Why You Should Compare Cheap Car Insurance Quotes

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Joel Ohman

Certified Financial Planner

Joel Ohman is the CEO of a private equity-backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He also has an MBA from the University of South Florida. ...

Certified Financial Planner

UPDATED: Dec 8, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Dec 8, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

It would be best to compare car insurance quotes because it’s the easiest way to find an affordable policy. It will help you find insurance coverage for a low-cost price.

We’ll help you compare coverage for drivers.

But before you shop for quotes, here are a few key considerations and takeaways.

| Cheap Car Insurance - Quick Hits |

|---|

| With over 600 insurers choose from, how do you compare and find affordable car insurance? |

| There are three ways to find cheap quotes. Use an agent, call an insurance company, or use comparison sites. |

| Each has its advantages and disadvantages, but we recommend doing all three. |

| When comparing, we at AutoInsureSavings.org recommend getting quotes from a local, regional, and a national insurance company. |

Why You Should Compare Insurance Quotes

No two drivers are the same. Especially if one of the drivers is a young driver. If you’re considering buying a new car, adding teenagers to your policy, or even just checking to see if you’re still getting the best rate, you may be wondering how to find the cheapest car insurance rate possible.

Several factors affect your auto insurance rates, like your age, gender, where you live, whether you are married or not, the car you drive, and your driving record.

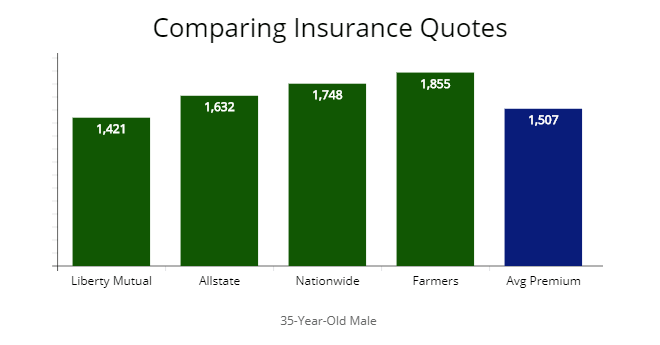

Illustrated above is a 35 year-old male with the same profile, getting different quotes from different car insurance companies. Image credit: AutoInsureSavings.org all rights reserved.

Illustrated above is a 35 year-old male with the same profile, getting different quotes from different car insurance companies. Image credit: AutoInsureSavings.org all rights reserved.

Some carriers also look at your credit history and turn that into a score for their ratings. Insurance companies call this specialized score an “Insurance Score.”

Each carrier rates these factors differently, so not only will your rate differ from your neighbor’s, but it will also vary from company to company. Carriers also offer car insurance discounts for various things. Examples include being a safe driver, bundling your home and auto insurance together, group or affinity discounts, or good student discounts. Taking a defensive driving course often yields a car insurance discount that is good for several years.

USAA, for example, offers military service members and their families auto insurance and is often ranked the cheapest if you qualify for it. What you pay for cheap car insurance can vary by quite a few different factors.

Here’s how insurance quotes compare depending on:

- Individual

- Location

- Rent or Homeowner

- Age

- Driving or Accident History

- Vehicle

- Marital Status

- Gender

When shopping for an affordable car insurance company, be sure to compare low-cost quotes with the same or similar levels of coverage.

When shopping for an affordable car insurance company, be sure to compare low-cost quotes with the same or similar levels of coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

No Drivers are the Same

Every individual has different circumstances that will cause their car insurance rates to differ. Premiums are determined by many risk factors captured at one moment in time. Since you are an individual, your rate will be, too.

| Motorist | Age | Average annual rate |

|---|---|---|

| Person 1 (Liberty Mutual) | 35 | $1,243 |

| Person 2 (Liberty Mutual) | 35 | $1,419 |

Note: Average auto insurance rates are based on non-guaranteed estimates by Quadrant Information Services. Your results will vary by zip code when you get a car insurance quote.

Where you Live

If you live in a rural area, your insurance rate is less expensive than those living in an urban area. It also depends on which city or zip code you live in. Detroit, Michigan, tops the most expensive cities, followed by New York City and New Orleans. These areas have a very high population relative to their size, which could mean more auto accidents; thus, their car insurance rates tend to be higher than the norm.

| City | Average annual rate |

|---|---|

| New York City | $1,582 |

| Detroit | $5,471 |

| New Orleans | $3,735 |

| Columbus, Ohio | $1,170 |

Note: Average rates are based on non-guaranteed estimates by Quadrant Information Services. Your results will vary by zip code when you compare auto insurance.

Your Home

The place where your vehicle is principally garaged overnight can influence car insurance rates, as well. Is your vehicle parked on the street where it could potentially be stolen, vandalized, or involved in a hit-and-run? Or is it kept safe inside a garage, gated community, or other secured structure overnight? Garaging location matters.

| Vehicle location | Average annual rate |

|---|---|

| Parked on the street | $1,231 |

| Garaged at home | $1,118 |

Note: Average auto insurance rates are based on non-guaranteed estimates by Quadrant Information Services. Your results will vary by zip code when you get a quote.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Your age

You may be aware that teens and those in their early twenties are costly to insure, but did you also know that rates tend to start going down for mature drivers in their mid-forties and older? Some car insurance companies give senior discounts, and affinity groups like AARP also provide discounted offerings.

| Driver's Age | Average annual rate |

|---|---|

| 16 | $7,653 |

| 18 | $6,311 |

| 21 | $2,495 |

| 25 | $2,379 |

| 30 | $2,072 |

| 35 | $1,964 |

| 40 | $1,837 |

| 45 | $1,802 |

| 50 | $1,638 |

| 55 | $1,499 |

| 60 | $1,582 |

Your Driving Record

If you have a poor driving history, it can make your car insurance rates more expensive. Surcharges are added to your rate for several years following tickets or at-fault accidents. Good drivers always pay less for car insurance coverage.

| Driving record | Average annual rate | Rate Increase |

|---|---|---|

| No tickets or accidents | $1,508 | |

| Speeding ticket | $1,715 | +15% |

| At-fault accident | $2,034 | +45% |

Your car

The type of vehicle you drive can affect your car insurance costs. Its safety record and safety features factor into an insurance company’s rating, as well as the likelihood it will be stolen and the average cost of repairs. This is why traditional insurance for a Tesla, for example, can be pricy. The parts and labor cost to repair is high, and due to the vehicle’s seamless construction, damage to one part may require a replacement of an entire piece.

