Best Usage-Based Car Insurance & Telematics Options

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

UPDATED: Feb 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Feb 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

Do you feel that your traditional auto insurance plan doesn’t accurately reflect the type of driver you are?

Would you like to switch to an auto insurer that actually rewards your safe driving behavior?

If you’re looking for an insurance carrier that reflects your driving habits more accurately, then a usage-based option (UBI) might be more suitable for you.

Before you get an insurance quote, here are the key considerations and takeaways:

| UBI key takeaways |

|---|

| Usage-based insurance is an effective way to reduce premiums, sometimes by as much as 40%. |

| There is less chance for rate discrimination based on your driver profile. |

| UBI programs are excellent for drivers, particularly teens, to encourage safe behind the wheel behaviors. |

| UBI plans aren't beneficial for drivers with poor driving history or those with a lead foot. |

UBI, also known as pay-per-mile and pay-as-you-drive (PAYD) auto insurance, has been gaining popularity recently. All of these refer to a telematics program.

Some car insurance companies offer a telematics device to reduce premiums, which measures metrics such as:

— Your driving skills

— Excessive speed

— Quick deceleration incidents

— Time of vehicle use

— Amount of automobile use

In general, the better you drive, the lower your auto insurance rates.

| UBI program | Premium discount |

|---|---|

| Allstate Drivewise | Every six months offers cashback as a reward for safe driving; up to 30% in certain states. |

| MetroMile | Save $500 on average. |

| Progressive Snapshot | Users report 20% average discount. |

| Nationwide SmartRide | 5% upon enrollment and up to 40% discount. |

| Esurance DriveSense | 5 to 10% upon enrollment and up to 25% for safe drivers. |

| Travelers IntelliDrive | Up to 20% upon policy renewal. |

| Geico DriveEasy | Up to 25% on your insurance bill, but it's not available in all states. |

Here are some things you should know about the programs.

How does usage-based insurance work?

Unlike most car insurance companies that calculate premiums according to your age, type of car you own, and an accurate driver profile, the program determines your insurance premiums based on your driving habits.

The auto insurer uses an installed tracking device (usually sent to you in the mail) to record results and reward you for safe driving behaviors with a lower premium.

In some instances, all you have to do is download a mobile app, such as Geico’s DriveEasy or Esurance’s DriveSense.

If you have good driving habits or don’t drive often, you may get reduced rates.

How much can you save on coverage?

If you have a clean driving record, you may be able to get as much as 20% off your insurance coverage.

If you don’t drive often, it could be as much as 30%.

How does the insurer monitor my driving habits?

Auto insurance companies monitor your habits and performance via a wireless plug-in device that attaches to your car’s diagnostic port (OBD-II).

Or through a mobile device called a “tag” on your vehicle’s front or rear windshield.

The device collects vehicle data from a cellular or global positioning system (GPS) and sends it to the insurance provider, assessing your performance and risk.

The collected data enables auto insurers to determine your eligibility for auto insurance discounts and other perks.

Most plug-in devices only work on vehicles manufactured from 1996 onwards.

These devices collect factors like:

– Mileage

– Acceleration

– Braking (specifically “fast deceleration”)

– Turns (specifically “hard corning”)

– Speed (Specifically 80 mph or over)

– Time of day

– Cell phone use, including calls and text messages

Drivers typically have access to the collected data online or through a mobile app. They may also get information on car diagnostics and fuel efficiency.

The technology used to track your automobile’s telematics data depends on the insurer.

Data is collected in various ways, such as:

– Mercury insurance will use your vehicle’s built-in OnStar or TeleNav.

– Through a plug-in device, usually sent in the mail, plugged into your diagnostics (OBD-II) port such as Allstate’s Drivewise.

– Through a “tag” attached to your windshield that pairs with your smartphone’s Bluetooth, such as StateAuto Safety 360 or Liberty Mutual’s RightTrack.

– All systems are connected to a mobile app or available online.

With tracking features, you receive personalized feedback and a weekly progress update.

Available UBI & PAYD Programs

The good news for those looking for UBI or pay-as-you-drive programs is its increased popularity over the past several years has given drivers many options to choose from.

Here are some of the more popular programs in the insurance industry and their benefits.

All resulted in a good user experience when we tested them.

| Insurer | UBI Tracking Technology | Benefits |

|---|---|---|

| American Family | KnowYourDrive | Up to 20% discount and 10% off when enrolling |

| Farmers | Signal | Initial 5% for safe driving, up to 15% on policy renewal, and another 10% for enrolling drivers under the age of 25 |

| Liberty Mutual | RightTrack | Up to 30% off for the life of the policy, plus 10% discount for participation. |

| MAPFRE | DriveAdvisor | Participation discount and potential lower premium at renewal. |

| Noblr | App-based insurance company | Fixed rate in full |

| Root Insurance | App-based insurance company | Up to $900 per year |

| Safeco | RightTrack | Up to 30% discount |

| StateAuto | Safety 360 | Up to 50% with 10% participation discount |

| State Farm | Drive Safe & Safe | An initial discount up to 5% for participating, updates to your policy at renewal time |

Safe Driver Discounts: Allstate Drivewise

Image Credit: Allstate

Allstate Drivewise is available in Colorado, New Jersey, Michigan, Ohio, Illinois, Arizona, and New York.

