The Ultimate Cheap Car Insurance Guide for Different Situations

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

The fact of the matter is everyone wants the cheapest car insurance rate.

The slightest hit to your credit score or driving record can rapidly change your automobile insurance coverage into what seems like a house payment.

Getting the Cheapest Car Insurance in Different Situations

If you are on a budget getting lower rates might seem like an easy way to save money.

However, that’s not always the case.

Note: Illustrated above are the primary strategies to find the best auto insurance rates possible before and after buying a policy. Most importantly, you want to maintain these strategies over the life of any or all policies. This is so you don’t unknowingly overpay when you shop around and compare rates.

Car owners like you will need an affordable policy from an auto insurer with the financial wherewithal to help you after an unforeseen automobile accident.

Our licensed experts are going to show you which companies have affordable auto insurance for drivers in various situations.

Some need cheap liability coverage, while others may need low-mile coverage. We recommended at least two or three auto insurers quotes for each motorist in their particular case.

In your often frustrating “car insurance quote” journey, we have simplified the process of finding the cheapest insurance companies in this comprehensive guide.

Before you shop around and compare rates, let’s find the most affordable car insurance companies.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Who has the Cheapest Liability Insurance Coverage?

The best way to get a lower car insurance premium is to maintain a good driving history.

We have found the best companies that, on average, can offer the lowest premium for a driver with a clean driving record and good credit report.

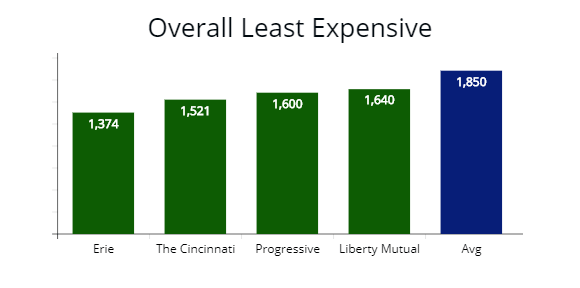

The overall cheapest is Erie.

They offer coverage in 12 states plus Washington, D.C.

If you reside in any of those states, you will probably find Erie is the cheapest car insurance company.

Further, they have ranked well on all the latest insurance studies.

Note: The overall cheapest rate with the best options are Erie, The Cincinnati, and Progressive. Each insurer’s cost is offering full coverage for a 30-year-old driver.

Note: The overall cheapest rate with the best options are Erie, The Cincinnati, and Progressive. Each insurer’s cost is offering full coverage for a 30-year-old driver.

The Cincinnati offers protection in 41 states and Washington, D.C.

On average, we have found The Cincinnati insurance offers coverage at a lower rate than the “big guys” with the same coverage levels.

They have been in business since 1950, and their financial strength is excellent.

If you want to find the best national company with the most affordable insurance quotes, Progressive can offer lower rates across the board for good drivers.

The table below compares quotes with all three companies for good drivers, credit score, and minimum car insurance.

| Company | Good drivers | Drivers with poor credit | Minimum coverage |

|---|---|---|---|

| Erie | $1,374 | $1,833 | $532 |

| The Cincinnati | $1,521 | $1,929 | $588 |

| State Farm | $1,571 | $2,097 | $599 |

| Progressive | $1,600 | $2,132 | $625 |

Who has the Cheapest Car Insurance for Young Drivers?

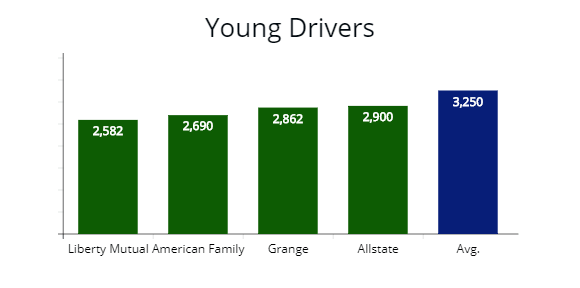

Drivers under the age of 25 pay extremely high car insurance premiums.