It can also be more expensive to insure a car of the same make, but higher trim level – the Camry’s luxury version will be more costly to insure than the base trim level Camry.

| Vehicle | Average annual rate |

|---|---|

| Chevrolet Equinox | $1,511 |

| Chevrolet Silverado 1500 | $1,724 |

| Dodge Ram 1500 | $1,615 |

| Ford Escape | $1,476 |

| Ford Explorer | $1,641 |

| Ford F-150 | $1,505 |

| Grand Cherokee | $1,592 |

| Honda Accord | $1,667 |

| Honda Civic | $1,720 |

| Honda CR-V | $1,439 |

| Hyundai Elantra | $1,673 |

| Jeep Cherokee | $1,521 |

| Jeep Wrangler | $1,416 |

| Nissan Altima | $1,781 |

| Nissan Rogue | $1,585 |

| Nissan Sentra | $1,724 |

| Sierra 1500 | $1,622 |

| Subaru Forester | $1,465 |

| Subaru Outback | $1,392 |

| Tesla Model 3 | $2,215 |

| Toyota Camry | $1,704 |

| Toyota Corolla | $1,701 |

| Toyota Highlander | $1,773 |

| Toyota RAV4 | $1,555 |

| Toyota Tacoma | $1,728 |

Note: Average rates are based on non-guaranteed estimates by NerdWallet. Your results will vary by zip code when you get a quote.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Your Marital Status

Married drivers enjoy slightly better auto insurance rates than their single counterparts. Since car insurance companies have found married drivers have fewer accidents, your marital status can affect your car insurance premium.

| Status | Average annual rate |

|---|---|

| Single | $1,439 |

| Married | $1,361 |

Your Gender

Most people do not know that gender tends only to matter when drivers are young with insurance companies. After drivers are in their 30s, gender matters less in rating decisions – other factors outweigh it, and the difference between male and female drivers is minimal.

| Gender | Average annual rate |

|---|---|

| Male | $787 |

| Female | $765 |

Cheap Car Insurance by Location

There can be a large difference in premium depending on what state and zip code you live in. On average, drivers in Michigan pay the most, and Maine drivers can expect the cheapest auto insurance rates.

The national average is $1,517.

| State | Monthly Car Insurance Rate | Annual Car Insurance Rate | Liability Limits (in thousands of dollars) | Uninsured Motorist Coverage Required? |

|---|---|---|---|---|

| Alabama | $127 | $1,529 | 25/50/25 | No |

| Alaska | $134 | $1,605 | 50/100/25 | No |

| Arizona | $102 | $1,426 | 15/30/10 | No |

| Arkansas | $117 | $1,400 | 25/50/25 | No |

| California | $164 | $1,963 | 15/30/5 | No |

| Colorado | $130 | $1,560 | 25/50/15 | No |

| Connecticut | $137 | $1,644 | 20/40/10 | Yes |

| Delaware | $149 | $1,788 | 15/30/10 | No |

| Florida | $163 | $1,956 | 10/20/10 | No |

| Georgia | $190 | $2,280 | 25/50/25 | No |

| Hawaii | $121 | $1,452 | 20/40/10 | No |

| Idaho | $103 | $1,236 | 25/50/15 | No |

| Illinois | $143 | $1,716 | 20/40/15 | No |

| Indiana | $136 | $1,632 | 25/50/10 | No |

| Iowa | $106 | $1,272 | 20/40/15 | No |

| Kansas | $112 | $1,344 | 25/50/10 | Yes |

| Kentucky | $136 | $1,632 | 25/50/10 | No |

| Louisiana | $111 | $1,332 | 15/30/25 | No |

| Maine | $86 | $1,032 | 50/100/25 | Yes |

| Maryland | $98 | $1,176 | 30/60/15 | Yes |

| Massachusetts | $103 | $1,236 | 20/40/5 | Yes |

| Michigan | $206 | $2,472 | 20/40/10 | No |

| Minnesota | $148 | $1,776 | 30/60/10 | Yes |

| Mississippi | $93 | $1,116 | 25/50/25 | No |

| Missouri | $99 | $1,188 | 25/50/10 | Yes |

| Montana | $145 | $1,740 | 25/50/10 | No |

| Nebraska | $116 | $1,392 | 25/50/25 | No |

| Nevada | $98 | $1,176 | 15/30/10 | No |

| New Hampshire | $123 | $1,476 | 25/50/25 | Yes |

| New Jersey | $168 | $2,016 | 15/30/5 | Yes |

| New Mexico | $114 | $1,368 | 25/50/10 | No |

| New York | $103 | $1,236 | 25/50/10 | Yes |

| North Carolina | $122 | $1,464 | 30/60/25 | Yes |

| North Dakota | $130 | $1,560 | 25/50/25 | Yes |

| Ohio | $69 | $828 | 25/50/25 | No |

| Oklahoma | $64 | $768 | 25/50/25 | No |

| Oregon | $112 | $1,344 | 25/50/20 | Yes |

| Pennsylvania | $113 | $1,356 | 15/30/5 | No |

| Rhode Island | $156 | $1,872 | 25/50/25 | No |

| South Carolina | $123 | $1,872 | 25/50/25 | No |

| South Dakota | $148 | $1,776 | 25/50/25 | Yes |

| Tennessee | $135 | $1,620 | 25/50/15 | No |

| Texas | $126 | $1,512 | 30/60/25 | No |

| Utah | $96 | $1,152 | 25/65/15 | No |

| Vermont | $94 | $1,128 | 25/50/10 | Yes |

| Virginia | $108 | $1,296 | 25/50/20 | Yes |

| Washington | $124 | $1,488 | 25/50/10 | No |

| Washington D.C. | $212 | $2,544 | 25/50/10 | Yes |

| West Virginia | $91 | $1,092 | 20/40/10 | Yes |

| Wisconsin | $101 | $1,212 | 25/50/10 | Yes |

| Wyoming | $83 | $996 | 25/50/20 | No |

Note: Average rates are based on non-guaranteed estimates by Quadrant Information Services. Your results will vary by zip code when you compare auto insurance.

The most expensive states to insure a car are:

- Michigan

- Louisiana

- Florida

- Texas

- California

The five cheapest states to insure car are:

- Maine

- New Hampshire

- Ohio

- Wisconsin

- Idaho

How a Car Insurance Comparison Works

To get cheaper car insurance coverage for the best price, you have to compare quotes. And you have to compare auto insurance quotes with the same coverage. If not, you are basically comparing apples and oranges. So, be sure you are comparing insurance quotes properly.

What’s the correct way to compare auto insurance quotes? The most important part of the process is to compare car insurance for the same types and amounts of coverage. The easiest way is to use comparison sites. Insurify, The Zebra, ValuePenguin, are all good sites to compare insurance quotes. And you can use AutoInsureSavings.org to compare. Or a combination of comparison sites, your local agent, and call the insurance company directly.

[one_half]

Full coverage car insurance

A full-coverage cheap car insurance plan includes liability, collision and comprehensive coverage, and possibly other insurance add-ons required in your state.

Average annual rate: $1,517

[/one_half]

[one_half_last]

State-minimum car insurance

A minimum cheap car insurance plan only comes with liability coverage. In some states, you need uninsured motorist (UM) and personal injury protection (PIP).

