Why a Super Low-Cost Car Insurance Policy may not be the Right Choice After All

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: May 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: May 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

If you’ve searched for a low-cost policy near you, then you’ve probably seen these ads like these:

“Get full coverage car insurance for $29”

“$19 super cheap policy for young drivers”

“Lower your monthly or average car insurance payment to $29”

These offers for a $19 a month policy sound out of this world good; too good to be true.

They almost always are.

Note: An example of a company offering rates as low as $19 a month. They are offering $1/day policies too. This type of advert is likely to get you to click on the ad. Then you may not be getting the low quote as advertised.

Getting bargain-priced policies on a new car isn’t possible.

And getting a bargain-basement policy on a car that is a few years old is a bad idea, period.

Don’t get me wrong; paying less for coverage car insurance is a good thing.

But paying a lot less to get minimal protection is more dangerous than good.

You want a policy that will have you covered no matter the situation.

A $19/month policy won’t do that.

Note – Another ad offering quotes at $29/month or low-income policies. State programs are offering low-income policies for drivers. Source @ theSimpleDollar.com

Don’t Be Joe

Let me explain.

Two years ago, a good friend of mine… we’ll call him Joe… purchased a lightly used 2016 Honda Civic.

Joe considered himself to be a safe driver and wanted to save money.

After all, he thought he probably wouldn’t need it since he had a clean driving record.

Joe did all the right things at first.

He searched phrases like “how to find super low-cost coverage policy” and “super affordable auto policies near me.”

He got bargain basement quotes online and compared policies.

Joe’s Savings

Here’s a snapshot of the savings Joe was dreaming about:

| Standard Policy | Low-Cost Policy | Savings / month | Savings / year |

|---|---|---|---|

| $120 | $29 | $91 | $1,092 |

The majority share of drivers is not going to get savings, as illustrated. Unless you have a good credit report with an excellent credit history of payments and no lapse in coverage, plus, you would have to be an older driver driving a Hyundai Elantra. Your insurance score has to be excellent with standard coverage without add-ons such as underinsured motorist coverage.

But none of the quotes he got were as low as the $29/month ads he kept seeing on Facebook and Google.

Why would he pay $120/month to insure his Honda Civic when he could buy a coverage policy for $29/month elsewhere?

The $29/month insurance that Joe purchased covered the bare minimum.

It had an insanely high deductible and really low bodily injury liability limits.

At first, it was great for Joe.

Here is a snapshot of Joe’s coverage car insurance compared to a standard policy:

| Coverage | Joe's Coverage | Standard Coverage |

|---|---|---|

| Bodily Injury | $25,000 / $50,000 | $100,000 / $300,000 |

| Property Damage | $10,000 | $50,000 |

| Personal Injury Protection | $50,000 | $50,000 |

| Comprehensive | $2,500 | $500 |

| Collision | $2,500 | $500 |

Joe had an excellent credit score and was able to get a claims bonus in the past. He drove a passenger car and other types of affordable vehicles. No moving violations either with good driving habits. He thought he didn’t need other types of insurance, such as add-ons or higher coverage levels. He was able to get low-cost full coverage with extremely high deductibles.

He was a safe driver, and he was saving nearly $100/month on car insurance.

And he decided to miss out on uninsured motorist coverage too, even with driver discounts applied to his policy.

Joe’s Debt

Four months later, it was a different story.

Joe was running late for work.

He sent his manager a text to let him know he’d be a few minutes late.

As he was driving to the office, he got a text message back from his boss.

He looked down for a split second to check the message.

Unfortunately, at that moment, the two cars in front of him stopped short because a garbage bin had blown onto the road.

Joe rear-ended the car in front of him and was ruled at fault.

The $100/month savings that Joe got from buying the policy was nothing compared to the deductible he paid for his repair bill.

Worse, his bodily injury liability limit wasn’t enough to cover the injuries of the person he rear-ended.

Long story short, Joe learned the hard lesson that the $29/month policy was, in fact, too good to be true.

Here I created a snapshot of the savings Joe had before the accident “if” he was accident-free for a year.

And the losses Joe had after the accident:

| Lower Cost Policy | Standard Policy | Result after accident |

|---|---|---|

| $1,092 | $0 | ($2,500) deductible |

| x | x | ($3,500) repairs to other driver's vehicle |

| x | $0 | ($6,000) |

| $1,092 in savings per year | ($4,908) Loss |

Joe had the minimum coverage per crash. He had to pay out $2,500 for a combination of collision and comprehensive policy. The cost of repairs over $3,500. So what he thought was affordable car insurance during his initial analysis of rates turned into nearly $5,000 in debt.

The $100 he thought this crazy policy would save him each month ended up costing him thousands of dollars.

