South Dakota Cheapest Car Insurance & Best Coverage Options

South Dakota's cheapest car insurance and best coverage options are at American Family Insurance and State Farm. American Family has the cheapest minimum coverage in South Dakota, averaging $24 per month. State Farm has the cheapest South Dakota full coverage policies, averaging $99 per month.

Free Car Insurance Comparison

Compare Quotes From Top Companies and Save

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Jan 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

UPDATED: Jan 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.

On This Page

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Want South Dakota’s cheapest car insurance and best coverage options? American Family has minimum coverage that is 38% less expensive than SD’s average, and State Farm has full coverage that is 33% cheaper than the SD average.

Continue reading to learn more about the best auto insurance companies for cheap South Dakota insurance. You can also enter your ZIP code into our free quote tool to get South Dakota auto insurance quotes.

Affordable Car Insurance Rates in South Dakota

South Dakota insurance shoppers should compare quotes with the same coverage level with at least three insurance companies to find the best rate and save more on their auto insurance premiums.

| Cheapest Car Insurance in South Dakota - Key Takeaways |

|---|

The cheapest South Dakota car insurance options are: The cheapest South Dakota car insurance options are:Cheapest for minimum coverage: American Family Cheapest for full coverage: State Farm Cheapest after an at-fault accident: Auto-Owners Cheapest after a speeding ticket: Allied Insurance Cheapest after a DUI: Progressive Cheapest for poor credit history: State Farm Cheapest for young drivers: State Farm For younger drivers with a speeding violation: Farmers Insurance For younger drivers with an at-fault accident: State Farm |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Cheapest Car Insurance in South Dakota Minimum Coverage

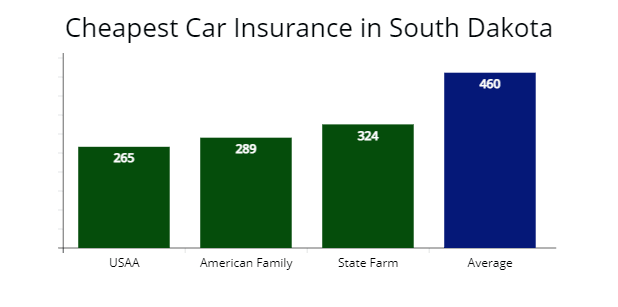

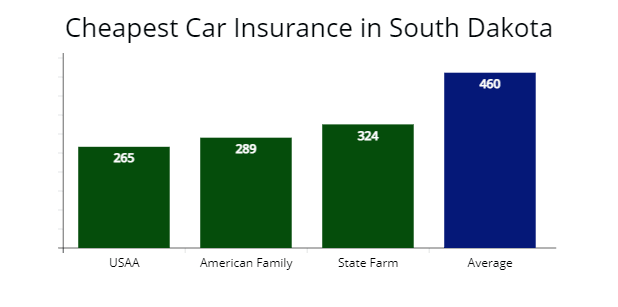

American Family (AmFam) offers the cheapest minimum coverage rates for drivers in South Dakota with a good driving record, which provided us a $289 per year rate or $171 cheaper than the $460 average rates for our 30-year-old sample driver.

Suppose you are a military member or a family member of military personnel. In that case, the best car insurance options for veterans and military are with USAA, which offered our agents a $265 per year insurance quote or $22 per month for minimum liability coverage.

Read more: A Review of USAA Car Insurance, Policy Options & Military Benefits

However, since standard policy auto coverages offered by USAA exempts a lot of customers, it isn’t the first choice for many despite it being the cheapest car insurance company for minimum coverage.

| Auto Insurer | Average annual rate |

|---|---|

| USAA | $265 |

| American Family | $289 |

| State Farm | $324 |

| Allied | $341 |

| Progressive | $390 |

| Geico | $398 |

| Farmers | $434 |

| Farm Bureau Mutual | $514 |

| Auto-Owners Insurance | $617 |

| Liberty Mutual | $637 |

*USAA is for qualified military members, their spouses, and direct family members. Your auto insurance rates may vary based on the driver’s profile.