Liberty Mutual is going to offer you affordable auto insurance coverage if you are a young driver.

Note: Young and teen drivers pay extremely high car insurance premiums no matter what they do. Illustrated above are the least expensive companies by quote. Liberty Mutual offers a quote at $2,582. In comparison, American Family and Grange offer quotes at $2,690 and $2,862 respectfully for full coverage. All three are nearly 20% lower than average rates of $3,250 for a 21-year-old driver.

Note: Young and teen drivers pay extremely high car insurance premiums no matter what they do. Illustrated above are the least expensive companies by quote. Liberty Mutual offers a quote at $2,582. In comparison, American Family and Grange offer quotes at $2,690 and $2,862 respectfully for full coverage. All three are nearly 20% lower than average rates of $3,250 for a 21-year-old driver.

They offer coverage in every state with a full array of discounts to help you save money on your annual premium.

Discounts offered by Liberty Mutual are:

- Good student discount

- Student away at school

- Defensive driving

In many cases, American Family is another insurer with an excellent teen driver program to help young drivers get the cheapest car insurance rate with lower than average auto insurance rates.

You will get 10% or more off your premium after completing 3,000 hours of driving habits on the app.

Grange offers coverage in 13 states, which would be the best rate for young drivers in the Midwest.

Below we have compared auto insurance quotes from all three car insurance companies for a 21-year-old driver.

| Company | Good drivers | Drivers with speeding ticket | Minimum coverage |

|---|---|---|---|

| Liberty Mutual | $2,582 | $2,900 | $1,433 |

| American Family | $2,690 | $3,431 | $1,582 |

| State Farm | $2,700 | $3,501 | $1,601 |

| Geico | $2,711 | $3,590 | $1,611 |

| Grange | $2,862 | $3,565 | $1,710 |

Good strategies for young drivers to help lower auto insurance rates drive an older model vehicle that is paid for.

You would be able to drop comprehensive and collision coverage to save money on your monthly or annual premium.

Just make sure the safety features and are up to snuff.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Who has the Cheapest Car Insurance by State?

We analyzed each state and compared car insurance providers offering the cheapest coverage by cost.

As well as having the financial wherewithal to pay out a claim in the event you filed one.

The state’s insurers are offered here since many insurance companies we recommended cannot offer coverage in all regions or states because of regulations.

For example, Erie is an excellent car insurance company but only offers coverage in 12 states, plus Washington D.C.

In many instances, USAA offered the cheapest car insurance rate for many states.

For instance, USAA is cheaper than New York Central Mutual (NYCM) in New York, but we left out USAA since most drivers wouldn’t qualify.