Drivers usually get a 30% discount, on top of which they may receive a deduction on their auto insurance policy every six months.

With the Allstate plan, motorists could earn the maximum safe driving discount if they:

– Consistently drive slower than 80 mph and travel at least 30 miles a day.

– Avoid driving from 10 p.m. to 4 a.m.

– Avoid quick decelerations

– Drive their vehicle for at least 90 days over a 6 month period

Low Mileage: MetroMile

Image credit: MetroMile.com

MetroMile, based in San Fransisco, is currently available only in Illinois, California, Pennsylvania, Virginia, Oregon, and Washington, although there are plans to make the service available in other states in the future.

Unlike other auto insurers offering a usage-based program, MetroMile only tracks your mileage and doesn’t track fast deceleration incidents or cornering.

MetroMile offers a base premium and a charge per mile. Normally, it’s a $40 monthly rate and .05 cents per mile.

Anything over 150 miles for New Jersey or 250 miles for other states is free, so you don’t have to sweat mileage with MetroMile.

This arrangement saves you the trouble of keeping track of your mileage when going on long drives.

You get the most savings if you drive less than 10,000 miles in a year.

Ultimately, you are paying for car insurance by the mile.

Auto insurance coverage options with MetroMile are:

| Coverage | |

|---|---|

| Bodily injury liability | Limits of up to $250,000/$500,000 |

| Property damage liability | Limits of up to $250,000/$500,000 |

| Uninsured and underinsured motorist coverage | Limits of up to $250,000/$500,000 |

| Collision & Comprehensive | $250, $500, and $1,000 deductible options |

| Personal injury protection | State requirements |

| Medical payments coverage | State requirements |

| Rental reimbursement | Less than 5% of policy |

| Emergency roadside assistance | $5 – $7 a month. |

For Convenience: Progressive’s Snapshot

Progressive’s Snapshot device is available only for vehicles manufactured after 1995. It is available throughout the United States, except in California, Alaska, North Carolina, and Hawaii.

Upon signing up for Progressive insurance, you will receive a small device in the mail.

The device attaches to your vehicle’s diagnostic port (OBD-II), usually located in the center console or under the steering wheel.

It records driving data such as mileage, vehicle use, and decelerations, and hard-cornering incidents.

It’s as simple as plug and play.

Once the data is collected over 30 days of safer driving skills, you return the Snapshot plug-in device via Progressive’s pre-paid box.

After the data is collected and evaluated, your insurance policy will be applied if you qualify for a discount.

Good drivers can expect a 30% discount if:

– You have a few hard-braking and hard-corning incidents.

– Drive mostly during daylight hours

– Drive less than the average daily number of miles.

| Pros | Cons |

|---|---|

| Enrollment discount | Significant rate increase with poor performance. |

| Future premium discount | Limit mileage to get discount |

| Helps you improve your motorist skills. | Limit nighttime use for premium reduction. |

| Parents can monitor teens’ behind the wheel behavior | Users report hard stops and braking quickly raises rates. |

For Technology: Nationwide SmartRide

Nationwide SmartRide offers the highest discounts of all the UBI insurance options reviewed here. Some diesel-powered and hybrid vehicles are not covered, and it’s only available for vehicles manufactured after 1996.

Nationwide SmartRide offers the highest discounts of all the UBI insurance options reviewed here. Some diesel-powered and hybrid vehicles are not covered, and it’s only available for vehicles manufactured after 1996.

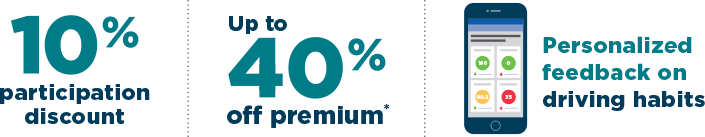

Upon enrollment in the program, policyholders get an automatic 5% discount and up to 40% off if you qualify based on telematics data from mileage, acceleration, time of day, and hard-braking data.

Once you install Nationwide’s device, discounts are updated weekly.

All collected data is used only to determine eligibility for discounts.

The device will not be used to increase your insurance premium.

Policyholders earn the best discounts by:

– Avoid vehicle use between 12 a.m. and 5 a.m.

– Maintain safe driving habits by avoiding rapid acceleration, hard braking incidents, and hard cornering.

– Drive fewer miles than the average daily motorist.

Best SmartPhone App: Esurance DriveSense

Drivers enrolled in Esurance’s DriveSense UBI program can get up to 30% off an auto premium.

With Esurance’s DriveSense plan, you install a device in your vehicle’s diagnostics port, collecting data such as mileage, time of day, acceleration, hard brake incidents, and speed.

Also, the DriveSense program is capable of only using a smartphone app but is limited to certain states.

Take a look at features and connected services recorded by DriveSense.

