What is Proof of Financial Responsibility? And Why It Matters

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Mar 28, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Mar 28, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Driving a motor vehicle comes with many responsibilities in the United States.

One of them is making sure you can meet any financial obligations that arise from driving.

What You Should Know

Before we go into detail, here are the key takeaways.

| Key Considerations |

|---|

Proof of financial responsibility guarantees a driver has the necessary coverage to cover expenses from a car accident. Proof of financial responsibility guarantees a driver has the necessary coverage to cover expenses from a car accident. |

| Carrying your state minimum insurance requirements is a form of financial responsibility. |

| A Surety Bond, Cash Bond, or Government Bond is another way to have financial responsibility for your vehicle. |

If you have been involved in a car accident or hit and run, you know costs can quickly add up when motor vehicles or other property are damaged, and people are injured.

Because of these costs, every state requires drivers to show proof that they can cover these damages.

This is called proof of financial responsibility, and it is an important part of driving.

Many states require drivers to carry a liability insurance policy to protect others against these financial burdens.

However, some states allow other means to prove financial responsibility in addition to carrying auto insurance coverage that meets or exceeds the minimum limits.

After insurance, providing a cash deposit, surety bond, or even a government bond is the most common way to prove compliance with financial responsibility laws.

What is Proof of Financial Responsibility?

Proof of financial responsibility related to auto insurance means a person or entity can pay for losses incurred due to a car accident.

It does not necessarily mean having auto insurance, but it does mean having evidence of financial responsibility or the ability to pay for damages.

Not every state has a compulsory insurance law, so to protect other drivers, financial responsibility laws were passed.

Drivers are obligated to show proof of financial responsibility to be allowed to drive.

While financial responsibility can be demonstrated in various ways, most states require auto insurance coverage as the simplest way to prove this.

Every state decides its minimum insurance requirements, so most people meet financial responsibility requirements by keeping auto insurance in place carrying at least state minimum limits, if not more in auto insurance coverage.

Below is the minimum amount of car insurance requirement by each state.

Most states require financially responsible drivers to carry bodily injury and property damage liability insurance policy as the minimum amount of coverage.

While other states require a liability insurance policy plus personal injury protection (PIP) and uninsured and/or underinsured motorist coverage (UM & UIM).

A few states require medical payments coverage (MedPay).

If you prefer not to obtain automobile coverage, you can opt to pay the minimum bond amount to DMV.

| State | Minimum liability coverage | Policies required* | Minimum Bond or Cash** |

|---|---|---|---|

| Alabama | 25/50/25 | BI + PD | $50,000 |

| Alaska | 50/100/25 | BI + PD | $50,000 |

| Arizona | 15/30/10 | BI + PD | $40,000 |

| Arkansas | 25/50/25 | BI + PD, PIP | 1.5 times the appraised value of the vehicle. |

| California | 15/30/5 | BI + PD | $35,000 |

| Colorado | 25/50/15 | BI + PD | $35,000 |

| Connecticut | 25/50/20 | BI + PD , UM, UIM | $50,000 |

| Delaware | 25/50/10 | BI + PD, PIP | $40,000 |

| District of Columbia | 25/50/10 | BI + PD, UM | $25,000 |

| Florida | 10/20/10 | BI + PD, PIP | $25,000 |

| Georgia | 25/50/25 | BI + PD | 2 times the appraised value of the vehicle. |

| Hawaii | 20/40/10 | BI + PD, PIP | n/a |

| Idaho | 25/50/15 | BI + PD | $50,000 |

| Illinois | 25/50/20 | BI + PD, UM, UIM | 1.5 times the appraised value of the vehicle. |