| State | Company | State | Company |

|---|---|---|---|

| Alabama | ALFA | Montana | State Farm |

| Alaska | Umialik | Nebraska | Farm Bureau Financial Services |

| Arizona | State Farm | Nevada | Allied |

| Arkansas | State Farm | New Hampshire | Concord |

| California | Auto Club of Southern California | New Jersey | NJM |

| Colorado | Progressive | New Mexico | Farm Bureau Financial |

| Connecticut | Unitrin | New York | New York Central Mutual |

| Delaware | Nationwide | North Carolina | Auto-Owners |

| Florida | Florida Farm Bureau | North Dakota | USAA |

| Georgia | Country Financial | Ohio | Erie |

| Hawaii | Fireman's Fund | Oklahoma | OK Farmers Union |

| Idaho | Grange | Oregon | State Farm |

| Illinois | Unique | Pennsylvania | NJM |

| Indiana | Indiana Farm Bureau | Rhode Island | Travelers |

| Iowa | Pekin | South Carolina | Southern Farm Bureau |

| Kansas | Geico | South Dakota | Farmers Mutual of Nebraska |

| Kentucky | Kentucky Farm Bureau | Tennessee | Tennessee Farmers Mutual |

| Louisiana | Southern Farm Bureau | Texas | Texas Farm Bureau |

| Maine | Patriot | Utah | State Farm |

| Maryland | Progressive | Vermont | Co-operative |

| Massachusetts | Norfolk & Dedham | Virginia | USAA |

| Michigan | State Farm | Washington | PEMCO |

| Minnesota | Farm Bureau Mutual | West Virginia | Progressive |

| Mississippi | Unitrin | Wisconsin | Partners Mutual |

| Missouri | Farmers | Wyoming | State Farm |

Who has the Cheapest Car Insurance for High-Risk Drivers?

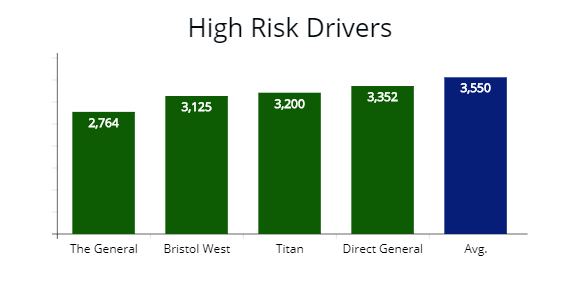

If you have a sub-par driving record or your car insurance company dropped you for reckless driving, there are three insurers you could get your vehicle insured.

Drivers looking to compare car insurance companies will find lower rates with The General, which offers insurance in all 50 states, including Washington D.C.

The General makes it easy to file an SR-22, and their mobile app is user-friendly.

The interesting thing about The General is they take clients where other insurance companies don’t.

They specialize in high-risk drivers.

The General has poor reviews, but they could be your best rate when you few options left.

Note: High-risk drivers typically have to file an SR-22 or FR-44. Both are certificates of financial responsibility or CFR, which the state requires. Illustrated above are insurance companies that specialize in insuring high-risk drivers needing such forms.

Note: High-risk drivers typically have to file an SR-22 or FR-44. Both are certificates of financial responsibility or CFR, which the state requires. Illustrated above are insurance companies that specialize in insuring high-risk drivers needing such forms.

In many cases, Bristol West is another option for high-risk drivers.

They are owned by Farmers and is available in 42 states.

Bristol West has a high number of complaints relative to its size.

However, this would be expected since they are insuring high-risk drivers.

Dairyland is another insurance company specializing in high-risk drivers with good reviews.

Sentry Insurance owns Dairyland. Most likely, if you get a Dairyland policy, Sentry Insurance will underwrite it.

| Company | No violation | With violation | Minimum coverage |

|---|---|---|---|

| The General | $1,521 | $2,764 | $726 |

| Bristol West | $1,683 | $3,125 | $786 |

| Dairyland Insurance | $1,722 | $3,192 | $812 |

| State Farm | $1,391 | $3,411 | $801 |

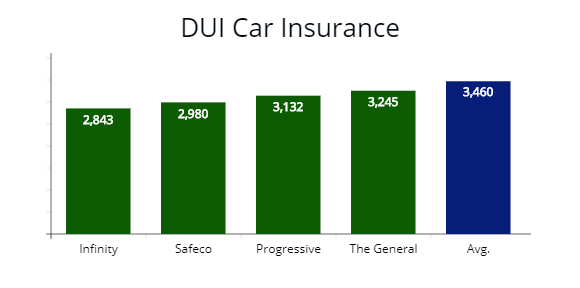

Who has the Cheapest Car Insurance for a DUI?

If you have a DUI on your record, the company offering the cheapest car insurance protection is Infinity.

We wouldn’t exactly call it cheap, but it’s lower than other auto insurers.

Infinity is the second-largest nonstandard car insurance company in the U.S. and is backed by Kemper.

They primarily target the Hispanic communities in Florida but do offer coverage in other states.

If you have a DUI and your average rates have skyrocketed, you should get car insurance quotes from Infinity to help you save money.