Average annual rate: $821

[/one_half_last]

So, if you get a quote for state-minimum coverage from one car insurance company, you shouldn’t compare it with quotes for full coverage you get from other insurance companies. When you compare insurance quotes, some companies may have added uninsured motorists coverage or other add-ons. And it necessarily wouldn’t be full coverage.

What’s the difference between full coverage and minimum coverage? Full coverage is always going to have collision and comprehensive coverage.

To put it another way, if you get a quote for 25/50/25 coverage from one car insurance company, the quotes you get from other auto insurers should be for the same coverage.

But what does 25/50/25 mean? It means the auto insurance policy has:

- $25,000 of bodily injury liability coverage per person

- $50,000 of bodily injury liability coverage per incident

- $25,000 of property damage liability coverage per incident

You may get a quote with 25/50/25 of liability coverage. Your cheap car insurance policy may include other coverage types, too, like collision, comprehensive, uninsured and underinsured motorist (UM & UIM), medical payments (MedPay), personal injury protection (PIP).

Listed below is how each protects you in the event of an automobile accident.

| Coverage type | What does it cover? |

|---|---|

| Liability | Financial protection for injuries or damages to third parties and their property. |

| Collision | Damage to your vehicle after it hits another vehicle, a stationary object or tree branch falls on your car. |

| Comprehensive | Damage to your vehicle caused by animals, falling objects, fire, natural disasters, theft or vandalism. |

| Medical payments | Medical bills up to limits and funeral costs. |

| Personal injury protection | Immediate medical bill relief tied to a car accident, plus funeral expenses, lost wages, childcare, and home care if necessary. |

| Uninsured and underinsured motorist | Damages to your vehicle caused by an uninsured or underinsured motorist. |

Using Insurance Comparison Websites

When it comes to finding affordable car insurance rates, there are many paths you can take. You can call a broker or insurance agent, go directly to a car insurance company website, or you can use a comparison tool. Each will have advantages and disadvantages.

With many dozens of sites, it’s hard to choose. Insurance comparison sites is another tool you can use when shopping for the best value insurance policy. Here we are reviewing each cheap car insurance comparison website so you can make an informed decision.

Compare.com: Excellent

Compare.com is a car insurance comparison shopping website and licensed agency in all 50 states. Headquartered in Glen Allen, Virginia, it is own owned by Admiral, an international insurance group. They partner with insurers such as Allstate, Liberty Mutual, and Geico. Compare.com stresses to customers that it offers quotes from trusted, licensed, and reputable partner insurance companies, all of whom have been approved by each state’s Department of Insurance.

| Metric | Rating |

|---|---|

| Trust | Excellent |

| Online Quotes | Excellent |

| Reputation | Excellent |

| Type Coverage | Auto, home, and health insurance |

| Better Business Bureau | A |

| Customize Policy | Average |

| Type | Licensed Insurance Agency |

Compare.com auto insurance quotes

We pulled a premium coverage quote to compare cheap car insurance from Compare.com for a 35 year-old male with excellent credit, one ticket in driving history, driving a 2020 Toyota Camry. We used a zip code from New York. We could pick deductibles and had the option to add a teen driver or other family members. Coverage limits included:

- Bodily Injury/Property Damage: $100,000 / $300,000 / $100,000

- Uninsured Motorist Bodily Injury: $100,000 / $300,000

- Medical Payments: $5,000

- Comprehensive: $500 deductible

- Collision: $500 deductible

- Rental: Included

- Towing: Included

- Gap insurance: Included

- Uninsured Motorist Property Damage: $100,000

| Insurance Company | Premium | Term |

|---|---|---|

| Amica Mutual | $1,588 / $264 a month | 6 months |

| Mercury Insurance | $1,693 / $282 a month | 6 months |

| Allstate Insurance | $2,012 / $335 a month | 6 months |

| Liberty Mutual | $3,815 / $317 a month | 12 months |

| Safeco Insurance | $4,321 / $360 a month | 12 months |

EverQuote.com: Fair

EverQuote.com is an online insurance lead generation website. Which means they can sell your information to insurers to sell you a policy. They claim to provide car insurance quotes to fit your needs and budget. Founded in 2011, they have partnered with Progressive, Nationwide, Allstate, and Liberty Mutual. Also, EverQuote will offer quotes from insurance carriers from which they don’t partner.

| Metric | Rating |

|---|---|

| Trust | Fair |

| Online Quotes | Poor |

| Reputation | Fair |

| Type Coverage | Auto, home, renters, life, health, and commercial insurance |

| Better Business Bureau | B |

| Customize Policy | Poor |

| Type | Licensed Insurance Agency |

EverQuote.com auto insurance quotes

We went through the quoting process to compare quotes on EverQuote.com. The only insurers available to get a quote were Liberty Mutual, State Farm, and Nationwide. We went ahead and received quotes from each. The quotes are for a 30-year-old female driver profile with good credit and no history of accidents. And driving a 2020 Honda Civic. We used a zip code from Columbus, Oh. Coverage limits included:

- Bodily Injury/Property Damage: $100,000 / $300,000 / $100,000

- Uninsured Motorist Bodily Injury: $100,000 / $300,000

- Medical Payments: $5,000

- Comprehensive coverage: $500 deductible

- Collision: $500 deductible

- Uninsured Motorist Property Damage: $100,000

| Insurance Company | Premium | Term |

|---|---|---|

| Liberty Mutual | $4,511 / $375 a month | 12 months |

| State Farm | $2,481 / $412 a month | 6 months |

| Nationwide | $2,619 / $436 a month | 6 months |

Insurify: Excellent

Insurify.com is a tech-savvy and innovative cheap car insurance comparison website. Insurify has partnered with top insurers in the nation, including Farmers, Nationwide, Travelers, and Liberty Mutual. Their website is well organized and easy to navigate. They are licensed in all 50 states. If you are looking for a low-cost insurance company, Insurify would be an excellent choice.

| Metric | Rating |

|---|---|

| Trust | Excellent |

| Online Quotes | Excellent |

| Reputation | Good |

| Type Coverage | Auto, life, and home insurance |

| Better Business Bureau | A+ |

| Customize Policy | Excellent |

| Type | Licensed Insurance Agency |

Insurify auto insurance quotes

We pulled insurance quotes from Insurify for a 44-year-old male with excellent credit and a good driving record, insuring a 2018 BMW 3 series. We used a zip code from Atlanta, Ga. We decided to go with minimum coverage requirements. Since it was only minimum coverage, we weren’t able to get car insurance discounts. It is easy to make a payment, add family members for everyone interested in a quote.