| Indiana | 25/50/25 | BI + PD | $40,000 |

| Iowa | 20/40/15 | BI + PD | $55,000 |

| Kansas | 25/50/25 | BI + PD, PIP | n/a |

| Kentucky | 25/50/25 | BI + PD, PIP, UM, UIM | $25,000 |

| Louisiana | 15/30/25 | BI + PD | $55,000 |

| Maine | 50/100/25 | BI + PD, UM, UIM, MedPay | $127,000 |

| Maryland | 30/60/15 | BI + PD, PIP, UM, UIM | $75,000 |

| Massachusetts | 20/40/5 | BI + PD, PIP | $10,000 |

| Michigan | 20/40/10 | BI + PD, PIP | 2 times the appraised value of the vehicle. |

| Minnesota | 30/60/10 | BI + PD, PIP, UM, UIM | 1.5 times the appraised value of the vehicle. |

| Mississippi | 25/50/25 | BI + PD | $15,000 |

| Missouri | 25/50/25 | BI + PD, UM | $60,000 |

| Montana | 25/50/20 | BI + PD | $55,000 |

| Nebraska | 25/50/25 | BI + PD, UM, UIM | $75,000 |

| Nevada | 25/50/20 | BI + PD | 1.5 times the appraised value of the vehicle. |

| New Hampshire | 25/50/25 | BI + PD, UM, MedPay | 1.5 times the appraised value of the vehicle. |

| New Jersey | 15/30/5 | BI + PD, PIP, UM, UIM | n/a |

| New Mexico | 25/50/10 | BI + PD | $60,000 |

| New York | 25/50/10 | BI + PD, PIP, UM, UIM | $25,000 |

| North Carolina | 30/60/25 | BI + PD, UM, UIM | $85,000 |

| North Dakota | 25/50/25 | BI + PD, PIP, UM, UIM | $10,000 |

| Ohio | 25/50/25 | BI + PD | $30,000 |

| Oklahoma | 25/50/25 | BI + PD | $75,000 |

| Oregon | 25/50/20 | BI + PD, PIP, UM, UIM | n/a |

| Pennsylvania | 15/30/5 | BI + PD, PIP, MedPay | $25,000 |

| Rhode Island | 25/50/25 | BI + PD | $75,000 |

| South Carolina | 25/50/25 | BI + PD, UM, UIM | $35,000 |

| South Dakota | 25/50/25 | BI + PD, UM, UIM | $25,000 |

| Tennessee | 25/50/15 | BI + PD | $65,000 |

| Texas | 30/60/25 | BI + PD, PIP | $55,000 |

| Utah | 25/65/15 | BI + PD, PIP | $160,000 |

| Vermont | 25/50/10 | BI & PD, UM, UIM | $115,000 |

| Virginia | 25/50/20 | BI + PD, UM, UIM | $50,000 |

| Washington | 25/50/10 | BI + PD | $60,000 |

| West Virginia | 25/50/25 | BI + PD, UM, UIM | $25,000 |

| Wisconsin | 25/50/10 | BI + PD, UM, MedPay | $60,000 |

| Wyoming | 25/50/20 | BI + PD | $25,000 |

*BI = Bodily Injury, PD = Property Damage, PIP = Personal Injury Protection, UM = Uninsured Motorist Coverage, UIM = Underinsured Motorist Coverage, MedPay = Medical Payments Coverage.

**In some states, automobile owners can forgo coverage from an insurance provider and pay a bond with the State’s Department of Motor Vehicles (DMV) to maintain the equivalent of the minimum amount of motor vehicle liability coverage.

Are There Other Ways to Show Financial Responsibility?

The financial responsibility law states, individuals must show they can financially cover the damages resulting from an accident, not that they must have insurance to cover these losses.

And yes, there are other ways individuals can provide proof of financial responsibility rather than a liability insurance policy.

A person can hold a surety bond, real estate bond, cash deposit, or government bond in some instances.

Surety or Government Bond

An individual or business could provide a surety bond, real estate bond, or government bond to the state to prove financial responsibility in place of an auto insurance policy.

This shows they have a guarantor in the form of the surety, or bond amount, who will promise to cover the individual or business’s financial obligations.

Cash Deposit

In Virginia, a driver may elect to carry insurance that meets the commonwealth’s minimum insurance requirement, or they may show proof of financial responsibility by depositing cash with the DMV.