Note: A driver driving under the influence (DUI) charge will double their auto insurance rates. On average, the least expensive companies are Infinity, Safeco, and Progressive. All three offer quotes at $2,843, $2,980, and $3,132 when you compare insurance rates to the average DUI premium at $3,460.

Note: A driver driving under the influence (DUI) charge will double their auto insurance rates. On average, the least expensive companies are Infinity, Safeco, and Progressive. All three offer quotes at $2,843, $2,980, and $3,132 when you compare insurance rates to the average DUI premium at $3,460.

Safeco is another option for drivers with a DUI.

They are a subsidiary of Liberty Mutual and have been in business since 1923.

And they offer coverage in 46 states.

Safeco doesn’t “specialize” in DUI’s, but they can offer one of the cheapest car insurance costs compared to other insurers in many cases.

Progressive is another company offering competitive policies when you compare car insurance rates.

In fact, Progressive is one of the first companies to specialize in high-risk car insurance rates.

If you are in a bind with a DUI on your record, we recommend putting Progressive on your list to compare quotes to find additional ways to save money.

| Insurance company | No DUI | With DUI | Liability Coverage |

|---|---|---|---|

| Infinity | $1,632 | $2,843 | $742 |

| Safeco | $1,725 | $2,980 | $790 |

| State Farm | $1,702 | $2,999 | $813 |

| Progressive | $1,745 | $3,132 | $831 |

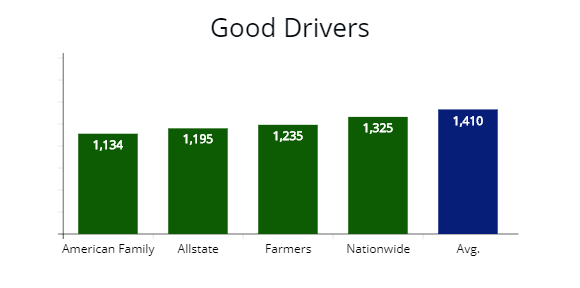

Who has the Cheapest Car Insurance for Good Drivers?

If you have a good driving history, you can find the best rate and an affordable policy with American Family.

You might find the initial car insurance quote with American Family is higher than average.

Since you are a good driver, you can lower your rate substantially through car insurance discounts with American Family.

They offer coverage in 19 states with a lower than average customer complaint ratio.

Note: The best way to get cheaper insurance coverage is to maintain good driving habits. Illustrated above are the least expensive companies. American Family offers quotes at $1,134 per year for a 30-year-old driver. Allstate and Farmers offer quotes at $1,195 and $1,235, respectfully, which is nearly 15% lower than average when you compare car insurance rates at $1,410.

Note: The best way to get cheaper insurance coverage is to maintain good driving habits. Illustrated above are the least expensive companies. American Family offers quotes at $1,134 per year for a 30-year-old driver. Allstate and Farmers offer quotes at $1,195 and $1,235, respectfully, which is nearly 15% lower than average when you compare car insurance rates at $1,410.

Allstate is an excellent the best car insurance carrier for good drivers, according to Benzinga.

They, too, have a high initial quote, but when you apply Allstate’s suite of discounts, your quote will be lower than average to save money.

Farmers is another company to put on your list of quotes if you have a good driving history to find additional savings.

They have been in business since 1923 and are a subsidiary of Zurich Group.

Farmers have a nice array of car insurance discounts to offer, and if you have a good record, you could get a rate well below the average policyholder in your area.

| Company | Good driver | At-Fault accident | Minimum coverage |

|---|---|---|---|

| American Family | $1,134 | $1,853 | $612 |

| Allstate | $1,195 | $1,963 | $645 |

| Farmers | $1,235 | $2,021 | $690 |

If you have a home or other property to insure, all three car insurance companies offer generous discounts for bundling.

With a good driving record, any three insurers could be a win for your wallet.