- Bodily Injury/Property Damage: $25,000 / $50,000 / $15,000

- Uninsured Motorist Bodily Injury: $25,000 / $50,000

| Insurance Company | Premium | Term |

|---|---|---|

| Safe Auto | $294 / $49 a month | 6 months |

| Dairyland | $348 / $58 a month | 6 months |

| Elephant | $354 / $59 a month | 6 months |

| Liberty Mutual | $864 / $72 a month | 12 months |

| Nationwide | $1,848/ $154 a month | 12 months |

The Zebra: Excellent

The Zebra, headquartered in Austin, Texas, is an independent and licensed insurance agency that writes insurance policies in all 50 states, including Washington D.C. They partner with top providers like Liberty Mutual, Esurance, Farmers, MetLife, Nationwide, Progressive, State Farm, and USAA. The Zebra’s biggest claim is getting quotes from 100+ insurance companies with no spam emails or phone calls. Their goal is to help drivers keep their insurance costs low. They provide over 1,800 car insurance products from 200 insurers according to their website.

| Metric | Rating |

|---|---|

| Trust | Excellent |

| Online Quotes | Excellent |

| Reputation | Excellent |

| Type Coverage | Auto, home, renters, condo, and RV insurance |

| Better Business Bureau | A+ |

| Customize Policy | Excellent |

| Type | Licensed Insurance Agency |

The Zebra auto insurance quotes

We retrieved quotes from The Zebra by entering the information on The Zebra’s website for a 43-year-old male driver. With no history of accidents or speeding violations and excellent credit. The vehicle used was a 2020 Ford Explorer. We used a zip code from Boston, MA. There was a point in the quoting process asking about car insurance discounts. We don’t know if they were applied to our quotes. You can choose deductibles too. The coverage limits and exclusions are below.

- Bodily Injury Liability: $25k/$50k

- Property Damage Liability: $25k

- Uninsured Motorist Bodily: $25k/$50k

- Uninsured Motorist Property: Not covered

- Personal Injury Protection (PIP): No coverage

- Collision (Deductible): $1k

- Comprehensive coverage (Deductible): $1k

- Roadside Assistance: No coverage

- Rental Reimbursement: No coverage

| Insurance Company | Premium | Term |

|---|---|---|

| Direct Auto | $312/ $52 a month | 6 months |

| Nationwide | $1,452/ $121 a month | 12 months |

| Elephant | $744 / $124 a month | 6 months |

| Travelers | $2,220 / $185 a month | 12 months |

| Liberty Mutual | $1,680 / $280 a month | 6 months |

PolicyGenius: Fair

PolicyGenius is an independent online insurance marketplace for auto policies. They also provide quotes for other types of insurance products, including pet insurance. PolicyGenius partners with insurers such as Travelers, Liberty Mutual, Nationwide, Direct Auto, and others. They don’t underwrite policies but is a licensed insurance agency in New York. Their goal is to provide cheap car insurance for qualified drivers.

| Metric | Rating |

|---|---|

| Trust | Excellent |

| Online Quotes | Fair |

| Reputation | Excellent |

| Type Coverage | Auto, home, renters, condo, travel and disability insurance |

| Better Business Bureau | A+ |

| Customize Policy | Fair |

| Type | Licensed Insurance Agency in New York |

PolicyGenius auto insurance quotes

One of the biggest drawbacks with PolicyGenius is you have to go through the home insurance process to retrieve quotes. It is cumbersome when you only want to retrieve car insurance quotes. Of course, they are a lead generation website, so we were forwarded to other car insurers to get through the quoting process. We entered a 35 year-old female with an excellent driving history and a fair credit score. The vehicle used is a 2020 Nissan Altima. The coverage limits are:

- Bodily Injury Liability: $25k/$50k

- Property Damage Liability: $25k

- Uninsured Motorist Bodily: $25k/$50k

| Insurance Company | Premium | Term |

|---|---|---|

| Farmers | $456 / $76 a month | 6 months |

| Geico | $474 / $79 a month | 6 months |

| Nationwide | $1,176/ $98 a month | 12 months |

| Liberty Mutual | $840 / $140 a month | 6 months |

| Mercury Insurance | $852 / $142 a month | 6 months |

Compare the best cheap auto insurance companies

Whether you’re looking for the company with the cheapest car insurance coverage, the best customer service team, or a bit of both, there are several companies to choose from.

Cheapest Car Insurance Companies

Erie and USAA have the cheapest car insurance policies according to ValuePenguin and QuoteWizard.com However, Erie is available in only 12 states and Washington, D.C., and USAA only covers the active and former military. Of nationally available insurance companies, Geico and Progressive have the cheapest car insurance rates.

| Insurance Company | Minimum coverage | Full coverage |

|---|---|---|

| Erie | $418 | $823 |

| USAA | $421 | $839 |

| Geico | $515 | $1,098 |

| Progressive | $562 | $1,181 |

| State Farm | $587 | $1,190 |

| American Family | $596 | $1,211 |

| Travelers | $661 | $1,219 |

| Liberty Mutual | $737 | $1,417 |

| Allstate | $758 | $1,638 |

| Farmers | $781 | $1,691 |

| Safeco | $911 | $1,748 |

| Nationwide | $1,001 | $1,771 |

| Esurance | $1,032 | $1,835 |

Note: Average rates are based on non-guaranteed estimates by Quadrant Information Services. Your results will vary by zip code when you get a car insurance quote.

Comparing Insurance Quotes by Insurer

We’ve selected some of the best car insurance companies and providers in the United States and compared them with our range of metrics. We used a scale of 1 to 5. 5 is excellent, and 1 is poor service. Here are the metrics we used we evaluating each car insurance company:

- Value: does the car insurance company provide value to their customer base? Do most customers believe they are receiving good insurance and coverage benefits?

- Customer service: how is the car insurers customer service experience via online, mobile apps, and direct to local insurance agents? How is the quoting process when getting free car insurance quotes?

- Coverage: what each insurer offers, insurance coverage types, and amounts?

- Claims service: how is the claims process with insurance companies for car accidents and vehicle repairs?

- Website & Apps: how user-friendly are the website and smartphone apps for each auto insurer? Is it easy to use, or is it cumbersome?

- Reputation: what is the brand reputation of each insurance company online based on customer reviews and authoritative sources such as NerdWallet, ValuePenguin, WalletHub, and Bankrate.

- Financial strength rating: does the insurance company have the good financial strength to pay out a claim.

- Savings: how are the savings compared to other auto insurers with the same amount of coverage in the same zip code.

- High risk: are high-risk drivers able to get coverage, or are they usually denied? Including those with a DUI and need an SR-22 certificate.

- All states: does the car insurance company offer coverage in all 50 states?

Here’s our review of getting direct car insurance quotes from the best, cheap auto insurance companies.