This cash deposit is meant to show good faith that the entity could cover any damages they are associated with or cause.

Self-Insurance Certificate

If an entity decides to self-insure their motor vehicles, they may apply for a self-insurance certificate from their state’s DMV, bypassing traditional insurance.

This is done more often by businesses than individuals.

A company may decide to self-insure its entire fleet for many reasons, such as lowering costs and controlling claims.

If the DMV approves of the entity’s application, they will issue the certificate to waive the need for traditional coverage from an insurance agency to meet the state’s financial responsibility laws.

What is the purpose of SR-22 & FR-44 Certificates?

The SR-22 and FR-44 are insurance certificates issued by insurance carriers in certain instances.

The DMV requires the SR-22 certificate to reinstate a driver’s license following certain driving tickets, infractions, and at-fault accidents.

The FR-44 is similar; however, it is only used in Florida and Virginia.

It is similarly issued to high-risk drivers with a traffic violation but generally following drug or alcohol-related incidents or felony convictions.

The FR-44 requires its issuant to carry higher liability insurance requirements than required by the SR-22.

The SR-22 and FR-44 are both certificates issued by the driver’s insurance provider and sent to the DMV to show its financial obligations have been met.

It is a way to show the driver has met the state’s minimum financial responsibility requirements by carrying insurance.

It does not replace insurance. Rather it is merely proof the individual has met the financial responsibility through having auto insurance.

If the driver cancels their auto insurance policy, their carrier will promptly notify the DMV by filing a form.

The DMV can then take action to suspend or revoke the driver’s license or vehicle registration.

Once suspended, an administrative fee will apply to reinstate the driver’s license after a liability insurance policy is secured again.

How to File Proof of Financial Responsibility

To get a motor vehicle registration or license plates from the local DMV, you will need to file proof of financial responsibility with your insurance card and identification card.

The paperwork proves that you have the liability insurance policy requirements.

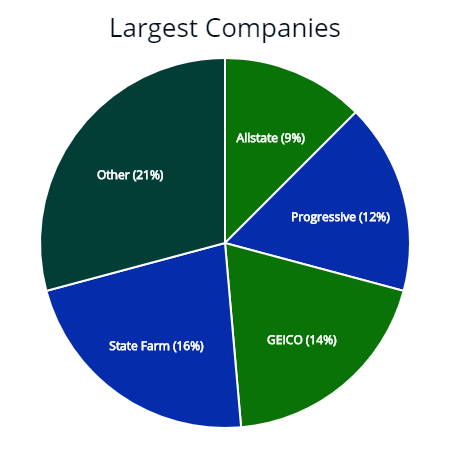

The most common way to prove financial responsibility is to buy motor vehicle coverage from an insurer. The top insurers are listed above by market share of insurance policies—S&P Global Market Intelligence based on direct written premiums in 2019.

The most common way to prove financial responsibility is to buy motor vehicle coverage from an insurer. The top insurers are listed above by market share of insurance policies—S&P Global Market Intelligence based on direct written premiums in 2019.

If you have opted to carry a security deposit with your DMV, they will give you an authorized letter.

If you have a surety bond or a real estate bond with the state, you’ll need an official document to prove financial responsibility to the DMV.

The DMV is not the only time you’ll be required to provide proof of financial responsibility.

If you are ever in a collision or pulled over by law enforcement, they will ask to see your identification card (ID cards) or policy.

Finding Insurance Providers

It is important to shop around for an insurance carrier to get the best insurance rates.

Having to show financial responsibility through insurance does not mean it has to be expensive.

Each state sets its minimum insurance requirements so you know how much coverage you must carry.

You can then use that information to compare rates, policy offerings, and insurance products from various carriers in your state.

Car insurance calculators can help you compare your options and make the best decision to comply with financial responsibility laws and fit your budget.

You should also be sure to compare insurance rates, often with various carriers in the insurance industry.

If you have had the same auto insurance company for a while, they may no longer be offering you the most competitive rates, especially if your driving circumstances have changed.