Buying a minimum coverage policy is the cheapest way to meet South Dakota’s insurance requirements to ensure you stay legal.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

A state minimum car insurance policy only covers up to $50,000 per accident in bodily injury coverage and $25,000 per accident in property damage liability.

Cheapest Full Coverage South Dakota Car Insurance

State Farm offers the cheapest insurance rates for South Dakota drivers with full coverage. State Farm’s $1,190 per year rate is 39% less expensive than state average rates of $1,885 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $1,190 | $96 |

| Allied Insurance | $1,432 | $119 |

| American Family (AmFam) | $1,553 | $129 |

| South Dakota average | $1,885 | $157 |

A full-coverage policy costs more than liability-only policies but offers more asset protection with comprehensive and collision insurance included (learn more: Benefits of Adding Comprehensive & Collision Coverage). Your motor vehicle is protected no matter who is at fault, or any inclement weather caused the damage, which really is an asset for the average driver, even for the simple fact of peace of mind alone.

Cheapest Car Insurance in South Dakota with a Speeding Ticket

Allied offers the cheapest auto insurance quotes for drivers in South Dakota with a speeding ticket on their driving record. Allied’s $1,480 per year rate is 37% or $848 less expensive than state average rates.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Allied Insurance | $1,480 | $123 |

| State Farm | $1,562 | $130 |

| Progressive | $1,874 | $156 |

| South Dakota average | $2,328 | $194 |

How much will my auto insurance go up with a speeding ticket in South Dakota? According to the South Dakota Department of Public Safety, your auto insurance rates can increase by $439 per year or 20% with one traffic violation for speeding.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

Most auto insurers will increase insurance rates after traffic tickets, so you want to make sure to comparison shop for cheaper insurance companies after any traffic violation on driving records. You want to ensure that you have the cheapest options available to you, and comparison shopping is the best way to give yourself those choices.

Cheapest Car Insurance Coverage in South Dakota With a Car Accident

According to our analysis, Auto-Owners offer the cheapest auto insurance rates for drivers in South Dakota with an accident history with a $1,943 per year insurance premium for our sample driver.

Auto-Owners’ rate is 32% less expensive than South Dakota’s average rates ($2,829 per year) for drivers with one accident in their driving history.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Auto-Owners | $1,943 | $161 |

| State Farm | $2,057 | $171 |

| American Family | $2,265 | $188 |

| South Dakota average | $2,829 | $235 |

Getting into an at-fault accident may cause a rate increase of 34% or $944 per year over six years, showing the importance of shopping for cheaper auto insurance if you have a change on your driving record.

Learn more: Will car insurance rates increase after an accident?

To make sure you get the best rates, be sure to compare auto insurance quotes with at least three car insurance companies after a car accident.

Cheapest Car Insurance With a DUI in South Dakota

Drivers in South Dakota with DUI offenses on their driving records can find the cheapest insurance with Progressive, which provided our insurance agents a quote at $2,062 per year or a $171 monthly rate for full coverage. A DUI can result in expensive costs, and enough will put you in the category of being a high-risk driver. However, this doesn’t mean drivers with a DUI will only face a high prices when it comes to the cost of auto insurance.

Read more: The Best Car Insurance Companies After a DUI

The average annual rate increase for drivers with DUI violations is $1,364, making Progressive’s rate 37% cheaper than South Dakota’s average DUI rate.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Progressive | $2,062 | $171 |

| State Farm | $2,358 | $196 |

| American Family | $2,770 | $230 |

| South Dakota average | $3,249 | $270 |

According to the Insurance Information Institute, car insurance premiums increase by 42% on average for South Dakota drivers with driving while intoxicated violations (DUI’s).

Along with higher car insurance rates, the South Dakota Office of Highway Safety states you may be required to participate in their “24/7” impaired driving program to reinstate your suspended driver’s license after a DUI.