Features and Events

Idle time Acceleration event Trip rejection reason

Miles driven at or above 80 mph Braking event Successive acceleration and deceleration

High-speed event GPS trail Miles driven in each time range

All telematics data gathered by the DriveSense device is viewable from your personal mobile app. Drivers can easily monitor their performance and make adjustments to meet discount qualifications.

When you enroll, to get the best discounts:

– Limit driving from 10 p.m – 5 a.m.

– Limit quick accelerations.

– Limit fast deceleration and hard cornering incidents.

It is available in Colorado, Arizona, Georgia, Louisiana, Michigan, Connecticut, Kentucky, Maryland, Missouri, Ohio, New Jersey, Texas, Utah, South Dakota, Washington, Virginia, Minnesota, and Pennsylvania.

Esurance plans to eventually switch from the current plugin device solely to a mobile application.

For Teens & New Drivers: Travelers IntelliDrive

Travelers IntelliDrive gives you a 10% discount immediately after enrolling in the program. Also, policyholders who drove less than 13,000 miles in the previous year could get as much as 30% off insurance rates.

IntelliDrive is especially useful to help teen motorists or young drivers to establish safer vehicular practices.

The program lets you arrange for alerts to be sent to your email or cellular phone when they go beyond safe driving guidelines.

Traveler’s IntelliDrive GPS technology has location tracking, which allows you to locate your vehicle and know where it has been driven.

Information tracked by the telematics device installed in your diagnostics (OBD-II) port:

– Mileage

– Time of day

– Speed and braking

– Acceleration

– Smartphone use, including texting, calling, or use of apps.

Traveler’s IntelliDrive is available in the following states.

| Where IntelliDrive is available | ||

|---|---|---|

| Arizona | Kentucky | Nevada |

| Alabama | Maine | Ohio |

| Colorado | Minnesota | Oklahoma |

| Connecticut | Missouri | Oregon |

| Iowa | Mississippi | Pennsylvania |

| Idaho | Nebraska | Tennessee |

| Illinois | New Hampshire | Texas |

| Indiana | New Mexico | Virginia |

Easiest to Use: Geico DriveEasy

Geico’s DriveEasy offers a good user experience.

It was relatively new, launching in 2019. It is also one of the easiest mobile apps to use compared to other usage-based programs.

According to Geico, those who enroll in the DriveEasy program can get a 25% reduction in auto premiums.

Current Geico policyholders can sign up for DriveEasy by downloading the mobile app and leaving it installed while participating in the program.

While the app is installed on your phone, it can detect things like:

– When you drive

– Quick decelerations

– Phone use behind the wheel

Lastly, Geico monitors how much time you spend on the road. According to them, those who drive less see the most savings.

Frequently Asked Questions

Is usage-based (telematics) car insurance worth it?

Telematics technology or usage-based insurance plans are worth it if you are a careful driver that limits mileage.

And limits cellular use behind the wheel, rapid acceleration, and avoids driving from 11 p.m. to 5 a.m.

Some insurers give you a discount just for signing up, such as Traveler’s IntelliDrive or Nationwide’s SmartRide.

Some insurers may raise your insurance rates after your initial review phase of the UBI program.

For example, Progressive’s Snapshot has been reported to increase rates with excessive smartphone use while driving.

Traveler’s Intellidrive has been reported to do the same, particularly for teen drivers.

What’s the difference between usage-based insurance and pay-as-you-drive insurance?

Usage-based insurance tracks your driving habits such as speeding over 80 MPH, rapid accelerations, hard braking or cornering incidents, and phone use.

Allstate Drivewise and Esurance DriveSense are examples of usage-based insurance programs.

A pay-as-you-go auto policy calculates a base rate and a per-mile rate.

For example, a pay-per-mile program may charge $40 per month for a base rate and .05 cents cost per mile.

If you drove 100 miles in a month, you would pay $45.

MetroMile is an example of such a company.

What type of driver is usage-based insurance good for?

Telematics insurance is beneficial for a careful driver who drives less than 12,000 miles per year.

Lower risk drivers who don’t speed, brake hard, or do a lot of nighttime driving.

And drivers who don’t mind privacy concerns with an auto insurer tracking their driving behaviors through GPS, Smartphone apps, or “tag” technologies.

Which auto insurers offer pay-per-mile insurance?

If you want pay-as-you-go insurance as a mileage-based solution, the following providers offer it with various coverage selections.

– Metromile, available in 8 states.

– Mile Auto, available in Georgia, Illinois, and Oregon.

– Nationwide SmartMiles, available in 21 states, including Washington D.C.

– Allstate Milewise is available in 13 states.

To learn more about usage-based car insurance, contact our licensed insurance agents, who will be happy to answer any questions you may have.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Kalyn Johnson

Insurance Claims Support & Sr. Adjuster

Kalyn grew up in an insurance family with a grandfather, aunt, and uncle leading successful careers as insurance agents. She soon found she has similar interests and followed in their footsteps. After spending about ten years working in the insurance industry as both an appraiser dispatcher and a senior property claims adjuster, she decided to combine her years of insurance experience with another...

Insurance Claims Support & Sr. Adjuster

UPDATED: Feb 5, 2025

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.