2,808 | $2,732 | $2,664 | $2,587 |

| Porsche 911 Turbo S | $3,050 | $2,962 | $2,843 | $2,742 | $2,632 | $2,601 |

| Tesla Model S 60 | $2,659 | $2,573 | $2,490 | $2,322 | $2,265 | $2,196 |

The percentage drop for flashy vehicles was much lower too.

For example, the decrease in price for the Honda Accord was 24% while the Maserati was on 15% over the course of 5 years.

Note: When you begin to upgrade to more expensive vehicles the price of an auto premium skyrockets. As illustrated, to insure a Maserati would be over $3,000 and nearly $2,500 for a BMW M4. The price of the premium did decline year over year. Percentage wise each of the vehicles did not decline as much compared to more popular vehicles such as Honda or Toyota. Each only 14% to 15% respectfully over a 5 year period.

Note: When you begin to upgrade to more expensive vehicles the price of an auto premium skyrockets. As illustrated, to insure a Maserati would be over $3,000 and nearly $2,500 for a BMW M4. The price of the premium did decline year over year. Percentage wise each of the vehicles did not decline as much compared to more popular vehicles such as Honda or Toyota. Each only 14% to 15% respectfully over a 5 year period.

Comparing Various Models

To truly find the perfect vehicle for a driver’s limited budget, online car rating websites like J.D. Power provide the necessary insight to locate the right make and model.

Consumers can read through many personal reviews about specific cars so they can make an educated vehicle purchase decision.

Without these reviews, consumers are left to make their own judgments about the right car with the perfect premium to match.

Cheapest Cars to Insure with Average Premium Price

Below I provided a table of the cheapest cars to insure with the price for the current to 6 years later for the average price.

I don’t suspect the quotes will go up with the cars anytime soon. Unless serious modifications are made by the manufacturer. Unlikely though.

The average price is from $1,100 to $1,200 per year for each of the models for full coverage.

And if you are in the market for an older model then you should be able to get pretty low rates for all the models listed.

Particularly the Honda Odyssey and Jeep Wrangle both of them have premiums less than $900 for a 2012 vehicle.

| Vehicle | Premium Price 2018 | 2016 | 2014 | 2012 |

|---|---|---|---|---|

| Honda Odyssey LX | $1,131 | $1,090 | $987 | $870 |

| Jeep Renegade Sport | $1,142 | $1,096 | $1,009 | $911 |

| Jeep Wrangler Black Bear | $1,155 | $1,098 | $989 | $894 |

| Honda CR-V LX | $1,178 | $1,076 | $970 | $862 |

| Jeep Compass | $1,201 | $1,104 | $1,004 | $912 |

| Subaru Outback 2.5l | $1,203 | $1,093 | $982 | $904 |

| Jeep Cherokee Sport | $1,212 | $1,109 | $1,093 | $1,003 |

| Subaru Forester 2.5l | $1,214 | $1,107 | $1,093 | $980 |

| Ford Escape SE | $1,221 | $1,136 | $1,053 | $967 |

| Buick Encore | $1,232 | $1,160 | $1,058 | $951 |

When I queried for quotes for each of the vehicles I used a 30 year old male driver with good credit, minimal driving violations, and married.

Final Thoughts

Insurance companies typically reward their customers for remaining loyal to their business, so try to stay on a policy for several years without switching around.

Although it’s still a smart idea to price other insurance companies when a policy is up for renewal, consumers should be wary about changing their coverage just to save a few dollars.

In the end, they’ll probably save more by staying loyal to their original company.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Justin Wright

Licensed Insurance Agent

Justin Wright has been a licensed insurance broker for over 9 years. After graduating from Southeastern Seminary with a Masters in Philosophy, Justin started his career as a professor, teaching Philosophy and Ethics. Later, Justin obtained both his Property & Casualty license and his Life and Health license and began working for State Farm and Allstate. In 2020, Justin began working as an i...

Licensed Insurance Agent

UPDATED: Apr 11, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.