Cheapest Car Insurance for Drivers With Poor Credit in South Dakota

State Farm provides the cheapest insurance for drivers with a poor credit score in South Dakota with a $2,011 per year rate for full coverage or 30% less expensive than the average bad credit rate increase of $2,846 per year.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $2,011 | $167 |

| Progressive | $2,261 | $188 |

| American Family | $2,433 | $202 |

| South Dakota average | $2,846 | $237 |

AutoInsureSavings.org analysis shows South Dakota drivers who have a poor credit score will pay on average 34% more for car insurance premiums. And drivers with poor credit are more likely to file a claim or get involved in an at-fault accident than drivers with a good credit score.

For that reason, their auto insurance costs are higher than average. Make sure to maintain good credit scores, pay credit cards and student loans on time to ensure your car insurance rates won’t increase at renewal.

Cheapest Car Insurance for Young Drivers in South Dakota

We found young South Dakota drivers looking for the cheapest full coverage insurance is with State Farm Insurance, which provided our agents a $3,265 per year quote or 28% less expensive than our sample young driver’s average rates.

USAA is the best car insurance option for younger drivers who qualify, which offered AutoInsureSavings’ agents a $2,932 per year rate for full coverage car insurance.

The cheapest state minimum coverage in South Dakota for teenage drivers is American Family Insurance, which offered us a quote at $903 per year or 41% cheaper than average rates. The next best option for younger drivers is State Farm, with a $910 per year rate for minimum liability coverage.

| Insurer | Full coverage | Minimum coverage |

|---|---|---|

| USAA | $2,932 | $618 |

| State Farm | $3,365 | $910 |

| Auto-Owners Insurance | $3,790 | $1,529 |

| Progressive | $3,968 | $1,640 |

| Farm Bureau Mutual | $4,126 | $987 |

| Farmers | $4,553 | $1,942 |

| American Family | $5,321 | $903 |

| South Dakota average | $4,618 | $1,512 |

*USAA is for qualified military members, their spouses, and direct family members. Your rates may be different based on the driver’s profile.

Statistics show a teen driver is more prone to car accidents than older experience drivers, making car insurance rates higher. Our licensed agents recommend younger drivers in South Dakota buy full coverage auto policies to have motor vehicle coverage in an auto accident as an added layer of protection.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

It is best to find an insurance company that offers the cheapest insurance rates for young or teen drivers in Mount Rushmore State, such as State Farm, Auto-Owners, or AmFam, to cut down on your costs of the best car insurance for teens.

Cheapest Car Insurance for Young Drivers with a Speeding Ticket

Young South Dakota drivers with a speeding violation should look to Farmers for the cheapest auto insurance coverage in South Dakota.

Farmer’s average car insurance cost is $4,453 per year or $1,064 less per year for car insurance policies with comprehensive and collision coverage for young drivers.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| Farmers | $4,453 | $371 |

| State Farm | $4,571 | $380 |

| American Family | $5,321 | $443 |

| South Dakota average | $5,517 | $459 |

Learn more: How a Traffic Ticket Can Impact Your Car Insurance Rates

Cheapest Car Insurance for Young Drivers with an At-Fault Accident

Inexperienced drivers in South Dakota with an accident history can find the best car insurance with State Farm, which provided our agents a $4,618 per year rate for full coverage insurance.

State Farm’s at-fault accident rate is 30% cheaper than South Dakota’s average rates of $6,547 per year for teen drivers with an accident.

| Insurer | Annual cost | Monthly cost |

|---|---|---|

| State Farm | $4,618 | $384 |

| American Family | $5,438 | $453 |

| Auto-Owners | $5,577 | $464 |

| South Dakota average | $6,547 | $545 |

Best Car Insurance Companies in South Dakota

AutoInsureSavings.org team of licensed insurance agents rated the best car insurance companies in South Dakota by customer satisfaction, surveys, J.D. Powers claims satisfaction score, A.M. Best, and the National Association of Insurance Commissioners (NAIC) complaint index.

We found that Auto-Owners and American Family Insurance are the best insurance companies based on excellent customer service, claims satisfaction, and NAIC’s complaint index.