If you have moved, bought a new car or home, improved your credit rating since you last shopped for insurance, you may be surprised by the rates you could be getting.

It is easy to input your details and compare rates online by visiting the insurance company website.

The top 10 most common insurance companies with the average percent of American drivers that they insure.

– State Farm – 16.12%

– Geico – 13.76%

– Progressive – 12.24%

– Allstate – 9.32%

– USAA – 6.01%

– Liberty Mutual – 4.62%

– Farmers Insurance – 4.15%

– Nationwide – 2.46%

– American Family Insurance – 2.28%

– Travelers – 1.93%

It should be noted that popular doesn’t necessarily mean better.

There may be a local insurance agency in your area that may offer you better auto insurance policies and discounts.

Frequently Asked Questions

What are the financial responsibility laws?

Financial responsibility laws require an individual or business to prove they can cover financial losses incurred due to auto accidents.

Most people do this when they purchase a liability insurance policy. This becomes part of their driver record.

How do you prove compliance with financial responsibility laws?

Most drivers elect to carry auto insurance, which proves compliance with financial responsibility laws to meet state minimum limits.

Besides insurance, drivers can prove compliance by showing proof of self-insurance or by providing a cash deposit or surety bond in some instances.

Each state handles proof of financial responsibility differently.

Can proof of financial responsibility replace auto insurance?

Yes, in some instances. Not all states require auto insurance; rather, they require proof an entity can cover the financial damages they may cause.

This can be accomplished by carrying insurance and providing proof of acceptable minimum limits, but it can also be accomplished by showing proof of other financial resources to cover losses.

Which states allow financial responsibility instead of insurance coverage?

New Hampshire and Virginia allow proof of financial responsibility instead of minimum limits through an auto insurance policy.

In Virginia, drivers can pay a $500 charge annually to the state to waive the usually-required minimum limits or provide a surety bond showing funds sufficient to cover losses that have been deposited with the DMV.

They can also apply for a self-insurance certificate, if applicable.

In New Hampshire, drivers do not have to carry a liability insurance policy or show proof of financial responsibility in other ways unless they are subject to the SR-22.

In that case, the SR-22 is proof of financial responsibility. They carry sufficient coverage, so insurance coverage must be obtained when the DMV requires the SR-22.

What happens if I do not comply with financial responsibility laws?

Penalties range from state to state; however, being uninsured can cause fines and additional surcharges.

It can be challenging to obtain insurance again after a period of uninsured time.

The DMV may impose administrative fees to reinstate your license.

If you do cause damages while uninsured, those damages will be your responsibility to cover.

The financial expenses may be high and could cost you your home, vehicle, savings, and other assets. Lawsuits following accidents can be devastating.

Is the SR-22 or FR-44 proof of financial responsibility?

Yes. The SR-22 and FR-44 prove evidence of financial responsibility an individual carries insurance coverage to meet state minimum limits.

However, because the SR-22 and FR-44 are only required in certain, limited circumstances, these certificates will not be issued to most drivers, so they cannot be used to prove financial responsibility for those drivers not subject to them.

What happens if I am involved in an auto accident with an uninsured motorist who is not compliant with our state’s financial responsibility laws?

You should contact your insurance company if you are involved in an auto accident, even if you think the other driver is at fault.

Your carrier can help you report the loss, manage the claim, and work with the drivers.

If the other driver does not carry auto insurance or lacks evidence of financial responsibility, you may be able to file the claim against your carrier, who will then seek to recover from the uninsured motorist directly.

If you can, get the other driver’s phone number.

It may take longer than a claim against a driver who is compliant with your state’s financial responsibility laws.

To learn more about proof of financial responsibility and how to show it, contact our experts today at AutoInsureSavings.org.

Our licensed insurance agents will be happy to answer any questions you have.

References

https://www.investopedia.com/terms/f/financial-responsibility-law.asp

https://www.iii.org/automobile-financial-responsibility-laws-by-state

sr22insurance.net/guide/

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: Mar 28, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.