AAA Auto Insurance Quotes: 4.1/5

AAA (American Automobile Association) is known for its emergency roadside assistance programs with over 60 million customers. AAA doesn’t actually provide car insurance itself but offers some low-cost auto insurance policies via third-party vendors then to its members. AAA or “Triple-A” targets their existing roadside service customers for auto insurance. Most non-members don’t realize AAA can offer quality coverage, particularly for Arizona, California, and Nevada drivers. To read reviews and apply for AAA auto insurance quotes, visit AAA Insurance.

Pros & Cons of AAA

| Pros | Cons |

|---|---|

| Generally receive an auto insurance discount for being a member of AAA | Insurance products differ depending on where you live |

| Some useful additional benefits | Insurance is provided via a third party |

| Multiple insurance products offered | Requires AAA membership |

We’ve used 1 to 5 scale ratings:

- 5: Excellent

- 4: Good

- 3: Fair

- 2: Bad

- 1: Poor

| Metric | Rating |

|---|---|

| Value | 4 |

| Customer Service | 5 |

| Coverage | 5 |

| Claims Service | 4 |

| Website & Apps | 4 |

| Reputation | 4 |

| Financial Strength rating | 4 |

| Savings | 5 |

| High Risk | 3 |

| All States | 3 |

Allstate Auto Insurance Quotes: 4.2/5

Allstate is the 4th largest car insurance company in the United States, with a 10 percent market share. Allstate focuses on the importance of a local agent, value, and insurance products and services that meet customers’ needs. They offer a comprehensive range of innovative products such as Allstate Your Choice Auto with options such as accident forgiveness, a safe driving bonus, and a safe driving deductible. Most policyholders bundle auto and home insurance with Allstate. To apply for your Allstate auto insurance quote, visit Allstate. You could save 10% with Allstate.

Pros & Cons of Allstate

| Pros | Cons |

|---|---|

| Allstate is a carrier that offers auto, home, and life insurance. | Allstate writes six-month auto insurance policies, which exposes the policyholders to twice as many opportunities for rate increases as with companies that offer 12-month policies. |

| Super local service via agents. | Allstate has rated below average for overall purchase user experience in past J.D. Power surveys. |

| Industry leader in automobile safety and education. | Allstate offers a "Student-Away-at-School" discount, it hasn't always shown up on the online quoting system. |

We’ve used 1 to 5 scale ratings:

- 5: Excellent

- 4: Good

- 3: Fair

- 2: Bad

- 1: Poor

| Metric | Rating |

|---|---|

| Value | 3 |

| Customer Service | 4 |

| Coverage | 5 |

| Claims Service | 4 |

| Website & Apps | 5 |

| Reputation | 5 |

| Financial Strength rating | 5 |

| Savings | 3 |

| High Risk | 3 |

| All States | 5 |

Amica Auto Insurance Quotes: 4.1/5

Amica is America’s longest established mutual insurer of automobiles since 1907. Amica targets customers who put value and customer service first. They are known to charge higher than average rates. With car insurance discounts, such as Legacy, most coverages are as competitive as cheaper insurers. Bundling auto and home insurance with Amica is 10% in savings. To apply for your Amica auto insurance quote, visit Amica.

Pros & Cons of Amica

| Pros | Cons |

|---|---|

| Many policy perks and discounts. | May deny coverage to some people deemed risky by the company. |

| High customer satisfaction ratings and low consumer complaints. | Not available in all states |

| Excellent choice of auto insurance policies and coverage options | As a mutual insurance company, Amica offers both dividend and non-dividend policies |

We’ve used 1 to 5 scale ratings:

- 5: Excellent

- 4: Good

- 3: Fair

- 2: Bad

- 1: Poor

| Metric | Rating |

|---|---|

| Value | 4 |

| Customer Service | 5 |

| Coverage | 5 |

| Claims Service | 5 |

| Website & Apps | 3.5 |

| Reputation | 5 |

| Financial Strength rating | 5 |

| Savings | 5 |

| High Risk | 1 |

| All States | 2 |

Farmers Car Insurance Quote: 4.4/5

Farmers is one of the top ten providers of low-cost car insurance coverage in the nation. They are among the most widely known insurance companies in the country, with agents in small towns to large metropolitan cities across America. They are not known for low-cost coverage, but rather customer service with personable local agents. Farmers dominate in the Midwest and Central United States markets. To apply for your Farmers auto insurance quote, visit Farmers. You could save 15% with Farmers.

Pros & Cons of Farmers

| Pros | Cons |

|---|---|

| Many coverage options for home and auto insurance. | May deny coverage to some people deemed risky by the company. |

| Excellent local presence. | Quality of customer service can depend on how good your agent is. |

| Lots of discounts available. | Even if you purchase your policy online, a Farmers agent may still contact you. |

We’ve used 1 to 5 scale ratings:

- 5: Excellent

- 4: Good

- 3: Fair

- 2: Bad

- 1: Poor

| Metric | Rating |

|---|---|

| Value | 4 |

| Customer Service | 5 |

| Coverage | 5 |

| Claims Service | 4 |

| Website & Apps | 4 |

| Reputation | 5 |

| Financial Strength rating | 5 |

| Savings | 5 |

| High Risk | 2 |

| All States | 5 |

Freeway Car Insurance Quote: 4.0/5

Freeway Insurance is America’s largest, privately-owned low-cost insurance distribution company. They specialize in mandatory minimum car insurance coverage for high-risk drivers, including personal injury protection and uninsured motorist coverage. Freeway offers traditional insurance coverage, including:

- Property damage liability insurance

- Bodily injury liability insurance

- Collision and comprehensive coverage

- Uninsured/underinsured motorist

- Medical payments

- Personal injury protection

Freeway is good for those with poor credit, a recent bankruptcy, or have a DUI violation. To apply for your Freeway auto insurance quote, visit Freeway Insurance.

Pros & Cons of Freeway

| Pros | Cons |

|---|---|

| Available in all states. | Company may charge a broker fee for finding you a policy. |

| Good for high risk drivers. | Coverage is via a third party. |

| Can get insurance quotes from multiple companies. | Some policies may come from insurers with high customer complaints or financial stability concerns. |

We’ve used 1 to 5 scale ratings:

- 5: Excellent

- 4: Good

- 3: Fair

- 2: Bad

- 1: Poor

| Metric | Rating |

|---|---|

| Value | 3 |

| Service | 3.5 |

| Coverage | 5 |

| Claims Service | 3 |

| Website & Apps | 5 |

| Reputation | 4 |

| Financial Strength rating | 3.5 |

| Savings | 3 |

| High Risk | 5 |

| All States | 5 |

Geico Car Insurance Quote: 4.85/5

Geico is the 2nd largest provider of low-cost auto insurance in the United States. In America, their target market is male and female motorists from 24 to 64-years-old for cheap car insurance. Geico appeals to customers with humor and wit. They offer quality coverage with affordable car insurance. To apply for your Geico auto insurance quote, visit Geico.