ValuePenguin had similar results from their recent South Dakota customer survey, with Auto-Owners scoring 93% with customers in claims satisfaction.

| Car Insurer | % respondents satisfied with recent claim | % respondents rated customer service excellent |

|---|---|---|

| Auto-Owners | 93% | 67% |

| American Family | 86% | 50% |

| USAA | 78% | 62% |

| Allied | 75% | 39% |

| Progressive | 74% | 34% |

| State Farm | 73% | 46% |

| Liberty Mutual | 72% | 59% |

| Farmers Insurance | 71% | 38% |

Our licensed insurance agents also collected information on each insurance company in South Dakota from the NAIC, J.D. Power, and A.M. Best’s financial strength ratings.

The car insurance company with the lowest NAIC complaint ratio is Farm Bureau Insurance, with a 0.43 complaint ratio compared to their market share and below the national average of 1.00.

| Advertiser Disclosure: Some of the offers within the content are from companies where AutoInsureSavings.org may receive compensation. This does not influence our analysis of services or products. Our opinions are our own in good faith. |

The NAIC’s complaint ratio compares the number of complaints an auto insurer has based on South Dakota’s market share. Any car insurance provider below 1.00 is better than the national average.

Auto-Owners and USAA have the highest J.D. Power claims satisfaction scores of 890 each.

A.M. Best financial strength ratings are a grade describing an auto insurer’s financial health and their ability to pay out claims.

| Insurer | NAIC complaint index | J.D. Power claims satisfaction | AM Best rating |

|---|---|---|---|

| Farm Bureau (South Dakota) | 0.43 | n/a | A |

| Auto-Owners | 0.44 | 890 | A++ |

| Farmers | 0.45 | 872 | A |

| American Family | 0.45 | 862 | A |

| Allied Insurance | 0.60 | n/a | A+ |

| State Farm | 0.66 | 881 | A++ |

| USAA | 0.68 | 890 | A++ |

| Progressive | 0.82 | 856 | A+ |

While comparison shopping for car insurance companies in South Dakota, it is essential to remember that many factors contribute to your premium cost. Your age, driving experience, and even your credit score can influence your total monthly or annual cost.

It is always best for drivers in South Dakota to compare car insurance plans to find the best company that offers the lowest insurance rate.

Average Cost of Car Insurance by City in South Dakota

We collected insurance quotes from South Dakota zip codes from top insurance companies and found average rates can vary by $763. Typically, you will pay higher rates if you live in urban cities rather than the state’s rural areas. Your South Dakota rate is based not only on your zip code but also on the type of vehicle, liability coverage limits, marital status, and many other risk factors.

Cheapest Car Insurance in Sioux Falls, SD

Drivers in Sioux Falls can find the cheapest insurance quotes with State Farm, which provided AutoInsureSavings.org agents a rate of $1,514 per year with $500 deductibles for comprehensive and collision coverage. State Farm’s quote is 38% less expensive than Sioux Falls’ average rates.

| Sioux Falls Company | Average Premium |

|---|---|

| State Farm | $1,514 |

| American Family | $1,710 |

| Geico | $1,841 |

| Sioux Falls average | $2,412 |

Cheapest Car Insurance in Rapid City, SD

Rapid City drivers can look to Progressive for the cheapest auto quotes, with a rate of $1,474 per year with full coverage insurance.

Read more: Progressive Car Insurance Review

Progressive’s rate is 37% cheaper than Rapid City’s $2,354 average rates for similar driver profiles.

| Rapid City Company | Average Premium |

|---|---|

| Progressive | $1,474 |

| Farmers Mutual of Nebraska | $1,528 |

| Geico | $1,736 |

| Rapid City average | $2,354 |

Cheapest Car Insurance in Aberdeen, SD

Good drivers in Aberdeen can find the cheapest full coverage with State Farm, which offered us a $1,448 per year rate for our sample 30-year-old driver with comprehensive and collision $500 deductibles. State Farm’s car insurance rate is $863 less per year than Aberdeen’s average rates of $2,311 per year.

| Aberdeen Company | Average Premium |

|---|---|

| State Farm | $1,448 |

| Progressive | $1,631 |

| Allied Insurance | $1,704 |

| Aberdeen average | $2,311 |

Cheapest Car Insurance in Brookings, SD

Our insurance agents found the cheapest auto insurance rate in Brookings is Farmers, with a $1,487 per year rate for a full coverage policy. Farmer’s quote is 35% less expensive than Brookings’ average rates.