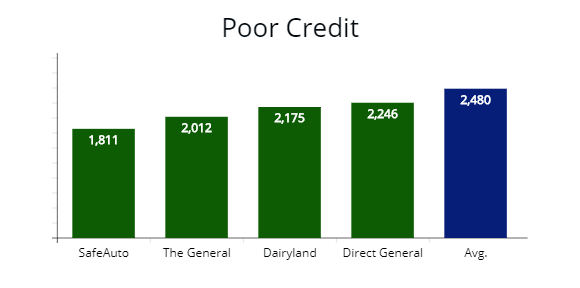

Who Has the Cheapest Insurance For Poor Credit History?

SafeAuto specializes in drivers with bad credit, offering coverage in 17 states.

You should be able to get a lower rate with SafeAuto if you have a poor credit history.

SafeAuto has poor claims handling reviews, but we recommend a car insurance company when you have bad credit.

Staying with nationally recognized auto insurance companies, you could pay 30% more for coverage when comparing car insurance rates to SafeAuto.

If you want a cheaper car insurance quote go with SafeAuto.

If you want an insurer with a smooth claims process, we wouldn’t recommend them.

Note: Illustrated above are companies specializing in bad credit premiums. If you have poor credit and looking for some financial relief, SafeAuto offers the least expensive car insurance rate at $1,811 per year for a 30-year-old driver. The General and Dairyland are 10% more with quotes at $2,012 and $2,175, respectfully.

Note: Illustrated above are companies specializing in bad credit premiums. If you have poor credit and looking for some financial relief, SafeAuto offers the least expensive car insurance rate at $1,811 per year for a 30-year-old driver. The General and Dairyland are 10% more with quotes at $2,012 and $2,175, respectfully.

The General is the leader in insuring drivers with poor credit. They have mixed reviews for auto insurance claims service and handling.

If you are in a situation where a low credit score has hit your premium, you could give The General a shot.

Dairyland offers coverage in 42 states specializing in nonstandard car insurance. According to Nerdwallet’s editorial team, Dairyland has a 3.0 out of 5.0 rating.

Dairyland is a subsidiary of Sentry, which has an A+ rating with AM Best.

We found Dairyland quotes are slightly higher than The General and SafeAuto, but lower than insurers offering standard auto insurance.

| Company | Excellent Credit | Poor Credit | Minimum coverage |

|---|---|---|---|

| SafeAuto | $1,197 | $1,811 | $732 |

| The General | $1,327 | $2,012 | $821 |

| Dairyland | $1,480 | $2,175 | $875 |

Who has the Cheapest Insurance for Military Members?

If you are in the market to find an affordable car insurance policy and are a current or former military member, put USAA on your quotes list.

USAA has excellent financial reviews, and customer satisfaction is the best in the industry.

They offer a generous array of auto insurance discounts such as:

- Family

- Safe driver

- Good student

- Multi-car

- Vehicle storage

USAA’s website is packed with auto policy information and coverage options.

Plus, you can get a full suite of services and quality car insurance such as:

| Other coverage offered by USAA | |

|---|---|

| Classic car insurance | Mobile home insurance |

| Renters insurance | Boat insurance |

There is a one-stop-shop for financial services with USAA, such as auto, home insurance, banking, investing, and life.

| Pros | Cons |

|---|---|

| Excellent customer satisfaction rating | Available to members of the U.S. Military and relatives |

| Low number of complaints | Few physical locations |

| Complete line of car, home, property, banking, and investments | No guaranteed renewal |

According to the NAIC, USAA had a lower than the average number of complaints.

Who has the Cheapest Car Insurance for Low Mileage?

If you don’t mind your mileage being tracked and drive less than 6,000 miles per year, you should put MetroMile on your list of quotes.

You should be able to get lower auto insurance rates with MetroMile since they exclusively sell pay-per-mile auto insurance policies.

With MetroMile, you will have a base rate and mileage rate.