Pros & Cons of Geico

| Pros | Cons |

|---|---|

| Excellent website and mobile app. | Only available direct. |

| Trusted company with excellent customer service. | Some coverage types available only through third-party partners. |

| Many discounts available. | Doesn’t offer gap insurance. |

We’ve used 1 to 5 scale ratings:

- 5: Excellent

- 4: Good

- 3: Fair

- 2: Bad

- 1: Poor

| Metric | Rating |

|---|---|

| Value | 4.5 |

| Customer Service | 5 |

| Coverage | 5 |

| Claims Service | 4 |

| Website & Apps | 5 |

| Reputation | 5 |

| Financial Strength rating | 5 |

| Savings | 4 |

| High Risk | 2 |

| All States | 5 |

Liberty Mutual Car Insurance Quote: 4.1/5

Liberty Mutual is the 6th largest and one of the longest-established auto insurance companies offering quality coverage in the United States. Liberty Mutual’s target demographics are homeowners and those with multiple cars to sell multi-car and multi-policies. To apply for your Liberty Mutual auto insurance quote, visit Liberty Mutual. You could save 10% with Liberty Mutual.

Pros & Cons of Liberty Mutual

| Pros | Cons |

|---|---|

| Many types of coverage available. | Rates can be fairly high if you don't fit into the company's target demographic. |

| Good online experience via website and apps. | Complaints about poor customer service. |

| Excellent digital tools for techy types. | Customer satisfaction ratings are average or below. |

We’ve used 1 to 5 scale ratings:

- 5: Excellent

- 4: Good

- 3: Fair

- 2: Bad

- 1: Poor

| Metric | Rating |

|---|---|

| Value | 3.5 |

| Service | 5 |

| Coverage | 5 |

| Claims Service | 2.5 |

| Website & Apps | 5 |

| Reputation | 5 |

| Financial Strength rating | 5 |

| Savings | 3 |

| High Risk | 1.5 |

| All States | 5 |

Mercury Car Insurance Quote: 3.85/5

Mercury is one of the best providers of affordable car insurance coverage in the Southwest United States. They offer standard liability insurance with limited options. Other optional coverage with Mercury is Mercury Mechanical Protection, Rental Car coverage, and emergency roadside assistance. To apply for your Mercury car insurance quote, visit Mercury.

Pros & Cons of Mercury

| Pros | Cons |

|---|---|

| Wide range of discounts. | Some of lowest car insurance claims satisfaction ratings. |

| Rideshare insurance available. | Few options to customize policies. |

| Affinity Membership is available. | No discount for Green Vehicles. |

We’ve used 1 to 5 scale ratings:

- 5: Excellent

- 4: Good

- 3: Fair

- 2: Bad

- 1: Poor

| Metric | Rating |

|---|---|

| Value | 3.5 |

| Service | 4 |

| Coverage | 3.5 |

| Claims Service | 2 |

| Website & Apps | 3.5 |

| Reputation | 4 |

| Financial Strength rating | 4 |

| Savings | 3 |

| High Risk | 5 |

| All States | 3 |

MetLife Car Insurance Quote: 3.8/5

MetLife has been providing affordable car insurance services to customers since 1863. MetLife’s target market has been to middle income and more affluent customers. They are known for higher than average premiums. But rather focus on customer service, needs, attitudes, and behaviors. Metlife’s brand has been changing since partnering with Walmart. To apply for your MetLife auto insurance quote, visit MetLife Insurance. You could save 15% with MetLife.

Pros & Cons of MetLife

| Pros | Cons |

|---|---|

| The affiliation discount program offers discounts to members of hundreds of groups, associations, and organizations. | Very user-unfriendly quoting system if not in a state with MyDirect online platform. |

| Highly trusted brand. | Users report customer service can be less than optimum at times. |

| Includes several extras at no cost, such as expanded coverage when you rent a car and identity theft protection. | Scored about average in satisfaction across the board on the J.D. Power claims satisfaction study. |

We’ve used 1 to 5 scale ratings:

- 5: Excellent

- 4: Good

- 3: Fair

- 2: Bad

- 1: Poor

| Metric | Rating |

|---|---|

| Value | 4 |

| Service | 3.5 |

| Coverage | 4 |

| Claims Service | 3 |

| Website & Apps | 4 |

| Reputation | 5 |

| Financial Strength rating | 5 |

| Savings | 3 |

| High Risk | 1 |

| All States | 5 |

Nationwide Car Insurance Quote: 4.15/5

Nationwide is one of the top auto insurers in America. They have higher quotes than their competitors with similar levels of auto coverage. Policy offerings through Nationwide include a vanishing deductible, accident forgiveness, and rideshare protection. From a well-designed and easy-to-use website, they are an attractive choice for many customers. To apply for your Nationwide auto insurance quote, visit Nationwide. You could save 10% with Nationwide.

Pros & Cons of MetLife

| Pros | Cons |

|---|---|

| Wide variety of products for customers who want to buy multiple products from one company. | Lower than average customer satisfaction. |

| Some nice insurance add-ons, benefits and additional resources. | Lack of flexibility in some policies. |

| Excellent programs offered such as SmartRide. | Online quoting tool is limited where you may have to speak to an insurance agent. |

We’ve used 1 to 5 scale ratings:

5: Excellent

4: Good

3: Fair

2: Bad

1: Poor

| Metric | Rating |

|---|---|

| Value | 4 |

| Service | 4 |

| Coverage | 5 |

| Claims Service | 3.5 |

| Website & Apps | 4 |

| Reputation | 4.5 |

| Financial Strength rating | 4.5 |

| Savings | 3.5 |

| High Risk | 2.5 |

| All States | 5 |

Progressive Car Insurance Quote: 4.45/5

Progressive, known for “Flo” commercials, is the 3rd largest low-cost car insurance provider in America. Their target market is young adults to inspire people to evaluate their own insurance choices. And not to blindly pick their parent’s choice of insurer. Their popular Name Your Price Tool helps drivers find a car insurance premium to match their budget with quality coverage. To get your Progressive auto insurance quote, visit Progressive. You could save 15% with Progressive.

Pros & Cons of MetLife

| Pros | Cons |

|---|---|

| Name Your Price tool for customers to pay what they can afford. | Below average rating for car insurance shopping customer satisfaction from J.D. Power. |

| Rideshare coverage available. | High-risk coverage is higher than average according to customers. |

| Pet insurance for customers. | May require you to keep telematics device Snapshot installed in your vehicle for 6 months rather than 30 days. |

We’ve used 1 to 5 scale ratings:

5: Excellent

4: Good

3: Fair

2: Bad

1: Poor

| Metric | Rating |

|---|---|

| Value | 4.5 |

| Service | 5 |

| Coverage | 5 |

| Claims Service | 4 |

| Website & Apps | 5 |

| Reputation | 5 |

| Financial Strength rating | 5 |

| Savings | 3.5 |

| High Risk | 2.5 |

| All States | 5 |

Safe Auto Insurance Quote: 3.5/5

SafeAuto specializes in providing low-cost nonstandard car insurance to customers who may not be able to source it elsewhere, such as high-risk drivers. Or motorists who require an SR-22, according to The Zebra. They offer cheap car insurance coverage in 19 states, including Ohio, Indiana, Kentucky, Georgia, Pennsylvania, South Carolina, Tennessee, Louisiana, Mississippi, Illinois, Missouri, Arizona, Oklahoma, Kansas, Virginia, Texas, California, Alabama, and Colorado. To get a Safe Auto car insurance quote, visit Safe Auto.