| Brookings Company | Average Premium |

|---|---|

| Farmers | $1,487 |

| Progressive | $1,541 |

| Geico | $1,727 |

| Brookings average | $2,254 |

Cheapest Auto Insurance in Watertown, SD

Drivers in Watertown, SD can get cheap auto insurance with State Farm, which provided our licensed agents a $1,165 per year rate for a full coverage insurance policy with $100,000 in liability insurance. State Farm’s quote is 47% less expensive than the average rates in Watertown.

| Watertown Company | Average Premium |

|---|---|

| State Farm | $1,165 |

| AmFam | $1,341 |

| Geico | $1,658 |

| Watertown average | $2,187 |

Cheapest Auto Insurance in Mitchell, SD

Good drivers in Mitchell can find the least expensive policy with American Family, which offered us a $1,218 per year rate for our sample 30-year-old male driver. AmFam’s full coverage quote is 46% cheaper than Mitchell’s average rates.

| Mitchell Company | Average Premium |

|---|---|

| AmFam | $1,218 |

| State Farm | $1,417 |

| Geico | $1,781 |

| Mitchell average | $2,262 |

Average Car Insurance Cost for All Cities in South Dakota

| City | Annual Premium Cost | City | Annual Premium Cost |

|---|---|---|---|

| Sioux Falls | $2,412 | Ipswich | $1,649 |

| Rapid City | $2,354 | Hill City | $1,723 |

| Aberdeen | $2,311 | Piedmont | $1,768 |

| Brookings | $2,254 | Wanblee | $1,667 |

| Watertown | $2,187 | Martin | $1,750 |

| Mitchell | $2,262 | Newell | $1,804 |

| Yankton | $2,040 | Parker | $1,723 |

| Pierre | $2,033 | Howard | $1,782 |

| Huron | $1,898 | Alcester | $1,789 |

| Spearfish | $1,942 | Antelope | $1,741 |

| Vermillion | $2,043 | Lake Andes | $1,807 |

| Brandon | $1,986 | Lower Brule | $1,865 |

| Box Elder | $1,667 | Lake Madison | $1,789 |

| Rapid Valley | $1,782 | Centerville | $1,822 |

| Madison | $1,741 | Wessington Springs | $1,807 |

| Sturgis | $1,983 | Philip | $1,667 |

| Harrisburg | $1,865 | Elkton | $1,935 |

| Belle Fourche | $1,649 | Faulkton | $1,782 |

| Tea | $1,789 | Wall | $1,929 |

| Pine Ridge | $1,925 | Marion | $1,893 |

| Dell Rapids | $1,723 | Estelline | $1,865 |

| Hot Springs | $1,951 | Aurora | $1,649 |

| Canton | $1,865 | Viborg | $1,925 |

| Mobridge | $1,782 | Kadoka | $1,741 |

| Hartford | $1,789 | Avon | $1,723 |

| Milbank | $1,822 | Ashland Heights | $1,667 |

| Dakota Dunes | $1,929 | Colton | $1,893 |

| Blackhawk | $1,984 | Shindler | $1,789 |

| Lead | $1,649 | Highmore | $1,782 |

| North Sioux City | $1,893 | Woonsocket | $1,929 |

| Winner | $1,807 | Menno | $1,723 |

| Redfield | $1,741 | Armour | $1,893 |

| Chamberlain | $1,723 | New Underwood | $1,649 |

| Lennox | $1,789 | Parmelee | $1,822 |

| Summerset | $1,865 | Edgemont | $1,904 |

| Sisseton | $1,807 | Canistota | $1,918 |

| Flandreau | $1,925 | Alexandria | $1,865 |

| Colonial Pine Hills | $1,667 | Valley Springs | $1,789 |

| Beresford | $1,929 | Tripp | $1,723 |

| Custer | $1,904 | Plankinton | $1,741 |

| North Spearfish | $1,822 | Humboldt | $1,904 |

| Fort Pierre | $1,927 | Big Stone City | $1,925 |

| North Eagle Butte | $1,649 | White River | $1,942 |

| Elk Point | $1,723 | Scotland | $1,904 |

| Springfield | $1,741 | St. Francis | $1,807 |

| Volga | $1,782 | Corsica | $1,649 |

| Rosebud | $1,893 | Burke | $1,667 |

| Britton | $1,904 | Colman | $1,948 |

| Groton | $1,807 | Jefferson | $1,904 |

| Webster | $1,865 | Castlewood | $1,741 |