In this situation, Joe has $4,908 of debt.

The Harsh Reality of Really Low Policies

It’s hard to ignore the bargain price of $19 or $29/month policies.

Companies offering supra-low policies know that buyers will focus more on the price than what is covered.

Sadly, research and data show that most customers will pay more with this auto insurance policy.

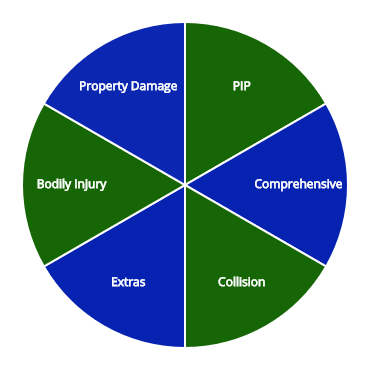

Note: Illustrated above are standard protection for most policies. You can raise or lower the amount you want. However, you must maintain the minimum laws regulated by your state. Property damage liability and liability coverage car insurance are required in most states. In some states, personal injury protection (PIP) is required. The amount you pay for comprehensive insurance and collision coverage is determined by the type of vehicle you drive and the deductible amount. Extras are add-ons such as GAP or roadside assistance.

Note: Illustrated above are standard protection for most policies. You can raise or lower the amount you want. However, you must maintain the minimum laws regulated by your state. Property damage liability and liability coverage car insurance are required in most states. In some states, personal injury protection (PIP) is required. The amount you pay for comprehensive insurance and collision coverage is determined by the type of vehicle you drive and the deductible amount. Extras are add-ons such as GAP or roadside assistance.

That’s why it is important to compare plans with more standard policies.

Here’s what you should look for when you are trying to find a policy:

Deductibles

Most car insurance policies offer deductibles of $500 or $1,000 for collision and comprehensive insurance.

The policy plans you see in ads on Facebook, and Google may have deductibles as high as $2,500.

There is an article here to help you choose the correct deductible.

What does a High Deductible mean for You?

To put it simply, if you get into a car accident, you’ll pay more to get your car fixed.

With a $500 deductible for collision coverage or comprehensive insurance, you pay for the first $500 in repair costs, and your car insurance company pays the rest.

The higher the deductible, the more you’ll pay for repairs.

Below I created a table to show the extra cost with different comprehensive and collision insurance deductibles:

| Deductible | Comprehensive Premium | Collision Premium |

|---|---|---|

| $100 | $128 | $550 |

| $250 | $101 | $458 |

| $500 | $84 | $375 |

| $1000 | $52 | $280 |

| $2500 | $43 | $197 |

One way to lower the average annual premium cost is to raise your collision and comprehensive deductible. Going from $100 to $2,500 saves you over $350 on a collision policy. This is NOT recommended. It better to go with an insurer offering accident forgiveness. You could initially save money, but it could be a waste of money if you need protection.

Supra low-cost policies with a sky-high deductible might save you some money each month, but one accident could cost you as much as $2000 more than you’d pay with a standard auto insurance provider. Ouch!

Coverage

Supra low-cost policies offer the bare minimum in protection.

That means you’ll have to foot the bill for repairs for collision damage or vandalism.

Let’s be honest.

Nobody plans to have a car accident, and nobody plans for their car to be vandalized.

It just happens, and it could happen anywhere.

I’m sure you’ve heard stories of parked cars being hit in store parking lots.

Maybe a windshield cracked by a small rock that flew out of nowhere.

A standard auto insurance policy helps to cover most of if not all, the costs in these situations.

In the table below, I have the cost different amount of full cover and liability only.

| State | Full Coverage | State Minimum | Difference yearly | Difference monthly |