Pros & Cons of Safe Auto

| Pros | Cons |

|---|---|

| Flexible billing options. | Lacks in customer service. |

| Can get an SR-22 if you need one. | Limited in the amount of additional coverage and add-ons. |

| Excellent for high-risk drivers who have trouble getting affordable rates due to tickets, accidents, and license issues. | No umbrella or bundling discounts |

We’ve used 1 to 5 scale ratings:

5: Excellent

4: Good

3: Fair

2: Bad

1: Poor

| Metric | Rating |

|---|---|

| Value | 4 |

| Service | 3.5 |

| Coverage | 3 |

| Claims Service | 2 |

| Website & Apps | 3 |

| Reputation | 4 |

| Financial Strength rating | 3.5 |

| Savings | 3.5 |

| High Risk | 5 |

| All States | 3.5 |

State Farm Auto Insurance Premium: 4.35/5

State Farm is the number one auto insurer of private passenger automobiles in the United States with a 17% market share, according to NerdWallet. They offer a wide variety of insurance and financial products sold by State Farm agents. In the past, State Farm’s target market is the middle class to the more affluent. Now they focus more on young adults from 18 to 25. To get your State Farm auto insurance quote, visit State Farm. You could save 10% with State Farm.

Pros & Cons of State Farm

| Pros | Cons |

|---|---|

| Potential to earn a lot of discounts for multi-policyholders. | Customers say State Farm will not use original equipment manufacturer (OEM) for repairs. |

| Policies for any type of vehicle, including motorcycles, off-road vehicles, and classic cars. | Only average satisfaction from customers and online reviews. |

| Some coverage extends further than other insurers. Medical Payments Coverage with State Farm covers funeral expenses, as an example. | Quotes are higher than average with State Farm, but reasonable with discounts. |

We’ve used 1 to 5 scale ratings:

5: Excellent

4: Good

3: Fair

2: Bad

1: Poor

| Metric | Rating |

|---|---|

| Value | 4 |

| Customer Service | 4.5 |

| Coverage | 5 |

| Claims Service | 4 |

| Website & Apps | 5 |

| Reputation | 5 |

| Financial Strength rating | 5 |

| Savings | 4 |

| High Risk | 2 |

| All States | 5 |

Travelers Car Insurance Quote: 4.05/5

Travelers is a long-established insurer with 2% of the auto insurance market. They offer a personal insurance product targeting millennials and insurance customers who may not need traditional home insurance or auto policy. Travelers offer cheap car insurance options such as rideshare coverage, Premier New Car Replacement, and GAP insurance. Their mediocre car insurance prices can be reduced with their discount options. To get your Travelers affordable car insurance quote, visit Travelers.

Pros & Cons of Travelers

| Pros | Cons |

|---|---|

| Well trusted brand with coverage in all 50 states. | Traveler's claims process for repairs is poor. |

| Offers optional coverage packages designed to optimize specific features such as new car replacement or roadside assistance. | Technology available through their app or website isn't available in all states. |

| Online quoting tool helps you find optional coverage you may be missing. | Limited coverage in certain states. |

We’ve used 1 to 5 scale ratings:

5: Excellent

4: Good

3: Fair

2: Bad

1: Poor

| Metric | Rating |

|---|---|

| Value | 4 |

| Service | 4 |

| Coverage | 5 |

| Claims Service | 3 |

| Website & Apps | 4 |

| Reputation | 5 |

| Financial Strength rating | 5 |

| Savings | 3 |

| High Risk | 2.5 |

| All States | 5 |

USAA Car Insurance Quote: 4.6/5

USAA is the leading provider of low-cost auto insurance coverage to the military, veterans, and their families, known for excellent rates and reliability. USAA is consistently one of the cheapest auto insurers for liability, comprehensive, and collision coverage, according to ValuePenguin. They offer a suite of insurance products and financial services to their members. Including renters and home insurance. To apply for your USAA auto insurance quote, visit USAA.

Pros & Cons of USAA

| Pros | Cons |

|---|---|

| Excellent customer satisfaction for auto insurance. | Only available for active military members, veterans and their families. |

| Optional services such as banking and finance. | No local presence. |

| Know as one of the cheapest insurers for all type of coverage. | Website and app is difficult to use and navigate. |

We’ve used 1 to 5 scale ratings:

5: Excellent

4: Good

3: Fair

2: Bad

1: Poor

| Metric | Rating |

|---|---|

| Value | 5 |

| Service | 5 |

| Coverage | 5 |

| Claims Service | 5 |

| Website & Apps | 4 |

| Reputation | 5 |

| Financial Strength rating | 5 |

| Savings | 5 |

| High Risk | 2 |

| All States | 5 |

Erie Car Insurance Quote: 4.6/5

Erie Property & Casualty Company is the 11th largest car insurance company in America. They sell their insurance products through a network of independent agencies and licensed agents. According to ValuePenguin, Erie is consistently rated as a cheaper insurance company with the best value. They are known for the service tagline: The ERIE is Above all in SERvIcE,” To apply for your Erie low-cost auto insurance quote, visit Erie.

Pros & Cons of Erie

| Pros | Cons |

|---|---|

| Option to lock in your rate with Erie Rate Lock | Only in available in 12 states plus Washington D.C. |

| Low customers complaints | Unable to initiate a claim online, you have to go through an agent or Erie's 24/7 hotline. |

| Flexible coverage options to customize your policy. | Limited app technology if you have a multi-policy such as home, business, auto, or life insurance policies. |

We’ve used 1 to 5 scale ratings:

5: Excellent

4: Good

3: Fair

2: Bad

1: Poor

| Metric | Rating |

|---|---|

| Value | 5 |

| Service | 5 |

| Coverage | 5 |

| Claims Service | 5 |

| Website & Apps | 4 |

| Reputation | 5 |

| Financial Strength rating | 5 |

| Savings | 5 |

| High Risk | 2 |

| All States | 5 |

How Does Driving Safely Impact Insurance Quotes?

Being a safe driver has a large impact on your rates. An auto insurance company uses your individual risk factors to determine a base rate to which they add any surcharges determined by your driving record.

Any car insurance discounts for which you are eligible are taken off that total, which determines your premium. Surcharges for infractions on your driving record can be costly and affect your rates for several years following the ticket.