| Parkston | $1,904 | Irene | $1,893 |

| Oglala | $1,649 | Bryant | $1,822 |

| Deadwood | $1,789 | Goodwill | $1,723 |

| Platte | $1,904 | Timber Lake | $1,865 |

| Gregory | $1,925 | Johnson Siding | $1,651 |

| Wagner | $1,937 | Kimball | $1,807 |

| Porcupine | $1,655 | Onida | $1,922 |

| Freeman | $1,741 | Wilmot | $1,789 |

| Miller | $1,915 | Emery | $1,925 |

| Clear Lake | $1,667 | White | $1,782 |

| Clark | $1,915 | Selby | $1,900 |

| Mission | $1,723 | Meadow View Addition | $1,904 |

| Gettysburg | $1,807 | Dupree | $1,741 |

| Crooks | $1,822 | Lake Poinsett | $1,917 |

| Tyndall | $1,649 | Waubay | $1,912 |

| Garretson | $1,907 | Montrose | $1,667 |

| Salem | $1,925 | Lake Norden | $1,913 |

| Lemmon | $1,865 | Blucksberg Mountain | $1,807 |

| Fort Thompson | $1,789 | Mount Vernon | $1,649 |

| Green Valley | $1,741 | Warner | $1,723 |

| Baltic | $1,906 | Leola | $1,822 |

| Whitewood | $1,667 | McLaughlin | $1,865 |

| Kyle | $1,884 | Wounded Knee | $1,827 |

| De Smet | $1,782 | Herreid | $1,789 |

| Eagle Butte | $1,649 | Allen | $1,890 |

| Arlington | $1,787 | Veblen | $1,741 |

| Worthing | $1,816 | Rosholt | $1,788 |

| Eureka | $1,723 | Wolsey | $1,667 |

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Minimum Auto Insurance Requirements in South Dakota

According to the South Dakota Department of Insurance (SCDOI.gov), all drivers in South Dakota must comply with state law and have the minimum bodily injury liability, property damage liability limits, and uninsured motorist coverage in their auto insurance policies.

Below are the minimum coverage limits:

| Liability insurance | State minimum requirements |

|---|---|

| Bodily injury liability | $25,000 per person / $50,000 per accident |

| Property damage liability | $25,000 per accident |

| Uninsured/Underinsured motorist bodily injury insurance | $25,000 per person / $50,000 per accident |

AutoInsureSavings.org insurance agents recommend drivers have higher liability limits with collision and comprehensive coverage or a full coverage insurance policy with roadside assistance. You will be responsible for the extra costs in an at-fault auto accident if the cost of bodily injury and property damage exceeds the liability insurance requirements.

To learn more about South Dakota’s most affordable car insurance options, get expert advice at AutoInsureSavings.org.

Our licensed professionals will be happy to answer any questions you have.

Methodology

AutoInsureSavings.org comparison shopping study used a full-coverage auto policy for a 30-year-old driving a 2018 Honda Accord with the following coverage limits:

Average Coverage Limits for Full-Coverage Auto Policy

| Coverage type | Study limits |

|---|---|

| Bodily injury liability | $50,000 per person / $100,000 per accident |

| Property damage liability | $25,000 per accident |

| Personal injury protection | $10,000 |

| Uninsured / underinsured motorist bodily injury | $50,000 per person / $100,000 per accident |

| Comprehensive and collision coverage | $500 deductible |

We used insurance rates for South Dakota drivers with accident histories, credit scores, and marital status for other rate analyses. We used insurance rate data from Quadrant Information Services, which are publicly available for comparative purposes only. Your auto insurance rates may vary when you get quotes.