|---|---|---|---|---|

| Michigan | $3,141 | $1,855 | $1,286 | $107 |

| Louisiana | $2,601 | $771 | $1,830 | $153 |

| Nevada | $2,402 | $717 | $1,685 | $140 |

| Kentucky | $2,368 | $669 | $1,699 | $142 |

| Florida | $2,162 | $828 | $1,334 | $111 |

| California | $2,125 | $606 | $1,519 | $127 |

| New York | $2,062 | $867 | $1,195 | $100 |

| Rhode Island | $2,040 | $738 | $1,302 | $109 |

| Connecticut | $2,036 | $891 | $1,145 | $95 |

| New Jersey | $1,993 | $846 | $1,147 | $96 |

| Montana | $1,963 | $447 | $1,516 | $126 |

| Colorado | $1,948 | $553 | $1,395 | $116 |

| Delaware | $1,921 | $843 | $1,078 | $90 |

| Georgia | $1,865 | $684 | $1,181 | $98 |

| Texas | $1,823 | $538 | $1,285 | $107 |

| Maryland | $1,816 | $853 | $963 | $80 |

| Oklahoma | $1,815 | $418 | $1,397 | $116 |

| Missouri | $1,798 | $546 | $1,252 | $104 |

| Arizona | $1,783 | $578 | $1,205 | $100 |

| Wyoming | $1,782 | $328 | $1,454 | $121 |

| Arkansas | $1,763 | $449 | $1,314 | $110 |

| Alabama | $1,713 | $498 | $1,215 | $101 |

| Pennsylvania | $1,700 | $502 | $1,198 | $100 |

| Kansas | $1,689 | $464 | $1,225 | $102 |

| Mississippi | $1,684 | $413 | $1,271 | $106 |

| West Virginia | $1,654 | $541 | $1,113 | $93 |

| South Carolina | $1,653 | $617 | $1,036 | $86 |

| South Dakota | $1,643 | $323 | $1,320 | $110 |

| Washington | $1,620 | $537 | $1,083 | $90 |

| Minnesota | $1,619 | $614 | $1,005 | $84 |

| New Mexico | $1,604 | $479 | $1,125 | $94 |

| Hawaii | $1,589 | $485 | $1,104 | $92 |

| North Dakota | $1,577 | $423 | $1,154 | $96 |

| Alaska | $1,560 | $412 | $1,148 | $96 |

| Illinois | $1,538 | $493 | $1,045 | $87 |

| Nebraska | $1,500 | $393 | $1,107 | $92 |

| Oregon | $1,496 | $674 | $822 | $69 |

| Tennessee | $1,493 | $462 | $1,031 | $86 |

| Utah | $1,492 | $565 | $927 | $77 |

| Massachusetts | $1,466 | $520 | $946 | $79 |

| North Carolina | $1,425 | $438 | $987 | $82 |

| Vermont | $1,410 | $398 | $1,012 | $84 |

| Iowa | $1,352 | $326 | $1,026 | $86 |

| Wisconsin | $1,335 | $401 | $934 | $78 |

| Idaho | $1,285 | $377 | $908 | $76 |

| Indiana | $1,266 | $430 | $836 | $70 |

| Virginia | $1,196 | $380 | $816 | $68 |

| Ohio | $1,191 | $406 | $785 | $65 |

| New Hampshire | $1,086 | $424 | $662 | $55 |

| Maine | $1,080 | $355 | $725 | $60 |

*Data is for 2019 Honda Accord from all states. Data provided by Insurance.com via Quadrant Information Services.

With a $29/month plan, you’d be on the hook for those costs.

Basically, you’re paying less each month, but you’re getting next to nothing in protection.

When you need that protection the most, the company you bought the policy from won’t be there to help you.

Limits

One of the most important things to look for when buying a policy is coverage limits.

These limits typically cover bodily injury and property damage.

Bodily injury limits are usually separated into two categories:

Per person and accident.

A super low-cost policy is usually a bad idea because the policies offer the lowest liability limits possible.

To put it bluntly, getting the lowest rates with bodily injury and property damage limits could put you on the path to financial ruin if you get into an accident.

A $25,000 per person limit may seem like it is more than enough.

A $100,000 or $250,000 per person limit offered with national average auto insurance policies might even seem like overkill.

Sadly, the cost of an ambulance ride and a stay in the ER offers a sobering reality about how much bodily injury could cost you if you are at fault.

Most good affordable plans will include limits listed as at least 100/300/50, $100,000 in bodily injury liability per person, $300,000 total bodily injury liability per accident, and $50,000 in property damage liability per accident.

Below is an example comparing liability only with full coverage:

| Type Coverage | Cost | Minimum Coverage |

|---|---|---|

| Liability | $792 | $792 |

| Collision | $576 | 0 |

| Comprehensive | $282 | 0 |

| Total | $1,650 | $792 |

The policy offerings that you see in ads on Facebook and Google from little known companies usually offer far lower liability limits.

These lower limits might save you a few bucks each month, but they will cost you dearly in even a minor accident.

So by now, you hopefully get it.

Stay far away from those misleading low-cost policies advertised all over Google and Facebook.

Car insurance policies that sound too good to be true are too good to be true.

They are a bad idea, plain and simple. But that doesn’t mean you still can’t save money on auto insurance each month.

Here’s how you can save money on car insurance premiums each month without sacrificing the protection you need in case of an accident or damage.

Compare Quotes Online

It would be best if you compare quotes at least once per year.

When you shop for an affordable policy, you should get quotes from at least two providers.

Using our quote comparison tool, you can see how much you’ll pay for your car insurance rates each month.

You’ll also see what kind of coverage each policy offers for your money.