For example, your base rate could be $50 a month, and your mileage rate could be 5 cents per mile.

If you drive 300 miles per month, your monthly car insurance premium would be $65 a month.

Or $50 + .05 x 300 miles ($15) = $65

Currently, MetroMile offers coverage, including property damage liability and bodily injury liability insurance, in eight states with a decent suite of coverage such as:

- Rental car reimbursement

- Rental car coverage

- Roadside assistance

- Pet Injury

- Glass repair

- Personal injury protection

- Underinsured motorist coverage

- Medical payments (MedPay)

The downside is MetroMile requires a device called Pulse to be installed on your vehicle.

The free device plugs into your vehicle’s diagnostic port and transmits data to the insurer.

| Company | 6,000 Miles | 12,000 | 18,000 |

|---|---|---|---|

| MetroMile | $1,120 | $1,328 | $1,623 |

| Nationwide | $1,178 | $1,317 | $1,545 |

| Progressive | $1,268 | $1,430 | $1,590 |

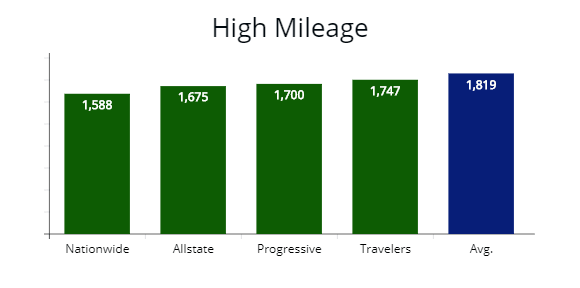

Who has Cheap Insurance for High Mileage?

If you are a driver who puts 30,000+ miles on your vehicle, Nationwide can offer the lowest premium when comparing car insurance rates to other insurers.

According to The Zebra, high mileage car insurance rates depend on the state you reside in.

For example, the difference between a 15,000 mile and 30,000-mile driver in California is 38 percent.

While in other states, it is as low as 3 or 4 percent.

Note: If you drive 30,000+ miles per year, illustrated above are options to find a lower premium. Nationwide offers auto insurance rates at $1,588 per year for full coverage. Allstate offers a car insurance quote at $1,675, while Progressive offers $1,700 per year for the same coverage.

Note: If you drive 30,000+ miles per year, illustrated above are options to find a lower premium. Nationwide offers auto insurance rates at $1,588 per year for full coverage. Allstate offers a car insurance quote at $1,675, while Progressive offers $1,700 per year for the same coverage.

Nationwide offers all that you expect from a top car insurance company with additional perks such as:

- SmartRide

- Vanishing deductible

- On Your Side Review

- Accident forgiveness

- Gap insurance

According to the NAIC, Nationwide has fewer than the expected number of complaints to state regulators.

The table below shows Nationwide, Allstate, and Progressive’s price comparisons at different mileage and compare car insurance rates.

| Company | 12,000 Miles | 20,000 | 30,000 |

|---|---|---|---|

| Nationwide | $1,287 | $1,452 | $1,588 |

| Allstate | $1,236 | $1,490 | $1,675 |

| Progressive | $1,322 | $1,585 | $1,700 |

Which Company Offers the Best Customer Service?

If you compare car insurance to similar customer service-oriented companies, you should compare quotes from Amica.

They are known for their customer service with an excellent claims process from JD Power and AM Best.

There are very few car insurers who can offer low rates with stellar customer service, such as Amica.

| Good for | Bad for |

|---|---|

| Highest scores in claims satisfaction | Fairly Selective |

| Online quote generator | Dividend and non-dividend selection process is confusing |

| Low customer complaints | |

| Easy to change coverage options |

Amica has standard coverage and policy options and excellent perks such as

- Identity fraud

- Glass coverage

- Prestige rental

- Dividends

- Gap insurance

A big bonus with Amica is the ability to lower rates substantially with discounts.