Sources

– Insurance Information Institute. “Facts + Statistics: Alcohol-impaired driving.”

– National Highway Traffic Safety Administration. “Traffic Safety Facts.”

– South Dakota Legislative Research Center. “Codified Law 32-23-2.”

– National Association of Insurance Commissioners. “Market Share Reports for Property/Casualty Groups and Insurance Companies.”

– Division of Insurance Consumer Information. “Division of Insurance Consumer Information.”

– AIPSO. “South Dakota Automobile Insurance Plan.”

– Department of Public Safety. “Impaired Driving.”

Frequently Asked Questions

Who has the cheapest car insurance in South Dakota?

American Family offers the state minimum’s cheapest auto insurance rate at $287 per year for 30-year-old drivers. The average annual auto insurance premiums for minimum coverage in South Dakota are $460 per year, and AmFam’s premium costs 38% less per year, making this provider the best for finding the lowest rate. Other good options for affordable car insurance are State Farm at $324 per year and Allied Insurance at $341 per year.

How much is South Dakota car insurance per month?

The average car insurance costs $157 per month for full coverage in South Dakota and $38 per month for state minimum coverage for a 30-year-old driver with a clean driving record.

How much is full coverage car insurance in South Dakota?

The average cost of full coverage car insurance in South Dakota is $1,885 per year or $157 per month with $100,000 per accident in liability coverage. State Farm’s average rate for full coverage is $1,190 per year or $96 per month or 38% less per year, while Allied’s $1,432 rate is 25% below South Dakota’s state average rates.

How do I save on car insurance in South Dakota?

The best way to save on your insurance premium in South Dakota is to find out from your car insurance provider if you are eligible for a money-saving driver discount offered by the company. If you have a clean record, you’ll be eligible for discounts like defensive driving, safe driver discount, and more. Many insurance providers in South Dakota will lower your overall insurance prices if you have more than one policy with them, such as life or home insurance policies.

Another way to save on car insurance premiums is to practice safe driving habits and maintain clean driving records. Many auto insurance companies offer good driving discounts for drivers in South Dakota that have clean driving records for five years. One example is American Family, which offers good drivers a safe driver discount for being five years accident-free. Not only will you keep and your passengers safe, but it will also help you avoid car accidents or traffic violations that could cause your premium to increase.

How much will my car insurance rates rise with a speeding ticket in South Dakota?

Car insurance rates increase by an average of $439 per year or 20% with one speeding traffic violation.

What is the best car insurance in South Dakota?

The best South Dakota auto insurance is full coverage. To save on full coverage, make sure you are comparing South Dakota car insurance quotes.

What is the minimum car insurance in South Dakota?

South Dakota drivers must carry liability insurance and uninsured/underinsured motorist insurance.

Is it illegal to drive without insurance in South Dakota?

Yes, all SD drivers need to meet South Dakota car insurance requirements.

Is South Dakota a no-fault state?

South Dakota is an at-fault state, so make sure you carry the right South Dakota auto insurance coverage.

Is PIP required in South Dakota?

No, South Dakota doesn’t require PIP coverage.

Free Auto Insurance Comparison

Enter your ZIP code below to view companies that have cheap auto insurance rates.

Secured with SHA-256 Encryption

Schimri Yoyo

Licensed Agent & Financial Advisor

Schimri Yoyo is a financial advisor with active insurance licenses in seven states and over 20 years of professional experience. During his career, he has held roles at Foresters Financial, Strayer University, Minnesota Life, Securian Financial Services, Delaware Valley Advisors, Bridgemark Wealth Management, and Fidelity. Schimri is an educator eager to assist individuals and families in ach...

Licensed Agent & Financial Advisor

UPDATED: Jan 22, 2024

It’s all about you. We want to help you make the right coverage choices.

Advertiser Disclosure: We strive to help you make confident auto insurance decisions. Comparison shopping should be easy. We are not affiliated with any one auto insurance provider and cannot guarantee quotes from any single provider. Our partnerships don’t influence our content. Our opinions are our own. To compare quotes from many different companies please enter your ZIP code on this page to use the free quote tool. The more quotes you compare, the more chances to save.