Below is the information you will need to an online quote fast and easy:

| Information | Documents |

|---|---|

| Personal information | Have the address, date of birth, occupation, driver's license and marital status. |

| Vehicle information | Mileage, date of purchase and Vehicle Identification Number (VIN) for each car. |

| Driving history | Include all claims, violations, driving courses, and tickets you've had over the past five years. |

| Current or previous insurer’s name | Include anyone on the policy or in your household. |

Don’t Wait Until the Last Minute to Look

It is never too early to start looking for a cheaper policy.

If you’re looking to buy a new or used car shortly, you should start comparing quotes now.

How much you pay for car insurance will depend on the car you buy.

We recommend picking out a few car models that interest you and compare how much you’ll pay for a policy for each model.

If you aren’t buying a car but still want to pay less for car insurance premiums, you should start getting quotes about one month before your renewal date.

Why one month?

Well, according to theBalance.com, you’ll get a slightly better quote a few days before your policy’s renewal date since insurers know you are ready to get a new policy.

As you get closer to your renewal date, quotes will be higher.

The one thing you should NOT do is just let your policy auto-renew.

If you do that, you’ll pay as much as $100 more each year.

If you are happy with your provider, that’s great.

But don’t assume for a minute that they will give you loyalty car insurance discounts.

They won’t unless you specifically ask, and even then, it’s not guaranteed.

Even if you plan on staying with your current auto insurance provider, get a few comparisons quotes about 21 days before your policy renewal date.

Contact your car insurance provider and ask for a loyalty discount.

Use the comparison quotes you got to help you get the protection you want for a price that works for you.

Keep Your Personal Information Updated

Once you’ve purchased your policy, it’s easy to forget about it.

Most of us don’t even think about it until we need it.

However, any changes in your daily life can lower how much you pay for car insurance rates.

For example, if you changed jobs and drive less to get to work, you should let your company know.

Car insurance costs less when you drive less each day.

Updating your job title can also help you pay less.

Below is the price difference for a bank teller and retail worker with a college degree and high school diploma:

| Occupation | Quote |

|---|---|

| Bank Teller with HS diploma | $607 |

| Bank Teller with college education | $511 |

| Retail worker with HS diploma | $722 |

| Retail worker with college education | $510 |

Just be careful in the title you give your company.

Data shows that the job title you use could impact how much you pay for a policy.

For instance, using the job title “office manager” will cost you more for a policy than using the title “office administrator.”

Go figure!

Why You Should Avoid Companies That Promise Super Low Policies

It might look like you’ll save a lot of money each month if you buy a super low-cost policy.

Don’t be misled.

Buying one of those advertised plans is a terrible idea.

You won’t save money.

In fact, data shows you will pay way more with those so-called “Supra Low-Cost” plans than you would with more standard coverage.

When you need proper car insurance coverage the most, you will be left out to dry.

There are far better ways to save money.

Sure, you won’t save $100/month as the ads claim.

However, when you shop around and compare quotes from trusted companies, you will still save money.

More importantly, you can enjoy peace of mind knowing you’re properly insured should the unthinkable happen.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Frequently Asked Questions

Can you really get super cheap car insurance?

If you have a newer vehicle, then no.

The reason is you want protection for you and your automobile. By law, you have to carry the minimum requirements.

If you have a newer vehicle, you probably want comprehensive and collision cover.

You may want additional add-ons such as an underinsured motorist’s property damage, roadside assistance, etc.

This will not make insurance costs cheap.

You can get super cheap protection on your own.

It’s easy.

Get minimum property damage liability and bodily injury protection, plus whatever else is required in your state from any insurer.

This is ONLY recommended for vehicles 10 years of age or older.

What do you recommend to lower insurance costs?

Most policyholders want to be sure they are protected. Not overprotected or under-protected.

For example, you may have excess coverage or additional add-ons you don’t need.

You are required to carry minimum liability coverage. Collision is not required unless you lease or have a loan on your vehicle.

However, you can raise the collision deductible to lower expenses. Remember, you are taking more risk by doing so.

Consult with your agent or insurer to make necessary changes to budget your auto insurance rates according to your personal situation.

Sources

NAIC.org Study

Treasury.gov affordability study

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Tracey L. Wells

Licensed Insurance Agent & Agency Owner

Tracey L. Wells is a licensed insurance agent and Farmers insurance agency owner with 23 years of experience. He is proud to be a local Farmers agent serving Grayson, Georgia and surrounding areas. With experience as both an underwriter and agent, he provides his customers with insight that others agents may not have. His agency offers all lines of insurance including home, life, auto, RV, busi...

Licensed Insurance Agent & Agency Owner

UPDATED: May 4, 2023

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.