Along with their full suite of services, Amica offers a nice array of car insurance discounts such as:

- Multi-line

- Claims free

- Multi-car

- E-discount

Below is a list of quotes comparing Amica with top insurers offering similar policy packages and options.

| Company | 25 year-old | 40 year-old |

|---|---|---|

| Amica | $1,745 | $987 |

| Nationwide | $1,850 | $972 |

| Allstate | $1,924 | $1,035 |

Amica is fairly selective with whom they will sell a policy.

If you have a major mark in your driving history, you probably won’t be offered a policy.

Who has the Cheapest Comprehensive Insurance?

Farmer’s customers enjoy a nice array of auto insurance coverage options and bundles.

If you need to get cheap comprehensive coverage – Farmers would be it.

They are rated 5th overall for claims experience and customer satisfaction, according to JD Power.

Not only could you get a suite of services through Farmers, but they also offer excellent discounts such as:

- Alternative fuels

- Safe driver

- Mobile glass repair

- Accident forgiveness

- Paperless policy

If you need rideshare insurance, Farmers has you covered.

They will extend your personal auto policy to fill the gaps while you work with Uber or Lyft.

This provides coverage between rides, so you are always covered.

Below is a comparison of comprehensive car insurance quotes from Farmers and other top insurers.

| Company | Comprehensive | Minimum coverage |

|---|---|---|

| Farmers | $165 | $720 |

| Liberty Mutual | $188 | $738 |

| MetLife | $196 | $780 |

Farmers has additional features to add to your policy, such as:

- New car replacement

- Loss of use

- Customized equipment

- OEM coverage

Year by year, Farmers can rank in the top 10 in JD Powers analysis of insurers.

If you are in the market to find affordable insurance premiums, you may want to consider Farmers.

Your initial quote may be higher than average with Farmers.

However, if you maintain a clean driving record and take advantage of their perks, you should have lower than average rates.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

How to Get the Cheapest Car Insurance?

Many companies listed in this article will offer you a lower premium.

That doesn’t mean you have the cheapest insurance rates – or an affordable policy with optimum coverage.

You want to control and use strategies to shop around and compare insurance rates while still maintaining robust coverage.

Below we have a list to help car owners combat the monthly rate increase of an auto insurance policy.

1. Always shop around.

Check the financial health by using Standard & Poor’s, AM Best, Consumer Reports, or National Consumers League.

2. Before buying, compare car insurance rates from each auto insurer.

To help you decide what car to buy, use the Insurance Institute for Highway Safety or IIHS.org.

3. Raise your deductibles.

If you have a low deductible ($100), raise it to $500 or more.

4. Reduce auto coverage on older vehicles.

Is your vehicle worth less than 10 times your premium?

If so, drop comprehensive and collision coverage.

Check Kelly Blue Book for your car’s value.

5. Maintain good credit and apply available car insurance discounts.

6. Bundle your policies.

7. Take advantage of low mileage and member discounts.

Methodology

| AutoInsureSavings.org collects quotes by zip code from the state's largest car insurance companies for a 30-year-old male or female motorist for our driver profile. Each driver has a clean driving record and good credit, and we applied a good driver, anti-theft, and paperless discounts. Price quotes for each insurer are via Quadrant Information Services. The full coverage six-month premium included: $50,000 bodily injury liability per person. $100,000 bodily injury liability per accident. $50,000 property damage liability per accident. $50,000 uninsured motorist coverage per person. $100,000 uninsured motorist coverage per accident. Collision coverage with a $500 deductible. Comprehensive coverage with a $500 deductible. AutoInsureSavings.org uses sample rates and data from Quadrant Information Services. We sourced quotes from insurer filings that are publicly available for rate comparison. |

Sources

https://www.treasury.gov/auto-affordability-study

https://www.ftc.gov/report-credit-based-insurance-scores.pdf

www.nerdwallet.com/blog/insurance/best-cheap-car-insurance/