Many car insurance companies offer discounts for taking a defensive driving course, which can lower your rates for up to three years.

Is Auto Insurance Cheaper for a Teen Driver, Middle-Aged, or Senior?

Teen drivers pay the most in this group based on age as a risk factor. Middle-aged drivers start to see relief around their mid-forties, with seniors paying the least on average. Some car insurance carriers give discounts for seniors and good students.

What are the Cheapest and Most Expensive Cars to Insure?

Three of the cheapest cars to insure are the Honda CR-V, the Ford Escape, and the Subaru Outback.

Three of the most expensive cars to insure are the Mercedes-Benz S-Class, the Tesla Model X, and the BMW X6.

Below are the most expensive vehicles to insure:

| Vehicle | 6-Month Premium |

|---|---|

| BMW i8 | $2,151 |

| Maserati Quattroporte | $2,030 |

| Nissan GT-R | $1,932 |

| Maserati GranTurismo | $1,867 |

| Mercedes-Benz S-Class | $1,841 |

| Mercedes-AMG GT | $1,838 |

| BMW X6 | $1,767 |

| Tesla Model X | $1,757 |

| BMW 7-Series | $1,745 |

| Porsche Panamera | $1,692 |

Note: Average car insurance rates are based on non-guaranteed estimates by Quadrant Information Services and The Zebra. Your results will vary by zip code when you get a quote from car insurance companies.

Cost of Repairs – The cost of parts and labor is a factor in keeping the S-Class, Model X, and X6 at the top of the most expensive cars to insure list.

Parts and labor are often more specialized, too, keeping repair costs high. The CR-V, Outback, and Escape are simpler and cheaper to fix, and oftentimes mechanics can safely use after-market parts rather than name-brand parts with these vehicles.

Theft Rates – Topping the most-stolen list is the Accord and Civic, but the CR-V does not fall on the list.

The newer models with better safety features also do not top the theft list.

Annual Mileage – The number of miles driven per year will affect cheap car insurance rates, and where you live has a greater effect on that.

For example, California drivers can expect to see a 30% difference in drivers’ rates in the high mileage range and low mileage range.

Safety Test Results – The Outback and CR-V are inexpensive to insure, and they do very well in safety ratings.

The higher-end vehicles on our list do well in safety tests, but that is not enough to offset the higher car insurance rate due to other factors, such as repair costs.

Primary use – Using your vehicle to commute to work results in higher car insurance premiums than pleasure use.

The types of miles driven can also play a part, as traffic and weather conditions affect car insurance rates.

If you often drive in heavy highway traffic during rush hour, this type of vehicle use can result in higher car insurance premiums.

Crime Rates – While Hondas tend to be stolen often – the Accord and Civic often top the list of most-stolen vehicles – the CR-V does not share that distinction, which keeps the premium lower. Most modern automobiles with excellent safety features help keep theft lower, thus lower car insurance premiums.

Below are the least expensive cars to insure:

| Vehicle | 6-Month Premium |

|---|---|

| Subaru Outback | $644 |

| GMC Canyon | $651 |

| Nissan Frontier | $694 |

| Fiat 500X | $719 |

| Jeep Compass | $729 |

| GMC Sierra | $732 |

| Ford Escape | $735 |

| Ford Transit Connect | $735 |

| Chevrolet Traverse | $735 |

| Kia Sportage | $737 |

Note: Average cheap car insurance rates are based on non-guaranteed estimates by Quadrant Information Services and The Zebra. Your results will vary by zip code when you get a quote from car insurance companies.

Frequently Asked Questions

How Can I Compare Car Insurance Quotes Online?

Have your basic information handy, like your current car insurance company, your demographic details, and your vehicle information, and go online and enter your zip code at AutoInsureSavings.org to review your options and compare car insurance quotes online. It is fast and easy!

Are Car Insurance Quotes Free?

Yes. You can get free car insurance quotes and compare rates by using our site. You can take your time and feel comfortable in your research and decision by comparing rates online. If any agency out there tries to charge you for an insurance quote, look elsewhere because they are always free.

How Can I Find Cheap Rideshare Insurance?

By using a car insurance comparison calculator, you can compare your rideshare options. Some carriers will offer additional coverage to fill in the gaps from the rideshare company’s policy. Other carriers have created a sort of hybrid policy to replace your personal policy with one that will cover both rideshare needs and personal auto coverage needs.

In either case, compare your options quickly and conveniently online at AutoInsureSavings.org to learn more.

Is Auto Insurance Cheaper for Male or Female Drivers?

The premium differences between male and female drivers are less than 1%. This is not a large difference due to gender, except for young male drivers, who are the most expensive group to insure.

Is Auto Insurance Cheaper for Homeowners?

Yes. Auto insurance rates can be up to 47% more for renters than homeowners with similar other risk factors. To add to that, homeowners can bundle their home and auto insurance to achieve even greater savings. It is possible to bundle other products – like renter’s insurance or a life insurance policy – with your auto insurance to gain this multi-policy discount.

Renters do not necessarily miss out on this discount, but they pay more overall than their home-owning peers.

Is Auto Insurance Cheaper for Immigrants or US Citizens?

Recent immigrants are often viewed as new drivers by insurance company rating systems to pay more premiums. Without a US driving record, car insurance companies consider it as no driving record and rate accordingly.

To learn more about getting a cheap car insurance quote, contact the experts at AutoInsureSavings.org.

Our licensed professionals will be happy to answer any questions you have.

Methodology

Unless otherwise stated, we collect quotes from various states from each car insurance company to present information to users. Whenever a certain state or zip code is present within the content, we collect 3 to 5 quotes from a car insurance company.

For other tools, including comparison or lead generation websites, we collect available quotes. This is one quote per car insurance company.

Unless mentioned, our driver is a 35 year-old male who drove a 2018 Toyota Camry. The driver is profiled as having fair credit and no accident history. And we attempt to find cheap car insurance for this driver.

AutoInsureSavings.org uses rate data from Quadrant Information Services. The rates are publicly sourced from insurer filings and can only be used for rate comparison. All rights reserved.

Sources – Insurance

ValuePenguin.com

NerdWallet.com

Bankrate.com

https://www.thesimpledollar.com/car-insurance-guide/

Sources – Automobile Safety

https://www.usa.gov/car-repair

https://www.safercar.gov/

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Joel Ohman

Certified Financial Planner

Joel Ohman is the CEO of a private equity-backed digital media company. He is a CERTIFIED FINANCIAL PLANNER™, author, angel investor, and serial entrepreneur who loves creating new things, whether books or businesses. He has also previously served as the founder and resident CFP® of a national insurance agency, Real Time Health Quotes. He also has an MBA from the University of South Florida. ...

Certified Financial Planner

UPDATED: Dec 8, 2022

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.